Wages: reporting data to the Incomes Register

- Date of issue

- 12/4/2023

- Record no.

- VH/6561/00.01.00/2023

- Validity

- 1/1/2024 - Until further notice

These instructions replace the earlier instructions entitled ‘Wages: reporting data to the Incomes Register’.

The following clarifications have been made to the instructions:

- Complemented the guidance in Section 1.1 for submitting income in the gross amount.

- Complemented the instructions in Section 1.2 for submitting the country code in conjunction with an artificial identifier.

- Clarified the instructions in Section 2.5 for the deadline for reports submitted using a paper form.

- Clarified the instructions in Section 3.1.5 regarding situations where the ‘Payment other than money’ data must be entered.

- Added a new additional income earner detail ‘Individual with no business ID using an invoicing service’ and its description to Section 4.2.

Otherwise, the contents are unchanged.

1 Data reporting principles

These instructions describe the general principles and practices of reporting earnings payment data to the Incomes Register. This summary of general instructions is intended to support detailed instructions published regarding the Incomes Register.

These instructions describe, for example, deadlines for submitting data and the logic behind the use of data in the Incomes Register. These instructions include links to detailed Incomes Register instructions.

1.1 The payer is obligated to submit data

Paid wages and other similar payments are reported to the Incomes Register. The employer or other payer reports data after each payment transaction. The payments made are reported to the Incomes Register in the gross amount.

All payers report their payments to the Incomes Register. This means that households, housing companies and associations, among others, are obligated to report their payments made, such as wages, reimbursements of expenses and non-wage compensation for work.

A law, decree or a decision of the Tax Administration may include exceptions to the obligation to withhold tax or collect tax at source in certain situations. Even if the withholding of tax or the collection of tax at source is unnecessary, income must be reported to the Incomes Register.

1.2 An earnings payment report is submitted separately for each income earner

Data is reported separately for each income earner by submitting an earnings payment report to the Incomes Register. It is not important from the perspective of the reporting obligation whether or not the payer or income earner has a Finnish customer identifier.

Primarily, the Finnish customer identifier, entered in the Population Information System, is reported for an income earner. If the income earner does not have a Finnish customer identifier, the foreign identifier is reported. In this case, more detailed identification data regarding the income earner must be provided, such as the first name, last name and address, as well as the date of birth and gender, if the income earner is a natural person. It is recommended that both identifiers be reported if the income earner has both a Finnish and a foreign identifier.

For an income earner who is a non-resident taxpayer, the Tax Identification Number (TIN) of the country of residence must also be reported, if the identifier is in use in the non-resident taxpayer’s country of residence. A person is regarded as a non-resident taxpayer if their residence and home is located abroad and they do not reside in Finland for more than six months consecutively. A company is regarded as a non-resident taxpayer if its registered domicile is elsewhere than in Finland. If a non-resident taxpayer also has a Finnish customer identifier, both identifiers must be entered on the report. If a Finnish customer identifier is later provided for a non-resident taxpayer, previously submitted reports do not need to be corrected. Once the identifier has been provided, data must be reported using the Finnish and foreign identifiers. For more information, see Reporting data to the Incomes Register: international situations.

If an income earner has been provided with an artificial identifier, and the artificial identifier is reported to the Incomes Register, ‘Other identifier’ must be selected as its type and the country code of the country that granted the identifier must also be reported, e.g. FI. If an income earner does not have a Finnish personal identity code registered in the Population Information System and the Finnish Tax Administration has provided the income earner with an artificial identifier for taxation, the payer must report the artificial identifier provided by the Tax Administration in addition to the foreign identifier. As a result, the report can be allocated to the correct person. Every time data is submitted with an identifier other than a Finnish personal identity code registered in the Population Information System, the following data must be submitted: name, date of birth, gender, and address. The foreign identifier must also be reported.

The earnings payment report consists of data on a single income earner on a single payment date. This means that if several payments have been paid to an income earner on several occasions during the same month, the payer must submit a separate report on each payment on each payment date. Therefore, the payer cannot add several payments paid during one month to a single report and submit them to the Incomes Register at the same time. Exceptions include tax-exempt compensation for travel expenses that can be reported monthly no later than on the fifth day of the calendar month following the payment month, and advance pay that can be reported together with the actual pay to be paid later, provided that both are paid during the same calendar month. However, if advance pay was paid during the previous calendar month and the pay period’s actual payment date is in the following month, the advance pay must be reported separately as the previous month’s income.

Several reports may be submitted for a single income earner on a single payment date if, for example, wages and travel expenses are paid and reported from different systems (see Section 1.4 for more information). However, data on a single wage payment transaction must be reported on a single report.

The payer does not need to report the total amount of wages, withholding tax or tax at source for data users. Data users who monitor social insurance contributions and the Tax Administration calculate the income on which the contributions are based from income earner-specific earnings payment reports submitted to the Incomes Register. Only the total amount of the employer’s health insurance contribution must be calculated and reported separately every month to the Incomes Register on the employer’s separate report. The reason for this is that the employer’s health insurance contribution is a self-assessed tax. Instead, withholding tax and tax at source are not reported as a total amount, as the Finnish Tax Administration calculates the amounts from earnings payment reports (see Section 9, Employer’s separate report).

The employer pays withholding tax and social insurance contributions to parties responsible for collecting these payments following separate schedules. The Incomes Register has no impact on cash flows or payment deadlines.

1.3 Earnings payment data and other payments are reported to the Incomes Register

1.3.1 Data reported to the Incomes Register

The act on the incomes information system (Laki tulotietojärjestelmästä 53/2018) defines what data must be reported to the Incomes Register.

For example, the following data must be reported to the Incomes Register:

- identification data on the payer and income earner

- wages, fees, fringe benefits and other earned income, such as non-wage compensation for work

- reimbursements of travel expenses (to be reported even if no monetary wages are paid)

- insurance-related data

- data related to international working

- employment relationship data

- absence data.

1.3.2 Three different reports are submitted to the Incomes Register

Data is submitted to the Incomes Register on three different reports.

The earnings payment report is used to submit data on wages and other payments separately for each income earner. A single earnings payment report includes data on a single income earner on a single payment date. The earnings payment report is primarily submitted no later than on the fifth calendar day after the payment date (see Section 2, Deadlines for reporting data).

A regular employer entered in the Finnish Tax Administration’s employer register must report, every month, the total amount of health insurance contributions paid and deductions made from health insurance contributions on the basis of wages using the employer's separate report. If no wages have been paid during a month, a regular employer must report the ‘No wages payable’ data on the employer’s separate report. For submitting the employer’s separate report, see Section 9 and Reporting data to the Incomes Register: employer’s separate report.

Pension and benefits payment data are reported on the benefits payment report. Only certain benefit payers defined in the legislation, such as the Social Insurance Institution of Finland (Kela) and insurance companies, report benefits payment data to the Incomes Register. The benefits payment report is used to submit data, for example, on old-age pensions, unemployment allowances or care allowances. Instead, pensions paid by the employer are reported normally to the Incomes Register on the earnings payment report. Pension and benefits payment data is reported to the Incomes Register starting from the beginning of 2021. For more information on reporting benefits payment data, see Benefits: Reporting data to the Incomes Register.

