The contents, period of validity and verifying the reliability of the Investor Self-Declaration

Key terms:

- Date of issue

- 10/1/2020

- Validity

- 1/1/2021 - 9/25/2022

This is an unofficial translation. The official guidance is drafted in Finnish and Swedish languages.

Section 10 b of the Act on the Taxation of Nonresidents' Income (627/1978, Tax at Source Act) was amended on 12 April 2019 (legal amendment 522/2019). The legal amendment concerns the taxation at source procedure of dividends paid by a publicly listed company as referred to in Section 33a of the Income Tax Act (1535/1992) to a nominee-registered share. The legal amendment comes into force on 1 January 2021.

According to Section 10b(4) of the Tax at Source Act, an Investor Self-Declaration, that indicates the beneficiary's information necessary for taxation at source, can be deemed to be a reasonable measure to determine the beneficiary's country of residence. According to the provision, the dividend beneficiary must declare in the Investor Self-Declaration the necessary information for taxation at source, and the Investor Self-Declaration must be sufficiently reliably documented. The Authorised Intermediary must verify that the Investor Self-Declaration is consistent with the other information on the beneficiary possessed by the Authorised Intermediary.

According to Section 10b(4) of the Tax at Source Act, Tax Administration will give further instructions on the contents and period of validity of the Investor Self-Declaration, and the procedure with which the reliability of the Investor Self-Declaration is verified. The Tax Administration has 14.9.2020 issued a decision on the contents and period of validity of the Investor-Self Declaration and the procedure, with which its reliability is verified (dnro VH/4332/00.01.00/2020). The decision comes into force 1.1.2021. This guidance discusses the contents and period of validity of the Investor Self-Declaration and the procedure to verify its reliability in accordance with the Tax Administration's decision.

Explanatory note for the English version

In this guidance, the term 'dividend beneficiary' refers to the shareholder, i.e. the owner of the shares, who has the right to the dividend on the record date in accordance with the Finnish Companies Act (624/2006). The term 'beneficial owner' is used when referred specifically to the beneficiary entitled to the dividend in accordance with the tax treaty between Finland and the beneficiary's country of residence.

1 Foreword

This guidance concerns the identification of a dividend beneficiary who is a non-resident taxpayer when dividend is paid by a publicly listed company as referred to in Section 33 a in the Income Tax Act (1535/1992) to a nominee-registered share. The guidance discusses the contents, period of validity and procedure to verify the reliability of Investor Self-Declaration (hereinafter also ISD) in accordance with Section 10b of the Tax at Source Act and the Tax Administration's decision on the contents and period of validity of the Investor-Self Declaration and the procedure, with which its reliability is verified (record number of the original decision in Finnish and Swedish VH/4332/00.01.00/2020, hereinafter ISD decision).

According to Section 10b(2) of the Act on the Taxation of Nonresidents' Income (627/1978, Tax at Source Act), the dividend provisions of an international tax treaty may be applied if the payor or the Authorised Intermediary (hereinafter also AI) has taken reasonable measures to determine the beneficiary's country of residence and to verify that the criteria for the applicability of the tax treaty are fulfilled. According to Section 10b(4) of the Tax at Source Act, the following can be deemed as reasonable measure to ascertain the facts about the beneficiary’s country of residence: a tax-at-source card issued by the Finnish Tax Administration, a certificate issued by the tax authority of the beneficiary’s country of residence, or an Investor Self-Declaration, which contains the necessary information for taxation at source. The ISD must be sufficiently reliably documented and consistent with the information possessed by the AI on the dividend beneficiary.

According to the legislative materials (HE 282/2018 vp, pp. 37-38), the ISD means an Investor Self-Declaration in accordance with the OECD's Treaty Relief and Compliance Enhancement (hereinafter TRACE) system. The ISD forms in accordance with the TRACE system and their contents are described in the OECD's TRACE Implementation Package (hereinafter TRACE IP) document and taken into account in the Tax Administration's decision and this guidance. TRACE IP and other documents concerning the TRACE system are available on the website of the OECD.

Concerning the ISD in accordance with the ISD decision, this guidance discusses

- the contents (Section 1 of the ISD decision)

- the period of validity (Section 2 of the ISD decision), and

- the procedure, with which its reliability is verified (Section 3 of the ISD decision).

Instead of the procedure in accordance with the ISD decision, the beneficiary's country of residence can alternatively be ascertained based on a tax at source card or a certificate of residence. The procedure to be followed in these situations is discussed in Chapter 10 of this guidance.

The ISD decision is applied in situations where tax treaty benefits are granted to a non-resident dividend beneficiary. The procedure in accordance with the ISD decision can nevertheless be utilised in situations, where tax at source benefits are granted based on national legislation, provided that the requirements described in Chapter 7 are met.

This guidance discusses the responsibilities of the dividend beneficiary and the responsibilities of the AI, when the procedure in accordance with the ISD decision is applied for investigating and identifying a dividend beneficiary who is a non-resident taxpayer. Otherwise, the responsibilities and liabilities of the AI are discussed in the guidance Authorised Intermediary's responsibilities and liabilities.

2 Investor Self-Declaration

2.1 Dividend beneficiary's responsibility to provide the correct information

The ISD concerns dividend income received from Finland and paid by a publicly listed company. It refers to the declaration provided by an account holder who is a customer of an AI, i.e. the dividend beneficiary, which certifies that the account holder is the beneficial owner of the dividend in accordance with the applicable tax treaty. The declaration is the Investor Self-Declaration in accordance with the OECD's TRACE system that must be sufficiently reliably documented and consistent with the other information the AI has in its possession on the dividend beneficiary. The contents required on the ISD depend partly on whether the beneficiary is a natural person or other than natural person.

The purpose of the ISD is that the dividend beneficiary provides the AI with the information referred to in Section 1 of the ISD decision and confirms the information to be correct. The contents of the ISD is discussed in more detail in Chapter 3. It is the dividend beneficiary's responsibility to provide the information required in the ISD and inform the AI of changes in their circumstances without undue delay.

In situations described in this guidance, where a tax at source benefit is granted at the time of payment based on tax treaty provisions, the beneficial owner of the dividend refers to the beneficiary entitled to the dividend in accordance with the tax treaty between Finland and the beneficiary's country of residence. It is the dividend beneficiary's responsibility to verify the fulfilment of the criteria necessary to apply tax treaty benefits in accordance with the tax treaty between their country of residence and Finland with respect to the dividend to which the ISD is related. If necessary, the dividend beneficiary must verify the applicability of the tax treaty from the tax authority of their country of residence or the Finnish Tax Administration. If the dividend beneficiary claims a tax at source benefit to be applied based on national legislation, they must verify their eligibility for the benefit in question and provide the AI with evidence of the fulfilment of the criteria.

