Incomes Register certificate

You need a certificate if you want to submit data or search for data through technical interfaces (APIs). The technical interface means an integration built between different systems, for example, between payroll software and the Incomes Register.

For example, you can submit your employees’ earnings payment data directly from your payroll software to the Incomes Register. In addition to reporting, many software products allow you to correct data directly from the payment system to the Incomes Register. You can also request records or transcripts through the API. Ask your software supplier for more information.

Certificates are used to identify and authorise organisations that submit data or search for data through APIs. They are also used to verify the integrity of records. The solution is based on digital certificates (Public Key Infrastructure).

Certificates are issued in accordance with the purpose of use. A certificate granted for the Web Service channel for earnings payment data can also be used in other services of the Tax Administration.

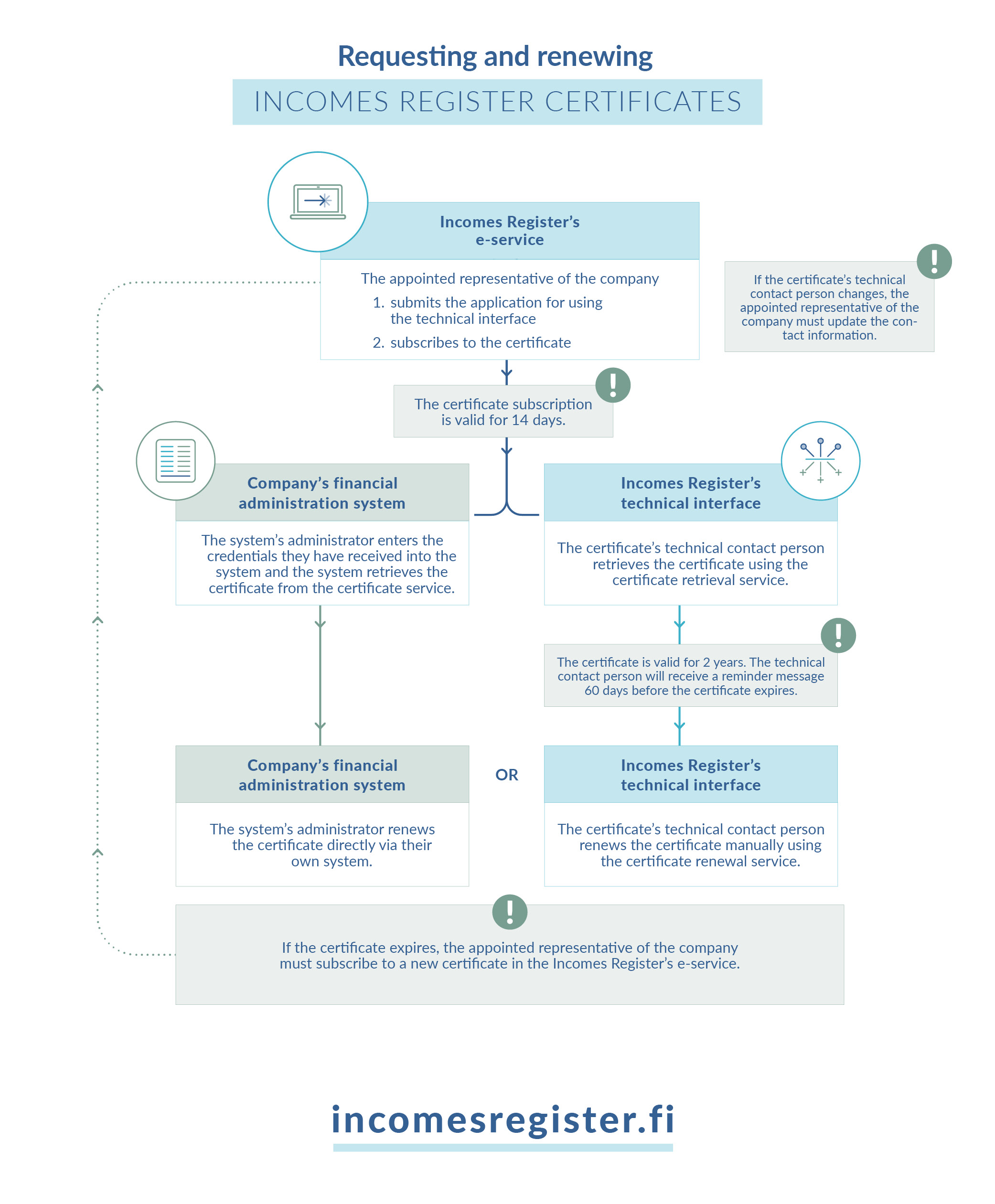

Submit an interface application ja request a certificate in the Incomes Register's e-service

The certificate is valid for two years

A certificate is valid for 2 years, after which it must be renewed. Each organisation is responsible for renewing their certificate.

Read more about renewing a certificate