Guidance and procedures in transfer pricing matters

This guidance will be updated.

The transfer pricing specialists of the Finnish Tax Administration provide customers with advice and guidance in transfer pricing matters. The guidance may be given proactively or in real time. Examining transfer pricing matters may also require other measures.

Resolving the transfer pricing matters in advance is recommendable

With the proactive guidance and advice provided by the Finnish Tax Administration's transfer pricing operation companies can clarify problematic and ambiguous transfer pricing issues as soon as they arise. The aim of the Finnish Tax Administration is that the procedures in the proactive guidance and advice are flexible and based on an open discussion with the taxpayers. The intention is that the amount of administrative rigidity in the provision of the guidance and advice is minimal. Clarifying the matters in advance reduces the necessity for examining them afterwards, for example in a tax audit.

Tax audits involving transfer pricing matters typically last long and require substantial resources from both the Finnish Tax Administration and the company under audit. As a rule, solving transfer pricing related problems in advance, or as soon as possible after the transaction has occurred, is easier and also less expensive for the companies concerned.

The aim is to identify the risks at an early stage

The Finnish Tax Administration identifies and assesses transfer pricing risks by carrying out risk assessments on an up-to-date basis. The Finnish Tax Administration selects the measures for examining the identified risk on a case-by-case basis, depending, among other things, on the nature of the problem and its stage in development. Simultaneously the tax authorities always assess whether it is possible to clarify and resolve the identified risk with guidance and advice.

The Finnish Tax Administration will contact the companies related to an identified risk phenomenon. The aim is to find a way to resolve the problem in cooperation with the company concerned. It is recommendable that the companies would contact the Finnish Tax Administration whenever there arise new transfer pricing matters that are difficult, interpretative or economically significant.

Advice and guidance are provided at meetings with customers

In practice, the advice and guidance are provided at meetings between the company and representatives of the Finnish Tax Administration. As a result of the discussions at the meetings the most suitable way to proceed with the matter is selected from the view point of both the company and the Finnish Tax Administration.

At Large Taxpayers' Office the meetings with customers are usually pre-emptive discussions of nature. A pre-emptive discussion relating transfer pricing matters can be arranged with a company whose taxation as whole is not handled at Large Taxpayers' Office but at some other unit of the Finnish Tax Administration. At the pre-emptive discussion it can be assessed, for example, whether a guidance is adequate for resolving the company's transfer pricing matter or should the company apply for a preliminary ruling.

The practices for each situation for giving advice and guidance such as frequency of the meetings, participants and the necessary material shall be agreed on a case-by-case basis. Also the quality of advice and guidance varies between the cases from guidance given on general level to guidance involving further detailed assessment of the particular matter. The taxpayer has the right to trust the guidance and advice provided by the tax authorities and to expect that the Finnish Tax Administration will not change the granted view afterwards. This principle of legitimate expectations can only be adhered to if the company has provided the Finnish Tax Administration with all relevant information regarding the matter.

Procedures for resolving transfer pricing matters

A company seeking to receive advice and guidance in its transfer pricing matter can contact the Finnish Tax Administration directly, seek a preliminary ruling from the Finnish Tax Administration or submit an application for an advance pricing agreement (APA) to the competent authority. The preliminary ruling issued by the Finnish Tax Administration can be appealed against. The Finnish Tax Administration assesses the taxes of the company based on the advice and guidance given, the preliminary ruling, the advance pricing agreement (APA) or other information obtained for the assessment.

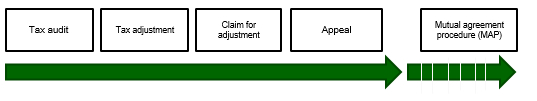

If a company notices errors in the applied transfer pricing afterwards, the company may submit a claim for adjustment regarding the assessed taxes. The Finnish Tax Administration may also identify a risk in the company’s applied transfer pricing and this may result in a tax audit concerning the transfer pricing. The Finnish Tax Administration may adjust the company’s taxes based on a tax audit and other information obtained regarding the matter. The company may appeal against the tax adjustment decision or initiate a mutual agreement procedure (MAP).

A tax authority in another country may also make a transfer pricing adjustment to the income of a foreign related company. In such case, the company may seek a corresponding adjustment to its taxation in Finland or initiate a mutual agreement procedure. A foreign related company may also initiate a mutual agreement procedure in the country where the transfer pricing adjustment has been made.

The transfer pricing procedure can be illustrated as follows: in an ideal situation, the procedure will end with a tax assessment based on the advice and guidance given, preliminary ruling, advance pricing agreement or the taxation carried out based on the information in the tax return.

If the Finnish Tax Administration adjusts the company's taxation on an ex-post basis, for example following a tax audit, the process can be described as follows:

Guidance and procedures — other pages

Key terms: