Quantifying the shadow economy

A deficit of hundreds of millions in state funds from undeclared work

Published 21.11.2022

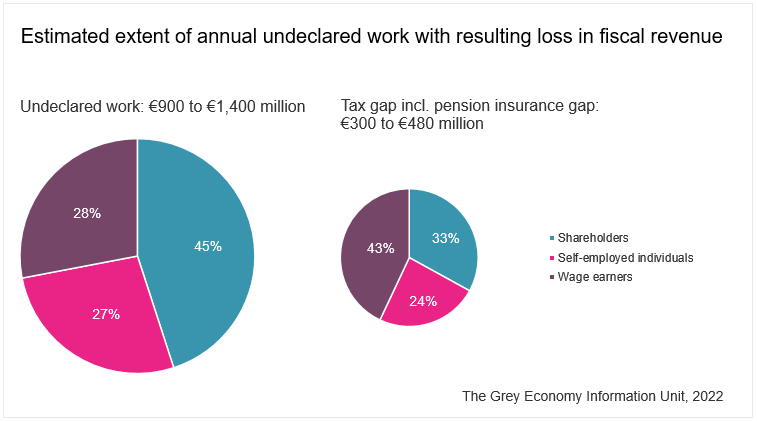

The annual value of undeclared work is estimated to be €900–1,400 million in Finland. Undeclared work also causes losses of taxes and social insurance contributions totalling €300–480 million. The amount of undeclared work and the resulting losses of income for the state were now estimated for the first time in Finland.

A billion euros in undeclared income

Undeclared funds withdrawn by shareholders and self-employed individuals account for a significant part of the total value of undeclared work. Entrepreneurs cover as much as three quarters of undeclared work and wage earners roughly a quarter.

When examining the deficit caused by undeclared work in taxes and social insurance contributions, the significance of wage earners increases relatively. Wage earners’ withheld taxes and social insurance contributions account for more than 40 per cent of the deficit. While shareholders and self-employed individuals make up almost 60 per cent, the estimate does not include entrepreneurs’ pension insurance contributions. Their amount cannot be estimated without each entrepreneur’s insurance information.

The extent of undeclared work can be perceived by comparing the estimates presented with the income of wage earners and entrepreneurs. Wage earners’ undeclared wages account for less than one per cent of the total payroll of employees in the business sector. Based on a rough estimate, some ten per cent of entrepreneurs’ income consists of undeclared work. Shareholders’ undeclared work was compared with the total wages of all shareholders. Because self-employed individuals cannot pay wages to themselves, their undeclared work was compared with the total business results of all self-employed individuals.

Undeclared wages are commonplace in certain known parts of the shadow economy

Undeclared wages are paid to employees in such sectors as food and beverage services and construction, in which the general level of wages is low, services are produced through work, and the use of cash is common. In these same sectors, shareholders of smaller limited liability companies, in particular, obtain income from their companies without paying taxes. Among self-employed individuals, food and beverage services and transport are significant sectors for undeclared work.

Extensive impact on society

Undeclared wages not only cause losses of income for society through taxes and social insurance contributions but they also have a more extensive impact on pensions and benefits, including sickness and housing allowances. In the most flagrant cases, the impact on society multiplies if taxes on wages are left unpaid while unfounded social allowances are being withdrawn.

New research data in Finland

Not many studies or investigations of undeclared wages have been published in Finland. Previously, undeclared work has mainly been identified using surveys, while no estimates of its value have been presented. The European Commission has investigated the amount of undeclared work in the Member States using the labour input method (LIM).

The Grey Economy Information Unit has now investigated undeclared work and estimated its value in 2014–2020. Undeclared work was studied based on data by using a number of different methods, taxation and tax audit data, and data compiled and collected by Statistics Finland. Four separate reports and their concise summary have been published.

