Instructions for filling in the application for refund of VAT, non-EU applicants (Form 9550)

Instructions for filling in the application for refund of VAT, non-EU applicants (Form 9550)

You can use this form to request a VAT refund from Finland if you are a self-employed individual in a non-EU country. Fill in the form in Finnish, Swedish or English. You can either type or write by hand, but make sure the text is easy to read.

Fill in all the fields. If you do not have a representative submitting the request on your behalf, you can leave section 5 Representative blank.

The form is available for download on our Forms page.

Detailed instructions

1 Applicant

In addition to the applicant’s official company name or business name and contact details, give the VAT number or the tax registration number issued by the registration authority of the applicant’s home country. The number must also be found in the document issued by the tax authority and enclosed with the application in original. If the applicant does not have a VAT number or tax registration number, for example because their home country has different practices, enter the applicant’s trade register number. If you do so, you must also enclose the original trade register extract.

Select the ID type by ticking one of the options given. If the ID you enter is a trade register number, tick Other. Enter this ID in the Applicant’s ID code field at the top of each page of the application.

Use the same registration number and ID type in your later applications.

Fill in all the address fields carefully to make sure you receive the decisions and any requests for further information sent to you by post.

2 Refund period

The refund period must be at least three consecutive full months. The months must be within the same calendar year. You can also request a refund for a shorter period, if the period is at the end of the calendar year, for example from 1 November to 31 December or from 1 December to 31 December.

The refund period must always consist of full calendar months. Enter the period in the format ddmmyyyy–ddmmyyyy, for example 01012019–31032019.

3 Claimed amount of refundable VAT

Calculate the total amount of value-added tax you request to be refunded. Enter it here.

If the application concerns the entire calendar year or if the application period ends on 31 December, the minimum VAT refund is €50. Otherwise, the minimum refund is €400.

4 Description of the applicant’s business operation in home country

Nature of business (TOL 2008)

Report the type of business by giving a four-digit Standard Industrial Classification (SIC) code in accordance with TOL 2008. Further information about the classification is available on the website of Statistics Finland.

Example: The applicant’s main line of business is Freight transport by road, which belongs to class H Transportation and Storage (49–53). The four-digit SIC code is 4941.

A document issued by the tax office of the applicant’s home country, confirming the line of business/industry

Attach a document issued by the tax office or other authority of the applicant’s home country that specifies the applicant’s business operation during the refund period. The document may not be older than 12 months.

Tick the appropriate box to indicate whether the document is attached to the request or has been delivered to the Tax Administration previously. Also enter the document’s date of issue.

5 Representative

Fill in this section only if you are acting as the applicant’s representative.

In addition to your official name and contact details, give the VAT number or the tax registration number issued by the registration authority of your home country. If you do not have a VAT number or tax registration number, for example because your home country has different practices, enter the trade register number. Select the ID type by ticking one of the options given. If the ID you enter is a trade register number, tick Other.

Fill in all the address fields carefully to make sure you receive the decisions and any requests for information sent to you by post.

Letter of authorisation (power of attorney)

Attach the power of attorney you have received from the applicant. You will find a template for the power of attorney in the Tax Administration guidance Refund of VAT to foreign businesses established outside the EU (section 5.4).

Tick the appropriate box to indicate whether the power of attorney is attached to the request or has been delivered to the Tax Administration previously.

6 Bank information for refunding

Bank information for a bank located in an EU country

We will pay the refund into a bank account. The bank account must be in Finland or another EU country. Enter the IBAN number of the bank account and the BIC code of the bank.

The beneficiary that receives the refund

Tick the appropriate box to indicate whether the beneficiary is the applicant, the representative or a third party.

The recipient’s name and details if it is a third party, not the applicant or representative

If the recipient is other than the applicant or representative, state their official name and contact details.

7 Other data

Here you can state the purpose why you bought those goods and services in Finland on which you are requesting a VAT refund. Tick the appropriate box to indicate the kind of operation the applicant has had in Finland during the refund period.

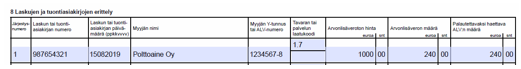

8 Specification of invoices and import documents

Specify in the table the invoices and import documents for which you are requesting a VAT refund. If there is not enough space for your invoices and import documents on the form, you can add new specification pages to your request (page 3 of the request form). Remember to enter the ID code you have used, such as the VAT number, in the Applicant’s ID field at the top of each page.

Use only the original form and its specification page. (Excel worksheets, for example, are not acceptable.) Do not modify the form.

How to fill in the specification table:

Sequence no.

Number the lines in the specification of invoices and import documents.

Invoice no. or import document no.

Enter the invoice number or import document number found in the invoice or document.

Invoice or import document date

Enter the date of the invoice or import document in the format ddmmyyyy, for example 15082019.

Code of the good or service

Enter the codes identifying the goods and services bought. You will find the codes in the Tax Administration guidance Refund of VAT to foreign businesses established outside the EU (section 7). You can enter two different codes for one invoice. Enter the code in the format x.y or x.y.z.

Price without VAT

State the price for the purchase without VAT.

Amount of VAT

Enter the amount of VAT included in the invoice.

Amount of VAT to be refunded

Enter the amount of VAT included in the invoice and requested to be refunded.

Example: A hotel bill includes two VAT items: €9.20 on accommodation and €0.60 on breakfast. In Finland, hotel breakfasts are considered personal use and the VAT included in the price is therefore not refundable. You can only request a refund for the VAT on accommodation. The amount of VAT you can request to be refunded is €9.20.

Percentage of the part that qualifies for refund

If you bought the goods or services for purposes that do not fully (100%) qualify for a refund – i.e. if you also conduct operations that do not qualify for a refund – enter here the percentage of the part qualifying for a refund. Enter the refundable part as percentage and specify the invoices to which this applies.

Example: Your company sells both consultancy services subject to VAT and healthcare services exempt from VAT. Your company’s employee has made a business trip to Finland. During the business trip, they participated in meetings relating to taxable operations (consultancy services) and other meetings relating to VAT-exempt operations (healthcare). The travel expenses (e.g. hotel and taxi costs) must be divided between the taxable and tax-exempt operations. Do this for each invoice.

Total VAT to be refunded

Add together the refundable amounts of VAT. Enter here the total amount, adding together the amounts from all the specification pages. If you have used more than one specification page, enter the total amount on the last page.

How many specifications of invoices are included

Enter the total number of invoices and import documents.

Signature of applicant or representative

The application must be signed by a person who is authorised to sign for the applicant’s business operation.

Sending the application

The application must be made within 6 months after the end of the calendar year during which the refund period took place. The application must thus arrive by 30 June. If 30 June falls on a Saturday, Sunday or other holiday, the application must arrive by the next business day.

The return address is found on the first page of the form.

Further information

Further information about the conditions for VAT refunds is available in the Tax Administration guidance Refunds of VAT to foreign businesses established outside the EU. You can also contact us about VAT by calling our service number 029 497 008 (calls from outside Finland +35829 497 008).