Withholding tax at source on dividends, interest and royalties, and the payor’s obligations

Key terms:

- Date of issue

- 4/8/2022

- Validity

- 4/8/2022 - Until further notice

This is an unofficial translation. The official guidance is drafted in Finnish and Swedish languages.

The payor must withhold tax at source on dividend, interest and royalty they pay, when the beneficiary is a nonresident taxpayer, and the payment is not exempt from tax at source based on an international treaty or Finland’s national tax legislation. This guidance concerns the withholding of tax at source and the payor's obligations and liabilities when paying dividend, interest or royalty to a nonresident taxpayer.

This guidance replaces the guidance Payments of dividends, interest and royalties to nonresidents (VH/3059/00.01.00/2018) insofar as the guidance concerns the procedure for withholding tax at source and the payor's related obligations and liabilities. The updated guidance Payments of dividends, interest and royalties to nonresidents concerns taxation on nonresident taxpayers’ dividends, interest and royalties.

1 General information on the tax at source procedure

1.1 Taxation at source

Nonresident taxpayers must pay income tax in accordance with the Act on the Taxation of Nonresidents’ Income (Laki rajoitetusti verovelvollisen tulon verottamisesta 627/1978, hereinafter Tax at Source Act) (section 1, subsection 1 of the Tax at Source Act). The taxation of nonresident's income is carried out as a final tax by withholding tax on the income at source (tax at source). In separate situations defined in the Tax at Source Act, tax will be imposed on the beneficiary in accordance with the Act on Assessment Procedure (Verotusmenettelylaki 1558/1995). (Section 2, subsection 1 of the Tax at Source Act.)

According to section 3 of the Tax at Source Act, tax at source must be paid on dividends, interest and royalties, unless otherwise provided. Tax on dividends, interest and royalties received by a nonresident corporate entity is assessed at source, unless the income in question is allocated to the corporate entity’s permanent establishment located in Finland.

In the tax assessment pursuant to the Act on Assessment Procedure, the Tax Administration imposes the income tax on the taxpayer, and tax prepayment is carried out for the payment of taxes as laid down in the Act on Tax Prepayments (Ennakkoperintälaki 1118/1996) (section 16, subsections 1 and 4 of the Tax at Source Act). Tax prepayment is discussed in more detail in the guidance Withholding preliminary tax (Ennakonpidätyksen toimittaminen, only available in Finnish and Swedish).

For payments subject to tax at source, the tax is withheld by the payor when making the payment. However, the amount of tax at source withheld by the payor is not always the final tax, as the beneficiary may claim a refund of any over withheld tax at source from the Tax Administration (section 11 of the Tax at Source Act). This may be the case, for example, if the payor has not received sufficient evidence on the beneficiary’s right to a lower tax at source rate when making the payment and, therefore, cannot have taken the tax at source benefit into account during the payment year.

1.2 Obligation to withhold tax at source

The payor is obligated to withhold tax at source on dividend, interest or royalty that they pay to a nonresident taxpayer (section 8 of the Tax at Source Act; section 9, subsection 1 of the Act on Tax Prepayments). In the Tax at Source Act, a party obligated to withhold tax means the payor or, in certain situations, a substitute payor.

The obligation to withhold tax at source concerns income received from Finland, i.e. dividends, interest and royalties paid by a payor who is a resident taxpayer in Finland (section 10, paragraphs 6, 7 and 8 of the Act on Income Tax (Tuloverolaki 1535/1992)). Royalties are also income received from Finland if the assets or rights acting as grounds for the compensation are used in business activities in Finland (section 10, paragraph 8 of the Act on Income Tax). Furthermore, dividends, interest and royalties paid by a foreign corporate entity are income that a nonresident taxpayer received from Finland, in accordance with section 10 of the Act on Income Tax, if the payor has its place of effective management in Finland (section 9, subsection 8 and 9 of the Act on Income Tax).

The payor can use a service provider, such as an account operator or accounting firm, to carry out their obligations related to the withholding of tax at source. However, the obligations and liabilities based on the tax legislation belong to the payor, regardless of whether the payor uses a service provider or not. If a service provider acting on the payor’s behalf fulfils the obligations related to the withholding of tax at source as described in this guidance, the payor can be deemed to have fulfilled their obligations. Correspondingly, the payor has the liability if the service provider has neglected the fulfilment of the obligations. The service provider does not have any obligations pursuant to the tax legislation when they act on behalf of the payor. In this case, service provider’s possible liability towards the payor is based on an agreement or another procedure that obligates the parties.

The Tax at Source Act does not apply to payments made to resident taxpayers. Therefore, the payor must identify whether the beneficiary is a resident or nonresident taxpayer. A preliminary tax must be withheld in accordance with the Act on Tax Prepayments on payment made to a resident taxpayer, unless it has been otherwise provided that no tax is withheld on the payment. Tax at source on interest income must be withheld on interest that belongs to the scope of application of the Act on Tax at Source on Interest Income (Laki korkotulon lähdeverosta 1341/1990) and is paid to a natural person who is a resident taxpayer. More detailed information on resident and nonresident tax liability is available in the Tax Administration’s guidance Tax residency, nonresidency and residency in accordance with a tax treaty – natural persons and Resident and nonresident tax liability of corporate entities. Withholding preliminary tax on capital income and royalty paid to a resident taxpayer is discussed in more detail in the Tax Administration’s guidance Withholding preliminary tax (Ennakonpidätyksen toimittaminen, only available in Finnish and Swedish).

1.3 General tax at source pursuant to section 7 of the Tax at Source Act

According to section 7 of the Tax at Source Act, tax at source withheld on dividend, interest or royalty paid to a nonresident taxpayer is

- 20 % when the beneficiary is a corporate entity (section 7, subsection 1(2) of the Tax at Source Act).

- 30 % when the beneficiary is other than a corporate entity (section 7, subsection 1(4) of the Tax at Source Act).

A corporate entity refers to a corporate entity specified in section 3 of the Act on Income Tax. According to section 3 of the Act on Income Tax, corporate entities are the state and its governmental institutions, wellbeing services counties and joint authorities for health and wellbeing, municipalities and joint municipal authorities, parishes and other religious communities, limited liability companies, cooperatives, savings banks, investment funds, special common funds, universities, mutual insurance companies, community grain-bank organisations, ideological and financial associations, foundations, public entities, foreign death estates, and other legal persons or assets intended for a specific purpose comparable to the corporate entities listed above.

The tax at source rate of 20% can be applied to a payment made to a foreign corporate entity if the payor receives evidence that the beneficiary is comparable to a domestic corporate entity specified in section 3 of the Act on Income Tax. As evidence, the beneficiary can provide, for example, a trade register extract or a certificate issued by a tax authority. Alternatively, the payor can verify the beneficiary’s legal form from public data sources. If the payor does not receive any reliable evidence on the beneficiary's comparability to a Finnish corporate entity, 30 % tax at source rate is withheld on the payment.

Example 1: A company distributing dividends pays dividends to a Swedish company. The payor verifies the dividend beneficiary’s information from the Swedish trade register, according to which the beneficiary is a Swedish limited liability company (aktiebolag, AB). Because a Swedish "aktiebolag" is comparable to a Finnish limited liability company, the payor can withhold 20 % tax at source on the dividend.

The concept of a corporate entity and the tax liability of foreign corporate entities are discussed in more detail in the guidance Resident and nonresident tax liability of corporate entities.

According to the Tax at Source Act, tax at source of 30% must be withheld on dividend, interest or royalty paid to a beneficiary other than a corporate entity. For example, the tax at source rate is 30% when the beneficiary is a natural person, a business operator or self-employed individual, or a partnership.