If the dividend beneficiary submits incorrect information for taxation, submitting such information may result in the imposition of tax, tax increase or late fees. If the incorrect information was submitted with the intention to avoid taxes, this may result in criminal punishment (tax fraud).

2.2 Authorised Intermediary's responsibilities

The dividend provisions of an international tax treaty are applied if the dividend payor or the intermediary closest to the beneficiary, who at the time of the dividend distribution is registered in the Register of Authorised Intermediaries referred to in Section 10d, has taken reasonable measures to determine the beneficiary's country of residence as well as verified that the provisions on dividends of an international treaty can be applied to the beneficiary (Section 10b(2) of the Tax at Source Act).

It is the AI's responsibility to make sure that the dividend beneficiary has in the ISD provided the information referred to in Section 1 of the ISD decision and confirmed the information to be correct. The requirement for granting tax treaty benefits is that the AI has verified the reliability of the ISD in accordance with the procedure referred to in Section 3 of the ISD decision. The procedure, with which the reliability of the ISD is verified, is discussed in more detail in Chapter 5.

The AI must also ensure that the dividend beneficiary understands the intended use for which information is submitted and collected. The AI must inform the dividend beneficiary at the time the account is opened and at regular intervals thereafter, e.g. with info letters, of the beneficiary’s reponsibility to ensure that the information given in the ISD are up-to-date and correct.

The AI shall inform the dividend beneficiary to pay attention to the certifications that are given in the ISD and advise the beneficiary to contact the tax authority of their country of residence or the Finnish Tax Administration insofar as the tax treaty definition is unclear to the beneficiary. Tax treaty benefits should not be granted, if the applicability of the tax treaty is unclear and the dividend beneficiary does not provide the AI with evidence supporting its applicability.

In the Finnish tax and legal practice, it is deemed that in the interpretation of the provisions of tax treaties in accordance with the OECD Model Tax Convention in Finland, it is reasonable to give significance to what is stated in the OECD Commentary of the Model Tax Convention about the interpretation of the treaty regardless of whether the other party of the treaty is an OECD member state (Supreme Administrative Court ruling KHO 2011:11). Thus when verifying the reliability of the ISD and interpretating the definition of the beneficial owner, the AI may use either the provisions of the tax treaty between beneficiary's country of residence and Finland or the latest OECD Commentary of the Model Tax Convention. Typical provisions of tax treaties are discussed in the Tax Administration's guidance Articles of tax treaties.

The AI's responsibilities and liabilities are otherwise discussed in the guidance Authorised Intermediary's responsibilities and liabilities.

3 Contents of the ISD

3.1 The dividend beneficiary is a natural person

3.1.1 Information on the dividend beneficiary

In accordance with Section 1(1) of the ISD decision, a dividend beneficiary who is a natural person must in the Investor Self-Declaration declare and confirm to be correct the following information:

- the number of the account where the shares are held;

- country of residence for tax purposes as referred to in the tax treaty between the dividend beneficiary's country of residence and Finland;

- tax identification number issued by the country of residence;

- as identifying information the natural person’s name, date of birth and address.

The ISD must specify the account that the ISD relates to, and where the shares based on which the dividend is paid are held. The account number is sufficient as the account's identifying information. If the ISD relates to several accounts, these are all specified in the ISD.

In the ISD, the dividend beneficiary must specify their country of residence for tax purposes referred to in the tax treaty between the beneficiary's country of residence and Finland. It is not required to specify particularly the tax treaty between beneficiary's country of residence and Finland, instead the information on the country of residence for tax purposes can be general like in the ISD in the TRACE IP (ISD-Individuals, hereinafter ISD-I, TRACE IP p. 43). However, the dividend beneficiary must then ensure, that their country of residence is their country of residence also according to the tax treaty between the country in question and Finland.

The ISD must also specify the beneficiary's Tax Identification Number (TIN). If the beneficiary's country of residence does not issue TINs, the ISD must state this.

The ISD must specify the full name of the dividend beneficiary, including the first and last name, and date of birth. Additionally, the ISD must specify the beneficiary's permanent address in the country of residence, and the mailing address if it is different from the permanent address. The address information must include the street name, property number, possible suite number, postal code, city and country.

3.1.2 Certifications concerning the applicable tax treaty

In the ISD, the dividend beneficiary must certify that they are a resident for tax purposes in their country of residence as referred to in the tax treaty between Finland and the country in question. Additionally, the dividend beneficiary must certify that they are the beneficial owner of the dividend income from Finland in the manner referred to in the applicable tax treaty, and therefore eligible for tax treaty benefits.

The dividend beneficiary's certification must comprise of the following certifications in accordance with Section 1(2) in the ISD decision:

- I certify that I am a resident of my country of residence for tax purposes as referred to in the tax treaty between my country of residence and Finland.

- I certify that I am not acting as an agent, nominee or conduit with respect to the income to which this declaration relates.

- I certify that I am the beneficial owner of the dividend as referred to in the tax treaty between my country of residence and Finland, and that I meet the criteria for tax at source benefits of the applicable tax treaty with respect to the dividend to which this declaration relates.

- I certify that the dividend, to which this declaration relates, is not attributable to a permanent establishment.

- I undertake to inform the intermediary of changes in my circumstances without undue delay.

The certifications in accordance with paragraphs 1 and 3 in Section 1(2) of ISD decision, that the dividend beneficiary is a resident of their country of residence for tax purposes as referred to in the tax treaty between Finland and their country of residence, can be part of a general certification regarding the country of residence for tax purposes like in the ISD-form in the TRACE IP (ISD-I, TRACE IP p. 43). However, the dividend beneficiary must then ensure, that they are resident for tax purposes in their country of residence as referred in the tax treaty between their country of residence and Finland so that the ISD can be applied to the dividend received from Finland.

3.2 The dividend beneficiary is other than a natural person

3.2.1 Information on the dividend beneficiary

In accordance with Section 1(1) of the ISD decision, a dividend beneficiary who is other than a natural person must in the Investor Self-Declaration declare and confirm to be correct the following information:

- the number of the account where the shares are held;

- country of residence for tax purposes as referred to in the tax treaty between the dividend beneficiary's country of residence and Finland;

- tax identification number issued by the country of residence;

- as identifying information name, address, legal form, and country of registration or the country under whose laws it is established.

Other than a natural person referred to in Section 1 of the ISD decision refers to a company, i.e. body corporate or entity, that is treated as a body corporate for tax purposes in accordance with the applicable tax treaty (hereinafter entity).

The ISD must specify the account that the ISD relates to, and where the shares based on which the dividend is paid are held. The account number is sufficient as the account's identifying information. If the ISD relates to several accounts, these are all specified in the ISD.

In the ISD, the dividend beneficiary must specify their country of residence for tax purposes referred to in the tax treaty between the dividend beneficiary's country of residence and Finland. It is not required to specify particularly the tax treaty between beneficiary's country of residence and Finland, instead the information on the country of residence for tax purposes can be general like in the ISD in the TRACE IP (ISD-Entities, hereinafter ISD-E, TRACE IP p. 46). However, the dividend beneficiary must then ensure, that their country of residence is their country of residence also according to the tax treaty between the country in question and Finland.

The ISD must also specify the beneficiary's Tax Identification Number (TIN). If the beneficiary's country of residence does not issue TINs, the ISD must state this.

The ISD must specify the entity submitting the ISD. The official name of the entity is specified in the ISD as it is recorded in the entity's constitutive documents. If the name has been changed at a later date, the official name is specified as it is valid at the time the ISD is given. The ISD does not need to specify the beneficiaries of the entity if the entity itself is the beneficial owner as referred to in the tax treaty.

The ISD must specify the beneficiary's statutory address in its country of residence, as well as the mailing address if it is different from the statutory address. The address information must include the street name, property number, possible suite number, postal code, city and country.

The ISD must specify the legal form of the entity being the beneficiary that submits the ISD. The options are the following:

- Body Corporate

- Government (including central bank of issue, agency or instrumentality)

- International organisation

- Pension institution or fund

- Charity (non-profit organisation)

- Collective investment vehicle

- Partnership

- Trust

- Estate

- Other (must be described what)

The ISD must specify the country where the entity is registered or the country, under whose laws it is established.

3.2.2 Certifications concerning the applicable tax treaty

In the ISD, the dividend beneficiary must certify that they are a resident for tax purposes in their country of residence as referred to in the tax treaty between Finland and the country in question. Additionally, the dividend beneficiary must certify that they are the beneficial owner of the dividend income from Finland in the manner referred to in the applicable tax treaty, and therefore eligible for tax treaty benefits.

The dividend beneficiary's certification must comprise of the following certifications in accordance with Section 1(2) in the ISD decision:

- I certify that I am a resident of my country of residence for tax purposes as referred to in the tax treaty between my country of residence and Finland.

- I certify that I am not acting as an agent, nominee or conduit with respect to the dividend to which this declaration relates.

- I certify that I am the beneficial owner of the dividend as referred to in the tax treaty between my country of residence and Finland, and that I meet the criteria for tax at source benefits of the applicable tax treaty with respect to the dividend to which this declaration relates.

- I certify that the dividend to which this declaration relates, is not attributable to a permanent establishment.

- I undertake to inform the intermediary of changes in my circumstances without undue delay.

The certifications in accordance with paragraphs 1 and 3 in Section 1(2) of the ISD decision, that the dividend beneficiary is a resident of their country of residence for tax purposes as referred to in the tax treaty between Finland and their country of residence, can be part of a general certification regarding the country of residence for tax purposes like in the ISD-form in the TRACE IP (ISD-E, TRACE IP p. 46). However, the dividend beneficiary must then ensure, that they are resident for tax purposes in their country of residence as referred in the tax treaty between their country of residence and Finland so that the ISD can be applied to the dividend received from Finland.

According to Section 1(3) of the ISD decision, if a dividend beneficiary other than a natural person claims a tax at source rate lower than the general tax at source rate in the tax treaty to be applied, they must specify the applicable tax rate, certify that they are eligible for the tax treaty benefit in question and specify the grounds for their claim. This kind of certification must be provided, for example, if a dividend beneficiary who is a pension fund claims a special tax provision in the tax treaty to be applied. The dividend beneficiary must then, if necessary, present further clarification that is required for applying the special tax provision.

3.3 Authorisation to disclose information

Pursuant to Section 1(4) in the ISD decision, the dividend beneficiary must authorise the AI to provide the Tax Administration with the information required to verify the correctness of tax at source and the reliability of the Investor Self-Declaration, if other applicable legislation requires this kind of authorisation.

The requirement for granting tax at source benefits is that the AI can provide the Tax Administration with the information referred to above. Thus, the AI must ensure that it can submit the information on the dividend beneficiary to the Tax Administration, other legislation notwithstanding. If, for example, data privacy, bank secrecy, personal data privacy or other legislation prevents the AI to provide the Tax Administration with information that the AI has collected and that is required for taxation at source, tax treaty benefits can not be granted.

In addition to the information reported on the AI's annual information return, information on the dividend beneficiary includes the information required for verifying the correctness of the procedure. For more details on the information submitted on the AI's annual information return, see Authorised Intermediary's annual information return, technical guidance.

3.4 The format of the ISD and confirmation of the information

In Finland, the ISD does not have a specific format requirement. The AI may collect the information referred to in Section 1 of the ISD decision by using the forms in accordance with the TRACE IP (ISD-I and ISD-E, TRACE IP pp. 43-49), which are attached to this guidance. The information referred to in Section 1 of the ISD decision are the mandatory information required of the ISD.

The AI may collect the information referred to in Section 1 of the ISD decision also by using some other form that contains the required information, or collect the information by other means. An ISD is sufficient when the information on the beneficiary referred to in Section 1 of the ISD decision are available to the AI. The information must be available in a compiled manner and confirmed to be correct by the dividend beneficiary. The ISD may also comprise of several different pieces of information and contain several documents and files.

The AI is not required to collect the ISD from the dividend beneficiary in Finland's official language, i.e in Finnish or Swedish. If the ISD has not been made in Finnish, Swedish or English, the AI must provide also a translation in one of the previous mentioned languages attached to the ISD at the request of the Tax Administration.

For the ISD, the information collected on the customer based on the legislation concerning prevention of money laundering and terrorist financing and know your customer rules (Anti-Money Laundering/Know Your Customer, hereinafter AML/KYC), as well as a declaration that the customer has provided for some other purpose may be utilised. Such a declaration provided for another purpose may be, for example, a Self-Certification in accordance with the CRS/DAC2 requirements submitted to a financial institution by the account holder, or a certificate collected for the Qualified Intermediary systems of the United States, Ireland or Japan. The declaration must always contain the information on the beneficiary referred to in Section 1 of the ISD decision and the dividend beneficiary must always provide the certifications and authorisations referred to in Section 1(2-4) of the ISD decision.

Principally, an ISD is account-specific, but it can also be customer-specific when the customer's information has been confirmed to be correct and it has been verified that the circumstances are in accordance with the ISD on all accounts that the ISD covers. When the dividend beneficiary opens a new account, they do not have to provide a new ISD, if they confirm that the original ISD is applicable also to dividend that is paid to shares held in the new account, and the AI verifies the reliability of the ISD also on in respect of the new account.

The AI may advise the dividend beneficiary in the submittal of the information and prefill the ISD on behalf of the beneficiary. However, the ISD must always be certified to be correct by the beneficiary in a documented manner. The beneficiary must certify the correctness of the information in the ISD with a signature, an electronic signature or some other certification given by the beneficiary (such as a recording or a digital footprint). The certification must indicate the time of the certification of the correctness of the information. In these respects, the OECD's CRS standard and its commentaries can be utilised in the interpretation.

When the beneficiary is an entity, in connection with the certification must be provided a clarification, that the person who certified the document has authority to sign on behalf of the entity, or a power of attorney. The AI or its employee cannot certify the correctness of an ISD on behalf of the beneficiary even with a power of attorney. However, in a situation where the AI itself is the beneficial owner of the dividend in accordance with the tax treaty, the AI may self-certify the information it has provided.

4 Period of validity of the ISD

Pursuant to Section 2 of the ISD decision, an Investor Self-Declaration is valid no more than the year it is signed and the following five years. If the dividend beneficiary is a government or other public entity, or an international organisation, the declaration is valid until further notice.

Consequently, an ISD is principally valid the year it is signed and the following five years. If an ISD, that is verified to be reliable, indicates that the dividend beneficiary is a government or other public entity, or an international organisation, the ISD will remain valid until further notice. A public entity in accordance with the provision, refers to an entity that by reference to the national legislation of the contracting state concerned, have been incorporated or formed as public entity in that state. Such public entities are, for example, the state, its agency or instrumentality, or a central bank.

The AI must monitor the correctness of the information submitted in the ISD also during the validity period of the ISD in the manner described in Chapter 5.3. In practice, the AI must have a procedure in place for ensuring that any changes detected in the account holder's circumstances also lead to a reassessment of the ISD's correctness and, if necessary, to its updating.

The ISD remains valid at most until there is a change in circumstances, due to which the AI knows or has reason to know that the original ISD is incorrect or unreliable.

Example 1

The customer has signed an ISD on 22 November 2020, certifying that the customer lives in Spain in the manner referred to in the tax treaty between Finland and Spain, and that the customer is the beneficial owner of the dividend. The validity of the ISD ends on 31 December 2025 unless there is a change in circumstances.

Example 2

On 20 April 2021, in the situation described in Example 1, the customer notifies the AI of a new permanent mailing address located in Germany. The AI must react to the change of the mailing address, because the mailing address is now in a different country than the one where the customer certified as the country of residence for tax purposes. The AI may not apply the tax treaty between Finland and Spain, nor any other tax treaty, before it has received an explanation from the customer on the customer's country of residence for tax purposes.

5 Procedure to verify the reliability of the ISD

5.1 General on verifying the reliability

Pursuant to Section 3(1) of the ISD decision, the payor or the AI referred to in Section 10d of the Tax at Source Act must make sure, that the dividend beneficiary has in the ISD provided the information referred to in Section 1 of the decision and confirmed the information to be correct. The reliability of the ISD must be verified based on the information required by the common information exchange standards, and anti-money laundering and know your customer legislation, as well as the information otherwise available to the payor or the Authorised Intermediary on the dividend beneficiary.The AI has to verify the reliability of the ISD in the manner referred to in Section 3 of the ISD decision when the dividend beneficiary submits the ISD for the first time. The procedure, with which the reliability of the ISD is verified, is described in Chapter 5.2 of this guidance.

Pursuant to Section 3(2) of the ISD decision, the reliability of the ISD must then be verified again, if the payor or the AI receives information on changes in the dividend beneficiary's circumstances. Consequently, it is the AI's responsibility to monitor, whether such changes in the dividend beneficiary's circumstances that affect the reliability and validity of the ISD take place. Dividend beneficiary's responsibility is to ensure that the information they have provided in the ISD are up-to-date as well as inform the AI of changes in their circmumstances. Changes in circumstances that affect the reliability of the ISD are discussed in Chapter 5.3 of this guidance.

Pursuant to Section 3(3) of the ISD decision, the payor or the AI must, based on the information available to them, confirm before the dividend payment whether the declaration is reliable. Pursuant to Section 3(4) of the decision, the confirmation referred to in subsection 3 is not required, if the tax at source withheld from the dividend is at least 15 per cent or the dividend amount is under 10 000 euros.

If the AI has taken reasonable measures to verify the reliability of the ISD when receiving the ISD and there has been no changes in beneficiary's circumstances that affect the reliability of the ISD, the reliability of the ISD is not required to be verified separately before dividend payment when applying tax treaty provisions, if the tax at source withheld from the dividend is at least 15 per cent or the dividend amount is under 10 000 euros. However, the AI can always verify the reliability of the ISD per dividend payment, if they wish to do so.

In situations, where the tax at souce withheld from the dividend is under 15 per cent and the dividend amount is at least 10 000 euros, the reliability of the ISD must always be confirmed before the dividend payment (ISD decision, Section 3(3) and (4)). The procedure to be followed in these situations, is described in Chapter 5.4. The AI may alternatively follow the procedure in accordance with Chapters 5.2 and 5.3 also in situations where it could be possible to apply a lower tax rate to the dividend, but the tax withheld is at least 15 per cent. In that case the reliability of the ISD is not required to be verified per dividend payment unless the AI knows or has reason to know that there has been a change in beneficiary's circumstances that affects the reliability of the ISD.

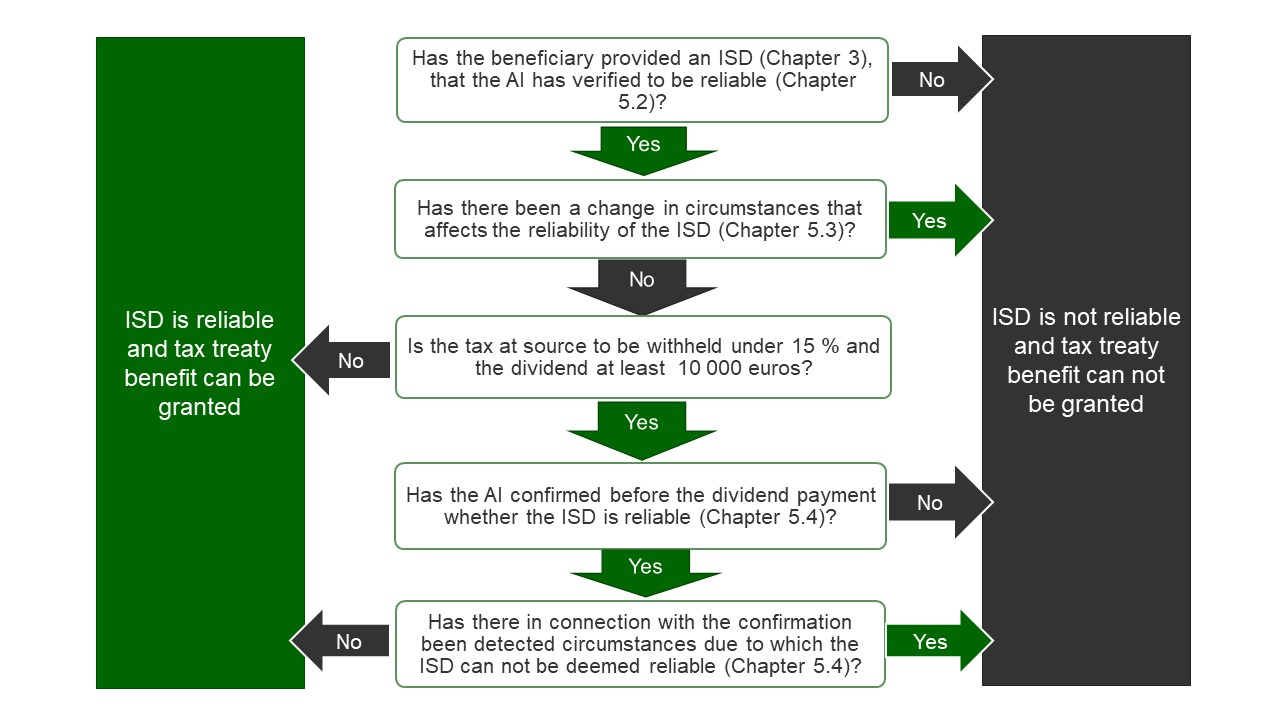

The procedure in accordance with Section 3 of the ISD decision, with which the reliability of the ISD is verified, is described in the diagram below.

The AI is released from the liability referred to in Section 10c(2) of the Tax at Source Act by proving that it has followed the procedure in accordance with the Tax Administration’s ISD decision when investigating and identifying the dividend beneficiary.

5.2 Procedure to verify the reliability of the ISD

Pursuant to Section 10b(4) of the Tax at Source Act, an ISD must be sufficiently reliably documented and consistent with the other information on the dividend beneficiary possessed by the AI.

Pursuant to Section 3(1) of the ISD decision, the payor or the AI must ensure that the dividend beneficiary has in the ISD provided the information referred to in Section 1 of the decision and confirmed the information to be correct. The reliability of the ISD must be verified based on the information required by the common information exchange standards, and anti-money laundering and know your customer legislation, as well as the information otherwise available to the payor or the AI on the dividend beneficiary.

Based on Section 3(5) of the ISD decision, at least the information required by the common information exchange standards, and anti-money laundering and know your customer legislation must be available to the AI when verifying the reliability of the ISD. The information required by the common information exchange standards are the information collected based on CRS/DAC2 standards and FATCA agreements. Information related to anti-money laundering and know your customer legislation refers to the information that the AI must collect of its customer obligated by the legislation concerning prevention of money laundering and terrorist financing and know your customer, i.e. AML/KYC legislation, and that is applied to the AI.

In addition to the information referred to above, in accordance with Section 3(1) of the ISD decision the AI must use other information otherwise available to the AI on the dividend beneficiary when verifying the reliability of the ISD. The information otherwise available to the AI refers to the information that affects the reliability of the ISD and that the AI or a Contractual Intermediary (hereinafter CI), who verifies the reliability of the ISD on behalf of the AI, has received on their customer in their business activities. The AI is not required to search information only for this purpose from public sources, such as the internet, public registries or commercial databases,

The reliability of the ISD is verified for the first time when the dividend beneficiary first submits an ISD. The reliability can be verified account-specifically when the information collected for the ISD is received.

An ISD is valid when the AI has received a documented ISD from the dividend beneficiary and verified its reliability based on the above referred information on the beneficiary available to the AI. A tax at source rate in accordance with a tax treaty may be applied only if the AI has received an ISD from the dividend beneficiary and verified the reliability of the ISD in accordance with Section 3 of the ISD decision.

The AI that assumes responsibility for the correctness of dividend payment information must take reasonable measures to verify the validity of the ISD. Reasonable measures mean that the AI who assumes responsibility for the dividend beneficiary's information compares the information received from the dividend beneficiary to all information on the beneficiary available to the AI, in order to verify whether the information provided by the dividend beneficiary in the ISD is reliable. If based on the information available to the AI, the ISD can not be deemed to be reliable, the requirement for granting tax treaty benefits is that the AI receives documentation from the dividend beneficiary that confirms the reliability of the ISD or the reliability of the ISD is verified based on publicly available information.

The AI must request a documented explanation from the dividend beneficiary for example, when the dividend beneficiary is claiming benefits that differ from the general tax rate of the tax treaty based on a certification in accordance with Section 1(3) of the ISD decision, and the reliability of the ISD cannot be verified based on the information available to the AI. The AI must then request a documented additional explanation from the dividend beneficiary that proves the beneficiary's eligibility for the benefit. When the dividend beneficiary claims a preferential tax rate to be applied based on its legal form, the requirement for granting the tax treaty benefit is a further clarification that confirms the beneficiary's legal form to be as referred to in the special provsion in question, such as constitutive documents, a public registry extract or a certificate issued by an authority of the country of residence.

Example 3

A dividend beneficiary who is an US pension fund provides the AI with an ISD, in which it claims a zero tax rate to be applied on the dividend under the tax treaty between Finland and the United States. The AI requests a further clarification from the beneficiary on the applicability of the special provision. The pension fund provides the AI with its constitutive documents that indicates that they are a pension fund as referred to in the tax treaty. The AI verifies the reliability of the ISD as required in Section 3 of the ISD decision. The further clarification provided by the beneficiary is sufficient and the tax treaty benefit may be granted.

The ISD cannot be deemed reliable if the AI knows or has reason to know that the ISD is unreliable. These situations are discussed in more detail in Chapter 5.5.

