Reportable cross-border arrangements

Key terms:

- Date of issue

- 4/30/2020

- Validity

- 1/1/2020 - 12/8/2022

This is an unofficial translation. The official instruction (record number VH/1283/00.01.00/2020) is drafted in Finnish and Swedish languages.

This instruction deals with questions related to the interpretation of regulation concerning the Act on Reportable Arrangements in the Field of Taxation (1559/2019) regarding a service provider’s obligation to inform and a taxpayer’s reporting obligation, and amendments made to the Act on Assessment Procedure. Instructions on the reporting procedure are available in data record specification DAC6 - Notification of a reportable arrangement (VSDAC6DC) on electronic reporting, and in the instruction Notification of a reportable arrangement, instructions for filling in the form.

1 Background

1.1 Act on Reportable Arrangements in the Field of Taxation, and amendments to the Act on Assessment Procedure

The Act on Reportable Arrangements (1559/2019) entered into force on 1 January 2020. At the same time, new provisions were added to the Act on Assessment Procedure (1558/1995) on a service provider’s and a taxpayer’s reporting obligation.

The new regulation implements the reporting obligation concerning certain cross-border tax planning structures as required by Directive (EU) 2018/822 (amendment to the “Administrative Assistance Directive”, DAC6 Directive). The main aim of this Directive is to provide tax authorities in the European Union´s Member States with information about cross-border tax planning arrangements that may contain elements of tax evasion or avoidance. The directive is based on OECD´S BEPS - project which concerned the erosion of the tax base and the transfer of profits, in order to prevent aggressive tax planning and international tax evasion. The Directive imposes on EU Member States the obligation to collect details concerning reportable cross-border arrangements from those subject to a reporting obligation. These details are exchanged between Member States on a quarterly basis, through the central directory implemented by the European Commission.

1.2 General information about the reporting obligation

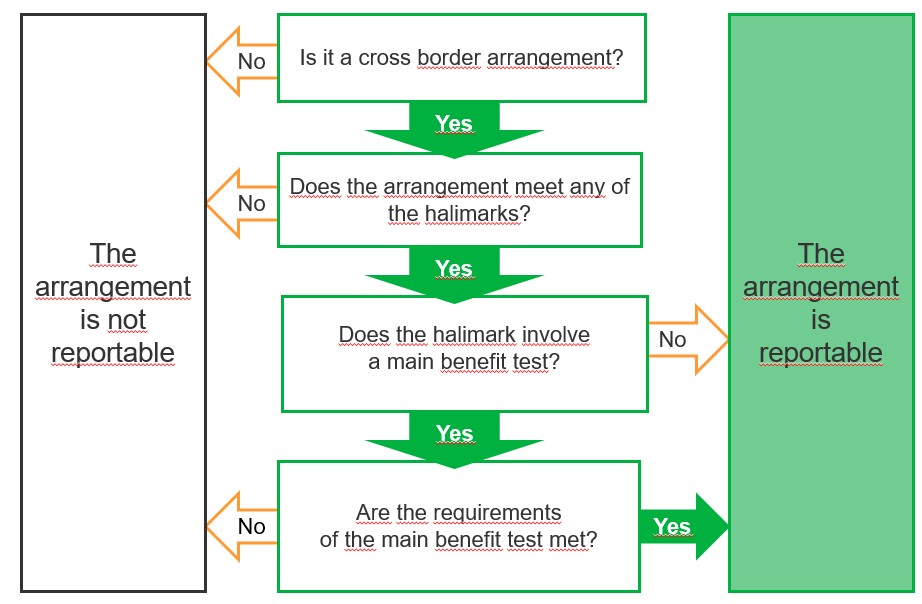

According to the Act on Reportable Arrangements, cross-border arrangements that may involve characteristics of tax avoidance or tax evasion must be reported to the Finnish Tax Administration. Arrangements that fall within the scope of application of the Act involve cross border tax planning. Reportable arrangements can be fully compliant with the law, and reporting does not automatically lead to taxation measures. It is not, however, necessary to evaluate when reporting whether the reportable arrangement is in accordance with the provisions of tax law. The (DAC6) return is not considered as a service provider´s or tax payer´s position on the interpretation of tax provision as regards the arrangement at handThe reporting is obligatory when

- the case involves a cross-border arrangement, i.e. the arrangement concerns more than one country (in this guidance, ‘country’ refers to both countries and other jurisdictions)

- the arrangement fulfils any of the distinguishing hallmarks laid down in Chapter 3 of the Act on Reportable Arrangements.

Reportable cross-border arrangements must be reported to the Tax Administration. The reporting obligation primarily concerns service providers that plan, market or manage reportable arrangements (see Chapter 4). A taxpayer is subject to a reporting obligation only when the arrangement does not include a service provider with a reporting obligation or when the service provider of the arrangement has been exempted from the obligation to inform due to legal professional privilege (see Chapter 5). A cross-border arrangement must be reported when the arrangement fulfils at least one of the hallmarks laid down in the Act (see Chapter 3). With regard to the reporting obligation, the reason why the arrangement has been planned or implemented is irrelevant.

The scope of reporting includes arrangements that have been implemented after the Directive’s entry into force on 25 June 2018. Arrangements implemented between 25 June 2018 and 30 June 2020 must be reported to the Tax Administration by 31 August 2020 at the latest. A 30-day deadline will apply to reporting as of 1 July 2020 (see Chapter 7).

2 Scope of application and certain definitions

2.1 Scope of application of the Act on Reportable Arrangements

The Act on Reportable Arrangements is applied to arrangements that can have an impact on the amount or determination of taxes laid down in the ‘Administrative Assistance Directive’ (2011/16/EU). Another condition is that the arrangement concerns more than one Member State of the European Union or one EU Member State and a third country, where at least one of the following conditions is met (section 1, subsection 2):

- not all of the participants in the arrangement are resident for tax purposes in the same jurisdiction;

- one or more of the participants in the arrangement is simultaneously resident for tax purposes in more than one jurisdiction;

- one or more of the participants in the arrangement carries on an activity in another jurisdiction without being resident for tax purposes or creating a permanent establishment situated in that jurisdiction;

- one or more of the participants in the arrangement carries on an activity in another country without being resident for tax purposes or creating a permanent establishment situated in that jurisdiction.

In the Act on Reportable Arrangements and in this guidance, ‘person’ refers to natural persons, legal persons, and legal arrangements or any other similar structures (section 2, subsection 1, paragraph 1).

The Act is also applied to arrangements that (section 1, paragraph 3):

- exert a possible impact on obligations concerning the reporting of financial account information under section 17a–d of the Act on Assessment Procedure or similar obligations in another country; or

- exacerbate the identification of beneficial ownership.

An arrangement must be reported if it meets any of the hallmarks laid down in Chapter 3 of the Act on Reportable Arrangements (section 3). Since the Act is only applied to cross-border arrangements, a purely domestic arrangement needs not be reported to the Tax Administration, even if it meets any of the hallmarks. For example, if a Finnish permanent establishment of a foreign company implements a purely domestic arrangement in Finland, the arrangement is not reportable. Similarly, when a foreign permanent establishment of a Finnish company implements a purely national arrangement in the country where it is located, the arrangement is not reportable.

2.2 Definition of an arrangement

The concept of an ‘arrangement’ is not defined in the Act on Reportable Arrangements or in the DAC6 Directive. The concept has not been defined in the law, in order to prevent evading the regulation solely on procedural grounds (Government proposal HE 69/2019, rationale for section 1). This is why an ‘arrangement’ as referred to in the Act must be broadly understood. An arrangement can be any business transaction, system, measure, contract, subsidy, understanding, promise, commitment, event or other transaction. In practice, arrangements falling within the scope of the Act are determined through hallmarks. An arrangement can also include a series of arrangements, and an arrangement can involve more than one step or part (Government proposal HE 69/2019, rationale for section 1). However, the reporting obligation always requires that the arrangement concerns at least two jurisdictions and meets at least one of the hallmarks laid down in the Act.