Read the summary in English (PDF 339 Kb)

Read the full reports in Finnish:

Pimeän työn määrä – Mittaamisselvitys osakeyhtiöiden verotarkastustietojen perusteella (PDF 0,98 MB)

Pimeän työn määrä – Mittaamisselvitys elinkeinonharjoittajien verotarkastustietojen perusteella (PDF 573 kB)

Pimeän työn mittaaminen profilointimenetelmällä – Osakeyhtiöiden pimeän työn määrä (PDF 363 kB)

Pimeän työn mittaaminen LIM-menetelmällä – Yksityisen sektorin palkansaajien pimeän työn määrä (PDF 473 kB)

What does undeclared work mean?

Normally, undeclared work and wages mean wages that are paid to employees but not reported to the authorities, and from which no taxes are withheld and no social insurance contributions are paid. In the reports prepared by the Grey Economy Information Unit, the concept of undeclared wages was defined broadly to also cover any undeclared funds and benefits withdrawn by shareholders of limited liability companies. Any income concealed by self-employed individuals and unfounded expenses aimed to avoid the payment of taxes were also regarded as undeclared work.

Not everyone pays as much VAT as they should

Published 18.1.2021

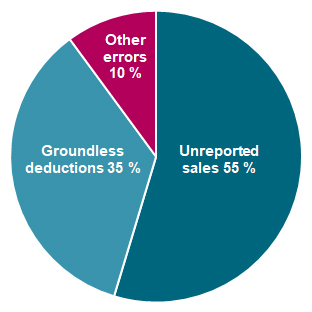

Groundless requests for VAT refunds are not the only form of VAT-related fraud. Abuse and errors also occur if some part of a VAT return is not filed and paid.

Some €300 million is never filed

The Finnish Tax Administration’s Grey Economy Information Unit investigated VAT fraud cases where the taxpayer did not file their VAT returns fully and as a result, did not pay as much VAT as they should have. The investigation included possible VAT fraud cases and minor VAT-related errors. According to estimates made, some €300 million in VAT returns was left unfiled in 2018.

Under-the-counter sales are thriving

The most common tax avoidance methods are not reporting sales subject to VAT truthfully and groundless VAT deductions. The largest numbers of unreported sales were found in the fields of catering and trade. Groundless VAT deductions were particularly found in the fields of home construction and real estate. Leaving sales income unreported is a particularly common method of tax avoidance.

Pennies turn into millions

According to the results, businesses that file less in VAT return than they should are often low-turnover businesses. Although the individual errors are small, there are many of them, and the VAT returns left unpaid cause a significant tax gap annually.

How to prevent abuse?

Most taxpayers file their VAT returns truthfully and pay the amount of VAT that Finnish legislation obligates them to pay. Requiring more extensive and detailed information for filing VAT returns would make it more difficult to file them untruthfully. It would increase the fairness of taxation.

One in four knows or knows of a business that has operated illegally

Published 28.1.2020

The Tax Administration commissioned a customer survey to map its corporate customers’ thoughts on taxes and the Tax Administration in general.

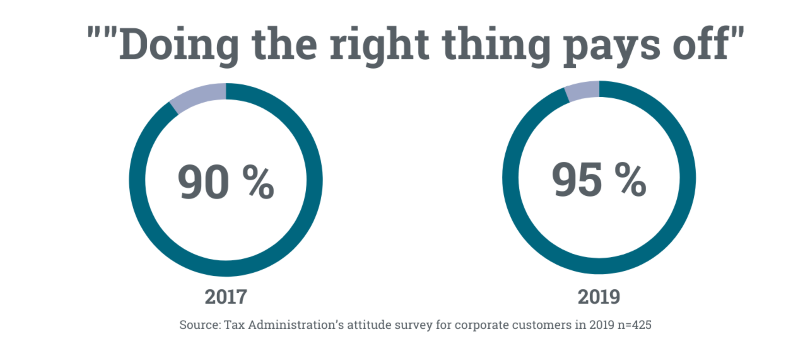

As in previous years, corporate customers agreed the most with the survey’s tax-related statement ‘Doing the right thing pays off’, with the share of the respondents who agreed with the statement increased to 95 per cent. On the other hand, only 40 per cent of the respondents agreed that businesses that operate honestly are protected.

