Guidance on the special scheme for VAT (the mini One Stop Shop)

- Validity

- In force until further notice

This guidance is currently being updated.

This is an unofficial translation. The official Letter of Guidance is drafted in Finnish and Swedish languages.

The guidance has a number of terminology changes because of the amendments of tax rules coming into force on 1 January 2017. New terminology replaces the terms used so far because the Act on Assessment of Self-Initiated Taxes (Oma-aloitteisten verojen verotusmenettelylaki) and the Act on Tax Collection (veronkantolaki) come into force, and because the act governing the Tax Account has been repealed. The guidance has also been updated with changes in the VAT Act and changes to the appeal procedure that come into force 1.1.2017.

The Letter of Guidance discusses the special scheme for VAT (the mini One Stop Shop) that will enter into force in 2015.

1 Introduction

As of the beginning of 2015, telecommunications, radio and television broadcasting (‘broadcasting services’ below) and electronically supplied services sold to non-taxable persons (‘consumers’ below) will be taxed in the country where the buyer is established.

At the same time, the Union scheme concerning telecommunications, broadcasting and electronically supplied services sold by businesses established in European Union (EU) Member States will enter into force (the mini One Stop Shop). It is a voluntary procedure for reporting and paying the VAT. The current special scheme for electronically supplied services concerning businesses established outside the EU (the non-Union scheme as of 2015) will be expanded to cover telecommunications and broadcasting services. Together, the schemes will be referred to as the (VAT) special scheme. The special scheme is applied in all EU Member States.

For more details on the definitions and place of supply rules concerning the services covered by the special scheme, see the Letter of Guidance: “Tele-, lähetys- ja sähköisten palvelujen arvonlisäverotus” (only available in finnish and swedish).

A business established in the EU may opt the special scheme when selling telecommunications, broadcasting or electronically supplied services to consumers in EU Member States where i http://ec.europa.eu/taxati-on_customs/sites/taxation/files/resources/documents/taxation/vat/how_vat_works/telecom/one-stop-shop-guidelines_en.pdft does not have a business establishment or a fixed establishment. A business established outside the EU may opt the special scheme when selling telecommunications, broadcasting or electronically supplied services to consumers in the EU.

A business using the special scheme will take care of the reporting and payment obligations related to the VAT of telecommunications, broadcasting or electronically supplied service sales in one EU Member State. A business not using the special scheme must be registered for VAT purposes in all Member States in which it sells telecommunications, broadcasting or electronically supplied services to consumers.

Businesses will be able to file a registration notice in the Tax Administration’s e-service as of 1 October 2014. If the notice is filed between 1 October and 31 December 2014, the registration will enter into force on 1 January 2015.

When a business registers for the special scheme, it must be applied to all sales that are covered by it.

The Regulation that enters into force in 2015 is based on the Council Directive 2008/8/EC amending the Council Directive 2006/112/EC. In Finland, the Act of Amending the VAT Act (27.6.2014/505) and the Act of Amending the Act on Derogations Concerning the Province of Åland from the Provisions of the Value Added Tax and Excise Duty Legislation (27.6.2014/506) are applicable. Further, the rules are based on the Council Regulation 967/2012 amending the Council Implementing Regulation 282/2011. Additionally, the Council Regulation 904/2012 on administrative cooperation and combating fraud in the field of VAT, and the Commission Implementing Regulation 815/2012 are applicable. The Commission has also published a non-binding Guide.

2 Concepts related to the special scheme

This section defines concepts related to the special scheme.

Member State of identification

The Member State of identification is the EU Member State where the business registers for the special scheme, files the VAT returns and pays the tax. The Member State of identification forwards the information on the returns and the payments to the Member States of consumption. The tax procedure applied to sales in the Member State of identification is discussed in sections 3.1.1-3.1.3 and 5.

Member State of consumption

A Member State of consumption is an EU Member State where a telecommunications, broadcasting or electronically supplied service is deemed to have been sold according to the place of supply rules. The Member State of consumption will receive the return details and payments from the Member State of identification.

Member State of establishment

The Member State of establishment is an EU Member State where a business using the Union scheme has a fixed establishment. The tax procedure applied to sales in the Member State of establishment is discussed in sections 3.1.1, 3.1.3 and 5.

3 Scope of the special scheme

The special scheme is applied only to telecommunications, broadcasting or electronically supplied services sold to consumers established in the EU.

A consumer is deemed to be a natural person and a legal entity not registered for VAT purposes. However, when selling telecommunications, broadcasting or electronically supplied services, any buyer that does not state a valid VAT number to the seller may in practice be considered to be a consumer.

For more details on the definitions and place of supply rules concerning the services, see the Letter of Guidance: “Tele-, lähetys- ja sähköisten palvelujen arvonlisäverotus” (only available in finnish and swedish).

Sales of telecommunications, broadcasting or electronically supplied services are covered by the national legislation of the Member State of consumption even though the tax for the sale in the special scheme is paid to the Member State of identification. National rules apply for example to the VAT rate, invoicing requirements, chargeability of VAT, adjustments and late filing and payment penalties. Certain national rules of Finland are discussed in section 8 .

