Reporting data to the Incomes Register: households as employers

- Date of issue

- 12/9/2022

- Record no.

- VH/6173/00.01.00/2022

- Validity

- 1/1/2023 - 2/18/2024

These instructions are intended for households that pay wages or other earned income and report the data to the Incomes Register.

The instructions describe:

- the information required for reporting in the most common payment situations

- deadlines for reporting

- channels for reporting data

- correcting submitted data

- handling employer obligations

- examples of different payment situations and the reports to be submitted for them.

These instructions concern domestic situations. International situations are described in Reporting data to the Incomes Register: international situations.

These instructions replace the earlier instructions named Reporting data to the Incomes Register: households as employers. The instructions have been updated:

- Added a sub-header for terms, as well as terms and their descriptions to section 1.

- Supplemented instructions for insurance information used in reporting if a household is engaged in agriculture or business in section 1.

- Clarified the instructions for the payer’s customer identifier used in reporting in sections 1 and 3.

- Supplemented the instructions for reporting tax-exempt reimbursements of expenses when the employee is not in an employment relationship in section 10.2.

- Supplemented instructions for reporting reimbursements of expenses when paying non-wage compensation for work in the example in section 12.

- Updated the instructions for increasing the lower age limit for the unemployment insurance contribution obligation.

- Updated the wage limits for temporary employers and contract employers for 2023, and changed the lower limit for occupational accident insurance and accident and occupational disease insurance according to the 2023 level.

- In addition, technical specifications to the instructions have been made.

In other respects, the contents of these instructions correspond to the previous instructions.

1 Household as employers and data providers

Households may have their house renovated or cleaned, pay childminders, or arrange festive occasions through a catering service. Private individuals and death estates may act as household employers. When you agree on the work-related details with the worker or service provider, you should ascertain whether the work is performed in an employment relationship or a commission relationship. In an employment relationship, the work is performed by a hired employee, i.e. wage earner, to whom you pay wages. In a commission relationship, you purchase the work from a company or an entrepreneur and pay them non-wage compensation for work based on an invoice. The obligations related to wages and non-wage compensation for work are different.

Wages and earned income have been reported to the Incomes Register since 1 January 2019. If a payment was made prior to 2019 and a report submitted for the payment needs to be corrected, the corrections should not be submitted to the Incomes Register but directly to the relevant authority.

Data reported to the Incomes Register include wages, bonuses, fringe benefits, non-wage compensations for work, and other earned income. Tax-exempt and taxable reimbursements of expenses must also be reported. The payments are reported to the Incomes Register on an earnings payment report separately for each income earner. Additionally, the employer's health insurance contributions paid are reported as a total sum, using the employer's separate report. If you use the Palkka.fi payroll system aimed at small employers for paying wages, the service will report earnings payment data to the Incomes Register on your behalf. In this case, you need not report any earnings payment data to the Incomes Register. If you use another payroll system, you need to check if this system reports data to the Incomes Register.

When a household acts as an employer, the payer is always an individual or death estate. The payer’s name and personal identity code are entered on the report. It is important that the member of the household who has entered into pension and occupational accident insurance policies is marked as the payer.

The wage or non-wage compensation for work paid by a household must be kept apart from the same person’s agricultural or business activities. The payer’s Business ID must always be entered on reports for work related to agriculture and business. Work for a household employer is not reported as business activities using a business ID. If separate pension and occupational accident insurance policies are taken out for agriculture or business, it must be ensured that the correct insurance information, including the pension policy number and insurance policy number, is used on reports.

The key points of reporting to the Incomes Register for household employers:

1. When you pay wages or other earned income, report the data to the Incomes Register. Earnings payment data is only reported once, to one place.

2. Submit an earnings payment report for each income earner and each payment separately. If you have paid employer’s health insurance contributions, you should also submit the employer's separate report every month.

3. Submit the earnings payment report and the employer's separate report no later than on the fifth day of the calendar month following the payment month. If you report on a paper form, the deadline is the eighth day of the month.

4. Report the data electronically. You can only report on a paper form in special circumstances.

When you hire someone to perform work, you should determine the following matters:

- Is the payment wages or non-wage compensation for work?

- Is the recipient of a non-wage compensation for work registered in the prepayment register?

- Are you obliged to withhold tax and pay the social insurance contributions? The limits for wages are checked annually. Read more about wage and age limits in Section 8. The amount of wages and the employee’s age can affect the following employer obligations:

- withholding tax and paying the employer’s health insurance contributions

- paying the employer’s unemployment insurance contributions

- the obligation to take out earnings-related pension insurance for the employees

- the obligation to take out accident and occupational disease insurance for the employees.

- Are you a temporary employer or a contract employer?

- Are you a regular employer or a casual employer?

If both spouses act as employers, both have the obligation to report their own payments to the Incomes Register. The monetary limits for employer obligations apply individually to each payer.

The amounts used in the examples are merely illustrative. You must check the amount of the social insurance contributions annually from the websites of pension insurance companies or the Tax Administration, for example. Tax is withheld according to each income earner's withholding rate.

