International tax dispute resolution procedure

Key terms:

- Date of issue

- 7/1/2019

- Validity

- 7/1/2019 - 3/23/2022

This is an English translation. The original guidance (record no. VH/2006/00.01.00/2019) is drafted in Finnish and Swedish languages. In case of divergence of interpretation, the versions in the two official languages, Finnish and Swedish, will prevail.

This guide concerns mechanisms of dispute resolution and, in particular, the resolution of tax disputes by means of a mutual agreement procedure. The procedure is based on the Finnish Act on the international tax dispute resolution procedure (Laki kansainvälisten veroriitojen ratkaisumenettelystä (530/2019)) and the Finnish Government Decree on the international tax dispute resolution procedure (Valtioneuvoston asetus kansainvälisten veroriitojen ratkaisu-menettelystä (661/2019)), which entered into force on 30 June 2019 and transposed the Council Directive (EU) 2017/1852 on tax dispute resolution mechanisms in the European Union into Finnish law.

After the entry into force of the national provisions, there are three alternative forms of the mutual agreement procedure available in Finland. This guide covers all the three forms.

Section 3.4 of this guidance has been updated on 1 June 2021 as the address for the secure mail service has changed. This change does not affect the functionality of the service.

1. Foreword

Taxpayers can ask for a mutual agreement procedure (MAP) to be initiated if they find them-selves taxed contrary to the provisions of a tax treaty. This guide describes the circumstances where a MAP can be initiated, and provides guidance on instituting the proceedings. The guide also describes the course of the procedure and the stages of the process on a general level.

The Council of the European Union issued a Directive on tax dispute resolution mechanisms in the European Union (2017/1852, “EU Dispute Resolution Directive”) on 10 October 2017. Finland implemented the legislative changes required to comply with the EU Dispute Resolution Directive by enacting a new law called the act on the international tax dispute resolution procedure (Laki kansainvälisten veroriitojen ratkaisumenettelystä (530/2019)), which entered into force on 30 June 2019, and by introducing certain amendments to existing laws.

Since the entry into force of the act on international tax dispute resolution procedure, there are three alternative forms of the MAP available in Finland:

- a procedure based on the EU Dispute Resolution Directive and the act on international tax dispute resolution procedure (EU-level MAP);

- a MAP based on a tax treaty between Finland and another country; and

- a MAP based on the Union Arbitration Convention in the context of disputes over transfer pricing and the attribution of profits to permanent establishments.

This guide focuses primarily on the first alternative, i.e. the EU-level MAP. Should any section of the guide only apply to one of the procedures, this will be clearly indicated.

The act on international tax dispute resolution procedure covers the procedure prescribed in the EU Dispute Resolution Directive in its entirety, in addition to which the national law contains some provisions that are applicable to other MAPs. To put it simply, the EU-level MAP and the procedure based on the Union Arbitration Convention are largely analogous and standardised between different countries, whereas processes derived from tax treaties and the associated rules (e.g. in terms of time limits) vary according to the applicable treaty and the associated MAP.

A MAP refers to negotiations between the competent authorities of two or more countries or comparable jurisdictions that are initiated at a taxpayer’s request. Due to the nature of the procedure, the taxpayer’s chances of influencing the case after filing their MAP request are limited. Nevertheless, the taxpayer may, depending on the chosen procedure, be called upon to take action, especially in the form of supplying additional information, initiating arbitration proceedings, and confirming their acceptance of the outcome of the case. These stages of the process are described in more detail below.

The aim of the negotiations is to find a way to eliminate any taxation that is contrary to the provisions of the applicable tax treaty. For example, one or more states can agree to not tax a taxpayer’s income or a part of their income or to otherwise adjust the amount of tax payable so as to comply with the provisions of the tax treaty. If agreement cannot be reached, the case can, in certain circumstances, be settled by arbitration.

In the context of a MAP, ‘competent authority’ means the authority of a country that has been authorised by that state to negotiate with the competent authorities of other countries. The competent authority designated by Finland is the Finnish Tax Administration, on the basis of section 88 of the Finnish act on assessment proce¬dure (Laki verotusmenettelystä 1558/1995) and the provisions of the majority of the tax treaties entered into by Finland. The Finnish Ministry of Finance can, in special circumstances, act as the competent authority instead of the Finnish Tax Administration, if the applicable tax treaty so stipulates or if the case concerns an important matter of principle.

This guide is based on the assumption that the competent authority is the Finnish Tax Administration. The Finnish Tax Administration is the body to which all MAP requests are initially sent, and any cases that fall within the mandate of the Ministry of Finance are referred to the Ministry by the Finnish Tax Administration ex officio.

No fee is payable by the taxpayer for the proceedings in Finland, but they must bear their own costs. Fees or charges may be payable in other countries.

2. Premises of the MAP

2.1. Relationship between a MAP and a national appeal procedure

Taxation contrary to a tax treaty can be eliminated by submitting an appeal to a national authority, either in Finland or in another country. Alternatively, the taxpayer can ask that a MAP be initiated. Tax decisions contrary to tax treaty can also be eliminated by applying for a refund of amounts withheld (withholding tax); this step should be taken before an appeal is submitted to a national authority or before a MAP is requested. If a taxpayer’s tax liability has been adjusted in another country in a manner that affects their tax liability in Finland, the taxpayer can also request a so-called consequent tax adjustment to account for the change (§ 75, act on assessment proce¬dure (Laki verotusmenettelystä 1558/1995)). It is up to the taxpayer to choose which legal remedies they wish to pursue in order to eliminate the taxation contrary to the provisions of the applicable tax treaty.

National appeal procedures and the MAP are not mutually exclusive in Finland, and the taxpayer can pursue both a national appeal procedure and a MAP simultaneously. The Finnish Tax Administration can acknowledge a MAP request even while national appeal proceedings are in progress, but the negotiations will not be initiated until those proceedings have been concluded. In other words, the competent authorities will not engage in negotiations, and the time limit set for the negotiations does not run, until the national appeal proceedings have finished. However, in the context of the EU-level MAP, if the Tax Recipients’ Legal Service Unit has appealed the case, the MAP can go ahead regardless of such appeal.

Taxpayers should also bear in mind that the competent authorities have the right to deviate from judgments delivered by national courts in appeal proceedings. This applies to all court decisions, and the MAP may therefore change a taxpayer’s tax liability, even if the case has been settled, for example, in the Supreme Administrative Court of Finland.

As soon as a MAP has been initiated, the competent authority evaluates whether any taxation contrary to the provisions of the applicable tax treaty can be eliminated by a unilateral decision without having to engage in negotiations with another country (see section 4.3). Regardless of the circumstances, the taxpayer always has the right to both file a national appeal and pursue a MAP.

However, the MAP limits the use of national remedies to the extent that the MAP reaches a solution. Such decisions are only binding if the affected person agrees to the changes and renounces their right to all other remedies as well as drops any pending appeal proceedings.

The initiation of a MAP does not limit a taxpayer’s right to file a national appeal per se, and appeal proceedings can therefore be brought even while a MAP is in progress. However, the initiation of national appeal proceedings stops the MAP negotiations and suspends any time limit, set for the negotiation stage of the MAP, for as long as the national proceedings are in progress. It is the taxpayer’s responsibility to promptly notify the competent authorities of any initiation of national appeal proceedings if a MAP was initiated before the national appeal was filed.

National appeal proceedings and other tax-related claims made by taxpayers do not have an impact on the time limit set for submitting a MAP request. The time limit must be followed regardless of whether or not the taxpayer in question chooses to exercise their right to file an appeal on a national level.