3.1 The place of establishment of the business

In the special scheme, the business will use either the Union scheme or non-Union scheme depending on whether the business is established in an EU Member State or outside of EU.

In Finland, the business will state the place of establishment upon opting the special scheme. The place of establishment determines whether the Union scheme or the non-Union scheme will be applied.

3.1.1 Business established in the EU

A business established in the EU is a company or an organization that has a business establishment or a fixed establishment in the EU. Such a business can use the Union scheme.

The concepts of the place of establishment of a business and ‘fixed establishment’ have been defined in articles 10 and 11 of the Council Implementing Regulation 282/2011 and have been discussed in the Letter of Guidance: “Euroopan unionin asetus 282/2011 yhdenmukaistaa arvonlisäverodirektiivin tulkintaa” (only available in finnish and swedish). If the business does not have a separate business establishment, it is deemed to be the domicile or the permanent address.

Registration for VAT purposes as such does not constitute a fixed establishment. VAT liability in another EU Member State (for example for distance selling) does not prevent the use of the Union scheme for sales in that EU Member State.

A business using the Union scheme cannot use the special scheme for sales in the Member State of identification or a Member State of establishment.

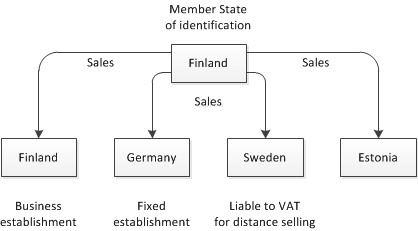

Example 1 (the Union scheme):

A company has its business establishment in Finland, and therefore its Member State of identification is Finland. The company has a fixed establishment in Germany. The company is registered for VAT purposes in Sweden for distance selling. The company sells services covered by the special scheme in all these three countries and in Estonia. The special scheme can be applied only to sales in Sweden and Estonia. Sales in Finland and Germany are reported on the national VAT returns of these countries.

3.1.2 Business established outside the EU

A business established outside the EU is a company or an organization that does not have a business establishment or fixed establishment in the EU. Such a business can use the non-Union scheme.

If a business established outside the EU is registered for VAT purposes or liable to do so in the EU, it prevents the use of the non-Union scheme. Such a business must be registered for VAT purposes in all EU Member States where it has sales covered by the special scheme.

A business using the non-Union scheme will also use the special scheme for sales in the Member State of identification.

Example 2 (the non-Union scheme):

A company has a business establishment in Russia. The company chooses Finland as its Member State of identification. The company sells services covered by the special scheme in Finland and Estonia. The special scheme can be applied to sales in both Finland and Estonia.

3.1.3 Business established on the Åland islands

On the Åland islands, the use of the special scheme involves special features which are based on the special act concerning the Åland islands (Act on Derogations Concerning the Province of Åland from the Provisions of the Value Added Tax and Excise Duty Legislation (1266/1996), ‘Special Act’ below).

The sales of a business established on the Åland islands in various situations, along with the applicable tax procedure, are presented as a table in the appendix.

A business established only on the Åland islands can use the non-Union scheme (see section 3.1.2) although it is registered for VAT purposes in Finland. It is required that the business does not carry on business on mainland Finland for which a business established outside the EU would be liable to register for VAT purposes (Special Act article 25 c).

When the Member State of identification of the business is Finland, the non-Union scheme is applied to sales to consumers established on mainland Finland and the Åland islands. When the Member State of identification of the business is an EU Member State other than Finland, the non-Union scheme is applied to sales to consumers established on mainland Finland but not to consumers established on the Åland islands.

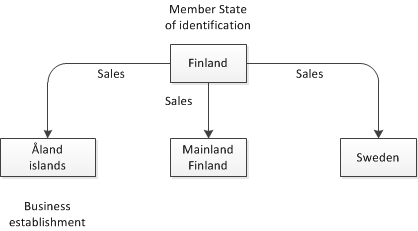

Example 3 (the non-Union scheme):

A company has a business establishment on the Åland islands and does not have fixed establishments in the EU. The company opts the special scheme as a business established outside the EU and chooses Finland as the Member State of identification. The company sells services covered by the special scheme on the Åland islands, mainland Finland and Sweden. The special scheme can be applied to all these sales.

A business established on the Åland islands can opt the Union scheme (see section 3.1.1) only if the business establishment is:

- on mainland Finland or in another EU Member State. In this case, the Member State of identification is the Member State in which the business establishment is located.

- on the Åland islands but the business has a fixed establishment on mainland Finland or in another EU Member State. In this case, the Member State of identification is the Member State in which the fixed establishment is located.

- on the Åland islands but the business has fixed establishments in several EU Member States. In this case, the business may choose one of these Member States as the Member State of identification.

When the Member State of identification of the business is Finland, the Union scheme cannot be applied to sales to consumers established on mainland Finland and the Åland islands. When the Member State of identification of the business is another EU Member State than Finland, the Union scheme is applied to sales to consumers established on mainland Finland (unless the business is established there) but not to consumers established on the Åland islands.

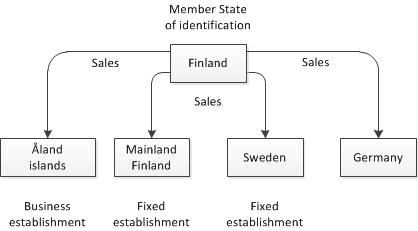

Example 4 (the Union scheme):

A company has a business establishment on the Åland islands and a fixed establishment in mainland Finland and in Sweden. The company opts the special scheme as a business established in the EU and chooses Finland as its Member State of identification. The company sells services covered by the special scheme on the Åland islands and mainland Finland and in Sweden and Germany. The special scheme can be applied to sales taking place in Germany. Sales taking place on mainland Finland and the Åland islands and in Sweden must be reported on the national VAT returns of these countries.

Situations related to the special status of the Åland islands, where the Member State of consumption is Finland, are discussed in detail in section 8.8.

3.2 Small entrepreneurs (VAT Act article 3)

Small entrepreneurs established in Finland whose turnover of the financial year is at most €10,500 are not obligated to register for VAT purposes.

The exemption for small entrepreneurs is not applied when goods and services are sold in an EU Member State where the seller is not established, and the seller has to pay the tax in this Member State (Council Directive 2006/112/EC article 283 paragraph 1 point c). In Finland, correspondingly, the exemption for small entrepreneurs is not applied to a foreigner, that does not have a fixed establishment in Finland (VAT Act article 3 paragraph 4).

Consequently, a small entrepreneur is obligated to register for VAT purposes in EU Member States, where it has sales of telecommunications, broadcasting and electronically supplied services to consumers, but where it does not have a business establishment or a fixed establishment.

Such a business can register as a user of the special scheme only if it is registered for VAT purposes in an EU Member State. If a small entrepreneur registers for VAT purposes in Finland, he becomes liable to VAT also for sales not covered by the special scheme.

3.3 VAT Group (VAT Act article 13 a)

A VAT group can use the special scheme.

There are cases pending in the European Court of Justice related to VAT groups, in which the judgments may affect the treatment of VAT groups.

4 Registration for the special scheme

A business wanting to use the special scheme must file a registration notice in the Member State of identification.

The Member State of identification is determined as follows:

- If the business has a business establishment in an EU Member State, that Member State is the Member State of identification.

- If the business does not have a business establishment in an EU Member State but has a fixed establishment in an Member State, that Member State is the Member State of identification.

- If the business does not have a business establishment but has fixed establishments in several EU Member States, the business may choose one of these Member States as the Member State of identification. The option binds the business for two calendar years from the end of the calendar year during which the option has been made.

- If the business does not have a business establishment or a fixed establishment within the EU, it can choose any Member State as the Member State of identification.

A business may have only one Member State of identification at one time.

When the Member State of identification is Finland, the registration notice is filed electronically in the special scheme e-service.

A Katso ID is required for electronic filing and filing the registration notice in Finland. The business can also authorize an agent by Power of Attorney to act in e-services on its behalf. For more information on applying for a Katso ID and authorizing an agent, see the Katso site.

The special scheme cannot be used until the registration notice has been approved. A statement of the approval or rejection can be read in the special scheme e-service. A message of the arrival of the statement will be sent by email. At the customer’s request, a decision that can be appealed will be issued for the registration.

4.1 Date of commencement

A business is registered from the beginning of the calendar quarter following the filing of the registration notice.

If the business has sales covered by the special scheme before the beginning of the calendar quarter following filing of the registration notice, the registration can be made as of the time of the first sale. A business wanting to use this option must notify the Member State of identification of this no later than on the 10th day of the month following the sale. In Finland, the notice is filed in the special scheme e-service.

If the notice is not filed in time, the business must register for VAT purposes in the EU Member States where it has had sales covered by the special scheme.

Example 5:

A company has filed a registration notice in Finland on 1 February. The company will be registered as the user of the special scheme as of 1 April. However, the company has had sales in Germany on 7 February. The company files a notice on 9 March and will be registered as of 7 February. Thus, the company will avoid registration in Germany.

In the non-Union scheme, the business will receive a unique VAT number (in the format EUxxxyyyyyz) after the approval of the registration notice.

In the Union scheme, the business will use the national VAT number previously issued in the Member State of identification. It is not possible to register for the Union scheme without a VAT number, and therefore using the Union scheme requires a valid VAT registration.

The VAT number of a business established in Finland using the Union scheme is formed of the country identifier FI and a sequence of numbers, which is the business ID (Business Identity Code) without the hyphen between the last two digits.

4.2 Changes to the registration information

A user of the special scheme must notify the Member State of identification of changes to the registration information no later than on the 10th day of the month following the change of the information.

A business registered for the special scheme in Finland may change its registration information in the special scheme e-service.

A business established in Finland cannot change its bank account information in the e-service, but instead using the MyTax e-service or with the Corporate taxpayer´s bank account notice (7209e).

4.3 Deregistration

A business may notify the Member State of identification that it will cease using the special scheme. In Finland, the notice is filed in the special scheme e-service. As a general rule, the registration will cease at the end of the calendar quarter during which the decision on deregistration has been sent.

Deregistration can be done for the following reasons:

- The business ceases the supply of telecommunications, broadcasting or electronically supplied services to consumers.

- The business ceases using the special scheme but continues the supply of services covered by the special scheme.

- The business no longer meets the requirements for using the special scheme (see section 3).

