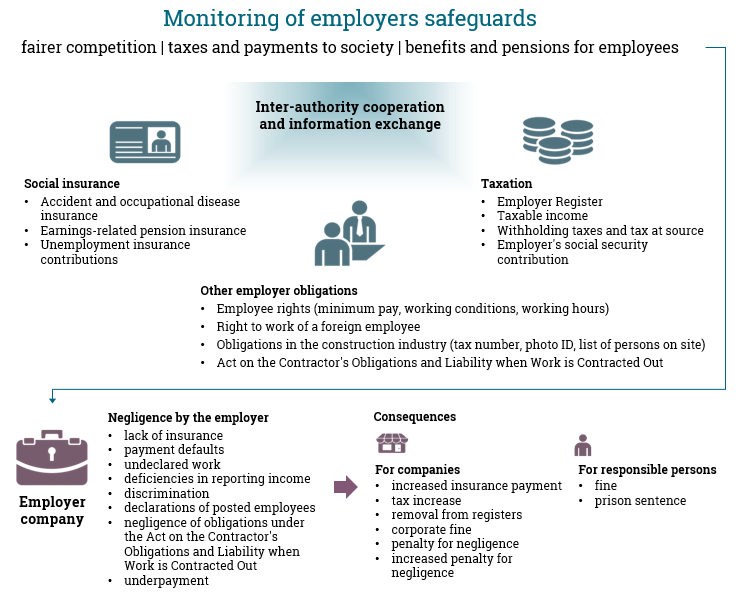

Employers and contractor’s obligations

Regional State Administrative Agency | Finnish Centre for Pensions | Finnish Workers’ Compensation Centre | Employment Fund

Regional State Administrative Agencies supervise companies that employ foreign workers in Finland

Source: Regional State Administrative Agency, OSH DivisionI

In 2023, the OSH Division carried out 2,490 inspections in companies operating in Finland that employ foreign workers. This included both companies registered in Finland and foreign companies that had posted their employees to Finland. This text is based on the 2023 inspections that were completed by the start of February 2024. Some 60 of the 2023 inspections were still in progress at that time, which means that the final number of inspections will be slightly higher than the figure given at the beginning of this text (2,490).

The inspections conducted under foreign labour supervision assessed whether the employers complied with Finland’s statutory minimum requirements set for the employment relationships of foreign employees in Finnish legislation and whether the employer had verified that their foreign employees have the right to work in Finland. The aim of the inspections was to ensure an equal and fair labour market for everyone and fair competition between businesses. In recent years, the Occupational Safety and Health Authorities have aimed at strengthening their role in uncovering and preventing labour exploitation, which is why a larger share of inspections focused specifically on supervising compliance with the minimum employment terms, i.e. wages and working hours.

In the 2023 inspections, cases in which it was suspected that employment relationships had been made artificially to appear as self-employment were highlighted more clearly than before. This phenomenon has become more common and is especially found in construction, but it has also been found in the cleaning industry, car repair shops and car washes, and in seasonal work. As the occupational safety and health authority only supervises work carried out in an employment relationship, it first needed to assess whether an employment relationship had been established. In supervision, this is assessed according to the characteristics of employment provided in the Employment Contracts Act. If the inspector deems that the inspected work is work carried out in an employment relationship, an improvement notice can be issued to the employer advising them to for example keep a record of their employees’ working hours or to issue pay slips. After issuing an improvement notice, the authorities may proceed to issuing binding administrative decisions including a notice of a conditional fine that oblige the employer to comply with the notice. The employer may request a judicial review of the decision from the administrative court.

Different types of inspections are used in foreign labour supervision. As in previous years, both limited and extended inspections were carried out in 2023. The limited inspections focused primarily on verifying that employees have the right to work and on collecting comparison data for inspections related to supervising compliance with the minimum employment terms. Limited inspections were also used in the follow-up supervision of individual responsibilities. The extended inspections involved both verifying that employees have the right to work and supervising compliance with the minimum employment terms. As agreed in the performance agreement, 50% of the inspections involved supervising compliance with the minimum employment terms.

