Projects and control

Finland updates risk assessment of money laundering and terrorist financing

The Ministry of Finance, the Ministry of the Interior 8.2.2024

Unofficial international money remittances involve a very high risk of money laundering and terrorist financing. In addition, public authorities responsible for anti-money laundering and countering the financing of terrorism and other key actors consider the risk to be high for virtual currency providers, banks and payment service providers.

The Ministry of Finance and the Ministry of the Interior have partially updated the Nation Risk Assessment of Money Laundering and Terrorist Financing that they published in 2021.

Shortcomings remain in the exchange of information between public authorities, with the private sector and between obliged entities. This is a significant risk in a variety of sectors.

Virtual currency providers have the highest number of individual money laundering risks. The industry is continually developing, and it is particularly important that public authorities stay up to date with current trends.

Public authorities have improved their ability to identify terrorist financing in many ways, but they should continue to specialise in the investigation and prosecution of terrorist offences. The risk management of obliged entities also needs improvement.

Impact of Russia’s invasion of Ukraine analysed

The impact of Russia’s invasion of Ukraine on money laundering and terrorist financing is one of the phenomena that the ministries analyse in the risk assessment. Various methods of circumventing sanctions emerged as a key risk.

Corruption and the use of remote services are the other phenomena analysed in the risk assessment. Cybercrime is considered the largest risk in remote services. The challenge of identifying corruption, particularly in political decision-making, is one of the risks relating to corruption highlighted in the assessment.

Updated action plan

The Ministry of Finance and the Ministry of the Interior have also updated the risk assessment’s action plan for this and next year.

The strategic priorities of the action plan are to:

- raise general awareness of money laundering and terrorist financing;

- enhance information exchange and statistical compilation and further develop national legislation;

- implement measures to mitigate the most significant individual risks highlighted in the assessment;

- further develop digitalisation in supervising the prevention of money laundering and terrorist financing and in risk management.

Unregistered hawala operators have been included in the action plan for the first time. There is a very high risk of money laundering and terrorist financing associated with these unofficial international money remitters.

Government adopts resolution

The Government adopted a resolution on the partial update of the risk assessment and action plan on 8 February. Together, the risk assessment and the action plan describe Finland’s national understanding of the risks of money laundering and terrorist financing and of the methods to manage those risks.

National Risk Assessment of Money Laundering and Terrorist Financing 2023, partial update [.fi]› (Institutional Repository (Valto))

Information on preventing money laundering and terrorist financing [.fi]› (moneylaundering.fi)

Collaboration between Finnish Customs and the Finnish Food Authority aims to prevent and reveal crime in the food chain

Source: Finnish Food Authority, Customs 21.11.2022

Food fraud is considered a phenomenon of international fraud in the strategy and action plan for tackling grey economy and economic crime in 2020–2023. The Finnish Food Authority and Finnish Customs have started a collaborative project to prevent food fraud. The project focuses on preventing food fraud in cross-border goods transport in accordance with the action plan.

In 2020, Finnish Customs established a separate project group to enhance food safety, reveal misconduct related to food safety, and prevent and reveal crime in the food chain. A project manager was appointed for the group on 1 April 2021. The Finnish Food Authority also created a crime prevention team in 2021. One fixed-term member of the team is a specialist in customs collaboration. The Finnish Food Authority and Finnish Customs started the collaborative project on April 2021, and the work will be carried out between 2021 and 2023.

Joint pilot produced results

In the early stages of the project, descriptions were drafted of the Finnish Customs’ and the Finnish Food Authority’s processes for revealing and investigating food fraud. The practical planning for making collaboration and coordination more efficient was then started. As a result, a joint pilot project between the Finnish Customs and the Finnish Food Authority was created that focused on targeting supervision at the import of spices, fresh berries and meat products. The pilot was carried out in three stages between May and September 2022. The Finnish Customs’ Enforcement Department, Offices Department, Foreign Trade and Taxation Department, Customs Laboratory and food sniffer dogs have contributed to the development of the collaboration between Finnish Customs and the Finnish Food Authority and the joint pilot project. From the Finnish Food Authority, the crime prevention team, the Laboratory and Research Division, and municipal food control authorities participated in the project.

Based on the pilot results, identifying the specialist competences of the Finnish Customs and the Finnish Food Authority and intensifying collaboration are vital for revealing food fraud in goods transport. The joint pilot produced valuable information on the collaboration between Finnish Customs, the Finnish Food Authority and the municipal food control authorities. This information can be used to further make the collaboration between the authorities in preventing crime in the food chain even closer and more efficient.

Image caption: Handler Seija Kontunen and sniffer dog Aino (left); Satu Virtaranta, Finnish Food Authority Specialist; and handler Kimmo Linden and sniffer dog Rico participated in the joint project between Finnish Customs and the Finnish Food Authority.

New cooperation model for the prevention and supervision of the exploitation of migrant workers

Source: Police University College 10.6.2022

Efficient supervision of labour migration requires close cooperation between the authorities. For the authorities to collaborate systematically and to jointly choose the targets of supervision, clear leadership and powers are required.

Together with a number of public authorities, the Police University College has prepared a new cooperation model for multi-authority action to prevent and supervise the exploitation of migrant workers. The cooperation model is presented in the report that outlines the key results of the project ‘Creating policy models for the police to support the planned management of multi-authority action’, implemented by the Police University College. The report states that successful multi-authority action is based on active and motivated planning, joint implementation of the activities, and provision of feedback.

“When risk-based targeted supervision is implemented in accordance with the cooperation model, it is possible to establish uniform procedures for multi-authority action throughout Finland. This will facilitate more consistency in the leadership of operations and the detection of and intervention in cases of exploitation of migrant workers,” says researcher Kimmo Kuukasjärvi from the Police University College.

“In the cooperation model, risk-based targeted supervision comprises three stages: planning, implementation and feedback and follow-up measures. The exchange of information between the authorities must be a low-threshold activity. It is important that the roles and responsibilities of each authority are specifically planned, so that the actual supervision event can be implemented efficiently,” says Tarja Valsi, Deputy Director at Finnish Tax Administration.