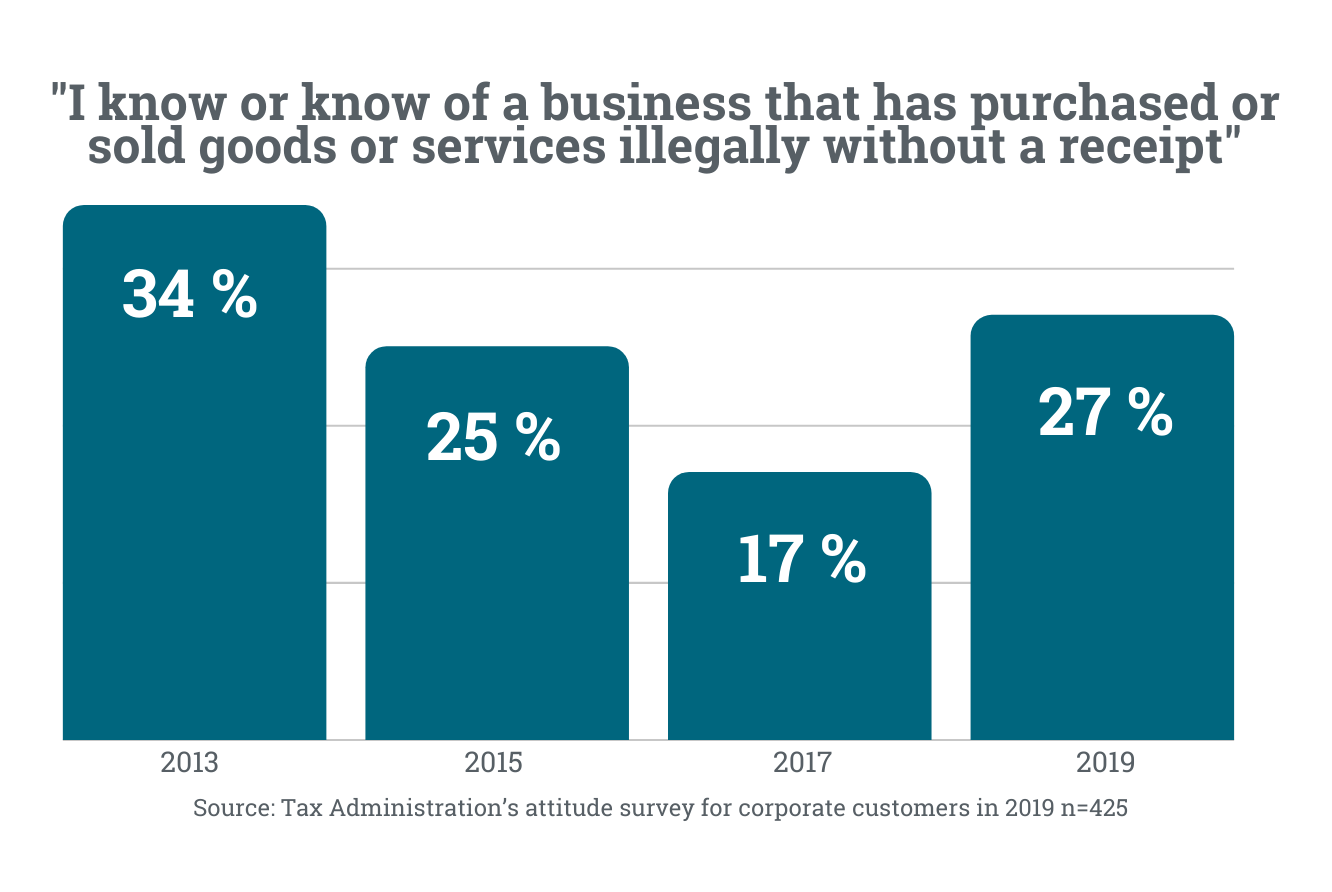

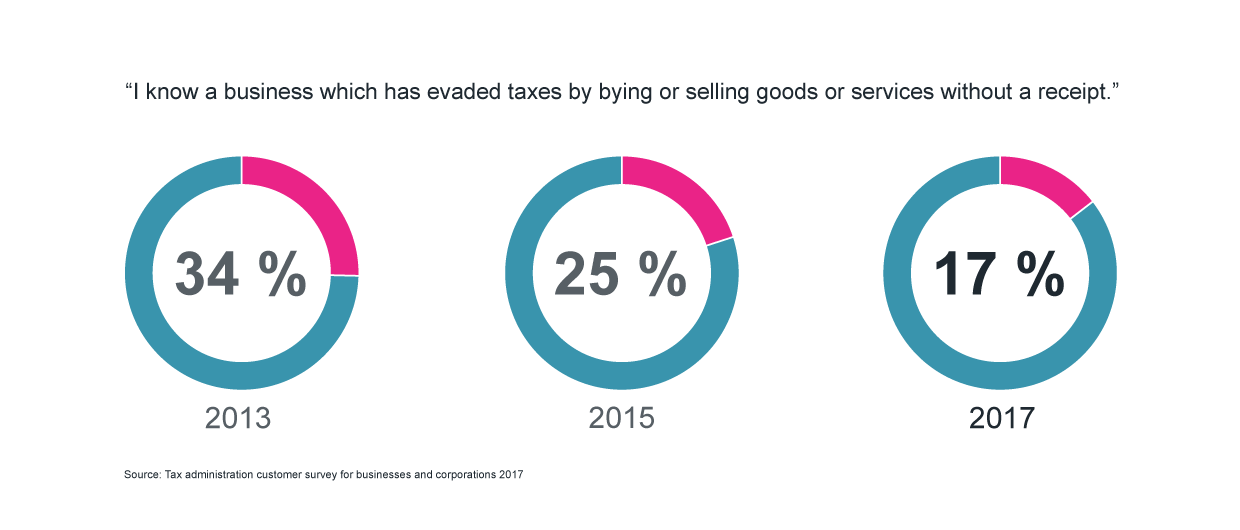

In 2019, 27 per cent of the survey respondents said they knew or knew of a business that had purchased or sold goods or services illegally without a receipt. The results show a significant turn for the worst, as the corresponding figure in 2017 was 17 per cent.

It appears that the previous surveys’ long-term downward trend in the share of people who know or know of businesses that operate illegally has ended. However, it should also be noted that a much higher number of respondents than before were able to say that they do not know any business that operates illegally.

Customers are mainly satisfied with how the Tax Administration operates

Overall, satisfaction with the way in which the Tax Administration operates has remained unchanged and only a few per cent of the respondents were dissatisfied. As in previous years, the respondents appreciated how up to date the Tax Administration’s services are. The respondents’ satisfaction increased the most regarding the predictability of the Tax Administration’s decisions.

Compared to previous years, the Tax Administration received a slightly lower rating for the level of expertise and reliability of its services. The backgrounds of the respondents had no impact on their attitudes towards the Tax Administration’s operations.

Respondents from 425 corporations were interviewed for the survey. The survey respondents represented the Tax Administration’s corporate customer segment evenly, ranging from small to large corporations. The survey was carried out by FeelBack Oy in the form of telephone interviews in October–November 2019. The survey has been carried out every two years, most recently in 2017.

Attitude survey results in more detail in Finnish (PDF 0,9 MB)

For further information, please contact: Janne Myyry, Senior Adviser, Finnish Tax Administration, +358 40 661 5347, janne.myyry@vero.fi

Is combating the shadow economy like firefighting? Prevention, rapid reaction, cooperation and information exchange are the cure

Published 11.6.2019

A survey about the shadow economy targeted at the authorities yielded plenty of information on challenges faced in combating it. The answers show that the shadow economy is becoming more international, professional and serious. The authorities call for enhanced cooperation and information exchange. They would like preventative measures and earlier intervention into the shadow economy.