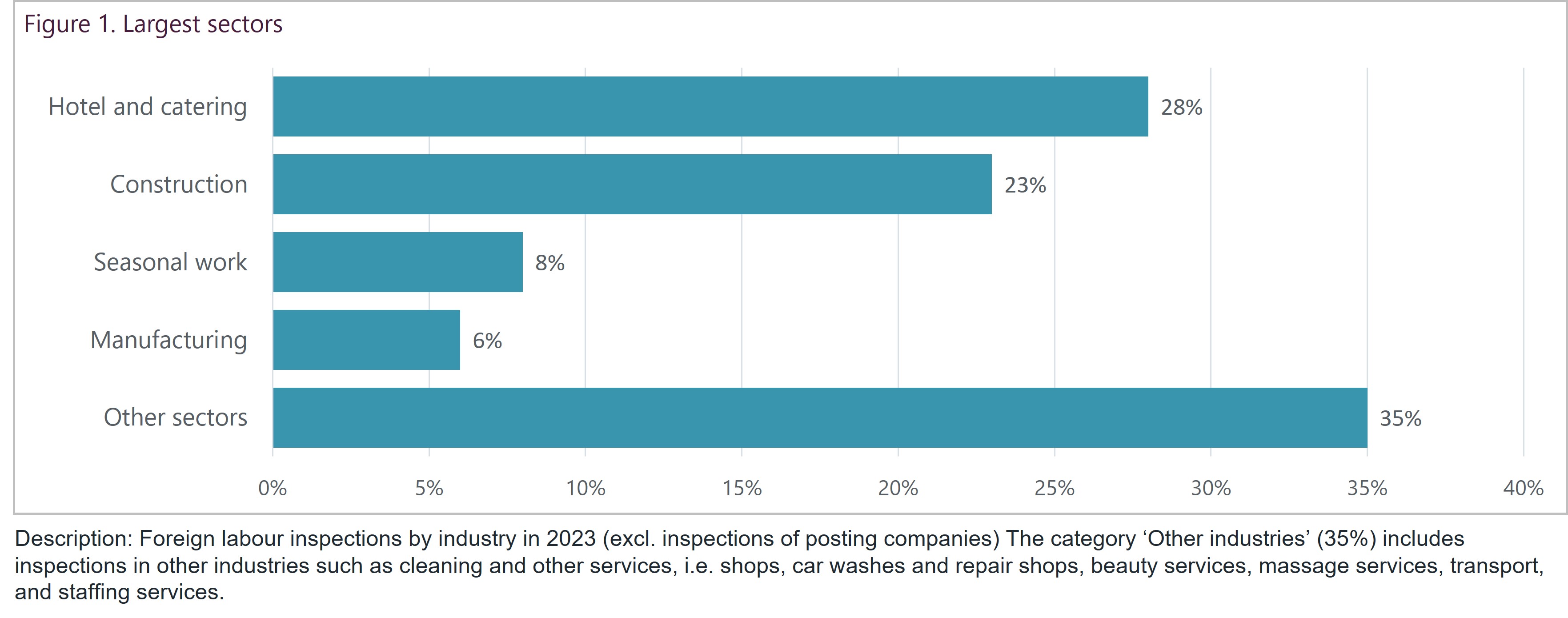

The largest share of the foreign labour inspections was carried out in the hotel and restaurant industry (28%) and in the construction industry (23%). Inspections were also carried out in manufacturing (6%) and industries involving seasonal work (8%), among others (Figure 1). Of the inspections, 35% targeted other industries such as cleaning, and other service companies, i.e. shops, car washes and repair shops, beauty services, massage services, transport, and staffing services. The share of inspections targeting other industries has increased from 2022.

