Taxation

Key figures in the prevention and investigation of tax fraud

Source: Finnish Tax Administration

In the Finnish Tax Administration, the prevention of the grey economy focuses on the prevention and investigation of tax offences using a variety of tools. Work to combat negligence is carried out in the context of registration and verifying the accuracy of reported information. Effective disruption of fraudulent activities is the key. Operators with a significant tax risk are subjected to a tax audit as a matter of principle. The audit can also be carried out simultaneously with a pre-trial investigation. However, the volume of these real-time tax audits has significantly and continuously decreased because the Finnish Police’s resources for preventing financial crime have been overloaded. Some of the employees at the Finnish Tax Administration specialise in the prevention of more serious forms of grey economy. The Finnish Tax Administration classifies as grey economy targets all tax cases that are considered for reporting to the police. Different types of preventive work with stakeholders is also ongoing. Exchange of information affecting taxation between the tax authorities of different countries and international cooperation at large play an important role in the Finnish Tax Administration’s fight against the grey economy.

The Finnish Tax Administration also works with various authorities to combat tax offences and other forms of economic crime. Control events focus more specifically on the activities of companies in a particular sector. This cooperation ensures a comprehensive approach to the control, identification, and prevention of the various types of economic crime.

Dishonesty occurs throughout business life

Tax control measures uncover grey economy activities in all fields of business. In labour-intensive industries, the grey economy has changed with the introduction of invoicing service companies and light entrepreneurship. Phenomena of the grey economy are most commonly detected in car sales and electronic trade, and other cross-border business. Cross-border money transfers, virtual banks and different payment platforms increase need efforts for the Finnish Tax Administration to combat the grey economy.

Turnover of audited grey economy businesses

More than €10 million 2,6 %€2–10 million 6,5 %

Less than €2 million 48,9 %

Not known 42,0 %

Turnover for the last year audited for income tax purposes; if not available, turnover for 2021

The Finnish Tax Administration does not have information on the turnover of all grey economy actors, including foreign companies and companies that have been reported dormant or dissolved. This category also includes natural persons.

Control results in 2023

The euro amounts involved in grey economy tax audits have decreased from the previous years, even though the number of tax audits has remained at the same level. There are issues in obtaining the third party information and the operations of companies have changed with the introduction of new forms of work, and smaller companies are used for grey economy activities. Other control measures methods are continuously being developed to supplement audits. For employees specialising in more serious forms of the shadow economy, 93 % of the audited cases resulted in taxes being levied and around 86 % in consideration for reporting the offence to the police.

The Tax Administration’s bankruptcy petitions in 2023

In 2023, the Finnish Tax Administration filed a total of 1,375 bankruptcy petitions, the amount is approximately 15% more than in the previous year. The Tax Administration accounted for 38% of all petitions in 2023.

Criminal matters

The Finnish Tax Administration filed 890 reports of an offence in 2023. In addition, there were 320 other criminal matters in which the Tax Administration was a party but the pre-trial investigation was based on a report by another party.

A criminal case may contain several criminal offences, which is why the number of criminal offences is higher than the number of criminal cases. For example, an accounting offence is commonly associated with tax fraud. The focus of criminal cases involving the Tax Administration is on aggravated tax frauds (Chart 2a).

Judgment according to court

The number stands for criminal matters involving the Finnish Tax Administration in which a judgment was rendered in 2023. It is not the same as the total number of judgments rendered, as more than one criminal matter may be considered under each criminal proceeding and sentencing phase (Chart 2b).

Tax debts

The statistics show all tax debts, regardless of whether they are accumulated in the shadow economy or by other taxable entities. The challenging economic situation is reflected in the amount of total tax debt. In the first months of 2024, the amount of total tax debt has been some €200 million larger than one year before. From the main categories of tax debt, the most debt is seen in value added tax and income tax of individuals, which also includes amounts withheld by employers that have been not been filed and paid.

In Figure 1 (tax debt by main category), the amount of tax debt on 1 March 2024 is presented in main categories following the largest tax types. Figure 2 shows the breakdown of tax debt under the main categories in more detail, e.g. the division of excise duty debt between different types of excise duties. Figure 3 presents the total amount of tax debt on the review date of 1 March 2024. The figures can be filtered by tax year to identify the amount of unpaid taxes for each tax year.

