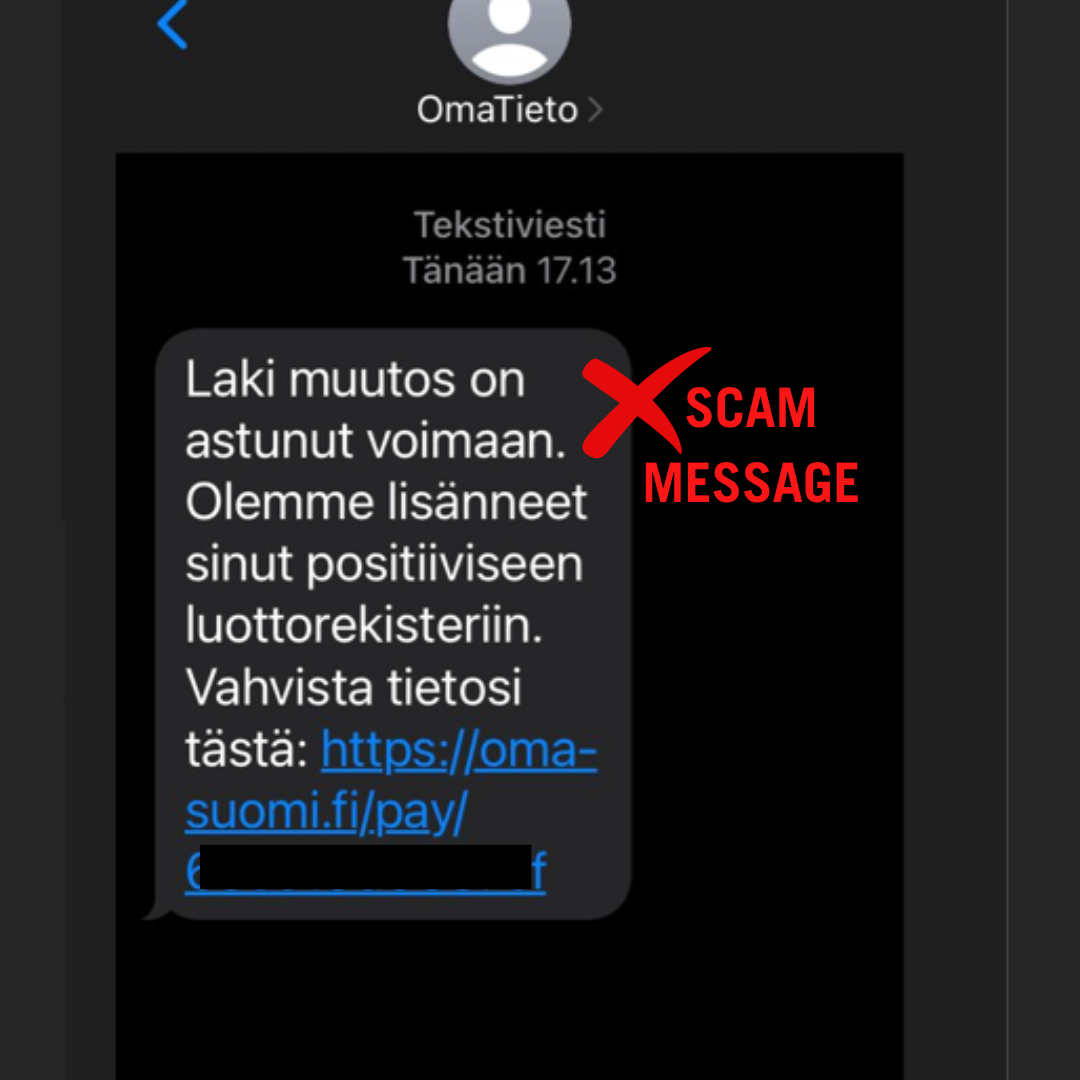

Scam messages circulating about the positive credit register

2/19/2024Scammers have become active now that the positive credit register’s launch is approaching. The positive credit register will open for private individuals on 1 April 2024.

The introduction of the positive credit register is approaching, and the first scam messages sent in the register’s name have been detected. Scam messages attempt to entice people to click on a link that leads to a scam website. Aino Sarakorpi, Project Director of the positive credit register, says that the register does not send text messages to private individuals, nor ask them to give information or confirm that information is correct. Messages sent in the register’s name are always scam.

- We receive data directly from lenders, we do not ask information from private individuals. People should never click on a link received by text message, and we do not send them such links, says Aino Sarakorpi.

A private individual can check information stored in the register only through the register's own e-service.

- However, the e-service for private individuals will not open until 1 April 2024, so checking is not even possible before that, says Aino Sarakorpi.

In future, you can access the service through the positive credit register’s website www.positivecreditregister.fi. To avoid scam websites, we recommend that you should type the address in the browser and avoid using search engines. At the moment, however, scam messages are mostly sent by text message.

What is the positive credit register?

The main purpose of the register is to prevent households from taking on too much debt. Private individuals can view up-to-date information about their loans in the register and set a voluntary ban on credits for themselves free of charge. Also, lenders can better assess the loan applicant's ability to repay the loan when they receive up-to-date data on the applicant's loans and income from the register.

Lenders started reporting data to the register at the beginning of February 2024, and they can start using the data for the assessment of creditworthiness on 1 April. For private individuals, the register and its e-service will open on 1 April 2024.

- The purpose of the register is to provide lenders with more up-to-date information to support their credit decisions and thereby prevent over-indebtedness, says Aino Sarakorpi.

A typical scam message

There are many kinds of scam messages, but they have a few things in common. Messages often urge the recipient to hurry up and act quickly. They may also tell you about an unexpected change regarding your information. Scam messages related to the positive credit register may refer to a legal amendment, for example, giving it as a reason why you are requested to check your information.

In addition, scam messages always include a link that the recipient is urged to click and thereby provide the scammer with access to their bank or personal information.

What to do if you receive a scam message

- Do not click on any links in the message or enter your online banking codes on pages that open through such links. Delete the message immediately.

- If you suspect that you have entered your information on a scam website, contact your bank immediately and ask them to close your e-banking codes and bank cards

- Also report the offence to the police immediately

- If you detect scam messages, you can also report them to the National Cyber Security Centre of the Finnish Transport and Communications Agency Traficom.