Undeclared wages and disguised dividends

Published 13.6.2022

The Grey Economy Information Unit has analysed criminal convictions related to tax audits in which undeclared wages and disguised dividends have been discovered. Typical methods of procedure have been identified based on the criminal convictions, and these are described below using example cases.

Case 1. Selling off the books

I’m all out of cash, again. How can a technician’s indirect costs be almost as high as another employee’s wages?

I run a respectable business. I’ve registered my company in the Trade Register, and my company is in the VAT register and the register of employers, as well as the prepayment register, because my customers may occasionally apply for tax credit for household expenses arising from my company’s installation projects. They say that honesty doesn’t pay.

The last customer paid in cash and didn’t even want a receipt. No-one will notice if I put the money straight into my pocket and buy something nice for my family. The children would like it. They’re starting to be at an age where they need to have everything.

My accountant just called and said that my sales have dropped and my wages aren’t what they used to be. I said that I’ve cut down my hours and focused on my family. My accountant wanted to know how anyone can live with such low income, but didn’t go into it any further.

I told the technician that I could pay part of his wages off the books or otherwise I couldn’t pay anything at all. He mumbled something and took off, so I guess it’s alright.

My books and financial statements are looking good. My accountant knows what he’s doing. While my business isn’t any successful money-maker, it’s still up and running, and I’ve much more money than I used to. They sent me my pre-completed tax return. My taxable income seems low, but I’m okay with it. I go back to the online shop and forget about MyTax.

Yesterday, I bought my company a top-of-the-line fishing boat – after all, there can be no business without pleasure, and I believe it entitles me to a tax deduction. When I don’t have the time, I can lend it to my friends. It can’t hurt anyone.

I’m starting to have some troubles with accounting. The books don’t seem to match. However, I’ve noticed that if I can’t get the books right, I can fix them by making a few fake invoices. VAT is no problem either. The Tax Administration only needs to know what they can find in the books.

I received a letter yesterday. It seems that the Tax Administration wants to audit my company. Be my guest, my books are looking fine!

The auditors don’t believe that my books are authentic. They say that cash sales are usually much higher in this sector than what my company’s figures say. My answer is that nobody uses cash anymore. Based on card sales and opening hours, the auditors believe that my company’s income is alarmingly low. They also question the wages I pay to my technician, because the amount of tax credit for household expenses applied for using my company’s business ID is much higher than what the technician’s workload suggests.

The auditors go through my books and check various comparative data. It looks like that my apparently accurate books can’t fool anyone. They’re going to prosecute me, that’s for sure.

I’m going to be charged with an aggravated accounting offence and aggravated tax fraud. The amount of undeclared sales is pretty high, other reported figures are maybe a bit low, and my books don’t give an accurate view of my company’s situation.

I decide to admit my guilt – I don’t know what else to do. They will hopefully treat me more leniently. I’ve already started to make payments to the Tax Administration according to my payment plan. In court, I’ll plead not to receive a business ban so that I could continue to run my business and make my payments to the Tax Administration.

They give me a conditional sentence of 14 months and a four-year ban on business operations. The legal proceedings cost me a fortune in legal fees, and the Tax Administration collects unpaid taxes from me in damages. However, I won’t lodge an appeal – I pleaded guilty after all.

Case 2. Undeclared wages and fake receipts

I’ve been given a ban on business operations. However, I’ve got good contacts and I should be able to continue my business. I guess my spouse has no problems with registering my business in her name. If she wants, she can make herself the CEO, or something like that, but she doesn’t have to do anything otherwise. I will take care of daily operations, as long as I get online banking codes and a credit card for the company’s account, as well as some powers of attorney.

I’ll be able to make some good deals. I know a few guys who’ll be happy to work for me, provided that I don’t pay wages in their accounts. I’m fine with that – after all, I won’t have to pay any other employee costs or get registered in the employer register. Of course, I’ll need cash to pay their wages. Maybe I’ll sell a few cars bought in my company’s name. I’ll pay their wages with the money I receive from the cars. They’re old cars and wouldn’t have been good for making money anyway. I’ll buy a new car as a replacement later. Then, I’ll report a much higher purchase price and use the difference to pay wages. The rest will stay in my pocket.

I’ll also start to make fake invoices. My parents’ company will receive regular payments through consulting. They know how to make things look good in their books, and they’ll pay me back in cash.

My books and tax returns have been made to look authentic; after all, we want to look like a regular business.

My spouse told me that my company will be audited. I quickly transferred money from my company to a friend of mine for safekeeping. I’ll get it back when I need to.