You can find more information on a household’s obligations in the Tax Administration guidelines Households as employers (in Finnish) and the Finnish Centre for Pensions' guidelines The criteria for an employment relationship and entrepreneurial activities and drawing the line between employment and self-employment (in Finnish).

1.1 Terminology

The income earner is a person or business to whom a contribution is paid. A person who is in an employment relationship is also called an employee or a wage earner. Income earners are not required to report their own income to the Incomes Register. The data is always reported by the payer.

Payment refers to the wages, non-wage compensation for work, or other related payment, such as a daily allowance, paid by the household.

The payer is a household, i.e. an individual or estate that makes a payment to an income earner.

Earnings payment report means a report on wages paid and other earned income submitted to the Incomes Register. Data about a single payment made to a single income earner can be reported using a single earnings payment report. A single earnings payment report can include several different income types.

Employer’s separate report means a report on the employer’s health insurance contribution submitted to the Incomes Register.

Work performed for a household refers to work performed for an individual or estate that is not related to the person’s agricultural or business activities.

Income type means the type of income according to which the payments reported to the Incomes Register are itemised. Income types include, for example, time-rate pay, contract pay, and non-wage compensation for work.

Temporary employer and contract employer are concepts used by earnings-related pension providers, describing whether or not the payer of the contribution has taken out a pension insurance policy from an earnings-related pension provider. The employer arranges pension provision for its employees either as a temporary employer or as contract employer.

- In terms of earnings-related pension insurance, the wage payer is a temporary employer if it pays no more than EUR 9,348 in wages over a period of six consecutive months (in 2023) and does not have any permanent employees. Temporary employers do not have a valid pension insurance policy with an earnings-related pension provider.

- Employers who have permanent employees or pay more than EUR 9,348 in wages over a period of six consecutive months (in 2023) must take out a pension insurance policy from an earnings-related pension provider. In such a case, the employer becomes a contract employer.

The concepts of casual employer and regular employer are related to the Tax Administration’s employer registration. This affects the deadlines for households’ reporting and their obligation to submit the employer's separate report.

- A payer is regarded as a casual employer if one of the following is true:

- The payer only has one permanent employee.

- The payer has up to five employees whose employment contracts do not cover an entire calendar year.

- A payer is regarded as a regular employer in the following cases:

- The payer regularly pays wages to at least two employees.

- The payer regularly pays wages to one employee and also pays wages to at least one other employee, whose employment is fixed-term or meant to be short-term.

- The payer simultaneously pays wages to at least six employees, even if their employment contracts are fixed-term and meant to be short-term.

Employers who pay wages regularly must register with the Tax Administration’s employer register before they begin wage payments.

2 A single earnings payment report

Submit one earnings payment report to the Incomes Register for each payment that you make. General rules for reporting:

- Submit a report for each payment. There is no monetary minimum threshold for reporting data.

- Report wages paid and other payments to the Incomes Register individually for each income earner. Each payer reports their own payments.

- An exception to this is a pool of household employers. Read more in Section 7.2.

- The report contains data on one payment transaction paid to a single income earner.

- You can report several income types for the same income earner on the same report if they have been paid at the same time.

- You can enter several different income types, but you should report the deductions made from the wages (for all income types) as a total amount:

- Deductions include, for example, withholding and the employee's earnings-related pension, and unemployment insurance contributions.

- Report the taxes withheld from payments such as hourly wages, overtime compensation, and holiday bonus as a total amount.

This will allow you to fulfil your statutory payment-related reporting obligations on a single earnings payment report. The data users of the earnings payment data, such as the authorities, will be able to access the data that you have reported and to which they are entitled directly from the Incomes Register.

Note that if you need to pay the employer’s health insurance contribution, you should submit the employer’s separate report in addition to the earnings payment report. For further instructions, see Section 9 Employer's separate report on the employer’s health insurance contribution.

Report monetary amounts to the Incomes Register to the cent.

3 Employing someone to work for a household

When you pay wages to an employee, you are responsible for the employer’s obligations, such as withholding tax and taking out an earnings-related pension insurance policy for the employee. The amount of wages and the employee’s age can affect the employer obligations.

As a rule, a household is obligated to take out earnings-related pension insurance for an employee in an employment relationship and pay unemployment insurance contributions. The household must also take out accident and occupational disease insurance from an accident insurance provider before the employee starts working. It is important that the name and personal identity code of the household member who has entered into pension and occupational accident insurance policies is entered on reports submitted to the Incomes Register. Read more about reporting wages paid and threshold values in Section 8.2.

You can find more information on

- the obligation to withhold tax and the employer's health insurance contribution in the Tax Administration guidelines Household hires a worker

- taking out pension insurance from the Finnish Centre for Pensions’ Pensions Act service and the pension insurance providers’ websites (in Finnish).

- taking out accident and occupational disease insurance from the Accident Compensation Centre’s website

- the obligation to pay unemployment insurance contributions from the Employment Fund website

- if you do not have internet access, you can contact these bodies personally.