1.3.3 Data excluded from the Incomes Register

For example, the following data is not reported to the Incomes Register:

- Trade union membership fees and unemployment fund fees

- Grants and scholarships

- Fees for elected officials paid directly by the income earner to a political party

- Data about a company’s line of business and ownership arrangements

- Causes of absence of a sensitive nature and sensitive income

- A majority of capital income, such as interest, dividends and capital gains

- Dividends based on work effort are reported to the Incomes Register.

- Capital income paid by the employer, such as interest on wage receivables and guarantee commissions, are reported to the Incomes Register.

- Shareholder loans granted by limited liability companies that are considered capital income for a natural person, and the repayment of such loans

- Travel and accommodation expenses paid by the employer against a receipt, such as tickets and hotel invoices

- Expense items attributable to the employer which an employee has paid and for which the employer has later compensated on the basis of a voucher

- A self-employed person’s income from work, if the self-employed person is insured in accordance with the self-employed persons’ pensions act (Yrittäjän eläkelaki 1272/2006) or the farmers’ pensions act (Maatalousyrittäjän eläkelaki 1280/2006)

- A self-employed person’s income from work means the annual income from work subject to the self-employed person’s pension insurance as confirmed by the pension provider.

The aforementioned data must, also later, be reported directly to data users who require the data, for example, on an annual information return or upon request to the party that needs the data in question.

1.4 Earnings payment data is reported over a specific payment data and pay period

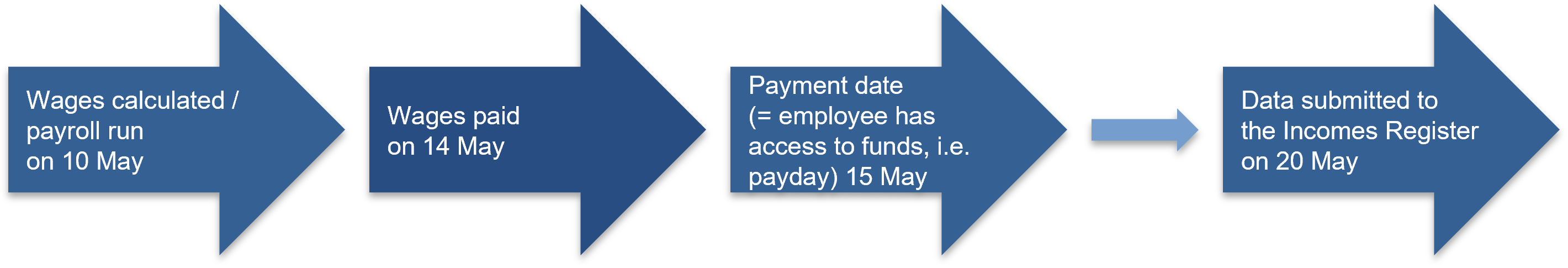

An income earner’s earnings payment data must be reported to the Incomes Register on the earnings payment report no later than on the fifth calendar day after the payment date. A single report can include data on a single income earner on a single payment date. In the Incomes Register, payment date is the date on which the payment is available to the income earner, e.g. the day on which the payment is registered in the income earner’s bank account (the income earner’s payday). It is irrelevant when the payment was earned (for more information on earnings periods, see Section 3.2, Income earnings periods). The deadline of five calendar days also includes Saturdays, Sundays and other holidays. However, if the report deadline is a Saturday, Sunday or other holiday, the data can be reported on the following business day. For more information about deadlines, see Section 2, Deadlines for reporting data.

If no euro-denominated payments are paid to an income earner, the date on which data was submitted to the Incomes Register must be reported as the payment date. Such other reporting date must be provided, for example, when only data about absences, employment relationships, work periods or stay periods is reported.

If several payments are paid to an income earner on a single day, the payer can report them on a single report. The payer may also report payments paid on a single day separately if, for example, wages and reimbursements of expenses paid on a single day are paid from different systems.

The payment date can be outside the pay period.

The pay period (wage period) is the period, over which wages or other income are paid. A company may have several pay periods, such as separate pay periods for employees earning monthly and weekly wages. The pay period of a single income earner may also differ from the company’s normal pay period. For example, if an employment relationship starts or ends during a pay period, the pay period also starts or ends on the same day. Therefore, the duration of the pay period may be different for different income earners in certain situations. The income payment date can also be outside the pay period. Income is deemed to be earned during the month, during which it is paid.

Example 1: A company has two pay periods: a one-month pay period for employees earning monthly wages and a two-week pay period for employees earning hourly wages. The employer pays wages earned during the previous pay period on the last day of the pay period. Income is deemed to be earned by an employee during the month, during which it is paid.

If pay periods are not normally used in the system, from which reports are sent, such as regarding non-wage compensation for work, the first and last work performance date, on which the payment of non-wage compensation for work is based, can be used as the pay period. The duration of a pay period may also be one day if the performance of work took one day. In such a situation, the company's normal pay period can be indicated as the pay period. If this is not possible, the current calendar month can be indicated. Correspondingly, the company’s normal pay period or the current calendar month can be used when reporting reimbursements of expenses. The payer can report the period, over which reimbursements of travel expenses are paid, as the pay period.

Records submitted to the Incomes Register through the technical interface or upload service can only include data on a single pay period, even if all payments had the same payment date. For example, if payments have been paid on a single payment date to employees earning monthly wages whose pay period is one calendar month and to employees earning hourly wages whose pay period is two weeks, data must be submitted in separate records. Correspondingly, if an income earner has had a differing pay period due to the start or end of their employment relationship, data must be submitted to the Incomes Register in separate records. The employment relationship as such is irrelevant: if the payment date and pay period are the same, the payer can report payments paid to employees in an employment relationship and persons not in an employment relationship in a single record.

1.5 Data is reported as code values

The Incomes Register uses different code sets: the Incomes Register’s codes and data users’ codes. Some of them are related to the technical implementation of report transfers, while some are related to the content of reports. The Incomes Register’s codes are published at incomesregister.fi. For example, wage income types comprise one set of codes, while error codes make up another. The use of codes is described in instructions and in more technical descriptions intended for software developers. Data users’ codes are mainly published on data users’ websites. A majority of external codes are related to occupational classes and pension provisions.

Many items of data on an earnings payment report are reported as code values. Data reported as codes include several employment relationship data, reasons for absence data, income types, other payer details, additional income earner details and the income earner’s occupational class.

Some payroll software products have started to use the Incomes Register’s codes as part of the payroll program, in which case the payer selects the data used from the payroll program and the program generates the code value required in the background. If the payroll program does not directly provide the codes and code values needed by the payer, some of the code sets used in the Incomes Register are described in the Code Sets documents available on the incomesregister.fi website. The payer can use these documents to select the code value used. The correct income type can be selected by using the Wage income types page, while occupational classes are presented in Incomes Register´s Classification of Occupations (TK10). Code values must be identified, particularly when data is reported on a paper form. The Incomes Register’s e-service offers guidance when selecting code values.

Example 2: Reporting employment relationship data as code values

An income earner works part-time in the paper industry, with total working hours being 25 hours per week. The fixed-term employment relationship will end at the end of the year.