The shadow economy is becoming more international and complex

Of the respondents, 84% were of the opinion that internationalisation has led to weaker opportunities in preventative efforts. Internationalisation is evident in problems related to foreign labour and money transfers via foreign bank accounts, for instance.

The shadow economy is becoming more serious and it is now more difficult to investigate its operations. So say 86% of the respondents. In the view of the authorities, financial crime has become professional, which is evident in, for instance, the use of companies for fraud or fraudulent conveyance. According to the respondents, more organised criminals are now involved in the shadow economy.

Authorities call for greater cooperation

Different authorities wrestle with similar problems and phenomena, but often only examine them from their own perspective. As a solution, they would like to step up cooperation and have a broader mandate to enhance their control efforts. For instance, the respondents would like to have joint investigation teams, engage in greater cooperation in practical operations and share knowhow. Information exchange between government organisations should be facilitated and obstacles to information exchange eliminated.

Preventative operations and early intervention are important

The respondents state that deficiencies in how companies attend to their taxes and other obligations should be public information. If a better overall picture were available of the condition and reliability of a company, this would serve to prevent the shadow economy. Of the respondents, 87% believe that increasing public availability of information on compliance with obligations could reduce the shadow economy.

The authorities are of the opinion that preventative measures against the shadow economy and real-time control are important, as retroactive control gives an advantage to shadow economy operators and financial criminals.

The survey of authorities was drafted by the Grey Economy Information Unit and carried out in March 2019. A total of 620 responses were received from 22 authorities and organisations engaging in statutory control efforts.

Refund fraud causes only a small percentage of the vat gap

Published 26.2.2019

VAT refunds under false pretences causes VAT losses of about EUR 30 million in Finland each year. However, refund fraud accounts for less than five per cent of the entire VAT gap, which amounts to about EUR 1.3-1.8 billion.

Fraudsters stand out

VAT refund fraud is committed when a fraudster applies for a VAT refund under false pretences and the Tax Administration pays this unjustified refund.

The Grey Economy Information Unit used special profiling to investigate those applying for VAT refunds under false pretences. Examination of the identified risk group could also be used to estimate the shadow economy VAT gap caused by refund fraud in Finland.

It was estimated that VAT refund under false pretences causes tax losses of about EUR 30 million annually.

Fraud is often committed by professional criminals

Europol estimates that organised crime is behind as much as EUR 60 billion in annual VAT losses in the EU. In Finland, refund fraud is committed by Finnish and foreign actors in the shadow economy – and organised crime has been involved, too.

To prevent crime, the Finnish Tax Administration has enhanced control of VAT refunds in recent years, developed new real-time control mechanisms based on assessment of tax risks, and stepped up co-operation with other authorities both in Finland and internationally, such as with the Estonian Tax and Customs Administration.

Companies ready to take responsibility for combating the shadow economy – more information, incentives and tools are needed

Published 26.2.2019

According to a survey conducted with companies, they consider the shadow economy to have a neg-ative impact on fair conditions of competition between companies. According to the respondents, becoming involved in the shadow economy is, as a rule, a conscious act; with the goal to achieve competitive advantage and obtain economic benefit.

The internationalisation of the shadow economy and fraud crime threaten the ability of companies to act correctly

The most important factors preventing companies from acting correctly are a foreign workforce, in-ternationalisation of the shadow economy, and the exploitation of companies in fraud crime. The companies responding to the survey also felt that organised crime is a threat to acting correctly.

According to them, the most common manifestations of the shadow economy are sales without receipt and phenomena related to the use of an undeclared workforce. In their work, the officials of employee organisations have most often encountered inadequate pay, violation of the terms of employment, and neglect with regard to employer contributions.