In some cases, filing a national appeal either in Finland or in another country can prevent the arbitration stage of the MAP or even the entire MAP, due to interpretations, reservations or laws observed in the other country. It is the taxpayer’s responsibility to find out about the interpretations of the other country and to ensure that their rights are not affected by national appeal proceedings preventing a MAP.

2.2. Effect of a MAP on the imposition and collection of tax

The collection of taxes levied in Finland cannot be suspended on the basis of an ongoing MAP, because the proceedings do not satisfy the criteria for stays of execution laid down in section 12 of the Finnish Act on the Enforcement of Taxes and Public Payments. However, a pending MAP does not affect a national court's discretion in suspending the collection of tax in connection with national appeal proceedings.

Tax receivables can also be collected on the basis of Article 14, paragraph 4 of Council Directive 2010/24/EU of 16 March 2010 concerning mutual assistance for the recovery of claims relating to taxes, duties and other measures: “If a mutual agreement procedure has been initiated by the competent authorities of the applicant Member State or the requested Member State, and the outcome of the procedure may affect the claim in respect of which assistance has been requested, the recovery measures shall be suspended or stopped until that procedure has been terminated, unless it concerns a case of immediate urgency because of fraud or insolvency”.

2.3. Disputes that are resolvable through a MAP

The aim of a MAP is to eliminate any taxation that is not in line with the provisions of the applicable tax treaty. For a case to be eligible for the MAP, it must genuinely involve a question on the applicability of a tax treaty or the Union Arbitration Convention and an associated conflict of interpretations.

In the rare cases where Finland does not have a tax treaty with another EU Member State, a conflict of interpretations may arise in respect of the provisions of the Union Arbitration Convention. In such exceptional circumstances, a case can therefore be eligible for the MAP even when there is no tax treaty. In the interests of simple terminology, however, this guide does not always mention the Union Arbitration Convention separately as the tax treaty or tax convention that is being interpreted, and instead the concept of ‘tax treaty’ also covers the Union Arbitration Convention.

Because a MAP always involves at least one other country in addition to Finland, access to the MAP may be prevented by limitations, reservations or local laws observed in the other country, especially in MAPs that are subject to a tax treaty.

2.4. Alternative forms of the MAP

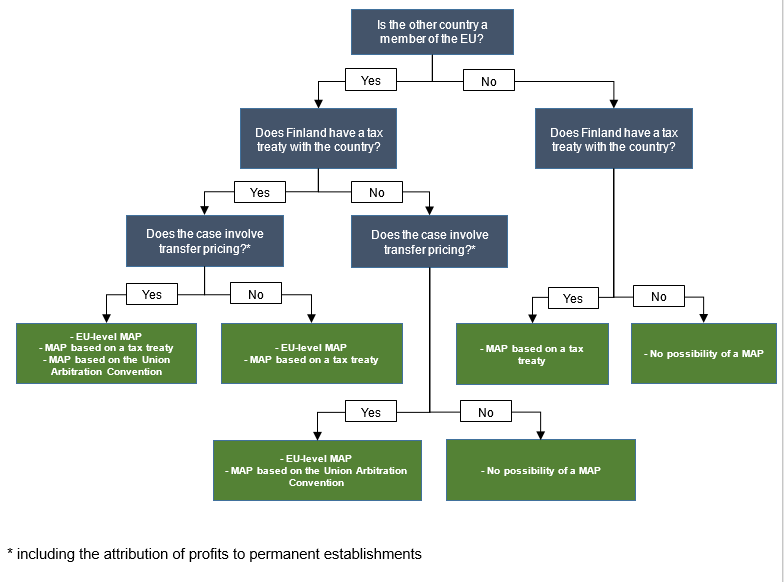

There are two alternative forms of the MAP available for resolving disputes involving EU Member States, and three alternatives in the context of disputes over transfer pricing:

- a procedure based on the EU Dispute Resolution Directive;

- a procedure based on a tax treaty between Finland and the other country; and

- a procedure based on the Union Arbitration Convention (90/436/EEC) in the context of disputes over transfer pricing and the attribution of profits to permanent establishments.

A MAP based on a tax treaty is the only alternative in cases that involve Finland and a country that is not a member of the European Union, and only if Finland and the country in question have a tax treaty in force.

If the other country involved in the dispute is an EU Member State with which Finland does not have a treaty, a MAP is an option only if the dispute concerns transfer pricing or if it concerns the attribution of profits to permanent establishments. Other kinds of tax disputes are not resolvable through a MAP in the absence of a tax treaty even if the other country is an EU Member State.

The available alternatives therefore depend on the nature of the dispute, on the existence of a tax treaty with Finland, and on the EU membership status of the country or countries involved.

Only one alternative can be chosen, and it is the taxpayer’s responsibility to pick the one that best serves their interests. If the taxpayer requests an EU-level MAP, priority is given to that procedure, and all other MAPs involving the same dispute are terminated pursuant to section 2, subsection 3 of the act on international tax dispute resolution procedure. It is up to the taxpayer to compare the different alternatives and choose the one that promises to be the most effective and best-suited to their aims.

DIAGRAM: Alternatives to choose from in different circumstances

There are both similarities (such as the fact that the authority competent to negotiate with the other country is usually the Finnish Tax Administration) and differences (such as the time limits for making the MAP request and the role of any Dispute Resolution Commission or Advisory Commission) between the alternatives. The main characteristics of the various forms of the procedure are described below. It is worth noting that the choice of process only affects the proceedings through which the authorities attempt to eliminate any taxation that has not been in line with the provisions of the applicable tax treaty. In other words, the process that has been chosen does not have an impact on how the tax substance is interpreted.

2.4.1. EU-level MAP

The EU-level MAP is based on Council Directive (EU) 2017/1852 of 10 October 2017 on tax dispute resolution mechanisms in the European Union (“EU Dispute Resolution Directive”), which has been transposed nationally in Finland by a law designated as the act on the international tax dispute resolution procedure (Laki kansainvälisten veroriitojen ratkaisu-menettelystä (530/2019). This act covers the EU-level MAP in its entirety, but also contains some provisions that are applicable to other MAPs.

The EU-level MAP is used to resolve disputes between EU Member States that have treaties in force, or used to resolve disputes about transfer pricing. The EU Dispute Resolution Directive applies to MAP requests submitted after 1 July 2019 that relate to a tax year commencing on or after 1 January 2018. However, the competent authorities of the Member States concerned can, on a case-by-case basis, agree to apply the Directive on a MAP request concerning an earlier tax year.

2.4.2. MAP based on a tax treaty

Article 25 of the OECD Model Tax Convention on Income and Capital deals with the MAP. Most of the tax treaties that Finland has negotiated and concluded with other countries are consistent with the OECD Model Tax Convention, but each is nevertheless unique. It is therefore important for any taxpayer who is seeking a MAP based on a tax treaty to check the applicable provisions of the treaty in question, especially in respect of any time limits.

Finland’s existing tax treaties do not currently provide for arbitration proceedings, i.e. the setting up of a Dispute Resolution Commission, in the context of a MAP based on a tax treaty. The OECD has co-ordinated the drafting of a Multilateral Convention that modifies existing tax treaties so as to also enable the setting up of a Dispute Resolution Commission to deal with a MAP based on a treaty. Finland adopted the Convention on 1 June 2019. However, the Convention will only apply after it has become valid for the other Contracting State of a treaty. The OECD keeps a list of signatories and parties to the Convention that shows the status of each country in real time.