Mobile application communicates information about employee rights and obligations

The project also developed a mobile application called ‘Work Help Finland’ for migrant workers coming to Finland or already staying in Finland. The application shares information about the rights and obligations of employees and the key parties that provide help. Persons in a vulnerable position are a special target group, for example if they suspect having been exploited.

“The content of the application has been translated into 24 languages, to enable migrant workers to access information about the rights and obligations of employees in their native language,” says Superintendent Olavi Kujanpää.

The content of the application complies with the information package Working in Finland, available on the website of the Ministry of Economic Affairs and Employment, but provides more comprehensive information about the obligations of employees as well. The application does not collect any identifying information about its users, and it is available for downloading, free of charge, in app stores.

“In the course of practical supervision in the field, it has been noted that for example the insufficient language skills of migrant workers significantly restrict their possibilities to get and find information. In such cases, the workers only get information provided by their employer or “fellow countrymen” and intermediaries. Unfortunately, such information is often distorted. The new application has been developed to address this problem,” says Minna Willman-Koistinen, Senior Specialist at Finnish Food Authority.

“The application completes the range of methods available for various public authorities in preventive work, and it enables sharing information about working in Finland with foreign employees at a low threshold,” says Katja-Pia Jenu, Senior Officer serving as Occupational Safety and Health Inspector.

Labour exploitation has been prevented for more than two decades

As part of the project, the European Institute for Crime Prevention and Control (HEUNI) prepared a review of how Finland has tackled the exploitation of migrant workers and labour trafficking. The wake-up call to the phenomenon came in the early 2000s, but particularly in the past decade, action against exploitation has progressed and become an established part of the operating field of various authorities and other parties.

“More victims of labour exploitation are identified in Finland than in the other Nordic countries. According to our analysis, this is related to the fact that we understand labour exploitation as a broader phenomenon,” says Anniina Jokinen, Senior Programme Officer at HEUNI.

Even though several positive steps have been taken in the action against human trafficking and labour exploitation, many problems related to criminal liability and victims’ rights still come to light. According to the report by HEUNI, systematic multi-authority cooperation is crucial for a comprehensive approach to these problems, one that takes into account victims’ rights and enhances employees’ awareness of their rights.

”Matalat kynnykset on helpointa ylittää.” Työperäisen hyväksikäytön ja ihmiskaupan torjunta moniviranomaistoiminnassa [.fi]› (“Low thresholds are the easiest to cross.” Prevention of labour exploitation and human trafficking in multi-authority action, abstract in English)

Katsaus työperäisen ihmiskaupan vastaisen toiminnan kehitykseen Suomessa [.fi]› (”Report on the development of action against human trafficking related to labour exploitation in Finland”, summary in English)

Mobile application called ‘Work Help Finland’ in Finnish (PDF 875 kt)

The National Enforcement Authority Finland’s RATKE and Grey projects use the latest technology

Source: Office of Director General, 20 December 2021

The National Enforcement Authority Finland has two projects underway, RATKE and Harmaa (Grey), that use the latest technology. Their purpose is to improve the efficiency of access to the data required in enforcement proceedings, the review of data, and decision making using robotics and data analytics.

The Ministry of Finance has granted special funding for emerging technologies for the project aimed to automate enforcement solution proposals. The goal of the RATKE project is to improve the efficiency of enforcement activities by automating the processing of data using robotics. The Grey project supports the goals of tackling the grey economy and economic crime. It develops methods based on data analytics to process large volumes of data in enforcement systems and identify cases that require a more detailed investigation. Gofore Oyj acts as the supplier in both projects.

Robotics to support enforcement officers

The RATKE project serves to build new interfaces in Uljas, the National Enforcement Authority Finland’s data system, and automate the enforcement process by automatically providing enforcement officers with proposals for decisions and measures.

“From the enforcement perspective, this means that data obtained through interfaces such as bank account and Incomes Register data is already being and will be processed automatically. The responsibility for decision making still rests with officers,” says Riina Tammenkoski, senior administrative bailiff at the National Enforcement Authority Finland.

The project will be completed by the end of 2022.

Large data volumes can be screened using data analytics

Having a large number of enforcement customers makes it difficult to identify cases that require special measures. The Grey project uses data analytics, which means that data is made available to users for interpretation in the desired format. Data analytics helps to more easily identify cases that require special measures from large data volumes and, in this way, measures and investigations can be better allocated.

“Uljas, the enforcement data system, contains the entire enforcement process and all the data involved in a single database, which offers an excellent starting point for the deployment of analytics. In practice, data analytics helps to process large data volumes and identify the cases that require further investigation,” Tammenkoski says.

The recently deployed Power BI system, which is also used to compile enforcement statistics, was selected as the tool in the Grey project. Power BI is a collection of software services, applications and gateways that convert data obtained from unconnected sources into consistent and visual format. When the Grey project ends, the National Enforcement Authority Finland will have the first version of data analytics for the enforcement process, including one or two key analytics features. For data analytics, this is only the beginning, as it will be used broadly in the processing of data in the future, certainly also in enforcement proceedings.

The Grey project is part of the strategy and action plan for tackling the grey economy and economic crime.

New EU Regulation enhances controls on cash at the borders

Source: Customs 17.5.2021

In June, there will be changes to controls on cash in border traffic, when the new Regulation on controls on cash entering or leaving the Union becomes applicable in the European Union on 3 June 2021. Among other things, the new Regulation extends the definition of cash and harmonises the declaration practices. In Finland, movements of cash are controlled at border crossing points by Finnish Customs. The aim of the controls is to prevent money laundering and terrorist financing.

The new Cash Controls Regulation replaces the earlier Regulation, which entered into force in 2007. As the controls have developed, it has been necessary to update the legislation to reflect the current situation and to enable the authorities to act effectively.

– This change will make it easier for us to control cross-border cash movements. Effective controls enable us to detect funds related to money laundering or terrorist financing and thus to protect society, says Ms Heli Lampela, Senior Customs Officer.