How data is reported to the Incomes Register is presented below. A plain text description of the given code value is presented in brackets.

| EMPLOYMENT RELATIONSHIP DATA |

|---|

|

Employed: Yes The collective agreement applicable to the employment relationship: 118 (collective agreement for the paper industry) Type of employment: 2 (Part-time) Duration of employment: 2 (Fixed term) Part-time %: 64,95 Regular agreed working hours per week: 25 Form of payment: 1 (Monthly wages) |

| Time of employment: |

|

Start date of the employment: 15.2.20xx End date of the employment: 31.12.20xx Reason codes for termination of employment: 3 (Incomes Register’s codes) Reason for the termination of employment: 7 (end of a fixed-term employment relationship) |

1.6 Data is reported in electronic format

As a ground rule, data is reported to the Incomes Register within five calendar days after the payment of wages. Electronic reporting is a pre-requisite for activities and enables the effective and real-time use of the Incomes Register.

Data can be submitted to the Incomes Register in four different ways:

- via the technical interface

- via the e-service’s upload service

- using the e-service web form

- on a paper form.

The technical interface means that payroll software is integrated with the Incomes Register via a technical interface. The payer’s software is identified using a technical certificate, and no other identification is necessary. Via the technical interface, earnings payment data can be submitted directly from the payroll system to the Incomes Register without the user having to access a separate Incomes Register service.

If it is not possible to use the technical interface, data can also be submitted via the Incomes Register’s e-service, which can be logged in to from the incomesregister.fi page. In the e-service, data can be submitted to the Incomes Register in two ways: by uploading files or by entering the data of a single report onto a web form.

In the e-service’s upload service, the payer can upload a file, which they have first generated in their payroll system, to the Incomes Register. Users are identified in the e-service using the Suomi.fi identification service. Users of the upload service must also be identified.

The payer can also submit data using the e-service web form. In this case, the payer enters data manually on a web form, one report at a time. Users are identified in the e-service using the Suomi.fi identification service.

In special circumstances, the payer can submit data on a paper form. Special circumstances can be regarded as situations in which the electronic submission of data cannot reasonably be required, such as when a natural person, estate, temporary employer or foreigner does not have the possibility of electronically submitting the data.

Read more about data reporting channels.

1.7 Earnings payment reports include mandatory and complementary data

Both mandatory data and complementary, or voluntary, data are reported to the Incomes Register. Some mandatory data must be submitted on every report, while some must only be submitted if the income in question has been paid or if a certain condition is in effect.

In addition to mandatory data, the payer may also submit voluntary complementary data.

1.7.1 Mandatory data

Mandatory data includes identifying and identification data, such as data on the payer and income earner, as well as the pay period and payment date.

Some of the income types available on the earnings payment report are mandatory data when the income in question is paid. Mandatory data includes wages, fringe benefits, fees, prizes and other taxable benefits (act on the incomes information system, section 6).

Monetary wages must be reported to the Incomes Register at least as a total amount. This means that the payer adds up the pay types of the monetary wages in the payroll system and reports the total monetary wages on an earnings payment report. If monetary wages are reported as a total amount, some data users may have to request more detailed information from the payer, because this more limited level of detail is not sufficient for all users. The reporting of monetary wages is described in more detail in Reporting data to the Incomes Register: monetary wages and items deducted from wages.

Certain employment relationship data is mandatory, if the employment is insured under the public sector pensions act (Julkisten alojen eläkelaki 81/2016) or is employment with the Bank of Finland. The reporting of employment relationship data is described in Section 7.

1.7.2 Complementary data

Voluntary complementary data includes:

- the reporting of monetary wages itemised according to complementary income types (the greater level of detail for reporting monetary wages, i.e. reporting method 2), e.g. contract pay, holiday bonus or overtime compensation

- other additional data, such as certain employment relationship data, absence data and earnings periods of income types.

Complementary data should be reported to the Incomes Register as comprehensively as possible, so that all data users who receive information from the Incomes Register can use the data at the required level of detail. Complementary data is necessary for data users who grant benefits, for example, as grounds for granting or paying such benefits.

When the employer submits necessary complementary data with data on paid wages, fewer complementary reports will be required afterwards. If data is not reported, data users may need to request further information from the payer separately at a later date.

The reporting of regularly submitted mandatory data and voluntarily submitted complementary data is described in more detail in Reporting data to the Incomes Register: mandatory and complementary data in the earnings payment report.

1.8 Storage and correction of data

Data is stored in the Incomes Register for ten years from the beginning of the year following the year during which the data was registered. This equals the time private employers are obligated to retain their payroll and other accounting data. The retention period for payroll and other accounting data is longer than ten years for employers within the scope of the public sector pensions act.

Payments made on 1 January 2019 and later and any corrections to be made to these incomes are reported to the Incomes Register. If data on payments made prior to 2019 is corrected, the corrections are not reported to the Incomes Register. The correction of data includes the following principles:

- Payments made on and prior to 31 December 2018 and corrections to be made to these incomes are reported in accordance with practices valid before 2019, such as directly to pension providers and other social insurance providers, as well as the Finnish Tax Administration.

- If payments made prior to 2019 are recovered in or after 2019, recovery data must be reported to the Incomes Register.

The payer is responsible for the accuracy of data they have reported to the Incomes Register. If incorrect data in the Incomes Register is based on the payer’s report, the payer is obligated to correct the incorrect data they have reported.

As a rule, data in the Incomes Register is corrected using the replacement method. This means that the original report is corrected so that all data on the report is resubmitted, including the data that was correct in the original report, in addition to new and changed data. In certain situations, payments must be corrected by cancelling a previous report and submitting a new report. A more detailed description of how to correct data is provided in the instructions Correcting data in the Incomes Register.

1.9 Administrative consequences for neglecting to submit data

A late-filing penalty will only be imposed on mandatory data reported late to the Incomes Register by an employer or other payer. The late-filing penalty will be imposed by the Finnish Tax Administration on the basis of information received from the Incomes Register.

Penalty fees for failure to fulfil the reporting obligation to the Incomes Register with regard to taxation data include a tax increase in accordance with the act on assessment procedure for self-assessed taxes (Laki oma-aloitteisten verojen verotusmenettelystä 768/2016) and the third-party-information provider’s negligence penalty in accordance with the act on assessment procedure (Laki verotusmenettelystä 1558/1995). Other sanctions may be imposed by the data users of the Incomes Register.

The late-filing penalty and other sanctions are described in the instructions Reporting data to the Incomes Register: penalty fees.

1.10 Reporting in a nutshell

The payer reports data separately on each income earner to the Incomes Register in accordance with jointly accepted practices. The following general principles apply to reporting data to the Incomes Register:

- Paid wages and other payments are reported to the Incomes Register separately for each income earner.

- The total amount of wages, withholding tax and tax at source is not reported.

- Only the total amount of health insurance contributions is reported separately on a monthly basis on the employer’s separate report.

- The obligation to report data is established when a payment is made.

- Primarily, there is no lower euro limit for the data to be reported to the Incomes Register.

- Competition prizes are only reported if their value is more than EUR 100.

- Data on a single income earner on a single payment date is only provided on a single earnings payment report.

- Several income types can be submitted on a single earnings payment report for one income earner.

- The items deducted from wages can be reported as a total amount of all income types, even if the report includes several income types.

- Deductible items include withholding tax, tax at source and the employee’s earnings-related pension and unemployment insurance contributions.