2.3 Cross-border arrangement

The Act on Reportable Arrangements is only applied to cross-border arrangements. Domestic arrangements do not fall within the scope of the reporting obligation. An arrangement crosses borders if it concerns more than one EU Member State or one EU Member State and a third country (section 1, subsection 2). In addition, the person(s) participating in the arrangement must have a connection to several countries in the form of residence for tax purposes, permanent establishment or engagement in business activity (Government proposal HE 69/2019, rationale for section 1).

In other words, the persons participating in the arrangement have an adequate connection to several countries through their residence for tax purposes when not all of the participants in the arrangement are resident in the same country, or when one or more of the participants is simultaneously resident in more than one country. A person may have double residence, for instance, when one jurisdiction finds that the corporate entity is a resident, because it was established there, and another country deems that the corporate entity is resident there due to the place of management. A natural person can also have double residence, for more information, please see the Tax Administrations guidance on Tax residency and nonresidency.

An arrangement crosses borders also when one or more of the participants in the arrangement carries out a business in another country through a permanent establishment situated in that country and the arrangement forms at least part of the business of that permanent establishment.

An arrangement also crosses borders when one or more of the participants in the arrangement carries out a business in another country or jurisdiction without being resident for tax purposes or creating a permanent establishment situated in that country or jurisdiction.

Example 1

Company X, which is resident in country 1, manufactures and sells products there. It also sells these products to countries 2, 3 and 4. Company Y is also resident in country 1. Companies X and Y participate in an arrangement that meets one hallmark but is only related to operations taking place in country 1. The arrangement is not related to sales carried out by company X to countries 2, 3 and 4. The arrangement does not cross borders because it does not concern more than one country.

2.4 Reportable arrangement

A cross-border arrangement must be reported when it meets at least one of the hallmarks laid down in Chapter 3 of the Act on Reportable Arrangements (section 3). Hallmarks are discussed in Chapter 3 of this guidance.

A reportable arrangement consists of all functions that, must be performed in order to meet a hallmark or to obtain a possible tax advantage. An arrangement is reported as a whole, and individual transactions or parts of the arrangement included in it are not reported separately. An individual transaction may fall within the scope of the reporting obligation if implementing it alone is enough to obtain a tax advantage and to meet a hallmark.

Example 2

A Finnish parent company makes repetitive payments to a subsidiary located in a country with a zero tax rate. The case constitutes one arrangement reported as a whole. Each payment is not reported separately.

Example 3

Parties implement a series of arrangements where a tax advantage is obtained as a combined effect of these arrangements. The case constitutes one arrangement reported as a whole

Ordinary intra-group business transactions that cross borders can be part of a reportable arrangement, if any of the hallmarks in the Act is met.

Instead, the following situations, for instance, are not reportable arrangements:

- Strategic documents on taxation written at a general level, such as a group's internal guidelines on tax policy, since they do not ordinarily include detailed information about tax planning structures.

- Transfer pricing documentation does not either ordinarily include information about tax planning structures.

2.5 Marketable arrangement

A ‘marketable arrangement’ is a cross-border arrangement that is designed, marketed, ready for implementation or made available for implementation without a need to be substantially customised (section 1, subsection 1, paragraph 9). A marketable arrangement must be reported only if it crosses borders and meets any of the hallmarks laid down in Chapter 3 of the Act on Reportable Arrangements. A marketable arrangement is not designed for a specific taxpayer, instead it is designed to be ready for use by several taxpayers without substantial customisation. If an arrangement is designed for a specific taxpayer, it is not a marketable arrangement but a ‘bespoke arrangement’.

Reporting of a marketable arrangement involves special characteristics (see section 7.3). A marketable arrangement always meets the hallmark in section 14 of the Act on Reportable Arrangements (standardised documentation and structures of the arrangement), but even other hallmarks may be applicable to a marketable arrangement.

3 Hallmarks

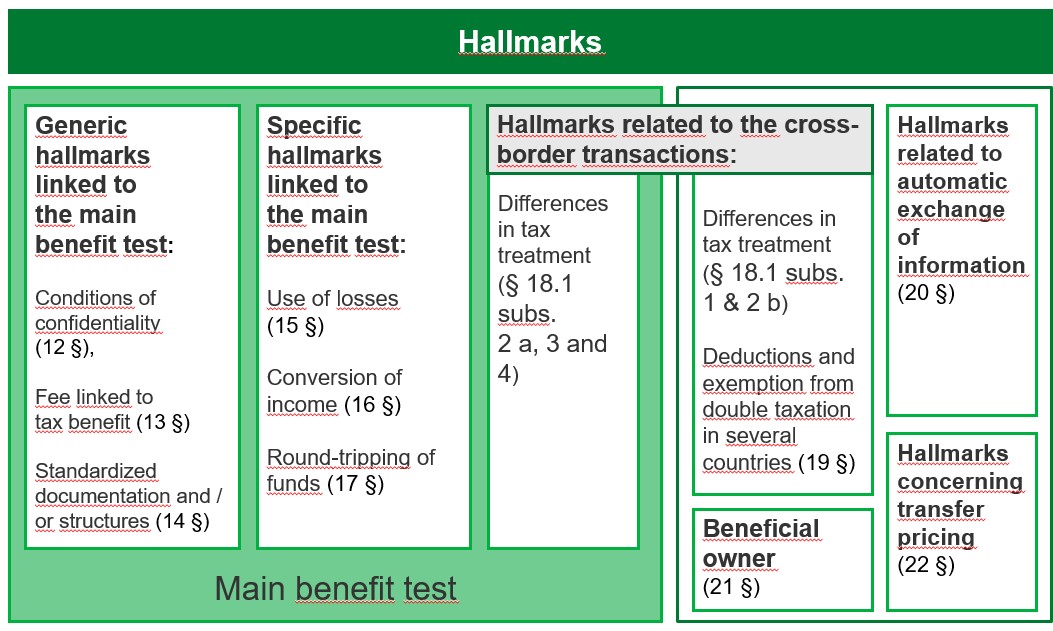

3.1 Generic and specific hallmarks

A cross-border arrangement must be reported if it meets at least one hallmark. Provisions on hallmarks are laid down in Chapter 3 of the Act on Reportable Arrangements. Hallmarks are divided into generic and specific hallmarks. Generic hallmarks are characteristics that are often included in widely marketed and utilised arrangements, or new and innovative tax planning arrangements. Specific hallmarks are primarily aimed at intervening in the utilisation of known deficiencies and vulnerabilities in tax systems and of commonly used procedures in tax planning arrangements (Government proposal HE 69/2019, rationale for section 3). Provisions on generic hallmarks are laid down in sections 12–14 and specific hallmarks in sections 15–22 of the Act on Reportable Arrangements.

Some of the hallmarks are applied as such, some are linked to the “main benefit test” (see section 4.2).

3.2 Main benefit test

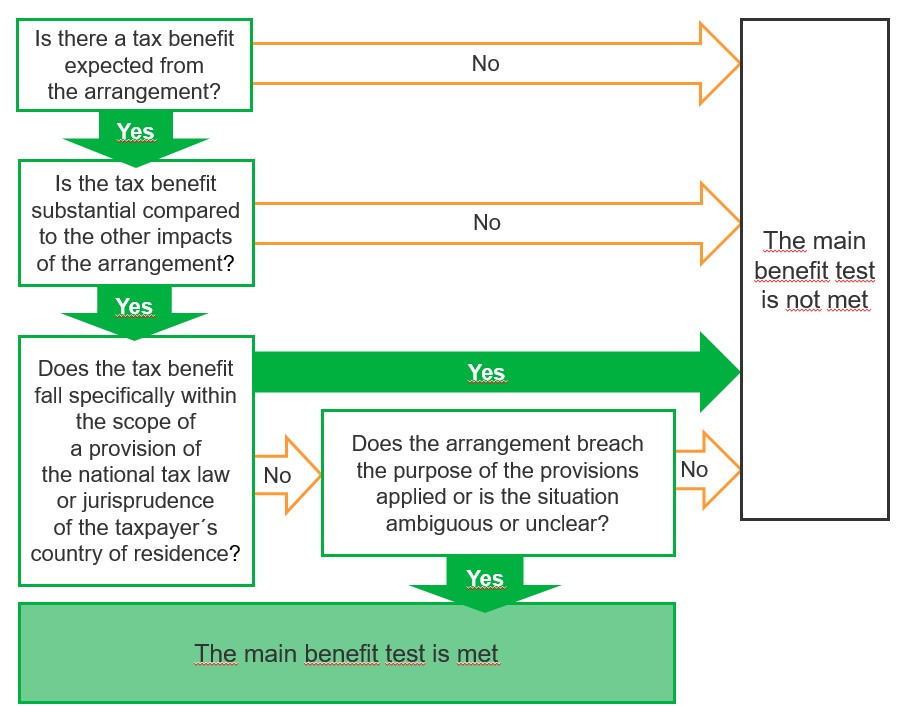

In the Act on Reportable Arrangements, the “main benefit test” means evaluating whether obtaining a tax advantage is, having regard to all relevant facts and circumstances, the main benefit or one of the main benefits a person may reasonably expect to derive from an arrangement (section 2, subsection 1, paragraph 3). The purpose of this provision is to exclude from reporting arrangements where there is no tax advantage excpected or tax advantage that is of minor significance (Government proposal HE 69/2019, rationale for section 3).

