The e-service for lenders

What lenders can do in the e-service

In the e-service, an organisation can

- sing up as a data notifier

- request a data permission.

After signing up as a data notifier or requesting a data permission, your organisation can

- submit a change notification if changes take place in the organisation's reporting or sign-up or if the organisation wants to make additions to or cancel the sign-up request it has submitted

- request changes to the data permission if the grounds for the data permission change

- contact us on the contact form for data permission matters if the organisation wants to make additions to or cancel the data permission application it has submitted

- manage contact person details and invoicing information.

The e-service can be used by organisations with a Finnish Business ID. A foreign organisation needing to update its contact or invoicing information can send a message to our customer service on the contact form for lenders.

The e-service cannot be used to report credit data or order credit register extracts.

Who can act on behalf of a lender in the e-service?

You can use the e-service on behalf of a lender if you have a Finnish personal identity code and if either of the following conditions is met:

- a certain official role has been assigned to you in the Trade Register or the Business Information System

- you or the company you represent has been granted the “Registering as a credit information reporter and user” authorisation.

The designated role has to be one of the following:

- managing director

- managing director’s substitute

- chairperson of the board

- general partner (limited partnership)

- partner (general partnership)

- business operator

- holder of procuration who is authorised to sign alone

- individual with the right to sign alone (authorised individual).

How do I authorise someone to act on behalf of a lender in the e-service?

Lenders can grant and change authorisations as needed in the Suomi.fi e-Authorization service.

The Suomi.fi authorisation “Registering as a credit information reporter and user” can be used to sign up as a data notifier, request a data permit and change invoicing information and contact details.

If the lender wants to authorise different individuals to manage signing up as a data notifier and requesting a data permit, they have to use a paper form to do so.

Read more about granting authorisations (Suomi.fi)

How do I log in to the e-service?

You can log in to the e-service of the Positive credit register directly by clicking the link below.