Examples of reporting wages paid in different situations can be found in Section 8.

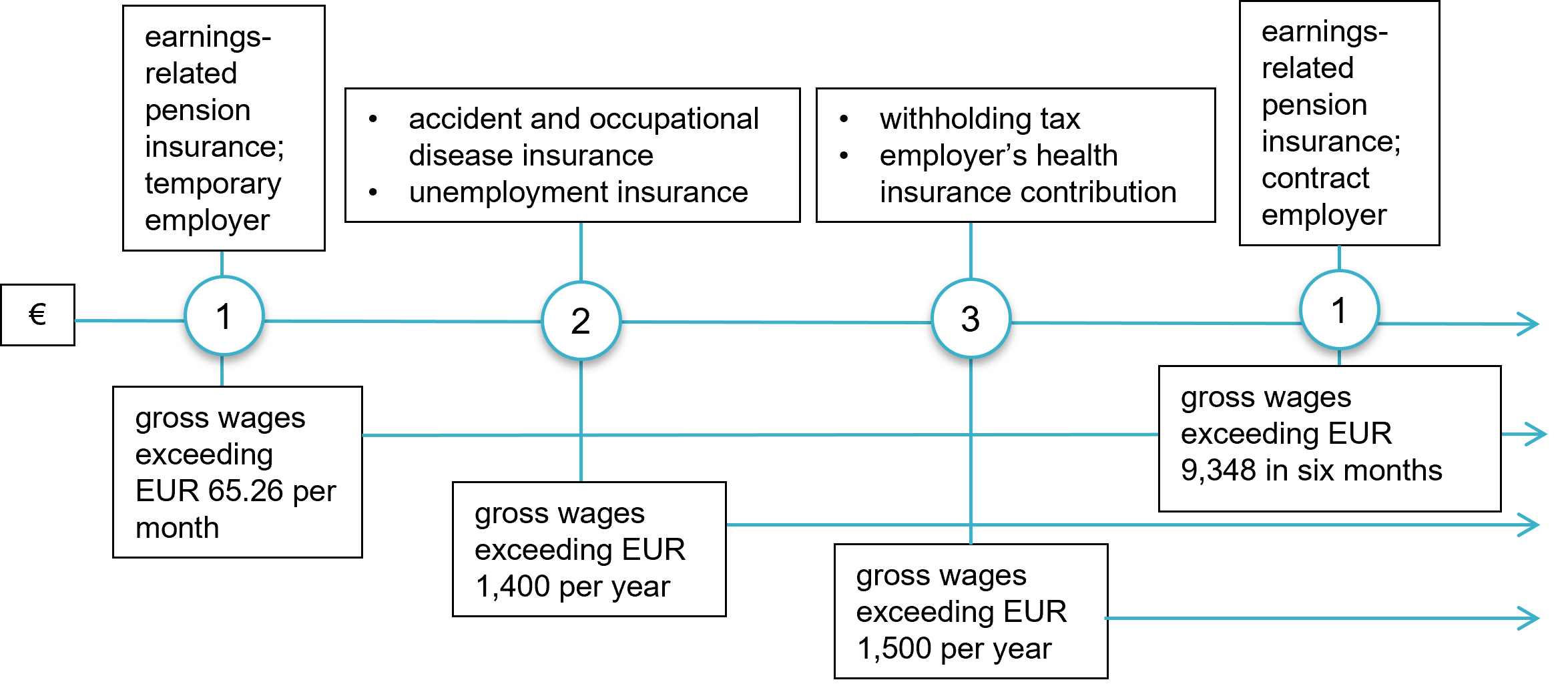

Monetary thresholds for households’ obligations related to the payment of wages (in 2023):

When the wages paid exceed one of the limits above, you must fulfil the respective obligation, such as taking out an insurance policy for the employee.

- If you pay wages more than EUR 65,26 per month (in 2023), you must take out earnings-related pension insurance for the employee. Earnings-related pension insurance must be taken out for employees between the ages of 17 and 68. The obligation to provide insurance begins after the month during which the employee turns 17 and ends at the end of the month during which the employee turns 68.

In terms of earnings-related pension insurance, you are a temporary employer if you pay one person no more than EUR 9,348 in gross wages over a period of six consecutive months and do not employ anyone permanently. In other cases, you are a contract employer.

Even if you are a temporary employer, you can still become a contract employer if you wish, i.e. take out a pension insurance policy from an earnings-related pension provider. - If you pay EUR 1,400 or more in gross wages to one or more employees during a calendar year, you must take out accident and occupational disease insurance for them and pay unemployment contributions. Please note that the employee's share of the unemployment insurance contribution must be collected from the employee, also when no more than EUR 1,400 is paid in wages. Unemployment insurance contributions must be paid for employees between the ages of 18 to 64.

- If you pay one employee more than EUR 1,500 in gross wages per year, you must withhold tax from the wages and pay the employer's health insurance contribution. If requested by the employee, tax can also be withheld from lower wages. The employer's health insurance contribution must be paid for employees between the ages of 16 and 67.

