Filing self-assessed taxes ‒ detailed guidance up to 2020

This guidance is for filing the following taxes and making corrections to the tax-return information you have filed previously:

- Value added tax (VAT)

- Other self-assessed taxes including lottery tax, insurance-premium tax, amounts withheld on paid interest and paid profit-shares

If you are a filer of employer's contributions, here’s what to do:

- You are required to report your payroll information to the Incomes Register

- Filing reports on wages and employer’s contributions

Send us your tax returns electronically – filing on paper forms is not allowed but as an exception

You must use electronic filing for your VAT reporting and other self-assessment, including both filing and paying. Paper forms can only be used if you do not have access to e-filing. The name of the form to complete is “Tax return on self-assessed taxes”.

Please note that if your tax return concerns an equity savings account and the tax period is in 2020, you can only submit the return electronically.

More information on tax returns Filing and paying self-assessed taxes

Table of contents

Key changes as of 1 January 2020

Changes that came into force on 1 January 2019 with the Incomes Register

Changed rules on value added tax on imports VAT since 1 January 2018

Previous Changes

Parties that must file self-assessed taxes

Start and end dates of Tax Period

Filing self-assessed taxes ‒ how and when to do it

During this tax period, will you pay VAT on a cash basis?

Paying self-assessed taxes

VAT

If you have no operations subject to VAT during your tax period

How to report VAT relief information

Special groups of taxpayers (including sub-accounting units, account operators)

Filing and paying other self-assessed taxes

Making corrections to submitted returns

The Tax Administration imposes late-filing penalties for overdue returns

Key changes as of 1 January 2020

- The new act governing equity savings accounts (laki osakesäästötilistä; lag om aktiesparkonton (680/2019)) is in force from the beginning of 2020.

Savings, within the meaning of the new act, can be made with the help of an equity savings account as a service offered by a bank that accepts ordinary deposits, or by foreign credit institutions in the EEA, or offered by investment service companies including foreign investment companies in the EEA. For more information on the providers of the service, see the Act on Credit Institutions and the Act on Investment Services.

The yearly return earned by every equity savings account must be reported to the Tax Administration on an annual information return that the service provider must send: Annual information return about equity savings accounts. The service providers must report the amount withheld or the tax at source withheld on the yearly return; this can be done in MyTax either as “Withholding on interest and shares” or as “Tax at source on interest (non-residents)”. This information can only be submitted electronically.

- As of 2020, the annual information return on paid pensions and benefits will have the new “Q4” type of payment. This will be used for reporting the returns derived from certain insurance contracts subject to special tax treatment (under § 35b, subsection 4 of the act on income tax (Tuloverolaki 1535/1992)). The related tax withheld can be reported in MyTax on the report designed for pensions and benefits.

Changes that came into force on 1 January 2019 with the Incomes Register

Since the start of 2019, employers and other payors have had to submit reports on the following payments to the Incomes Register:

- Paid wages and the employer’s health insurance contributions

- Withholding on payments made to limited company, cooperative or other corporation

- Tax withheld at source on any royalties you have paid out

- The tax return for self-assessed taxes is used by payors of pensions and benefits in 2019 and 2020

Changed rules on value added tax on imports VAT since 1 January 2018

- Value added taxation of imported goods is no longer administered by the Customs because as of 1 January 2018, the Finnish Tax Administration has been the authority in charge of this branch of taxation. Businesses registered for VAT are affected by this administrative change.

- Payments and import declarations including VAT reporting must now be addressed to the Tax Administration. This concerns the importation of goods with import dates 1 January 2018 or later.

- Import VAT must be filed and paid on your own initiative, using the VAT return form.

- The form contains specific fields for import transactions: ”Tax on imports of goods from outside the EU” and ”Imports of goods from outside the EU”.

Read more:

Import VAT as of 1 January 2018

Basis of value added tax for imported goods

Tax border between Åland and the rest of Finland

- Log in to MyTax, the Tax Administration's e-service, to submit your returns and pay the taxes.

Read more: Filing and paying self-assessed taxes

Previous Changes

- Making corrections to mistakes on a tax return: To make a correction, you must file a replacement return regarding the tax in question.

- However, for mistakes involving small amounts of money, it is acceptable to put things right more simply. If you need to correct a small mistake, you can do so simply by including the correction in your next tax return, i.e. the return you must file by the due date that comes after the month when you detected the error.

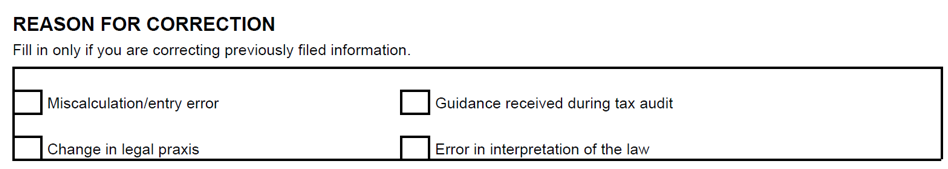

- The form now contains a Reason for correction field. You should fill it in to explain why a correction is being made to VAT or employer's contributions as of 1 January 2017 and later.

- If you filed a return where the VAT was too high or a refundable VAT was too low, you must put it right by submitting a replacement. It is important that the tax period of the replacement is the same as that of the original return. If you filed and paid a too high amount of VAT, you cannot complete a refund request form to ask for it to be corrected.

- The way you ask for VAT relief continues to be the same as before, however, you can no longer fill out a specific application form. If you have not submitted the amounts that qualify you for the relief, you must submit a replacement VAT return that contains all the amounts for the tax period concerned.

- If you are late in filing your self-assessment, we impose a late penalty i.e. same as before. However, a number of changes were introduced to the calculation rules of the penalty charges. In cases where assessment by the Tax Administration’s estimation has been carried out; if you file your return after such estimation process and the Tax Administration then cancels its estimate, you are still treated as having filed the return late.

Read more:

- The Tax Administration imposes late-filing penalties for overdue returns

- Late-filing penalty on self-assessed tax returns

Parties that must file self-assessed taxes

VAT returns must be filed by individuals, businesses, companies etc. that are

- VAT payers operating a trade or business

- VAT payers who provide the usufruct of real property and have registered themselves for VAT because of that

- liable to pay VAT as a primary producer

- buyers in certain VAT schemes (reverse charge, and intra-Community acquisitions)

- foreigners with the obligation to complete a VAT return

- a “taxpayer group for VAT” (=verovelvollisuusryhmä)

Parties that must file pensions and social benefits (amounts withheld, tax at source) are businesses or other entities that are

- payors of social benefits or

- payors of pensions.

List of other self-assessed taxes and information on who must file and pay them

- Lottery tax: the party in charge of the event

- Insurance premium tax: parties in the insurance industry, liable to pay this tax

- Amounts withheld from the purchase price for timber: the buyer

- Amounts withheld from interest and shares: the party paying the interest, etc., liable to withhold tax on the payments under the act on income tax

- Amounts withheld on dividends and cooperative surplus: the payor

- Tax withheld at source on dividends and cooperative surplus paid to a nonresident: the payor

- Tax withheld at source on payments of interest income to a nonresident: the payor

- Tax withheld at source on payments of interest income to a resident taxpayer: the payor

- Pharmacy tax: the party legally defined as liable to this tax (e-filing only)

Read more about Pharmacy Tax (only in Finnish, Apteekkivero)

Start and end dates of tax periods

'Tax period' refers to the time for which you must file and pay the tax. For most taxpayers, the tax period is the month.

However, the VAT period can be the calendar year in the following circumstances:

- You are an individual and a primary producer, or an estate or consortium/partnership operating a primary production, and you do not operate another trade or business liable to VAT.