1.4 Tax at source benefits when making a payment

As a rule, the payor must withhold tax at source on dividends, interest and royalties in accordance with the tax at source rates laid down in section 7 of the Tax at Source Act. However, the beneficiary may be entitled to a lower tax at source rate or an exemption from tax at source based on a special provision of the Tax at Source Act or other tax law, such as the Act on Income Tax.

For example, under section 12, subsection 1 of the Act on Income Tax and international conventions, foreign employees working in Finland in the service of certain international organisations and foreign diplomats working in Finland do not pay tax at source on dividends, interest or royalties in Finland. Therefore, the payor can leave tax at source unwithheld if the beneficiary presents evidence on the fulfilment of the requirements for applying the provision. The requirements are discussed in more detail in the guidance Taxation of employees from other countries.

The right to a tax at source benefit may also be based on a tax treaty, another international treaty or European Union (EU) law. Tax treaties that Finland has signed are listed on the page Valid tax treaties. Other valid international treaties that obligate the State of Finland may also include tax provisions. These kinds of international conventions may concern, for example, an international organisation. For example, according to article 2, section 7 of the Convention on the Privileges and Immunities of the United Nations (UN), the UN, its assets, income and other property are exempt from all direct taxes.

The payor must verify the tax at source rate applicable to the beneficiary and whether the application requirements are fulfilled for the payment in question. The fulfilment of the requirements must thus be verified for each payment. The beneficiary must provide the payor with the evidence required for verifying the fulfilment of the requirements. By applying a lower tax at source rate or by leaving tax at source unwithheld, the payor assumes the responsibility for having sufficient evidence on the beneficiary’s right to the tax at source benefit in question.

The payor cannot grant tax at source benefits when making a payment if they have not received sufficient evidence on the fulfilment of the requirements for applying the tax at source benefit or if the beneficiary’s right to the tax at source benefit remains subject to interpretation or is otherwise unclear despite the evidence provided. In this case, the payor must withhold tax at source on the payment in accordance with section 7 of the Tax at Source Act. The beneficiary can apply for refund of tax at source from the Tax Administration, in which case the Tax Administration will determine whether the beneficiary has the right to the tax at source benefit they have requested to be applied.

The beneficiary or the payor obligated to withhold the tax can also apply for an advance ruling on applying an international treaty when withholding tax at source and on determining whether tax at source needs to be withheld, or what should otherwise be applied when withholding tax at source (section 12a of the Tax at Source Act). More information on how to apply for an advance ruling is available in the Tax Administration’s guidance Applying for an advance ruling and the decision issued (Ennakkoratkaisun hakeminen ja siihen annettava päätös, only available in Finnish and Swedish).

A tax at source benefit cannot be granted for income if, based on the information that the payor or the service provider acting on their behalf has, the Principal Purpose Test provision in the tax treaty or a national tax evasion provision may be applied to the granting of the benefit (section 10 of the Act on Assessment Procedure for Self-assessed Taxes (Laki oma-aloitteisten verojen verotusmenettelystä 768/2016); section 28 of the Act on Assessment Procedure). If the payor deems that a tax evasion provision could be considered applicable in the situation, it is recommended that the matter be verified beforehand, for example by applying for an advance ruling. The Principal Purpose Test provision of tax treaties and its application is discussed in more detail in the Tax Administration’s guidance Articles of tax treaties.

1.5 Applicable law and sources of interpretation

According to section 1, subsection 3 of the Tax at Source Act, when a treaty entered into with another country or another international convention which Finland has joined includes provisions on taxation on income or assets, the Tax at Source Act is applied only if the referred provisions do not provide otherwise.

According to section 2a of the Tax at Source Act, the Act on Assessment Procedure for Self-assessed Taxes is applied to the assessment and appeal procedures for the party obligated to withhold tax at source and the Act on Tax Collection (Veronkantolaki 11/2018) is applied to the collection of taxes. The Finnish tax legislation is thus always applied to issues concerning assessment, even if a tax treaty or another international treaty would be applied when withholding tax at source.

Tax treaty and other international treaty

Whether the requirements for applying a tax treaty are fulfilled is determined based on the tax treaty and its sources of interpretation. If another international treaty that includes provisions on taxation is applied to the beneficiary, the treaty in question and its sources of interpretation are applied.

In the Finnish legal and tax practice, it is deemed in the interpretation of the provisions of tax treaties in accordance with the OECD Model Tax Convention in Finland, it is reasonable to give significance to what is stated in the OECD Commentary on the Model Tax Convention about the interpretation of the treaty regardless of whether the other contracting party is an OECD member (Supreme Administrative Court ruling KHO:2011:101).

The basis for interpretation is always the tax treaty whose provisions are applied. The payor may interpret, for example, the tax treaty’s concept of beneficial owner on the basis of the most recent OECD Commentary on the Model Tax Convention. Therefore, it is not required for the payor to separately identify whether there are specific grounds for an interpretation to deviate from the commentary or be in line with a certain commentary version with regard to a single tax treaty.

The interpretation of the OECD Model Tax Convention, including the concept of the beneficial owner of dividend, interest and royalty income, is discussed in more detail in the guidance Payments of dividends, interest and royalties to nonresidents and Articles of tax treaties.

Tax at Source Act and other national legislation

If tax at source is withheld in accordance with the provisions of the Tax at Source Act and the provisions of a tax treaty or another international treaty are not applied when making a payment, the fulfilment of the application requirements are interpreted on the basis of the national legislation. Therefore, for example, the party that is considered to be the dividend beneficiary when granting tax at source benefits in accordance with the national legislation is determined on the basis of national legislation. In this case, the tax treaty’s provisions on the beneficial owner are not significant when granting the benefit.

2 Tax at source on dividends

2.1 General

The provisions of the Tax at Source Act on dividends apply to payments that are considered as dividends in taxation. Generally, the distribution of assets to shareholders as profit on the basis of a decision made at a shareholders’ meeting is considered as dividend in taxation (see e.g. Central Tax Board ruling KVL 33/2018). Dividends can be paid in cash or in other assets (in kind). Furthermore, the provisions of the Tax at Source Act on dividends apply to the distribution of assets from an unrestricted equity fund, insofar as the distribution of assets is considered dividend, not a transfer. The concept of dividend is discussed in more detail in the guidance Taxation of dividend income (Osinkotulojen verotus, only available in Finnish and Swedish) and Payments of dividends, interest and royalties to nonresidents, and the distribution of assets from an unrestricted equity fund in the guidance Distribution of assets from an unrestricted equity fund in taxation (Vapaan oman pääoman rahaston varojenjako verotuksessa, only available in Finnish and Swedish).

The provisions of the Tax at Source Act on dividends also apply to the following income (section 3, subsection 2 of the Tax at Source Act):

- the distribution of assets from an unrestricted equity fund that is considered to be dividend (sections 33a and 33b of the Act on Income Tax, and section 6a of the Act on the Taxation of Business Income (Laki elinkeinotulon verottamisesta 360/1968)),

- The surplus received from a cooperative or the distribution of assets from an unrestricted equity fund that is considered surplus (sections 33a and 33f of the Act on Income tax, and section 6d of the Act on the Taxation of Business Income),

- profit share from an investment fund (section 32 of the Act on Income Tax),

- manufactured dividend (section 31, subsection 5 of the Act on Income Tax),

- constructive (=hidden) dividend (section 29 of the Act on Assessment Procedure), and

- income increased as a transfer pricing adjustment (section 31 of the Act on Assessment Procedure).

The payor must withhold tax at source on dividend that it pays to a nonresident taxpayer, unless the taxpayer is exempt from tax at source based on other legislation or an international treaty (section 3 of the Tax at Source Act).