Harmonised practices facilitate controls

With the new Regulation, the declaration practices will be harmonised: in future, all EU countries will use harmonised cash declaration forms to ensure that the same details of cash movements will be collected in every Member State. Carrying cash across the border is not restricted as such, but large sums of cash must be declared to Customs. Travellers must still submit a cash declaration every time they carry cash of a value of 10 000 euros or more.

The obligation to disclose unaccompanied cash will also become applicable, which makes it possible to also carry out controls on movements of cash that is not carried by travellers. The obligation concerns movements of cash by post or courier or as freight. If the amount of cash moved is at least 10 000 euros, Customs may ask the sender or the recipient to provide the information for control.

The definition of cash and the period of detention are extended

The definition of cash is extended to also include coins with a certain gold content as well as gold bars and nuggets. Later, the controls may also cover certain prepaid cards. At present, the definition of cash includes banknotes and coins in circulation as means of payment as well as certain other means of payment, such as cheques and negotiable promissory notes.

Customs may detain cash if there is reason to suspect money laundering or terrorist financing. The new Regulation extends the period of temporary detention of cash, which improves the possibilities for controls by Customs. In future, the period of detention may be 30 days, instead of the earlier five working days.

More information for travellers on the Finnish Customs website: Travelling – cash [.fi]› (the page will be updated when the new Regulation becomes applicable)

Money laundering powers international crime

Source: Police 24.2.2020

Definition of money laundering

Money laundering is the act of obliterating the origin of assets or funds from criminal activities and making them look legitimate. It is an intentional criminal activity aimed at concealing assets acquired through crime and avoiding enforcement or other measures taken by the authorities. Money laundering is a key part of economic crime, organised crime and the shadow economy, which also makes it an integral part of transnational crime.

Acts of money laundering

Acts considered money laundering include the reception, use, conversion, change of ownership, transfer, transmission or possession of assets acquired through crime for the benefit of oneself or others, or for the purpose of concealing or obliterating the illegal origin of the assets. The key factor is being aware or suspecting that the source of the assets or funds is illegal and still taking the above actions.

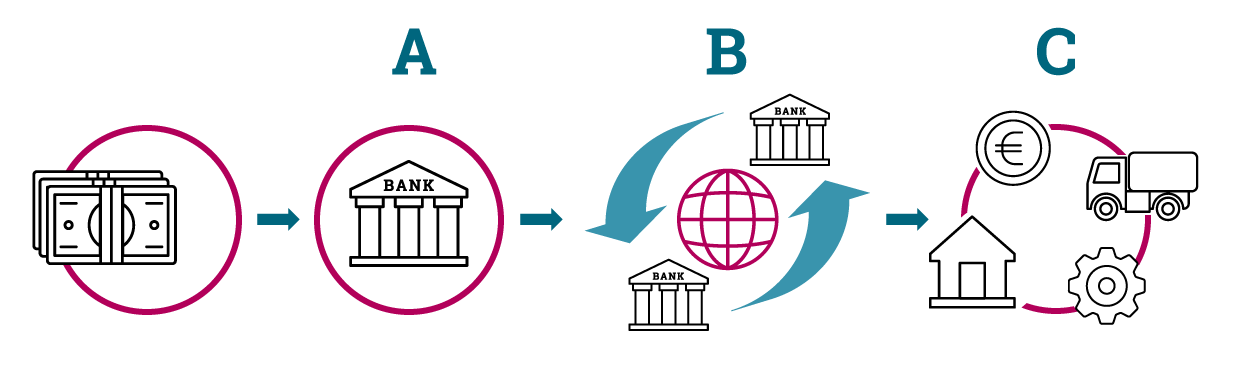

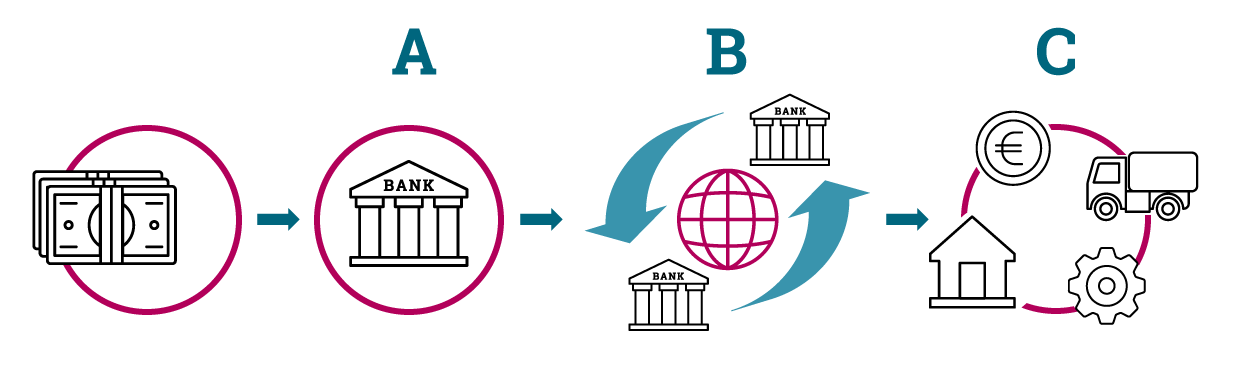

Figure 1. Example money laundering process

- Proceeds of crime enter the financial circulation through opening a bank account or several accounts in the name of a private individual or a company. The sums deposited in the account(s) may be small, and transactions are frequent. The funds may also be invested in virtual currencies.

- The aim is to conceal the proceeds of crime by using many banks and wire transfers. The funds may pass through individuals and businesses. Some businesses are fronts, meaning that they are shell companies that only exist on paper. Such businesses are purposefully registered in many different countries. Virtual currencies and virtual wallets are also used.

- Finally, the funds are deposited back to an account and/or are converted into property such as a house, an apartment, a car, a company, valuables, gold, etc. – anything you can imagine!

Do not become a money mule!