- You are a creator of works of art, under the definition of § 79 c, VAT Act, and you do not operate another trade or business liable to VAT.

In a similar way, if you are liable to Pharmacy Tax, your tax period is always the calendar year.

The tax periods for VAT and the tax periods for employer’s contributions are not interconnected. The periods can have different lengths.

If your annual turnover is low (low sales volume), your tax period can be extended

If your turnover is no more than €10,000, VAT and employer's contributions can be filed and paid by calendar year if you request for an extension.

You can request the quarterly period for employer's contributions and VAT if your turnover (or other comparable annual sales) is below the threshold of €100,000 a year.

You can request the calendar-year period for VAT if your turnover (or other comparable annual sales) is below the threshold of €30,000 a year.

To ask for changes to your tax period, log into MyTax to send an application, or fill out the Request form for change of tax period of self-assessed taxes.

Read more: Applying for an extended tax period

Filing self-assessed taxes ‒ when and how to do it

The self-assessed tax return must be filed electronically.

Read more: Filing and paying self-assessed taxes

You must file the return for each tax period that you have; period lengths may be the month, the calendar quarter, and the year. You can log in to MyTax to check your tax period.

When filing returns for each month or for each quarter, they must arrive to the Tax Administration by the 12th of the calendar month. If the 12th falls on a Saturday, Sunday or a public holiday, the date is extended to the next business day. The self-assessed tax return must arrive at the Tax Administration on the due date.

If your tax period is the calendar month, follow this plan:

- Pensions and social benefits: You must pay employer’s contributions by the 12th day of the calendar month following the month when you paid out the pensions and benefits.

- VAT: file and pay VAT no later than on the 12th day of the second month after your tax period for VAT. For example, you must file and pay VAT for February on April 12.

- Lottery tax: file it by the general due date of the second month after the tax period. For example, you must file and pay for February by April 12.

If your tax period is the quarter, you must file for pensions, benefits and VAT by the 12th of the second month after the end date of a calendar quarter. For example, the return that relates to first quarter (January to March) must be filed by 12 May.

In some circumstances, the tax period for VAT can be the calendar year. Then the last day to file is the last day of February in the following calendar year.

Note: If your tax period has been the calendar year and it changes to a shorter period mid-year, or if your business operation is terminated during the year/mid-year, you must file and pay VAT earlier.

You must file the return and pay the taxes by the general due date of the month following the calendar month of the month when your new tax period came into force (or of the month when you wrapped up your business operation and your activities ceased). Example: If your tax period is changed from quarterly to monthly on 1 March, you must file the return and pay the taxes for January and February by 12 April.

Filing in advance

Payors of pensions and social benefits cannot submit a return (containing amounts withheld and other values) further into the future than for the tax period that follows the current one. If you are a filer of pensions and benefits, you do not have to provide a “zero” return for periods when you have not made any payments.

Example: For example, if your tax period for employer's contributions is the month, the 3/2019 return (for which 12 April 2019 is the normal deadline) can be filed 1 February 2019.

Other taxes than employer's contributions (such as VAT, insurance premium tax, withholding on the price you paid for timber) cannot be filed in advance: the earliest possible time to file them is during the tax period.

Example: For example, if your tax period for VAT is the month, the 3/2019 return (for which 13 May 2019 is the normal deadline) can be filed 1 March 2019.

Withholding on dividends and tax at source (type codes 92 and 39) can be filed max. 12 months in advance.

You can file a zero return for six months into the future (unless you are a payor of pensions).

During this tax period, will you pay VAT on a cash basis?

The VAT return in MyTax asks you whether you file and pay VAT on cash basis. The default answer is “No”.

Change your answer into “Yes” if you are liable to keep accounting records and you have chosen the cash basis. Cash basis means that you report both the VAT you must pay – and the VAT you can deduct – as relating to the month when you received payment from your customer or when you paid for a VAT-deductible purchase. This method of VAT accounting is available to businesses with a turnover of less than €500,000 a year.

Read more about how to file and pay VAT on cash basis (In Finnish and Swedish only)

Note: In the following circumstances, do not change the default answer “No” even if you pay VAT on the cash basis:

- You are an individual and you operate agriculture, forestry or fishing, and the provisions of the Accounting Act are not applied on your activities.

- You are a self-employed operator of a trade or business. You use cash-basis accounting in accordance with the provisions of the Accounting Act that entitle you to draw up the financial statements on a cash basis, regardless of annual turnover.

Paying self-assessed taxes

Guidance on payments for self-assessed taxes

Detailed instructions

About you

Taxpayer’s name

Registered business or association: fill in the name entered in the Trade Register or the Register of Associations.

Other taxpayers: fill in the full name.

Business ID or personal identity code

This entry is required. Fill in your personal identity code only in case you have no Business ID. This code is needed for the purpose of matching the submitted information with the taxpayer concerned.

Date and signature

Returns must be dated and authorised with your signature. In e-filing, electronic identification replaces the signature.

Telephone

Fill in the telephone number of a contact person giving additional information if necessary.

Tax period

Indicate the reported tax period by its number:

- If it is the calendar month, enter a number (1-12). Example: For filing taxes for March, enter '3'.

- If your tax period is the quarter, enter 1, 2, 3 or 4. Example: if the tax period you are filing a return for is April-to-June, enter ‘2’ for the 2nd quarter.

- If your period is the year, leave this field blank.

Year

Indicate the year of the tax period, fill in all the four digits.

VAT

Tax on domestic sales by tax rate 24%, 14% and 10%

Enter the VAT on domestic sales of goods and services, specified by VAT rate.

The general VAT rate is 24%. Reduced VAT rates: 14% and 10%. The current rates of value-added tax.

Illustration: VAT taxable net selling equals €19,310.00 (= tax base) – the amount of 24% VAT equals 24% × €19,310.00 = €4,634.40.

Illustration: VAT taxable net selling, reduced rate, equals €1,700.00 (= tax base) – now the amount of 10% VAT equals 10% × €1,700.00 = €170.00.

You must include the VAT to be paid e.g. for the following reasons:

- Goods and services taken into private use

- Sales of fixed assets

- Public subsidies directly linked to the selling price or quantity of the goods or services

- Purchase of goods or services from a foreigner not registered for VAT in Finland (the reverse charge scheme)

- Purchase of emission rights

- Distance selling from other EU country to Finland, if the sales go over the threshold of €35,000 or if the seller is registered for VAT in Finland due to the distance sales

Do not report here the VAT

- on imports of goods. You must enter that under “Tax on imports of goods from outside the EU”

- on sales of telecommunications or broadcast services and electronic services to consumers in another EU country

- paid on purchases of construction services and scrap metal, where the reverse charge scheme is applicable (enter that kind of VAT under “VAT on services purchased from other EU member states on purchases of construction services and scrap metal”)

Tax on goods purchased from other EU Member States

Enter the VAT on goods bought from other EU countries (intra-Community acquisitions).

“Intra-Community acquisition” means that you buy goods

- From a company registered for VAT in another EU country

- The goods are transported to Finland either by the buyer or the seller or an external transport company, commissioned by the buyer or the seller

You are required to report intra-Community acquisitions under:

- Purchases of goods from other EU Member States (the price paid)

- Tax on goods purchased from other EU Member States (the VAT due for the goods)

To work out the amount of VAT, multiply the purchase price (excluding VAT) by the domestic VAT rate applied to the goods concerned. If several VAT rates apply, you must add the VAT together (representing 24%, 14% and 10% rates) and enter the sum total.

If the intra-Community VAT is deductible for you, include it in "Tax deductible for the period".

Example: Your business enterprise has bought goods in EU Member States (also called “intra-Community acquisition” of goods) for €18,000. The goods are in a category for which the VAT rate is 24%. Enter the VAT, which is €4,320 (= 24% x €18,000). This intra-Community VAT is deductible (in other words, you can include it in the appropriate line) according to the same rules on VAT deductibility as applied to goods bought in Finland.