Pretty soon the auditors found out that my spouse has no knowledge of what my company does, even though she’s the CEO and a member of its Board of Directors. They were also able to identify my employees, and now they’re estimating the amount of wages paid based on lists of hours attached to sales invoices. They told me that the amount of funds withdrawn from my company’s account proves that I haven’t submitted my tax returns according to actual income and expenses. They also say that any company that pays wages to its employees should be in the employer register. The purchase price of my car also amuses them – it’s not as fancy as the price suggests.

They’ll see me in court. I receive a conditional sentence, reduced by my previous conviction, for a violation of my ban on business operations, an aggravated accounting offence and aggravated tax fraud. I don’t fully agree with the decision, and I’m considering an appeal. While my spouse says in court that she has no knowledge of or experience in business activities, she receives a fine for aiding and abetting in an aggravated accounting offence and aggravated tax fraud.

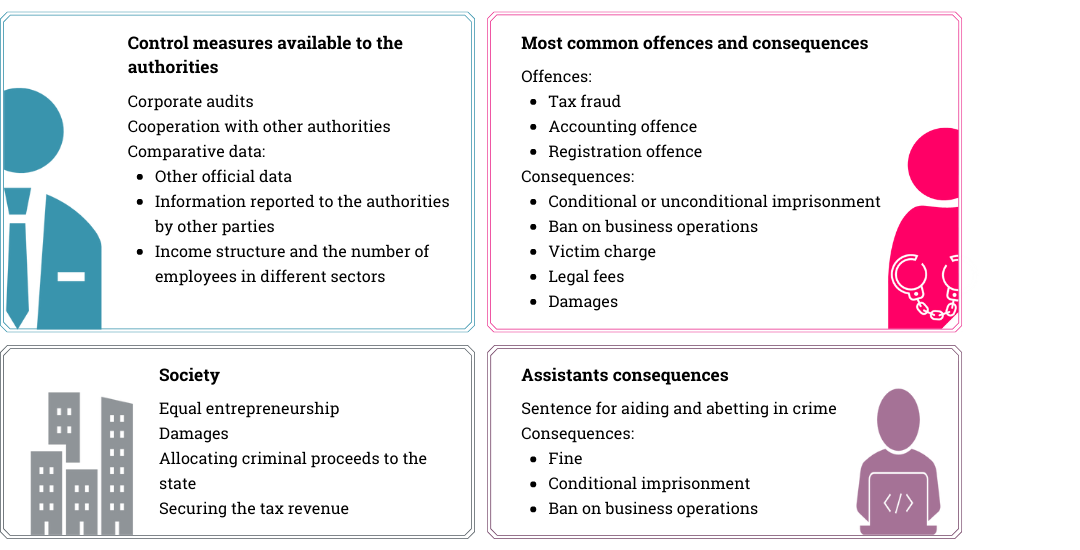

Tax control

Tax control ensures that tax revenue is collected accurately and at the correct time. In addition, tax control ensures that the tax burden is divided even-handedly, and it offers significant means for preventing tax violations. Effective tax control aims to uncover and prevent tax crime. Tax control increases the credibility of the tax system.

Tax audits improve taxpayers’ ability and will to fulfil their tax obligations. When self-employed persons know that they may be audited, they are less likely to engage in fraudulent activities when sanctions are effective.

A tax audit identifies not only whether accurate and sufficient information has been provided for taxation, but also the type and scope of the audited company’s activities based on accounting material. As a result, the Finnish Tax Administration also supervises the reliability of accounting and is the largest authority that systematically investigates companies’ accounting material.

Undeclared wages

Undeclared wages mean wages that are paid without paying any taxes or other employer contributions, such as pensions and statutory insurance contributions, and without declaring the wages to the authorities. Funds for paying undeclared wages are typically obtained from sales that are not registered in accounting and from assets received using fake invoices and receipts. Undeclared wages are often paid in cash, but they can also be paid otherwise.

Disguised dividends

Disguised dividends mean situations where a shareholder uses their company’s assets without any consideration or at a lower price. In addition, income not registered in accounting can be considered to have been transferred to the principal shareholder and can be taxed as disguised dividends.

Tax fraud

Methods of tax fraud include providing inaccurate information to affect the levying of taxes, concealing information, violating an obligation set for taxation and other fraudulent activities whose goal is the avoidance of taxes, the levying of lower taxes or an unfounded refund.

If tax fraud seeks significant financial benefits or is particularly systematic and can be considered to be aggravated, the perpetrator will be sentenced for aggravated tax fraud.

Attempted tax fraud is also punishable. And accounting fraud is punishable separately.

One or more instances of tax fraud

Different types of tax fraud are often treated as a single offence because undeclared wages or cash withdrawals by the principal shareholder are often concealed using fake receipts, whose registration in accounting has an impact on income tax and VAT.