Withholding tax and the employer's health insurance contribution are self-assessed taxes, which you must calculate and pay yourself. Other social insurance contributions are paid using the invoicing method used by the insurance provider.

4 Household buys services from a company or an entrepreneur

If you buy services from a company or an entrepreneur and pay them non-wage compensation for work on the basis of an invoice, this is a commission relationship, not an employment relationship. When work is based on a commission relationship, you must check whether the company or entrepreneur is registered in the prepayment register.

If the company or entrepreneur is registered in the prepayment register, the non-wage compensation for work is not reported to the Incomes Register. For example, if you pay non-wage compensation for work on a monthly basis for home cleaning to a company or entrepreneur registered in the prepayment register, you do not report information to the Incomes Register. You only need to pay the invoice for the work done.

If the company or entrepreneur is not registered in the prepayment register, you must always report work-related payments to the Incomes Register. For more information on reporting, see Section 12 Non-wage compensation for work to a company or an entrepreneur not registered in the prepayment register.

You can check if the company or entrepreneur is registered in the prepayment register from BIS company search or by contacting the Tax Administration.

More information on registration in the prepayment register can be found in the Tax Administration Guidelines Prepayment register.

5 Temporary employer

From the perspective of earnings-related pension insurance, you are a temporary employer if you pay no more than EUR 9,348 in wages over a period of six consecutive months (in 2023) and do not have any permanent employees. Temporary employers do not have a valid pension insurance policy with an earnings-related pension provider. In this case, you must enter both Household and Temporary employer (no TyEL insurance policy) as the payer types on the Incomes Register earnings payment report. In the Incomes Register e-service, the information on a temporary employer must be reported in the income earner’s insurance information.

You must select the earnings-related pension provider for your employee’s insurance yourself. If you report the data in the Incomes Register’s e-service, choose the earnings-related pension provider from the menu. If you are reporting on a paper form, provide the earnings-related pension provider code. If you are reporting the data via the technical interface or in the upload service, you must enter the pension policy number (technical insurance policy number) in addition to the code. You should request the pension policy number from the earnings-related pension provider. The pension provider will send you an invoice based on the data you have submitted.

If you are using the Palkka.fi service, you can choose the earnings-related pension provider and pay the earnings-related pension insurance contribution at the same time as you calculate the wages. The Palkka.fi service will automatically send a report to the Incomes Register. If you use another payroll system, you need to check if this system reports data to the Incomes Register.

The turn of the calendar year will not interrupt the calculation of the six-month time limit. If you have a permanent employee or pay more than EUR 9,348 in wages over a period of six consecutive months (in 2023), you are no longer a temporary employer but considered a contract employer, which means you must take out a pension insurance policy from an earnings-related pension provider. In this case, enter the payer type as Household in the earnings payment report to the Incomes Register.

If you take out an insurance policy as a temporary employer and thus become a contract employer, report your new pension policy number to the Incomes Register starting from the following payment of wages.

If you wish, you can take out an earnings-related pension insurance policy even if the limit of EUR 9,348 is not exceeded.

6 Reporting to the incomes register

6.1 Mandatory and complementary data in the earnings payment report

Some of the data reported to the Incomes Register on the earnings payment report is mandatory data and some is voluntarily reported complementary additional data. The earnings payment report must always include at least the mandatory data.

Some of the mandatory data must be provided on every report and some in specific situations, such as when making a specific payment. You can also report complementary data in addition to mandatory data. The complementary data is necessary for the enforcement of income earners’ statutory benefits or customer fees, for example, or the performance of other duties by the data users. The data is used for example for social insurance purposes. It is recommended that complementary data be provided as comprehensively as possible, so that all data users obtaining data from the Incomes Register can use the data at the level of precision they need. This fulfils the single report principle, so that the data in the register does not need to be requested from the payer or income earner afterwards.

Mandatory data includes:

- pay period

- payment date or other report date

- identification of the payer using a customer identifier (personal identity code) or, in its absence, contact information

- identification of the income earner using a customer identifier (personal identity code or business ID) or, in its absence, contact information

- some of the income types used in the Incomes Register, which must always be reported when the payment in question is made.

Some of the complementary data concerns individual income types and some concerns separate data sets.

Complementary additional data includes

- certain data on employment or public-sector employment relationships

- absence data

- the earnings periods of the income types.

Reporting different types of data is described in more detail in Reporting data to the Incomes Register: mandatory and complementary data in the earnings payment report.

6.2 Two methods of reporting monetary wages

There are two methods of reporting monetary wages to the Incomes Register. It is recommended to report monetary wages in an itemised manner, but at a minimum, they must be reported as a total amount (reporting method 1).

Reporting method 1, reporting monetary wages as a total amount: If the wages are reported as a total amount, some data users may have to request more detailed information, since a lower level of detail is not sufficient for all users. For example, Kela needs more detailed information on monetary wages when granting sickness allowances or parental allowances.