Read more: “VAT treatment of EU commerce of goods” (Arvonlisäverotus EU-tavarakaupassa (only in Finnish).

Tax on services purchased from other EU Member States

Enter the VAT on services purchased from other EU countries to which the reverse-charge provisions are applied in accordance with the general rule of sales between suppliers liable to VAT. When reverse charge is applied, VAT is payable to Finland.

The general rule governing the sales of services:

The country where the buyer is located and tax resident is the country where the VAT is payable.

However, the general rule does not apply to the following service categories when services are sold to a business:

- Services relating to land and real estate property

- Passenger transport

- Renting out means of transport for a short term

- Admissions to events, entertainment and cultural performances – including sports events, exhibitions, conferences, meetings or seminars – additional services such as payments for cloakrooms or similar facilities

- Restaurant and catering services

- Travel Agency services

Enter your purchases of services from other EU countries:

- Purchases of services from other EU Member States (enter the price you paid)

- Tax on services purchased from other EU Member States (enter the VAT)

To work out the amount of VAT: it is the price, excluding VAT, multiplied by the VAT rate applicable If several VAT rates apply, you must add the VAT together (representing 24%, 14% and 10% rates) and enter the sum total.

Example: Purchases of services from other EU Member States are €10,000. The standard VAT rate is applied on this service category, i.e. the rate is 24%. Enter the VAT, which is €2,400 (= 24% x €10,000). You are allowed to deduct this VAT in the same way as you deduct the input VAT when you have bought services in Finland. In other words, you are expected to include it in the VAT deductible for the period.

If the VAT is related to construction services that you have bought in Finland, or to employee-leasing contracts for construction work in Finland, from a seller registered for VAT elsewhere in the EU, enter it in "Tax on purchases of construction services and scrap metal (reverse charge)”.

VAT on import of goods from outside the EU

Enter the VAT you must pay on import transactions.

As of 1 January 2018, the collection of VAT on imports was taken over by the Tax Administration. (Finnish Customs is no longer in charge.) This means that you should enter the imports here, if the customs declaration for the imported goods was approved on or after 1 January 2018. The approval date is indicated on the customs clearance decision.

To work out the amount of VAT, multiply the base with the applicable rate of VAT. If several VAT rates apply, you must add the VAT together (representing 24%, 14% and 10% rates) and enter the sum total.

You must report the amounts for the calendar month when the decision was issued. That month is the month of the customs clearance date, printed on the decision.

You must record the VAT deduction in the same month. Enter it in “Deductible for the tax period”. You cannot deduct the VAT unless you purchased the goods for a VAT-taxable business purpose.

If the importation is handled by Finnish Customs and its VAT value does not go above €5.00, you don’t have to pay it. However, for importation handled by and reportable to the Finnish Tax Administration, no 5-euro threshold is applicable, so you must give details on all your imports (§101, VAT Act).

Import activities operated in Finland may be exemptible from VAT (under §94–§96, and §72h, VAT Act). However, for these imports also, you must report the VAT base values in “Imports of goods from outside the EU”. In this case, do not enter anything in "Tax on imports of goods from outside the EU" and "Deductible for the tax period".

If the Finnish Customs were to change its decision and alter the VAT base and other facts that affect your tax liability, you must make corrections to your VAT return accordingly. You would have to file a replacement return for the tax period concerned.

Example: Your business enterprise enters €80,000 as Imports of goods from outside the EU. The general VAT rate of 24% is applicable to the goods you imported. Enter the VAT, which is €19,200 (= 24% x €80,000). You are allowed to deduct this VAT in the same way as you deduct the input VAT when you have bought goods in Finland. In other words, you are expected to include it in the VAT deductible for the period. This requires that the purchase is for an acceptable purpose.

It is within the jurisdiction of the Finnish Tax Administration to demand that the special VAT scheme governed by §100a, VAT Act be applied on the taxpayer’s import operation. This means that the business enterprise would not receive the goods from Customs until the VAT return is filed and the VAT payment is made to the Tax Administration. In these circumstances, you must report VAT in advance of the tax period’s usual deadline date for VAT return filing. Enter the VAT for the calendar month when the liability to pay it came about; this means the month when Customs accepted the customs declaration (the date of the customs decision). File the tax period’s normal VAT return as a “replacement return” – and do it by the usual deadline date.

Read more:

“Import VAT as of 1 January 2018” – Maahantuonnin arvonlisäverotusmenettelystä 1.1.2018 alkaen

"Basis of value added tax for imported goods" – Maahantuonnin arvonlisäveron peruste

Import operations between Åland Islands and mainland Finland

Finnish Customs does not issue customs decisions on import transactions between these territories because no customs duties are being levied. The VAT on these transactions must be reported on the return filed for the calendar month when you had submitted the sales invoice or bill-of-lading to the Customs office.

In the same way, Finnish Customs does not determine values for the goods' customs clearance in connection with import operations between Åland Islands and mainland Finland when the Tax Administration is in charge of the duties.

In these circumstances, the taxpayer is expected to calculate the customs clearance value independently in order to file and pay the VAT.

Read more: Tax border between Åland and the rest of Finland

Tax on purchases of construction services and scrap metal (reverse charge)

Tax on purchases of construction services and scrap metal, under the reverse-charge scheme.

Enter the purchases of construction services as follows:

- All buying under the reverse-charge scheme must be entered in "Purchases of construction services and metal scrap”. Enter the price paid for these purchases.

- The VAT that must be paid on these must be entered in "Tax on purchases of construction services and scrap metal". To work out the tax, multiply the net price by the 24-percent tax rate of VAT.

If you have paid for employee leasing because you have obtained people to work for your building site as leased employees, you must also report the VAT included in the leasing payments you made. - Although you perhaps are not a seller of construction services, you must give details on any construction service you buy if the sellers are foreigners but the construction work relates to real estate in Finland and for which you as the buyer (under §9, VAT Act) pay the VAT.

Read more: The VAT reverse charge scheme in the construction industry

If you bought scrap metal, you should fill in the form like this:

- Fill in “Purchases of construction services and scrap metal (reverse charge)” as appropriate. Enter the price paid for these purchases.

- Enter the VAT in “Tax on purchases of construction services and scrap metal”.

- However, if you buy the metal from another EU country and it is treated as intra-Community trading, enter the VAT in "Tax on goods purchased from other EU Member States".

Read more: The VAT reverse-charge scheme in the scrap industry (Metalliromun ja -jätteen myynnin käännetty arvonlisäverovelvollisuus (only in Finnish)

Deductible for the tax period

Enter the total amount of VAT, deductible for the period.

VAT included in the purchase price of goods or services that have been bought for a VAT liable business operation can be deducted from the VAT on sales.

Examples of what can be deducted and is bought for a business purpose:

- Input VAT, included in a domestic purchase. The seller must be VAT-registered in Finland

- The VAT on purchases you make that serve a business activity subject to zero-rate VAT

- The VAT on purchase of goods from other EU countries i.e. tax payable on Intra-Community acquisitions (You must also fill in “Tax on goods purchased from other EU Member States”)

- Import VAT i.e. the VAT on imported goods (= purchases from outside the EU, including Åland Islands)

- The VAT on purchases in Finland where the reverse charge mechanism is applicable, when the seller has been a foreigner not liable for VAT

- The VAT on purchases of construction services and scrap metal, where the reverse charge scheme is applicable (enter the VAT in “Tax on purchases of construction services and scrap metal” as appropriate”)

- The VAT on purchases in Finland of rights to emit industrial pollution (enter it in “VAT on domestic sales by tax rate”).

