Authorities

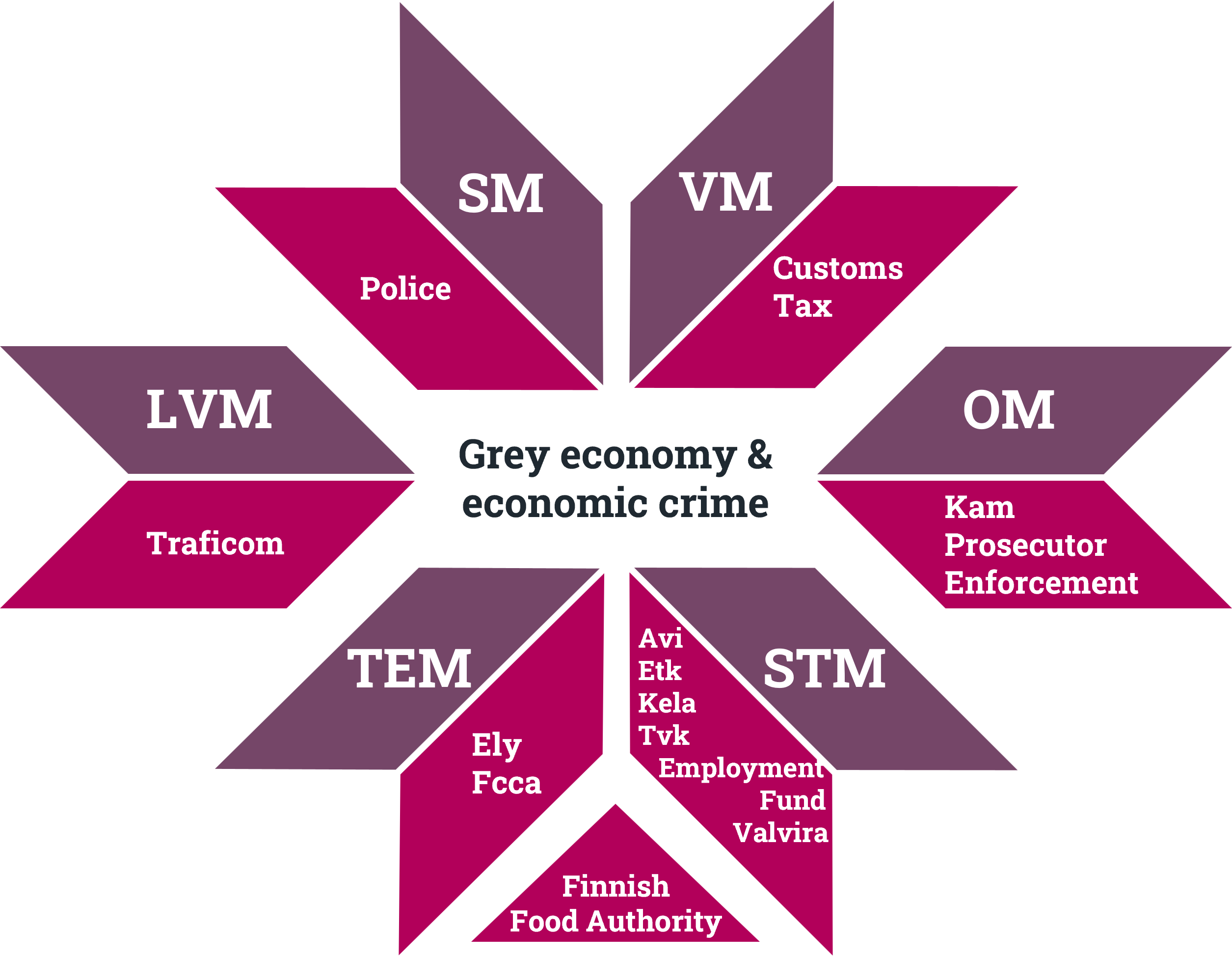

On the shadow economy and economic crime website, different public authorities introduce their operations in relation to the shadow economy. The website content is produced in collaboration with the ministries and public agencies appearing on these pages.

Crime prevention | Ministry of the Interior, Police, Customs, National Prosecution Authority

Taxation | Ministry of Finance, Tax Administration

Legal protection and insolvency | Ministry of Justice, Enforcement Authority, The Office of Bankruptcy Ombudsman

Employers and contractor’s obligations | Ministry of Social Affairs and Health, Regional State Administrative Agencies, Finnish Centre for Pensions, Employment Fund, Finnish Workers’ Compensation Centre

Products, services and equal competition | Ministry of Economic Affairs and Employment, Finnish Food Authority, National Supervisory Authority for Welfare and Health, Finnish Transport and Communications Agency, Finnish Competition and Consumer Authority

Crime prevention

Ministry of the Interior

The Ministry of the Interior is the ministry that oversees internal security and immigration, as well as activities such as policing. Its key tasks include legislative drafting and the strategic planning, control and supervision of its administrative sector.

On 28 April 2016, the Government issued a resolution on a national strategy to tackle the shadow economy and economic crime during the period 2016–2020. The resolution required that a separate action programme be developed for the implementation of the strategy in practice.

The strength of the action programme lies in co-operation between sectors. Projects have been advanced through cross-administrative co-operation. Responsibility for projects is divided among various authorities. Some projects will have a preventative impact and some will directly affect operational activities, whilst the impact of some can only be evaluated in the longer term.

Key measures with the greatest impact (from the perspective of the goals of the national strategy to tackle the shadow economy and economic crime) have been selected for the action programme. The implementation of the current action programme is on schedule. There is a total of 20 projects. According to an update drafted in May 2019, a total of 12 projects had been concluded. Four had reached 90-95% completion, one 80-85% completion, and three 60-75% completion.

The projects included in the action programme are related to one of the strategy’s four key projects.

The key projects include:

- Securing the functioning of the market and healthy competition by improving the scope for businesses and citizens to act appropriately, reducing the administrative burden, and stepping up the fight against and preventing corruption

- Proactive intervention in shadow economy activities and economic crime, and shaping attitudes

- Further development of information exchange between authorities

- Intensifying the impact of the anti-shadow economy chain of actors, and developing administrative sanctions

A party with main responsibility and in charge of starting up the project has been appointed for each project. Monitoring of the action programme is based on notifications received from these parties, and the Ministry of the Interior is responsible for updating the monitoring report. Progress is also monitored by the steering group for the prevention of economic crime, which assesses potential change needs and reports on progress made in the projects to the Ministerial Committee on Economic Policy and the parliamentary monitoring group for tackling the shadow economy and economic crime.

The strategy and action programme were drafted to extend beyond the term of the previous government. The longer programme duration may turn out to be an excellent decision, as the work of the authorities on implementing the current programme has continued uninterrupted as the new government took office. In addition, the steering group for the prevention of economic crime has started the preparation of a new action programme in accordance with the Rinne Government Programme: “the action programme to tackle the shadow economy and economic crime is to be continued”. The preparation of the new action programme will take into consideration the policies of the Government Programme, for instance, and make use of reports on projects under the earlier action programme.

Most economic crimes investigated by the police are reported by other crime prevention authorities

The measures taken and crime-prevention priorities of the supervisory authorities affect the number and nature of economic crimes reported to the police. Most requests for investigation received by the police are made by the Finnish Tax Administration and receivers of bankrupt estates. Economic trends also tend to affect police investigations of economic crime.