2.4.3. MAP based on the Union Arbitration Convention

EU Member States are subject to an intergovernmental Convention on the elimination of double taxation in connection with the adjustment of profits of associated enterprises (90/436/EEC, “Union Arbitration Convention”). The Union Arbitration Convention only applies to cases that involve transfer pricing and the attribution of profits to permanent establishments, and a MAP based on the Convention is therefore only available to businesses that have incurred double taxation in connection with the adjustment of transfer pricing or profits of associated enterprises in an EU Member State. In addition to the nature of the dispute, the Union Arbitration Convention also limits the scope of the procedure to EU Member States.

The fact that a procedure based on the Union Arbitration Convention is only available in the case of disputes that involve transfer pricing does not prevent these kinds of disputes from being resolved through another kind of MAP. It is still the taxpayer’s responsibility to choose the procedure through which they want the competent authorities to resolve their case.

3. Drafting and submission of MAP requests

3.1. Format and content of a MAP request

A MAP can only be initiated at the affected person’s specific request. The Finnish Tax Administration has not prepared a template for MAP requests, and there are consequently no formal requirements as long as the request contains at least the information specified in the act on international tax dispute resolution procedure. For example, a simple mention of a taxpayer’s intention of pursuing a MAP in a reply or some other document submitted to the Finnish Tax Administration does not satisfy the legal requirements.

MAP requests can be made in Finnish, Swedish or English. The Finnish Tax Administration recommends using English. Submitting the request and any supporting documents in English speeds up the processing of the case and reduces the risk of mistranslations.

Requirements for the content of MAP requests are laid down in section 3 of the act on international tax dispute resolution procedure, which includes a list of the information to be provided. The same rules apply to all forms of the MAP. Consequently, the request must satisfy the criteria laid down in the law, regardless of the chosen procedure. Compliance with the content requirements is what matters; the title and structure of the document do not need to be identical to the list provided in section 3, subsection 1 of the act on international tax dispute resolution procedure. For example, any formal requirements laid down in the laws of the other country involved can be observed instead. In other words, a MAP request cannot be rejected on the basis of its title or structure deviating from the list provided in section 3, subsection 1 of the act on international tax dispute resolution procedure.

Pursuant to section 3, subsection 1 of the act on international tax dispute resolution procedure, MAP requests must contain the following information:

1. the procedure pursued within the meaning of section 1 [of the act on international tax dispute resolution procedure];

2. the country/countries involved in the dispute;

3. personal details of the affected person and any other interested parties;

4. the tax years in question;

5. the facts and circumstances of the case, the nature of the actions giving rise to the dispute, dates and monetary amounts as well as copies of any relevant documents;

6. the applicable national rules and the applicable tax treaty or convention within the meaning of section 1;

7. the following explanations and copies of supporting documents:

a) an explanation as to why the affected person considers that there is a question in dispute;

b) details about any appeals, court proceedings and decisions relating to the dispute;

c) a commitment to respond as completely and quickly as possible to all appropriate requests made by a competent authority and to provide any documentation at the request of the competent authorities;

d) a copy of the final tax assessment and, where necessary, copies of other documents issued by the tax authorities with regard to the question in dispute; and

e) details about any other MAPs initiated pursuant to the tax treaty or convention referred to in section 1 in relation to the dispute and a commitment by the affected person to comply with section 2, subsection 3; as well as

8. any specific additional information requested by the competent authorities that is considered necessary to undertake the substantive consideration of the case.

Failure to satisfy the content requirements outlined above can affect the taxpayer’s legal rights because the Finnish Tax Administration can only accept MAP requests that meet the legal requirements, and only in so far as the taxpayer is able to provide any additional information requested by the Finnish Tax Administration. The Finnish Tax Administration has the right to deny requests for an EU-level MAP that do not contain all the necessary information on the basis of section 6 of the act on international tax dispute resolution procedure; however, the Finnish Tax Administration’s first course of action in such cases is to ask the taxpayer to provide additional information for their request.

The following paragraphs explain the content requirements in more detail.

3.2. Detailed content requirements

3.2.1. The procedure pursued

The request must specify the procedure pursued by the taxpayer. The alternatives are as follows:

- an EU-level dispute resolution procedure;

- a procedure based on a tax treaty between Finland and another country; and

- a procedure based on the Union Arbitration Convention (only in the case of disputes over transfer pricing).

Reasons for the choice of procedure need not be given. Identifying the chosen procedure clearly – in the title of the document or at the very beginning of the request, for example – helps the authorities in initiating the correct procedure as fast as possible.

If the chosen procedure makes arbitration proceedings possible and the affected person already knows that they want to take advantage of the opportunity, this should ideally be mentioned in the request. The affected person can express their interest in arbitration proceedings, for example, in connection with specifying their chosen procedure.

3.2.2. The country or countries involved in the dispute

The request must specify the other country involved in the dispute and any other countries that may have an interest in the case, as well as whether a MAP request has also been submitted in any other countries.

3.2.3. Personal details of the affected person and any other interested parties

The request must identify the affected person. If there are other interested parties (such as enterprises belonging to the same group of companies), their details must also be provided.

The following personal details suffice:

- Name

- Business ID or personal identity code as well as any tax registration number or personal identity code issued in another country; individuals who live abroad and who do not have a Finnish personal identity code should include their date of birth, gender and any tax registration number or personal identity code issued to them in their home country

- Address

- Telephone number and/or email address

- Name and correspondence address of the affected person’s attorney (where applicable)

If the taxpayer is part of a group of companies, any codes used in internal communications or other internal identifiers can be provided in order to make it easier to differentiate between business entities in the group’s internal documentation or other documentation.

3.2.4. The tax years in question

The request must clearly indicate the tax years to be covered by the MAP. The authorities will only consider the years indicated by the affected person and only if the request arrives on time and satisfies the legal requirements otherwise.

The MAP is a voluntary process for taxpayers, which is why the affected person is free to limit their MAP request to specific tax years even if they have been taxed contrary to the provisions of the applicable tax treaty during other tax years as well.

3.2.5. A description of the dispute

The request must include a general description of what the dispute concerns. A simple and concise description suffices if the case is straightforward. On the other hand, if the details of the case are complex or ambiguous, it is important to describe the relevant facts and circum¬stances in sufficient detail. A detailed description of the dispute and the underlying facts reduces the need for the authorities to request additional information afterwards, preventing delays.

The description must cover the facts and circumstances of the case, such as the nature of the contested transaction and/or the taxed income. The description must also include information about the affected person’s role in the transaction and the relationship between the affected person and other parties to the transaction.

Example 1: A Finnish taxpayer’s income from abroad has, on the basis of a tax treaty, been treated as business income in Finland and as royalties in the source country, which has resulted in the taxpayer’s having been taxed contrary to the provisions of the treaty. The MAP request should explain the nature of the income.

Example 2: A Finnish individual has been deemed to reside in both Finland and in another country on the basis of a tax treaty, as a result of which the taxpayer’s income from Finland has been taxed in both countries. The MAP request should describe the circumstances of the case in as much detail as possible in order for the authorities to be able to determine the taxpayer’s country of residence for treaty purposes, and to determine the nature of the income received.

The request must also explain the nature of the actions giving rise to the dispute and the relevant dates. ‘Action’ refers to, for example, the taxpayer’s earnings or capital and the tax payable on the same as well as the Finnish Tax Administration’s actions by which tax has been levied, such as an adjustment decision. Detailed information must also be provided about any income that has been included in the taxpayer’s taxable income in another country as well as of the tax charged in that country, including the related amounts in the local currency and information about the applicable local rules.