- The VAT on purchases in Finland having to do with sales of telecommunications or broadcast services and electronic services when the VAT taxable person is registered for VAT Special Scheme (M1SS) in another EU country and is also registered for distance sales in Finland

VAT is deductible only for the part the goods and services are used for the purposes of VAT-taxable business. It is not deductible when restrictions of the right to deduct are applied to the goods and services used. Nor does the use for private purposes qualify for deduction.

Read more:

Restrictions of VAT deductibility (Vähennysoikeuden rajoitukset (only in Finnish)

VAT special scheme

Guidance on VAT deduction rights

Amount of VAT relief

If you are entitled to the relief, enter its amount.

Read more: How to report VAT relief information

Tax payable / Negative tax that qualifies for refund (-)

The end result of the VAT computations for the tax period. First, add:

- Your VAT due for sales in Finland

- Your VAT on goods purchased from other EU Member States

- Your VAT on services purchased from other EU Member States

- Your VAT on purchases of construction services and scrap metal

The sum you get must then be adjusted: deduct the deductible VAT from it, and subtract any VAT relief (for small businesses) from it.

If the above computation results in a negative figure, enter a minus sign. In this case, you have less VAT to pay than what you can reclaim.

However, the VAT that is refundable will not affect your MyTax balance until the Tax Administration has approved your computation and refund.

Turnover taxable at zero VAT rate

Report the sales taxable at the zero VAT rate for which you are entitled to deduct the input VAT. Examples of such supplies (=sales):

- Sales of goods to a destination outside the EU, e.g. to Norway, or sales from mainland Finland to the Åland Islands

- Sales of goods, including installation or assembly, to a destination in another EU country

- Tax-free sales to travellers

- Tax-free sales to diplomats and international organisations

- Tax-exempt selling of goods that relates to warehousing procedures

- Tax-exempt sales of print runs of membership bulletins to nonprofit organisations

- Sales of tax-exempt vessels and of work on such exempted vessels

- Sales of services performed in EU territory or outside, which are not reported as Selling of services to EU, such as construction services sold to a real estate situated e.g. in Norway or in Sweden

- Sales of goods in EU territory or outside if it is taxed in another EU country or taxed in a non-EU country; for example, the selling of goods in the Russian Federation

- Sales of telecommunications or broadcast services and electronic services to consumers in another EU country

Do not include:

- The VAT-exempt sales for which you are not entitled to deduct the input VAT, such as healthcare and medical services, and social services

- What you report as “Sales of goods to other EU Member States”

- What you report as "Sales of services to other EU Member States" under the general rule (in reference to §65, VAT Act)

- Government subsidies of any kind, including agricultural

Sales of goods to other EU Member States

Report the total of your Intra-Community selling, which means the sales of goods to other EU countries to buyers that are VAT-registered taxpayers. The goods must be physically transported from Finland to another EU country.

The amount of the sales is the price based on an agreement between the seller and the buyer including all surcharges and transportation costs that the seller has charged from the buyer for the delivery.

Transfer of goods to another EU country for selling is also treated as Intra-Community sale. For example, the value of goods transported from Finland to Germany in order to sell them is reported here.

In the case of triangulation, do not report the second supply on your VAT return. You must report it on the VAT EU Recapitulative Statement only.

Cross-border sales to consumers in other EU countries are not regarded as tax-exempt Intra-Community sales. Instead, they must be reported as “domestic” selling. Enter such sales in “VAT on domestic sales by tax rate”. However, the selling of a new means of transport to a private person in another EU-state is always regarded as an Intra-Community sale, which is reported in "Turnover taxable at zero rate”.

Read more: “VAT treatment of EU commerce of goods” – Arvonlisäverotus EU-tavarakaupassa (in Finnish)

Note: intra-Community sales of goods must be also reported monthly on the VAT Recapitulative Statement. This statement must only be submitted for the calendar months when you have had sales of goods to other EU countries. Submit it electronically no later than on the 20th of the following calendar month. Example: For EU sales of goods for March, the deadline is 20 April.

Read more: EU VAT Recapitulative Statement

If you file the Recapitulative Statement late, a penalty charge is imposed.

Sales of services to other EU Member States

Enter the sales of services, to other EU countries to VAT-liable buyers, which under the general rule on sales from one VAT taxpayer to another are taxable in the buyer's country (another EU country than Finland).

The buyer of the service is expected to pay the VAT, as a reverse-charge tax, in the EU country where the service is being rendered.

If the selling of such services is exempt from VAT in the other EU country concerned, do not enter your sale in this field. Use “Turnover taxable at zero VAT rate”.

The general rule governing the sales of services:

The country where the buyer is located and tax resident is the country where the VAT is payable.

The general rule does not apply to the following service categories when services are sold to a business. Do not enter the sales of the following here:

- Services relating to land and real estate property

- Passenger transport

- Renting out means of transport for a short term

- Admissions to events, entertainment and cultural performances – including sports events, exhibitions, conferences, meetings or seminars – additional services such as payments for cloakrooms or similar facilities

- Restaurant and catering services

- Travel Agency services

This field is not for reporting sales to consumers or to business operators, liable to pay VAT, who are taxed in other EU countries under special provisions, other than the VAT general rule.

The amount of the sales is the price based on an agreement between the seller and the buyer including all surcharges that the seller has charged from the buyer. This means that you must also include any amounts your company may have charged as “delivery costs” of the service.

Note: You must also file a buyer-specific VAT EU Recapitulative Statement for the sale of these services. Only file for the months when you have had sales. Submit it electronically no later than on the 20th of the following calendar month. Example: For EU sales of goods for March, the deadline is 20 April.

Read more: EU VAT Recapitulative Statement

If you file the Recapitulative Statement late, a penalty charge is imposed.

Purchases of goods from other EU Member States

Enter the total price paid of goods bought in other EU countries than Finland (your intra-Community acquisitions); also include any intra-Community acquisitions that are exempt from VAT.

“Intra-community acquisition”

- means that you buy goods from a company registered for VAT in another EU country, and either the seller or the buyer orders the transport of the goods to Finland.

Although you are entitled to deduct the input VAT of the Intra-Community acquisition, the purchase of goods and the VAT must be reported as follows:

- Purchases of goods from other EU Member States (the price paid)

- Tax on goods purchased from other EU Member States

- If the purchase entitles you to a VAT deduction, enter the VAT in "Tax deductible for the tax period"

If you buy services, not goods, in other EU Member States, enter the amount in “Purchases of services from other EU Member States” as appropriate.

Read more: “VAT treatment of EU commerce of goods” – Arvonlisäverotus EU-tavarakaupassa (in Finnish)

Purchases of services from other EU Member States

Enter the total price of services bought from other EU countries to which the reverse charge mechanism applies under the general rule that governs the selling of services from one business to another, and you must pay the VAT on these services in Finland. Enter the total of such purchases here, the tax on them in the field "Tax on services purchased from other EU Member States", and if it entitles you to deduction, enter the VAT in “Tax deductible for the tax period”.

Do not enter the following:

- If the service you bought is exempted from VAT under the general rule (such as services performed on tax-exempted vessels)

- If you have bought employee leasing services for the construction sector (reverse charge), only use the "Purchases of construction services and metal scrap" field.

- Because the general rule does not apply to the following service categories, do not enter them:

- Services relating to land and real estate property

- Passenger transport

- Renting out means of transport for a short term

- Admissions to events, entertainment and cultural performances – including sports events, exhibitions, conferences, meetings or seminars – additional services such as payments for cloakrooms or similar facilities

- Restaurant and catering services

- Travel Agency services

For purchases of goods from other EU countries, use the "Purchases of goods from other EU Member States” field.