Reporting method 2, reporting monetary wages in an itemised manner: If the payer wishes, they can report wages they have paid in more detail than required by the mandatory reporting method, using the separate complementary income types intended for this purpose. With this reporting method, the wage is generated from the reported earnings, and the payer does not have to calculate the wage by adding up earnings.

Reporting methods 1 and 2 cannot be used simultaneously in the same report. However, you are free to change reporting methods between reports.

The examples in the instructions describe the reporting of data. The examples do not present all mandatory data, only the data related to the reporting method.

Example 1: A household makes a total wage payment of EUR 2,600 to a housekeeper as a lump sum. In addition to the regular monthly salary of EUR 2,100, the wages consist of a EUR 500 holiday bonus.

The payer can report the monetary wages in two ways: either by reporting the wages as a total amount or by itemising them in more detail using complementary income types:

|

MANDATORY MINIMUM LEVEL |

ALTERNATIVE METHOD |

||

|---|---|---|---|

|

Reporting method 1 |

EUR |

Reporting method 2 |

EUR |

|

101 Total wages |

2600.00 |

201 Time-rate pay |

2100.00 |

|

|

|

213 Holiday bonus |

500.00 |

When reporting method 2 is used, the income earner’s wages comprise the total amount of the reported income types. The payer does not separately need to report the total amount of the income types.

The wages are reported using the income type Time-rate pay (201) if the wages are paid according to hourly or weekly rates, for example. The wages are reported using the income type Contract pay (227) if the wages are paid based on a contract.

6.3 Reporting channels

If you calculate the wages in the Palkka.fi service, the service will automatically report the data of the wages calculated in the service to the Incomes Register. You are not required to report this data separately to the Incomes Register. Note that the Palkka.fi service can only be used to calculate and report wages, not non-wage compensation for work.

The Incomes Register has its own e-service, which you can log in to at incomesregister.fi. Through the e-service, you can submit a report by entering the data on an online form.

If you use payroll software, you should check how to submit reports to the Incomes Register. The payroll software may be able to generate a complete set of data, which you can send to the Incomes Register in the Incomes Register’s e-service.

If electronic reporting is not an option, you can also submit the report on wages paid to the Incomes Register on a paper form. You can print out the form at incomesregister.fi.

6.4 Reporting deadlines

The reporting deadline depends on whether the household is a casual or regular employer from the perspective of the Tax Administration’s employer registration.

If your household is a casual employer, report the wages paid and other payments made electronically to the Incomes Register no later than on the fifth day of the calendar month following the payment month. If you submit the report on a paper form, the deadline is the eighth day of the following calendar month. If you have paid wages more than once during the calendar month, report the wages you have paid on different reports, separately for each payment date.

Example 2: A household that is a casual employer pays wages twice in June (5 and 23 June), and once in September. Separate earnings payment reports must be submitted electronically for both wage payments in June, no later than on 5 July or, if a paper form is used, no later than on 8 July. The report for the September wage payment must be submitted electronically on 5 October at the latest or on a paper form on 8 October at the latest.

If you are registered in the Tax Administration’s employer register, i.e. you are a regular employer, you should report the wages paid and other payments made to the Incomes Register electronically no later than on the fifth calendar day following the payment date. If you submit the report on a paper form, the deadline is the eighth day from the wage payment. However, even then you can report tax-exempt reimbursements of travel expenses (kilometre allowances, meal allowances and daily allowances) electronically on the fifth day of the calendar month following the payment month or, if you are using a paper form, on the eighth day of the calendar month following the payment month. Correspondingly, if an income earner is only granted a fringe benefit, it is reported monthly, no later than on the fifth day of the next calendar month. If monetary wages are also paid during the calendar month following the fringe benefit’s accrual month, the fringe benefit can also be reported as income for the calendar month following its accrual month. The report must then be submitted no later than on the fifth day of the calendar month following the month for which the fringe benefit was reported as income.

Example 3: A household that is a regular employer pays wages on 15 June. The report for this wage payment must be submitted electronically on 20 June at the latest or on a paper form on 23 June at the latest.

If you need to pay the employer’s health insurance contribution, submit the employer's separate report electronically no later than on the fifth day of the next calendar month. If the report is submitted on a paper form, the deadline is the eighth day of the calendar month following the payment.

If you are a regular employer and do not pay wages during the month, you should only report the No wages payable information on the employer's separate report for this month. Even in this case, the employer's separate report must be submitted no later than on the fifth day of the next calendar month. For example, if no wages are paid in July, submit the report electronically on 5 August at the latest or on a paper form on 8 August at the latest. If you are a casual employer, you only need to submit the employer's separate report for the months in which you have paid wages or reimbursements of expenses.

There is no specific deadline for reporting complementary data, but it is advisable to provide it simultaneously with mandatory data whenever possible.