Inspections were often carried out with other authorities. In 2023, more than 20% of inspections were carried out as a collaboration of multiple authorities. Most joint inspections were carried out with the Police of Finland. Several joint inspections were also conducted with the Finnish Tax Administration, fire safety inspectors and the Finnish Border Guard.

Several non-compliances with statutory minimum employment terms of foreign employees

A key issue that foreign labour inspections focus on is the supervision of compliance with the statutory minimum terms in the employment of foreign employees. These compliance inspections involve assessing whether the employer complies with the Finnish Working Hours Act and Employment Contracts Act and with the provisions on working hours and wages in the sector’s generally binding collective agreement in the employment of foreign employees. As agreed in the performance agreement, 50% of the inspections involved supervising compliance with the minimum employment terms.

In the foreign labour inspections, a significant number of deficiencies in compliance with the statutory minimum terms was observed in the employment of foreign workers. As in previous years, many wage-related deficiencies were found, and a wage-related deficiency was found in 47% of the inspections where the appropriateness of wages were inspected. Deficiencies of varying severity were found from missing evening work supplements to serious cases of labour exploitation.

Matters related to working hours were also a central issue in inspections involving the supervision of compliance with minimum employment terms. Records on working hours are often found deficient, which is reflected in the number of obligations imposed on employers. Deficiencies in records on working hours were found in 46% of inspections. The share of missing work schedules was 38%. In seasonal work, deficiencies in records on working hours were found in 40% of inspections. The share of missing work schedules was high at 71% of the inspections. Obligations related to working hours records and work schedules were imposed in situations where these documents did not exist at all or they were deficient. For working hours records, deficiencies were especially found recording working hours in project-based work.

Deficiencies is working hours records mean that the correctness of wages cannot be verified, as no information on the actual hours worked exists. Neglecting the provisions on working hours records and work schedules significantly affects the correctness of an employee’s wages.

The Occupational Safety and Health Authorities do not have the right to supervise compliance with collective agreements among employer organisation members. This means that the Occupational Safety and Health Authorities cannot supervise the wages of those employed by employer organisation members other than for the part of compliance with non-discrimination. Any failures to comply with the collective agreement and the wages set therein by companies that are members of an employer organisation are still reported to their employer organisation.

On 1 June 2023, the Occupational Safety and Health Authorities received the right to issue improvement notices to employers on wages, which can be escalated into an administrative decision including a notice of a conditional fine. An improvement notice can be issued if material and significant deficiencies are found in wages and the basis and amount of the wages can be unambiguously determined. Previously, only written advices could be given on wages even if the wages were very low. With the improvement notice employers are advised to remedy the deficiencies. Employers cannot be obliged to retroactively pay missing wages with notices. If the employer does not comply with the improvement notice, the Occupational Safety and Health Authorities can issue a notice of a conditional fine and oblige the employer to correct the wages to comply with the binding collective agreement.

In 2023, attention was also paid to whether employers observed the principle of non-discrimination in the payment of wages. In foreign labour inspections, the principle of non-discrimination mostly refers to ensuring no one is discriminated against in terms of wages due to their origin, nationality or language. In 2023, deficiencies in non-discrimination were found in 11% of the inspections where the matter was examined. The share has slightly increased from the previous year.

Workers without a right to work still found in many inspections

Another key element of foreign labour supervision is whether the employer has ensured their foreign employees’ right to work in Finland. In the OSH Division’s foreign labour supervision in which foreign employees’ right to work was examined, 10% of workplaces had at least one foreign employee with no right to work in their current role in Finland. This figure had slightly decreased from the previous year. Each employee’s residence permit defines the field(s) in which the permit holder can work. Working in an incorrect field was the most common deficiency.

Many deficiencies still found in wages paid to posted employees

The OSH Division carried out 181 inspections in foreign companies that had posted employees in Finland in 2023. Posting companies are mainly inspected based on documents. The inspections of posting companies mainly focused on supervising compliance with the minimum employment terms to prevent labour exploitation. In addition, all inspections involved examining the posting company’s compliance with the obligations for which a negligence fee can be imposed, which are appointing a representative, submitting a posting notice, and enabling access to information in Finland for the duration of the posting.