Of economic crimes investigated by the police, most involve tax, accountancy and debtor offences, and various kinds of benefit offences and fraud. Economic crimes also involve money laundering, whereby the criminal tries to disguise the origin of money.

The police investigate an average of 1,800 cases of economic crime each year. Such crimes are primarily investigated by regional police departments. The police cooperate with authorities both nationally and internationally when combating and investigating economic crime. Tracing and seizure of the proceeds of crime and securing damages form an essential part of criminal investigations by the police.

Economic crime is increasingly professional

Economic crime reported to the police is continuously acquiring new features. Economic crime increasingly involves international connections, organised crime and other organised and professional criminal activities, such as cybercrime.

Criminals are keen to exploit companies as a means of committing crimes such as fraud and tax offences. On the other hand, companies themselves fall victim to crimes such as identity theft.

In cases of corruption, corporate structures and positions of power are being abused to the benefit of the perpetrator or for financial gain. In Finland, corruption occurs in the construction sector in particular.

As the foreign workforce increases in Finland, the risk of employee abuse is also rising. Employees are either underpaid or not paid at all. The most serious cases involve trafficking in human beings, including forced labour and employee control.

The development of inter-authority cooperation on environmental crime has led to growth in the number of police investigations of environmental crime in recent years. In cases of environmental crime, the proceeds arise from minimising costs. A party engaged in illegal activity saves costs on issues such as waste management or investments in environmental protection, with environmental damage being just one of the harms caused.

In accordance with the Ministry of the Interior’s definition, the police investigate offences as economic crimes if they involve a punishable act or neglect relating to the activities of or exploiting a company, public administration or other organisation, with the purpose of achieving significant direct or indirect gain. Economic crime can also involve the neglect of statutory, financial or other obligations such as occupational safety or environmental regulations.

Customs promotes smooth foreign trade, secures a level competitive playing field for its customers, and intervenes effectively in cases of wrongdoing

In the years 2012–2016, Customs collected EUR 207 million in unpaid fees to the State on the basis of company and documentation audits. In the same period, its economic crime prevention activities accrued EUR 113 million to the benefit of the state. The number of cases of tax fraud uncovered and investigated by Customs rose by around 73% between 2012 and 2016. The number of tax fraud offences of all types has increased. A total of 58% more cases of aggravated tax fraud were detected last year (2016) than in 2015.

Customs combats tax evasion by a number of means. The key issue is that Customs has continuous control over the goods that it taxes. Customs combats the shadow economy through all of its functions, which are organised to be mutually supportive – from customer identification onwards.

Responsibility for the collection of over EUR 10 billion in excise taxes and tax-related duties will be transferred to the Finnish Tax Administration during the years 2017–2018, although the related tax control will remain with Customs. It should be noted that Customs will still collect taxes and tax-related fees amounting to hundreds of millions of euros after the change.

Customs promotes foreign trade, protects society and performs duties in the administrative areas of all ministries

Customs has the task of promoting the smooth flow of trade in international goods, ensuring that trade is valid and effectively collecting excise duties. Customs is a cross-sectoral service and law enforcement organisation, which protects society, the environment and citizens. Customs promotes the functioning of the EU's internal market and ensures a level competitive playing field for companies. It performs statutory duties within the operational sectors of all 11 ministries and the Prime Minister's Office.

One of the tasks of Customs is to implement the national strategy for combating the shadow economy and economic crime, employing measures such as the more effective tracking and recovery of criminal proceeds, minimising proceeds of crime and increasing awareness of the risk of detection among criminal operators. Within Customs, this is not limited to minimising tax evasion and the proceeds of crime; the agency also intervenes on a wider basis in breaches of international trade regulations and the implementation of UN and EU sanctions. In addition, Customs engages in the control of taxes collected by the Tax Administration and targets its activities based on the evaluation of uncollected taxes.

Customs is the only authority that controls the flow of internationally traded goods and the luggage of cross-border passengers. It therefore plays a major role in protecting society. Customs’ role in internal security primarily involves supervising the flow of goods, through which it engages in the prevention of emerging threats. Customs has so far succeeded in performing these tasks effectively, despite its continuously shrinking resources and outdated technology. Customs has been sufficiently effective at intercepting drugs, weapons and explosives, other dangerous goods and banned and restricted goods among freight, post and luggage. To the extent permitted by its resources, Customs is present at all of Finland's frontiers. In practice, it is often the only authority that cross-border traffic will meet within the Schengen area.

Customs as an agency combating the shadow economy and economic crime

One of the key objectives of Customs is the effective collection of taxes under its responsibility and combating the shadow economy. Customs’ various functions include a broad range of activities aimed at combating the shadow economy, economic crime and tax evasion. These are present throughout its organisation and are viewed as the joint task of all of its staff. Correct tax collection is ensured by a number of means, including both pre-emptive measures and real-time and retrospective control. Cooperation between authorities, which involves close liaison between Customs and several Finnish and overseas authorities, plays a key role in combating the shadow economy and tax evasion. Customs plays a major role in combating internationally organised economic crime.

Within Customs, combating the shadow economy takes the form of supervising legal activities and detecting illegal ones. Since this entire process has been refined to support the exposure of non-compliances and the detection of possible illegal activity, Customs can be regarded as a key player in the fight against the shadow economy and cross-border crime. In this respect, Customs has the objective of preventing the harm caused to society and business by the shadow economy and unfair competition.

The prosecutor's role in handling shadow economy offences

The shadow economy impacts on the prosecutor's work when actions taken to combat the shadow economy have resulted in crime reports and tangible suspicion of an offence. The prosecutor must be actively involved in the pre-trial investigation, handling the matter all the way to its conclusion, i.e. a legal judgement. In such processes, bringing the perpetrators to justice tends to take years.

The prosecutor's duty is to enforce criminal liability. In the case of shadow economy phenomena, this refers to the prosecutor deciding whether there are grounds for deeming that the preconditions of a criminal offence have been met. Shadow economy crimes tend to involve tax offences, debt evasion, accounting offences, occupational pension insurance fraud and registration offences. Corruption offences, fraud, benefit fraud and money laundering are also involved.

As a rule, the prosecutor must press charges when there are probable grounds for doing so on the basis of the evidence gathered in the pre-trial investigation. A criminal case is initiated in a District Court on the basis of an application for a summons and progresses to the main hearing after the related preparations. In many cases, after the District Court proceedings the case is referred for a further hearing in the Court of Appeal, after which leave to appeal is sought from the Supreme Court.

Cooperation between public authorities in the criminal justice chain

The criminal justice chain refers to all authorities that participate in criminal investigations. In addition to the prosecutor, a Tax Attorney from the Finnish Tax Administration is involved at all stages of the criminal justice chain in the case of tax offences. The surest guarantee of enforcing criminal liability within the shadow economy in particular is provided by close cooperation between the prosecutor and Tax Attorney from the very beginning. This also enables the success of claims made in court regarding the proceeds of crime.

Like all economic crime, criminal cases in the shadow economy tend to involve many international connections. This further underlines the importance of the prosecutor's tasks during the pre-trial investigation.