- A report cannot include deductible items only (400 series income types), as the report must always include the payment, from which items are deducted.

- On earnings payment reports, many items of data are reported as code values selected from the Incomes Register’s codes.

- For example, payments made and the income earner’s occupation are reported as code values. The reporting of income types is described in Section 3.

- A single record can include all earnings payment reports of a single payer, a single payment date and a single pay period for different income earners.

- It is irrelevant whether some income earners are in an employment relationship and whether some are not.

An example of the progress of the reporting of wages:

2 Deadlines for reporting data

The deadlines for reporting data to be submitted to the Incomes Register concern mandatory data, such as wage income and fees (act on the incomes information system, sections 6 and 8). No similar deadlines exist for reporting voluntarily submitted complementary data. However, it is recommended that complementary data be submitted at the same time as mandatory data. In addition, it is recommended that complementary data be submitted no later than on the payment date to make it available to data users in real time.

2.1. Deadlines for reporting monetary wages and other payments

Monetary payments

- Data must be reported to the Incomes Register no later than on the fifth calendar day after the payment date.

- The payment date is the date on which the payment is available for use by the income earner, i.e. the payday.

- The calculation of five calendar days following the payment date includes Saturdays, Sundays and other holidays. However, if the last filing date falls on a Saturday, Sunday or other holiday, the data can be reported on the following business day in accordance with section 5 of the act on the calculation of decreed time limits (Laki säädettyjen määräaikain laskemisesta 150/1930).

- Private individuals and death estates must report data on a monthly basis no later than on the fifth day of the month following the payment date. If an individual or estate is registered in the employer register as referred to in section 31 of the tax prepayment act (Ennakkoperintälaki 1118/1996), the data must, however, be reported by the fifth calendar day after the payment date.

- Tax-exempt reimbursements of expenses (daily, meal and kilometre allowances) can be reported monthly, no later than on the fifth day of the month following the payment date.

- Advance pay paid (Employment Contracts Act 55/2001) can be reported following the same deadline as that set for wages to be paid later during the same pay period, as long as the wages are paid during the same calendar month. This regulation also applies to wages paid during the same calendar month to a shareholder in a limited liability company, a partner in a general partnership or limited partnership or a person acting in a leading position, who is not considered to be in an employment relationship with the payer due to their position, such as the managing director of a limited liability company or a co-operative.

- When wages are withdrawn from a company, the payment date is the actual payday of the month or, if there is no such payday, the last day on which wages have been withdrawn during the month. The report must be submitted within five calendar days after the last withdrawal of the month.

- One-off payments of no more than EUR 200 made by a registered association can be reported monthly, no later than on the fifth day of the month following the payment date.

Fringe benefits

- If an income earner is only granted a fringe benefit, it must be reported monthly, no later than on the fifth day of the next calendar month.

- If monetary payments are also made to the income earner at the same time, the fringe benefit can be reported no later than on the fifth day of the next calendar month. Alternatively, the fringe benefit can be reported together with the monetary wages for the same month, no later than on the fifth calendar day after the payment date.

- If monetary wages are also paid for the fringe benefit’s accrual month during the next calendar month, the fringe benefit can also be reported as income for the calendar month following its accrual month. The report must then be submitted no later than on the fifth day of the calendar month following the month as the income for which the fringe benefit was reported.

Example 3: Wages accrued during December are paid on 10 January the next year. The payer can report the fringe benefit as income for December, separately from the December wages, no later than on 5 January. Alternatively, the payer can report the fringe benefit as income for January, together with the monetary wages, no later than on 15 January, or separately no later than on 5 February.

Non-monetary payments and benefits other than fringe benefits

- If an income earner is only granted a benefit, it must be reported monthly, no later than on the fifth day of the next calendar month.

- If monetary payments are made to the income earner at the same time, all benefits and payments must be reported no later than on the fifth day after the payment date.

- Non-monetary payments and benefits include employee stock options, stock options and grants, and share issues for employees granted to the income earner.

Amount of wages for insurance purposes

- Data must be reported each month, no later than on the fifth day of the calendar month following the performance of work.

Total amount of the employer’s health insurance contribution

- Data must be reported monthly, no later than on the fifth day of the calendar month following the wage payment month. The payer calculates the amount from wages paid during the month and submits the data on the employer’s separate report.

- If the payer is a regular employer entered in the Finnish Tax Administration’s employer register, the total amount of the health insurance contribution or the ‘No wages payable’ data must be reported every month.

- Casual employers are not included in the Finnish Tax Administration’s employer register. Casual employers must only report the total amount of the health insurance contribution on the employer’s separate report regarding the months, during which they pay wages or reimbursements of expenses. In this case, the due date is the same as that defined for regular employers, i.e. the fifth day of the following calendar month.

2.2 Deadlines for reporting other data

‘No wages payable’ data

- Data must be reported monthly, no later than on the fifth day of the calendar month following the wage payment month.

- The 'No wages payable’ data is reported separately for each month, during which the employer has not paid any wages or reimbursements of expenses. The data can be reported in advance for six calendar months, if it is known that there is no intention of paying wages over the next six months.

- If the payer is a casual employer who does not pay any wages during a month, it does not have to submit the employer’s separate report or the ‘No wages payable’ data for that month.

The odometer reading of a fringe benefit car

- Data on the odometer reading of a fringe benefit car must be reported when the operating costs of an income earner’s company car benefit are calculated as a per-kilometre value rather than a monthly value.

- The data must be reported on the last report of the year at the latest. The Tax Administration can issue further regulations concerning the time at which the data must be submitted.

The number of kilometres for a tax-exempt kilometre allowance

- Data on the number of kilometres based on which tax-exempt kilometre allowances have been paid during the year must be submitted on the final report of the year at the latest. The Tax Administration can issue further regulations concerning the time at which the data must be submitted.

Data related to working abroad

- Data must be reported no later than on the fifth calendar day following the payment date of the first wages paid for working abroad.

- However, data on the employee’s periods of stay in Finland must be reported by the end of January of the year following the payment year.

Substitute payer situations

- Regular employers must submit an earnings payment report and the employer’s separate report to the Incomes Register on a wage payment month-specific basis regarding payments made by a substitute payer no later than on the fifth day of the calendar month following the payment month. In addition to payments made by a substitute payer, regular employers must report payments they have paid to income earners. In this case, however, it must be noted that the deadline for reporting payments made by regular employers is primarily the fifth calendar day following the payment date.

- Substitute payers must primarily submit reports on their monetary payments no later than on the fifth calendar day following the payment date.

2.3 Deadlines for correcting data

Correcting errors

- The payer must correct any erroneous reports submitted without undue delay. This means that erroneous reports must be corrected as soon as the error is noticed.

Unjust enrichment

- Data on an unjust enrichment must be reported without undue delay and no later than within one month after becoming aware of the unjust enrichment.

Reporting recovered payments

- Data on recovered amounts must be reported no later than on the fifth calendar day following the day of becoming aware of the payment of the recovered amount, its payer and the unjust enrichment to which the payment is connected.

2.4 Reporting data in advance

Data can also be submitted to the Incomes Register before the payment date, for example, directly from the payroll run. Data can be reported no earlier than 45 days before the payment date.