The obligation to withhold tax at source applies to income that a nonresident taxpayer receives from Finland. Dividends, surplus received from a cooperative and other income equivalent to these are income that a nonresident taxpayer has received from Finland if they have been received from a Finnish limited liability company, cooperative or other corporate entity (section 10, paragraph 6 of the Act on Income Tax). Furthermore, dividend paid by a foreign corporate entity is income that a nonresident taxpayer has received from Finland if the payor has its place of effective management in Finland (section 9, subsections 8 and 9 of the Act on Income Tax). The tax status of foreign corporate entities and the formation of the place of effective management is discussed in more detail in the Tax Administration’s guidance Resident and nonresident tax liability of corporate entities.

2.2 Tax at source on dividends in accordance with the Tax at Source Act

When tax at source rates in accordance with the Tax at Source Act are applied, the dividend beneficiary is determined in accordance with Finland’s national legislation. As a rule, the shareholder registered in the share register can be considered the dividend beneficiary. Exceptions include situations where a custodian of nominee registered shares has been registered in the share register in place of the shareholder. With regard to dividends paid to nominee registered shares, the dividend beneficiary must be identified separately in pursuance of the dividend payment. When applying tax at source rates in accordance with the national legislation, the payor can then consider the party that has the right to the dividend on the record date defined in the dividend distribution decision to be the dividend beneficiary.

According to section 7 of the Tax at Source Act, tax at source withheld on dividend paid to a nonresident taxpayer is

- 20 % when the dividend beneficiary is a corporate entity (section 7, subsection 1(2) of the Tax at Source Act).

- 30 % when the dividend beneficiary is other than a corporate entity (section 7, subsection 1(4) of the Tax at Source Act).

The requirements for applying the 20 % and 30 % tax at source rates referred above are discussed in more detail in Section 1.3.

On dividend paid to a nonresident corporate entity, 15 % tax at source can be withheld if the dividend beneficiary provides the payor with evidence that the shares of the corporate entity that distributes the dividends are part of the dividend beneficiary’s investment assets and that any of the following three conditions are met (section 7, subsection 1(3) of the Tax at Source Act):

- The dividend beneficiary is a nonresident corporate entity as laid down in section 3, subsection 5, and the dividend beneficiary is not a company listed in the directive on the common system of taxation applicable in the case of parent companies and subsidiaries (90/435/EEC, Parent-Subsidiary Directive), which holds at least 10 % of the share capital of the corporate entity that distributes the dividends directly when the dividend is distributed.

- The dividend beneficiary is a foreign corporate entity equivalent to a domestic pension institution, whose domicile is in the European Economic Area (EEA), and the dividend beneficiary is not a company listed in the Parent-Subsidiary Directive, which holds at least 10 % of the share capital of the corporate entity that distributes the dividends directly when the dividend is distributed.

- The dividend beneficiary is a foreign corporate entity equivalent to a domestic pension institution, which directly holds less than 10% of the share capital of the corporate entity that distributes the dividends, Finland has an agreement on the exchange of information on tax matters with the dividend beneficiary’s country of domicile, and sufficient information is obtained from the dividend beneficiary’s country of domicile for the tax assessment.

Taxation at source on dividends paid to shares that belong to dividend beneficiary's investment assets is discussed in more detail in the guidance Payments of dividends, interest and royalties to nonresidents.

As an exception to the aforementioned tax at source rates, a publicly listed company must withhold a tax at source of 35 % on dividend paid to nominee registered shares, if it or an Authorised Intermediary cannot report information on the nonresident dividend beneficiary to the Tax Administration on an annual information return (section 7, subsection 2 of the Tax at Source Act). If dividend is paid to a nonresident taxpayer and the beneficiary’s information can be reported to the Tax Administration on an annual information return, 30 % tax at source can be withheld on dividend paid by a listed company to nominee registered shares instead of 35 %. More information on the information to be reported on annual information returns is available in the technical guidance for annual information return Annual information return on dividends paid to nonresidents by a listed company.

2.3 Tax treaty benefits during the payment year

2.3.1 General information on the application of tax treaties at source

Tax at source is withheld in accordance with the Tax at Source Act, unless otherwise provided in the provisions of a treaty entered into with a foreign country or another international convention, which Finland has joined, on the taxation of income or assets (section 1, subsection 3 of the Tax at Source Act).

Therefore, based on a tax treaty, a nonresident dividend beneficiary can be entitled to a tax at source rate that is lower than what is laid down in section 7 of the Tax at Source Act. Tax at source rates applied to dividends in accordance with valid tax treaties are listed in the guidance Tax rates on dividends and other payments from Finland to nonresidents.

When the dividend is paid, the tax at source rate set in a tax treaty can be applied if the payor has received evidence from the dividend beneficiary on their right to the tax at source benefit. The payor must verify that the evidence provided by the dividend beneficiary fulfils the requirements set for granting the tax at source benefit.

First of all, the payor must identify the dividend beneficiary’s country of residence for tax purposes, i.e. the country with which Finland has entered into the tax treaty applied to the income that the dividend beneficiary receives from Finland. In addition, the payor must verify that the dividend beneficiary fulfils the requirements for applying the tax treaty’s provisions. For example, it is essential to identify the dividend beneficiary referred to in the tax treaty, that has the right to the tax treaty benefit with respect to the dividend in question. If the dividend beneficiary claims a special provision in the tax treaty to be applied, for example based on their legal form, the dividend beneficiary must also present the required evidence of the fulfilment of the requirements for applying the special provision in question. The most general provisions of tax treaties are discussed in more detail in the Tax Administration’s guidance Articles of tax treaties.

Among other things, the application of tax treaties' dividend articles usually requires that the person resident in the other Contracting State is the beneficial owner of the income as referred in the tax treaty. According to the OECD Commentary for Model Tax Convention, the income recipient is the beneficial owner of the income when they have the right to use and enjoy the income unconstrained by a contractual or legal obligation to pass on the payment received to another person. The beneficial owner may not always be the legal owner of the shares to which the dividends are paid. As a rule, the payor must, therefore, verify whether the tax treaty’s provisions are applicable to the dividends paid to the recipient with regard to each dividend payment. If the requirement for the beneficial owner of income is not fulfilled, the tax benefit in accordance with the tax treaty’s dividend article cannot be granted. The majority of Finland’s tax treaties include the concept of beneficial owner. The concept of beneficial owner pursuant to tax treaties and its interpretation is discussed in more detail in the guidance Payments of dividends, interest and royalties to nonresidents.

Foreign entities, that are transparent (i.e. flow-through) in the taxation of their country of residence, are not typically considered separate taxpayers in their country of residence, and they are not, therefore, usually considered persons resident in the other Contracting State in Finland either. This kind of flow-through entity is not entitled to tax treaty benefits, while a tax treaty between the country of residence of its unitholder or shareholder and Finland may, however, be applicable to paid dividends. The payor can apply the tax treaty between the country of residence of the flow-through entity’s unitholder and Finland to dividends if the unitholders can be considered beneficial owners as referred to in the tax treaty. The requirement is that the payor obtains sufficient evidence on the unitholder’s country of residence for tax purposes and the fulfilment of other requirements for applying the tax treaty, as well as the unitholder’s share of the dividend in question (sections 10 and 10b of the Tax at Source Act). For example, a foreign partnership may be a flow-through entity in its country of residence, in which case the tax treaty of its shareholders’ country of residence may be applicable. The concept of person resident in the Contracting State and tax at source on income received by a foreign partnership is discussed in more detail in the guidance Payments of dividends, interest and royalties to nonresidents.

