Business activities outside registers

Business activities outside official registers

Publication date 18 September 2023

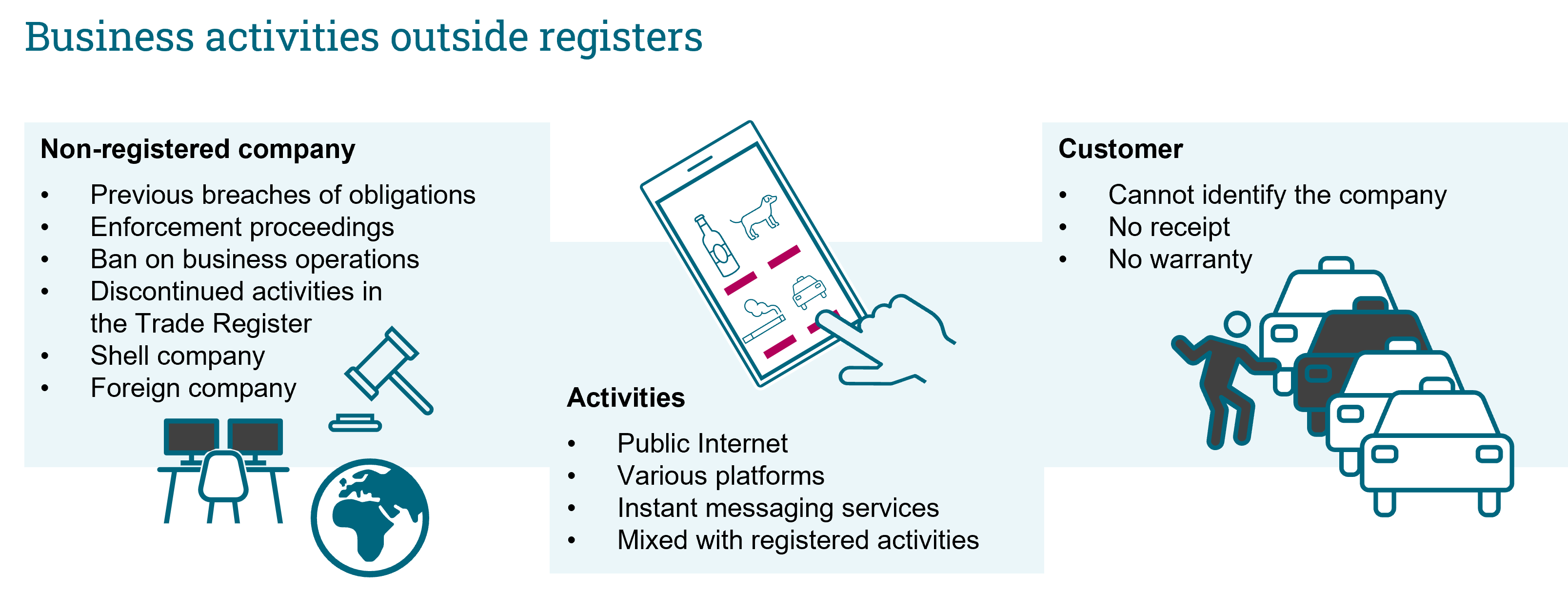

According to the authorities that combat the shadow economy, business activities are increasingly carried out outside official registers. The shadow economy involving non-registered companies is linked to the avoidance of taxes and statutory insurance contributions. In addition, such companies may also breach other legislation and safety regulations. Business activities may need to be entered in registers of several authorities.

Business activities are financial business or professional operations, the aim of which is to gain profit by selling, producing, exchanging or leasing products or services. When business activities are carried out outside official registers, undeclared income is generated, undeclared wages may be paid and other provisions may be breached, including environmental legislation and provisions on food or consumer safety. Operators may also apply for unfounded social benefits at the same time. The accurate and up-to-date content of registers lays the foundation for official supervision and also safeguards the interests of consumers. Business activities carried out outside official registers may place consumers at risk if, for example, the indicated product properties do not meet the facts or a service provider does not have the skills required.

What business activities are carried out outside registers?

Business activities can be carried out outside registers wholly non-registered without any business ID or through a discontinued shell company that has not been added to the Finnish Tax Administration’s VAT, prepayment or employer registers. A limited liability company may have been discontinued in the Trade Register, while its operators continue shadow economy activities in the company’s name. In addition, foreign companies operate in Finland that do not register with the Finnish Tax Administration regardless of being requested to do so. Similarly, non-registered business activities can be carried out in the name of associations.