In some countries, taxpayers can enter into mutually binding agreements with the tax authorities. Such agreements may relate to the outcome of a tax audit, or to what should be deemed as the facts of a case. If the affected person has entered into such an agreement with the tax authorities of another country, the MAP request must contain a reference to the agreement and explain the facts agreed. The Finnish Tax Administration’s interpretation of the rules is that such agreements are not an obstacle to initiating a MAP.

The affected person can include their own interpretation of the applicable tax laws and treaties in their MAP request, but the Finnish Tax Administration’s negotiations with the competent authority of the other country involved do not need to reflect the affected person’s views.

3.2.6. The applicable national rules and the applicable tax treaty or convention

The request must reference the national substantive tax rules on which the national tax assessment decisions relating to the dispute are based. The request must also specify the tax treaty or convention in need of interpretation in the course of the MAP. In this context, ‘tax treaty or convention’ refers to a tax treaty entered into by Finland, or to the Union Arbitration Convention.

Example 1: The income of an enterprise that belongs to an international group of companies has been adjusted in another country; this has been a transfer pricing adjustment. The MAP request should therefore reference the substantive tax rules applied by the country in question to the adjustment of transfer pricing. The request must also reference either the tax treaty between Finland and the country in question or the Union Arbitration Convention.

If several countries are involved in a case, or if there are multiple applicable treaties or conventions otherwise, a separate MAP request must be submitted in respect of each country. Any special rules concerning MAP requests in the other countries involved also need to be taken into consideration. Each such request should only reference the tax treaty signed with the country in question or the Union Arbitration Convention. All the countries involved in the dispute must nevertheless be mentioned in the description of the case.

Example: The dispute concerns transfer pricing in the context of management fees. The Finnish parent company of the group has subsidiaries in countries X and Y with which it has engaged in management fee transactions that are now subject to a single tax dispute.

To request the initiation of a MAP, the Finnish parent company must submit a MAP request concerning country X in which it must reference the tax treaty between Finland and country X and describe its business with the subsidiary based in country X. The request must explain that the dispute also concerns a similar business arrangement with a subsidiary based in country Y.

The parent company must also submit a MAP request containing the corresponding information from the perspective of country Y and a reference to the tax treaty between Finland and country Y.

3.2.7. Explanations and copies of documents

The request must include the following information and copies of supporting documents:

- An explanation as to why the affected person considers that there is a question in dispute; this is usually covered by the description of the dispute but a more detailed explanation should be given in ambiguous cases;

- Details about any appeals, court proceedings and decisions relating to the dispute in respect of all the countries involved; in this context, ‘decisions’ also include any preliminary rulings and advance pricing agreements relating to transfer pricing;

- A copy of the final tax assessment decision; if necessary, copies of other documents issued by the tax authorities can also be appended to the request;

- A commitment to respond as completely and quickly as possible to all appropriate requests made by a competent authority and to provide any documentation at the request of the competent authorities; and

- Details about any other MAP initiated in relation to the dispute; if the request is for an EU-level MAP that, by law, takes precedence over other forms of MAP, the request must include a commitment by the affected person to drop any other pending MAP concerning the same dispute. This means dropping any other pending proceedings not only in Finland but also in all the other countries involved in the case.

3.2.8. Additional information requested by the Finnish Tax Administration or the competent authorities of other countries concerning the MAP request

The provisions of the act on international tax dispute resolution procedure require that MAP requests must also include any additional information requested by the Finnish Tax Adminis-tration or the competent authorities of other countries. This means that a MAP request is only deemed to satisfy the legal requirements, and that a MAP can only be initiated, when all the additional information requested has been submitted. There is no need to amend the original request to include the additional information, and instead the additional information can be supplied separately.

The competent authorities have the right to request additional information at any stage of the MAP, but there are special consequences attached to requests for additional information made at the beginning of the process in respect of the EU-level MAP and the procedure based on the Union Arbitration Convention. Requests for additional information are discussed in more detail in section 4.1.

3.3. Time limits for requesting a MAP

MAP requests must be submitted to the Finnish Tax Administration within the applicable time limits. The time limit depends on the MAP chosen by the affected person. In the case of a procedure based on a tax treaty, the time limit depends on the tax treaty in question.

In most cases, the time limit is calculated from the date on which the affected person becomes aware of an action that contravenes the provisions of the applicable tax treaty. Such an action can be, for example, a decision to adjust the taxpayer’s tax liability following a tax audit or another decision made by the Finnish Tax Administration. Other examples include a tax assessment decision in which expenses claimed by the taxpayer have been rejected or in which the amount of the taxpayer’s taxable income is given as higher than what the taxpayer reported. In other words, the time limit is calculated from the date on which the affected person is first notified of the action giving rise to the dispute, regardless of whether or not the decision in question is final.

The time limit is not triggered, for example, when a final tax audit report is approved but only when a decision is issued that affects the taxpayer. A taxpayer’s correspondence with the Finnish Tax Administration concerning the amount of or the grounds for a future tax adjustment, for example, also does not count as an event that triggers the time limit for submitting a MAP request. The time limit only begins to run when the taxpayer receives notice of an official decision, regardless of whether or not the decision is final or can be appealed. It is important to remember that the rules for calculating time limits and the interpretations of the rules can vary from one country to another, and it is therefore worth also checking the protocols followed in the other countries involved. The time limits applicable to different forms of MAP are discussed in more detail below.

In the event that a MAP request concerns multiple tax years and the request is submitted late in respect of some of the tax years but not in respect of others, the Finnish Tax Administration can only entertain the request in respect of the years that have not become time-barred. The Finnish Tax Administration does not reject the entire request on the basis of its covering one or more tax years in respect of which the time limit has expired.

National appeal proceedings have no effect on the time limits for requesting a MAP. In order to prevent a situation where access to a MAP is rejected because the MAP request had been submitted late, taxpayers are advised to submit their request already at the stage when national appeal proceedings in their case are still ongoing in an administrative court or other national body that deals with appeals. This allows the Finnish Tax Administration to evaluate the request’s compliance with the formal requirements, although the actual negotiations cannot begin until the national proceedings have concluded. However, in the context of the EU-level MAP, negotiations can begin even if national appeal proceedings are in progress, if the appeal proceedings have been brought by the Tax Recipients’ Legal Service Unit.

Time limit for requesting an EU-level MAP

To initiate an EU-level MAP, identical requests must be submitted simultaneously both to the national competent authority, i.e. the Finnish Tax Administration, and the competent authorities of all the countries involved in the dispute within three years of the date on which the affected person first learns about the action giving rise to the dispute. Individuals and small businesses can choose to only approach the competent authority of their country of tax residence (see section 6.1 for more details).

Time limit for requesting a procedure based on the Union Arbitration Convention

Pursuant to Article 6, paragraph 1 of the Union Arbitration Convention (90/436/EEC), cases must be presented within three years of the first notification of the action which results, or is likely to result, in double taxation. The time limit for initiating a procedure based on the Union Arbitration Convention is calculated in the same manner as the time limit for the EU-level MAP.

Time limit for requesting a procedure based on a tax treaty

The time limit for requesting the initiation of a MAP based on a tax treaty depends on the treaty in question.