Criminals have various ways of recruiting people to act as money mules. Always be sceptical of any emailed offers for work in which your main task would be to receive and transfer funds or goods. Your account will be used for money laundering purposes by criminals who are covering their tracks. By accepting money whose origin you do not know, you may become guilty of money laundering. Acting as a money mule is a punishable offence!

• The punishment for money laundering is a fine or up to two years in prison.

• The punishment for aggravated money laundering is at least four months and up to six years in prison.

Money laundering predicate offences are often associated with economic crime

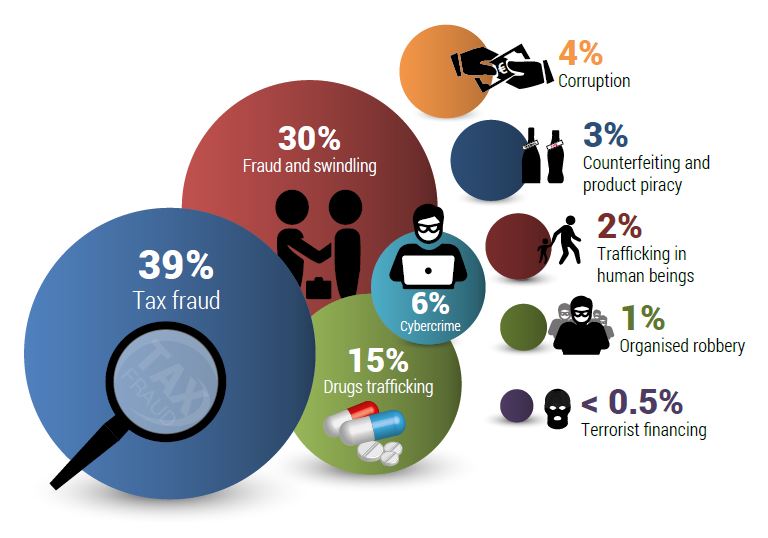

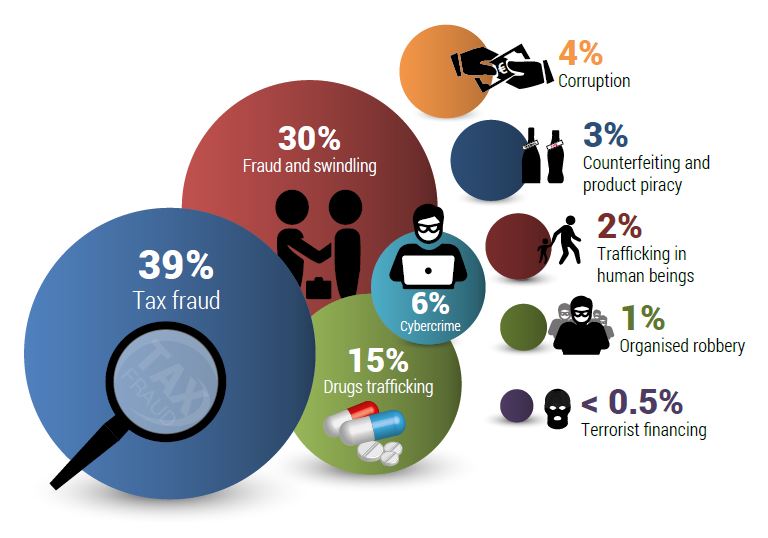

Figure 2. Background on predicate offences

source: Europol 2017 [.fi]›

Money laundering predicate offences are often related to frauds and tax frauds as well as drug trafficking and online frauds, of which the latter have been burgeoning recently. Corruption is also a significant global predicate offence underlying money laundering.

The confiscation of criminal proceeds and tackling money laundering are the most effective means of preventing new offences

Parties subject to the reporting obligation

Parties subject to the reporting obligation (“obliged entities”), i.e. corporations and entrepreneurs that can, within their normal activities detect money laundering or which can be exploited for money laundering purposes and thereby play a key role in combating money laundering. Obliged entities are, for example, operators in the investment, financial and insurance sectors and providers of virtual currencies as well as auditors, accountants, lawyers and real estate businesses.

Duties of the parties subject to the reporting obligation

- Obliged entities must identify their customers and verify their identity.

- Obtain information on their customers’ transactions, the nature and extent of the customers’ business, and the grounds for the use of a service or product (duty to investigate and continuous monitoring).

- Report any suspicious transactions. Reports must be filed electronically!

Pursuant to the amendments to the Act on Detecting and Preventing Money Laundering and Terrorist Financing, providers of virtual currencies are also subject to the reporting obligation. These amendments and the new Act on Virtual Currency Providers (572/2019) obligate providers of virtual currencies to comply with the key obligations of the Act on Detecting and Preventing Money Laundering and Terrorist Financing. Providers of virtual currencies must identify their customers and the actual beneficiary and the person acting on behalf of the customer. Virtual currency providers are also obligated to report suspicious transactions to the Financial Intelligence Unit. Both in Finland and internationally, the criminal use of virtual currencies and their use for money laundering purposes generally involve drug trafficking and various forms of fraud.

Supervisory authorities

In Finland, compliance with the Act on Detecting and Preventing Money Laundering and Terrorist Financing is supervised by the Finnish Financial Supervisory Authority, National Police Board, Finnish Patent and Registration Office, Southern Finland Regional State Administrative Agency and the Finnish Bar Association. Their task is to monitor that those subject to the reporting obligation have the mechanisms they require by law to prevent money laundering and the capability to report suspicious transactions to the National Bureau of Investigation’s Financial Intelligence Unit.

The Financial Intelligence Unit of the National Bureau of Investigation

The duties of the Financial Intelligence Unit (FIU) include preventing, and detecting money laundering and terrorist financing and referring such matters to investigation. The FIU receives, processes and analyses reports on suspicious transactions from those subject to the reporting obligation and discloses relevant information to other authorities in Finland, such as the police, Tax Administration, Finnish Security Intelligence Service, Customs and Border Guard. Finland also co-operates closely with other countries.

The Financial Intelligence Unit has the right to access, use and disclose information. Act on the Financial Intelligence Unit (445/2017) [.fi]› in Finnish

Financial Intelligence Unit statistics for 2019

- Reports on suspicious transactions: 64,403.