5.3 Changes in the dividend beneficiary's circumstances

Pursuant to Section 3(2) of the ISD decision, the reliability of the ISD must then be verified again, if the payor or the AI receives information on changes in the dividend beneficiary's circumstances. A change in circumstances referred to in the provision is any change due to which the AI receives new or changed information related to the beneficiary's country of residence for tax purposes or the applicable tax treaty, which is in conflict with the country of residence for tax purposes or applicable tax treaty that the beneficiary has declared.

If a change in the dividend beneficiary's circumstances that affects the reliability of the ISD has taken place, tax treaty benefits can not be granted based on the original ISD. However, tax treaty benefits may be granted if the dividend beneficiary provides a new reliable ISD, establishing the beneficiary's country of residence for tax purposes and certifying that the application criteria for the tax treaty between the country of residence and Finland are fulfilled. Alternatively, the AI may collect a reliable explanation and the necessary documentation from the dividend beneficiary with which the reliability of the original ISD is verified. The AI must retain all original and new documents, such as copies and notes, proving the verification of reliability.

An AI is deemed to always be informed of a change in circumstances if

- the dividend beneficiary reports a change in their circumstances or submits a new ISD;

- the AI receives information on a change in the dividend beneficiary's circumstances by other means, such as from a public address information system;

- the AI detects a change in the dividend beneficiary's circumstances in its AML/KYC, FATCA, CRS/DAC2 or other procedure; or

- the AI knows or has reason to know, based on their own operations, that the ISD is not reliable.

Also changes or additional information related to the account, such as adding or replacing an account holder, are changes in circumstances that affect the reliability of the ISD, if they are contradictory with the information that the dividend beneficiary has provided in the ISD. The reliability of the ISD must always be verified again if in above referred situations the AI receives new or changed information, that is contradictory with the tax treaty that is applicable based on the ISD.

5.4 Verifying reliability in situations where the tax at source withheld is less than 15 % and the amount of the dividend at least 10 000 euros

The AI must confirm the reliability of the ISD before the dividend payment as referred to in Section 3(3) of the ISD decision based on the information available to the AI, if

- the tax at source to be withheld from the dividend is less than 15 per cent, and

- the amount of dividend is at least 10 000 euros.

In the provision, the dividend amount of 10 000 euros refers to a dividend that the dividend beneficiary has received from one dividend payor per payment.

If the above described requirements are fulfilled, the AI must, before the dividend payment, go through the information in accordance with Section 3(1) of the ISD decision as referred to in Chapter 5.2. In pursuance of the confirmation, the AI must go through possible changes in share ownership, including the trading information, that the AI, or the CI who verifies the reliability of the ISD on behalf of the AI, has received on their customer in their business activities. This procedure also ensures that the Tax Administration receives sufficient and correct information on the payment of dividends in the manner referred to in the Government proposal (HE 282/2018 vp, pp. 5-6) for tax control purposes, and a tax treaty rate lower than the customary tax treaty rate of 15 per cent would not be used for tax evasion purposes or aggressive tax planning.

The ISD is not valid without a further clarification that ensures the reliability, if due to the confirmation referred to above, the AI knows or has reason to know that

- the shares have been acquired no more than 30 days before the dividend payment,

- arrangements related to share ownership or derivatives are linked to the dividend payment, or

- the information in the ISD are otherwise contradictory with the information available to the AI or the ISD can not be deemed reliable due to other reason.

The ISD can not be deemed reliable without a further clarification, if the shares were acquired no more than 30 days before the dividend payment. The effect of changes in ownership on the reliability of the information submitted by the dividend beneficiary in the ISD is assessed based on whether the changes affect the dividend beneficiary's eligibility for the tax treaty benefit. If, for example, the dividend beneficiary bought the shares just before the time of the dividend distribution and gave up the shares right after the dividend distribution, the AI must determine whether such transactions involved arrangements that affect the interpretation of the tax treaty and, if necessary, request the related documentation.

The ISD is not valid if the AI knows or has reason to know, that arrangements related to share ownership or derivatives, that affect the reliability of the ISD, are linked to the dividend payment. This kind of arrangement can be, for example, stock lending arrangement or other agreement based on which a third party is compensated for the dividend. If the AI knows or has reason to know that ownership arrangements that affect the reliability of the ISD are linked to the dividend payment, the ISD can not be deemed reliabile unless the AI receives a reliable explanation and documentation that the beneficiary is eligible for the tax treaty benefit regardless of the arrangement. If it is a question of a stock lending arrangement, the AI must request the documents concerning the stock lending and determine the contents of the lending agreement. Concerning possible derivatives, such as synthetic financing arrangements, other derivative contracts or swap arrangements, the AI must determine the purpose of the arrangement and the related documentation as well as the beneficial owner of the dividend on the record date of the dividend.

The ISD can be deemed reliable and the tax treaty benefit granted if the AI receives a reliable explanation and related documentation that proves, that the share transaction or ownership arrangements does not affect the interpretation of the tax treaty. If the AI can not ensure the reliability of the ISD and the dividend beneficiary's eligibility for tax treaty benefits remains ambiguous, tax treaty benefits can not be granted. In these kinds of situations the requirement for granting tax treaty benefits is a Tax Administration's decision in pursuance of which the matter has specifically been decided, such as an advance ruling. The beneficiary may alternatively apply for a refund of tax at source after the payment year, in which case the Tax Administration determines the dividend beneficiary's eligibility for the tax treaty benefit.

5.5 Situations where the Investor Self-Declaration is unreliable or incorrect

Pursuant to Section 3(1) of the ISD decision, an AI must make sure, that the dividend beneficiary has in the ISD provided the information referred to in Section 1 of the decision and confirmed the information to be correct. The ISD is not valid, if the dividend beneficiary has not provided all the mandatory information in accordance with Section 1 of the ISD decision.

Tax treaty benefits cannot be granted to the dividend beneficiary based on the ISD, if the AI knows or has reason to know that the information or certifications that the dividend beneficiary has provided in accordance with Section 1 of the ISD decision, are unreliable or incorrect.