The dividend beneficiary must provide the required evidence on the fulfilment of the requirements for applying the tax treaty’s provisions when claiming the tax treaty’s tax at source rate to be applied to the dividend payment (sections 10 and 10b of the Tax at Source Act). The dividend beneficiary in accordance with the Finnish legislation has the responsibility to provide the evidence, regardless of whether the beneficiary is also considered a tax treaty subject or a beneficial owner as referred to in the tax treaty.

Example 2: Dividend is paid to a foreign fund, that has two unitholders. However, the fund is considered a flow-through entity, that is not a tax treaty subject in its country of residence. The fund’s unitholders are beneficial owners as referred to in the tax treaty, and the dividend is allocated to them in taxation in the unitholders’ country of residence. The fund is a dividend beneficiary in accordance with Finland’s national legislation. The fund being the dividend beneficiary claims the tax treaty of its unitholders’ country of residence to be applied. The fund must provide evidence showing that its unitholders fulfil the requirements for applying the tax treaty.

The dividend beneficiary must provide the payor with the evidence laid down in section 10 of the Tax at Source Act on the fulfilment of the requirements for applying the tax treaty. In the case of dividends paid by a publicly listed company to nominee registered shares, the dividend beneficiary must, however, provide the dividend payor or an Authorised Intermediary with the evidence laid down in section 10b of the Tax at Source Act. The requirements for applying tax treaty benefits are discussed in more detail in Section 2.3.2 for dividends paid by a company other than a listed company and in Section 2.3.3 for dividends paid by a listed company.

Tax treaty benefits cannot be applied at the time of payment if the dividend beneficiary does not provide the evidence as referred to in the Tax at Source Act on its country of residence and the application of the tax treaty’s provisions. In this case, tax at source is withheld on dividends in accordance with section 7 of the Tax at Source Act. Tax at source is also withheld in accordance with section 7 of the Tax at Source Act in situations where there is no valid tax treaty between Finland and the dividend beneficiary’s country of residence.

The dividend payor cannot apply a tax treaty’s provisions when paying dividend if the dividend beneficiary’s right to the tax treaty benefit remains subject to interpretation or unclear. However, the dividend beneficiary can provide the payor with an advance ruling, in which the Tax Administration has expressly decided on the specific question subject to interpretation. In this case, the payor can withhold tax at source in accordance with the advance ruling if the actual circumstances correspond to the situation described in the advance ruling. The dividend payor can also apply for an advance ruling regarding tax at source (section 12a of the Tax at Source Act). More information on how to apply for an advance ruling and its scope of application is available in the Tax Administration’s guidance Applying for an advance ruling and the decision issued. (Ennakkoratkaisutekeminen ja siihen annettava päätös, only available in Finnish and Swedish).

Example 3: The dividend beneficiary has provided the payor with evidence on the requirements for applying a tax treaty. However, the dividend received is related to a stock lending arrangement, which may have an effect on whether the dividend beneficiary can be considered the beneficial owner as referred to in the tax treaty. The dividend beneficiary provides the payor with an advance ruling issued by the Tax Administration, which expressly determines that the beneficiary can be considered the beneficial owner as referred to in the tax treaty, regardless of the arrangement. The dividend payor can apply the tax at source rate set in the tax treaty on the basis of the advance ruling if the actual circumstances correspond to the situation described in the advance ruling.

If the tax at source rate set in the tax treaty was not applied at the time of payment or when making a correction during the payment year and tax at source was withheld on the dividend in accordance with section 7 of the Tax at Source Act, the taxpayer can apply for a refund of tax at source from the Tax Administration (section 11 of the Tax at Source Act). In this case, the Tax Administration will determine the dividend beneficiary’s right to the tax treaty benefit when processing the refund application. Tax at source can be refunded to the taxpayer after the dividend payment year. More information on refund applications is available in the guidance Payments of dividends, interest and royalties to nonresidents.

2.3.2 Dividend paid by a company other than a publicly listed company

According to section 10 of the Tax at Source Act, the provisions of a tax treaty are applied to the withholding of tax at source if the beneficiary provides the payor with evidence on their country of residence and other requirements for applying the tax treaty before the payment. As evidence, the beneficiary can present a tax at source card or declare their name, date of birth and other possible official identifier, and their address in their country of residence.

The payor must receive the evidence laid down in section 10 of the Tax at Source Act from the dividend beneficiary relating to the dividend payment to which the tax treaty is applied. For example, a tax at source card indicates the country of residence for tax purposes of the taxpayer to whom it has been issued and the tax at source rate applied to dividend they receive in accordance with the tax treaty. The payor must also verify that the party presenting the tax at source card is the shareholder registered in the share register. The payor must also check that the taxpayer's identification information in the tax at source card applied correspond to the information the payor has on the dividend beneficiary. In addition, it must be noted that a tax at source card is usually granted for the current calendar year, and the beneficiary must present a valid tax at source card before the dividend payment.

Example 4: Company A Oy is an unlisted company, which has four shareholders registered in the share register. Three of the shareholders are natural persons who are resident taxpayers in Finland. R, the fourth shareholder, is a natural person who is a nonresident taxpayer and resident in Sweden. Company A Oy decides to distribute dividends. Before the dividend payment, dividend beneficiary R provides the payor with a tax at source card, according to which the tax treaty between the Nordic countries applies to the dividends received by R. The payor verifies that R is a shareholder entered into the share register and, therefore, entitled to the dividends being distributed. The payor also checks that the taxpayer's identification information in the tax at source card correspond to the information the payor has on the dividend beneficiary. Tax at source of 15% can be withheld on the dividend paid to R in accordance with the tax treaty between the Nordic countries.

Dividends paid to nominee registered shares

Nominee registration means that a book entry security is entered into the book-entry system in the name of a custodian of the nominee registration in place of the actual owner of the book entry security. Therefore, the shareholder is not disclosed in the shareholders' register if the shares have been entered in the name of the custodian of the nominee registration. For this reason, the payor must, when paying dividends to nominee registered shares, otherwise verify that the party presenting a tax at source card is entitled to dividends and tax treaty benefits. For example, the dividend beneficiary can in addition to a tax at source card provide the payor with their certification that they are the beneficial owner of the dividend in question as referred to in the tax treaty and that the shares are not part of any arrangement that might affect the interpretation of the tax treaty. In this case, the payor must verify that the dividend beneficiary’s certification is reliable. The intermediary who holds the shares in question can, on the payor’s behalf, obtain the dividend beneficiary’s certification and verify its reliability. However, the payor must verify that it can report information on the dividend beneficiaries on its annual information return and, if requested by Tax Administration, submit evidence and documentation on how the beneficiary’s right to the tax treaty benefit was verified.

Section 10b of the Tax at Source Act is not applied in situations where the dividend payor is other than a publicly listed company as laid down in section 33a of the Act on Income Tax. However, the dividend payor can utilize the procedure laid down in section 10b of the Tax at Source Act to verify the beneficiary’s country of residence and other requirements for applying a tax treaty (see Section 2.3.3.2).

2.3.3 Dividend paid by a listed company

2.3.3.1 Dividend paid based on direct shareholding

An updated register of shareholders based on book-entry account registrations must be maintained regarding shares and their holders incorporated to the book-entry system, into which the shareholder or a custodian of nominee registration must be entered (chapter 4, sections 3 and 4 of the Act on the Book-Entry System and Settlement Activities, 348/2017). Shareholding is direct when the shareholder is entered into the register of shareholders. When a publicly listed company pays dividends based on direct shareholdings to a shareholder entered into the register of shareholders, section 10 of the Tax at Source Act is applied to the granting of tax treaty benefits.

According to section 10 of the Tax at Source Act, the provisions of a tax treaty is appled to the withholding of tax at source if the beneficiary, before the dividend payment, provides the payor with evidence on their country of residence and other requirements for applying the tax treaty. As evidence, the beneficiary may present a tax at source card or declare their name, date of birth and other possible official identifier, and their address in their country of residence.