- The highest number of reports were filed by gaming communities, money services businesses (MSB) and banks.

- Information was disclosed to other authorities concerning 1,170 cases.

- The most common reasons for filing a suspicious transaction report were unusual wire transfers, unusual behaviour within a customer group, and lack of information on the origin of funds.

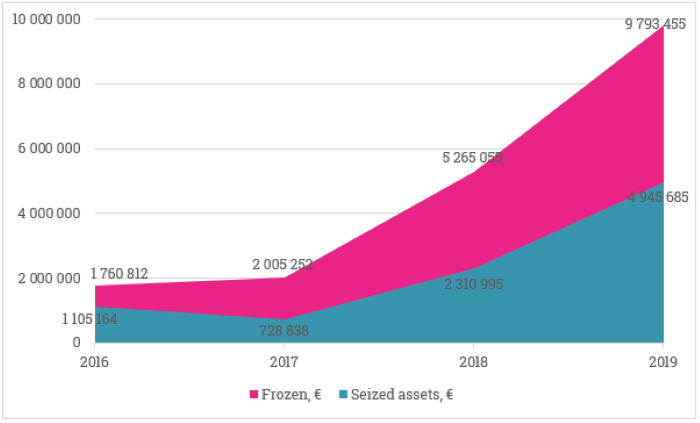

In 2019, funds amounting to almost EUR 10 million were frozen.

In 2019, transaction cancellations (temporary asset freezing) were targeted at EUR 9,793,455, of which EUR 4,945,685 remain seized by the police.

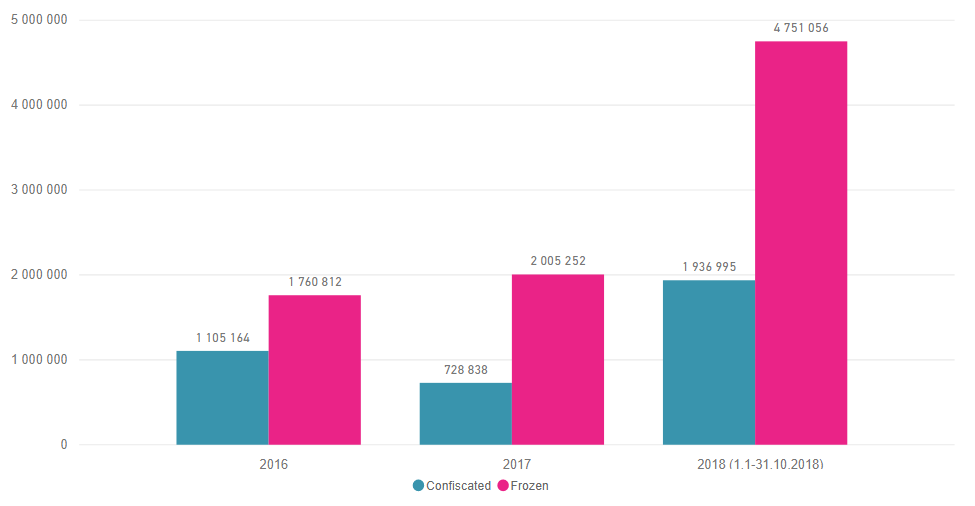

Table 1. Value of frozen and seized assets 2016-2019

Anti-money laundering challenges

- Money laundering always involves a predicate offence. Proving that the source of foreign funds is criminal activities is difficult.

- There are many methods to implement money laundering, and it can be small-scale or extensive. Criminals know how to utilise new technologies such as virtual currencies in money laundering and develop new methods constantly. Professional money laundering is disguised as legitimate business operations, often involving the use of tax havens.

- Funds move rapidly from one country to another. Recovering the proceeds of criminal activities is hindered by skilfully hiding the funds in countries where there is no cross-border assistance between the authorities. The transnational nature of money laundering is challenging.

Read more about money laundering on the website of the Finnish police [.fi]›.

The Employment Fund takes an anticipatory approach to combating the shadow economy

Source: Employment Fund 17 December 2019

Failure to pay a statutory payment always causes harm to the societal purpose for which the payment is collected – this is referred to as the shadow economy. In the case of the Employment Fund, unpaid unemployment insurance contributions take away from the unemployment benefits paid to the unemployed and adult education subsidies used to develop the expertise of wage earners, for instance.

Failure to pay an unemployment insurance contribution is recorded as a payment default in the company’s credit report. This report entry is intended to indicate payment problems – and thus the registration of such defaults and the fair and equal assessment of when the defaults can be deleted from the report are important aspects of the fight against the shadow economy. In the experience of the Employment Fund, few employers consciously intend to avoid paying unemployment insurance contributions – such failures are usually caused by human error. With preventative customer service and counselling, the need to record a default in the company’s credit report can most often be avoided.

“Our service experts are glad to engage in preventative work. However, employers themselves should be proactive when they notice that they cannot pay unemployment insurance contributions on time,” says Jaakko Karhunen, Team Manager in insurance payment services.

“We can be flexible with respect to the payment of unemployment insurance contributions in several ways. We can draft a payment plan for the customer, divide the payment into instalments or change the due date,” says Tytti Koskinen-Vaara, Collection Manager.

Employers should also keep their contact information up to date in the Employment Fund’s online service, so that the Fund can contact them when necessary.

“When we want to contact an employer about unpaid bills, we try to send a request by email or text message to contact the Employment Fund,” says Tytti Koskinen-Vaara.

Active employers avoid defaults in their credit report

Although the Employment Fund seeks to prevent employers from having defaults recorded in their credit report, it is the responsibility of the employer to report the correct wages and salaries to the Incomes Register and to pay their unemployment insurance contributions to the Employment Fund on time. For this reason, employers should be proactive if they notice that they cannot pay unemployment insurance contributions to the Employment Fund by the due date.

Customer feedback indicates that the Employment Fund provides very good service.

“One customer was delighted and said: ‘Oh, you’re this flexible,’” says Team Manager Jaakko Karhunen with a laugh.