Examples of relevant time limits in Finland's tax treaties (emphasis added):

Pursuant to Article 28 of the Nordic Income and Capital Tax Treaty, “cases must be presented within five years from the time the person first received notification of the action resulting in taxation not in accordance with the provisions of the treaty”.

Article 23 of the tax treaty between Finland and the Federal Republic of Germany stipulates that “cases must be presented within three years of the person first receiving notice of the action resulting in taxation not in accordance with the treaty”.

3.4. Submitting the MAP requests

MAP requests should be sent to the Finnish Tax Administration’s email address reserved for correspondence on mutual agreement procedures: MAP@vero.fi. Email transmissions are only secure if sent via https://turvaviesti.vero.fi. The secure email server and the MAP email address should not be used for general enquiries.

As a rule, the affected person must submit a MAP request in all the countries involved in the procedure simultaneously. In the event that different submission rules are followed in different countries, the Finnish Tax Administration deems the requirement of simultaneous submission to be satisfied as long as the relevant information is sent to all the competent authorities at the same time (during the same day) using standard methods of communication. For the avoidance of ambiguity, it is best, if possible, to supply the information to all the countries involved using the same method.

However, in the case of the EU-level MAP, individuals and small businesses within the meaning of section 17 of the act on international tax dispute resolution procedure can choose to only approach the competent authority of the country in which they are resident (see section 6.1 for more details). The exception only concerns the authority to which requests can be addressed. Any rules on, for example, language requirements that apply in the other countries involved in the dispute still need to be followed even if the request is only sent to the Finnish Tax Administration.

Individuals can also send their MAP request by post. The Finnish Tax Administration’s postal address can be found in the natural persons’ MAP request guide.

The Finnish Tax Administration confirms receipt of all MAP requests.

4. Stages of the MAP

4.1. Requests for additional information made by the Finnish Tax Administration before the initiation of the MAP or during the MAP

The competent authorities may need additional information even before they begin to process a MAP request or at various stages of the MAP. Requesting additional information before a MAP request is accepted does not prevent the competent authorities from making further requests during the subsequent stages of the MAP.

A request for an EU-level MAP must, by law, be rejected if the affected person fails to supply any additional information required by the authorities for the consideration of the case. The competent authorities must make their enquiries within three months of receiving the request, and the affected person must respond within three months of receiving a request for additional information. The requested information must be sent to all the competent authorities involved in the case simultaneously.

Once a request for an EU-level MAP has been granted, the case cannot be automatically dismissed on the grounds of the affected person’s failing to respond to any subsequent requests for additional information made by the competent authorities. Although the affected person’s chances of influencing the MAP per se are limited, they must nevertheless be on hand to facilitate the process, for example, by responding promptly to any requests for additional information.

In the case of a procedure based on the Union Arbitration Convention, the competent authority has up to two months from the receipt of the MAP request to notify the affected person if their request does not satisfy the minimum content requirements. The affected person then has two months to supply the additional information requested.

In the case of a procedure based on a tax treaty, any time limits and more detailed rules on requests for additional information depend on the treaty in question. The Multilateral Convention that modifies existing tax treaties also introduces changes to the process of requesting additional information in the course of a MAP.

Because the rules applicable to the procedure depend on whether the Multilateral Convention applies to the tax treaty in question and on whether the parties to the treaty have made reservations, taxpayers are advised to check the status of the treaty concerned.

4.2. Effect of requests for additional information on time limits

Requests for additional information can have an impact on the calculation of time limits for certain stages of the process.

The six-month time limit for the competent authorities to either grant a MAP request or issue a unilateral decision in the context of the EU-level MAP only begins to run once any requested additional information has been received.

Similarly, the two-year time limit imposed on the negotiation stage in the case of the procedure based on the Union Arbitration Convention only begins to run from the receipt of any additional information requested.

The impact of requests for additional information on the time limits applicable to a procedure based on a tax treaty depends on the tax treaty in question and must always be checked separately.

4.3. Effect of a unilateral decision made by a competent authority

All three forms of the procedure can conclude with a unilateral decision that one competent authority has made, without involving the competent authorities of the other countries. In such circumstances, the decision is immediately communicated to the affected person and the competent authorities of the other countries involved. After that, the case is closed and no actual MAP or arbitration proceedings take place.

In the case of the EU-level MAP, the deadline for delivering a decision on a unilateral basis is six months from the receipt of the MAP request or any additional information requested, whichever occurs later. If there are national appeal proceedings in progress, however, the time limit for delivering a unilateral decision only begins to run once the national proceedings have been concluded or suspended.

No such deadline for deciding cases on a unilateral basis has been set in the Union Arbitration Convention, and a unilateral decision can therefore be taken at any point after a MAP request has been submitted.

A decision taken by one competent authority on a unilateral basis is only enforceable if the affected person agrees with the decision and consents to not pursuing any national legal remedies in respect of the dispute in question. The affected person has 60 days from the receipt of the decision to communicate their consent to the competent authorities. Any appeal proceedings brought by the Tax Recipients’ Legal Service Unit concerning the same dispute that are in progress at the time are automatically discontinued.

The Finnish Tax Administration makes the necessary changes to the taxpayer’s tax liability in Finland ex officio, and the taxpayer therefore does not need to ask for the outcome of the proceedings to be enforced separately. Unilateral decisions are enforced in Finland pursuant to the provisions of sections 55 and 56 of the Finnish act on assessment procedure or sections 40 and 41 of the act on assessment of self-assessed taxes (Laki oma-aloitteisten verojen verotus-menettelystä (768/2016)). In practice, such decisions are therefore enforced by means of tax adjustment. However, the normal time limits set for tax adjustment do not apply in these cases. Any amount to be refunded to a taxpayer in Finland on the basis of a unilateral decision on a MAP request submitted on or after 1 July 2019 is paid with interest pursuant to section 76 of the act on assessment procedure and section 37 of the act on tax collection (Veronkantolaki (11/2018)).

4.4. Acceptance of a request for a MAP

Decisions on MAP requests are taken by the Finnish Tax Administration. The Finnish Tax Administration’s decision to accept a request does not resolve the dispute itself but only confirms its eligibility for the MAP. If a request is rejected, reasons are provided.

Decisions concerning requests for an EU-level MAP are subject to special provisions laid down in section 5 of the act on international tax dispute resolution procedure. As a rule, the deadline for the competent authority to make its decision in response to a request for an EU-level MAP is six months from the receipt of the request or any additional information requested, whichever occurs later.

If there are national appeal proceedings in progress, however, the time limit for delivering the decision only begins to run once the national proceedings have been concluded or suspended. The date on which the taxpayer is notified of the decision is irrelevant. However, in order to speed up the negotiation process, taxpayers are advised to notify the competent authorities as soon as the national appeal proceedings in their case are concluded.

The act on international tax dispute resolution procedure lays down specific grounds on which requests for an EU-level MAP can be rejected. Pursuant to section 6 of the act, such grounds include the following:

1) The request does not satisfy the content requirements laid down in section 3 of the act on international tax dispute resolution procedure or the affected person fails to submit any requested additional information to the competent authorities within the three-month time limit;

2) There is no question in dispute; or

3) The request was not submitted within the three-year time limit set out in section 2, subsection 2 of the act on international tax dispute resolution procedure.

The grounds for denying requests for other forms of the MAP have not been laid down in law. Such requests can be dismissed, for example, if they are submitted late or turn out to be unfounded.