Most inspections related to posting workers were conducted in the construction industry, with more than half of inspections targeting construction companies. Manufacturing companies were the second largest group, and 33% of inspections involved them. The volume of discovered deficiencies in wages paid by posting companies was at the same level as in foreign labour supervision targeted at Finnish companies. Deficiencies in wages were found in approximately 50% of the inspections of posting companies. In addition, obligations were imposed in the supervision of non-discrimination in posting companies in nearly every seventh inspection (15%) in which the matter was examined. In addition, 147 inspections carried out in 2023 focused on verifying that the Finnish contractors of the posting companies complied with their obligations, i.e. the obligation to ensure that the posting company appoints a representative in Finland and submits a posting notification.

Data access rights used extensively

The occupational safety and health authority’s data access rights were exercised broadly in foreign labour inspections. Data access rights were exercised in more than 1,556 inspections. The exercise of data access rights has increased from 2022. The electronic case management system (UMA) of the Finnish Immigration Service was used the most. The UMA system is used to identify foreign employees’ right to work and information related to residence permit applications. The Incomes Register was also used in many cases. The Incomes Register has data on wages paid, and the information of employees met during inspections is compared with data submitted to the Incomes Register to identify any undeclared wages. The Incomes Register can also be used to identify the duration of any illegal work periods.

In addition to the UMA system and the Incomes Register, the Population Information System, the visa registry, compliance reports and the Finnish Tax Administration’s Raksi information regarding construction sites have been used in foreign labour supervision.

The Act on the Contractor’s Obligations and Liability when Work is Contracted Out combats the grey economy

Source: The Division of Health and Safety of the Regional State Administrative Agency for Southern Finland

The Division of Health and Safety of the Regional State Administrative Agency for Southern Finland is responsible for supervising compliance with the Act on the Contractor’s Obligations and Liability when Work is Contracted Out (1233/2006, “the Contractor’s Liability Act”) in the whole of Finland. The purpose of the Contractor’s Liability Act is to promote even-handed competition between companies and compliance with terms of employment. The Act provides contractors with tools to ensure that their subcontractors and partners providing temporary agency workers fulfil their statutory obligations, including regarding the payment of taxes and taking out pension insurance for employees.

Compliance with the contractor’s obligation to provide information is supervised with inspections

In 2023, a total of 1,393 contractor liability inspections were carried out, of which 48 were still in progress on 5 March 2024. The contractor liability inspections served to supervise the compliance of roughly 4,900 contractual partners with the obligation to provide information in agreements on the use of temporary agency workers or work based on subcontracting (Figure 1).

Data utilization was important in contractor liability supervision and collaboration between authorities. In 2023, supervision was targeted based on risks and phenomena rather than business sectors as usual. Information available to the authorities was broadly used in the selection of targets for supervision and in individual cases. Contract and employee information in the construction sector and compliance reports conducted by the Finnish Tax Administration’s Grey Economy Information Unit were in particularly extensive use, which the occupational safety and health authority obtains from the Finnish Tax Administration. The use of public-sector information has enabled supervising to be targeted more accurately at subcontracting agreements and agreements on the use of leased employees, in which the companies carrying out work have flaws in the fulfilment of their statutory obligations.

In 2023, follow-up inspections were carried out in companies where deficiencies in compliance with the obligation to check had been found in previous inspections. The project assessed what impact the obligations issued during previous inspections has had on compliance with the Contractor’s Liability Act and whether contractors have made changes in their operations as a result of the previous inspections. The project’s results showed that most contractors had made changes after the previously issued obligations. During the project, it was discovered that contractors had provided training for their personnel, prepared agreement templates, deployed electronic services and information systems, and adopted practices stricter than the minimum requirements set out in the Contractor’s Liability Act. Then again, the results show that there is a significant need for follow-up inspections. In only 18 follow-up inspections (13 per cent of all inspections conducted during the project) the contractor had complied with their obligation to provide information correctly, even though 96 contractors had made changes (66 per cent).