If you notice an error in the data you reported, you must correct it by submitting a replacement report. In certain situations, a report with errors must first be cancelled, and a completely new report submitted afterwards. For more information on errors requiring cancellation, see Section 15, Correcting data reported to the Incomes Register. There is no specific deadline for submitting a replacement earnings payment report or replacement employer's separate report, but it is advisable to correct the error as soon as it is detected.

|

Payer |

Mandatory data in the report |

Electronic report |

Paper form |

|---|---|---|---|

|

A casual employer |

|||

|

Earnings payment report |

|

Fifth day of the calendar month following the payment month |

Eighth day of the calendar month following the payment month |

|

Employer's separate report: only the months for which wages or reimbursements of expenses were paid |

|

Fifth day of the calendar month following the payment month |

Eighth day of the calendar month following the payment month |

|

A regular employer |

|||

|

Earnings payment report |

|

Fifth calendar day after the payment date |

Eighth calendar day after the payment date |

|

Earnings payment report: reimbursement of expenses |

|

Fifth day of the calendar month following the payment month |

Eighth day of the calendar month following the payment month |

|

Employer's separate report: the months for which wages were paid |

|

Fifth day of the calendar month following the payment month |

Eighth day of the calendar month following the payment month |

|

Employer's separate report:"No wages payable" data |

|

No wages payable: fifth day of the next calendar month |

No wages payable: eighth day of the next calendar month |

|

All payers |

|||

|

Complementary data |

|||

Earnings payment report |

for example:

|

No deadline. Recommended to be submitted simultaneously with the mandatory data. |

No deadline. Recommended to be submitted simultaneously with the mandatory data. |

|

Data submitted on a replacement report |

|||

|

Earnings payment report Employer's separate report |

|

No deadline. Must be corrected immediately after the error has been detected. |

No deadline. Must be corrected immediately after the error has been detected. |

|

Data to be submitted when cancelling a report |

|||

|

Earnings payment report Employer's separate report |

|

No deadline. Must be cancelled immediately after the error has been detected. |

No deadline. Must be cancelled immediately after the error has been detected. |

Paper forms must arrive at the Incomes Register Unit by the due date.

Saturdays, Sundays, and other holidays must be counted when determining the fifth calendar day after the payment date, but if the report's due date falls on a Saturday, Sunday, or other holiday, the information can be reported on the following business day.

The concepts of casual and regular employer are defined in Section 1.

The employer's separate report is described in more detail in Section 9 Employer's separate report on the employer's health insurance contribution.

Replacement reports are described in more detail in Section 15 Correcting data reported to the Incomes Register.

6.5 Sanctions for submitting data late

The Tax Administration will not impose a late filing penalty or negligence penalty for failures in reporting to the Incomes Register for individuals or estates. The Incomes Register's data users may impose other sanctions.

7 Payer’s and recipient’s identifying information

7.1 Individual household as payer

Report data on the payer and payment receiver to the Incomes Register on every earnings payment report. If you pay wages, enter the pay period and payment date. The pay period is the period for which wages are paid. The income earner's identifier is the personal identity code for individuals and the business ID for companies or entrepreneurs.

When reporting data as a household employer, you should always report the data using a personal identity code. This applies to both regular and casual employers. In addition, the policyholder of the accident and occupational disease insurance must be the payer indicated in the earnings payment report so that the insurance company can process the data correctly.

A household may have a guardian or agent who, in practice, handles data reporting and wage payments on behalf of the household. The principal, i.e. the household, is still responsible for ensuring that the data is reported to the Incomes Register, and the household is the actual wage payer. An underage person can be the payer using their own income.

When the payer type is specified as Household, the Tax Administration will know that there is a EUR 1,500 limit for the obligation to withhold tax and pay the employer's health insurance contribution.

Example 4: A household pays EUR 40 in wages to one 19-year-old employee as a lump sum. The household does not make any other payments during the year to this or other employees. The wages are so low that the household is not obliged to pay social insurance contributions. Despite this, the employee's unemployment insurance contribution must be collected from the employee. In this case, the employer keeps the contribution.

The household reports the following identifying data to the Incomes Register:

|

FIRST REPORT |

|

|---|---|

|

Type of action: New report |

|

|

Pay period |

|

|

Payment date: 20.01.20xx The start date of the pay period: 01.01.20xx The end date of the pay period: 31.01.20xx |

|

|

Payer details |

|

|

Payer type: Household Payer type: Temporary employer (no TyEL insurance policy)* Name of the contact person: Essie Example Contact person's telephone number: 0000000 Contact person’s email: example@example.fi Payer's identifier (personal identity code): 010101-1111 |

|

|

Income earner details |

|

|

Income earner's identifier (personal identity code): 020202-2222 Type of exception to insurance: |

* If the household is a contract employer, this section is left blank. In the Incomes Register e-service, the information on a temporary employer must be reported in the income earner’s insurance information.

The type of exception to insurance "No obligation to provide insurance (unemployment insurance)" is used when the employee is under 18 or over 64 years of age.

If the payment is non-wage compensation for work and the income earner is not registered in the prepayment register, enter the data for the payer and recipient in accordance with the example above.