The main benefit test includes a case-specific overall review of circumstances related to a cross-border arrangement, in which the expected tax advantage is compared to the circumstances and overall effects of the arrangement.

The following hallmarks require that the conditions for the main benefit test are fulfilled:

- Condition of confidentiality

- Fee linked to a tax advantage

- Standardised documentation and structures of the arrangement

- Use of losses

- Conversion of income

- Round-tripping of funds

- Differences in tax treatment when

- the recipient is not resident for tax purposes in any country or jurisdiction; or

- the recipient’s country is included in a list of jurisdictions which have been assessed by the EU or the OECD as being non-cooperative jurisdictions.

Hallmarks that do not require an evaluation of the main benefit are as follows:

- Differences in tax treatment when

- the recipient’s country does not impose any corporate tax or imposes corporate tax at the rate of zero or almost zero;

- the payment benefits from a full exemption from tax in the recipient’s country;

- the recipient may benefit from a specific tax relief.

- Deductions and exemption from double taxation in several countries or jurisdictions

- Hallmarks related to automatic exchange of information

- Beneficial owner

- Hallmarks concerning transfer pricing

The main benefit test is specifically related to the reportability of arrangements. The conditions for the fulfilment of the test differ from national provisions on tax evasion (such as sections 28 and 52(h) of the Act on Assessment Procedure) and from the general tax evasion provision concerning tax treaties (the principle purpose test, OECD Action 6 BEPS, in Article 29(9) of the 2017 OECD Model Tax Convention). The conditions for the main benefit test can be fulfilled even if the application requirements for the aforementioned provisions on tax evasion are not fulfilled.

3.2.1 Tax advantage referred to in the Act

A tax advantage referred to in the Act on Reportable Arrangements can be, for example, benefitting from a lower tax rate, exemption from income tax, a deduction of expenses, a tax loss, avoidance of tax at source, a deduction of foreign tax, or another financial benefit obtained in taxation.

A tax advantage must be related to direct taxes imposed by a Member State, its regions or local authorities, or imposed on their behalf. When an arrangement includes a party located in a country outside the EU, similar taxes imposed there are also taken into account in an evaluation of a tax advantage. Value added tax, customs tax, and excise duty are outside the scope of application of the Act on Reportable Arrangements, so they are irrelevant in an evaluation of a tax advantage. (Government proposal HE 69/2019, rationale for section 2)

A tax advantage sought from an arrangement can be realised in Finland, in another EU Member State, or in a country outside the EU (Government proposal HE 69/2019, rationale for section 2)

If the arrangement utilises a beneficial provision specifically legislated for such circumstances in the taxpayer's country of residence, the tax advantage does not meet the main benefit test. Instead, if the tax advantage obtained is ambiguous or contrary to the purpose of the Act, it falls within the scope of the reporting obligation (Finance Committee Report 19/2019).

3.2.2 Evaluation of main benefits of a tax advantage

According to the government proposal, the fulfilment of the conditions for the main benefit test is evaluated on the basis of objective criteria (Government proposal HE 69/2019, rationale for section 2). A cross-border arrangement is reviewed objectively, on the basis of observable facts and circumstances. Even an outsider should be able to see that there is a tax advantage obtained from the arrangement. A person’s reasons for utilising an arrangement are irrelevant in terms of the evaluation of the main benefit test (Government proposal HE 69/2019, rationale for section 2).

An evaluation is based on facts and circumstances known by the service provider or taxpayer upon the design phase of the arrangement. The test is met if there will be an expected tax advantage. It is irrelevant whether the tax advantage will ultimately be obtained from the arrangement.(Government proposal HE 69/2019, rationale for section 2)

An evaluation if the tax advantage is the main benefit or one of the main benefits is made as a case-specific overall evaluation, and the fulfilment of the conditions for the main benefit test usually cannot be evaluated by calculated measurement and comparison of the benefits produced by the arrangement, such as by means of percentages.

3.2.3 Situations in which a tax advantage is the main benefit

The requirement for the main benefit is fulfilled when the expected tax benefit is of significant value and one the principal benefits obtained from the arrangement. A tax advantage is reviewed in proportion to the circumstances and the overall effect of the arrangement as a whole. If the expected tax advantage is of minor significance in comparison with the overall benefit expected from the arrangement, then, according to the government proposal, the conditions for the main benefit test are not fulfilled. (Government proposal HE 69/2019, rationale for section 2).

The conditions for the main benefit test are fulfilled when the arrangement involves tax planning means that are in conflict with the purpose of the tax system. Similarly, the conditions for the main benefit test are fulfilled when the arrangement involves tax planning means that are in conflict with the purpose of the law applied in the arrangement or the purpose of provisions concerning the tax assessment procedure. (Finance Committee Report 19/2019)

In other words, the conditions for the main benefit test are fulfilled when a tax advantage is one of the main advantages expected, and the case does not involve a tax advantage specifically laid down in the legislation of the taxpayer’s country of residence or accepted in established legal and taxation practice.

A tax advantage can be one of the main benefits of an arrangement when the seeking of the tax advantage has affected the way in which the arrangement has been implemented. A tax advantage is always the main benefit when the seeking of the tax advantage is the specific reason why the arrangement has been undertaken.

3.2.4 Situations in which a tax advantage is not the main benefit

The conditions for the main benefit test are not fulfilled when the arrangement involves tax planning means that have been accepted in legal and taxation practice (Finance Committee Report 19/2019). When a tax planning arrangement has been accepted in legal and taxation practice in the taxpayer’s country of residence, the arrangement is then also deemed to be in line with the law applied to the arrangement and its purpose. If such an arrangement is part of a larger whole of arrangements that also generates other tax advantage referred to in the law, and the tax advantage is the main benefit expected to be derived from the entire arrangement or one of the main benefits, the arrangement must, however, be reported as part of this whole.

The conditions for the main benefit test are not fulfilled in situations that are in line with the legislation in the taxpayer’s country of residence and its purpose. One example of such an arrangement comprises provisions concerning deduction of expenses according to tax legislation. When a taxpayer makes payments to a foreign group company, this does not automatically involve a tax advantage according to the definition of the main benefit test. However, if an arrangement that is ostensibly in line with provisions involves characteristics or other arrangements that produce an advantage contrary to the purpose of the provision concerning the deduction of the expense, such as an artificial deduction or deduction of an expense belonging to another taxpayer, this is a tax advantage referred to in the test. (Finance Committee Report 19/2019)

3.3 Generic hallmarks of the main benefit test

3.3.1 Condition of confidentiality

If the relevant taxpayer or a person participating in an arrangement has agreed not to expose to other service providers, the Tax Administration or tax authorities in other countries how a tax advantage can be obtained through the arrangement, and the arrangement fulfils the conditions for the main benefit test (section 12). The condition of confidentiality protects, for example, a feature that produces value to the service provider of the arrangement.

The condition can be specifically stated in a contract or verbally agreed on. The condition of confidentiality does not mean a general condition used in a contract that the parties agree not to expose information they have obtained concerning the other party. Instead, it is essential for the application of the hallmark that the confidentiality clause protects the new or innovative tax planning features included in the arrangement.