Summary of 2023 supervising results

Of the inspections carried out, the contractor’s obligation to provide information had been complied with in the scope required by legislation in 300 inspections, two thirds of which concerned the construction sector. The high figure in the construction sector can partly be explained by the follow-up project, but also by worksite inspections carried out at the level of main contractors. Even though awareness of the contractor’s liabilities is higher in the construction sector than in other sectors, supervising results show that there are still flaws in compliance with minimum legal requirements, especially in long subcontracting chains.

When the occupational safety and health authority observes an unlawful situation, it issues written advices and may impose a negligence penalty on the contractor. Slightly under 2,200 written advices were issued. The highest number of written advices per inspection were issued to foreign contractors. They were followed by inspections regarding construction companies, industrial companies, and inspections targeted at seasonal work (Figure 2).

The use of public-sector information was reflected in inspections resulting in further measures. A negligence fee was considered in 80 inspections; four in five inspections involved using data received from other authorities based on the data access right as comparison data. Imposing a negligence fee was most often considered in the case of foreign contractors (Figure 3).

A negligence fee may be imposed if the contractor has:

1. neglected its obligation to provide information;

An increased negligence fee may be imposed if the contractor has:

2. made an agreement on work specified in the Contractor’s Liability Act with a self-employed individual who has been subject to a ban on business operations pursuant to the Trading Prohibition Act (1059/1985) or with a company whose co-partner, board member, CEO or other comparable person has been subject to a ban on business operations; or

3. made an agreement of the type specified in the Contractor’s Liability Act even though the contractor must have known that the partner does not intend to comply with statutory obligations and payments as the contracting party and employer.

In most cases, the negligence fee was considered on the grounds of the obligation to provide information being neglected. In individual cases, a negligence fee was considered in individual cases on the grounds that the contractor must have been aware that the other party to the agreement did not intend to fulfil its statutory payment obligations as the contracting party and employer. In every case, one or more foreign companies acted as the contracting party. These types of cases often have indications of underpayment and underpricing.

It was also observed in supervisory activities that, in subcontracting chains, the number of foreign self-employed individuals has continued to increase even further. Supervision cannot always provide full certainty to determine whether the question is of appropriate self-employment or “bogus self-employment”. Bogus self-employment enables employer obligations to be evaded, and the person may not always know that they are a self-employed individual. In the worst case, these situations may be linked to labour trafficking or involve other milder forms of discrimination.

Accuracy of earnings-related pension insurance has remained at a good level

Source: Finnish Centre for Pensions (ETK)

One of the statutory tasks of the Finnish Centre for Pensions is to supervise earnings-related pension insurance. It supervises insurance taken out under the Employees Pensions Act and the Self-Employed Persons’ Pensions Act. Ensuring that employers and the self-employed have equal responsibilities with respect to the insurance obligation promotes equal competition between companies and prevents the shadow economy. Supervising insurance also helps pension providers administer the insurance and collect pension contributions, which helps secure the funding base of the earnings-related pension scheme. With its supervision, the Finnish Centre for Pensions (ETK) also secures pension provision for employees and self-employed persons as required by law.

Supervision of employers’ earnings-related pension insurance obligation

Employers generally meet their pension insurance obligations well, but supervision by the Finnish Centre for Pensions reveals deficiencies in pension insurance in almost all sectors. The results indicate that the sum of earnings missing from the insurance contributions decreased in 2020–2023 compared to previous years (Figure 1). Since 2019, employers have reported earnings payments to the Incomes Register whereas, before that, they were reported to several different parties, including pension insurance providers. The change of reporting method has most likely reduced the number of mistakes and therefore decreased the sum of earnings missing from insurance contributions.