Sometimes employers only realize they should contact the Employment Fund after a default has been recorded in their credit report.

“Those kinds of phone calls are tough for our service experts – they would like to help, but can’t, because the default has already been recorded appropriately. Our task is statutory and thus it’s important to ensure that we treat all customers equally. That’s why we cannot delete any credit report entries made for individual employers without a good reason,” says Karhunen.

“We have reviewed our collection process with the Finnish Financial Supervisory Authority. The entire Employment Fund is committed to these principles – whether one contacts a service expert or the management group, the answers are always consistent. When a default is recorded in an employer’s credit report, our hands are tied. For this reason, we encourage customers to immediately contact us when they notice they’re facing payment challenges – we can do more when the payments aren’t late yet,” says Collection Manager Tytti Koskinen-Vaara.

Account Register Project proceeding as planned

Source: Customs 21.10.2019

The national legal act concerning a bank and payment account monitoring system (571/2019) entered into force on 1 May 2019. The purpose of the legal act is to give the authorities better access to information on bank accounts and payment accounts, and to ensure correct targeting of enquiries by authorities. The act is based on EU Directive 2018/843 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing. Finnish Customs was given the task of setting up a register on bank and payment accounts, and of issuing a regulation on a data retrieval system. For this purpose, Customs started the Account Register Project. The project started in autumn 2018. The bank and payment account monitoring system comprises the bank and payment account register (Account Register) and a decentralised data retrieval system.

The legal act on a bank and payment account monitoring system determines the authorities who have the right to make queries in the Account Register and in data retrieval systems. According to the legal act in force, the Financial Intelligence Unit of the Finnish National Bureau of Investigation has extensive data acquisition rights. Data retrieval rights concerning the Account Register and data retrieval systems will be extended when the national legal act relating to EU Directive 2019/1153 enters into force in 2021. The preparatory work involving the national legislation and lead by the Ministry of the Interior will start in 2019.

Customs will set up the Account Register which will store data on customers, customer accounts and safety deposit boxes provided by payment institutions, electronic money institutions and providers of virtual currency. Credit institutions can also provide information to the Account Register under exemption from the Financial Supervisory Authority. Payment institutions, electronic money institutions, providers of virtual currency, and credit institutions acting under exemption are to provide data defined by law to the Account Register through a data updating interface which will be set up by the Account Register Project personnel. Authorities who have the right to utilise data are to apply for data through the query web service interface which is set up by the project personnel. The Account Register and its web service interfaces must up and running as of 1 September 2020.

Credit institutions for their part will, as a rule, create and maintain their own data retrieval systems through which authorities entitled to utilise information can search data on customers, customer accounts and safety deposit boxes through data retrieval web service interfaces of credit institutions. Parties who utilise data will implement their own solutions based on specifications defined in the project. Also payment institutions, electronic money institutions and providers of virtual currency can, if they so wish, create and maintain data retrieval systems. However, a binding notification must be given to Customs in advance.

Customs has cooperated closely with various interest groups in the Account Register Project which has progressed according to schedule. The project is coordinated by the Ministry of Finance.

Regulations concerning the bank and payment account monitoring system now published

Customs has notified information suppliers about the regulations concerning the bank and payment account monitoring system on 21 October 2019. Regulations issued by Customs are available in Finnish at https://tulli.fi/tietoa-tullista/tullin-toiminta/tullin-maarayskokoelma [.fi]›.

Customs implements the Account Register application and the related web service interface meant for updates and queries. Suppliers of information are to create integrations and connections for interacting with the Account Register interfaces. The regulation concerning the Account Register determines the electronic procedures and certifications for transferring information to the Register. Furthermore, in connection with the regulation, Customs gave instructions on the notification procedure, and on deployment and maintaining the Account Register. The notification procedure means that suppliers of information notify Customs when they start using the Account Register. In this way, Customs can schedule testing and system implementation smoothly with all suppliers of information.

The regulation concerning the data retrieval system lays down specific technical system requirements for suppliers of information. Based on the regulation, information suppliers can go through with their own data retrieval system implementations. Customs issued instructions on deployment and maintaining a data retrieval system in connection with the regulation. There are also instructions on the notification procedure concerning data retrieval systems. Each party utilising data will join the web service interfaces provided by suppliers of information. Query and response messages are transmitted between data suppliers and utilisers through the web service interfaces. Customs project personnel can carry out testing to ensure that query and response messages are transmitted in data retrieval systems created by data suppliers.

In addition, authorities who have the competence and rights to obtain information from the bank and payment account monitoring system will receive a regulation concerning the query web service interface. Instructions on technical implementation are meant only for use by authorities.

All orders contain information on service level requirements, as well as data security and data protection matters, such as certificates.

The new Government Programme combats the shadow economy

Source: The Tax Administration, Grey Economy Information Unit 10.6.2019

The new Government Programme introduces extensive and detailed actions against the shadow economy. There are also actions aimed at combating international tax evasion. What has been recorded in the Government Programme will form the framework for the next Action Plan against the Shadow Economy and Economic Crime. It remains to be seen whether it will be possible to also tackle other aspects of the shadow economy.

The current Action Plan against the Shadow Economy and Economic Crime is in force until the end of 2020; however, most of its projects have already been completed.

Government promises more money for actions against the shadow economy

The Government Programme has approximately twenty proposals for actions that promote the fight against the shadow economy, with EUR 20 million earmarked for funding the proposed actions. The decision to implement has been made on a dozen of the proposed actions. There is a great deal that still needs investigating, but the research data needed to back some of the actions already exists.

The Government has promised roughly EUR 30 million for projects related to digitisation and improving transparency, which are also ways of combating the shadow economy. Besides this, the separate appropriation for police operations to combat economic crime will be made permanent and additional funding for the Office of the Bankruptcy Ombudsman will be continued.

Government promotes transparency in business

In addition to the current Tax Debt Register, the Government aims to expand the availability of information for managing key business obligations in the Business Information System (YTJ). Another way of improving transparency stated in the Government Programme is amending the legislation on the disclosure of tax information to ensure that any changes to tax information made after the close of the tax year will be made public.