Shadow economy prosecutors

The most challenging and extensive criminal cases involving the shadow economy are handled by prosecutors specialising in economic crime. Such prosecutors must follow the related developments in both national and European legal practice, so that they can direct the pre-trial investigation of shadow economy cases in accordance with the applicable case law.

Economic crime trials

Trials for economic crime tend to last from a few weeks to several months. The oral testimony for the main hearing alone can take over six months in a District Court. Extensive cases involving so-called fake sales receipts, corruption and VAT fraud keep prosecutors specialising in economic crime busy in the Greater Helsinki area in particular. Each of these very extensive trials ties down several prosecutors.

Prosecutors dealing with economic crimes must also handle a considerable number of cases involving debtors’ offences, due to the efficient system for handling bankruptcies. In addition to shadow economy offences involving various phases of the criminal justice chain, prosecutors specialising in economic crime are in charge of several serious and time-consuming suspected cases of fraud and money laundering in international business, as well as various cases of securities fraud.

Taxation

The Ministry of Finance safeguards the future

It is the vision of the Ministry of Finance (MoF) to build a stable foundation for the finances and well-being of future generations. The core idea of the strategy is: The MoF safeguards the future. Each year, the Ministry of Finance drafts the state budget and prepares tax legislation, amongst other things.

Tasks and administration

The Ministry of Finance prepares the government's financial and fiscal policy, drafts the state budget each year, and serves as an expert on tax policy. The Ministry is also responsible for preparing financial market policy and the development of legislation with regard to municipal administration and finances. The MoF prepares the framework for the development of public administration, develops the central government's steering systems, and leads the way in the digitalisation of public administration. The wide purview of the Ministry also includes the state's employer and HR policies. The MoF is also heavily involved in international co-operation. The Ministry participates in EU activities and those of a number of international organisations and financial institutions.

The Ministry has Economics, Budget, Tax and Financial Markets departments; a Local Government and Regional Administration Department; a Public Sector ICT Department; and a Public Governance Department, in connection with which the Office for the Government as Employer also operates. Administrative Governance and Development is responsible for the Ministry's internal administration, also including Media and Communications. The Secretariat for EU Affairs and the International Financial Affairs Unit operate directly under this management. The Ministry also has a Government Financial Controller's Function.

The Ministry of Finance's administrative agencies include the Finnish Tax Administration, Customs, the Financial Supervisory Authority, the Financial Stability Authority, the Regional State Administrative Agencies, local register offices, the Government Institute for Economic Research (VATT), the State Treasury, Statistics Finland, the Population Register Centre and the Finnish Government Shared Services Centre for Finance and HR. Senate Properties is a state enterprise. HAUS Finnish Institute of Public Management and Hansel Oy are limited companies of the state. The State Pension Fund, the local government pensions institution Keva and the Municipal Guarantee Board also fall within the administrative sector of the Ministry of Finance.

The Tax Department of the Ministry of Finance is the Government's expert on tax policy. It is responsible for developing the tax system and assessing the effects of tax policy measures. It drafts tax legislation and participates in developing the work of the Tax Administration and Customs. It also prepares Finland's tax treaties with other countries and represents Finland in tax and customs preparation in the European Union. A representative of the Tax Department of the Ministry of Finance is also included in the senior management group for tackling the grey economy and financial crime, which has prepared a strategy for combating grey economy and an action programme to tackle the latter as well as financial crime.

Combating the grey economy

Combating the grey economy plays an important role in the government programme of Prime Minister Rinne's Government. For instance, the programme includes a separate, 20-item annex on actions against the grey economy. Funding for actions against the grey economy is also budgeted within the government programme.

With respect to the Ministry of Finance's administrative branch, the government programme also includes an entry in accordance with which the tax number already in use in the construction industry will be implemented on shipyards. The challenges posed to tax control by the platform economy have also been taken into consideration in the government programme. The tax authority will be provided with the necessary legislative and technological means it can use to collect the data of digital platform economy actors for taxation purposes as automatically as possible.

The Finnish Tax Administration tackles tax fraud efficiently

The Tax Administration has intensified the fight against more serious manifestations of the shadow economy. Personnel specialising in the task, up-to-date monitoring, enhanced information exchange between authorities, and extensive use of comparative information play a key role. The Finnish Tax Administration plays a major role in combating the shadow economy, and handling tax-related and other forms of economic crime. Cooperation between the Tax Administration and other authorities ensures a holistic approach to identifying, combating and monitoring various shadow economy phenomena.

New phenomena reaching Finland, challenges are growing

Actors in the shadow economy often operate internationally. Professional criminals and organised crime are also involved. In addition, the number of foreign companies and employees in Finland has grown, which poses new challenges to monitoring. For instance, monitoring undeclared workers calls for even greater co-operation between the authorities. Identity misuse is exploited in economic crimes, such as in fraud involving tax returns. Many forms of welfare fraud have been identified throughout the Nordic countries.

E-commerce, many alternative payment methods and platforms, virtual currencies, and the sharing economy and its variations are all creating challenges for those combating the shadow economy. Bookkeeping and other financial documentation may be kept in various cloud services, which can be difficult for the supervisory authorities to access. Business is also being conducted in Finland from abroad, without fulfilling the statutory declaration and payment obligations here.

Many crimes, including tax offences, are interlinked. Ascertaining the facts can be complicated, which places further importance on inter-authority co-operation and information exchange, both internationally and nationally.

The Finnish Tax Administration stops fraudsters at the earliest possible stage

The Finnish Tax Administration must react quickly to both traditional and new shadow economy phenomena. In combating the shadow economy, the Tax Administration is focusing more on eliminating the potential for shadow economy activities in an early stage, instead of retrospective control.

Efficient monitoring and registration to halt fraudulent activities lie at the heart of the Tax Administration’s efforts to combat the shadow economy. These tasks differ in many respects from traditional ideas of taxation.

Tax audits are the ‘big bazooka’ in combating the shadow economy

A major share of the tax offences detected by the Tax Administration are uncovered during tax audits; in many cases, tax audits of shadow economy operations are the only way of determining the facts in order to define the right tax amount and refer the case to a pre-trial investigation if necessary. Shadow economy tax audits also uncover other instances of abuse and neglect, which are reported to other monitoring authorities.

Tax recipients are represented by the Tax Collection Unit in tax offences

The Finnish Tax Administration speaks on behalf of tax recipients in criminal cases involving taxes and fees handled by the Tax Administration. In criminal matters, the Finnish Tax Administration is represented by Tax Attorneys – who specialise in handling criminal offences – from the Tax Collection Unit. Tax Attorneys represent the tax recipients in the actual criminal case and in seeking compensation for damages due to the offence in question.

Crime reports are most often initiated during tax control, but suspected crimes are also reported by stakeholders. If the prosecutor presses charges, the Tax Attorney will present a claim for damages. After the judgement, the Tax Attorney considers a possible appeal and handles the matter in the higher courts.

Information about the shadow economy

The Finnish Tax Administration’s Grey Economy Information Unit studies the phenomenon and its impacts and publishes analyses and research articles. The Grey Economy Information Unit also prepares compliance reports and customer classifications to help the other authorities involved in the fight against the shadow economy to focus their efforts in the right places.