If the household paying wages has employer obligations (see Sections 3 and 8 for details), you must provide more information on the payer and payment recipient.

Example 5: temporary employer.

A household pays EUR 1,400 in wages to one employee as a lump sum. The household does not make any other payments during the year to this or other employees. The household must take out earnings-related pension insurance, unemployment insurance, and accident and occupational disease insurance for the employee. The household reports the following identifying data to the Incomes Register:

|

FIRST REPORT |

|

|---|---|

|

Type of action: New report |

|

|

Pay period |

|

|

Payment date: 20.01.20xx The start date of the pay period: 01.01.20xx The end date of the pay period: 31.01.20xx |

|

|

Payer details |

|

|

Payer type: Household Payer type: Temporary employer (no TyEL insurance policy)* Name of the contact person: Essie Example Contact person's telephone number: 0000000 Contact person’s email: example@example.fi Payer's identifier (personal identity code): 010101-1111 |

|

|

Income earner details |

|

|

Income earner's identifier (personal identity code): 020202-2222 Occupational class**: 12345 |

|

|

Information on insurance |

|

| Earnings-related pension insurance information: Employee's earnings-related pension insurance Code of the selected earnings-related pension provider***: NN Pension policy number****: NNNNNNN |

* If the household is a contract employer, this section is left blank. In the Incomes Register e-service, the information on a temporary employer must be reported in the income earner’s insurance information.

** The occupational class must be specified if the income earner is covered by occupational accident insurance and they receive earnings subject to the occupational accident insurance contributions. Reporting the occupational class is also recommended when the income earner is not covered by occupational accident insurance, but the payment made to them was earned in an employment relationship. Accident and occupational disease insurance is mandatory when the employer pays more than EUR 1,400 in wages to one or more persons. Enter the occupational class code according to Statistics Finland’s classification of occupations (TK10). The classification is available on Statistics Finland’s website.

*** Code of the selected earnings-related pension provider: Select the earnings-related pension provider of your choice and specify its code. Examples below:

- 46 Ilmarinen Mutual Pension Insurance Company

- 54 Elo Mutual Pension Insurance Company

- 55 Varma Mutual Pension Insurance Company

- 56 Veritas Pension Insurance Company

**** If you are a temporary employer and submit the report in the Incomes Register’s e-service or on a paper form, you do not need to provide a pension policy number.

7.2 Joint pool of household employers as payer

Households can jointly pay wages to a single income earner for cleaning, for example. In such a case, they form a pool of household employers. When the members of the pool hire an employee under one common employment contract, they are jointly responsible employers for the employee. In such a case, the members of the group of employers are jointly responsible for paying the employer obligations related to the employment relationship. The households must mutually agree on who will collect and pay the tax withholding and the employer's health insurance contribution, and who will handle the rest of the employer obligations, i.e. the earnings-related pension insurance, accident insurance and occupational disease insurance, and pay the unemployment insurance contributions. The responsible person is the group's representative and uses their own personal identity code for reporting and paying.

When the payer is a pool of household employers, the payer type entered in the earnings payment report should be Pool of household employers.

The employer is obligated to provide insurance to its employees for an occupational accident or illness when the employer pays or has agreed to pay more than EUR 1,400 for work it has commissioned during one calendar year. The limit for the obligation to provide insurance is specific to the employer and the calendar year, i.e. all work commissioned by the employer in question during the calendar year will be taken into account and the wages paid or agreed by the employer for these are totalled. Households can agree on and authorise one person to take out the insurance. A pool of employers is considered to be one employer, so the limit for the obligation to provide insurance also applies to the entire group, though one insurance policy is sufficient. If each household concludes a separate work contract with the employee, this is a case of several employment relationships, and the arrangement is not considered to be a pool of employers referred to here.

The Employment Fund will not determine an unemployment insurance contribution until the employer has paid more than EUR 1,400 per year in wages to an employee or employees. Even if the EUR 1,400 limit for the obligation to pay unemployment insurance contributions is not exceeded, the employee's unemployment insurance contribution must be collected from the income earner and the data reported to the Incomes Register.

In the case of earnings-related pension insurance, the amount of wages paid and the EUR 9,348 limit (in 2023) determine whether the payer is a temporary employer or contract employer (see Section 1 or 8.3). If households form a joint pool of employers, they can have a single insurance policy with an earnings-related pension provider, taken out in the name of the party responsible for arranging earnings-related pension insurance coverage. The limit for earnings-related pension insurance then applies jointly to all members of the pool of employers. If each employer has taken out their own insurance policy and each one reports their own share of the wages – for example, as a temporary employer – the threshold for providing earnings-related pension insurance concerns each employer separately.

Households do not need to withhold taxes or pay the employer's health insurance contribution when the wages paid to the same recipient do not exceed EUR 1,500 per calendar month. This limit is applied to each member of the pool of employers; the total amount paid by the group or a family does not matter here.

If the employer pool pays non-wage compensation for work to an income earner who is not registered in the prepayment register, only tax is withheld from the compensation. Only the amounts of payment and withholding are reported as income data. Other social insurance contributions are not paid or reported. If the income earner is registered in the prepayment register, no data is reported to the Incomes Register.