The payor must receive the evidence laid down in section 10 of the Tax at Source Act from the dividend beneficiary relating to the dividend payment to which the tax treaty is applied. For example, a tax at source card indicates the country of residence for tax purposes of the taxpayer to whom it has been issued and the tax at source rate applied to the dividend they receive in accordance with the tax treaty. The payor must also verify that the party presenting the tax at source card is the shareholder entered into the register of shareholders. The payor must also check that the taxpayer's identification information in the tax at source card that is applied correspond to the information the payor has on the dividend beneficiary. In addition, it must be noted that a tax at source card is usually granted for the current calendar year, and the beneficiary must present a valid tax at source card before the dividend payment.

Example 5: Company B Oy is a publicly listed company, which has decided to distribute dividends. Before the dividend payment, person Z who is resident in Denmark, has provided the payor with a tax at source card. According to the tax at source card the tax treaty between Nordic countries applies to the dividends received by Z. In the previous year, Z owned Company B Oy’s shares and received dividends from it. The payor verifies whether Z is a shareholder entered into the register of shareholders and, therefore, entitled to the dividend being distributed. According to the list of shareholders, Z no longer holds any shares on the record date set in the dividend distribution decision. Tax at source cannot be withheld on the dividend in accordance with the tax at source card presented by Z because Z is not the dividend beneficiary.

The dividend payor can also utilize the procedure laid down in section 10b of the Tax at Source Act to verify the beneficiary’s country of residence for tax purposes and other requirements for applying the tax treaty (see Section 2.3.3.2).

2.3.3.2 Dividends paid to nominee registered shares

Nominee registration means that a book entry is entered into the book-entry system in the name of a custodian of the nominee registration in place of the actual owner of the book entry. The custodian of the nominee registration can be the book-entry account operator, a central bank or a central securities depository (Chapter 4, section 4 of the Act on the Book-Entry System and Settlement Activities).

Section 10b of the Tax at Source Act lays down the requirements for applying tax treaty benefits when

- the dividend payor is a publicly listed company as laid down in section 33a of the Act on Income Tax, and

- the shares for which dividends are paid are nominee registered.

According to section 10b, subsection 2 of the Tax at Source Act, the dividend provisions of an international treaty as laid down in section 1, subsection 3 can be applied if the dividend payor or the intermediary closest to the dividend beneficiary who at the time of the dividend distribution is registered in the Register of Authorised Intermediaries referred to in section 10d, has taken reasonable measures to determine the dividend beneficiary’s country of residence as well as verified that the dividend provisions of an international treaty can be applied to the dividend beneficiary.

According to section 10b, subsection 4 of the Tax at Source Act, as reasonable measures to determine the country of residence can be deemed

- a tax at source card issued by the Tax Administration,

- a certificate provided by the tax authority of the dividend beneficiary’s country of residence, or

- an Investor Self-Declaration, that indicates the information on the dividend beneficiary required for taxation at source.

The certificate of residence or the tax at source card indicates the country of residence for tax purposes of the taxpayer to whom it has been issued and the applicable tax treaty. In addition, the tax at source card indicates the tax at source rate based on the tax treaty applied to the dividends received by the taxpayer. The payor must also check that according to the information in the tax at source card or the certificate of residence, it is applicable at the time of payment and the taxpayer's identification information therein correspond to the information that the payor has on the dividend beneficiary

The payor must also verify that the taxpayer presenting a tax at source card or a certificate of residence is the dividend beneficiary as referred to in the applicable tax treaty and, therefore, entitled to the tax at source benefit in accordance with the tax treaty regarding the dividend in question. The dividend beneficiary has the responsibility to present the required evidence of this. For example, the dividend beneficiary can provide the payor with a tax at source card or a certificate of residence and a certification that they are the beneficial owner of the dividend in question as referred to in the tax treaty and that the shares are not part of any arrangement that might affect the interpretation of the tax treaty. In this case, the payor must verify that the dividend beneficiary’s certification is reliable and that tax treaty benefits can be granted based on it. A service provider, such as an account operator or Contractual Intermediary (i.e. unregistered intermediary), can also obtain the certification and verify its reliability on the payor’s behalf.

Reasonable measures to determine the country of residence can be deemed an Investor Self-Declaration (ISD) provided by the dividend beneficiary indicating the information on the dividend beneficiary required for tax at source. According to section 10b, subsection 4 of the Tax at Source Act, an Investor Self-Declaration must be sufficiently reliably documented and consistent with the other information on the dividend beneficiary the intermediary has in its possession. According to the provision, the Tax Administration will issue further provisions on the contents and period of validity of the Investor Self-Declaration and the procedure with which its reliability is verified. The Tax Administration has issued a decision on the contents and period of validity of the Investor Self-Declaration referred to in section 10b, section 4 of the Tax at Source Act, and the procedure with which its reliability is verified (ISD decision). The Investor Self-Declaration, which the payor or an Authorised Intermediary has verified to be reliable as defined in the Tax Administration’s ISD decision, is also evidence on the requirements for applying a tax treaty. The Investor Self-Declaration and the procedure with which the payor or an Authorised Intermediary verifies reliability of the ISD is discussed in more detail in the guidance The contents, period of validity and verifying the reliability of the Investor Self-Declaration.

A service provider, such as an account operator or Contractual Intermediary, can, on the payor’s behalf, obtain the Investor Self-Declaration and verify its reliability. The information does not need to be in the possession of the payor at the time of dividend payment, but the service provider can collect the required information from the custody chain and keep it on the payor’s behalf. However, the payor must make sure that it can report the information on the final dividend beneficiaries on its annual information return and, if required, submit evidence and documentation, at the Tax Administration’s request, indicating how the beneficiary’s right to the tax treaty benefit was verified.

Dividends for which an Authorised Intermediary has assumed responsibility

An Authorised Intermediary (AI) refers to an intermediary entered into the Register of Authorised Intermediaries maintained by the Tax Administration. An Authorised Intermediary can assume responsibility for determining the dividend beneficiary’s country of residence and verifying the applicability of a tax treaty’s provisions. In this case, the Authorised Intermediary will obtain the required evidence from the beneficiary, and it does not need to be delivered to the payor. The Authorised Intermediary has also the responsibility for reporting the identifying information on the final dividend beneficiaries to the Tax Administration on an annual information return and, if required, submitting the evidence and documentation, at the Tax Administration’s request, indicating how the beneficiary’s right to the tax treaty benefit was verified.

The Tax at Source Act does not contain any format requirements for the notification, with which an Authorised Intermediary notifies the payor of assuming responsibility. The parties can mutually agree upon the applicable procedure. The tax legislation does not require any separate agreement between the parties, and the mutual procedure can also be based on another procedure binding on the parties. When an Authorised Intermediary assumes responsibility for reporting identifying information of the dividend beneficiaries to the Tax Administration, it is not necessary to deliver the information on the country of residence or the applicable tax at source rates to the payor. From the perspective of the payor’s liability, it is sufficient that the payor can indicate the dividends for which the Authorised Intermediary has assumed responsibility and the total amount of tax at source withheld on them in euros based on the Authorised Intermediary’s notification. The payor can, for example, agree with an account operator that the account operator makes the verification and collects the information on the payor’s behalf. The Tax Administration can verify the registration status of the intermediary which has assumed responsibility from the register it maintains, and the payor does not need to later submit register extracts from the Register of Authorised Intermediaries to the Tax Administration.