The volume of the shadow economy has remained unchanged

According to most of the companies, the volume of the shadow economy has remained unchanged during the past three years, though there were sector-specific differences between the responses. Slightly over half of the companies in construction were of the view that the shadow economy has decreased slightly or considerably, whereas more than 80% of the transportation companies were of the opinion that shadow economy has either increased or remained unchanged during the past three years. Unlike other sectors, most of the companies in the transportation sector felt that international-isation has increased the shadow economy during the past three years.

Companies to adopt a more prominent role in combating the shadow economy

Companies are willing to take more responsibility and a bigger role in combating the shadow econ-omy. According to the survey, more than 60% of the companies consider that the responsibility to combat the shadow economy belongs to companies rather than the authorities. However, the respond-ents considered active co-operation between companies and the authorities as an effective way to combat the shadow economy. The companies were also of the opinion that other effective means are tax incentives, control and audits, as well as supporting correct action. They felt that the general atmosphere and attitudes can be positively affected by acting correctly.

Better services are desired for the assessment of companies’ financial reliability

According to the respondents, companies are well-positioned to identify and find reliable partners. However, they would appreciate new, even better tools for combating the shadow economy. In par-ticular, better services should be available for recognising and assessing the reliability of partners. According to the respondents, the better availability and broader publicity of information on the ob-ligation compliance of companies would promote measures to combat the shadow economy.

Shadow economy - results of the survey of companies and officials in Finnish (PDF 340 kB)

Intra-Community trade fraud leads to major tax gap in Finland too

Published 21.5.2018

VAT losses due to intra-Community trade fraud amount to at least tens of millions of euros a year in Finland.

Fraudsters abscond once they have reaped the tax benefits

According to the European Commission, tax fraud in intra-Community trade causes VAT losses of as much as EUR 50 billion annually. VAT fraud cases in intra-Community trade are complex and such schemes often involve numerous actors in different countries. One of the key roles is that of the fraudulent intra-Community purchaser – referred to as a “missing trader.”

Missing traders are often fictitious companies that do not engage in actual business operations. During a four-year monitoring period, at least 100 intra-Community purchasers were active in Finland that had indications of intentional neglect of VAT.

Such missing traders caused a tax gap of about EUR 12-15 million per year. When other fraudulent actors connected to these missing traders are counted, the tax gap can rise to as much as EUR 35 million per year.

Fraudsters stand out

Special profiling was used to identify companies that probably engage in fraudulent intra-Community trade. Examination of the identified fraudulent companies could also be used to estimate the shadow economy VAT gap caused by intra-Community trade in Finland.

The missing traders identified during profiling were primarily limited companies. They most commonly engaged in wholesale, retail and construction. Such companies were often subject to assessment by estimation, and it was common for them to have tax debts. These companies paid scant taxes to the Tax Administration.

Missing traders comprise clusters of companies in the shadow economy – further research is needed

In terms of their operations, the missing traders identified during profiling were exceptionally strongly grouped in clusters of several companies. In addition, it was far more common than usual for these companies and their responsible officers to be connected to companies entered in the Estonian Trade Register. The largest cluster of companies in the target group comprised a total of 99 companies, 62 of which were Estonian.

Profiling and estimates were based on fraudulent actors found in tax audits. As few shadow economy cases had been analysed, statistically speaking, the analysis could only cover one role in intra-Community fraud: missing traders. Assessing the total tax gap caused by intra-Community fraud in Finland would require a more detailed analysis of other roles.

This article is based on a report by the Grey Economy Information Unit 1/2018

Companies identify the grey economy less frequently than before

Published 21.5.2018

In the autumn of 2017, the Tax Administration surveyed Finnish companies and entities’ views and attitudes towards taxes and the Tax Administration. Among other things, respondents were asked about the ways in which the values and strategy of the Tax Administration are visible to customers.

x

Of the strategic objectives, “it is worth for taxpayers to meet their obligations in full” was considered the objective with the most potential to be realised. No less than nine out of ten respondents felt this way. Only a small percentage of the respondents took the opposite view. At the same time, three out of four respondents were of the opinion that there are “minimal opportunities for error”. Nearly a fifth of respondents nevertheless felt that this had not been achieved.