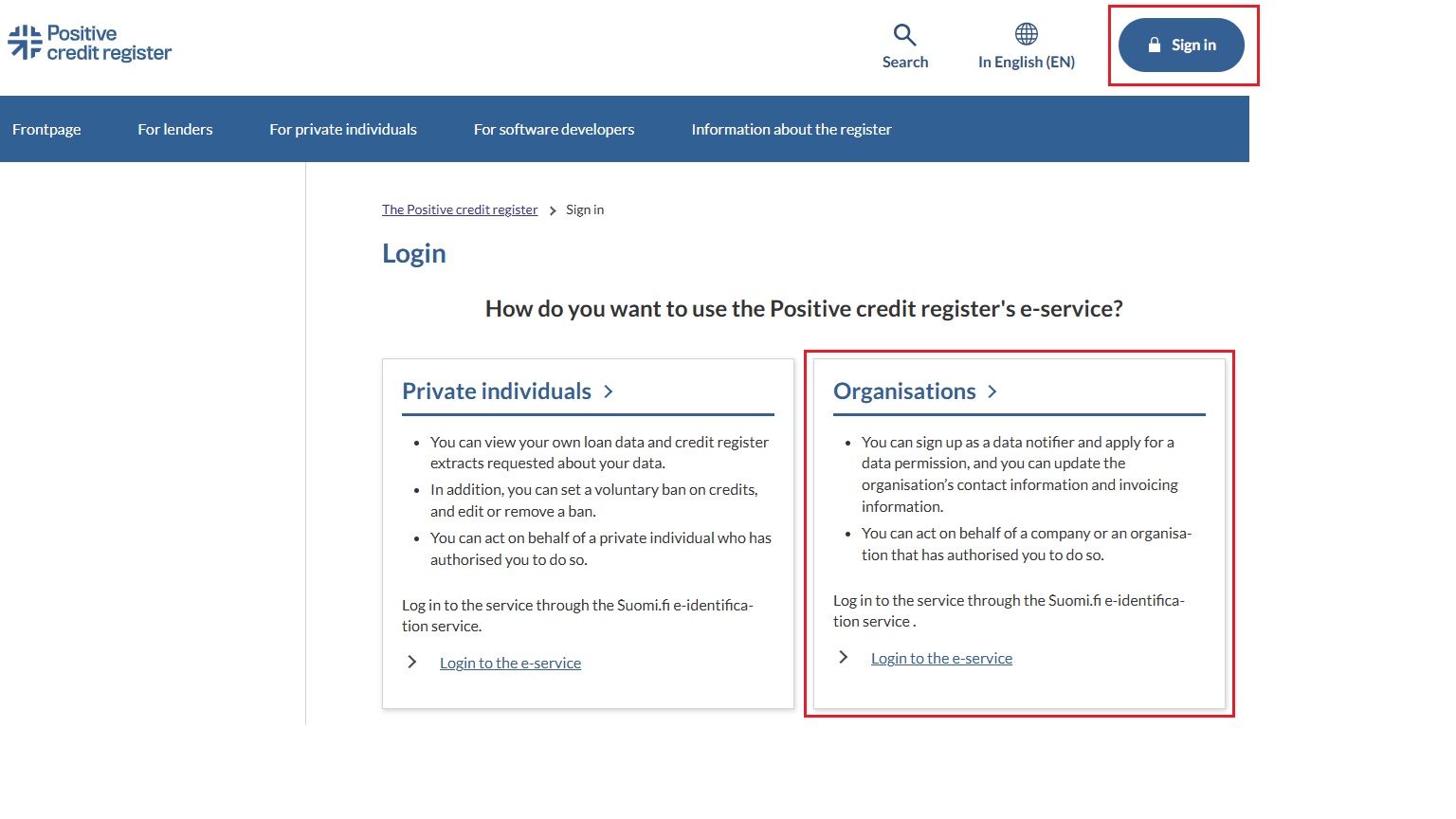

You can also always log in to the service by clicking the Sign in button on the register website.

Start the login process by selecting Organisations.

Figure 1: Logging in to the e-service for organisations.

Logging in takes place through the Suomi.fi e-identification service. You will need a means of strong e-identification, such as personal online banking codes, a mobile certificate or a certificate card.