Imports of goods from outside the EU

Enter the total of what was imported from outside the EU. This is your VAT base. The usual formula for the base is customs value, plus:

- The goods’ loading, freight, unloading, insurance,

- Other importation expenses, and

- Taxes going to the State of Finland and the EU, customs duties, import duties and others with the exception of VAT (under §91, §93 and §93a, VAT Act).

The Finnish Customs determines the value in accordance with the Customs Code of the EU (§88, VAT Act).

You must report the amounts on the VAT return for the tax period when the customs decision was issued. That month is the month of the customs clearance date, printed on the decision.

You must record the VAT deduction in the same month. Enter it in “Deductible for the tax period”. You cannot deduct the VAT unless you purchased the goods for a VAT-taxable business purpose.

If the import transaction entitles you to deduction, you must report it and the VAT on it in the following lines:

- Imports of goods from outside the EU (indicate the customs value on the decision)

- Tax on imports of goods from outside the EU

- Tax deductible for the tax period (if you are entitled to deduct it).

Import activities operated in Finland may be exemptible from VAT (under §94–§96, and §72h, VAT Act). However, for these imports also, you must report the VAT base values in “Imports of goods from outside the EU”. However, there’s no need to enter anything in “VAT on import of goods from outside the EU” for them.

If the Finnish Customs were to change its decision and alter the VAT base and other facts that affect your tax liability, you must make corrections to your VAT return accordingly. You would have to file a replacement return for the tax period concerned.

Example: Your business enterprise enters €80,000 as Imports of goods from outside the EU. The goods are prosthetic dentures, exempted from VAT on import (under §36.3 and under §94–§96, VAT Act). You must enter the base in "Imports of goods from outside the EU" but not enter anything in "Tax on imports of goods from outside the EU" and "Deductible for the tax period".

It is within the jurisdiction of the Finnish Tax Administration to demand that the special VAT scheme governed by §100a, VAT Act be applied on the taxpayer’s import operation. This means that the business enterprise would not receive the goods from Customs until the VAT return is filed and the VAT payment made to the Tax Administration. In these circumstances, you must report VAT in advance of the tax period’s usual deadline date for VAT return filing. Enter the VAT for the calendar month when the liability to pay it came about; this means the month when Customs accepted the customs declaration (the date of the customs decision). File the tax period’s normal VAT return as a “replacement return” – and do it by the usual deadline date.

Read more:

Import operations between Åland Islands and mainland Finland

Finnish Customs does not issue customs decisions on import transactions between these territories because no customs duties are being levied. The VAT on these transactions must be reported on the return filed for the calendar month when you had submitted the sales invoice or bill-of-lading to the Customs office.

Finnish Customs does not determine values for the goods' customs clearance if:

- The Tax Administration (instead of Customs) is in charge of the duties on the importation

- If goods was imported from Åland Islands to mainland Finland, or from mainland Finland to Åland Islands.

In these circumstances, the taxpayer is expected to calculate the customs clearance value independently in order to file and pay the VAT.

Read more: Tax border between Åland and the rest of Finland

Sales of construction services and scrap metal (reverse charge)

Report the total selling of the services to which the reverse-charge scheme applies.

Read more: The VAT reverse charge scheme in the construction industry.

If you are a seller of scrap metal, report the total value sold, i.e. the value treated by the reverse-charge scheme.

If you sell the scrap to another EU country as an intra-Community supply, do not enter it in this field. Enter it in “Sales of goods to other EU Member States” instead.

Read more:

- The VAT reverse charge applied on the selling of scrap metal (Metalliromun ja -jätteen myynnin käännetty arvonlisäverovelvollisuus (only in Finnish)

- Metalliromun myynnin käännetty arvonlisäverovelvollisuus – usein kysyttyä

Purchases of construction services and scrap metal (reverse charge)

Construction services

Report the total amount of construction services purchased, to which VAT reverse charge applies.

- Include any purchases made that are connected with your leasing of employees for construction work (reverse charge)

- Any construction service you buy if the sellers are foreigners but the construction work relates to real estate in Finland and for which you as the buyer (under §9, VAT Act) pay the tax. You are required to report this information even if you are a company that does not sell construction services. Enter the VAT in “Tax on purchases of construction services and scrap metal” as appropriate.

Read more: The VAT reverse charge scheme in the construction industry

Scrap metal

If you are a buyer of scrap metal, report the total value purchased, i.e. the value treated by the reverse-charge scheme. If you buy the metal in another EU country and it is treated as intra-Community acquisitions, you must report the purchases as buying goods from other EU countries.

If you have no operations subject to VAT during your tax period

If you are VAT-registered, you must file the self-assessed taxes even if your VAT operation is seasonal, temporarily closed, or interrupted for several tax periods.

Nevertheless, you may report "No VAT Activity" in advance. If you have not had any operations subject to VAT, enter zero in "Tax payable / Negative tax that qualifies for refund". The maximum length of filing such a “zero” return is six months.

When you use MyTax to file, you must report “no activity” specifically for each period. When completing the VAT return in MyTax, select “No activities during the tax period”.

However, if the situation changes and you do have a transaction liable to VAT, you must file the return for that tax period as usual.

- If your tax period is the calendar month, the maximum length of filing a zero return is six months in advance.

- If your tax period is the calendar quarter, the maximum length is two quarters.

If your company no longer conducts business subject to VAT, you should file a Notification on termination of business (www.ytj.fi/en/).

Do not forget to add the VAT on your final balances of inventory and accounts receivable when you submit the VAT return for your final tax period.

Note: If you still have any sales subject to the zero rate of VAT and are entitled to VAT deductions, enter it in "Turnover taxable at zero VAT rate". In this case, you must not file a zero return.

How to report VAT relief information

Turnover that qualifies for VAT relief

Note: Do not enter anything in this field unless you are a taxpayer entitled to the relief scheme.

The threshold values for the relief were raised as of 1 January 2016. The base threshold is now €10,000 (old threshold: €8,500) and the higher threshold is now €30,000 (instead of €22,500).

The entire VAT for the 12-month accounting period is relieved if your turnover is €10,000 or lower. If you have more than €10,000 but less than €30,000 of turnover per year, you get a partial relief.

For accounting periods with start dates prior to 1 January 2016, the corresponding thresholds are €8,500 and €22,500.

No specific refund application form is needed. However, if you already filed your VAT for the tax period for which relief can be paid but you did not include that information, you must file a replacement return (complete with the usual VAT amounts and your VAT-relief information).

Enter the amounts on the VAT return form as follows:

- If your tax period is the month, include your VAT relief information in the return for the month when your accounting period closes and include the qualifying net sales for the entire accounting period.

- If it is the quarter, include your VAT relief information in the return for the last quarter of the calendar year and include the qualifying net sales for the entire calendar year.

- If it is the year, include your VAT relief information in the return for the calendar year and include the qualifying net sales for the entire calendar year; follow the rules effective from 1 Jan 2016.

Note: Under § 216 of VAT Act, your accounting period must be the calendar year if your tax period is the quarterly or the year.

How to calculate the sales that qualify for VAT relief?

Adjust your sales/turnover figure as follows:

- When summing up the sales that qualify for VAT relief (make sure you exclude the VAT on the sales), then deduct the receipts you received for forestry sales (timber), and transfers of rights to immovable property (§ 30, VAT Act), and sales of fixed assets.

- Your qualifying sales cannot include any tax-exempt government subsidies such as area-based subsidies paid to farmers.