The importance of cooperation is continually growing

Both preventative measures and retrospective control of the shadow economy often require seamless co-operation between several authorities. The pre-trial investigation authorities, with which the Finnish Tax Administration engages in extensive information exchange, are the most important partners. For example, co-operation in tax audits involving inter-authority co-operation is highly advanced. Real-time co-operation with the pre-trial investigation authorities is being continuously developed. In addition, practical co-operation with new public agencies has been stepped up.

Legal protection and insolvency

The Ministry of Justice fosters legal protection

The Ministry of Justice maintains and develops legal order and legal protection, and oversees the structures of democracy and the fundamental rights of citizens. The Ministry is responsible for the drafting of the most important laws, the functioning of the judicial system and the enforcement of sentences. As a part of the Government, the Ministry of Justice lays down guidelines for legal policy, develops statute policy and directs its administrative sector.

The Ministry of Justice participates in combating the shadow economy and economic crime by preparing legislation within the scope of its sector, such as in the areas of criminal and procedural law. In addition, the Ministry of Justice participates in the law drafting projects of other ministries that are relevant to the sector of the Ministry of Justice. Units such as various boards and the Legal Register Centre, which maintains criminal records, operate in connection with the Ministry of Justice.

International cooperation

The Ministry of Justice participates in the preparation and handling of matters concerning its sector in the European Union, the preparation of international agreements, and monitoring the enforcement of agreements, such as in related country assessments.

The Ministry of Justice engages in Nordic cooperation and international judicature, as well as performing tasks in criminal law cooperation between countries, which may also involve economic crime. The Ministry of Justice or its unit serves as a central authority for a range of international agreements and European Union instruments.

Anti-corruption efforts

The Ministry of Justice serves as the national coordination authority for anti-corruption efforts. The anti-corruption work of the Ministry of Justice is also firmly connected to combating the shadow economy. Investigations indicate that suspected cases of bribery, for example, are closely linked to economic crime and to the shadow economy in particular. For instance, in the construction industry, bribing those who decide on contracts, or influencing them in other inappropriate ways, fosters an operating environment that is favourable to criminal activity and also distorts competition.

Accordingly, in combating the shadow economy, the Ministry of Justice seeks to pay even greater attention to anti-corruption efforts in cooperation with other authorities and stakeholders, in order to weaken the ability of shadow economy actors to engage in profitable criminal activity. As the authority coordinating anti-corruption efforts, the Ministry leads and coordinates development projects to tackle and prevent corruption, supports the anti-corruption efforts of various authorities and leads an anti-corruption cooperation network that promotes anti-corruption efforts at national level.

Enforcement offices prevents the shadow economy and economic crime

Enforcement offices participate in enforcing the rule of law. Well-functioning enforcement proceedings ensure that rights are respected in debt-related matters. In addition, the activities of enforcement offices support the prevention of defaults, while maintaining payment morality and the prerequisites of a credit-based society. Opportunities to commit and benefit from financial abuses are diminishing. On the whole, the enforcement offices’ actions prevent economic crime and shadow economy activities.

The Enforcement Authority fights the shadow economy and economic crime

In Finland the enforcement authority is a part of judiciary. Enforcement officers / bailiffs are civil servants and carry out court rulings and collect directly distrainable receivables, such as taxes, fines and insurance contributions. The enforcement officers seek to combat the shadow economy and economic crime through their statutory tasks; that is, efficient enforced collection.

Enforcement officers co-operate actively with other authorities in combating the shadow economy and seizure of criminal proceeds, such as with the Police, Customs and Tax Administration. To carry out their tasks, the enforcement officers have an extensive mandate to obtain information and can, for instance, bypass artificial asset arrangements. The Criminal Code stipulates that concealing information or providing false information in enforcement proceedings is a punishable act.

Most monetary debt collection cases are handled electronically by the national Basic Enforcement Unit, without meeting debtors in person. National Enforcement Authority Finland’s five regional Extensive Enforcement Units are responsible for selling distrained assets and other more demanding enforcement tasks in their respective jurisdictions. The national Special Enforcement Unit manages enforcement tasks requiring a lot of time and investigation, cooperates with other authorities and participates in the fight against financial crime and the grey economy. The Extensive Enforcement Units and national Special Enforcement Unit enforce all types of pending obligations and preventive measures. In Åland, enforcement measures are carried out by the Extensive Enforcement Unit.

Distrainable assets are converted into monetary funds

Most commonly, the debtor’s salary or other income is garnished. In addition, enforcement officers can seize bank accounts, vehicles, apartments, real estate and other assets, such as virtual currency, that can be liquidated.

When enforcement proceedings are initiated, the debtor receives a notification and a payment reminder from the enforcement officer. If a payment is not received after this, the sum is garnished from the debtor’s income, cash assets or property. The assets of the debtor may also be sold to cover the debts. The monies received are remitted to the creditor.

If the debt is not paid and the debtor does not have income or assets to garnish or distrain, the debtor is declared insolvent. A payment default is then entered in the credit information register.

Those in financial difficulties may be tempted to do undeclared work

A small percentage of those in financial difficulties who are subject to enforcement proceedings may be tempted to do undeclared work, hide assets or neglect their obligations as an employer and otherwise in their business operations.

The message of the enforcement authority is clear. It is possible to overcome debt problems. The enforcement officers are obligated to advise their indebted clients to seek assistance from other parties if necessary, such as financial and debt counselling or the social welfare office. Getting one’s own finances under control also helps ensure legal income from work or business activity.

Bankruptcy Ombudsman – The Office of Bankruptcy Ombudsman

Bankruptcy Ombudsman is an independent special authority supervising the administration of bankruptcy estates. The Ombudsman is attached to the Ministry of Justice with branch offices in Helsinki and Tampere. The duty of the Ombudsman is to see to the effective, economical ja prompt administering of bankruptcy proceedings and restructuring of enterprises.

Combatting grey economy and economic crime

Combatting and preventing grey economy and economic crime form the most essential part of the activities of the Ombudsman. Auditing the accounts and activities of bankrupt debtors and placing them under public receivership have proven effective methods of investigating financial and other bankruptcy-related offences. The Ombudsman works actively together with other authorities involved in combatting grey economy and economic crime.

Special audits

Bankruptcy Ombudsman can order a special audit of the debtor’s activities to be carried out by an authorized auditor. Special audits orderedby the Ombudsman aim at finding out offences and possible grounds for recovery in the actions of the debtor. Special audits can also be carried out in cases where the assets of the bankruptcy estate are insufficient for the continuationofthe bankruptcy proceedings.

The costs of the special audits are paid from public funds. The state’s costs are recovered from the bankruptcy estate if the audit has been necessary for the estate and assets have been obtained to the estate as a result.

Public receivership

At the request of the Ombudsman the court may orderthat a bankruptcy is to continue under public receivership if this is to be deemed justified due to lack of funds in the estate, the need to investigate the debtor or the bankruptcy estate, or for some other special reason. In practice, cases of bankruptcy tend to move into public receivership if there is a reason to suspect that the debtor has committed a serious economic crime.

Public receivership can be used to establish criminal liability or liability for damages; to tackle undesirable bankruptcy-related phenomena such as the fraudulent acquisition of a company on the verge of bankruptcy and bankruptcy chains; to carry out bans on business operations; and to take action for recovery on behalf of the bankruptcy estate.

Public receiverships can be regarded as cost-effective for society, since the costs recovered by the state and the disbursements paid to creditors usually exceed the amount of expenses paid from public funds.