An interesting detail revealed by the results was that the number of customers who agreed with the claim “I know or know of a company that has bought or sold goods or services undeclared, without receipts” had halved in the course of four years. In 2015, nearly a third of the respondents knew or knew of a company that has bought or sold goods or services undeclared, without receipts. This time around, 17 per cent of respondents agreed with the claim.

“Given that the percentage has declined systematically during the past two surveys, it is fairly safe to say that the trend is indeed declining,” says Janne Myyry, the Tax Administration’s research expert.

Customers also think that the Tax Administration’s values are realised well in its activities. Four out of five customers were of the opinion that the Tax Administration trusts its customers and operates in a way that allows customers to trust the operations of the Tax Administration.

The survey was conducted in the autumn of 2017 in the form of phone interviews to companies of various sizes, chosen through random selection. The survey has been conducted every two years.

Legal changes in the construction sector increased national tax revenue

Published 21.5.2018

Legislation changes made in the construction sector since 2011 – such as the VAT reverse charge, the Public Register of Tax Numbers, and contract and employee reporting – increased the payroll in the construction sector in 2015 by around €300 million in total. National tax revenue grew by €100 million in the same year.

Further, reporting of contract and employee details in the construction sector increased the tax revenue by €31 million. The increase was attributable to both employer’s contributions and VAT.

Foreign labour now better accounted for

With the extended duty to report on foreign employees, the number of foreign labour reported to the Tax Adminstration has increased. Wages paid to foreign employees now fall within the scope of taxation better than before.

The Tax Administration’s Grey Economy Information Unit studied how the legislation relating to the requirement of reporting on contract and employee details has affected the construction sector.

Estimate: More than half of the tax gap is attributable to intentional neglect

Published 21.5.2018

In Great Britain, conscious and intentional neglect is estimated to account for around 54 percent of the total tax gap. The remaining 46 percent are estimated to consist of errors and negligence, insolvency and disputes about the interpretation of law.

The tax gap means the difference between the theoretical tax receivable and the actual tax revenue. The size of the tax gap shows to what extent the tax payment obligations are met.

The Grey Economy Information Unit has published a Finnish translation of Great Britain’s tax gap report Measuring tax gaps 2014. One aspect analysed in the report is the division of the tax gap based on taxpayer behaviour.

The reverse charge mechanism in the construction industry increased VAT revenue by at least €75 million a year

Published 21.5.2018

The VAT reverse charge in the construction industry entered into force on 1 April 2011. The reverse charge mechanism means that the main contractor in a construction contract chain pays the Finnish Tax Administration the value added tax on all the construction services included in the contract.

On account of the amended legislation, the portion of VAT payable by main contractors has increaed significantly and the portion payable by subcontractors in the lowest level has decreased correspondingly.

The Grey Economy Information Unit has calculated the impact of the VAT reverse charge on VAT revenue in the “F Construction” sector. The calculation was based on analysing the transaction data of the tax account and the data in periodic tax returns submitted to the Tax Administration. The data before and after the tax reform were compared.

The reverse charge mechanism in the scrap industry would increase tax revenue by around €7–8 million a year

Published 21.5.2018

Tax audits performed in the scrap industry have revealed concealed sales, unjust VAT deductions and failures to report and pay taxes. Other shadow economy phenomena detected include straw men and the use of fake sales receipts.

The scrap trade report surveys the shadow economy activities detected in tax audits in the scrap industry, and particularly their effect on VAT revenue.

The report also discusses the application of the VAT reverse charge to scrap trade in Finland – how many companies would fall within the scope of the reverse charge and how big a benefit could be achieved by amending the legislation.