If there are several Authorised Intermediaries in the custody chain, it is not required that the payor obtains information on all of the intermediaries and verifies whether they have been entered into the register. Considering the release of the payor from its primary liability, it is therefore sufficient that the payor can indicate that the closest intermediary, from which it obtains information on the application of a lower tax at source rate and assuming responsibility, is an Authorised Intermediary. In this case, the Authorised Intermediary in question must be able to show the Tax Administration, if necessary, that it has forwarded the information received from another Authorised Intermediary for the payment of dividends and the withholding of tax at source to the payor with an identical content.

The Authorised Intermediary can also notify the payor of assuming responsibility through a Contractual Intermediary. In this case, the payor must verify that the intermediary which assumed responsibility has been entered into the Register of Authorised Intermediaries. The payor still does not need to verify whether other intermediaries in the custody chain are Authorised or Contractual Intermediaries.

If an Authorised Intermediary has assumed responsibility for dividends as described above, it is also responsible for tax that has been left unwithheld due to its neglect (section 10c, subsection 2 of the Tax at Source Act). However, the payor has still the secondary responsibility for tax as a precautionary measure (for the secondary tax responsibility, see Section 5). The Authorised Intermediary is responsible for reporting the information of the final dividend beneficiary laid down in section 15e of the Act on Assessment Procedure to the Tax Administration. The payor is responsible for reporting the information on the dividends forwarded to the Authorised Intermediary on its annual information return. The Authorised Intermediary's responsibilities and liabilities are discussed in more detail in the guidance Authorised intermediary’s responsibilities and liabilities.

If there is no Authorised Intermediary in the custody chain that has assumed responsibility for dividends, the payor is responsible for determining the dividend beneficiary’s country of residence and verifying the application of the tax treaty’s provisions as required in section 10b of the Tax at Source Act. In this case, the payor also has the tax liability and responsibility for reporting the identifying information of the dividend beneficiary to the Tax Administration on an annual information return.

2.3.3.3 Examples of procedures in nominee registration situations

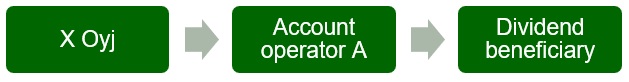

The account operator closest to the payor is an AI

Example 6:

Publicly listed company X Oyj distributes dividends and notifies the account operator of the upcoming dividend payment. Of the dividends, 10 000 euros will be paid to nominee registered shares. At the time of dividend payment, account operator A is registered in the Tax Administration’s Register of Authorised Intermediaries.

X Oyj and account operator A have not entered into any mutual agreement. However, the parties’ mutual procedures and responsibilities have been defined in the central securities depository’s decisions, which obligates the parties, and on the basis of which the account operator fulfils certain dividend payment obligations on the payor’s behalf. For example, the account operator collects and retains information on the payment of dividends and tax at source, and submits the information to the central securities depository for reporting self-assessed taxes. According to the decision, the account operator is also responsible for the correctness of the information it has submitted. X Oyj withholds tax at source on the dividends in accordance with the information provided by the account operator and pays net dividends to the account operator. According to the decision, the maximum tax at source must be withheld on dividends if no Authorised Intermediary has assumed responsibility for the dividends and regardless of this the payor has not decided to assume responsibility for the application of a lower tax at source rate.

X Oyj verifies that account operator A is registered in the Tax Administration’s Register of Authorised Intermediaries. Tax at source of 1 500 euros is withheld on the dividends (15%), and account operator A reports the tax at source on the payor’s behalf for reporting self-assessed taxes. On the tax return for self-assessed taxes, account operator A’s information is also reported. If, according to the parties’ mutual procedures and shared understanding, account operator A, which is registered in the Tax Administration’s Register of Authorised Intermediaries, assumes responsibility by reporting the tax at source information for taxation on the payor’s behalf, this fulfils the requirements for assuming responsibility as laid down in section 10c, subsection 2 of the Tax at Source Act. As a result, X Oyj is released from the primary liability if it has verified that account operator A is registered in the Tax Administration’s Register of Authorised Intermediaries at the time of dividend payment.

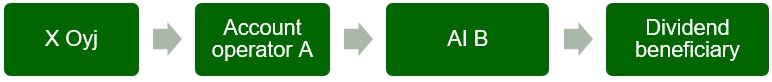

Example 7:

In the situation presented in Example 6, account operator A has received a notification from Authorised Intermediary B (AI B), which is next in the custody chain, according to which tax of 1 500 euros (15%) should be withheld from dividends of 10 000 euros paid by X Oyj for nominee registered shares. Account operator A verifies that intermediary B is registered in the Tax Administration’s Register of Authorised Intermediaries at the time of dividend payment. The dividend payor verifies that account operator A is registered in the Tax Administration’s Register of Authorised Intermediaries.

The payor is released from the primary liability if it indicates that account operator A has assumed responsibility for the dividends as presented in Example 6. It is not required that the payor verifies whether intermediary B is an AI. Account operator A will be released from liability if it indicates to the Tax Administration that Authorised Intermediary B assumed responsibility for the dividends and that tax at source was collected in accordance with intermediary B’s report.

It is not required that the payor or account operator A verifies whether there are any other Authorised Intermediaries between Authorised Intermediary B and the dividend beneficiary. Therefore, the requirements for release from the primary liability concerning the responsibility of the payor and account operator A are the same, regardless of how many intermediaries there are in the custody chain and how many of these are AIs.

The account operator closest to the payor is not an AI, but there is an AI in the custody chain

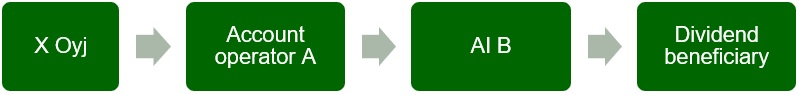

Example 8:

Publicly listed company X Oyj distributes dividends and notifies the account operator of the upcoming dividend payment. Of the dividends, 20 000 euros will be paid to nominee registered shares. At the time of dividend payment, account operator A is not registered in the Tax Administration’s Register of Authorised Intermediaries.

X Oyj and account operator A have not entered into any mutual agreement. However, the parties’ mutual procedures and responsibilities have been defined in the central securities depository’s decisions, which obligates the parties, and on the basis of which the account operator fulfils certain dividend payment obligations on the payor’s behalf. For example, the account operator collects and retains information on the payment of dividends and tax at source, and submits the information to the central securities depository for reporting self-assessed taxes. According to the decision, the account operator is also responsible for the correctness of the information it has submitted. X Oyj withholds tax at source on the dividends in accordance with the information provided by the account operator and pays net dividends to the account operator. The account operator is also responsible for verifying whether the custody chain includes any Authorised Intermediary, which has assumed responsibility for the dividends. According to the decision, maximum tax at source must be withheld on dividends if no Authorised Intermediary has assumed responsibility for the dividends and the payor has not, regardless of this, decided to assume responsibility for the application of a lower tax at source rate.

Authorised Intermediary B (AI B) has notified account operator A of assuming responsibility for the dividends and that tax at source of 3 000 euros should be withheld on dividends of 20 000 euros (15%). Account operator A verifies on the payor’s behalf that intermediary B is registered in the Tax Administration’s Register of Authorised Intermediaries at the time of dividend payment. Tax at source is withheld on the dividends in accordance with intermediary B’s notification, and account operator A reports the tax at source information for taxation on the payor’s behalf.

The payor is released from the primary liability if account operator A acting on its behalf indicates that Authorised Intermediary B has assumed responsibility for the dividends and that tax at source was withheld in accordance with intermediary B’s notification.

Example 9:

Publicly listed company X Oyj distributes dividends and notifies the account operator of the upcoming dividend payment. Of the dividends, 20 000 euros will be paid to nominee registered shares. At the time of dividend payment, account operator A is not registered in the Tax Administration’s Register of Authorised Intermediaries.