Pursuant to Section 3(1) of the ISD decision, the reliability of the ISD must be verified based on the information required by the common information exchange standards, and anti-money laundering and know your customer legislation, as well as the information otherwise available to the the AI on the dividend beneficiary. In the assessment of whether the AI knew or had reason to known that the ISD is unreliable or incorrect, the information required by CRS/DAC2, FATCA, AML/KYC -procedures that must be available to the AI on the beneficiary in accordance with Section 3(5) of the ISD decision, including the beneficiary's account information, is taken into account. In the assessment the information on the dividend beneficiary that is otherwise available to the AI as referred to in Section 3(1) of the ISD decision, i.e. the information that affects the reliability of the ISD and that the AI or a CI, who verifies the reliability of the ISD on behalf of the AI, has received on their customer in their business activities, is also taken into account. Information that affects the reliability of the ISD can be for example an information received from an authority on the unreliability or incorrectness of the ISD.

If the AI knows or has reason to know that the Principal Purpose Test provision applies to the dividend payment transaction, the ISD cannot be deemed reliable. The AI is deemed to know or have reason to know that the ISD is not reliable in situations where the AI or its related entity is planning, marketing, organising, making available, giving support or advice, or is a party in an arrangement that affects the reliability of the ISD. An entity is a related entity of another entity, if either the other entity controls the other entity, or two entities are under mutual control. When this is applied, control means direct or indirect ownership of the votes or value of the entity that exceeds 50 per cent. More infromation on the applicability of the Principal Purpose Test provision in the Tax Administration's guidance Articles of tax treaties.

See below for a list of examples of situations where the AI is considered to have reason to know that the ISD is unreliable or incorrect (TRACE IP, pp. 31-32). The list is not exhaustive.

- The beneficiary is a natural person, and the AI has examined, in order to comply with applicable Know Your Customer Rules, the passport of the beneficiary and the photograph in the passport does not match the appearance of the person presenting the passport.

- The AI shall not treat a beneficiary as a resident of a country other than the Source Country if the permanent residence address on the ISD is outside the Source Country but the AI has a mailing or residence address for the beneficiary inside the Source Country, i.e., Finland. The AI nevertheless may treat the beneficiary as a resident of a country other than the Source Country if the AI has in its possession or obtains additional corroborative documentation that supports the beneficiary’s claim not to be a resident of the Source Country.

- The AI shall not treat a beneficiary as a resident of a country under an income tax treaty if the permanent residence address on the ISD is not in the applicable treaty country. The AI nevertheless may treat the beneficiary as a resident of the applicable treaty country if the AI has in its possession or obtains additional corroborative documentation that supports the beneficiary’s claim that it a resident of the applicable treaty country.

- The AI shall not treat a beneficiary as a resident of a country under an income tax treaty if the permanent residence address on the ISD is in the applicable treaty country but the AI has a mailing or other address for the beneficiary outside the applicable treaty country. The AI may nevertheless treat the beneficiary as a resident of the applicable treaty country if the AI has has in its possession or obtains additional corroborative documentation that supports the beneficiary’s claim that it is a resident of the applicable treaty country.

- The AI may not rely on the ISD to reduce the withholding rate on a dividend payment if

- the AI has been involved in arranging or structuring a transaction pursuant to which the person that provided the ISD obtained from the AI the security which generates the dividend payment; and

- under the law of the Source Country, that person is not entitled to a reduced rate with respect to income on securities received pursuant to such transaction.

- The AI shall not treat a beneficiary as a resident of a country under an income tax treaty if the only residence or mailing address it has for the beneficiary in that country is an in-care-of address or a P.O. Box. The AI may nevertheless treat the beneficiary as a resident of the applicable treaty country if the AI has in its possession or obtains additional corroborative documentation that supports the beneficiary’s claim that it is a resident of the applicable treaty country.

- The AI will be considered to know that the information contained in the ISD is incorrect if it has been informed by the beneficiary, the competent authority, the payor or another intermediary that the information contained in the ISD is unreliable.

Example 4

A customer of an AI has a permanent address in Sweden, and in a ISD, they have reported being a resident of Sweden for tax purposes. However, the customer has reported a mailing address in Finland. The AI may not treat the customer as a resident of Sweden unless the customer provides documentation that proves that they are resident of Sweden in accordance with the tax treaty between Sweden and Finland. The customer provides the AI with a certificate of residence issued by the Swedish tax authority, proving that they have tax liability to Sweden, and a certificate of being a nonresident taxpayer issued by the Finnish Tax Administration. Based on the received explanation, the AI may treat the customer as a resident of Sweden.

In a situation where the AI detects after the dividend payment that the ISD is unreliable, and there has been an under-withholding of tax at source, the AI must correct the error without undue delay. AI's tax liability and responsibilities in a situation where the dividend beneficiary has submitted an incorrect ISD or failed to notify the AI of a change in the their circumstances are discussed in more detail in the guidance Authorised Intermediary's responsibilities and liabilities.

6 Indirect customers of an Authorised Intermediary

Authorised Intermediaries may utilise service providers when fulfilling their responsibilities related to an ISD. The use of a service provider does not affect the AI's responsibilities; the responsibility for the reasonable measures being taken as required in Section 3 of the ISD decision is always with the AI.

An AI may assume responsibility for dividend payment information collected by a Contractual Intermediary, i.e. an intermediary that is not registered as an AI, or some other third party. In this case, the AI is responsible for the reliability of the ISD having been verified in the manner referred to in Section 3 of the ISD decision. The AI must ensure that the CI has collected the information as referred to in the Section 1 of the ISD decision and verified the reliability of the ISD in the manner referred to in Section 3 of the ISD decision.

For verification of the reliability, the information referred to in Section 3(1) of the ISD decision, which is discusssed in Chapter 5.2, must be available to the party who verifies the reliability of the ISD. If the AI itself does not possess these information or the ISD at the time of dividend payment, they must ensure that they will be able to present and deliver the information to the Tax Administration for tax control purposes if necessary.

More on the responsibilities and liabilities of the AI in situations where the AI uses a service provider, in the guidance Authorised Intermediary's responsibilities and liabilities.

7 Tax at source benefits based on national legislation

An ISD may be utilised for investigating and identifying the dividend beneficiary also in situations, where a tax at source benefit is granted based on national legislation. The AI must verify the reliability of the ISD in the manner described in Chapter 5.

The requirement for granting tax at source benefit based on national legislation is always that the AI verifies before the dividend payment that the criteria for granting the tax at source benefit in accordance with the national legislation are fulfilled. If the dividend beneficiary does not present evidence on the fulfilment of the criteria for the tax exemption to the AI, tax at source benefits can not be granted. Tax at source benefits can not be granted either if the AI knows or has reason to know that the national tax evasion provision (the Act on Assessment Procedure for Self-assessed Taxes 768/2016, Section 10; the Act on Assessment Procedure 1558/1995, Section 28) applies to the dividend payment transaction.