Some data, such as work and stay periods and absences, can be reported in advance without any time limits. For example, if it is known beforehand that the duration of an income earner’s fixed-term employment relationship is 12 months, the end data of the employment relationship can be reported in advance. Employment relationships starting in the future can be reported no earlier than 45 days before the start of employment. It is recommended that information about the start of employment relationships be submitted immediately in the first report regarding the payment of wages. The reporting of absence and employment relationship data is described in more detail in separate instructions Reporting data to the Incomes Register: employment relationship data and Reporting data to the Incomes Register: absence data.

The ‘No wages payable’ data can be reported in advance for 6 calendar months on the employer’s separate report, if it is known that there is no intention to pay any wages during the next six months. The total amount of the employer’s health insurance contribution and any deductions made from the employer’s health insurance contribution can be reported for no more than one month before the beginning of the reporting period.

2.5 Deadline for data submitted on a paper form

The five-day deadline for monetary payments applies to electronically submitted data. The deadline for reporting data on a paper form is longer than in electronic reporting: the data must be submitted no later than on the eighth calendar day after the payment date (instead of the fifth calendar day). If a household submits the data using a paper form, the report must be submitted no later than on the eighth day of the following month. Data can only be submitted on a paper form in special circumstances, for example, if submitting an electronic report is impossible for an individual, estate, casual employer or foreigner due to technical obstacles.

3 Income types

3.1 Incomes types used in the Incomes Register

The income types used in the Incomes Register provide the level of precision required by all or some data users. Paid income is reported to the Incomes Register according to the basis for payment, such as time-rate pay or contract pay. In addition to income, data on absences, such as an absence period, any amount of wages during this period and the cause of absence, such as an illness, training or military refresher training, can be reported. The causes of absence saved in the Incomes Register are described in instructions Reporting data to the Incomes Register: absence data.

The income types used on earnings payment reports largely correspond to the most common pay types used by payroll software. Each income type used in the Incomes Register has a unique three-digit code value for reporting income. The description of each income type indicates the situations where the income type is to be used. Several different income types can be reported on an earnings payment report for a single income earner. Income types, and their descriptions and code values are described on the Wage income types page at incomesregister.fi.

The income types of the Incomes Register have been defined so that they are suitable for various payment situations. The payer must ensure that the income type used corresponds to the situation where a payment was paid to an income earner. In other words, the income type used when reporting data must match the payment situation in question.

The payer selects the income type to be used and reports the paid amount in addition to the code value of the income type. The paid amount is reported as a euro amount, even if the payment was made in some other currency. If a payment is made in some other currency, the payment must be converted into euros using the European Central Bank's (ECB) reference exchange rate valid on the payment date. If the payment is reported in the Incomes Register before the payment date, for example, in connection with a payroll run, the income amount reported must be converted using the reference exchange rate valid on the reporting date in question.

3.1.1. Grouping income types

The following income type groups are used on earnings payment reports:

- 100 series income types: reporting of monetary wages as a total amount (reporting method 1, mandatory minimum level)

- 200 series income types: itemised reporting of monetary wages (reporting method 2, complementary income types)

- 300 series income types: separately reported income types, e.g. fringe benefits and reimbursements of expenses

- 400 series income types: items deducted from income and other payments, e.g. withholding tax and employee contributions.

Several different income types can be reported on a single earnings payment report for a single income earner. However, 100 and 200 series income types cannot be reported on a single earnings payment report. As new income types have also been added to the Incomes Register after its deployment, each income type has a validity period. The income type used must be valid on the payment date.

3.1.2 Overpaid income

If an income earner is not entitled to a payment paid to them and reported to the Incomes Register, the payer must report the conversion of the income into an unjust enrichment without undue delay and no later than within one month after becoming aware of the unjust enrichment.

An unjust enrichment must always be reported when noticing that a payment has been paid erroneously to an income earner. If an overpayment has been made to an income earner, and the payment has been reported to the Incomes Register, the submitted report can no longer be corrected by using negative amounts. Overpaid income is corrected by submitting a replacement report, indicating the changed nature of the income, for example, the conversion of paid income into an unjust enrichment. The previously reported amount of income is corrected, and the overpayment is marked as an unjust enrichment.

Therefore, the overpayment and recovered income are reported as positive amounts to the Incomes Register. However, the Incomes Register includes certain exceptions when certain items deducted and charged from wages can be negative amounts. Items deducted from wages include the income types listed below that can exceptionally be negative:

- 402 Withholding tax

- 404 Tax at source

- 412 Employee’s health insurance contribution

- 413 Employee’s earnings-related pension insurance contribution

- 414 Employee’s unemployment insurance contribution

The reporting of an unjust enrichment and negative data is described in more detail in instructions Correcting data in the Incomes Register, Sections 2.4 and 3.

3.1.3 Recovered income

When an income earner repays an overpayment to the payer, data on the repayment must be reported to the Incomes Register. The recovered amount is not corrected on the original report; instead, the recovered amount is submitted on a report of the pay period during which the income is recovered.

Income can be recovered as either a net or a gross amount. Income can be recovered from the income earner as a net amount until the due date determined in the Tax Administration’s decision.

The procedure is described in more detail in instructions Correcting data in the Incomes Register, Section 4.

3.1.4 One-off remuneration

When reporting an income type, the payer may provide additional information to indicate that the income paid was a one-off payment.

A one-off remuneration is occasional income that is made only once and its payment does not recur. The income may have accumulated earlier or it can be paid in advance. For example, monthly payments are regularly recurring, which is why they are not reported as one-off remunerations, even if their amount changed during every payment. The Finnish Tax Administration requires data on one-off remunerations when it assesses the accuracy of withholding. The Finnish Tax Administration assesses whether a certain payment is made identically throughout the year, for example. If a payment is reported as a one-off remuneration, the Finnish Tax Administration knows that it is occasionally paid one-off non-recurring income. One-off remuneration is complementary additional data, which can be reported by the payer on a voluntary basis.

It is recommended that the ‘One-off remuneration’ data is only used when a bonus or a certain amount accrued over a specific period is paid to the income earner at the end of employment. These situations truly involve one-off payments, and they are not expected to recur. For some income earners, full-year earnings may largely consist of one-off payments (e.g. for freelancers) or the amount of paid income may vary. In these situations, the ‘One-off remuneration’ data is not reported. Furthermore, a household does not need to report the data when it pays a one-off payment to an income earner, even if there is no intention to make any subsequent payments. When the amount of paid income varies from one payment to the next, but payments are recurring, this data is not used.

If only some of the income is paid as a one-off remuneration, the data in question is reported as separate income types: the regularly paid amount separately and the one-off remuneration separately.

3.1.5 Income paid in other than money

In addition to money, remuneration for work can be given as some other remuneration, such as shares, options or the reciprocal exchange of work. If a payment has been made in other than money, additional data ‘Payment other than money’ and the fair value of the remuneration amount must be reported for the income type. Fair value means, for example, the costs incurred from obtaining a benefit. However, additional data ‘Payment other than money’ does not need to be reported for fringe benefits.

If only some of the income was paid in other than money, the data in question is reported as separate income types: amount paid in money separately, and amount paid in other than money separately.