- Add the proceeds for the following tax-exempt selling:

-

- Sales of goods to other EU Member States (intra-Community supply, §72a – §72c, VAT Act)

- Export sales (§ 70, VAT Act)

- Tax-free sales to travellers (§ 70b, VAT Act)

- The selling of services that are VAT-exempt under the provisions of § 71 and § 72

- Sales of tax-exempt vessels and of work on such exempted vessels (§ 58)

- Exempt sales of print runs of membership bulletins published at least four times a year to nonprofit organisations (§56)

- Exempted sales to diplomats and international organisations (§72 d)

- Exempted sales of motor vehicles (§72 e)

- Sales of financial and insurance services, other than those of ancillary nature

- Disposals of real estate or associated rights (unless the provisions of §30, VAT Act are applicable)

- Sales of construction services to which VAT reverse charge is applied (under §8 c)

Note: If you ask for relief for a non-12-month accounting period, enter an adjusted turnover figure in "Turnover that qualifies for VAT relief" so as to reflect 12 months: Multiply your actual turnover by 12, then divide it by the number of full calendar months of the accounting period concerned.

Read more:

The relief scheme for VAT Arvonlisäveron alarajahuojennus (in Finnish and Swedish) (acc. years starting 1 January 2016 or later)

The tax that qualifies for VAT relief

You must work out the difference between the VAT on your sales and the sum of VAT deductible for your purchases.

Calculate the tax that qualifies for VAT relief as follows: deduct from the tax payable (= difference between the tax on domestic sales and deductible VAT) the following amounts:

- VAT payable on forestry operations

- VAT on any transfer of rights to use immovable property within the meaning of § 30, VAT Act

- VAT on any sales of fixed assets

- VAT that the buyer must pay (Sections 2a, 8a–8c, 9, VAT Act) (reverse charge)

- VAT on any intra-Community sales of goods and services

- VAT on imports (VAT that must be paid on imports is not VAT on the sales of the taxpayer requesting the relief. However, VAT deductible from imports is taken into account.)

This means the VAT relief calculation cannot include the VAT amounts for sales if they relate to items 3–6 above.

Read more:

The relief scheme for VAT Arvonlisäveron alarajahuojennus (in Finnish and Swedish) (acc. years starting 1 January 2016 or later)

Calculating the VAT relief for an accounting period with a start date 1 January 2016 or later

Use the formula below to work out the amount of relief. Enter it in the “Amount of VAT relief” field.

If turnover is €10,000 or less, you should not use the formula. The relief will simply equal the qualifying VAT if turnover stays below €10,000. In other words, you recover all of the paid-in VAT as VAT relief.

If your turnover goes over the threshold of €10,000, use the formula:

tax - (turnover – €10,000) × tax

€20,000

The ‘turnover’ in the above formula means qualifying sales only; and 'tax' means the amount of VAT that qualifies for relief.

Illustration: calculating the VAT relief for a small business

The business has the calendar year as its accounting year. Its taxable domestic turnover amounts to €9,000 (VAT €2,160), zero-rated export selling: €2,000 and intra-Community supply: €6,000.

The business sold some of its fixed assets during the year for €3,000, and is VAT liable under the reverse-charge mechanism for €250. The VAT on deductible purchases amounts to €400.

This business has €17,000 in net sales that qualifies for VAT relief (taxable selling, zero-rated exports, and intra-Community sales, the sale of fixed assets cannot be included); Enter €17,000 in "Turnover that qualifies for VAT relief”.

The amount of VAT that qualifies for relief is the difference between taxable domestic sales and deductible VAT for the year, i.e. €1,760, which you must enter in “Tax that qualifies for VAT relief”. The sales of fixed assets and the VAT liability under the reverse charge mechanism are not included.

Applying the formula, the calculation for this small business is:

€1,760 – (€17,000 – €10,000) × €1,760 = €1,144.

20,000

Enter €1,144 as the “Amount of VAT relief”.

Calculating the VAT relief for an old accounting year with a start date prior to 1 January 2016

Use the formula found in the old guidance (including calculation examples) on VAT relief dated 17 June 2013 and effective until 31 December 2015 (Arvonlisäveron alarajahuojennus (in Finnish and Swedish). The old guidance contains some examples. It ceased to be in force on 31 December 2015.

Special groups of taxpayers

Accounting units

Large employers with several business locations may have a number of sub-accounting units entered in the Tax Administration’s registers. These units must use their own Identity Codes when filing their tax returns for paid pensions and social benefits. However, their VAT and other self-assessed taxes are reported with the main-company Business ID codes only. The Tax Administration only uses the main-company account when entering the payments reported by sub-accounting units.

Account operators as filers

Account operators (such as banks taking care of dividend payments of a listed company) are entitled to submit self-assessed tax returns on behalf of their clients in connection with the following taxes:

- 68 Amounts withheld on interest and profit-shares paid out

- 92 Amounts withheld on dividends and cooperative surplus

- 39 Tax withheld at source on dividends and cooperative surplus (paid to nonresidents)

- 69 Tax at source on interest (non-residents)

- 84 Tax withheld at source on interest income (residents)

The actual payers (e.g. listed companies paying dividends) must give a Letter of Authorisation in order to officially give permission to the account operator for tax-return filing. In such arrangements, the account operator’s Business ID must be shown on each submitted return.

Filing and paying other self-assessed taxes

Tax type code

The codes (to use when you submit your tax return on paper):

10 = Lottery tax

16 = Tax on insurance premiums

24 = Amount withheld from the purchase price for timber: the buyer

68 = Amounts withheld on interest and profit-shares paid out

92 = Withholding on dividends and cooperative surplus

39 = Tax withheld at source on dividends and cooperative surplus (paid to nonresidents)

69 = Tax at source on interest (non-residents)

84 = Tax at source on interest income (residents)

40 = Pharmacy tax, must be filed electronically

10 Lottery tax

The tax period is always the month.

Due date for filing and payment is the 12th of the second month following the event for competitions, games and other events where either consumer goods or other benefits, including cash, are given out as prizes.

This way, for an event organised in January, the due date for filing and payment would be 12 March.

Lottery tax is payable to the State of Finland for events organised in Finland. The party accountable for paying the tax is the operator or organiser of the lottery. If several bodies or persons share the work relating to the operation or organisation, each one of them is accountable and each one of them bears responsibility for the entire amount.

The concept of 'lottery' (Finnish: arpajaiset; Swedish: lotteri) refers to:

- Cash competitions or sweepstakes; non-money lotteries where consumer goods are given out as prizes; guessing games; bingo games;

- 1x2 betting related to football; other betting and horse races;

- Operation of slot machines that may give cash or consumer goods as prizes;

- Operation of gambling games in a casino establishment

For more information on the concept of lottery, see provisions of the act on tax on lottery prizes (arpajaisverolaki 552/1992).

The provisions of this act also control temporary, one-time public competitions or sweepstakes, guessing games, betting, and other comparable events where random results will determine who will win money in cash or in the form of noncash benefits. Nevertheless, a prize is taxable under other tax laws if it is an amount of money, paid in exchange for goods or services, or if it is paid as wages.

Read more: Tax on lottery prizes (Arpajaisten verotus (only in Finnish)

16 Tax on insurance premiums

The tax period is always the month.

File and pay the insurance-premium tax by the 12th of the month after the end of the calendar month (in other words, if a payment relates to June, file and pay it by 12 July).

Parties liable to this tax are the insurance companies that operate an insurance business in Finland. In some circumstances, the policyholder (a private individual, or a company) may be liable to pay the tax. This may occur when the insurance premium is paid to an insurer that does not conduct insurance business in Finland.

The rate of insurance premium tax is 24%. Its base is the accumulated or paid-in insurance premiums (sections 3 and 4 of the act on the tax on insurance premiums (Vakuutusmaksuverolaki 664/1966). In fire insurance, the fire protection fee of 3% must be included in the base for the tax.

Read more: Guidance on Tax on Insurance Premiums

24 Amount withheld from the purchase price for timber

The tax period is usually the month. You can only file by the quarter if the Tax Administration has granted you an extended tax period.