X Oyj and account operator A have not entered into any mutual agreement. However, the parties’ mutual procedures and responsibilities have been defined in the central securities depository’s decisions, which obligates the parties and on the basis of which the account operator fulfils certain dividend payment obligations on the payor’s behalf. For example, the account operator collects and retains information on the payment of dividends and tax at source, and submits the information to the central securities depository for reporting self-assessed taxes. According to the decision, the account operator is also responsible for the correctness of the information it has submitted. X Oyj withholds tax at source on the dividends in accordance with the information provided by the account operator and pays net dividends to the account operator. The account operator is also responsible for verifying whether the custody chain includes any Authorised Intermediary, which has assumed responsibility for the dividends. According to the decision, maximum tax at source must be withheld on dividends if no Authorised Intermediary has assumed responsibility for the dividends and the payor has not, regardless of this, decided to assume responsibility for the application of a lower tax at source rate.

Intermediary B (CI B) has provided account operator A with intermediary C’s (AI C) notification that it assumes responsibility for the dividends and tax at source of 3 000 euros should be withheld on the dividends of 20 000 euros (15%). Account operator A verifies on the payor’s behalf that intermediary C is registered in the Tax Administration’s Register of Authorised Intermediaries at the time of dividend payment. Tax at source of 3 000 euros is withheld on the dividends in accordance with intermediary C’s notification, and account operator A reports the tax at source information for taxation on the payor’s behalf.

The payor is released from the primary liability if account operator A acting on its behalf indicates that Authorised Intermediary C has assumed responsibility for the dividends and that tax at source was withheld in accordance with C’s notification.

No AI in the custody chain

Example 10:

Publicly listed company X Oyj distributes dividends and notifies the account operator of the upcoming dividend payment. Of the dividends, 20 000 euros will be paid to nominee registered shares. At the time of dividend payment , account operator A closest to the payor is not registered in the Tax Administration’s Register of Authorised Intermediaries.

X Oyj and account operator A have not entered into any mutual agreement. However, the parties’ mutual procedures and responsibilities have been defined in the central securities depository’s decisions, which obligates the parties, and on the basis of which the account operator fulfils certain dividend payment obligations on the payor’s behalf. For example, the account operator collects and retains information on the payment of dividends and tax at source, and submits the information to the central securities depository for reporting self-assessed taxes. According to the decision, the account operator is also responsible for the correctness of the information it has submitted. X Oyj withholds tax at source on the dividends in accordance with the information provided by the account operator and pays net dividends to the account operator. The account operator is also responsible for verifying whether the custody chain includes any Authorised Intermediary, which has assumed responsibility for the dividends. According to the decision, maximum tax at source must be withheld on dividends if no Authorised Intermediary has assumed responsibility for the dividends and the payor has not, regardless of this, decided to assume responsibility for the application of a lower tax at source rate.

Account operator A verifies on the payor’s behalf whether intermediary B closest to it is registered in the Tax Administration’s Register of Authorised Intermediaries at the time of dividend payment. Intermediary B (CI B) is not registered in the Register of Authorised Intermediaries. Furthermore, account operator A has not obtained information indicating that there is an Authorised Intermediary in the custody chain that had assumed responsibility for the dividends. Account operator A obtains the identifying information of the dividend beneficiaries from the custody chain but cannot verify their right to tax treaty benefits. Tax at source of 6 000 euros can be withheld on the dividends (30%) if account operator A reports the identifying information of the dividend beneficiaries in its knowledge on an annual information return to the Tax Administration on the payor’s behalf.

Example 11:

Publicly listed company X Oyj distributes dividends and notifies the account operator of the upcoming dividend payment. Of the dividends, 20 000 euros will be paid to nominee registered shares. At the time of dividend payment, account operator A is not registered in the Tax Administration’s Register of Authorised Intermediaries.

X Oyj and account operator A have not entered into any mutual agreement. However, the parties’ mutual procedures and responsibilities have been defined in the central securities depository’s decisions, which obligates the parties, and on the basis of which the account operator fulfils certain dividend payment obligations on the payor’s behalf. For example, the account operator collects and retains information on the payment of dividends and tax at source, and submits the information to the central securities depository for reporting self-assessed taxes. According to the decision, the account operator is also responsible for the correctness of the information it has submitted. X Oyj withholds tax at source on the dividends in accordance with the information provided by the account operator and pays net dividends to the account operator. The account operator is also responsible for verifying whether the custody chain includes any Authorised Intermediary, which has assumed responsibility for the dividends. According to the decision, maximum tax at source must be withheld on dividends if no Authorised Intermediary has assumed responsibility for the dividends and the payor has not, regardless of this, decided to assume responsibility for the application of a lower tax at source rate.

Intermediary B (CI B) has notified account operator A that tax at source of 3 000 euros should be withheld on the dividends of 20 000 euros. Intermediary B provides account operator A with the identifying information of the dividend beneficiaries. Intermediary B also notifies that it has collected Investor Self-Declarations from the dividend beneficiaries and verified their reliability as required in the Tax Administration’s ISD decision and guidance. Furthermore, intermediary B undertakes to provide the account operator acting on the payor’s behalf with evidence and documentation (including the Investor Self-Declarations) indicating how the beneficiaries’ rights to tax treaty benefits has been verified.

Account operator A verifies on the payor’s behalf whether intermediary B, which is closest to it, is registered in the Tax Administration’s Register of Authorised Intermediaries at the time of dividend payment. Intermediary B is not registered in the Register of Authorised Intermediaries. Furthermore, account operator A has not obtained information indicating that there is an Authorised Intermediary in the custody chain that had assumed responsibility for the dividends. Account operator A notifies the payor of this, and the payor notifies the account operator that tax at source can be withheld in accordance with the information provided by intermediary B. Tax at source of 3 000 euros is withheld on the dividends (15%), and account operator A reports the tax at source information for taxation on the payor’s behalf.

The payor must organise its procedures so that on request it can provide the Tax Administration with evidence and documentation collected by intermediary B indicating that intermediary B has verified the dividend beneficiaries’ rights to tax treaty benefits as required in the Tax Administration’s ISD decision and guidance.

2.4 Tax at source benefits based on the national legislation or EU law

2.4.1 Tax at source benefits in accordance with section 3 of the Tax at Source Act

No tax at source is withheld on dividend in situations defined separately in section 3 of the Tax at Source Act. The requirements for applying the provision are interpreted in accordance with the national legislation, in which case it is significant to identify the dividend beneficiary pursuant to Finland’s national legislation (see Section 2.2).

As a rule, the dividend beneficiary must provide the payor with evidence on the fulfilment of the requirements laid down in section 3 of the Tax at Source Act. The payor can apply a tax at source benefit when paying the dividend if it obtains sufficient evidence in order to verify the fulfilment of the requirements for applying the provision in question.

According to section 3 of the Tax at Source Act, tax at source is not paid in the following situations if the requirements laid down in the provision in question are fulfilled (more information on the requirements is available in the guidance Payments of dividends, interest and royalties to nonresidents):

- A corporate entity resident in the EEA as a dividend beneficiary (section 3, subsection 5 of the Tax at Source Act)

- A dividend beneficiary in accordance with the Parent-Subsidiary Directive (section 3, subsection 6 of the Tax at Source Act)

- A foreign fund equivalent to a domestic investment fund and special common fund as a dividend beneficiary (section 3, subsection 10 of the Tax at Source Act)

- Dividends paid to an equity savings account (section 3, subsection 11 of the Tax at Source Act)

A corporate entity resident in the EEA as a dividend beneficiary (section 3, subsection 5 of the Tax at Source Act)

According to section 3, subsection 5 of the Tax at Source Act, dividends received based on shares belonging to assets other than investment assets are tax-exempt for foreign corporate entities when they are paid to a corporate entity resident of an EEA state equivalent to a Finnish corporate entity and the dividends would be tax-exempt when received by a Finnish corporate entity by virtue of section 33d, subsection 4 of the Act on Income Tax or section 6a of the Act on the Taxation of Business Income. The provision also applies to profits and interest paid for a domestic savings bank’s basic fund share or a fund of funds (FOF) investment, as well as interest on a capital-protected fund paid by a mutual insurance company or insurance association.