Efforts needed to combat international tax evasion

The Government Programme proposes examining various measures for combating international tax evasion, such as intervening with tax avoidance schemes and fixing the problems with the indirect holding system. The Government has also expressed its willingness to renegotiate bilateral tax treaties. The Government also aims to hinder the operation of tax havens by preventing the establishment of businesses in countries with low tax rates more effectively.

Government Programme 2019 [.fi]› (see pp. 23-24 and Annexes 4 and 5)

The Incomes Register supports efforts to combat the grey economy

Source: Project to establish the National Incomes Register 20.5.2019

The Incomes Register is a national online database of incomes information. In the first phase, beginning in 2019, any paid wages, fringe benefits, bonuses, non-wage compensation for work and other earned income will be reported to the Incomes Register. Beginning in 2020, pensions and benefits payment data will also be reported to the Incomes Register.

The Incomes Register data is used by various authorities. In the first phase, the data will be used by the Finnish Tax Administration, earnings-related pension providers and the Finnish Centre for Pensions, Employment Fund and Social Insurance Institution (Kela). In 2020, the number of data users will increase as accident insurers, unemployment funds, municipalities and occupational safety and health authorities, among others, start using the Incomes Register data.

Data is reported in real time and in an itemised manner

The key principles of the Incomes Register are real-time reporting and accurate itemisation of data based on the payment date and the income earner.

With the deployment of the Incomes Register, the totalling of data and monthly reporting has been discontinued. Reporting has been linked to paying, instead. Data is reported separately for each payment of wages after each payment date, within five calendar days of the payment date. Data is reported to the Incomes Register separately for each income earner on individual earnings payment reports.

The Incomes Register is tool for combating the grey economy

One objective of the Incomes Register is to support the combat against the grey economy. The data being real-time also improves the tools for combating the grey economy. The implementation of the Incomes Register is one of the projects for combating the grey economy and financial crime in the Ministry of the Interior's action plan for the years 2016–2020.The action plan emphasises the importance of real-time income data in the combat against the grey economy.

The Incomes Register checks the technical format requirements of the reported data before the data is stored in the Incomes Register. However, the Incomes Register does not monitor the income data; it is merely a tool for the authorities using the data. Each data user can only obtain the data to which it is entitled according to the law. Authorities use the data to carry out their monitoring duties, for example.

The Incomes Register allows real-time monitoring

The Incomes Register allows the grey economy to be combated more effectively than before. Cases of abuse can be dealt with more rapidly through monitoring or guidance.

The wage income, pension income and taxable benefits income reported to the Incomes Register cover about 90 per cent of all taxable income of the income earners. In roughly two out of three cases, the income reported to the Incomes Register matches the income earner's total income.

Before the deployment of the Incomes Register, earnings payment data could sometimes be reported a very long time after the payment transaction. Employers reported wage data monthly or even annually. The authorities often carried out monitoring based on the previous year's final taxation.

Real-time income data improve information exchange between the authorities, which is evident in the information services offered by the authorities. The Incomes Register offers new possibilities for monitoring and diverse co-operation between the authorities.

The Incomes Register's up-to-date income data allows a transition to real-time monitoring in several areas:

- The correspondence of taxes withheld to the actual earnings can be improved, so that more of the income taxes are paid in the correct amounts during the tax year.

- Real-time monitoring of obligations related to insurance becomes possible.

- The data in the prepayment register and the employer register, for example, can be monitored in real time.

- Benefits payments can be cut rapidly if abuses are detected.

- Deficiencies in reporting are detected through the monitoring of several authorities, which allows cases of neglect to be identified and intervened in effectively and quickly.

Different authorities get identical data from the Incomes Register

Income data can no longer be reported separately to different authorities; instead, all of the Incomes Register's data users use the data submitted on the same report. The same data are reported to all authorities requiring it at once, which means that data submitters can no longer intentionally edit the data to suit each authority.

Data can be monitored at a precision of a single income earner

Occupational safety and health authorities, for example, have duties related to combating the grey economy in addition to their monitoring related to occupational safety and other labour protection. Occupational safety and health authorities will be able to utilise income data beginning in 2020 when they monitor compliance with the so-called Contractor's Liability Act, fulfilment of the minimum conditions of an employment relationship and the use of foreign labour.

When the duration of foreign workers' work in Finland can be monitored in real time, the workers' tax liability in Finland can also be monitored.

Everyone can check their own income data from the Incomes Register

Income earners are able to see their up-to-date income data in the Incomes Register's e-service. Income earners can check in the Incomes Register whether their employers have fulfilled their reporting obligations.

Automation improves the quality of data

Online transactions are a basic requirement of the Incomes Register. Almost all reports are submitted electronically to the Incomes Register. For the first time in the central government, the Incomes Register has deployed technical interfaces between the systems of companies and the authorities. Uniform data is automatically transferred from the companies' payroll systems to the Incomes Register and further to the systems of the authorities. When data is automatically transferred between systems, the data will be of a higher quality.

Construction firms typical customers of the supervisory department of the Finnish Centre for Pensions

Source: Finnish Centre for Pensions 9.4.2019

Shortages in earnings-related pension insurance exist in all fields. Yet the construction field shows more insurance irregularities than other fields. This is evident from the customer classification made by the Grey Economy Information Unit of the Finnish Tax Administration.

The customer classification shows that a typical customer of the Supervisory Department of the Finnish Centre for Pensions is an established construction firm that has been in business for more than a decade and operates in the Uusimaa region. Of the employer groups caught through supervision, 23 per cent were construction firms.

Building contracts are often split into smaller entities that are carried out through a chain of subcontrac-tors. The work force often comes from abroad. That explains the high risk of grey economy in the con-struction field.

It is noteworthy, however, that there are companies with irregularities in earnings-related pension insur-ance in all fields. In some cases, it is a question of unintentional mistakes while in others, it’s a question of grey economy and economic crime.

Problems pile up

Employers who have shortcomings in pension insurance matters very often also have tax debts. In 2018, around 41 per cent of the employers supervised by the Finnish Centre for Pensions had tax debts, com-pared to 32-55 per cent in 2016. Around 17% of the employers supervised by the Finnish Centre for Pen-sions were also undergoing debt recovery procedures.

The customer classification applies to employers who have shown irregularities in connection with the supervision of earnings-related pension insurance conducted by the Finnish Centre for Pensions. Tax Finland's Grey Economy Information Unit makes statistical customer classifications to support the planning and targeting of authority operations.

Money laundering poses challenges to the global financial system

Source: Police 16.11.2018

Money laundering is a key engine of transnational crime, and combating it should be prioritised.

Definition of money laundering

Money laundering is the act of obliterating the origin of assets or funds from criminal activities and making them look legitimate. It is an intentional criminal activity aimed at concealing assets acquired through crime and avoiding enforcement or other measures taken by the authorities. Money laundering is a key part of economic crime, organised crime and the shadow economy, which also makes it an integral part of transnational crime.

Acts of money laundering

Acts considered money laundering include the reception, use, conversion, change of ownership, transfer, transmission or possession of assets acquired through crime for the benefit of oneself or others, or for the purpose of concealing or obliterating the illegal origin of the assets. The key factor is being aware or suspecting that the source of the assets or funds is illegal and still taking the above actions.

Figure 1. Example money laundering process

- Proceeds of crime enter the financial circulation through opening a bank account or several accounts in the name of a private individual or a company. The sums deposited in the account(s) may be small, and transactions are frequent. The funds may also be invested in virtual currencies.

- The aim is to conceal the proceeds of crime by using many banks and wire transfers. The funds may pass through individuals and businesses. Some businesses are fronts, meaning that they are shell companies that only exist on paper. Such businesses are purposefully registered in many different countries. Virtual currencies and virtual wallets are also used.

- Finally, the funds are deposited back to an account and/or are converted into property such as a house, an apartment, a car, a company, valuables, gold, etc. – anything you can imagine!

Do not become a money mule

Criminals have various ways of recruiting people to act as money mules. If you receive a job offer via email, for example, and the job description mainly involves the reception or transmission of assets or goods, you should proceed with caution. Your account may be used for money laundering purposes by criminals who want to cover their tracks. Acting as a money mule is a punishable offence!

- The punishment for money laundering is a fine or up to two years in prison.

- The punishment for aggravated money laundering is at least four months and up to six years in prison.

Money laundering predicate offences are often associated with economic crime

Figure 2. Background on predicate offences (source: Europol 2017 [.fi]›)

Money laundering predicate offences are often related to frauds and tax frauds as well as drug trafficking and online frauds, of which the latter have been burgeoning recently. Corruption is also a significant global predicate offence underlying money laundering.

The confiscation of criminal proceeds and tackling money laundering are the most effective means of preventing new offences

Supervisory authorities

The Finnish supervisory authorities are the Financial Supervisory Authority, the National Police Board, the Patent and Registration Office and the Regional State Administrative Agency for Southern Finland. Besides these supervisory authorities, the Energy Authority and the Finnish Bar Association must report information on suspicious transactions obtained in connection with any control activities directly to the Financial Intelligence Unit (FIU) of the National Bureau of Investigation (NBI), which is the competent authority for suspicious transaction reporting in Finland.

Parties subject to the reporting obligation

Parties subject to the reporting obligation (“obliged entities”), i.e. corporations and entrepreneurs who can within their normal activities detect money laundering or who can be exploited for money laundering purposes, play a key role in combating money laundering. Obliged entities are, for example, operators in the investment, financial and insurance sectors as well as accountants, lawyers and real estate businesses.

Duties of the parties subject to the reporting obligation

- Obliged entities shall Identify their customers and verify their identity

- Obtain information on their customers’ transactions, the nature and extent of the customers’ business and the grounds for the use of a service or product (duty to investigate and continuous monitoring)

- Report any suspicious transactions. Reports must be filed electronically.

The Financial Intelligence Unit of the National Bureau of Investigation has the right to access, use and disclose information

The duties of the Financial Intelligence Unit (FIU) include preventing, exposing and detecting money laundering and terrorist financing and referring such matters to investigation. The FIU receives, processes and analyses reports and discloses relevant information to other authorities in Finland, such as the police, the Tax Administration, the Finnish Security Intelligence Service, Customs and the Border Guard. Finland also cooperates closely with other countries.

Statistics on the operations of the Financial Intelligence Unit

- The total number of reports filed during the current year (2018) will be roughly 40,000.

- The number of reports filed by banks is increasing rapidly and expected to exceed 8,000 this year. (The total number of reports filed by banks in 2017 was roughly 5,600)

- The highest number of reports were filed by gaming communities, money services businesses (MSB) and banks.

- During the current year, information contained in suspicious transaction reports was disclosed to other authorities over 2,200 times.

- The most common reasons for filing a suspicious transaction report in 2017 were unusual wire transfers, unusual behaviour within a customer group and lack of information on the origin of funds.

By 31 October 2018, transaction cancellations (asset freezing) were targeted at EUR 4,751,056 of which EUR 1,936,995 remain confiscated by the police

Large amounts of assets were frozen on several occasions during 2018. As a whole, the amount of criminal assets confiscated by the authorities is higher compared to previous years.

Table 1. Value of frozen and confiscated assets 2016–2018

Anti-money laundering challenges

- Proving that the source of foreign funds is criminal activities is difficult. Is it tax avoidance or money laundering?

- There are many methods to implement money laundering, and it can be small-scale or extensive. Criminals know how to utilise, for example, virtual currencies, and new money laundering methods are developed constantly.

- Professional money laundering is disguised as legitimate business operations, often involving the use of tax havens.

- Recovering the proceeds of criminal activities is hindered by skilfully hiding the funds in countries where there is no cross-border assistance between the authorities. The transnational nature of money laundering is challenging.

Read more about money laundering on the website of the Finnish police [.fi]›.