3.2 Income earnings periods

An earnings period (income accrual period) can be marked for each individual income type. The earnings period is the period over which the income has been accrued. The earnings period for wages and other income may be longer than the pay period, such as one year, or the earnings period may be shorter than the pay period, such as one day. The earnings period is indicated separately for each income type, and earnings periods of different durations can be given for different income types on a single report.

The earnings period is voluntarily reported complementary data which is, however, needed by many data users, such as social insurance providers, unemployment funds and Kela. Even though the earnings period is voluntary data, it is recommended that it be reported. It is particularly important to report earnings period data for income subject to social insurance contributions and other taxable incomes.

Reporting the earnings period is particularly useful when the earnings period of the income type extends to the time before the pay period, for example, when pay supplements, profit-sharing bonuses, holiday bonuses or holiday compensation are paid retroactively. When the earnings period is inside the pay period, it is particularly useful to report it when the work is part-time or occasional work.

For tax-exempt payments, such as daily allowances and kilometre allowances, earnings periods do not need to be reported. The payer may also report the earnings period for tax-exempt income. In this case, the period over which the remuneration has been earned and accrued is reported.

Several different income types can be reported on an earnings payment report for a single income earner. In addition, a single income type can be reported several times for a single income earner on a single report if, for example, the earnings periods of incomes differ from one another. The only exception is the ‘Total wages’ income type (code value 101), which can only be once on a report, except if part of income is reported as an unjust enrichment or recovered income. If the ‘Total wages’ income type includes several different incomes, the period over which the majority of the income was accrued is reported as the earnings period. Because some data users need to request more detailed data on the accrual of income from the payer in these situations, it is recommended that data be reported using income types of reporting method 2.

Example 4: A payer has paid monthly wages of EUR 3,000 to an income earner, plus a holiday bonus of EUR 1,500 and an overtime pay of EUR 450.

These incomes have been accrued on different occasions. In addition, the income earner has had accommodation and telephone benefits during the month, as well as a meal benefit provided by the employer.

The payer can report all of the income earner’s incomes on a single earnings payment report. By using reporting method 2, overtime pays accrued on different occasions can be reported separately

| MONETARY WAGES | |||

|---|---|---|---|

| Reporting method 1 | EUR | Reporting method 2 | EUR |

|

101 Total wages Earnings period: 1.4.2021–30.4.2021 |

4950.00 |

201 Time-rate pay Earnings period: 1.4.2021–30.4.2021 |

3000.00 |

|

|

213 Holiday bonus Earnings period: 1.4.2018–31.3.2021 |

1500.00 |

|

|

|

|

235 Overtime compensation Earnings period: 8.3.2021–12.3.2021 |

300.00 |

|

|

|

235 Overtime compensation Earnings period: 16.4.2021–17.4.2021 |

150.00 |

| SEPARATELY REPORTED INCOME TYPES: | |||

| Alternative method 1 | EUR | Alternative method 2 | EUR |

|

317 Other fringe benefit |

770.00 |

301 Accommodation benefit |

600.00 |

|

Type of benefit: Accommodation benefit Type of benefit: Telephone benefit Type of benefit: Meal benefit |

|

330 Telephone benefit |

20.00 |

|

|

|

334 Meal benefit |

150.00 |

Income earnings periods must be separated from pay periods used by the company. Pay periods are described in more detail in Section 1.4.

3.3 Social insurance contributions of income types

The different social insurance contributions, which income is subject to, have been defined in advance for each income type on the earnings payment report. Therefore, each income type is subject to a default social insurance contribution. If the income is paid according to the default, the employer does not have to specially determine the social insurance contributions when submitting the report. Data users determine the social insurance contributions based on the income type used by the payer.

The grounds for the social insurance contributions of some income types may vary according to the situation, even if the payer is the same. The payment of social insurance contributions may vary according to, for example, whether or not the payment was made in an employment relationship (employment or public service relationship). In such situations, the payer can change the default value of the social insurance contribution of the income type by reporting the Exception to insurance information data.

The Wage income types page at incomesregister.fi explains which social insurance contributions are the default for which income type, and descriptions of income types present the situations where the social insurance contributions may vary. The instructions Reporting data to the Incomes Register: insurance-related data describe how the payer can change the default values of social insurance contributions.

3.4 Unit of wages

The payer may report the unit of wages for an income type. The unit of wages is voluntary additional data, which complements the income type in question. The payer reports the unit according to how wages have been paid. If time-based wages are paid to a person, an hour, day, week or period is selected as the unit. The number of realised units is reported as data, such as completed hours.

Only time-based units are used on the earnings payment report. For example, there are no contract-based codes (e.g. item or square metre). Therefore, the number of units cannot be reported for contract pay, except if the contract is based on time. However, an indication that pay has been paid on the basis of a contract is necessary for data users. It is important to report the earnings period for contract pay.

Example 5: A person receiving a monthly salary is paid a time-rate pay of EUR 1,800

| Income type | EUR |

|---|---|

| Time-rate pay | 1800.00 |

| Unit | Data |

| Unit price | 1800.00 |

| Number of units | 1 |

| Unit | Period |

Example 6: A person receiving an hourly salary is paid EUR 15 per hour, and the person has worked 80 hours

| Income type | EUR |

|---|---|

| Time-rate pay | 1200.00 |

| Unit | Data |

| Unit price | 15.00 |

| Number of units | 80 |

| Unit | Hour |

4 Payer type and additional income earner information

Certain additional information about the payer and income earner is reported on the earnings payment report. On the basis of this information, the Finnish Tax Administration, for example, knows whether the payer is subject to withholding tax or whether the income received by the income earner must be taxed differently from normal. Earnings-related pension providers obtain information about whether the payer has made an agreement on earnings-related pension. In addition, international treaties obligate Finland to collect and transmit data on certain wages separately to the income earner’s country of residence.

4.1 Payer type

The following data can be reported as the payer type:

- Public sector organisation

- International specialised agency

- Pool of household employers

- Household

- Temporary employer (no TyEL insurance)

- Foreign group company

- Foreign employer

- State

- Unincorporated state enterprise or governmental institution with separate administration.

The situations where each data is used are described below. Several pieces of additional data can be reported on the payer on a single report, such as a household and temporary employer.

This data is not reported if the payer is none of the aforementioned. Therefore, if the payer is a limited liability company or other company which pays wages regularly, and none of the additional data is applicable, no payer type is reported.

Public sector organisation

This data is reported when the income earner is a non-resident taxpayer and the payer is any of the following: the state, a municipality, a joint municipal authority, a wellbeing services county or joint authority, the Provincial Government of Åland, the Evangelical Lutheran Church of Finland or the Finnish Orthodox Church, or their parish or group of church parishes. Public sector organisations do not include private law associations and foundations, or universities and higher education institutes. This data is needed in international exchanges of data. When the payment is made to a person with unlimited tax liability, the data does not need to be provided even if the payer is a public sector entity.

International specialised agency

This data is reported when the payer is an international specialised agency, which pays wages, from which no income tax is levied in Finland based on an agreement concerning international specialised agencies. However, the wages may be subject to certain insurance contributions. Such specialised agencies include the European Chemicals Agency ECHA, the Baltic Marine Environment Protection Commission HELCOM, the World Institute for Development Economics Research and the International Organisation for Migration IOM.