Maintaining the lender’s contact information

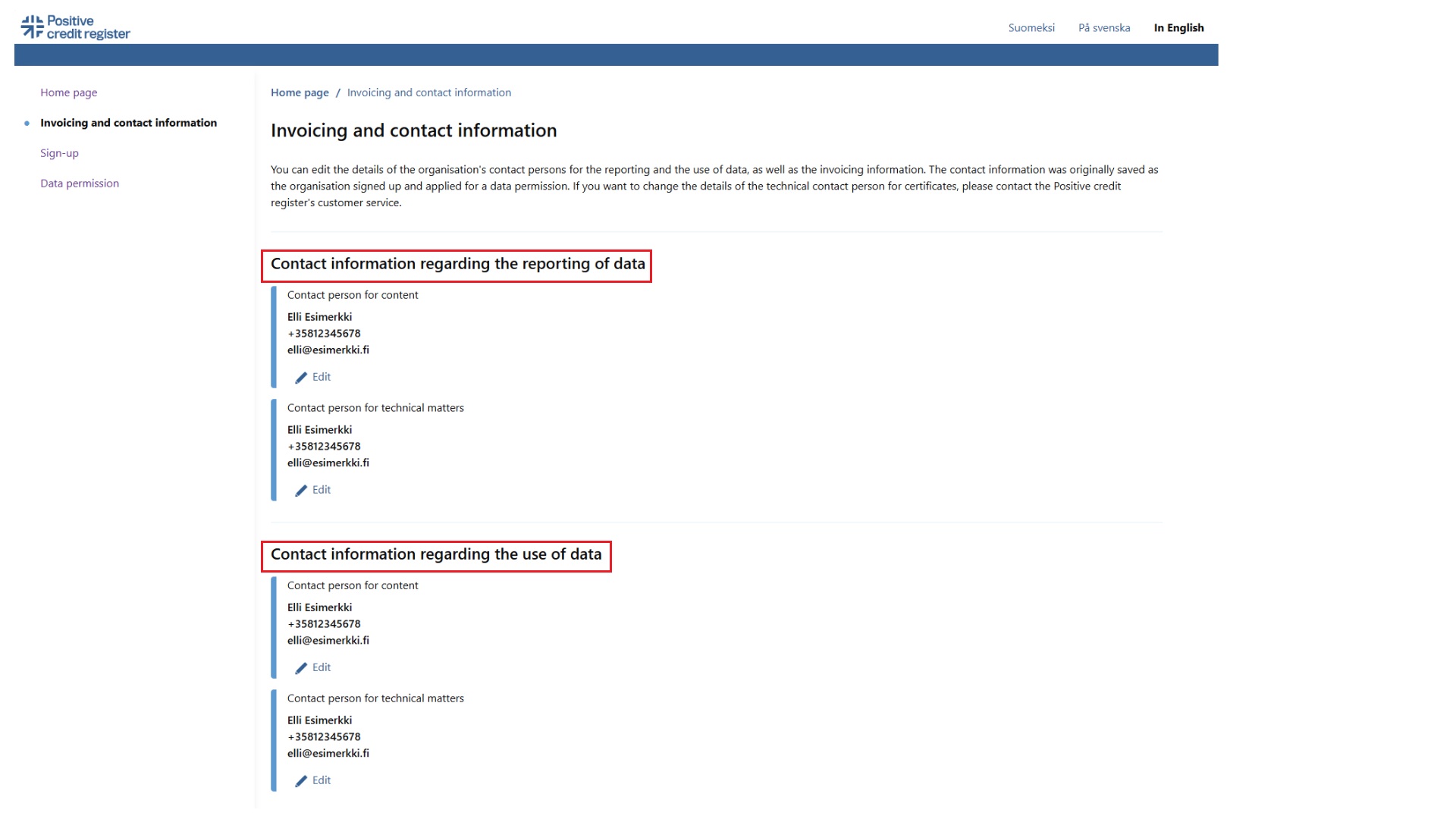

Organisations reporting or using data can edit contact details on the Invoicing and contact information page. Check the organisation’s contact information regularly and update it if necessary.

You can change the following contact information in the e-service:

Contact information regarding the reporting of data:

- contact person for content

- contact person for technical matters

Contact information regarding the use of data:

- contact person for content

- contact person for technical matters

The information about contact persons in the Positive credit register are name, telephone number and email address. The email address does not have to be an individual’s email address; it can also be some other email address, such as a distribution list or a shared mailbox.

Figure 2: Updating of contact information on the Invoicing and contact information page

Contact details of the technical contact person for certificates can be updated in the Tax Administration’s certificate service.

Maintaining the lender’s invoicing information

If necessary, invoicing information can be edited on the Invoicing and contact information page. The invoicing information recorded in the Positive credit register is:

Invoice address

- Recipient

- Street address or P.O. Box

- Postal code

- City/town

- Country

E-invoicing

- E-invoicing address

- Intermediary code

E-invoicing is the primary invoicing method, which is why the option of sending invoices to the organisation’s e-invoice address is selected by default. You can deselect this option if your organisation does not use e-invoicing.

Invoicing practices

- Invoice language: the options are Finnish, Swedish, English

- Organisation’s reference (e.g. cost department’s reference)

Enter the reference if you want it to be indicated on invoices on data usage for purposes of posting, for example. You can enter the reference even if the organisation has not activated e-invoicing. The reference may not have more than 35 characters.

Contact person for invoicing

The contact person for invoicing provides additional information on questions related to invoicing. The contact person will be contacted if any issues arise with invoicing.

- Name

- Telephone number (in international format, e.g. +358...)

- Email address

If you need help using the e-service, you can contact our customer service. The contact information is available on the Contact information and service page.