Employers and contractor’s obligations

Ministry of Social Affairs and Health

The Ministry of Social Affairs and Health contributes to the fight against the shadow economy by working with other agencies to implement the action plan, approved by the Government, for tackling the shadow economy and economic crime. Agencies and institutions within the Ministry's administrative branch combat the shadow economy, alongside other public authorities, in accordance with their own sectors and powers. Anti-shadow economy activities within the Ministry’s sector have a particular focus on compliance with labour legislation and the supervision of alcohol regulations.

Supervision of alcohol regulations

The task of the National Supervisory Authority for Welfare and Health (Valvira) is to ensure, via effective supervision, that uniform practices apply to the licensing and supervision of the serving and retail of alcohol across Finland. Valvira also functions as a licensing and supervisory authority for the wholesale and production of alcoholic beverages. Depending on the division of responsibilities, Regional State Administrative Agencies supervise the serving and retail of alcohol within their geographical areas. Alongside Valvira, through their supervisory activities Regional State Administrative Agencies prevent the occurrence of shadow economy activities and economic crime in the alcoholic beverages sector.

Compliance with labour legislation

The occupational safety and health authorities contribute to fighting the shadow economy by ensuring that employers only use labour force with work permits valid in Finland, comply with the minimum terms of employment and only use subcontractors and temp agencies that have fulfilled their social obligations. Together with the Finnish Tax Administration, such agencies ensure that employees on construction sites wear a photo identification card with a tax number.

The Occupational Safety and Health The Occupational Safety and Health Administration supervises compliance with the rules of the game in working life

The Occupational Safety and Health Administration monitors compliance with the minimum employment conditions and that companies do not gain financial benefits by neglecting their statutory payments and obligations. In addition, the Occupational Safety and Health Administration attempts to ensure that companies do not use subcontractors and leased labour providers that have not taken care of their obligations. By stepping up efficiency in information exchange and co-operation with other authorities, the Occupational Safety and Health Administration does its part in tackling the use of undeclared workers and abuse of social benefits.

Monitoring foreign employees and posted employees is part of preventing the shadow economy

The Occupational Safety and Health Administration supervises the minimum conditions of employment of foreign and posted workers, i.e. whether such workers are paid in accordance with the related collective agreements for work done in Finland. The aim is that the minimum terms of employment at least fulfil the minimum level required by law. The Occupational Safety and Health Administration attempts to ensure that employers only employ foreign employees who have the right to work in Finland. Employees who do not have the right to work have a great risk of being exploited due to their financial plight and dependence. In addition, the Administration monitors that the posting employer has submitted a declaration about posting employees to Finland before they start work.

Contractors’ obligations and liability promote healthier competition

The Occupational Safety and Health Administration attempts to ensure that employers acting as clients of employee rental firms and subcontractors only use partners that observe employers’ legal obligations concerning disclosure (in terms of tax and pension contributions, for example). Monitoring under the Act on the Contractor’s Obligations and Liability when Work is Contracted Out ensures that clients do not enter into contracts with companies under a business prohibition or contracts in which the client should have known that the other party had no intention of fulfilling its legal payment obligations (a so-called under-priced contract).

Activities to monitor the shadow economy in the construction sector

The Occupational Safety and Health Administration attempts to ensure that actors in the construction sector (developers, main contractors and employers) require all construction workers to have a photo ID card with a tax number that has been entered into the public Tax Number Register. In addition, the Administration monitors that the main contractor on the building site has an up-to-date list of all employees working on the site.

Current shadow-economy issues in the supervision of occupational health and safety

More employees without work permits have been observed during immigration control operations. This phenomenon may be due to better targeting of surveillance and the development of control methods. Asylum seekers who have been denied asylum is one reason for the growing number of such workers.

Responsibility for occupational safety has been a key supervisory task of the Occupational Safety and Health Administration in combating the shadow economy. Through extensive monitoring, legislative changes and active cooperation with stakeholders and other public authorities, the construction sector has achieved good results, especially regarding compliance with the Act on the Contractor's Obligations and Liability when Work is Contracted Out. In addition, planned supervision of tax and personal identification numbers has reduced the use of so-called undeclared workforce on construction sites. This is reflected in statistics compiled by Statistics Finland, which compare the amount of salary paid in the construction sector with that reported to the Tax Administration relative to the workforce.

In terms of supervision, a new phenomenon has arisen based on which work traditionally done in employment relationships is organised as one-off entrepreneurship through a so-called invoicing cooperative. The relationship is not always problem-free and in some cases it is not clear whether, in practice, it involves an employment relationship in which the employer determines issues such as the hours and performer of the work.

The Finnish Centre for Pensions supervises that employers and the self-employed take out earnings-related pension insurance

One of the statutory tasks of the Finnish Centre for Pensions (ETK) is to supervise earnings-related pension insurance. Employers that fail to take out earnings-related pension insurance gain an unjustified competitive advantage over employers that comply with their obligations. ETK combats the shadow economy with extensive register comparisons and tip-offs from other authorities.

Employers insure correctly for the main part

On average, earnings-related pension contributions account for 24.4% of the payroll. The question of how well employers handle statutory obligations, such as earnings-related pensions, is far from irrelevant from the perspective of guaranteeing fair competitive circumstances and combating shadow economy. Most employers insure their employees correctly.

The results of the supervision by the Finnish Centre for Pensions have been consistent throughout the 2010s. Annual wages amounting to 100–120 million euros have been left uninsured. This equals roughly 0.2% of the insurable sum under the Employees Pensions Act.

There are companies in all business sectors that either intentionally or accidentally insure their employees inadequately. Most of the shortcomings are found in labour-intensive fields, such as construction.

ETK combats shadow economy through supervision

One of the statutory tasks of the Finnish Centre for Pensions is to monitor earnings-related pension insurance under the Employees Pensions Act and the Self-Employed Persons’ Pensions Act.

Supervision ensures that all employers and entrepreneurs in Finland are in an equal position with regard to their insurance obligations. Supervision promotes fair competition between companies and combats shadow economy. The Finnish Centre for Pensions makes sure that employees get the pensions they are entitled to by law. In addition, insurance supervision supports pension providers as they administer insurance and collect pension contributions. These measures secure the funding base of earnings-related pensions.

Comprehensive and topical supervision

The Finnish Centre for Pensions cooperates with pension companies and various public authorities in its supervisory work. It is entitled to get information from employers and authorities for the supervision. If an employer does not voluntarily meet its insurance obligation, the Finnish Centre for Pensions takes out insurance on behalf of and at the expense of the employer (enforced insurance).

The Finnish Centre for Pensions aims to prevent companies from neglecting their insurance obligation. For example, ETK sends all newly self-employed a bulletin on their insurance obligations.

Extensive register comparisons of mass data ensure that the supervision conducted by the Finnish Centre for Pensions is comprehensive and up to date. In addition, the Supervisory Department at the Finnish Centre for Pensions comes across cases through individual inquiries by workers, via risk target screenings, as well as authority reports and authority cooperation.

The Employment Fund provides security for changes in working life

One of the statutory tasks of the Employment Fund is to combat the shadow economy by monitoring the payment of unemployment insurance contributions. Unemployment insurance contributions are collected from wage earners and employers, but the payments are paid by the employer. Unemployment insurance contributions fund unemployment security and promote the development of the expertise of wage earners with adult education benefits.