The payor can leave tax at source unwithheld pursuant to section 3, subsection 5 of the Tax at Source Act if it obtains evidence on the fulfilment of the requirement for applying the provision before the payment of dividends. The application of the provision requires that tax at source cannot, according to the dividend beneficiary’s account, be fully remunerated in the dividend beneficiary’s country of residence based on the tax treaty between Finland and the beneficiary’s country of residence. However, information about the partial remuneration can only be usually obtained after taxation in the country of residence has ended, which is why the payor cannot grant the tax at source benefit in question on at the time of payment. In this case, the beneficiary can request the benefit to be taken into account in the tax at source refund procedure. However, if the payor can already verify at the time of payment that the dividends will not be taxed in the dividend beneficiary’s country of residence and tax at source cannot therefore be actually remunerated in full in taxation in the beneficiary’s country of residence, the payor can already grant the tax at source benefit when paying the dividend.

Example 12: B AB (limited liability company), an unlisted Swedish company equivalent to a Finnish limited liability company, receives dividends of 10 000 euros from an unlisted Finnish company. The payor knows that dividends received from an unlisted company are not taxable income for B AB in Sweden. The payor has also been provided with evidence that B AB is unlisted and that shares are not part of its investment assets. Based on the evidence, the payor can verify that the dividends would be tax-exempt when received by a Finnish corporate entity on the basis of section 6a of the Act on the Taxation of Business Income. The payor can pay the dividends to B AB without withholding any tax at source.

A dividend beneficiary in accordance with the Parent-Subsidiary Directive (section 3, subsection 6 of the Tax at Source Act)

The payor can leave tax at source unwithheld on dividends paid to a company referred to in Article 2 of the Parent-Subsidiary Directive if the company directly holds at least 10% of the capital of the company that pays the dividends (section 3, subsection 6 of the Tax at Source Act). More information on the requirements is available in the guidance Payments of dividends, interest and royalties to nonresidents.

A foreign fund equivalent to a domestic investment fund and special common fund as a dividend beneficiary (section 3, subsection 10 of the Tax at Source Act)

The application of section 3, subsection 10 of the Tax at Source Act requires that the dividend beneficiary provides the Tax Administration with evidence on the fulfilment of the requirements for tax exemption. Therefore, the application of the benefit when paying the dividend always requires that the dividend beneficiary presents the Tax Administration’s decision concerning the matter, such as a tax at source card or an advance ruling, to the payor. The payor must also verify that the taxpayer to whom the tax at source card or advance ruling has been issued to, is the dividend beneficiary in accordance with Finnish legislation.

Dividend paid to an equity savings account (section 3, subsection 11 of the Tax at Source Act)

No tax at source is withheld on dividend received on the basis of shares in an equity savings account as laid down in the Act on Equity Savings Accounts (Laki osakesäästötilistä 680/2019). The taxation of nonresidents’ equity savings accounts is discussed in more detail in the guidance Taxation on equity savings accounts (Osakesäästötilin verotus, only available in Finnish and Swedish).

Tax at source deduction of a foreign corporate entity equivalent to a domestic pension institution (section 3, subsection 7 of the Tax at Source Act)

Pension institutions equivalent to domestic pension institutions can request a deduction of the dividend income, as a result of which the amount of tax at source collected on dividends decreases (section 3, subsection 7 of the Tax at Source Act). The application of the provision requires that the dividend beneficiary provides the Tax Administration with evidence on the amount of and the grounds for the deduction. However, a dividend beneficiary cannot usually present the evidence required for granting the deduction at the time of dividend payment or during the payment year. In this case, the dividend payor cannot apply the benefit when paying the dividend. In practice, the beneficiary must always request the deduction to be taken into account in the refund procedure. The evidence required for granting the deduction is discussed in more detail in the guidance Taxation of dividends received by foreign entities offering statutory pension insurance.

2.4.2 Equivalence with a corresponding Finnish actor

A foreign corporate entity can also be entitled to an exemption from tax at source based on EU law in situations other than those laid down separately in section 3 of the Tax at Source Act. For example, a tax at source benefit can be based on the beneficiary being equivalent to a Finnish corporate entity, for which corresponding dividends would be tax-exempt.

For Finnish corporate entities, the requirements for tax exemption are assessed as a whole on a case-by-case basis for each beneficiary. Typically, the Tax Administration assesses whether the requirements for tax exemption are fulfilled on a tax year-specific basis. For example, if there have been changes in a taxpayer’s conditions, it is possible that the requirements for tax exemption are no longer fulfilled during subsequent years. For example, concerning Finnish non-profit organisations, the Tax Administration determines whether each corporate entity fulfils the requirements set for non-profit organisations in section 22 of the Act on Income Tax on a tax year-specific basis.

Correspondingly, the equivalence of foreign corporate entities will be assessed as a whole on a case-by-case basis for each beneficiary. Therefore, only the Tax Administration can in practice determine whether a beneficiary is equivalent to a corresponding Finnish corporate entity. The Tax Administration assesses whether the requirements for equivalence are fulfilled based on the evidence presented by the dividend beneficiary. For this reason, the dividend payor can only leave tax at source unwithheld based on an equivalence subject to EU law if the dividend beneficiary presents the Tax Administration’s decision concerning the matter, such as a tax at source card or an advance ruling, to the payor. The payor must also verify that the party presenting the evidence is the dividend beneficiary as laid down in the Finnish legislation. Alternatively, the dividend beneficiary can apply for a refund of tax at source from the Tax Administration.

If the requirements are fulfilled, a natural person who is a nonresident taxpayer and resides in an EEA state can claim their dividend income to be taxed as laid down in the Act on Assessment Procedure (section 13, subsection 1(3) of the Tax at Source Act). In this case, dividends are taxed similarly to dividends received by a natural person who is a resident taxpayer. The claim for taxation in accordance with the Act on Assessment Procedure can only be presented after taxation in the country of residence has ended, in which case the dividend beneficiary can only apply for taxation in accordance with the Act on Assessment Procedure using a refund application.

More information on equivalence based on EU law and the taxation in accordance with the Act on Assessment Procedure of natural persons who are resident taxpayers and reside in an EEA state is available in the guidance Payments of dividends, interest and royalties to nonresidents.

3 Tax at source on interest

3.1 General

The Finnish tax legislation does not include any general concept of interest. In legal and tax practice, a remuneration paid for liabilities has been regarded as interest, usually defined as a certain percentage based on the debt capital and elapsed time. In taxation, payments other than those named as interest can be regarded as interest if their actual financial characteristics make them a remuneration for liabilities.

When making a payment, it is important to determine whether it is a question of interest, dividend or other capital income. With regard to bonds, for example, it is important to separate the price paid for the debt capital from interest payments, as provisions on capital gains and losses apply to gains and losses arising from capital. The concept of interest is discussed in more detail in the guidance Deduction of interest in personal taxation (Korkojen vähentäminen henkilöverotuksessa, only available in Finnish and Swedish). The taxation on bonds is discussed in the guidance Taxation on bonds pursuant to the act on income tax (Joukkovelkakirjalainojen verotuksesta tuloverolain mukaan, only available in Finnish and Swedish).