- The business changes its Member State of identification.

Situation 1:

A business ceasing the use of the special scheme because it no longer supplies telecommunications, broadcasting or electronically supplied services must notify the Member State of identification no later than on the 10th day of the month following the cessation.

Situation 2:

A business wanting to cease the use of the special scheme regardless of the continuing the supply of the services must notify the Member State of identification no later than 15 days before the end of the calendar quarter during which it wants to cease using the special scheme.

If the notice is not filed in time, deregistration will not take place until as of the end of the following calendar quarter.

The cessation will invoke a quarantine period during which it is not possible to re-register for the special scheme (see section 4.5).

Situation 3:

A business that no longer meets the requirements for using the special scheme (see section 3) must notify the Member State of identification by the 10th day of the month following the cessation of meeting of the requirements. Such a situation will arise when, for example, a business using the Union scheme no longer has a business establishment or a fixed establishment in the Member State of identification.

If the business no longer meets the requirements for using the special scheme due to a change of the business establishment or a fixed establishment, the registration will cease as of the date of the change.

Situation 4:

A business using the special scheme may change its Member State of identification for the following reasons:

- A business using the non-Union scheme wants to identify in another EU Member State.

- The business establishment of a business using the Union scheme is not located in the EU and the company wants to identify in another EU Member State where it also has fixed establishment.

- The business establishment of a business using the Union scheme is not located in the EU, the fixed establishment in one EU Member State has ceased, and the company wants to identify in another Member State where it has a fixed establishment.

- The business establishment of a business using the Union scheme is transferred from one EU Member State to another.

A business using the non-Union scheme that wants to change the Member State of identification must deregister in the current Member State of identification and file a registration notice in the new Member State of identification.

A business using the Union scheme that changes the Member State of identification without the cessation of a fixed establishment or a transfer of the business establishment must deregister in the current Member State of identification and file a registration notice in the new Member State of identification. The option of the Member State of identification is binding for the current calendar year and the subsequent two calendar years.

A business using the Union scheme that changes the Member State of identification because of the cessation of a fixed establishment or a transfer of the business establishment must notify both Member States no later than on the 10th day of the month following the change. Deregistration in the current Member State of identification will take place as of the date when the registration in the new Member State of identification commences. If the change of the Member State of identification is due to a change of the business establishment or a fixed establishment, deregistration will take place as of the date of the change. If the notice is not filed in time, the business must register for VAT purposes in the EU Member States where it has sales covered by the special scheme.

Example 6:

A company established in the EU has registered for the special scheme in Finland. The company’s business establishment is transferred from Finland to Sweden on 21 March. On 10 April, the company notifies that Sweden is the new Member State of identification. The company will be registered in Sweden as of 21 March and be deregistered in Finland as of 21 March. Supplies covered by the special scheme that took place on 21 March are reported in Sweden.

4.4 Exclusion from the special scheme

A business can be excluded from the special scheme by the tax authorities for the following reasons:

- It can be assumed that the business no longer has sales covered by the special scheme (for example, if the business has filed a nil return during eight consecutive quarters).

- The business no longer meets the requirements for using the special scheme (see section 3).

- The business repeatedly fails to comply with the obligations related to the special scheme.

As a general rule, the registration will cease at the end of the calendar quarter during which the decision on exclusion has been sent to the business. If the exclusion is due to a change of the business establishment or a fixed establishment, the registration will cease as of the date of the change.

Failure to comply with the obligations related to the special scheme will be deemed repeated in at least the following cases:

- The business has been sent a reminder to file the VAT return for the preceding three calendar quarters and the business has not provided the returns for each calendar quarter within ten days of the sending of the reminder.

- The business has been sent a payment reminder for the preceding three calendar quarters and the business has not paid the tax in full for each calendar quarter within ten days of the sending of the reminder, unless the outstanding amount is less than €100 for each calendar quarter.

- The business has not provided its records in electronic form on the request of the Member State of identification or Member State of consumption within a month after a reminder from the Member State of identification has been sent.

The Tax Administration serves the decision of exclusion by electronic means. The receiver is considered to have been served the decision by the seventh day after the decision has been made available for retrieval in the special scheme e-service. The business is notified by email when the decision is available in the e-service.

4.5 Quarantine period

After the registration has ended, there may be a quarantine period during which it is not possible to re-register as a user of the special scheme.

The quarantine period is two calendar quarters starting from the date of cessation if the business notifies that it will cease using the special scheme but will continue selling services covered by the special scheme. In such a case, the quarantine period applies only to using the special scheme in the scheme in which the business was on the cessation of the registration, i.e., either the Union scheme or the non-Union scheme.

The quarantine period is eight calendar quarters as of the date of exclusion if a business is excluded by the tax authorities because of non-compliance. In such a case, the quarantine period applies to the use of both the Union and non-Union schemes.

During the quarantine period the business must register for VAT purposes and take care of the reporting and payment obligations in all EU Member States where it sells telecommunications, broadcasting and electronically supplied services to consumers.

5 Reporting of VAT

The VAT return of the special scheme is used for reporting the sales covered by the special scheme (see section 3) and the VAT payable for the sales, specified by Member State of consumption and VAT rate. A business using the Union scheme will also report the sales according to which Member State of establishment the services have been sold from.