3.3.2 Fee linked to a tax advantage

An arrangement is reportable if the fee or other compensation received by a service provider is determined on the basis of the amount of tax advantage obtained from the arrangement, or if the amount of the fee or other compensation received by the service provider depends on whether actual tax advantage is obtained through the arrangement (section 13). In addition, the arrangement needs to meet the main benefit test. According to the government proposal, this hallmark is applicable, for instance, when a service provider’s fee is determined, in full or in part, on the basis of a tax advantage or when the service provider is obliged to refund a payment received, in full or in part, if the tax advantage sought does not materialise (Government proposal HE 69/2019, rationale for section 13).

In principle, assistant services related to tax returns or the payment or refund of tax, such as assistance with an application for a refund of tax at source, do not fulfil the conditions for this hallmark, even if the representative’s fee is linked to a tax advantage. Services like this do not involve the planning or implementation of a reportable arrangement, but rather assisting a taxpayer in an administrative procedure. However, an application for a refund of tax at source can be part of the implementation of a reportable arrangement on the basis of another hallmark, such as with an application for relief from double taxation in several countries, as referred to in the hallmark in section 19 of the Act on Reportable Arrangements. Such a situation may also fulfil the hallmarks in section 13.

3.3.3 Standardised documentation and structures of the arrangement

An arrangement is reportable if it involves substantially standardised documentation or structures, and the arrangement is available to more than one relevant taxpayer without a need to be substantially customised for implementation, and the arrangement fulfils the conditions for the main benefit test (section 14).

In practice, this hallmark involves reporting of marketable arrangements that can be implemented by several taxpayers without a significant customisation. For marketable arrangements, please see section 2.5 of this instruction. Since this hallmark involves reporting of only arrangements that fulfil the main benefit test, merely the fact that a contract used in an arrangement is standardised does not make the arrangement reportable.

For instance, contacts that are typically used in the financial sector and largely standardised between a customer and a bank, such as housing loan agreements, do not usually fulfil the conditions of the test, since any tax benefit possibly achieved from said contracts is usually irrelevant in comparison with other benefits achieved with the agreements (Government proposal HE 69/2019, rationale for section 14). Similarly, use of ordinary standardised contracts in other sectors, such as ordinary agreements concerning trading in goods or services, does not generate a reporting obligation.

3.4 Specific hallmarks of the main benefit test

3.4.1 Use of losses

An arrangement is reportable if a person participating in the arrangement acquires a loss-making company, discontinues its main activity, and uses its losses in order to reduce their taxable income, including through a transfer of those losses to another country or jurisdiction or by the acceleration of the use of those losses and the arrangement fulfils the conditions for the main benefit test (section 15).

According to the government proposal, this hallmark refers to a situation in which a person participating in an arrangement acquires a loss-making company and discontinues its main activity in order to use the company’s losses to reduce their own taxable income. In this context, measures reducing the taxable income also include a transfer of losses to be used in another country or jurisdiction, and use of losses at an accelerated rate. ’Hallmark’ refers to a business transaction of an artificial nature whose objective is exclusively or almost exclusively to obtain a tax advantage. No clear time limit within which the acquired activity should be discontinued for the hallmark’s conditions to be fulfilled has been stipulated. However, the hallmark’s conditions are not fulfilled if the activity of the company acquired continues for several years after the acquisition. Considering the intended use of the hallmark and to prevent easy evasion of the hallmark, depending on the circumstances and the case, the hallmark’s conditions can also be deemed to be fulfilled in situations where the main activity of the loss-making company is discontinued before the future acquisition transaction. (Government proposal HE 69/2019, rationale for section 15)

Example 4

A is a profit-making company in country 1. B is a company located in country 1 that has a loss-making permanent establishment B PE in country 1. A acquires B. Due to the consolidated taxation system applied in country 1, A can utilise the losses of B PE situated in the same country against its own profits. The activities of B and B PE are discontinued after the losses have been utilised. This constitutes a reportable arrangement.

If the purpose of an acquisition between independent parties is to buy a competitor out of the market, and the main objective is not utilisation of losses, the case does not constitute a reportable arrangement, in principle.

3.4.2 Conversion of income

An arrangement is reportable if it has the effect of converting income into capital, gifts or revenue which are taxed at a lower level or exempt from tax and the arrangement fulfils the conditions of the main benefit test (section 16). According to the government proposal, this hallmark applies to, for instance, arrangements by which earned income is converted into capital income, income is converted into a gift or dividends are converted tax-exempt or to be taxed at a lower level (Government proposal HE 69/2019, rationale for section 16).

The applicability of the hallmark does not require that a tax advantage is generated in Finland. However if the taxpayer´s country of tax residence grants particular tax subsidies to the arrangement at hand in its legislation the arrangement is not reportable (Government proposal HE 69/2019, rationale for section 16).

According to the government proposal, measures that can be implemented in two or more alternative ways all in accordance with the tax law and its purpose and one of the alternatives is more tax efficient than the others, are not reportable even though the most efficient alternative would be chosen.(Government proposal HE 69/2019, rationale for section 16).

Example 5

A person who is a customer of a bank decides to invest in an equity savings account or insurance instead of making a direct equity investment, due to their more advantageous tax treatment. This constitutes a selection of a more advantageous alternative in terms of taxation, according to the purpose of the law, so the hallmark’s conditions are not fulfilled even if the case involves a cross-border situation.

Example 6

A Oy’s employee X, who lives in Finland, is sent for a specified period to work in subsidiary B that is located in another EU country. B pays the salary partly as monetary wages and partly as personnel benefits subject to a lower tax . The arrangement involves tax expenditures that have been specifically stipulated, so the hallmark’s conditions are not fulfilled.

Example 7

Parent company A that is resident in country 1 converts an interest-bearing receivable from a subsidiary resident in country 2 into the subsidiary’s equity. Instead of taxable interest income, A receives tax-exempt dividends. The hallmark of the conversion of income is applicable to the situation and the arrangement must be reported, if the main benefit test is fulfilled when evaluating the circumstances of the situation as a whole (for the main benefit test, see section 3.2).

3.4.3 Round-tripping of funds

An arrangement which includes circular transactions resulting in the round-tripping of funds, namely through involving interposed entities without other primary commercial function or transactions that offset or cancel each other or that have other similar features, and the arrangement fulfils the conditions for the main benefit test (section 17).

According to the government proposal, this hallmark is based on round-tripping of funds in order to obtain tax advantages. The hallmark refers to, first of all, arrangements that include circular transactions if they involve interposed entities without other primary commercial function. This refers to situations in which funds are circulated through another country with the purpose of bringing the funds within the scope of more advantageous tax treatment applicable to foreign investments. (Government proposal HE 69/2019, rationale for section 17). It also involves reporting of arrangements that include transactions which offset or cancel each other or that have other similar features. However, on the basis of this hallmark, an arrangement is reportable only when it fulfils the conditions for the main benefit test.

Example 8

The financing of a group operating in multiple countries is arranged so that the group’s parent company A located in country 1 acquires all of the group's external financing and finances group companies according to their needs. The loans for subsidiaries situated in countries 1, 2 and 3 are arranged so that A invests the capital needed in financing company B located in country 4 and B lends the funds to the subsidiaries. B has no other activity.

According to the provisions of country 4, a nominal interest deduction can be made on equity, so B does not pay tax on the interest income it receives from the subsidiaries. B further distributes the proceeds to A as tax-exempt dividends. By circulating the funds through country 4, the interest expenses deducted by the subsidiaries flow to A as tax-exempt, when they would have been A’s taxable interest income without such circulation. This arrangement fulfils the conditions for the hallmark in section 17 and is reportable.

Example 9

Group company D located in country 1 transfers funds to parent company E situated in country 2, which lends the funds back to company D. The circulated funds are regarded as a foreign investment in country 1. This arrangement fulfils the conditions for the hallmark in section 17 and is reportable.