Usually, non-registered business activities are carried out in various sectors, with part of activities being subject to a licence and part even being illegal. During supervision, non-registered restaurant activities, unlicensed taxis, pet, cigarette and alcohol trading, currency exchange activities and the organisation of illegal entry into Finland have been discovered, among others. Sales are often carried out similarly to registered activities on websites, online shops and various platforms, and using instant messaging apps, for example. Activities may be openly available or targeted at a limited group of people. An entrepreneur’s previous breaches of obligations, bans on business operations or enforcement proceedings may cause business activities to be carried out outside registers.

Business activities cause obligations and responsibilities

Companies differ from one another in terms of their size, products and operations, while they may all have similar obligations. A company engaged in business activities has an accounting liability and must see to its tax obligations. Furthermore, companies often also have a VAT liability. Some “light entrepreneurs” are self-employed individuals, which means that they also need to comply with provisions on business activities. Everyone engaging in business activities is obligated to learn about any provisions and regulations governing their line of business and operations.

Self-employed individuals must take out statutory pension, unemployment and accident insurance, as well as any sector-specific insurance. Companies are responsible for their products and services, which are also often subject to a warranty. In addition, various other obligations have been set for business activities to protect consumers. Before selling any products or services, a company must provide consumers with relevant information about the self-employed individual or the company. If there are several operators with an identical or fairly similar names, the actual seller might remain unclear if it were not for an individual business ID. The obligation to give a receipt obligates sellers engaged in business activities to offer receipts to their customers if a payment is made in cash or using a similar payment method, including a payment card. When operating in online shops, companies must also comply with distance selling regulations on the information to be provided, order confirmations and cancellations.

If business activities are subject to a licence, the licence must be obtained from the authorities before the start of operations. Licensed business activities include the serving and sale of alcohol, as well as taxi operations. In some situations, the start of business activities must be reported to the authorities, even if the activities were not subject to a licence. For example, outlets that sell foodstuffs must, before starting to use the establishment, submit a report to the food supervisory authority or apply for the approval of food premises. Furthermore, business activities must meet requirements set for the import of animals and the provisions of the Environmental Protection Act and the Waste Act, for example. Environmental permits are required in food and feed production, the forest industry, and fish farming. In addition, certain activities require professional skills acquired through education. For example, a professional electrician must have a suitable degree and a taxi driver must have a taxi licence issued by the authorities.

Business activities outside registers sets challenges for supervision

The authorities have detected shadow economy activities in registered and non-registered companies alike. Any decrease in the financial situation and an increase in general costs may cause more business activities to be carried out outside registers. The diversity of the business markets makes it necessary to combat the shadow economy in various ways and develop official supervision continuously. Combating has been promoted by developing the exchange of information between the authorities and expanding the obligation of companies to provide information, as well as through extensively public business information, the obligations set out in the Act on the Contractor’s Obligations and Liability when Work is Contracted Out, and the authorities’ communication campaigns.

The system of tax credit for household expenses also helps reduce non-registered business activities. However, it is only targeted at certain sectors and the performance of work. As a result, any undeclared sales of goods and leasing by companies fall outside the scope of the system. It still encourages companies to see to their obligations and enter in the Finnish Tax Administration’s registers.

Information exchange and cooperation between authorities is important in preventing non-registered business activities, as activities are often linked to the supervisory field of various authorities. The authorities detect non-registered business activities during supervision and using comparative details and tip-offs effectively. Citizens’ alertness and the significance of tip-offs given to the authorities are emphasised in non-registered activities. The combating of the shadow economy ensures the accuracy of tax revenue and insurance contributions, enables a fair competitive market for companies, and protects the safety of consumers and the environment.

The Grey Economy Information Unit will publish reports on non-registered business activities on the basis of tax information in 2024.

How can I check whether a company is registered and what does registration mean?

- You can enter a business ID in the company search of the Business Information System (ytj.fi) to check whether the company in question is in the Finnish Tax Administration’s registers and the Trade Register.

- Companies must enter their business ID in their business letters and forms.

- Companies must provide their customers with receipts in cash sales and comparable payment card sales. Each receipt must also include the company’s business ID.

- Most companies are engaged in activities subject to VAT, which means that they must also be in the VAT register.

- If a company is in the prepayment register, payers do not need to withhold taxes from any non-wage compensation for work or royalty they have paid. The prepayment obligation does not apply to the sale of goods or leasing, for example.

- Any breaches of obligations by companies’ responsible persons in other companies they have previously run or any bans on business operations may prevent companies from being entered in the prepayment register.

- You can give a tip-off regarding non-registered business activities on the websites of different authorities.