Main focus of monitoring is on prevention

Around 170,000 employers in Finland have the obligation to pay unemployment insurance contributions. Employers generally attend to their unemployment insurance contributions well. According to our monitoring information, most cases of neglect and errors in reports are due to human or system errors.

We monitor that employers have fulfilled their unemployment insurance contribution obligations and reported the correct wage information to serve as the basis of payments. Monitoring is mainly based on comparing the wages reported by employers with wages received from the Finnish Tax Administration.

We also monitor employers on the basis of data obtained through co-operation between authorities. We work in close co-operation with the Finnish Centre for Pensions (ETK), the Workers’ Compensation Centre (TVK), and the Tax Administration. Monitoring of unemployment insurance contributions also supports compliance with other statutory obligations, thereby helping to prevent the shadow economy.

The supervision carried out by the Employment Fund mainly focuses on prevention. We advise and help our customers to report and pay unemployment insurance contributions correctly. As from 1 January 2019, we receive our wage information from the national Incomes Register, on the basis of which the unemployment insurance contributions are determined. Thanks to this up-to-date information, we notice errors faster than before, enabling us to provide guidance to the employer to correct the erroneous information in the Incomes Register. This means that now there is less frequently the need to afterwards adjust the imposed payments.

In co-operation with the Workers’ Compensation Centre, we send all new employers a newsletter informing them of the unemployment insurance contribution obligations of employers and how to report wages to the Incomes Register.

Further information is available at Employment Fund’s website [.fi]›

Finnish Workers’ Compensation Centre oversees Finland’s workers’ compensation insurance system

The Finnish Workers’ Compensation Centre (TVK) contributes to the fight against the shadow economy by carrying out checks to establish whether employers have complied with their insurance obligations. The process begins by a comparison between insurance register data and payroll records obtained from the Finnish Tax Administration. Any employers who have paid wages but have no workers’ compensation insurance are investigated more closely.

Suspected cases of non-compliance can also be reported to TVK by, for example, employers themselves or Regional State Administrative Agencies. In addition, TVK investigates cases involving cash-in-hand employment that are referred to it by the Finnish Tax Administration.

Deliberate neglect of insurance obligations feeds the shadow economy

Deliberate neglect of the obligation to take out workers’ compensation insurance contributes to the shadow economy just like any other non-compliance with employers’ obligations. Failure to carry insurance distorts competition between businesses and prevents the collection of statutory contributions.

Both enforcement and education are needed in the fight against the shadow economy

Many non-compliances are down to ignorance, and this can be remedied by means of education. TVK educates employers, for example, by explaining the obligation to carry insurance to any businesses that are included in the national Employer Register but are found to not have insurance.

The checks carried out by TVK are designed to ensure that all employers who operate in Finland comply with their statutory insurance obligations.

Failure to carry workers’ compensation insurance can be costly for businesses

Non-compliant employers can be ordered to pay a penalty. Potential sanctions include

- a fine equivalent to the insurance premium,

- a penalty equivalent to up to three times the insurance premium, and

- a deductible of up to EUR 5,140 in the case of an accident.

In some circumstances, a non-compliant employer can also be found guilty of accident insurance fraud, which carries a penalty of up to one year of imprisonment.

Products, services and equal competition

The administrative sector of the Ministry of Economic Affairs and Employment and the fight against the shadow economy

The key task of the Ministry of Economic Affairs and Employment (TEM) is to create good preconditions for business and industry, thereby improving employment and Finland's competitiveness. TEM is responsible for ensuring a good business environment for entrepreneurship and innovation, the functioning of the labour market, the employability of the labour force, and regional development. The objective is a business environment in which companies have a level playing field.

Among other issues, TEM is responsible for preparing and developing public procurement and competition and labour legislation. Key principles include open and effective competition for public procurements and the equal and non-discriminatory treatment of tenderers.

TEM contributes to the fight against the shadow economy and economic crime by developing legislation and ensuring that various projects take account of efforts to combat the shadow economy. These include the reform of the Act on Public Contracts and the supervision of auditors, as well as legislation on working life, posted workers and customer liability.

Combating undeclared work

TEM has established a network for promoting cooperation against undeclared work. The network supports the activities of the EU’s European Platform Tackling Undeclared Work and national strategies and programmes for fighting the shadow economy. A key task of the network is to disseminate information to various actors on cooperation, means of supervision, new phenomena and best practices in fighting undeclared work. Finland is committed to combating undeclared work. The issue was added to the action programme to tackle the shadow economy and economic crime in the years 2016 to 2020.

Social responsibility applies to everyone, including the public sector

Within the Government, TEM is responsible for the corporate social responsibility policy, which builds on a notion of social responsibility that takes account of one’s own social impacts. The themes of corporate social responsibility can therefore vary from respecting labour rights to privacy protection and the fight against corruption in land use issues. Corporate social responsibility not only concerns companies. The public sector too can meet its social responsibilities through responsible public procurement, for example. Social responsibility also promotes compliance with the statutory obligations of companies at a general level.

Fighting the shadow economy within TEM’s administrative sector

- The Finnish Competition and Consumer Authority is involved in fighting the shadow economy by means such as cooperation between public authorities and exchanging information, which help to expose cartels and create unfavourable conditions for them. Problems with consumer protection can involve consumer fraud and actions that undermine consumer confidence in the functioning of markets in general.

- The National Board of Patents and Registration is responsible for maintaining and monitoring information submitted to the Trade Register. However, the number of trade register offences brought to light and of Trade Register submissions investigated on a risk-basis are indicative of the possible amount of shadow economy activity.

- The TE Offices review the appropriateness of partial employee residence permit decisions, including so-called assessments of workforce availability, as well as ensuring the legality of employment relationships and the employer's capacity to operate as a socially responsible employer. Around 10% to 15% of partial decisions made by TE Offices are negative. TE Offices exercise their discretion on issues such as obligation compliance reports. Preventative supervision by TE Offices reduces the pressure to engage in retrospective monitoring of compliance with terms of employment and employers’ obligations.

- Uusimaa Centre for Economic Development, Transport and the Environment (ELY Centre)

An entrepreneur’s residence permit is granted in two stages: the ELY Centre makes an interim decision before the final decision is made by the Finnish Immigration Service. The Uusimaa ELY Centre is the designated national authority for making interim decisions concerning entrepreneurs’ residence permits. Entrepreneurs’ residence permits are granted on a case-by-case basis involving assessment of the profitability of the proposed enterprise and the applicant’s earning potential. The assessment includes considering documents to be submitted, such as a business plan, binding letters of intent or proof of funding. At the moment, the Centre returns a favourable interim decision in about 50% of the cases assessed. The assessment includes considering aspects of the grey economy. The Centre cooperates closely with other authorities in carrying out this duty. - Business Finland

The background details of applicants are investigated through Business Finland’s funding activities. Extensive public-sector information obtained through obligation compliance reporting is Business Finland’s largest single means of combating the shadow economy. Cases involving the shadow economy and economic crime are revealed each year through financial supervision. Most economic crime revealed in this way concerns suspected cases of benefit fraud or debtors’ offences.