Figure 2 presents numbers relating to the supervision of how well employers meet their earnings-related pension insurance obligation. In 2023, the Finnish Centre for Pensions took a closer look at how 3,892 employers met their insurance obligation. Around 411 employers (affecting about 5,626 workers) showed shortcomings in meeting their insurance obligation.

Supervision of self-employed persons’ earnings-related pension insurance obligation

As shown in Figure 3, about 4,774 self-employed persons were placed under enhanced supervision and 1 361 new insurance policies were taken out in 2023. The number of YEL insurance policies taken out in connection with supervision increased in 2023. The pension insurance supervision figures for self-employed persons have remained at the same level for several years now. Figures for 2019 and 2020 are different. In 2020, supervision was carried out based on data from two tax years (2018 and 2019). As a result, the number of supervised self-employed persons was higher.

Every year, the Tax Administration provides ETK with tax data on around 180,000 self-employed persons, and shareholders of business partnerships and consortiums for insurance supervision. Supervision of self-employed persons using invoicing services is based on the data reported to the Incomes Register. This data is compared with YEL insurance data.

Supervision of Finnish Workers’ Compensation Centre 2023

Source: Finnish Workers´ Compensation Center (TVK)

Employers are obliged to provide workers` compensation insurance to their employees. The employer is obliged to provide workers` compensation insurance when earnings from work paid to all employees exceed EUR 1,400 (1,500 euros in 2024) in a single calendar year.

The supervisory obligation of the Finnish Workers´ Compensation Center (TVK) is based on the Workers’ Compensation Act. Mass monitoring by TVK covers all employers in Finland, and it was started in 2016.

TVK’s supervision has become more effective and current since 2020 due to being able to use the data in the Incomes Register. Negligence can be addressed quickly after being observed. The number of employers who have neglected their obligation to take out workers’ compensation insurance decreased from the previous year, but was still higher than in the years before 2022. Negligence is often based on unawareness of insurance obligations and the grounds for these obligations: for instance, the difference between an employment relationship and self-employment as well as the earnings and age limits for the insurance obligation.

The employers who have neglected their insurance obligation are a heterogeneous group comprising not only Finnish companies but also foreign companies and household employers.The companies were divided across different sectors, had often operated for several years, and were mostly in the under EUR 400,000 turnover categories. Uninsured wages totalled roughly EUR 33.7 million in 2023.

The Employment Fund monitors the accuracy of earnings payment data submitted to the Incomes Register

Source: Employment Fund

The Employment Fund imposes and collects statutory unemployment insurance contributions, as well as monitors the fulfilment of obligations related to employers’ unemployment insurance contributions. The Incomes Register’s earnings payment data has been used as the basis of determining unemployment insurance contributions since 1 January 2019.

The Employment Fund focuses on ensuring the accuracy of earnings payment data in the Incomes Register. In its monitoring activities, it investigates any incorrect or otherwise irregular earnings payment data. In addition to the data submitted to the Incomes Register, information sourced from other authorities is used in monitoring.

The Employment Fund consults employers in investigating the accuracy of earnings payment data. If an error is identified in the Incomes Register’s earnings payment data, the employer in question will be requested to correct the data in the Incomes Register. Errors typically come from errors in payroll systems or the lack of knowledge of payment obligations. In the end, the Employment Fund can impose unemployment insurance contributions by assessing the information obtained through monitoring activities if the employer does not correct the data in the Incomes Register despite requests.

As a result of the deployment of the Incomes Register, the number of monitoring cases and the amount of additional charges imposed due to monitoring have decreased significantly. It is possible that the deployment of the Incomes Register has somewhat reduced situations where the wage amount reported as the basis of unemployment insurance contributions is too low.

The Incomes Register has also made monitoring a more real-time activity. The Employment Fund can already investigate the accuracy of earnings payment data a few months after the payment of wages, also making it easier to identify the situation with employers. This also prevents any recurring errors more effectively.