File the information on the withholding and pay it by:

- The 12th of the month after the tax period if you file monthly

- The 12th of the second month after the tax period if you file quarterly. In other words, if you are filing the return for the first quarter (January to March), file it by 12 May.

Buyers of timber are expected to withhold tax on the payments they make to forest owners. Note: Note: this must be done also in cases where the forest owner–seller of timber is someone who lives in a foreign country permanently and is a nonresident.

No withholding is necessary if:

- The entire proceeds for the timber stay below €100 (if the sellers are two spouses, the 100-euro limit is applied separately for each one of them)

- The seller that owns the forest is a corporate entity or a benefit under joint administration

- The wood being bought is a more refined product, not timber

If the buyer is an individual or an estate of a deceased individual, they do not have to withhold tax on amounts paid to the sellers of timber unless any of the following is true:

- The buyer has bought timber from one seller for more than €10,000 during the calendar year

- The buying has to do with the individual’s or estate’s business operation

If a forestry association is acting as an intermediary when several owners are selling, the association (not the buyer) becomes the party liable to withhold, file and pay the tax. However, if the buyer of timber pays the purchase prices directly into the bank accounts of the sellers, the party liable to withhold, file and pay the tax is still the buyer although an association has acted as the intermediary.

If you are a buyer, you must file an information return on the timber and the amounts you paid for it after the year is over. You must do so by the end of January after the end of the year of withholding.

Read more: Liability to withhold tax on purchases of timber (Puun ostajan velvollisuudet (only in Finnish).

68 Amounts withheld on interest and profit-shares paid out

This sub-type concerns the withholding on payments of interest, profit shares, and aftermarket bonus, etc., you make to a natural person.

If you are reporting an amount withheld on the yearly return earned by an equity savings account, file your report in MyTax by using the report for Amounts withheld on interest and profit-shares paid out. Answer “Yes” to question “Are you filing withholding from profits from an equity savings account? ” The tax withheld on the return on an equity savings account must be reported electronically. It cannot be reported on a paper form.

Submit the same report separately if you are filing any other amount withheld on interest and profit-shares paid out.

The tax period is usually the month.

File the information on the withholding and pay it by:

- The 12th of the month after the tax period if you file monthly

- The 12th of the second month after the tax period if you file quarterly. In other words, if you are filing the return for the first quarter (January to March), file it by 12 May.

Code 68 is only for the withholding on payments of interest, profit-shares, and the yearly return on an equity savings account, to a tax resident of Finland. If you paid a nonresident and withheld tax, specify code 69.

You must also file an annual information return in order to report the amounts withheld. You must do so once a year, by the end of January after the end of the year of withholding.

Read more:

- More information on withholding (Ennakonpidätyksen toimittaminen (only in Finnish)

- How to report annual information

92 Amounts withheld on dividends and cooperative surplus

The tax period is usually the month. You can only file by the quarter if the Tax Administration has granted you an extended tax period.

File the information on the withholding and pay it by:

- The 12th of the month after the tax period if you file monthly

- The 12th of the second month after the tax period if you file quarterly. In other words, if you are filing the return for the first quarter (January to March), file it by 12 May.

If you make a payment of dividends of listed and non-listed companies to an individual or to an estate of a deceased person, as defined in § 33 a and § 33 b, act on income taxation, you must withhold tax on the amount that you pay out. In the same way, if you pay out profit surplus of a cooperative, listed or non-listed, to an individual or to an estate of a deceased person, as defined in § 33 e, act on income taxation, you must withhold tax.

- Report the withholding on dividends and profit surplus on the return for the period that coincides with the date when the dividends/surplus first became available for payment to the shareholders. Only enter the withholding, not the gross amount of the entire dividends or surplus.

In addition to this tax return filing, you are required to file an annual information return, listing the amounts withheld on dividends and profit surplus. You must do so once a year, by the end of January after the end of the year of withholding.

Read more:

- For more information, see the guidance on withholding on paid-out dividends “Ennakonpidätys osingosta ja Verohallinnolle annettavat ilmoitukset” (in Finnish)

- More information on withholding (Ennakonpidätyksen toimittaminen (only in Finnish)

- How to report annual information

39 Tax withheld at source on dividends and cooperative surplus (paid to nonresidents)

69 Tax at source on interest (non-residents)

If you are reporting tax at source withheld on the yearly return earned by an equity savings account, file your report in MyTax. File the report Tax at source on interest. Answer “Yes” to question “Are you filing tax at source collected on profits from an equity savings account?” The tax withheld on the return on an equity savings account must be reported electronically. It cannot be reported on a paper form.

Submit the same report separately if you are filing tax at source withheld on interest (non residents).

For most taxpayers, the tax period for this sub-type is the month. You can only file by the quarter if the Tax Administration has granted you an extended tax period.

File and pay the tax at source by:

- The 12th of the month after the tax period if you file monthly

- The 12th of the second month after the tax period if you file quarterly. In other words, if you are filing the return for the first quarter (January to March), file it by 12 May.

Foreign corporate entities and citizens of foreign countries living outside Finland are treated as nonresidents, i.e. as having a limited tax liability. If they are beneficiaries of dividends or interest from a Finnish payor, it is required that a tax is withheld at source (as a final tax).

- Report the withholding on dividends (39) on the return for the period that coincides with the date when the dividends first became available for payment to the shareholders. Only enter the withholding, not the gross amount of the entire dividends.

The code to use is '39' also in the case of withholding on a payment of profit surplus to a nonresident by a cooperative society.

Distributions of money to the shareholders from a fund consisting of unrestricted corporate equity are taxed the same way as dividends are taxed. Consequently, use the '39' code also for reporting the tax at source withheld on such distributions.

If you made payments subject to tax at source, you must also report them on an information return after the year is over. Submit it by the end of January after the end of the year when you withheld the tax at source.

If you have paid a nonresident for a delivery of timber, you must not withheld tax-at-source. Instead, you must carry out an ordinary withholding. In this case, use the '24' code (Amount withheld on the purchase price of timber).

84 Tax withheld at source on interest income (paid to Finnish residents)

For this sub-type, the tax period is usually the month. You can only file by the quarter if the Tax Administration has granted you an extended tax period.

File and pay the tax at source by:

- The 12th of the month after the tax period if you file monthly

- The 12th of the second month after the tax period if you file quarterly. In other words, if you are filing the return for the first quarter (January to March), file it by 12 May.

Payments of interest subject to tax at source are those paid to tax-resident individuals in Finland – i.e. natural persons fully liable to tax – or estates of deceased persons in Finland:

- Interest paid on bank deposits by financial institutions and cooperative savings banks, to accounts opened for the purpose of collecting deposits from the public

- Interest paid on the amounts deposited in personnel service offices (=employees' banks)

If you have paid out interest of this type, you must also report it on an Information Return after the year is over. Submit the annual information by February 15 of the year after the year when you withheld tax at source.

Read more:

- More information on withholding (Ennakonpidätyksen toimittaminen (only in Finnish)

- How to report annual information

Tax period

Fill in the relevant periods for VAT and employer's contributions (employers must send payroll information to the Incomes Register in five days after they have paid their workers. The length of the tax period does not affect the five-day deadline) in the ”tax period” field . For most taxpayers, the tax period is the month. You can only file by the quarter if the Tax Administration has granted you an extended tax period.

Note: You must always apply the monthly tax period on the filing of insurance-premium and lottery taxes.

- If your tax period is the month, enter a number (1–12). Example: For filing taxes for March, enter '3'.

- If your tax period is the quarter, enter 1, 2, 3 or 4. Example: For filing taxes for the 2nd quarter, enter '2' (from April to end of June).

Year

Indicate the year of the tax period, fill in all the four digits.