More information:

tem.fi [.fi]›

European Platform tackling undeclared work [.fi]›

The Finnish Food Authority

The Finnish Food Authority began its operations on 1 January 2019 when the Finnish Food Safety Authority, the Agency for Rural Affairs and part of the IT services of the National Land Survey of Finland were merged into one single Authority. The Authority operates under the Ministry of Agriculture and Forestry. The Finnish Food Authority works for the good of humans, animals and plants, supports the vitality of the agricultural sector, and develops and maintains information systems.

The Finnish Food Authority

- promotes, monitors and studies the safety and quality of food; the health and wellbeing of animals; plant health; fertiliser products, animal feeds and plant protection products that are used in agricultural and forestry production; and propagating materials i.e. seeds and planting materials.

- is responsible for the use of the funds provided by the European Union's agricultural guarantee and rural development funds in Finland, operates as the EU's paying agency and monitors the implementation of EU and national grants – farming subsidies, project, entrepreneurship and structural subsidies as well as market subsidies.

Signs of crime can already be glimpsed in Finland’s food chain

In the food sector, 2013 is remembered as the year of the horse meat crisis. At that time, the authenticity of meat products, i.e. whether the type of meat listed on the packaging was the same as that established by laboratory tests, was examined in Ireland. It turned out that horse meat, which was much cheaper than beef, had been systematically used as a raw material for foodstuffs, despite the labels claiming that only beef had been used.

It was the horse meat scandal that ultimately led to awareness in the European Commission and Member States that fraud was being committed in pursuit of major financial gains in the food industry, and that such gains had been made. Consumers too became aware that crimes were being committed in the food chain. The Finnish Food Authority is responsible for combating crime in the food chain in collaboration with other authorities.

Closer cooperation in the EU

In the wake of the horse meat scandal, the European Commission established an EU Food Fraud Network of food supervision authorities, which began to meet regularly. In 2015, a system was introduced for suspected cases of fraud in the food chain, enabling authorities in Member States to request assistance from each other easily when handling cross-border cases.

Via this network and information exchange system, the food and pre-trial investigation authorities of Member States have jointly investigated several cases of food fraud that would have been virtually impossible to solve previously. The European Commission’s website on the issue [.fi]› was opened in the spring of 2017.

What is food fraud?

Food fraud is not defined under Finnish or EU legislation. According to a working definition of the concept, food fraud involves: A violation of EU food law - that is committed intentionally in order to - pursue economic or financial gain by - deceiving a trading partner or consumer.

Food fraud is a particularly tempting criminal activity because food counterfeiting is easy, highly lucrative and the risk of being caught is small.

The risk of being caught is lowered by the relatively low level of cross-sector or cross-border cooperation between the authorities. For example, sentences are very light compared to those issued for drug offences, making the food industry more tempting – in many respects – for criminals than more traditional types of crime.

Food fraud tends to take the form of economic crime. It often also involves the shadow economy: for example, food supervision fees are avoided by doing business ‘off the radar’ of food safety authorities, or taxes are avoided by non-disclosure of revenue.

The Finnish Food Authority is actively building official networks in Finland

In addition to more intensive cooperation between EU Member States, inter-authority cooperation has been intensified in Finland in recent years. The Finnish Food Authority is the central authority governing the food chain and is the contact point of the European Food Fraud Network in Finland.

The Finnish Food Authority has so far been engaged in coordinating cases of food fraud across several municipalities and has assisted municipal and Regional State Administrative Agency supervisory authorities in matters such as requesting inquiries.

Cooperation between authorities has also been strengthened by training sessions organised by The Finnish Food Authority. A training day focusing on food fraud, to which the authorities of each region were invited, received particularly good feedback. Officials representing the food chain, the police, prosecutors, the Tax Administration, the enforcement authorities and Customs formed effective new cooperation networks across the country during the training tour.

Identifying fraud is a challenge for conventional supervision

Fraud in the food chain has mainly been a hidden form of crime in Finland. It is not easy to detect with normal food safety supervision tools and methods, due to which crime in this sector has seldom been brought to court in Finland. However, the food safety authorities have recently sharpened their perspective on the issue, due to which far more criminal and pre-trial processes are under way around the country.

The suspected offences so far identified by the food safety authorities in Finland tend to be cases of fraud concerning the origins of food. There have also been more suspected cases of the illegal slaughter of animals in recent years. It is likely that the number of cases will increase further and they will become more varied as experience accumulates and cooperation between the authorities intensifies.

Valvira – Alcohol Administration

Alcohol administration means the overall system of licensing administration, control and steering formed by the National Supervisory Authority for Welfare and Health (Valvira) and the regional state administrative agencies (AVI), which act as the alcohol authorities. The core task of the alcohol administration is to prevent the harm caused by alcohol to its users, other people and society as a whole, by controlling and limiting alcohol-related business activities. This core task forms a sturdy buttress and foundation to be part of the network of authorities combating the grey economy.

Valvira’s role in the alcohol administration

In accordance with the Alcohol Act, the alcohol administration operates as a division between the National Supervisory Authority for Welfare and Health and six independent regional state administrative agencies.

Valvira's task in alcohol administration is to steer and develop the regional state administrative agencies' licensing and supervisory operations of the serving and retail sales of alcohol, as well as the production of information and communications services. Additionally, Valvira steers and supervises the serving and retail sales of alcohol and the marketing of alcohol throughout the country. Valvira also acts as the licensing and supervisory authority for the wholesale, production and commercial importers of alcoholic beverages, and is responsible for alcohol product control. The regional state administrative agencies are responsible for the licensing administration of the serving and retail sales of alcohol; and supervise the serving, retail sales and marketing of alcohol in their regions.

Valvira monitors the performance and impact of the supervision by the regional state administrative agencies. Fulfilment of the financial preconditions of licence holders and applicants is supervised in order to allow early intervention to prevent license-holders from becoming insolvent, as well as to reduce the number of actors failing to fulfil the reliability-, financial- or suitability-based preconditions set by the Alcohol Act with regard to the serving or retail sale of alcoholic beverages. From the perspective of alcohol administration, the evaluation and supervision of financial reliability are an established part of combating grey economy.

In co-operation with the regional state administrative agencies, Valvira draws up the national supervision programme of alcohol administration. The supervision programme guides the regional licensing administration, ensures the consistency of decisions and supervises the effective implementation of the Alcohol Act.

Combating the grey economy requires good interaction and close co-operation with stakeholders

The supervision of the companies' statutory prerequisites for operation requires co-operation with stakeholders, particularly with the Tax Administration, Police, municipal health protection authorities, and license-holders.

According to the Alcohol Act, both natural and legal persons are subject to the requirement of the applicant not being bankrupt and the applicant being able to handle their operations and fulfilment of their statutory obligations. Furthermore, the licence-holder or licence applicant must be known to be trustworthy and have personal characteristics that are suitable for conducting business activities pursuant to the Alcohol Act. The prevention of harm to the neighbouring and residential areas is also one of the objectives of the licence administration.

Within the alcohol administration, cooperation is based on a supervision programme, information system management, case-specific cooperation and information exchange. Cooperation on information flows is facilitated by Valvira’s national alcohol trade register and the alcohol administration's shared extranet.

Serving and retail sales of alcohol are supervised both in advance and retrospectively

Supervision by the regional state administrative agencies is divided into advance supervision, advance review and retrospective supervision. The advance review is carried out in connection with advance supervision when an actor applies for a licence, whilst retrospective supervision targets licence-holders already operating in the sector.