The Compliance Report supports decision-making

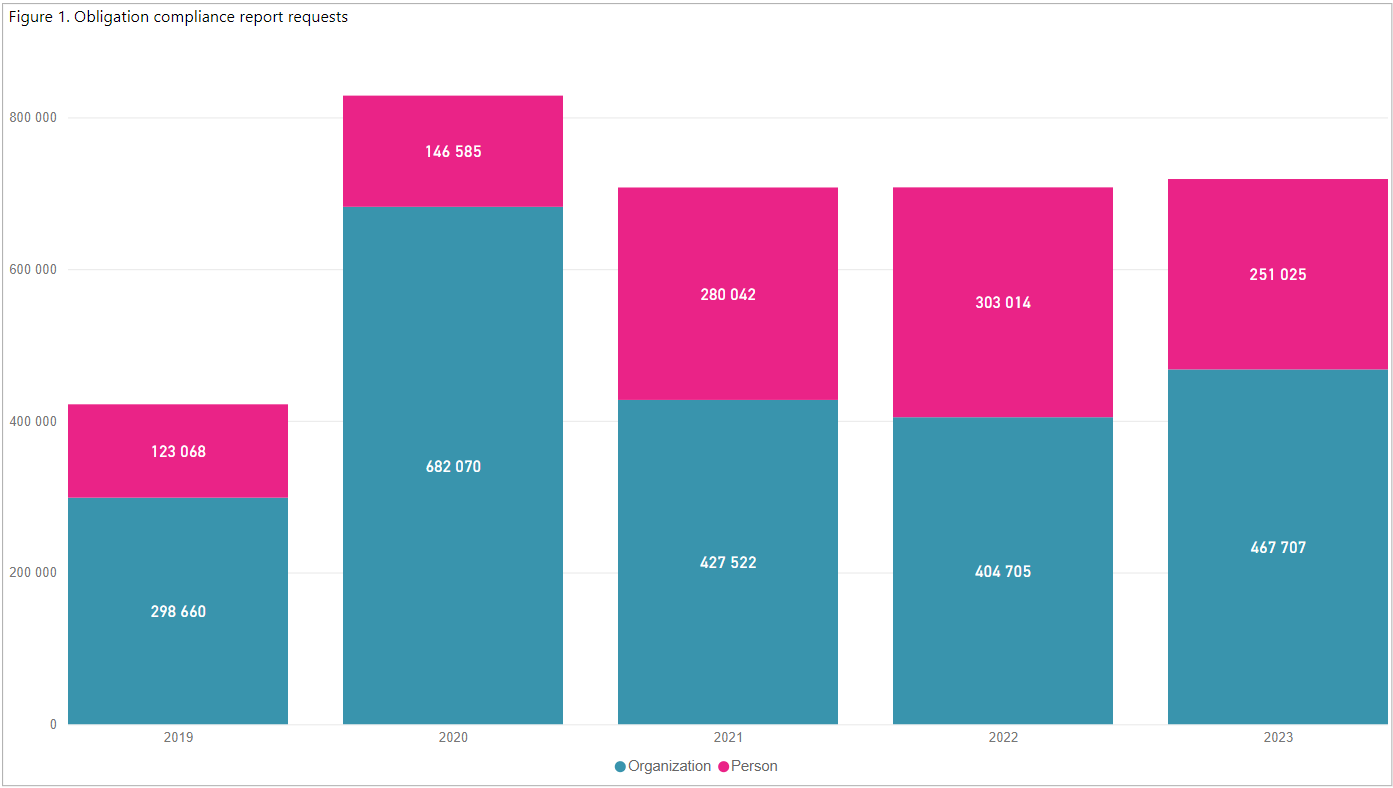

The information exchange between the authorities is at the core of the fight against the grey economy. It is difficult to make the right decisions without sufficient information on the financial standing of a subject or an applicant. The Compliance Report is an updated summary of the essential records held by the authorities. The Compliance Reports are issued by the Grey Economy Information Unit. The reports help authorities target and execute their control measures. The exchange of information between the authorities must always be based on the law.

The information on the Compliance Report is illustrative of the level of compliance of an organisation or a person with statutory obligations. The report includes information on activities, financial standing and compliance with obligations related to taxes, statutory pension, accident insurance and unemployment insurance contributions and fees levied by Customs.

The information on the Compliance Report is mostly based on information submitted by the subjects themselves. The report includes payroll information obtained from the Tax Administration, pension contribution information obtained from the Finnish Centre for Pensions and Customs information. The report also includes a possible extract from the enforcement register and information on bankruptcy and restructuring proceedings. The reports can be requested and received through an automated interface.

Act on Grey Economy Information Unit [.fi]› (in Finnish)