3.5 Hallmarks related to cross-border transactions

3.5.1 Differences in tax treatment

An arrangement is reportable if it involves a deductible cross-border payment made between two or more associated persons if at least one of the following conditions occurs (section 18):

- the recipient is not resident for tax purposes in any country of tax jurisdiction;

- the recipient is resident for tax purposes in a country or jurisdiction, but

- that country or jurisdiction either does not impose any corporate tax or imposes corporate tax at the rate of zero or almost zero; or

- that country or jurisdiction is included in a list by the Council of the European Union as being a non-cooperative jurisdiction in tax matters or assessed by the Organisation for Economic Co-operation and Development (OECD) as being non-cooperative;

- the payment benefits from a full exemption from tax in the country or jurisdiction where the recipient is resident for tax purposes;

- with regard to this payment, the recipient may benefit from a specific tax relief in the country or jurisdiction where the recipient is resident for tax purposes.

However, the arrangement is reportable on the basis of the hallmarks in subsection 1, paragraph 2, point (a) and in paragraphs 3 and 4 only if it fulfils the conditions for the main benefit test.

According to the government proposal, differences in tax treatment mean that the recipient can deduct the payment in their taxation in one jurisdiction, but income corresponding to the deduction is possibly not taxed in the recipient’s country of tax recidence. The hallmark’s scope of application may include ‘hybrid arrangements’ referred to in the Council Directive (EU) 2017/952 amending Directive (EU) 2016/1164 as regards differences in tax treatment with third countries. However, in this provision differences in tax treatment are reviewed more broadly than in said Directive, and the hallmarks also refer to measures other than hybrid arrangements. (Government proposal HE 69/2019, rationale for section 18). The hallmarks’ scope of application does not include investments in foreign investment funds or partnership-type fund structures, because these investments are not regarded as deductible payments referred to in the provision. The fact that an investment can later be deducted from the investment’s redemption price when calculating capital gain is irrelevant in an evaluation of the applicability of this hallmark.

On the basis of the hallmark, it is necessary to report arrangements that involve deductible cross-border payments between two or more associated persons. In addition, at least one of the conditions laid down in paragraph 1–4 needs to ne fulfilled. The fulfilment of the main benefit test is also required with regard to paragraphs 2a, 3 and 4. With regard to these paragraphs, the conditions of the test are not fulfilled only because the conditions for said paragraph are fulfilled, instead the arrangement must also include other features indicating the seeking of a tax advantage (Government proposal HE 69/2019, rationale for section 18). With regard to paragraphs 1 and 2b, the arrangement needs not to fulfil the conditions for the main benefit test.

According to the Act on Reportable Arrangements, an ‘associated enterprice’ means a person who participates in the management of another person by being in a position to exercise a significant influence over the other person, a person who holds more than 25% of the voting rights of the other person, a person who has a direct or indirect holding of more than 25% in the other person, or who is entitled to 25% or more of the profits of another person (section 2, subsection 1, paragraph 8). All the persons who are in a relationship described above with the same person are regarded as associated enterprices.

Indirect participations is determined by multiplying the rates of holding through successive tiers. Any person who has a relationship referred to in said paragraphs with several persons is regarded as an associated person in terms of all these persons. If a person acts together with another person in respect of the voting rights or capital ownership of an entity, that person is deemed to hold a participation in all of the voting rights or capital ownership of that entity that are held by the other person. A person holding more than 50% of the voting rights is deemed to hold 100%. An individual, his or her spouse and his or her lineal ascendants or descendants shall be treated as a single person (Government proposal HE 69/2019, rationale for section 2)

The conditions for paragraph 1 in this hallmark are met when the recipient of a deductible payment is not a resident for tax purposes in any jurisdiction(section 18, subsection 1, paragraph 1). That can be due to recipient´s nature under civil law. The hallmark is met for example when there is a transparent unit and its owners located in the same jurisdiction are not taxed for the income of of the transparent unit.

The conditions for paragraph 2a of the hallmark are fulfilled when the recipient of the payment is a resident for tax purposes in a country, but the said country does not impose any corporate tax or imposes corporate tax at the rate of zero or almost zero, in practice less than one percent (Government proposal HE 69/2019, rationale for section 18). On the basis of this paragraph, An arrangement is reportable under this paragraph for example when a group company makes payments to another group company located in a country with a zero tax rate. However, such a payment must be reported only if the conditions for the main benefit test are fulfilled, i.e. a tax advantage is one of the main benefits in the arrangement that involves the payment. An arrangement must be reported when the reporting threshold is exceeded (see Chapter 7). Recurring payments related to the same arrangement need not be reported multiple times. Corporate taxation is usually collected based on a company’s profits, but it can also be collected based on the distribution of profit, as in Estonia. Payments made to an Estonian company are not generally reportable on the basis of this hallmark.

The conditions for the hallmark in paragraph 2b are fulfilled when the recipient is a resident for tax purposes in a country that is in the European Union´s or in the OECD´s list of non-cooperative jurisdictions (section 18, subsection 1, paragraph 2b). The list of non-cooperative jurisdictions refers to the European Union’s list on non-cooperative jurisdictions and to the OECD’s list List of Unco-operative Tax Havens concerning non-cooperative jurisdictions in tax matters. The purpose of the EU’s list is to promote good governance in the tax sector globally. On 5 December 2017, the European Council approved a list that includes countries and jurisdictions outside the EU that are not committed to amending their taxation in accordance with the good governance model. The OECD’s list includes countries and jurisdictions that are not committed to international transparency and exchange of information in tax matters. (Government proposal HE 69/2019, rationale for section 18)

In practice, there may be situations in which a tax-exempt entity acting as a financier, is associated due to the circumstances with the borrower, as referred to in this Act. The Nordic Investment Bank or the European Investment Bank are for example such entities that are stipulated to be tax-exempt. Such situations do not constitute arrangements referred to in regulation which may involve characteristics of tax avoidance or tax evasion. Therefore, cross-border payments related to the payment of such a loan where the recipient is such an entity or another similar entity are not regarded as reportable arrangements.

The conditions for the hallmark in paragraph 4 are fulfilled when a preferential tax regime may be applicable to a payment in the country where the recipient is a resident for tax purposes (section 18, subsection 1, paragraph 2). According to the government proposal, this concept is similar to the concept of “preferential tax regime” in Action 5 (Countering Harmful Tax Practices More Effectively, Taking into Account Transparency and Substance) concerning an evaluation of harmful tax competition and the improvement of the openness of tax system and taxation in the BEPS Action Plan. Preferential tax regime refers to the regulation diverging from the said country’s general tax system where the tax treatment on its basis is more beneficial than the general tax system. Preferential tax regime can be, for example, industry-specific or income type specific tax reliefs, such as a ‘patent box’ system or reliefs provided for foreign investments. (Government proposal HE 69/2019, rationale for section 18

Example 10

Company A located in country 1 pays a market-based service fee to group company B situated in a country with a zero tax rate. B carries out sales and marketing of products manufactured by the group in the country where it is located. This arrangement fulfils the conditions for section 18, subsection 1, paragraph 2a, but the arrangement must be reported only if it fulfils the conditions for the main benefit test.

Example 11

The ownership and the management of intangibles at a multinational enterprise is consolidated at a separate IP company. Company A located in country 1 has a license granted by the group’s IP company B to use intellectual rights. Country 1 is an EU Member State that has a 20 % corporate tax rate. IP company B is located in a third country that has a zero corporate tax rate. In order to avoid the 15 % tax at source applied to royalties in country 1, the group establishes company C in the EU Member State 2 where tax at source is not applied to royalties. The 15 % tax at source applied in country 1 is not imposed due to the Interest and Royalties Directive, when a royalty is paid to a subsidiary located in another EU Member State. Company C is licensing further the enterprise’s intangibles to the group companies operating in the EU countries. With this arrangement, the royalties flow from company A through company C to IP company B without tax at source. The royalty revenue is taxable income for company C, but since it can deduct the royalties it provides to the IP company, no significant taxable income is generated. Thus, almost no tax is imposed on the royalties deducted in country 1. This arrangement fulfils the conditions for section 18, subsection 1, paragraph 2a, and it must be reported if it fulfils the conditions for the main benefit test.

3.5.2 Deductions and exemption from double taxation in several countries or jurisdictions

An arrangement is reportable if (section 19):

- deductions on the same assets are claimed in more than one country or jurisdiction;

- relief from double taxation in respect of the same item of income or capital is claimed in more than one country or jurisdiction; or

- the arrangement includes transfers of assets and there is a material difference in the amount being treated as payable in consideration for the assets in those countries or jurisdictions involved.

A cross-border arrangement where the deductions are claimed on the same assets in more than one country or jurisdiction is reportable (section 19, subsection 1). According to the government proposal, the hallmark refers to situations where the countries related to the arrangement have different rules regarding the deductibility of the acquisition costs of assets which can lead to the same deduction being claimed twice or multiple times. This refers to differences in tax treatment, and this hallmark’s scope of application may include “hybrid arrangements” referred to in Council Directive (EU) 2017/952, if the case involves differences in tax treatment with third countries. The hallmark can also be applicable to other measures than hybrid arrangements. (Government proposal HE 69/2019, rationale for section 19)

The implementation of Directive (EU) 2017/952 in EU Member States eliminates deductions based on hybrid arrangements and claimed on two or more occasions in the taxation of companies located in Member States. At the planning and implementation phase of an arrangement, it is not necessarily clear how regulation based on Directive (EU) 2017/952 is applicable to the arrangement. Therefore, even such hybrid arrangements are, in principle, reportable arrangements when the conditions for the hallmark are fulfilled.

Example 12

Upon the leasing of a certain asset item, the right of deduction according to the provisions of country 1 belongs to the owner of the asset item (legal ownership) and according to the provisions of country 2 to the holder, or lessee, of the asset item (financial ownership). Company A located in country 1 provides a fixed asset item it owns for use by company B situated in country 2 with a leasing agreement. The acquisition cost of the fixed asset item is deducted as depreciation in both companies’ taxation, in company A’s taxation on the basis of legal ownership and in company B’s taxation based on financial ownership. This arrangement fulfils the conditions for the hallmark in section 18, paragraph 1 and is reportable.

According to the government proposal, on the basis of this hallmark no situations are reported in which the same deduction is made in the country where both a company’s permanent establishment and its head office are located, if the country where the head office is located taxes the income of the permanent establishment and eliminates double taxation with the credit method. In such a case, both the permanent establishment’s income and expenses are taken into account when calculating the head office’s taxable income, so the case does not involve only a double deduction of the assets (Government proposal HE 69/2019, rationale for section 19).

An arrangement is reportable if relief from double taxation is applied for the same income or capital in several countries (section 19, paragraph 2). According to the government proposal, this hallmark is applicable to, for example, “hybrid transfers” referred to in Council Directive (EU) 2017/952 where it may be possible to claim multiple credits of tax at source (Government proposal HE 69/2019, rationale for section 19). A situation in which a credit for foreign tax is applied for in the country where the permanent establishment is located and thereafter in the head office’s country of residence, when the credit method is applied in a tax treaty to eliminate double taxation, is not regarded as a reportable arrangement on the basis of this hallmark.

An arrangement that includes a transfer of assets from one country to another, and there is a material difference in the amount being treated as payable in consideration for the assets in those countries (section 19, paragraph 3). According to the government proposal, this involves a situation in which countries related to the arrangement value assets transferred in ways that differ from each other. This can lead to either double taxation or a situation where a transaction is not taxed in any country if the countries do not cooperate to agree on the amount payable for the assets transferred. For instance, when assets are sold to another country, it is possible that the original country where the assets are located and the country to which the assets would be transferred use different discount rates when calculating the net present value of proceeds obtained from the assets.

3.6 Hallmarks related to automatic exchange of information

On the basis of hallmarks related to automatic exchange of information, it is necessary to report arrangements that are related to avoidance or evasion of the obligation to inform concerning financial accounts at financial institutions (section 20). Provisions on these “CRS, DAC2 and FATCA obligations to inform” are available in sections 17a–17d of the Act on Assessment Procedure

Arrangements according to this provision are reportable if they lead to, or if they can be presumed to lead to, avoidance or evasion of the obligation to report financial account information, or if they can be presumed to be used to avoid or evade this obligation to inform, or if they utilise the lack of such provisions. Reportable arrangements include the following measures, for instance:

- Use of an account, product or investment that is not and which is not intended to a financial account but which has materially similar characteristics as a financial account. A ‘financial account’ refers to an account that is specified, in detail, in the regulation mentioned above and maintained by a financial institution.

- Transfer of financial accounts or assets to jurisdictions not bound by a demand for automatic exchange of financial account information with the country of residence of the relevant taxpayer, or use of such jurisdictions to otherwise avoid obligations imposed by regulation concerning automatic exchange of information referred to in this section.

- Measures by which income and capital are reclassified as products or payments to which automatic exchange of financial account information does not apply. However, a situation in which payments or products related to investing or financing, for instance, are kept in a financial account of a financial institution subject to the CRS and FATCA reporting obligation, or paid on the basis of such assets in the account, is not a reportable arrangement.

- Transfer of a financial institution, financial account or such assets to a financial institution, financial account or assets, or conversion into a financial institution, financial accounts or assets to which reporting under automatic exchange concerning a financial account does not apply.

- Use of legal subjects, arrangements or structures that eliminate or are intended to eliminate reporting by one or more account holders or controlling persons on the basis of automatic exchange concerning a financial account.

- Measures that undermine procedures concerning financial institutions’ obligation to identify their customers. The provision refers to procedures used in the fulfilment of obligations related to the reporting of information concerning a financial account. A reportable arrangement also includes measures that utilise deficiencies in such procedures.

Examples of arrangements reportable on the basis of this hallmark:

Example 13

Capital is transferred to a custody account in a jurisdiction that is not included in automatic exchange of information. In such a case, authorities in the account holder’s country of residence for tax purposes do not receive information about the custody account.

Example 14

A company that is not a financial institution pays its employees resident in another country their salary partly as company shares that are not kept in a custody account. In such a case, the shares fall in direct ownership of the employees, without participation of the custodial institution, so authorities in the employees’ countries of residence for tax purposes do not receive information about such assets.

Example 15

A person resident in EU Member State A establishes in country B outside the EU a professionally managed trust that is regarded as a financial institution according to the CRS standard, more precisely an investment entity, through which an entity or other financial institution manages investment activity on behalf of the other persons. The trust opens a financial account in EU Member State C. From Member State A’s perspective, country B would be a ‘non-participating country’ according to the CRS standard, but from C’s perspective a participating country, because there is a bilateral agreement between countries B and C on automatic exchange of CRS information. The bilateral agreement between countries B and C means that country C does not need to investigate, identify or report beneficial owners of the trust located in country B. This leads to a situation where the arrangement is not reported to the Member State A and Member State A does not receive information about the trust of the person resident there or the financial account related to it.

Example 16

Use of jurisdictions that have an inadequate or poor system for implementing legislation against money laundering, or which have inadequate requirements for openness concerning legal persons or legal arrangements.

The Act implementing the DAC2 Directive (The Act on amendment of the Act on the national implementation of provisions in the field of taxation in the Council Directive on administrative cooperation in the field of taxation and on repealing Directive 77/799/EEC, section 5c (185/2013)) provides for financial institutions’ obligation to report arrangements circulating the reporting of financial account information. For this reason, situations that fulfil the conditions for said provisions must be primarily reported by means of CRS/DAC2 and FATCA annual information returns. Arrangements that fulfil the hallmarks related to automatic exchange of information, which are reported in Finland in accordance with section 17a–17d of the Act on Assessment Procedure, in their entirety, with a FATCA, CRS/DAC2 annual information return, need not be reported as a reportable arrangement under the Act on Reportable Arrangements.

3.7 Beneficial owner

An arrangement reported on the basis of the hallmark concerning the beneficial owner includes measures due to which the legal or beneficial owner is not identified or by means of which identification has been made difficult. An arrangement is reportable if it involves a non-transparent ownership chain with the use of persons or structures (section 21):

- that do not carry on a substantive economic activity supported by adequate staff, equipment, assets and premises;

- that are incorporated, managed, resident, controlled or established in any country or jurisdiction other than the country or jurisdiction of residence of one or more of the beneficial owners of the assets held by such beneficial owners; and

- where the beneficial owners of these are made unidentifiable.

Thus the hallmark is applicable only when the beneficial owner or legal owner is concealed by means of an arrangement that simultaneously fulfils all the conditions listed in paragraphs 1–3 and this is known by any party submitting the notification. The reporting obligation does not involve any separate, new obligation to investigate.