Sales covered by the special scheme will be subject to the VAT rate of the Member State of consumption. If the sale is exempt from tax in the Member State of consumption, the sale must not be reported in the special scheme VAT return. VAT rates applicable in the EU Member States can be found on the website of the European Commission.

The return must be made in euros. If the sale has been made in another currency, the exchange rates of the last day of the reporting period have to be used in the return. The rates published by the European Central Bank for that day have to be used in the conversion, or if no rates are published for that day, the rates of the following publication day. (VAT Act article 134 c)

The amounts in the return are not rounded to the nearest full monetary unit. The precise amount of tax must be reported and paid.

A business using the Union scheme does not report sales on the special scheme VAT return that take place in a Member State where it has its business establishment or a fixed establishment. These sales are reported on a national VAT return.

Businesses using the non-Union scheme will also report sales in the Member State of identification on the special scheme VAT return.

5.1 Due date of the VAT return

In the special scheme, the taxperiod is a calendar quarter. The VAT return must be filed by the 20th day of the month following the calendar quarter. The return cannot be filed before the end of the taxperiod. The due dates for the special scheme VAT return are as follows:

| Taxperiod | Due date |

|---|---|

| Q1 (January–March) | 20 Apr |

| Q2 (April–June) | 20 Jul |

| Q3 (July–September) | 20 Oct |

| Q4 (October–December) | 20 Jan |

The due date of the VAT return will not be postponed because of a weekend or public holiday. Thus, neither the due date of the payment will be postponed. If the due date is on a weekend or public holiday, the return must be filed by the due date. However, because of reasons related to payment transfers, the payment must be made before the due date of the report for it to be deemed arrived in time (see section 6.1).

The return must also be filed for taxperiods during which the taxable person did not have any sales covered by the special scheme. Such a report is called a nil return.’

5.2 Filing the VAT return

The VAT return is filed in the Member State of identification. When the Member State of identification is Finland, the report is filed electronically in the special scheme e-service. If the Member State of identification changes during the reporting period, separate returns must be filed in both Member States of identification for the time of the calendar quarter during which each Member State has been the Member State of identification.

Example 7:

A company has been registered as a user of the special scheme in Finland from 1 January to 15 February but has opted Sweden as the Member State of identification as of 16 February. The company will file two returns for the first calendar quarter. In Finland for 1 January to 15 February and in Sweden from 16 February to 31 March.

A return can be filed in the special scheme e-service within three years of the due date of the return. The return can be amended in the e-service within the same period of time. If the return is filed after the due date it may be subject to late filing penalties.

5.3 Amending the VAT return

A VAT return filed in Finland can be amended in the special scheme e-service.

When there is an error on the return, the amendment must be made for the taxperiod in which the error is. Correspondingly, when an adjustment is attributed to a reported sale, the taxperiod in which the original sale was reported is amended. The amount of the error or the adjustment cannot be taken into account in a later taxperiod. Once the amendment has been made, a replacement return is formed for the taxperiod.

The amendment can be made in the special scheme e-service within three years of the due date of the taxperiod. This also applies to businesses whose registration in the special scheme has ended.

If a business has changed its Member State of identification, the amendment must be made in the EU Member State where the original return was filed.

Example 8:

A company has been registered as a user of the special scheme in Finland from 1 January to 31 March but has opted Sweden as the Member State of identification as of 1 April. The company has noticed an error in the reports for both the first and the second quarter. The company will amend the report of the first quarter in Finland and the report of the second quarter in Sweden.

5.4 Right of deduction

The special scheme VAT return cannot be used for reporting deductible taxes. It is only used for reporting VAT payable for sales.

The user of the special scheme has the right to refund of VAT to foreign businesses.

Detailed information on the refund of VAT to foreign businesses can be found in following Letters of Guidance:

- “Refund of VAT to Finnish businesses from other EU countries”

- “Refund of VAT to foreign businesses established in other EU countries”

- “Refund of VAT to foreign businesses established outside the EU”

If a business using the Union scheme registers for VAT purposes in an EU Member State where it does not have its business establishment or a fixed establishment (for example for distance selling), deductions related to the sales covered by the special scheme in that country must be reported on the national VAT return of the country in question.

5.5 Failure to file a VAT return

If a taxable person does not file a return within ten days of the due date, the Member State of identification will send the taxable person one reminder of the late return. When the Member State of identification is Finland, the reminder can be read in the special scheme e-service. A notification will be sent by email on the arrival of the reminder.

The Member State of consumption may later take measures to obtain the return. However, the return must always be filed with the Member State of identification.

Late filing and payment penalties will be imposed according to the national regulations of the Member State of consumption. The taxable person must make these payments directly to the Member State of consumption.

Repeated failure to file a return is grounds for excluding the business from the special scheme (see section 4.4).

6 Payment of VAT

The amount of VAT paid for a taxperiod must correspond to the information on the VAT return. The payable amount can be amended only by amending the return the amount is based on. When the return is amended so that the amount of tax payable increases, the difference must be paid to the Member State of identification.

If the taxable person pays only part of the reported tax, the Member State of identification will distribute the paid amount to the Member States of consumption according to the proportion of taxes belonging to them based on the return filed.