If both the Finnish Tax Administration and the competent authorities of the other countries involved in the dispute deny a request for an EU-level MAP, the affected person can challenge the Finnish Tax Administration’s decision in an administrative court in Finland. The competent administrative court is the one in whose jurisdiction the affected person resides. If the affected person resides abroad, the competent court is Helsinki Administrative Court. The appeal must be filed within 30 days of the date on which the last competent authority involved in the case delivers their decision.

A rejection of a request for an EU-level MAP can be challenged separately in each of the countries in which the request was rejected that permit national appeal proceedings in such cases. If an appellate authority overturns even just one of the competent authorities’ decision, the affected person can request for an Advisory Commission to be set up to resolve the question of the MAP acceptance. However, if national appeal procedures have been exhausted, and the competent authority's decision to reject the MAP has been upheld with a non-appealable decision, a request to set up an Advisory Commission cannot be made.

If a request for an EU-level MAP is granted by just one of the competent authorities involved in the case, the affected person can request for an Advisory Commission to be set up, even if all the other competent authorities rejected the request. The Commission then decides whether or not the MAP acceptance should be granted and notifies the competent authorities accordingly. The affected person has up to 50 days from the date on which they are notified of their MAP request’s having being rejected to ask for an Advisory Commission to be set up. The procedure is discussed in more detail in section 4.5.

4.5. Setting up an Advisory Commission to decide on whether or not an access for an EU-level MAP should be granted

The competent authorities must set up an Advisory Commission at the affected person’s request if their request for an EU-level MAP has been rejected by at least one but not all of the competent authorities involved in the case.

If the objective is to determine whether or not a EU-level MAP request should be accepted, an Advisory Commission will be set up at an early stage of the process. If the Commission decides that the case is eligible for an EU-level MAP, the dispute itself may be resolved through the competent authorities’ negotiations. At this early stage, an Advisory Commission's only purpose is to decide on the acceptance of a MAP request and it does not participate in resolving the tax substance of the case.

There is a time limit for requesting that an Advisory Commission be set up. The request must be made within 50 days of the date on which the affected person received the notification for the competent authorities’ denial of the MAP request or the date on which a legally valid decision is delivered on their appeal against the competent authorities’ decision. The date of notification on which the affected person receives the decision of the appeal is irrelevant.

There is no need to justify the request to the Finnish Tax Administration to set up an Advisory Commission. However, the affected person’s request must come with the following assurances:

- the decision of the competent authorities to reject the affected person’s request for a MAP cannot be challenged under the applicable national rules of the countries involved;

- there are no pending appeals against the decision; and

- appeals have become time-barred or that the affected person renounces their right of appeal.

The competent authorities have the right to deny the affected person’s request for an Advisory Commission in the following circumstances:

- if an appellate authority in Finland or another country whose decisions cannot be deviated from in that country has confirmed the competent authorities’ decision to deny the affected person’s MAP request;

- if any decisions delivered in Finland in respect of the dispute are based on the provisions of the act on assessment procedure governing tax assessment by estimation, tax evasion, distribution of constructive dividends to shareholders, or unexplained increase in income (sections 27 to 30 of the act on assessment procedure), section 6(a), subsection 9 or section 52(h) of the act on the taxation of income from business (Laki elinkeinotulon verottamisesta (360/1968)), the Finnish Act on the Taxation of Shareholders in Controlled Foreign Companies or chapter 29, sections 1 to 4 of the Criminal Code of Finland; or

- if the question in dispute does not involve double taxation.

An Advisory Commission that has been set up for deciding whether or not a request for an EU-level MAP should be accepted must make its decision within six months of its setting up. The Advisory Commission’s decision is then communicated to the competent authorities.

If the Advisory Commission finds that the MAP request should have been accepted and that there were no grounds for rejecting the request on the basis of late submission, one of the competent authorities involved must initiate the procedure. The time limit set for the negotiation stage begins to run as of the date on which the competent authorities receive the Commission’s decision.

4.6. Withdrawing MAP requests

If the affected person wishes to withdraw their MAP request, they must notify each of the competent authorities of the countries involved of their decision simultaneously. In the case of an EU-level MAP, individuals and small businesses need only notify the competent authority of the country in which they are resident (see section 6.1 for more details). The notice automatically closes the case, and no formal decision need be issued. The withdrawal of the request terminates the proceedings.

The EU Dispute Resolution Directive gives the Member States the right to charge the affected person a portion of any costs incurred from an EU-level MAP if they withdraw their request and if certain other conditions are met. Finland has not taken advantage of the right conferred by the Directive to charge costs to the affected person.

4.7. Time limits for the negotiation stage of the MAP

There are certain time limits that the Finnish Tax Administration must observe in respect of the various stages of the MAP, which depend on the taxpayer’s choice of procedure. In respect of an EU-level MAP and a procedure based on a tax treaty, a case only proceeds to arbitration at the affected person’s request, and negotiations between the competent authorities involved in the case can continue beyond the time limits in the absence of such a request. In the context of a procedure based on the Union Arbitration Convention, cases proceed to arbitration automatically when the two-year time limit set for the negotiation stage is up, regardless of whether or not the affected person has made a request to that effect.

As a rule, an EU-level MAP requires the Finnish Tax Administration to settle the dispute with the other countries involved within two years of the date on which the last competent authority involved in the dispute has stated that it accepts the MAP request. An extension of up to one year is possible at the request of one of the competent authorities to all the other competent authorities involved in the case, if the requesting authority is able to provide written justification. There are no particular rules on the criteria for extending the time limit, and the affected person’s consent is not required. Extensions to time limits are not open to appeal.

In the case of a MAP based on the Union Arbitration Convention, the dispute must be settled within two years of the receipt of the affected person’s MAP request (or any additional information requested). Once the two-year time limit is up, an Advisory Commission must be set up, which has six months to deliver its opinion. The decision to eliminate double taxation must be made by the competent authorities within six months of the opinion of the Comission. However, the competent authorities can agree between themselves to deviate from the two-year time limit, if the affected persons involved in the dispute give their consent.

No time limits have previously applied to a MAP based on a tax treaty. The Multilateral Convention, which entered into force in respect of Finland on 1 June 2019, modifies some of Finland’s existing tax treaties so as to make it possible to settle cases through arbitration. In conjunction with this, time limits for the negotiation stage of the MAP and the entire process are introduced. The general time limits set by the Convention are either two or three years for the negotiations, but the time limit applied in a particular case depends on the tax treaty in question and must be checked on a case-by-case basis.

4.8. Effect of the outcome of a MAP

A MAP concludes with a settlement negotiated by the countries involved or the verdict delivered through arbitration. It is the national authorities’ responsibility to implement the outcome of the procedure. The affected person is notified as soon as their case is settled either through negotiations or arbitration. In the case of an EU-level MAP, the affected person must be notified of the final outcome following arbitration within 30 days of the date of the decision. The competent authorities involved in a case can agree to deviate from any opinion delivered by an Advisory Commission.

The outcome of a MAP is only enforceable if the affected person agrees with the decision and consents to not pursuing any national legal remedies in respect of the dispute. The affected person has 60 days from the receipt of the competent authorities’ decision to communicate their consent. Any appeal proceedings brought by the Tax Recipients’ Legal Service Unit concerning the same dispute that are in progress at the time are automatically discontinued.