Other agencies do not need to report this data. Non-profit organisations established in Finland, such as sports clubs, are not international specialised agencies. For more information, see Reporting data to the Incomes Register: international situations

Pool of household employers

This data is reported when the payer submits a report as a representative of a pool of household employers. A pool of household employers is formed when several households together have hired a cleaner, nanny or other employee, and one person pays wages and submit data to the Incomes Register on behalf of the pool using their personal identity code.

When the members of the pool hire an employee under one common employment contract, they are jointly responsible employers for the employee. In such a case, the members of the group of employers are jointly responsible for paying the employer obligations related to the employment relationship. The households must mutually agree on who will collect and pay the tax withholding and the employer’s health insurance contribution, and who will handle the rest of the employer obligations, i.e. the earnings-related pension insurance, accident insurance and occupational disease insurance, and pay the unemployment insurance contributions.

The responsible person is the pool’s representative and uses their own personal identity code for reporting and paying. Reporting payments paid by a pool of household employers is described in more detail in the Incomes Register’s instructions Reporting data to the Incomes Register: households as employers.

Household

This data is reported when the payer is a household or private individual formed by a private household. A household has a different tax withholding obligation than companies and organisations. For more information, see Reporting data to the Incomes Register: households as employers.

Temporary employer (no TyEL insurance)

This data is reported if the payer is a temporary employer. ‘Temporary employer’ is a term used in the earnings-related pension sector to refer to an employer which does not have a valid insurance policy with an earnings-related pension provider. The payer can be a temporary employer if they do not have any permanent employees and if the wages paid to temporary employees during a six month period do not exceed a specific euro limit.

Even if a temporary employer has no insurance policy on providing its employees with a pension cover, the payer must report data on an earnings-related pension if it pays earnings from work to employees, on which earnings-related pension is based. The payer must report the code of the earnings-related pension provider, from which it has provided insurance for its employees, and the pension policy number, which is the same for all temporary employers of a single pension provider. More information is available on pages Temporary employer and in instructions Reporting data to the Incomes Register: households as employers and Reporting data to the Incomes Register: insurance-related data.

Foreign group company

This data is reported when the payer is a company which was not founded in Finland and is part of a group.

This data is reported when a foreign group company pays wages to an employee working abroad. A Finnish company must submit a report on wages if the employee is insured in Finland and is working abroad in the service of a foreign group company. In this case, the Finnish company that posted the employee reports 'Foreign group company’ as the payer type and ‘Person working abroad’ as the additional income earner information type.

Wages paid for work performed abroad may be tax-exempt in Finland, if the six-month rule applies to it or if the income earner is a non-resident taxpayer.

The Finnish company must submit a report on wages and pay social insurance contributions, if the employee is insured in Finland as a worker posted by a Finnish employer. The Finnish company is obligated to submit reports as long as the worker is insured in Finland. For more information, see Reporting data to the Incomes Register: international situations.

Foreign employer

This data is reported when the payer is a company, which has not been established in accordance with the Finnish legislation or whose registered domicile is other than Finland. This data is also reported when the payer is an individual who does not live in Finland, such as a non-resident taxpayer.

If a foreign employer has a permanent establishment in Finland, this data is not reported. Even if the party submitting data is entered in the Tax Administration’s employer register as an employer that pays wages regularly, the ‘Foreign employer’ data must be reported if there is no permanent establishment. For more information, see Reporting data to the Incomes Register: international situations.

State

This data is reported when the payer is the State of Finland.

Unincorporated state enterprise or governmental institution with separate administration

This data is reported when the payer is a Finnish unincorporated state enterprise or governmental institution with separate administration.

4.2 Additional income earner information

The payer must indicate on the earnings payment report if the income earner is any of the following or if the condition in question applies to the income earner:

- Person working on a road ferry on Åland Islands

- Key employee

- Person receiving wages paid by a diplomatic mission

- Person receiving wages for insurance purposes under the EPPO Act

- Performing artist

- Individual with no business ID using an invoicing service

- Joint owner with payer

- Partial owner

- Person working in a frontier district

- Leased employee living abroad

- Person working abroad

- Athlete

- The income earner did not stay longer than 183 days in Finland during the Tax-Treaty-defined sojourn period

- Employer pays taxes on behalf of the employee (‘Net-of-tax’ employment contract)

- Employed with assistance from the State employment fund

- Organisation

- Self-employed person, no obligation to take out YEL or MYEL insurance.

In addition, the payer must indicate if the income earner is a non-resident taxpayer.

The situations where each data is used are described below. Several pieces of additional information can be reported for an income earner on a single report, such as a person working abroad and a joint owner with payer.

Person working on a road ferry on Åland Islands

This data is reported when income has been earned on a road ferry subject to the Provincial Government of Åland. If the income earner also receives income other than income earned on a road ferry, a separate earnings payment report must be submitted without this type of additional income earner information.

Key employee

This data is reported when income is pursuant to the key employee act (Laki ulkomailta tulevan palkansaajan lähdeverosta 1551/1995) or it is paid pursuant to the act on the taxation of employees of the Nordic Investment Bank, NIB (Laki Pohjoismaiden Investointipankin, Pohjoismaiden kehitysrahaston ja Pohjoismaiden ympäristörahoitusyhtiön palveluksessa olevien henkilöiden verottamisesta 562/1976).

A key employee is a foreign specialist to whom wages subject to tax at source for a key employee are paid. Wages can be reported using any income type of wages used in the Incomes Register. In addition, the income earner is marked as a key employee.

The wages of a foreign specialist are regarded as income under the key employee act when the employee comes to Finland for a period longer than six months and thus becomes a resident taxpayer when their work begins. The wages of a Finnish citizen cannot be treated as income under the key employee act. Key employee data is only reported as additional information when the employee has acquired a tax card and an entry has been made in the employee’s tax card regarding the application of the key employee act. The special tax at source collected from wages is reported as tax at source. The tax at source includes the employee’s health insurance contribution. For more information, see Reporting data to the Incomes Register: international situations.

Person receiving wages paid by a diplomatic mission

This data is reported when a payment is paid to a person who is employed by a diplomatic mission and who is not a Finnish citizen. This data is not used when the person is a Finnish citizen. For more information, see Reporting data to the Incomes Register: international situations.

Person receiving wages for insurance purposes under the EPPO Act

The data must be provided when the income earner is a European prosecutor authorised by the European Public Prosecutor’s Office (EPPO) for whom wages for insurance purposes are reported (act on the participation of Finland in the operations of the European Public Prosecutor’s Office (Laki Suomen osallistumisesta Euroopan syyttäjänviraston (EPPO) toimintaan 66/2021)). In such cases, the wages for insurance purposes are connected to a situation other than international employment. For more information, see Reporting data to the Incomes Register: international situations.

Performing artist

This data is reported when a payment is paid to an artist for their personal performance. The payment can be wages or non-wage compensation for work. Performing artists include stage and film actors, radio and television performers, and musicians. For more information, see Reporting data to the Incomes Register: rewarding employees, payments made to an entrepreneur and other special circumstances.

Individual with no business ID using an invoicing service

Entering this data is voluntary. The data is reported when the individual works in their own name and invoices the work carried out for clients through an invoicing service company. The individual performing the work acts like an entrepreneur without, however, establishing their own company. Such individuals are often called self-employed “light entrepreneurs”.