3.8 Hallmarks concerning transfer pricing

An arrangement is reportable on the basis of the hallmarks concerning transfer pricing (section 22), if:

- it involves the use of unilateral transfer pricing provisions specific to a country or jurisdiction instead of generic transfer pricing provisions;

- it involves the transfer of hard-to-value intangibles between associated persons or rights in intangibles for which, at the time of the transfer:

- no reliable comparables exist; and

- at the time the transaction was entered into, the projections of future cash flows or income expected to be derived from the transferred intangible, or the assumptions used in valuing the intangible are highly uncertain; or

- the arrangement involves an intragroup cross-border transfer of functions, risks or assets, and the projected annual earnings before interest and taxes (EBIT), during the three-year period after the transfer, of the transferor or transferors, are less than 50% of the projected annual EBIT of such transferor or transferors if the transfer had not been made.

The fulfilment of hallmarks concerning transfer pricing (section 22) is evaluated independently. These hallmarks do not involve any measurement of the main benefit. An arrangement according to the hallmarks can be a reportable arrangement under the Act, even if transfer pricing adjustment in section 31 of the Act on Assessment Procedure cannot be applied to it.

3.8.1 Specific unilateral transfer pricing provisions

An arrangement is reportable if it involves the use of unilateral transfer pricing provisions specific to a country or jurisdiction instead of generic transfer pricing provisions (section 22, paragraph 1).

According to the government proposal, “specific transfer pricing provisions” refer to “safe harbour rules” that give a taxpayer an opportunity to apply terms agreed beforehand in the pricing of a group’s internal transactions instead of generic transfer pricing rules. Unilateral safe harbour rules of various countries are rules that have been accepted by only one country. “Generic transfer pricing rules” refer to the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations and rules according to these. On the basis of this hallmark, reportable arrangements are only those that are not in accordance with the OECD Transfer Pricing Guidelines and the arm’s-length principle.

Safe harbour rules are often created to facilitate taxpayers’ administrative obligations related to transfer pricing. On the basis of the rule, a taxpayer can use a simplified model for internal transfer pricing without preparing a benchmark study, for instance. The safe harbour rule can also exempt certain taxpayers or transactions from some or all generic transfer pricing provisions. Pricing according to the safe harbour rule is usually accepted automatically by the tax authority in the country where the provision is issued.

According to the OECD Transfer Pricing Guidelines (paragraph 4.103), safe harbours do not include administrative simplification procedures which do not directly involve determination of arm’s length prices. One example is simplification of the documentation obligation in transfer pricing. Safe harbour rules also do not refer to provisions concerning the advance pricing arrangement (APA) or undercapitalization. Thus, arrangements according to these provisions are not reportable under section 22, paragraph 1.

This hallmark covers only safe harbour rules unilaterally granted by a country, because they can increase the risk of tax planning and an opportunity for multiple instances of tax exemption. The section of law thus does not apply to safe harbour rules agreed between two or more countries. Arrangements that utilise other safe harbour rules than those concerning transfer pricing also are not reportable according to the section of law.

An arrangement is not reportable if the arrangement applies the OECD Transfer Pricing Guidelines and the transfer prices used are, in line with the Guidelines, proven to be at arm’s length even if the pricing used is also classified at the level indicated by the safe harbour rule.

Example 17

Foreign group company in country A is planning to give a loan to a Finnish group company. The amount of interest that is at arm’s length and deductible in the taxation of a Finnish company is specified by means of a benchmark study, in compliance with Finnish and the OECD Transfer Pricing Guidelines. Country A applies to such interest the safe harbour rule, according to which taxable interest income is lower than the arm’s length amount. This constitutes a reportable arrangement. After the implementation of the plan and the reporting of the arrangement, every interest instalment paid by a Finnish group company need not be reported on the basis of this hallmark.

Example 18

Group company X, which provides a Finnish company that is a member of the group with sales and distribution services, operates in country B and carries out sales and distribution activity. The arm’s length compensation received by X for the sales and distribution services is determined on the basis of an operational analysis according to the OECD Transfer Pricing Guidelines. The transfer pricing method selected is the transactional net margin method (TNMM). The profit level indicator is the mark-up rate calculated for costs of sales and distribution services, and its arm’s length level is determined with a benchmark study. The arm’s-length range of the mark-up rate calculated for the costs of the comparison companies engaged in routine-type sales and distribution services was 2.9–6.5 percent. The compensation received by X for services from the Finnish group company is calculated so that the mark-up rate for the costs is 3.5%. Country B also has a safe harbour rule according to which the acceptable mark-up rate for costs of sales and distribution services is 3–4%. The arrangement is not reportable.

3.8.2 Transfer of hard-to-value intangibles

An arrangement is reportable if it involves the transfer of hard-to-value intangibles or rights in intangibles between associated enterprices (section 22, paragraph 2). However, an arrangement is reportable only if both of the following conditions are fulfilled:

- There are no reliable comparables for intangibles or rights in intangibles at the time of their transfer; and

- At the time the transaction was entered into, the projections of future cash flows or income expected to be derived from the transferred intangible, or the assumptions used in valuing the intangible are highly uncertain.

The concept of ‘hard-to-value intangibles or rights in intangibles’ corresponds, in terms of its content, to the definition of paragraph 6.189 in the OECD Transfer Pricing Guidelines. According to paragraph 6.190 of the OECD Transfer Pricing Guidelines, an intangible can be hard to value, for instance, when the intangible is only partially developed at the time of the transfer, or the intangible is not expected to be exploited commercially until several years following the transaction. Although the concept of ‘hard-to-value intangibles or rights in intangibles’ corresponds, in terms of its content, to the definition of paragraph 6.189 in the OECD Transfer Pricing Guidelines, reporting the arrangement according to section 22, paragraph 2 of the Act still does not necessarily mean that the arm’s length price of intangibles or rights in intangibles is determined according to section D.4. In Chapter VI of the OECD Transfer Pricing Guidelines.

A ‘transfer’ refers to all cross-border assignment of intangible or rights in intangibles, such as trading or licensing. In this section, a ‘transfer’ also refers to assignment without consideration, such as the granting of a free right of use.

Associated persons are defined in section 2, paragraph 8 of the Act on Reportable Arrangements (see section 3.5.1). This definition of ‘association’ differs from the definition of an association according to section 31 of the Act on Assessment Procedure, for example. Thus, reportable arrangements can also be ones that would not be regarded as associated transactions under section 31 of the Act on Assessment Procedure.

An arrangement is not reported if the price of the intangibles transferred can be determined on the basis of reliable comparables. Reliable comparables can be comparable transactions according to the comparable uncontrolled price method (CUP). Comparability is evaluated according to the OECD Transfer Pricing Guidelines. External comparables found with a database search can also serve as reliable comparables if they fulfil the conditions for comparability. In this context, the value of an intangible determined on the basis of other transfer pricing methods does not mean a reliable comparable.

An arrangement is not reported if the value of the intangibles transferred can be determined reliably, on the basis of transfer pricing or value determination methods. Forecasts concerning cash flows and income used in this context or other assumptions used in the assessment cannot be highly uncertain, however. Section D.3. in Chapter VI of the OECD Transfer Pricing Guidelines can be used to help with the interpretation of an assessment of such uncertainty.

Example 19

Finnish B Oy operates as the manufacturing company of foreign group company C. C has developed an ABC product that has potential especially in the European market. C is planning to license the product's manufacturing, sales and marketing rights to two independent manufacturers in central Europe and to B Oy. An exclusive market area is determined for every licensee. The main terms and conditions of the licence agreements signed by C will be similar between all licensees. After the agreements have been signed, the licensees will begin to independently manufacture, market and sell ABC products and to pay royalties to C. The rights licensed by C to the independent parties serve as reliable comparables of the royalties paid by B Oy to C. This does not constitute a reportable arrangement.

Example 20

Finnish A Oy that operates in the software sector acquired the capital stock of foreign start-up company B. Soon after acquiring the shares, A Oy is planning to acquire B’s registered and unregistered intangibles and to sign a contract product development agreement with B.

B had attracted a great deal of media attention even before the acquisition of the shares, but there were highly diverging views of its future among analysts monitoring the marketplace, for instance. Some analysts believed that the products developed by B had not future potential. Estimates by B’s management of its future turnover and profits, on the other hand, were highly optimistic.