The Finnish Tax Administration makes the necessary changes to the taxpayer’s tax liability in Finland ex officio, and the taxpayer therefore does not need to ask for the outcome of the proceedings to be enforced separately. Sections 10 and 16 of the act on international tax dispute resolution procedure provide that enforcement is based on the provisions of sections 55 and 56 of the act on assessment procedure or sections 40 and 41 of the act on assessment procedure of self-assessed taxes. In other words, the outcome of a MAP is always enforced by means of tax adjustment, regardless of whether the outcome is based on a decision taken by one of the competent authorities involved on a unilateral basis, negotiations between the countries involved, or arbitration.

There are some circumstances in which national tax rules may affect the enforcement process (for example, losses cannot be allowable for tax purposes on the basis of section 6 of the Finnish act on the payment of group contributions (Laki konserniavustuksesta verotuksessa, 825/1986). The enforcement of negotiated outcomes can also require the taxpayer to formally request a tax adjustment or refund in accordance with the national rules on legal remedies in one of the countries involved.

If an EU-level MAP is concluded through arbitration, only an abstract of the Advisory Commission’s final decision need be published. The competent authorities involved in the case can agree to publish the final decision in its entirety, subject to the consent of each of the affected persons concerned.

If only an abstract is published of the outcome of an EU-level MAP, the abstract must contain a description of the issue and the subject matter, the date, the tax periods involved, the legal basis, the industry sector, a short description of the final outcome, and a description of the method of arbitration used. The competent authorities must send the information to be published to the affected person before its publication. The Finnish Tax Administration always removes all confidential information and any information on the basis of which individual taxpayers can be identified from the abstract before its publication, but the affected person also has 60 days from the receipt of the information to be published to let the competent authorities know if they do not wish them to publish information that concerns any trade, business, industrial or professional secret or trade process, or that is contrary to public policy.

Any amount to be refunded to a taxpayer in Finland on the basis of the outcome of a MAP the request for which was made on or after 1 July 2019 is paid with interest pursuant to section 76 of the act on assessment procedure and section 37 of the act on tax collection.

5. Arbitration

5.1. Initiation of arbitration proceedings in the context of different forms of the MAP

Settling a tax dispute through arbitration is possible in the context of an EU-level MAP, a MAP based on the Union Arbitration Convention and, to an extent, a MAP based on a tax treaty. Access to arbitration proceedings and the method of arbitration to be used in the case of a MAP based on a tax treaty depend on whether arbitration is possible under the tax treaty in question and on what terms.

A case only proceeds to arbitration if the competent authorities involved in the case fail to settle the dispute within the time limits set through negotiations. Referring a case to arbitration in the context of an EU-level MAP or a MAP based on a tax treaty requires not only that the time limit for negotiations is up, but also that the affected person makes a request to that effect; while a MAP based on the Union Arbitration Convention proceeds to arbitration automatically, if the dispute cannot be settled through negotiations.

Arbitration proceedings neither suspend nor conclude a MAP but are an integral part of the MAP. In other words, arbitration proceedings are just one stage of the MAP, which are initiated when certain conditions are satisfied and the format of which depends on the form of the MAP in question.

5.2. Role of an Advisory Commission in an EU-level MAP

There are two sets of circumstances in which the affected person can request that an Advisory Commission be set up in connection with an EU-level MAP: 1) if even just one of the competent authorities involved in the case reject the affected person’s MAP request and the affected person feels that their request should have been granted; or 2) the competent authorities fail to reach agreement within the time limit set. The role of an Advisory Commission in the first set of circumstances is discussed above in section 4.5. The following paragraphs explain the role of an Advisory Commission in arbitration proceedings.

If the competent authorities involved in a case fail to settle the dispute through negotiations within the two-year time limit, the affected person can request for their case to be referred to an Advisory Commission. The role of the Advisory Commission in such circumstances is to settle the substantive tax dispute, after which the case is returned to the competent authorities for the final stages of the EU-level MAP.

If the affected person knows in advance that they want their case to proceed to arbitration if the negotiations are unsuccessful, this should ideally be communicated to the competent authorities in the MAP request.

The competent authorities have the obligation to notify the affected person if their negotiations fail. The affected person can wait for the competent authorities’ notification to formally request arbitration proceedings, although a request can also be made at an earlier stage of the process. In any case, the final deadline for requesting arbitration proceedings is 50 days from the date on which the affected person is notified of the competent authorities’ failure to settle the dispute through negotiations.

The request must be sent to the competent authorities of all the countries involved in the dispute. Individuals and small businesses need only send their request to the competent authority of the country in which they are resident (see section 6.1 for more details).

However, the competent authorities can deny the affected person’s request to set up an Advisory Commission for arbitration purposes in the following circumstances:

- if any decisions delivered in Finland in respect of the dispute are based on the provisions of the act on assessment procedure governing tax assessment by estimation, tax evasion, distribution of constructive dividends to shareholders, or unexplained increase in income (sections 27 to 30 of the act on assessment procedure), section 6(a), subsection 9 or section 52(h) of the act on the taxation of income from business, the Finnish Act on the Taxation of Shareholders in Controlled Foreign Companies or chapter 29, sections 1 to 4 of the Criminal Code of Finland; or

- if the question in dispute does not involve double taxation.

Due to these restrictions, arbitration is also not an option in the case of tax disputes that involve both tax evasion and taxation contrary to a tax treaty.

An Advisory Commission set up to settle a substantive issue must deliver its opinion to the competent authorities involved in the case within six months of its formation. A three-month extension to the time limit is possible if the nature of the dispute so requires. In such circumstances, the Advisory Commission must notify the affected persons and the competent authorities involved in the case of the delay.

The competent authorities have six months from the date on which the Advisory Commission delivers its opinion to settle the matter. The competent authorities can also use the six months to come to an agreement that deviates from the Commission’s opinion in order to eliminate the taxation contrary to the provisions of the applicable tax treaty.

5.3. Role of an Advisory Commission in a MAP based on the Union Arbitration Convention

In the case of a MAP based on the Union Arbitration Convention, an Advisory Commission is set up pursuant to Article 7 of the Convention if a dispute cannot be resolved through negotiations within two years of the affected person’s MAP request to the competent authorities, even if no request is made to that effect. The affected person can, if they so wish, make arrangements for the initiation of arbitration proceedings with the competent authorities once the time limit for the negotiation stage has been reached.

Similarly to the EU-level MAP, a Commission set up in the course of a procedure based on the Union Arbitration Convention must deliver its opinion within six months, and the competent authorities then have six months to settle on a solution that eliminates the affected person’s double taxation. The competent authorities can also use the six months to come to an agreement that deviates from the Commission’s opinion in order to eliminate the taxation contrary to the provisions of the applicable tax treaty.

5.4. Arbitration proceedings in the context of a MAP based on a tax treaty

The Multilateral Convention modifies some of the tax treaties that Finland has with other countries so as to also make arbitration possible in the context of a procedure based on a tax treaty. Based on the latest information, the Multilateral Convention introduces the possibility of arbitration into Finland’s tax treaties with at least the following countries:

Australia, Austria, France, Ireland, Japan, Luxembourg, Malta, Netherlands, New Zealand, Singapore, Slovenia and the United Kingdom of Great Britain and Northern Ireland.

In most cases, arbitration proceedings will be possible in respect of taxes withheld at source on or after 1 January 2020 and in respect of tax years commencing on or after 1 January 2010. However, the provisions on scope of application are treaty-specific and must always be checked on a case-by-case basis.

Whether or not a MAP includes the possibility of arbitration depends on the applicable tax treaty and any choices made and reservations introduced by Finland and other signatories to the Multilateral Convention.