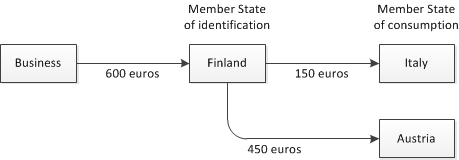

Example 9:

A company has reported €1,200 of VAT on sales, €300 of which belongs to Italy and €900 to Austria. By the due date, the company pays €600 to the Member State of identification, which is Finland. Finland will allocate one fourth of the €600 payment, €150 (300/1200*600), to Italy and three quarters, €450 (900/1200*600) to Austria.

6.1 Due date of the payment

The VAT should be paid when the return is filed, however no later than by the due date of the return (see section 5.1).

In the special scheme, the payment is deemed done at the time when the payment arrives on the bank account of the Member State of identification. Therefore, time must be allocated for the relaying of the payment. As the due date of filing the return is not be postponed because of a weekend or a public holiday, neither is the payment due date postponed. In such cases, the payment must be made before the due date of the return for it to be deemed arrived in time.

6.2 Making the payment

The VAT is paid to the Member State of identification. When the Member State of identification of the taxable person is Finland, the currency used in the payment is euro. The following information must be used when making a payment to the Finnish Tax Administration:

| Beneficiary | Tax Administration |

|---|---|

| IBAN | FI21 5000 0120 3252 45 |

| BIC | OKOYFIHH |

As the payment’s message information, the identifier of the return obtained by the taxable person from the special scheme after filing the return must be provided. The identifier of the return consists of the country code FI, the VAT number of the taxable person and the taxperiod. With the identifier of a return, the Tax Administration will allocate the payment to a specific return.

Exceptionally, when the payment is related to the Procedure for Reporting Sales on the Åland islands (in section 8.8), the identifier of the return consists of the country code AX, the VAT number of the taxable person and the taxperiod.

6.3 Refunding a payment

A payment can be refunded if the taxable person has paid too much compared to the information on the return.

A refund can be made in the following situations:

- The taxable person has paid too much compared to the information on a return.

- The taxable person amends a return based on which it has paid too much and the payment has not yet been relayed to the Member State of consumption.

- The taxable person amends the return based on which it has paid too much and the payment has already been relayed to the Member State of consumption.

Situation 1:

If a taxable person pays to much compared to information on the return filed, the Member State of identification will return the excess amount.

When Finland as a Member State of identification receives a payment, it cannot use the excess amount for other tax liabilities that the taxable person possibly has in Finland.

Situation 2:

If the Member State of identification has received the amount of the tax corresponding to the return filed and the taxable person amends the return so that the amount of the VAT payable is decreased, before the payment is forwarded to the Member State of consumption, the Member State of identification will return the excess amount to the taxable person.

Situation 3:

If the Member State of identification has received the amount of the tax corresponding to the return filed and distributed it to the Member States of consumption, and the taxable person amends the return so that the amount of the VAT payable is decreased, the Member States of consumption will return the excess amount to the taxable person.

Amending a return can lead to a situation where insufficient tax has been reported for one Member State of consumption and too much for another, and the original payment has already been distributed to the Member States of consumption. In this case, the Member State of consumption that has received too much will return the excess amount directly to the taxable person. The taxable person must pay the amount owed to the Member State of consumption that has received an insufficient amount to the Member State of identification.

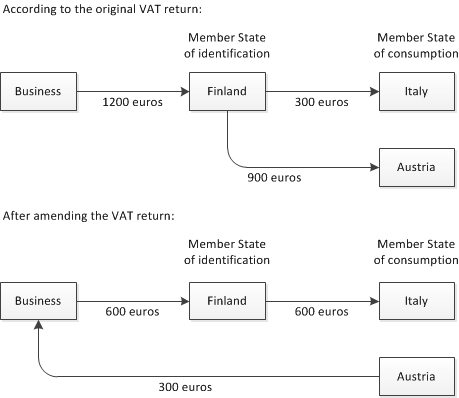

Example 10:

A company has reported €1,200 of VAT on sales, €300 of which belongs to Italy and €900 to Austria. The company has paid €1,200 to the Member State of identification, Finland, by the due date and the payment has been forwarded to the Member States of consumption. The company later finds out that the return information is not correct, and amends the return filed.

After the amendment, the tax payable is €1,500, €900 of which belongs to Italy and €600 to Austria. The company will receive €300 as a refund directly from Austria. The company must pay €600 to Finland. Finland will relay the payment to Italy.

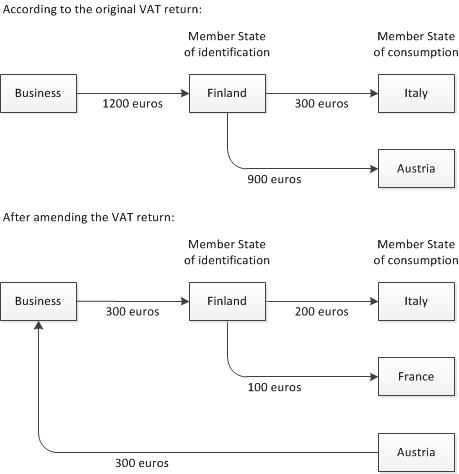

Example 11:

A company has reported €1,200 of VAT on sales, €300 of which belongs to Italy and €900 to Austria. The company has paid €1,200 to the Member State of identification, Finland, by the due date and the payment has been forwarded to the Member States of consumption. The company later finds out that the return information is not correct, and amends the return filed.

After the amendment, the tax payable is still €1,200, €500 of which belongs to Italy, €600 to Austria and €100 to France. The company will receive €300 as a refund directly from Austria and has to pay €300 to Finland. Finland will forward €200 to Italy and €100 to France.

The Member State of identification retains a certain part of the tax payments attributed to the calendar quarters from 1 January 2015 to 31 December 2018. This does not affect the amount of tax payable by or refunded to the taxable person. The transition period applies only to tax paid by users of the Union scheme.

During the transition period the taxable person will receive the refund partly from the Member State of identification and partly from the Member State of consumption, if the payment has been forwarded to the Member State of consumption.

6.4 Failure to pay the VAT

If a taxable person does not pay the reported tax within ten days of the due date or makes a partial payment, the Member State of identification will send the taxable person one reminder of a late payment. When the Member State of identification is Finland, the reminder can be read in the special scheme e-service. A notification will be sent by email on the arrival of the reminder.

The Member State of consumption may later take measures to obtain the payment. The payment can be made to the Member State of identification until the Member State of consumption contacts the taxable person because of the missing payment. After this, the payment must be made directly to the Member State of consumption.

The penalties from failure to pay the tax will be imposed according to the national regulations of the Member State of consumption. The taxable person must make these payments directly to the Member State of consumption.

Repeated failure to pay the tax is grounds for excluding the business from the special scheme (see section 4.4).

7 Keeping records

The taxable person must keep records of business transactions covered by the special scheme. The records must be sufficiently detailed so that the authorities of the Member State of consumption can verify that the information on the VAT return is correct. This section does not describe the content requirements of invoices and receipts.

Records containing the following information can be deemed sufficiently detailed:

- the Member State of consumption to which the service is supplied

- the type of service supplied

- the date of the supply of service

- the taxable amount indicating the currency used

- any subsequent increase or reduction of the taxable amount

- the VAT rate applied

- the amount of VAT payable indicating the currency used

- the date and amount of payments received

- any payments on account received before the supply of service

- where an invoice is issued, the information contained on the invoice

- the name of the customer, where known to the taxable person

- the information used to determine the place where the customer is established or has his permanent address or usually resides (see the Letter of Guidance: “Tele-, lähetys- ja sähköisten palvelujen arvonlisäverotus” (only available in finnish and swedish).

The taxable person has to keep records in such a way that they can be made available to the Member State of identification and the Member State of consumption by electronic means without delay and for each single service supplied.

If the taxable person does not provide the Member State of identification or Member State of consumption with the requested information, he can be excluded from the special scheme (section 4.4).

The information must be kept for ten years from the end of the year when the business transaction was carried out. The information must be kept even if the taxable person has ceased using the special scheme.

8 Finland as the member state of consumption

This section discusses various regulations applicable when Finland is the Member State of consumption.

8.1 VAT rate

Telecommunications, broadcasting and electronically supplied services sold in Finland are subject to the standard 24 percent tax rate (VAT Act article 84).

8.2 Invoicing requirements

A user of the special scheme must provide an invoice for supplies taking place in Finland if the buyer is a business or a legal person that is not a business (VAT Act article 209 b). The invoice can be issued electronically.

The invoice requirements are discussed in more detail in the Letter of Guidance: “Laskutusvaatimukset arvonlisäverotuksessa” (only available in finnish and swedish).

8.3 Chargeability of VAT

VAT becomes chargeable for a supply taking place in Finland when the goods have been delivered or the services rendered. Goods or services sold as a continuous supply are deemed delivered or rendered at the end of each accounting period. VAT becomes chargeable on advance payments when the consideration or part thereof has accrued. (VAT Act article 15)

8.4 Adjustments

A taxable person may deduct discounts, rebates and credit losses from the tax base (VAT Act article 78).

The Accounting Board of the Ministry of Employment and the Economy has issued a general guide on keeping record of VAT on 6 May 2008 (only available in finnish and swedish). Section 4.3 of the guide discusses the principles of the entry of adjustments.

If a taxable person cannot make these deductions in full for the tax period when calculating the tax payable to Finland, the remaining amount will be returned to the taxable person (VAT Act article 134 h paragraph 2).

8.5 Tax surcharge and penalty payments

A tax surcharge can be imposed if a VAT return is filed after the due date in section 5.1. or if no VAT return is filed. A tax surcharge can also be imposed if an incorrect or false VAT return is filed. (VAT Act article 134 r paragraph 2).

A taxable person must pay a penalty payment on tax paid late. If the taxable person does not pay the penalty payment, it will be imposed by the Tax Administration. (VAT Act article 134 m paragraph 3) A penalty payment is also imposed on an imposed tax.

The penalty payment is calculated according to the provisions of the Act on penalty payments and interest (1556/1995) (VAT Act article 134 m paragraph 4).