Generally speaking, forecasts concerning income streams produced by B’s business operations and intangibles can be regarded as highly uncertain. However, A Oy and its tax specialist estimate that the value of the intangibles transferred can be determined reliably. In the tax specialist’s view, the acquisition price of the shares describes the value of the business operations where the intangibles were under B’s ownership. The value of the intangible can thus be determined on the basis of the sale price, taking into account, for example, adjustments needed on the basis of the remaining operation and any other adjustments. In this situation, the sale price of the intangibles transferred is based on a reliable comparable. This does not constitute a reportable arrangement.

Example 21

Finnish A Oy, which is part of group B, has been developing a pharmaceutical product that is estimated to have significant commercial potential in the future. However, such development is still in the early stages and completing the development of the product and commercializing it still requires significant investment, such as testing, marketing, and additional financing. A Oy has been developing the product independently and at its own risk. A Oy owns all the intangibles related to the product.

A Oy is planning to sell the registered and unregistered intangibles related to the product to foreign group company B. B would pay A Oy a lump sum as compensation. In addition, B would sign a contract product development agreement with A Oy, after which A Oy would operate only as a contract product developer.

Since the case involves intangibles that have been only partially developed and which is not expected to produce income until several years following the transaction, there probably are no reliable comparables for the intangibles transferred. Furthermore, the cash flows expected to be derived at the time of the transfer are highly uncertain. On the basis of what is stated in the OECD Transfer Pricing Guidelines (e.g. Chapter VI, section D.3.), it can be interpreted that, in a similar transfer of intangibles, independent parties could have agreed on terms of contract, such as price adjustment clauses. This constitutes a reportable arrangement.

Example 22

Foreign group company J licenses manufacturing technology it owns and has patented to parties both within and outside the group. Finnish A Oy, which is a member of the same group with J, has developed products that are believed to have significant market potential in the future. A Oy estimates that it could improve the manufacturing technology owned by J to suit its own manufacturing process. A Oy is planning to acquire a license for the manufacturing technology from J, but on different terms and conditions than the ones J has used in its other license agreements. For instance, A Oy would have the possibility to further process the technology, unlike the other licensees.

Upon the planning of the arrangement, the level of the royalty charged by J to A Oy is determined on the basis of general value determination theories, such as by using highly optimistic global turnover forecasts and expected returns for the products manufactured by A Oy. In the forecasts, the products are expected to become commercialized only three years after the licence agreement has been signed. In addition, the forecasts prepared extend to more than ten years into the future. The price of the royalty specified on the basis of value determination is significantly higher than in the licence agreements signed by J with third parties. In this case, it is not likely that J’s external licence agreements could be regarded as reliable comparables under section 22, paragraph 2. If both conditions in section 22, paragraph 2 are fulfilled, this constitutes a reportable arrangement.

3.8.3 Transfer of intragroup functions, risks or assets

A cross-border transfer of intragroup functions, risks or assets is a reportable arrangement (section 22, paragraph 3). However, an arrangement need not be reported to the Tax Administration if the arrangement does not fulfil the “EBIT test” specified in the provision. EBIT projections are used to evaluate whether the projected annual EBIT, during the three-year period after the transfer, of the transferor or transferors, is less than 50% of the projected annual EBIT of such transferor or transferors if the transfer had not been made.

This hallmark involves the reporting of arrangements that are described in Chapter IX of the OECD Transfer Pricing Guidelines. According to the government proposal, the purpose of the hallmark is to include in the sphere of reporting cross-border business restructuring that would result in the transferring taxpayer losing a significant share of their earning potential.

The Directive, the Act or the government proposal does not specify what the term “intragroup” means with regard to this hallmark. In this context, it is thus possible to use the definition that is in line with section 31, subsection 2 of the Act on Assessment Procedure and is relevant for transfer pricing.

In order to establish the reporting obligation, it is necessary to prepare annual EBIT projections for the three years following the transfer. The earnings before interest and taxes (EBIT) according to the hallmark is in line with the separate company’s income statement, and the same as the operating profit. If a separate lump-sum or running compensation is paid to the transferor for a transfer referred to in paragraph 3, the compensation is eliminated from the EBIT projections calculated for the three years following the transfer.

In this section, ‘year’ refers to the taxpayer’s tax year. Therefore, if a transfer is made on 30 September 2020 and the taxpayer’s tax year is the calendar year, the three following years referred to in this section are tax years 2021–2023.

Only arrangements that are material with regard to transfer pricing are reportable. Tax-neutral corporate restructuring, such as cross-border mergers, are not reportable on the basis of this hallmark. Sales of shares in subsidiaries also need not be reported on the basis of this hallmark.

Example 23

A Finnish company develops, manufactures and sells a product in its own name and on its own account. The company’s functions are restructured such that certain functions, assets and risks of the company are transferred to a group company located in another country. The Finnish company is not paid any compensation for the functions, assets and risks transferred. After the transfer, the Finnish company’s annual EBIT is projected to be 10 million euros for the following three years. If the transfer had not been made and if business had been carried on as previously, the estimated annual EBIT would have been 25 million euros. The projected annual EBIT in the three years following the transfer would thus be less than 50% of the projected profit without the transfer. This constitutes a reportable arrangement.

Example 24

Finnish A Oy manufactures and sells products to sales companies in the same group and to distributors outside the group. The company develops its products independently and maintains their competitiveness with further development, when necessary. The company is also responsible for marketing and sales efforts. The company owns the intangibles related to its operation (e.g. patents, trademarks, and competence related to the production process). The multinational group enterprise now plans to centralize its business operation in a new way. A key role would in the future be given to ‘B’, a foreign group company that starts acting as a principal, making important business decisions regarding sales, product manufacture, product lines and related research & development. B would sign service contracts with A Oy on product development, manufacturing and sales functions, and A would receive cost plus-based compensation. In the future, B would sell the products to the group’s sales companies and distributors outside the group. A Oy and B would not sign a separate agreement on the transfer of functions, assets and risks from A Oy to B. B would pay A Oy separate compensation totalling 1,500,000 euros over the five following years (300,000 euros/year). A Oy’s annual EBIT before the arrangement was approximately 900,000 euros, which is estimated to be realised in the following three years without the arrangement. A Oy’s annual EBIT after the arrangement is projected to be approximately 250,000 euros in the following three years, when the separate compensation (300,000 euros/year) is not taken into account in the projections. The arrangement is reportable.

4 Service provider’s obligation to inform

4.1 Service provider

A ‘service provider’ is a person that designs, markets, organises or makes available for implementation or manages the implementation of a reportable arrangement. A service provider is also a person that knows or could be reasonably expected to know that they have undertaken to provide, directly or by means of other persons, aid, assistance or advice with any of the above (provider of assistant service) (section 2, subsection 1, paragraph 4). A service provider can be a natural person, legal person, an association of persons, or any legal arrangement. However, a natural person is a service provider only if s/he acts for the purpose of earning income in relation to the arrangement.

Example 25

When a company that provides tax services has signed an assignment contract concerning a reportable cross-border tax planning arrangement with another company or a natural person, the company providing tax services is a service provider subject to a reporting obligation.

The party with an obligation to inform is always the company providing the services. The company’s employees, who manage the assignment in practice, are not personally in the position of a service provider.

Only Finnish service providers are subject to an obligation to submit notifications on reportable arrangements in Finland (section 17e of the Act on Assessment Procedure). A service provider is Finnish when at least one of the following conditions is fulfilled (section 1, subsection 1, paragraphs 4–5):

- the service provider is resident for tax purposes in Finland

- the service provider provides services related to a reportable arrangement from a permanent establishment located in Finland

- the service provider is incorporated in Finland

- the service provider is governed by the laws of Finland

- the service provider is registered with a professional organisation or association related to legal, taxation or consultancy services in Finland.

4.1.1 Designer, marketer, organiser

A service provider is a person who is responsible for designing a reportable arrangement (section 2, subsection 1, paragraph 4). A person is deemed to be responsible for designing an arrangement at least when the person includes in the arrangement a feature that fulfils any of the conditions for the hallmark laid down in Chapter 3 of the Act on Reportable Arrangements.