The exact method of arbitration to be used also depends on the tax treaty in question. The Finnish Tax Administration, as Finland’s competent authority in these matters, will sign separate agreements on procedural issues concerning arbitration with the competent authorities of the countries with which arbitration in the context of a MAP based on a tax treaty is possible. These agreements between the competent authorities will specify, for example, what information the authorities need for the proceedings and the applicable time limits. Taxpayers are advised to check the status of the applicable tax treaty before they request a MAP.

Finland has introduced a reservation in respect of the Multilateral Convention that excludes the possibility of arbitration in the context of a procedure based on a tax treaty in certain circumstances. The circumstances in which arbitration proceedings are not possible are the same as those referred to in connection with the EU-level MAP above (in section 5.2). Similar rules introduced by other countries in respect of, for example, tax evasion, distribution of constructive dividends to shareholders, or tax offences also prevent the use of arbitration in the context of a procedure based on a tax treaty. A MAP is about the implementation and interpretation of the applicable tax treaty. This must also be the starting point when evaluating a case’s eligibility for arbitration.

Arbitration proceedings are also not possible in the context of a MAP based on a tax treaty if the dispute has been referred to an EU-level MAP or a procedure based on the Union Arbitration Convention.

Access to arbitration is further restricted by a general time limit stipulated in the Multilateral Convention, on the basis of which arbitration cannot be used to settle the following kinds of cases:

- cases involving tax withheld at source where the taxable event precedes the reference date; and

- other cases that involve tax years commencing before the reference date.

The reference date is one of the following, whichever is the latest:

- the date on which the Multilateral Agreement is adopted in respect of the tax in question in both Finland and the other signatory country involved in the case;

- 1 January of the year next following the expiration of a period of six calendar months beginning on the date of the communication by the Depositary of the Convention of the notification of withdrawal or replacement of a reservation that results in the application of the part of the Convention that concerns arbitration between the parties to the applicable tax treaty; or

- one day after the expiration of a period of six calendar months beginning on the date of the communication by the Depositary of the Convention of the notification of withdrawal of a reservation concerning arbitration (if the case would be eligible for arbitration after the part of the Convention that concerns arbitration becomes applicable between the parties to the tax treaty in question).

Due to the above, any time limits applicable to arbitration proceedings depend on the tax treaty in question. Taxpayers seeking the initiation of a MAP based on a tax treaty are advised to check the more detailed provisions applicable to the treaty in question if necessary.

The Finnish Ministry of Finance intends to publish synthesised versions of Finland’s tax treaties, including the latest amendments, in the Finlex online database (www.finlex.fi), which currently contains non-synthesised versions of Finland’s tax treaties with other countries. There is also a matching database for making projections on how the Multilateral Convention modifies a specific tax treaty on the OECD’s website.

6. Special considerations

6.1. Individuals and small businesses in an EU-level MAP

Section 17 of the act on international tax dispute resolution procedure introduces a special exemption for individuals and small businesses concerning the submission of requests for an EU-level MAP, replies to the Finnish Tax Administration’s requests for additional information, MAP request withdrawal notices, and requests for the setting up of an Advisory Commission.

The act on international tax dispute resolution procedure starts from the premise that taxpayers must submit their MAP requests, replies to the Finnish Tax Administration’s requests for additional information, MAP request withdrawal notices, and requests for the setting up of a Dispute Resolution Commission to the competent authorities of all the countries involved in the dispute simultaneously. However, individuals and small businesses within the meaning of section 17 of the act on international tax dispute resolution procedure can choose to only communicate with the competent authority of the country in which they are based. Small businesses and individuals who reside in Finland therefore only need to correspond with the Finnish Tax Administration.

Section 17 of the act on international tax dispute resolution procedure defines ‘small business’ as an undertaking that is not a large undertaking within the meaning of Directive 2013/34/EU of the European Parlia¬ment and of the Council of 26 June 2013 on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings, amending Directive 2006/43/EC of the European Parliament and of the Council and repealing Council Directives 78/660/EEC and 83/349/EEC, or a part of a large group. An undertaking is not deemed to satisfy the definition of a small business, if its financial statements show figures in excess of at least two of the following thresholds:

- a balance-sheet total of €20,000,000;

- a turnover of €40,000,000; or

- an average of 250 employees during the financial year.

In the case of an international group of companies, the above thresholds apply to the group in its entirety, and consequently, a business based in Finland that belongs to a group may be regarded as a large undertaking even if it only operates in Finland on a small scale.

The information can be submitted to the Finnish Tax Administration in Finnish, Swedish or English. The Finnish Tax Administration recommends providing the information in English, as negotiations with the competent authorities of other countries are usually conducted in English. If necessary, the Finnish Tax Administration can get the information supplied translated into English. However, any rules on, for example, language requirements that apply in the other countries involved in the dispute still need to be followed even if the request is only sent to the Finnish Tax Administration.

The Finnish competent authority has two months to forward the information to the competent authorities of all the other countries involved in the dispute. Once the information has been supplied, the affected individual person or small business is deemed to have notified all the countries involved.

The Finnish Tax Administration’s interpretation of the rules is that only submitting the information to one competent authority does not have an effect on how the time limits are calculated. A EU-level MAP request is therefore deemed to have been submitted to all the relevant competent authorities within the three-year time limit set out by the law as long as the affected individual person or small business, if they are based in Finland, submits their request to the Finnish Tax Administration on time. However, the competent authorities of other countries may interpret the rules differently.

6.2. Transfer pricing

Tax disputes that concern transfer pricing are different from other tax disputes in the sense that the affected person has recourse not only to the EU-level MAP and the MAP based on a tax treaty but also to a third alternative for eliminating any taxation contrary to the provisions of the applicable tax treaty, i.e. a MAP based on the Union Arbitration Convention.

Undertakings that are considering referring their transfer pricing dispute to a MAP are advised to contact the competent authority before submitting their request in order to find out whether their case could be resolved through the procedure.

6.3. Taxes withheld at source

Taxes are sometimes withheld by the source country in a manner that results in taxation that contravenes the provisions of the applicable tax treaty. This may create ambiguity as to whether the dispute is eligible for the MAP in terms of whether the tax can be considered “final” and which decision should be considered the final tax assessment, as well as whether the payer's obligation to withhold the tax can be regarded as “an action of state” ("an action of state" — as referred to in the OECD Model Tax Convention).

The Finnish Tax Administration’s interpretation is that, in most cases, if a foreign tax authority has issued a decision in response to a request for refunding a tax that had been withheld at source constitutes a final tax assessment decision. Some countries initially withhold tax on income at a higher national rate than the one agreed upon in the applicable tax treaty, in which case it is more convenient for the taxpayer, instead of requesting a MAP, to request refunding in order to apply the correct withholding rate set out by the treaty. However, the competent authorities of other countries may interpret the rules differently. It is the taxpayer’s responsibility to find out what kind of a withholding event constitutes a final tax assessment in the other country involved in the dispute and for the purposes of the different forms of the MAP.

6.4. Tax adjustments initiated by the taxpayer

The wording of the procedural rules applicable to the different forms of the MAP suggests that the procedure must generally be based on an action taken by a government or a government agency (this is referred to as “an action of state” in the OECD Model Tax Convention).

However, it is also possible for a taxpayer’s tax liability to contravene the applicable treaty because of the taxpayer’s own actions, namely a self-initiated request for a tax adjustment. These kinds of discrepancies typically arise in situations where a tax authority has conducted a tax audit limited to specific tax years, and the taxpayer then asks for their tax liability for subsequent tax years to be brought in line with the tax auditors’ conclusions.