The amount of the penalty payment can be calculated with the Tax Administration’s penalty payment and interest calculator (only available in finnish and swedish).

8.6 Advance ruling and written guidance

It is possible to apply for an advance ruling or a written guidance on the VAT treatment of a certain business transaction of the applicant. A written guidance can be given for general or procedural questions.

An advance ruling or a written guidance cannot be given regarding tax payable to another Member State (VAT Act article 134 n).

For more details on applying for an advance ruling, see the Letter of Guidance: “Ennakkoratkaisu- ja poikkeuslupahakemuksen tekeminen ja siihen annettava päätös” (only available in finnish and swedish).

8.7 Appeal procedure

The appeal procedure is discussed in the Letter of Guidance: "Verotuksen muuttaminen (only available in finnish and swedish).

An appeal can be filed within three years from the beginning of the calendar year that follows the year that includes the tax period during which the tax concerned should have been declared and paid.

An appeal can also always be filed within 60 days from the day when the business has been served the decision. The time to appeal against decisions on registration is 60 days.

8.8 Sales on the Åland islands

Situations when selling telecommunications, broadcasting and electronically supplied services on the Åland islands have been divided according to the following sellers:

- A business established on mainland Finland

- A business established on the Åland islands

- A business not established on mainland Finland, that uses the non-Union scheme with Finland as its Member State of identification

- Other businesses not established in Finland

Situation 1:

When a business established on mainland Finland sells a telecommunications, broadcasting or electronically supplied service on the Åland islands, it is a domestic supply that is reported on the national VAT return.

Situation 2:

The sales of a business established on the Åland islands in various situations, along with the applicable tax procedure, are presented as a table in the appendix.

Situation 3:

When a business is using the non-Union scheme with Finland as its Member State of identification, sales of telecommunications, broadcasting and electronically supplied services to consumers on the Åland islands are reported on the special scheme VAT return as sales in Finland.

Situation 4:

Other EU Member States than Finland are not obligated to apply the special scheme to sales of telecommunications, broadcasting and electronically supplied services to consumers on the Åland islands.

A business that does not have its business establishment or a fixed establishment on mainland Finland or the Åland islands, and does not use the non-Union scheme with Finland as its Member State of identification, can still use the special scheme when it sells telecommunications, broadcasting and electronically supplied services to consumers established on the Åland islands. The seller then has to report and pay the tax for sales to consumers established on the Åland islands directly to the Finnish Tax Administration in the so called Procedure for Reporting Sales on the Åland islands.

If the seller does not use the special scheme, the sale has to be reported on the national VAT return in Finland, which requires registration for VAT purposes in Finland.

The return for sales on the Åland islands is filed electronically in the special scheme e-service. Filing the return requires that the seller is registered as a user of the special scheme and that its Member State of identification is another EU Member State than Finland. These sales are not reported on the special scheme VAT return in the Member State of identification and the VAT on these sales is not paid to the Member State of identification.

The Procedure for Reporting Sales on the Åland islands does not apply to a business that has its business establishment or a fixed establishment on mainland Finland or the Åland islands, or to a business that uses the non-Union scheme with Finland as its Member State of identification.

A Katso ID is required for electronic filing in Finland. The business can also authorize an agent by Power of Attorney to act in e-services on its behalf. For more information on applying for a Katso ID and authorizing an agent, see the Katso site.

The return for sales on the Åland islands has the same reporting periods and due dates as the special scheme VAT return (see section 5.1). Paying the VAT is discussed in section 6.2. Unlike the special scheme VAT return in the Union scheme and non-Union scheme, the due date for the return for sales on the Åland islands and the associated payment of VAT is postponed to the next working day if it takes places on a weekend or public holiday. The payment is also deemed done when the payment is debited from the payer’s account.

The return for sales on the Åland islands can be filed and amended in the special scheme e-service within three years from the end of the accounting period for which the tax should have been reported.

Appendix – sales of a business established on the Åland islands

This appendix presents the sales of a business established on the Åland islands in various situations and which tax procedure will be applied to the sale. In Finland, the general tax procedure means that the sale is reported on the national VAT return.

A business established on the Åland islands using the non-Union scheme.

Member State of identification is Finland

| Place of supply | Tax procedure |

|---|---|

| Åland islands | Special scheme |

| Mainland Finland | Special scheme |

| Other Member State | Special scheme |

Member State of identification is other than Finland

| Place of supply | Tax procedure |

|---|---|

| Åland islands | General tax procedure |

| Mainland Finland | Special scheme |

| Other Member State | Special scheme |

A business established on the Åland islands using the Union scheme.

Member State of identification is Finland

| Place of supply | Tax procedure |

|---|---|

| Åland islands | General tax procedure |

| Mainland Finland | General tax procedure |

| Other Member State with a fixed establishment | General tax procedure |

| Other Member State without a fixed establishment | Special scheme |

Member State of identification is other than Finland

| Place of supply | Tax procedure |

|---|---|

| Åland islands | General tax procedure |

| Mainland Finland with a fixed establishment | General tax procedure |

| Mainland Finland without a fixed establishment | Special scheme |

| Other Member State with a fixed establishment | General tax procedure |

| Other Member State without a fixed establishment | Special scheme |