The licence administration determines whether the applicant meets the general prerequisites related to business activities in accordance with the Alcohol Act. Background checks based on, for example, any already existing register data and data provided by the licence applicants, as well as statements by the authorities, form an overall assessment of the applicants' capability to act responsibly in their business activities with respect to the financial prerequisites, trustworthiness and suitability. In some cases, the overall assessment requires that the neighbouring and residential areas are also reserved the opportunity to be heard, in order to determine significant drawbacks.

Among other things, retrospective supervision combats the grey economy, its tools including data on the licence-holders' taxes in default, data reported by the licence-holders, balance reports, and the obligation compliance reports requested from the Grey Economy Information Unit.

The permanent revocation of licences for the serving and retail sale of alcohol is primarily due to the failure to meet trustworthiness-, suitability- or financial-related preconditions required by the Alcohol Act. Most commonly this means significant or repeated failure to pay taxes and other fees governed by public law, or the detection during an inspection of issues related to trustworthiness or suitability or causing serious health hazards. The reasons for temporary revocations and milder sanctions are more varied, emphasising deviations from the actor's self-monitoring plan or reasons based on alcohol policy, such as serving alcohol to minors or persons who are clearly inebriated.

New Act on transport services brings changes to taxi services – the Finnish Transport and Communications Agency takes over responsibility for supervision

The new Act on transport services (Act 320 of 2017, only available in Finnish) relaxes regulation considerably and reduces the administrative workload of road transport operators while also creating equal operating conditions for current and new businesses on the market. The Finnish Transport and Communications Agency takes over the responsibility for processing transport licence applications, issuing licences and supervising licence holders from regional Centres for Economic Development, Transport and the Environment.

The Act on transport services enters into force on 1 July 2018. It repeals the Taxi Transport Act, the Act on the Professional Competence of Taxi Drivers, the Public Transport Act and the Act on Transport of Goods on the Road. The reform also introduces changes to many other acts governing road transport.

New taxi licensing procedure

The biggest change introduced by the Act on transport services relates to taxi licensing, as it abolishes demand-based municipal quotas for taxi licences. As of July, a taxi licence can be issued to anyone who satisfies the licensing requirements laid down in the Act, which include, among others, age of majority and legal competence, good repute, compliance with legal obligations and business viability. The Act also relaxes the rules on taxi services considerably, as it abolishes the minimum level of taxi service provision and the obligation to operate from a specific taxi rank. The cap on taxi fares, which until now has been decreed annually by the Government, also becomes history.

Licence still required for operating taxi services

Despite the many changes, operating a taxi service still requires a licence, and unlicensed taxi operation is still a punishable offence. The Act on transport services gives the Finnish Transport and Communications Agencythe right to issue a transport licence to any natural person who has submitted a basic notification to the Trade Register. New entrepreneurs also need to ensure that they submit all the necessary information to the Finnish Tax Administration’s registers:

- the provision of passenger transport services is subject to value-added tax, and service providers must be included in the Finnish Tax Administration’s VAT register.

- New entrepreneurs should ideally also be entered into the Finnish Tax Administration’s prepayment register. This prevents customers from having to withhold tax when paying for their services and leaves the responsibility for prepayments to the service provider.

- Any entrepreneur or business that makes regular salary payments to two or more permanent employees or simultaneous payments to at least six short-term or temporary employees must also be included in the Finnish Tax Administration’s employer register.

Fixed prices alongside taximeters

An amendment to Section 25 of the Vehicles Act, which enters into force at the beginning of July, makes taximeters compulsory for all passenger transport licence holders who charge for their services on the basis of distance or time. This applies to both taxis and charter buses. No taximeter is required if the customer is given a fixed price before the start of the journey.

Regardless of the method of pricing, customers who pay by cash must always be given a receipt either on paper or electronically. A receipt does not need to be printed out if the customer does not want one. However, all transactions must be recorded in the service provider’s accounting system.

No changes to accounting and taxation principles

There are no changes to the taxation and accounting principles applicable to taxi companies in the new Act on transport services. Taxi companies need to keep a record of the use of each of their vehicles for business (commercial/non-profit services) and private purposes as well as their in-come, broken down to cash and card payments and billed services. Only business expenses can be deducted in corporate tax declarations. A vehicle is classified as a business asset if more than half of its mileage comes from business use.

Licence information available from the Vehicular and Driver Data Register

As of July, taxis can be cars, vans or even heavy quadricycles but not buses (vehicles registered to carry the driver and nine or more passengers). Bus transport operators need a passenger transport licence. The licensing requirements are largely the same as for taxi licences, but operators also need to demonstrate sufficient financial resources as well as professional qualifications. While taxi licences are issued to businesses, passenger transport licences are always vehicle-specific and must be carried in the vehicle. The aforementioned rules relating to basic notifications to the Trade Register and the Finnish Tax Administration’s registers also apply to passenger transport licence holders. All licensed vehicles must be entered as being used for the provision of services that re-quire a licence in the Vehicular and Driver Data Register.

The Act on transport services also makes it possible to operate taxi services by simply notifying the Finnish Transport and Communications Agency, provided that the operator already has a passenger or goods transport licence. The Finnish Transport and Communications Agency updates the transport licence register based on the operator’s notice. The right to operate taxi services ends if the licence holder asks to be removed from the register or when their passenger or goods transport licence expires. The same obligations and responsibilities apply to all taxi services regardless of whether the operation is based on a licence or a notice.

Finnish Competition and Consumer Authority

The Finnish Competition and Consumer Authority (KKV) has several contact points with the shadow economy, particularly in relation to procurement supervision, cartels and corporate and consumer fraud. In addition, the KKV is involved in helping to lighten the regulatory burden associated with measures for fighting the shadow economy.

Procurement control

The Government resolution on the strategy to tackle the shadow economy and economic crime for 2016–2020 highlights the targeting of public procurement monitoring at the prevention of corruption.

The KKV drafts an annual report on supervision of the Act on Public Contracts, with a summary of:

- unlawful practices observed during supervisory activities, and detrimental practices with respect to transparency and non-discrimination, and their most common background factors;

- the number and content of measures referred to in Section 139 of the Act on Public Contracts;

- the number and content of prohibitions and commitments referred to in Section 140 of the Act on Public Contracts; and

- the number and content of proposals, and court judgements made on the basis of proposals, in Section 141 of the Act on Public Contracts (Section 144 of the Act on Public Contracts).

The regulatory burden

The Government Resolution on the strategy to tackle the shadow economy and economic crime in 2016–2020 emphasises the need to lighten the administrative burden of businesses. The action programme to tackle the shadow economy and economic crime in 2016–2020 designates the KKV as the party responsible for drafting a report on the regulatory burden. A model for lightening the regulatory burden will be developed together with the Ministry of Economic Affairs and Employment. The first calculations of the costs of means of combating the shadow economy will be ready by the end of 2017. The results of monitoring of the regulatory burden will be reported annually thereafter.

Cartels and fraud

Competition monitoring within the agency focuses on cartels, among other issues. Cartels have been detected during public procurements, for example. Links with corruption have also been observed within cartels. The Consumer Division and Market Research Unit also focus on consumer and business fraud.