In these situations an ISD can be utilised in the manner as referred to in the TRACE IP (attachment C to the ISD-E -form, TRACE IP p. 52). In this case the dividend beneficiary must in addition to other information and certifications in accordance with Section 1 in the ISD decision specify the tax rate they have requested to be applied and certify being eligible for the tax at source benefit in question as well as provide the further evidence that is required for applying the benefit.

In the RateReason element of Authorised Intermediary's annual information return, it must be speficied if tax at source benefits have been granted based on national legislation. Tax at source benefits based on national legislation may be granted for example in the following situations:

- Comparability to a corresponding tax exempt Finnish entity (TRACEFINDOM1)

- Dividend in accordance with the Parent-Subsidiary Directive (TRACEFINDOM2)

- Other reason based on national legislation (TRACEFINDOM3)

The dividend beneficiary must provide the AI with evidence of their eligibility for the benefit based on national legislation in question. The type of the required evidence depends on the criteria for granting tax at source benefit in question and therefore the criteria must always be checked from the national legislation. The ISD can be deemed valid unless the further explanation provided by the dividend beneficiary, like a tax at source card, shows that there has been a change in the dividend beneficiary's circumstances due to which the ISD can not be deemed reliable anymore.

Example: Foreign investment fund corresponding to a domestic investment fund or special investment fund

Tax at source shall not be levied on dividend paid to a foreign contractual investment fund that can be found comparable to a Finnish investment fund or special investment fund and fulfils the criteria for tax exemption under section 20a of the Income Tax Act. The exemption is contingent on the dividend beneficiary submitting an explanation to the Tax Administration of how the criteria for tax exemption are satisfied. (Tax at Source Act, Section 3(10)).

If the dividend beneficiary claims comparability with a Finnish investment fund or special investment fund, the criteria for granting tax at source benefits is that the Tax Administration has determined the matter and the dividend beneficiary provides a documented evidence of this in addition to the ISD. This kind of evidence can be a tax at source card or an advance ruling issued to the beneficiary by the Tax Administration.

These situations are reported in the annual information return as comparability to a corresponding tax exempt Finnish entity (RateReason=TRACEFINDOM1).

Example: Dividend beneficiary under the Parent-Subsidiary Directive

Tax at source shall not be levied on dividend paid to a company referred to in the directive on the common system of taxation applicable in the case of parent companies and subsidiaries of different Member States of the European Union (90/435/EEC, Parent-Subsidiary Directive) if the company directly holds at least 10% of the capital of the dividend paying company (Tax at Source Act, Section 3(6))

If the dividend beneficiary claims a tax at source benefit based on being a company referred to in the Parent-Subsidiary Directive, the AI must in addition to the ISD obtain explanation that the criteria for application of the directive are fulfilled. The explanation must show, for example, that the entity who is the beneficiary owns at least 10 per cent of the capital of the company distributing dividends and that the beneficiary's country of residence is in the European Economic Area. More information on the criteria for applying the directive in the Tax Administration’s guidance Payments of dividends, interest and royalties to nonresidents.

These situations are reported in the annual information return as dividend in accordance with the Parent-Subsidiary Directive (RateReason=TRACEFINDOM2).

8 Retention of information and access to the documentation

The AI must retain the original ISD submitted by every beneficiary with an account with the AI, a verified copy of it, or a reliable electronic scanned version. Furthermore, the AI must retain all documentation related to the ISD, including all information utilised in assessing the validity of the ISD. In situations referred to in Chapter 6, the AI must ensure that the CI retains the above referred information.

At the request of the Tax Administration, the AI must provide or present for review the above referred information and documents to the Tax Administration. The AI must also, upon request, correspondingly present the corresponding information and documents that a CI has collected and for which the AI assumed responsibility.

The information is possible to be submitted to the Tax Administration electronically in a manner that is data secure. The Tax Administration's established information security guidelines and confidentiality regulations are followed in the processing and storage of the materials. For more information on this, see the customer guidance Data security and the processing of personal data at the Finnish Tax Administration.

The documentation must be retained for a period of six years from the end of the dividend payment year. The information can be stored in an electronic format in such a manner that it can be provided and presented to the Tax Administration when necessary.

More on the collection and retention of materials, see the guidance Authorised Intermediary's responsibilities and liabilities.

9 Dividend payor

The dividend payor may follow the procedure described in this guidance when identifying a nonresident dividend beneficiary in accordance with Section 10b (2) and (4) of the Tax at Source Act in a situation where there is no AI in the chain, who would have assumed responsibility for the dividend payment information. In this case, the payor is responsible for investigating the beneficiary's country of residence and ascertaining that the provisions on dividends of an international treaty can be applied to the dividend beneficiary.

The payor may in practice agree that a CI will on behalf of the payor collect the ISD from the dividend beneficiary and verify its correctness with the procedure in accordance with Section 3 of the ISD decision, which is discussed in Chapter 5. The payor's responsibility is to submit the required information in an annual information return, and provide the additional information referred to in this guidance that is necessary for the Tax Administration's tax control purposes. If at the time of payment the payor itself is not in possession of this information nor the ISD, the payor must ensure that it can if necessary present and provide the information to the Tax Administration for tax control purposes.

If a CI has followed the procedure in accordance with the ISD decision when identifying the dividend beneficiary and ascertaining their eligibility for tax treaty benefits on behalf of the payor and the required information has been reported to the Tax Administration, a possible underwithholding is not deemed to be a negligence of party responsible for withholding the tax, i.e. the payor (Tax at Source Act, Section 16(2)).

10 Other evidence on dividend beneficiary's country of residence

The payor or the AI may investigate and identify the dividend beneficiary, determine their country of residence for tax purposes and the criteria for applying the relevant tax treaty based on the ISD in accordance with the ISD decision. Alternatively, the payor or the AI can ascertain the dividend beneficiary's eligibility for the tax treaty benefit with other procedure described in Section 10b of the Tax at Source Act or withhold tax at source in accordance with Section 7 of the Tax at Source Act. In this case, the beneficiary's country of residence and criteria for the application of international treaty must be determined separately per every dividend payment.

In addition to the ISD, a tax at source card issued by the Tax Administration or a certificate issued by the tax authority of the beneficiary's country of residence can be deemed to be a reasonable measure to determine the beneficiary's country of residence (Tax at Source Act, Section 10b(4)). Additionally, the AI must then verify that the one who presents the tax at source card or certificate of residence is the beneficial owner of the dividend as referred to in the applicable tax treaty.

More information on the situations in accordance with Section 7 of the Tax at Source Act in the guidance Authorised Intermediary's responsibilities and liabilities.

Attachments: