On the trail of the tax gap in e-commerce

E-commerce creates a tax gap in situations such as when a Finnish consumer does not submit a Customs declaration (the taxes remain entirely unpaid), or either undervalues the product or provides an incorrect description of the product in the Customs declaration.

Finnish Customs estimates that more effective monitoring of e-commerce deliveries would enable the collection of as much as millions of euros in more taxes per year.

When ordering from outside the eu, the consumer is responsible for taxes

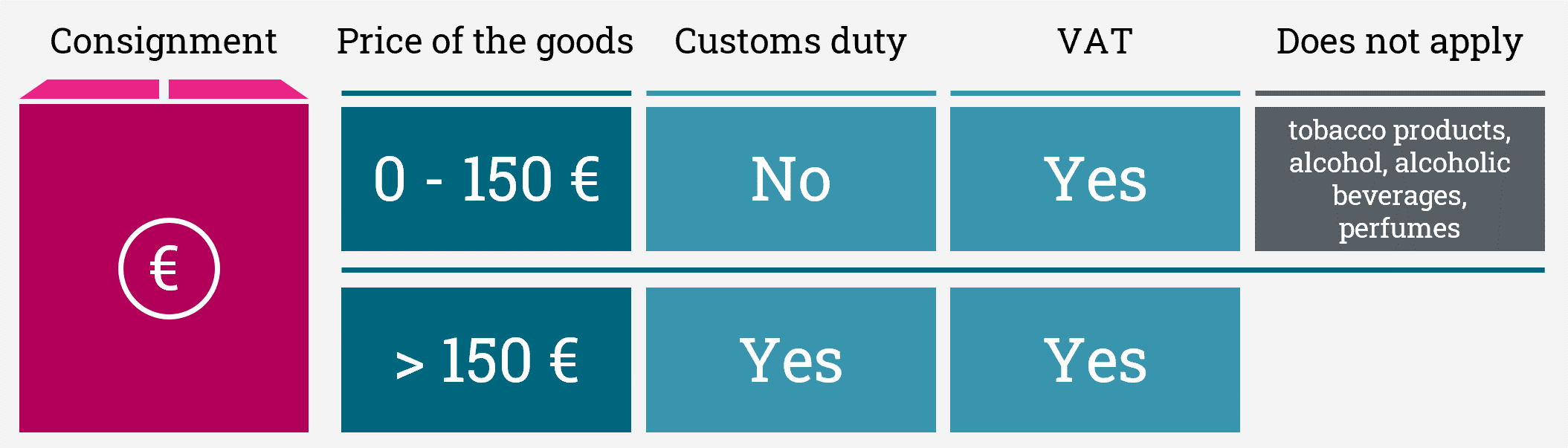

Those shopping online may often forget that the consumer is responsible for import taxes on goods bought from outside the EU. Value-added taxes must be paid for all deliveries.

The rule of thumb is that customs duties and taxes amount to about 30 per cent of the price paid to the vendor.

More information on shopping online is available on the Internet site of the Finnish Customs [.fi]›.

Online stores outside the eu may gain a competitive advantage through dishonest practices

Online stores outside the EU may help European consumers to avoid paying import taxes either partially or in full. According to Customs observations, such stores may underreport the value of their customers’ orders on the parcel tags. Some online stores also seek to enable customers to evade taxes and duties by declaring that the product is a sample or gift.

A consumer is not liable to pay import taxes when the goods imported from outside the EU are inside the EU at the time of sale. However, some online stores that are responsible for the payment of taxes do not submit periodic VAT declarations on imported goods, or underreport their value.

Taxes on imported goods might remain unpaid even when a declaration is made. In such cases, the online store sells out its inventory and empties out its bank account. The operations may have been transferred unchanged to a new company.

Will eliminating the tax limit for small consignments help reduce the tax gap in e-commerce?

All EU Member States started charging VAT for small consignments from online stores outside the EU by the beginning of july 2021, as the tax exemption for consignments of low value – that is, under EUR 22 – discontinued.

It remains to be assess what impacts this change will have on the tax gap or the total e-commerce volume. In spite of the elimination of the lower limit for VAT, online stores in third countries might still underreport the actual value of consignments.