Tax payable

Enter the amount due for the tax period.

No activity subject to Tax on Insurance Premiums

If your insurance business is seasonal or interrupted for several months, you can report a no-activity period. To report such breaks in advance, use the self-assessed tax return. If no activity took place during the tax period, enter zero in "Tax payable".

If you file in MyTax, you must submit such a report specifically for each tax period. When completing the return in MyTax, select “No activities during the tax period”.

The maximum length of filing such a “zero return” is six months in advance. You do not have to file returns for reported interruptions, unless you in fact have conducted some insurance business.

If your company no longer carries out an insurance business at all, you should file a Notification on termination of business (www.ytj.fi/en/). However, you must also file your self-assessed tax return for your final period as a business liable to tax on insurance premiums.

Making corrections to submitted returns

If you detect an error or omission, you are expected to put it right without delay. It is expected that any inaccuracies be corrected although no change would ensue to the taxes themselves.

The way to make corrections is by filing a replacement return for the tax period where the error occurred.

The making of corrections is the same, regardless of the fact that some corrections lead to an increase of the amount of tax, and others lead to a decrease. In other words, from the perspective of making corrections, it is not important whether your original return contained too much tax to pay – or too much refunds to receive.The replacement erases and revises the amounts for a certain tax (such as VAT or any other self-assessed tax). For this reason, it is required that you re-submit both the amounts that were inaccurate and those that were accurate, too. Pensions and benefits are treated as representing just one single sub-type of taxes. For this reason, if any paid-out pensions or benefits had contained errors and omissions, you must re-submit your withholding, health insurance and tax-at-source.

Note: when making corrections to tax returns where both the tax payable and the base of the tax are indicated, you must give the amounts consistently for the same tax period. Examples of changes include:

- “Purchases of goods from other EU member states” and “Tax on goods purchased from other EU Member States”

- “Purchases of construction services and scrap metal” and “Tax on purchases of construction services and scrap metal”

This method of substituting a previously filed return with a replacement has been available for filers since 1 January 2017. Note: if any corrections are made to filings dating back to before 1 January 2017, replacement returns must be filed also in that case.

Example: Your tax period is the month, and you want to make corrections to your VAT for the 12/2016 tax period in May 2018. The way to solve the problem is to file a replacement return, tax period 12/2016.

Illustration: The tax period of a limited company is the month, and its accounting period is 1 July 2016–30 June 2017. In October 2016, it has had €2,000 of VAT to pay. However, in May 2018 it is detected that the self-assessed return for October 2016 has indicated €2,500 as VAT. In other words, €500 too much. The way to correct the error is to file a replacement return for October 2016. It is not possible for the limited company in this example to ask for the VAT to be refunded after the accounting period is over.

If the mistake is small, it may be corrected by a simplified process

Notice that the simple correction method for low amount errors does not apply to payroll information reported to the Incomes Register.

If the excessive self-assessed tax or the unreported self-assessed tax is less than €500 per tax period and per tax, the amount is regarded as “low”.

When errors only involve a low amount, you can make the necessary corrections on your next tax return, i.e. the time when you should put things right, at the latest, is when you complete your tax return for the month after the month when you detected the error. However, despite the fact that the amount is low, you must correct the error even if you had nothing else to report.

You can make a correction in the simplified way even if you did not detect the error until after the end of the calendar year. You have the right to use the simplified process for as long as you otherwise continue to have the right to making corrections for the tax period concerned.

Illustration: A business taxpayer's tax period is the month. She notices a small mistake in May 2018 that concerns the self-assessed tax return she had filed for November 2017. There is no need to indicate that the correction relates to November 2017 by submitting a replacement tax return for the period of “November 2017”. She can put the mistake right on her next return. She must file it by the general due date for June 2018.

However, the simple correction method does not apply to old tax periods that ended prior to 1 January 2017.

Illustration: Your tax period is the month, and you want to make corrections to your VAT for 6/2016 after 1 January 2017. The way to solve the problem is to file replacement VAT return, tax period 6/2016. You must do so even if it were just a small mistake. This is because the simple correction method does not apply to tax periods that ended prior to 1 January 2017.

If the error has to do with the return you filed for the 1/2017 tax period and you notice it in April, you can apply the simplified correction: adjust the VAT return for March that you must file in May.

Errors that are small cannot always be corrected by entering a negative digit because negative values are only permitted on VAT returns. This means that if your corrections are for paid-out pensions and their value would end up being negative, you cannot adjust the following month’s values (and make them negative) on the return you must file on the general due date. Under the circumstances, the mistake must be corrected by-and-by, on a series of upcoming tax returns that you will file.

Illustration: The taxpayer had reported too much withholding on pension. The correction of this small mistake is spread out over a number of months.

In October 2019, the taxpayer notices a slight mistake involving the return for September 2019. The withholding entry on pension is 200 euros more than the actual amount withheld. The withholding for October had been €100. When filing the return for October, the amount can only be corrected for €100 because it is not allowed that the withholding value would become negative. This way, the taxpayer must spread out the correction of this small mistake over a number of months and over a number of upcoming tax returns.

Nevertheless, it is always allowed to file a replacement for the correct tax period i.e. for the period when the mistake occurred. If the amount of tax on the replacement return were to be negative, the Tax Administration will match that negative value up with a suitable tax period, i.e. with a period for which the taxpayer must pay an amount representing the same type of tax. This rule is applied on all types of taxes except VAT.

Another restriction of the simplified method of correcting is that if the correction does not impact the amount of tax, you cannot make the correction simply. Examples of errors and omissions falling into this category are the following mistakes on VAT returns:

- Mistakes in tax-exempt selling of goods and services to other EU countries

- Mistakes relating to sales of construction services and scrap metal (reverse charge)

- Mistakes in the selling reportable under zero-VAT rate

For the above, the way to make corrections is by filing a replacement return for the tax period when the error occurred. The same rule applies to corrections to a previous, incorrect indication of the type of tax: for example, tax-at-source should have been reported, but ordinary withholding was reported. In this case, no late-penalty charge would be imposed because the error and its correction only involve one type of tax, and there is no impact on the amounts to pay.

If your tax returns for employer’s contributions had contained too much withholding but you do not detect that mistake until the new year has begun, you must not only make a correction to your tax returns for employer’s contributions but also to your annual information reporting i.e. employer payroll report for the year that had ended. This is due to the fact that the Tax Administration relies on the amounts you had reported as amounts withheld when filing your employer payroll report when performing the tax assessments of individuals. In the same way, you must make corrections to your annual information reporting when you have had a mistake in the amounts withheld as tax at source.

Read more:

- Making corrections to mistakes on a tax return – official decision of the Tax Administration (Verohallinnon päätös veroilmoituksessa olevan virheen korjaamisesta (only in Finnish)

You are required to tell us why a VAT correction is made

If the correction you make relates to VAT, give the reason for correction:

Calculation error / entry error

Tick this reason as appropriate.

Change in legal praxis

Tick this as appropriate.

Guidance received during tax audit

Tick this as appropriate.

Error in interpretation of the law

Tick this if you had understood the rules incorrectly. This would be your reason for correction, for example, if you had first interpreted the law in one way and found out later that it must be interpreted in another way instead.

Because you can put smaller mistakes right by a simple process, it is enough if you enter a correction in a return for an upcoming tax period. You don’t have to file a replacement return or give a reason for the correction.

The Tax Administration imposes late-filing penalties for overdue returns

If you do not file a tax return by its deadline, or if you fail to make corrections to a filed tax return by the deadline date, you must pay a late-filing penalty. The penalty charges are specific for each sub-type of tax filed late. However, the withholding and taxes at source that relate to pensions and benefits are regarded as one single type.

Late filing of the first tax return for the period