The data is reported by the invoicing service company which the individual uses. This type of additional income earner information is only reported when the individual works without a business ID. If the individual who uses an invoicing service has a business ID, this type of additional income earner information is not reported.

When the invoicing service company pays income to the individual performing the work, it is wages from the perspective of taxation if so has been agreed. Instead, the question is not usually of an employment relationship from the perspective of earnings-related pension insurance, unemployment insurance or accident and occupational disease insurance. In most situations, insurance providers consider individuals who invoice through an invoicing service company to be entrepreneurs, and work must be insured in accordance with the self-employed persons’ pensions act (Yrittäjän eläkelaki 1272/2006).

For more information, see Reporting data to the Incomes Register: rewarding employees, payments made to an entrepreneur and other special circumstances.

Joint owner with payer

This data is reported if the income earner is a joint owner with the payer, i.e. involved in the company or participates in its operations through invested capital. This data does not need to be given if the income earner is a shareholder in a listed company.

Partial owner

This data is reported when the income earner is a partial owner in accordance with the unemployment security act (Työttömyysturvalaki 1290/2002). Partial owners of a company pay a lower income earner’s unemployment insurance premium than employees. Whether a person is a partial owner or an employee is affected by:

- the ownership share of the person and their family members;

- voting power and other control; and

- the person’s position in the company.

Read more on the Employment Fund’s website.

For more information, see Reporting data to the Incomes Register: rewarding employees, payments made to an entrepreneur and other special circumstances.

Person working in a frontier district

This data is reported when work is frontier work defined in the Nordic tax treaty. Work is frontier work if the income earner is a permanent resident of a Swedish or Norwegian municipality on Finland’s land border. It is also required that the income earner works in a Finnish municipality on the same land border.

On the basis of this data, no income tax is collected in Finland from the wages paid to the frontier worker, but the Finnish employer must pay social insurance contributions and collect the employee’s health insurance contribution from the wages.

If the employee performs part of their work in a non-frontier district in Finland, the share of the wages based on this work is subject to taxation in Finland. A separate earnings payment report must be submitted on this income without using this type of additional income earner information.

Read more from the Finnish Tax Administration’s guidelines Taxation on cross-border commuters. For more information, see also Reporting data to the Incomes Register: international situations.

The income earner did not stay longer than 183 days in Finland during the Tax-Treaty-defined sojourn period

This data is reported when a foreign employer pays wages to an employee who is a resident taxpayer in Finland but has stayed in Finland for no more than 183 days during the period defined in the tax treaty. This data is reported only when the foreign employer does not have a permanent establishment in Finland. This data can be specified only by a foreign employer.

In addition to this data, the country code of the country that has the taxation right to the income must be reported. For more information, see Reporting data to the Incomes Register: international situations.

Employer pays taxes on behalf of the employee (‘Net-of-tax’ employment contract)

This data is reported when a foreign employer pays wages to an income earner on the basis of a 'Net-of-tax’ employment contract. A net-of-tax employment contract is a contract based on which the employer promises to pay the taxes and employee’s social insurance contributions from the wages, on behalf of the employee. This data is reported only when the foreign employer does not have a permanent establishment in Finland. This data can be specified only by a foreign employer.

See the Finnish Tax Administration’s guidelines Taxable wages when a foreign company pays net wages for work performed in Finland. For more information, see also Reporting data to the Incomes Register: international situations.

Leased employee living abroad

This data is reported when a foreign employer makes a payment to a leased employee living abroad. This data is reported regardless of the duration of the work or whether the employee is a resident or non-resident taxpayer in Finland.

This data is used by an employer with no permanent establishment in Finland. If the employer has a permanent establishment in Finland, the income is reported as normal wages, and the ‘Foreign leased employee’ data is not given.

This data is only submitted for leased employees, with the tax treaty between their country of residence and Finland permitting taxation of leased employees.

This data is also be reported for leased employees coming from countries with which Finland does not have a tax treaty. Read more on the taxation of foreign leased employees in Finland.

For more information, see also Reporting data to the Incomes Register: international situations.

Person working abroad

This data is reported when an income earner works abroad. This data must be submitted when the income earner works abroad as a posted worker of a Finnish employer, and the Finnish employer must take out insurance from Finland for the work carried out abroad. In this case, the Finnish employer is responsible for reporting. This data must be also be submitted when the income earner works abroad in the service of a foreign employer, and the foreign employer must take out insurance from Finland for the work carried out abroad. In this case, the foreign employer is responsible for reporting. This data is not used when, for example, the income earner travels abroad on business for a short period of time. Furthermore, this data is not used if the person is not insured in Finland, even if they work abroad.

This data must also be submitted when a foreign group company pays the employee’s wages and the Finnish company that posted the worker is responsible for paying social insurance contributions. In this case, the Finnish company must submit a report on wages and pay social insurance contributions, if the employee is insured in Finland as a worker posted by a Finnish employer. The Finnish company is obligated to submit this data as long as the worker is insured in Finland. For more information, see Reporting data to the Incomes Register: international situations.

Athlete

This data is reported when a payment is received for sports on the basis of an athlete contract, for example. The payment can be, for example, wages or non-wage compensation for work. This data is only used for reporting payments received from sports. This data is not used if wage income received by an athlete from activities other than sports is reported.

An athlete’s wages are typically wages paid to a member of a sports team based on a player contract. The amount of the wages does not include wages transferred to an athletes’ special fund.

Athlete’s fees are typically paid to athletes involved in individual sports. Fees paid for sports that are not based on an employment relationship are payments treated and reported in taxation in the same way as non-wage compensation for work.

The athlete’s statutory insurance premium is based on the athlete’s wages and fees in accordance with the act on accident and pension provision for athletes (Laki urheilijan tapaturma- ja eläketurvasta 276/2009). The act lays down provisions on the athlete’s minimum level of earnings. Once this minimum level has been reached, the sports employer must take out accident and pension insurance for the athlete. In turn, an athlete in an individual sport who has reached the minimum level of earnings has the option of insuring themselves. For more information, see Reporting data to the Incomes Register: rewarding employees, payments made to an entrepreneur and other special circumstances.

Employed with assistance from the State employment fund

This data is reported when the employer has received government employment subsidy for the employment of the income earner (pay subsidy or an appropriation paid to a government agency or institute for employing an unemployed applicant). The subsidy is granted to the employer to cover wage expenses.

Organisation

This data is reported when the income earner is an organisation. In the Incomes Register, ‘organisation’ means the following parties:

- a general partnership, limited partnership, limited liability company, cooperative, association, foundation or some other legal person governed by civil law.

The definition used in the Incomes Register differs, for example, from the definition of an organisation used in the act on income tax.

Self-employed person, no obligation to take out YEL or MYEL insurance

This data is reported when an income earner who meets the requirements laid down in section 3 of the self-employed persons’ pensions act (Yrittäjän eläkelaki 1272/2006) but who is not under insurance obligation, pursuant to section 4 of the self-employed persons’ pensions act. This data must also be submitted regarding an income earner who meets the requirements laid down in section 3 of the farmers’ pensions act (Maatalousyrittäjän eläkelaki 1280/2006), but is not under insurance obligation pursuant to said act.