How to report retirement to the Incomes Register?

When an employee retires, report by submitting a earnings payment report

- start date and end date of the employment relationship

- reason code for the termination of the employment relationship according to Incomes Register codes: 6 Retirement.

If the employee’s pension insurance provider is either Keva or the Bank of Finland, also enter the Keva or Bank of Finland retirement code. Then proceed to enter the grounds for employment registration as well as occupational class and other occupation details.

The earnings-related pension provider receives the information from the Incomes Register.

Employment relationships can be based on an employment contract, a public-service contract, or a commission contract.

Report retirement

You can submit the information either directly from the payroll system using an interface or via the Incomes Register’s e-service.

Report retirement

Use an earnings payment report to submit employment relationship data to the Incomes Register. Employment relationship data is entered on the same page as absence data is reported.

1. Specify that the incomer earner is in an employment relationship with the payer.

2. Report the Type of employment.

Select Full-time if the employee works the maximum working hours of a full-time employee. In most cases, employees’ maximum working hours are specified in a collective agreement. If there is no applicable collective agreement, the maximum working hours of a full-time employee are the maximum hours stated in the Working Hours Act, i.e. 40 hours per week.

Select Part-time if the employee works less than the maximum working hours specified in either the collective agreement applicable to the industry or the Working Hours Act.

Select Not available if you do not know whether the employee works full-time or part-time.

3. Report the Duration of employment.

Select Until further notice if the end date of the employment relationship has not been specified in the employment contract or letter of appointment.

Select Fixed-term if a specific end date for the employment relationship has been entered into the employment contract or letter of appointment. Also select Fixed-term if the employment relationship is due to end upon the completion of a specific assignment.

You can also enter percentages for part-time employees, any agreed weekly working hours, and the form of payment. When reporting retirement, these are optional fields for providing complementary information.

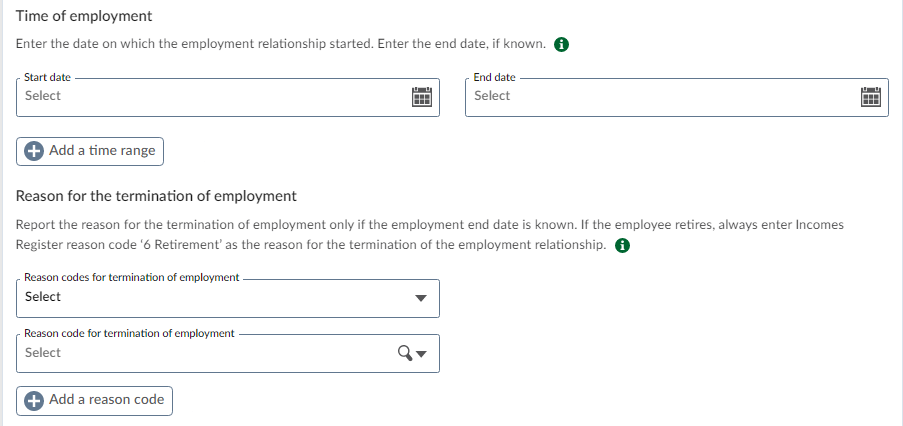

4. Report the Time of employment and the reason for the termination of employment

Enter the start date and end date.

To add a reason for the termination of the employment relationship. First, select Incomes Register codes. Then select reason code 6 Retirement.

If the employee’s pension insurance provider is either Keva or the Bank of Finland, also enter the Keva or Bank of Finland retirement code, click Add reason code. Then proceed to enter the grounds for employment registration as well as occupational class and other occupation details.

Correcting the end date of an employment relationship

If you have forgotten to report the retirement of an employee, you can make a correction to the previously submitted earnings payment report.

Search for the report in the Incomes Register’s e-service under Submitted reports by entering, for example, the report reference. Open the report and click Correct.

After that, enter the correct information as instructed above.

Final pay

Final pay refers to the pay the employer pays to the employee when his/her employment relationship ends. An employee’s final pay can include, for example, overtime bonuses, holiday pay and holiday bonuses, remuneration for leave not taken in exchange for longer working hours, and other similar remunerations. An employee’s final pay also includes any work-related income earned from the terminated employment relationship retroactively, such as performance bonuses.

If you already know the amount of the employee’s final pay, enter the amount into the earnings payment report in which you notify the Incomes Register of the end of the employment relationship. If the employee’s final pay is to be split into multiple instalments, the information on the end of the employment relationship must be entered into every report that relates to the employee’s final pay.

Specify the income type for the employee’s final pay, such as Time-rate pay (201).

Earnings-related pension insurance contributions are also payable on employees’ final pay, so do not enter the type of exception to insurance in the earnings payment report. However, if an employee’s final pay includes amounts on which earnings-related pension insurance contributions are not payable, indicate that by selecting “Subject to earnings-related pension insurance contribution: No” for the income type.

If the amount of final pay is not known

You can notify the Incomes Register of an employee’s retirement in an earnings payment report even if you do not yet know the amount of their final pay. In such circumstances, enter the information concerning the end of the employment relationship but leave the section Payments made to an income earner empty.

Once you know the amount of the employee’s final pay, you can submit a new earnings payment report to the Incomes Register. In connection with the final pay, you must also report the details of the employee’s retirement, i.e. the start and end dates of the employment relationship.

If an employee carries on working in retirement

There is nothing to stop an employee working past their old-age pension age. Any work performed while in retirement is reported to the Incomes Register just like any other work. These employees are usually also insured (with the exception of self-employed persons whose insurance under the self-employed persons’ pensions act (yrittäjän eläkelaki 1272/2006) lapses when they retire unless they take out voluntary insurance).

If an employee carries on working past the age at which the employer no longer needs to provide pension insurance

Employees can also carry on working past the age at which the employer no longer needs to provide pension insurance for them (68–70 years). Employees who carry on working past this age are not insured.

If no earnings-related pension insurance contributions are payable for an employee due to their age or if their earnings are below the threshold at which an employer must provide pension insurance, enter the type of exception to insurance No obligation to provide insurance (earnings-related pension insurance) in the earnings payment report.

No earnings-related pension insurance information, such as the earnings-related pension provider code or the pension policy number, need be entered for such employees.

Examples

Example 1: An employee retires, and their employment relationship ends on 30 April 2022. The employee gets their final pay that same day.

The last earnings payment report for April should contain the following information:

- Start date and end date (30 April 2022) of the employment relationship

- Reason code for the termination of the employment relationship: 6 Retirement

Example 2: An employee retires, and their employment relationship ends on 30 April 2022. The employee is paid for their services between 10 April and 23 April 2022 on 3 May 2022 and for their services between 24 April and 6 May 2022 on 17 May 2022.

In order to account for the wages paid to the employee when their old-age pension is calculated, both earnings payment reports should contain the following information:

- Start date and end date (30 April 2022) of the employment relationship

- Reason code for the termination of the employment relationship: 6 Retirement