If the pool of household employers has a business ID that is used to pay wages or non-wage compensation for work, the lighter obligations concerning household employers are not applied to the pool (such as the EUR 1,500 withholding limit or the deadline for reporting to the Incomes Register). In this case, the pool of employers reports the data to the Incomes Register in the same way as other employers. More information is provided in e.g. the instructions Reporting data to the Incomes Register: monetary wages and items deducted from the wages.

8 Reporting wages paid by a household

There is no monetary minimum threshold for reporting to the Incomes Register, so you should report all the wages and other payments you make. The age of the recipient has no impact on the reporting obligation.

The amount of wages and the age of the employee affect employer obligations, but they do not affect what must be reported. You should report earnings payment data to the Incomes Register even if no tax has been withheld due to the low wages or the tax rate specified in the employee's tax card. Neither is the reporting obligation affected by whether social insurance contributions need to paid on the wages.

- The employer's health insurance contribution must be reported and paid for employees between the ages of 16 and 67.

- The employee's unemployment insurance contribution must be paid for employees between the ages of 18 and 64.

- There are no similar age limits for accident and occupational disease insurance.

- Earnings-related pension insurance must be taken out when the employee turns 17 years of age, if the other criteria are met. The upper age limit for insurance depends on the employee’s year of birth, and it is

- 68 years for employees born in 1957 or earlier

- 69 years for employees born in 1958–1961

- 70 years for employees born in 1962 or later.

8.1 Composition of pay

In addition to money, wages may also include fringe benefits, various bonuses, exchange of work, and received goods with cash value.

If you provide fringe benefits to an employee or pay reimbursements for travel expenses or reimbursements of expenses (taxable or tax-exempt), you should also refer to Section 10 Income types related to wages for their reporting.

8.2 Reporting the actual wages paid

8.2.1 Gross wages up to EUR 1,400 per year

If the gross total amount of wages you pay to one or several employees is up to EUR 1,400 per year, you must report to the Incomes Register

- the wages paid

- the employee's share of the earnings-related pension insurance contribution withheld from wages if the wages exceed EUR 65.26 per month (in 2023);

- the employee’s share of the unemployment insurance contribution withheld from the wages for 18–64-year-olds.

- As an employer, you must always withhold the employee’s share of the unemployment insurance contribution from the wages even if you do not need to pay the employer's share. In this case, the employer keeps the unemployment insurance contribution. The income earner receives the collected amount as a deduction from their own taxation.

- The Employment Fund does not set the unemployment insurance contribution until EUR 1,400 is exceeded. In that case, the contribution is based on the total sum of wages, not only the share exceeding EUR 1,400. For this reason, also wages equal to or less than EUR 1,400 are entered as payments subject to unemployment insurance contributions.

No withholding tax or employer's health insurance contributions are payable from the wages if no employee’s wages exceed EUR 1,500 per year. However, if you have withheld tax or paid the employer's health insurance contributions, you should report those to the Incomes Register.

Example 6: A household pays EUR 40 in wages to a 15-year-old. There are no other employees. The wages are so low that the household does not need to pay earnings-related pension insurance contributions or take out an accident or occupational disease insurance. Based on the employee’s age, no employer's health insurance contribution, unemployment insurance contribution, or earnings-related pension insurance contribution is paid. In this example, no tax is withheld. As the employer's health insurance contribution does not need to be paid, the employer's separate report does not need to be submitted. The household reports the following data to the Incomes Register:

|

REPORT DETAILS |

EUR |

|---|---|

|

Type of exception to insurance: No obligation to provide insurance (earnings-related pension, health, unemployment or accident and occupational disease insurance) |

|

|

201 Time-rate pay |

40.00 |

The occupational class must be specified if the income earner is covered by occupational accident insurance and they receive earnings subject to the occupational accident insurance contributions. Reporting the occupational class is also recommended when the income earner is not covered by occupational accident insurance, but the payment made to them was earned in an employment relationship. Accident and occupational disease insurance is mandatory when the employer pays more than EUR 1,400 in wages to one or more persons.

Example 7: A household pays EUR 1,000 in wages to a 30-year-old. There are no other employees and no other payments are made during the same year. The earnings-related pension insurance contribution and employee’s unemployment insurance contribution must be paid and reported for the employee. In this example, no tax is withheld. The employer's health insurance contribution does not need to be paid and the employer's separate report does not need to be submitted.

The employee's share of the unemployment insurance contribution must always be collected from the employee even if the employer has no payment obligation because the EUR 1,400 limit applied to the employer is not exceeded. The household reports the following data to the Incomes Register:

|

REPORT DETAILS |

EUR |

|---|---|

|

Type of exception to insurance: |

|

|

201 Time-rate pay or Contract pay |

1000.00 |

|

413 Employee's earnings-related pension insurance contribution |

71.50 |

|

414 Employee's unemployment insurance contribution |

15.00 |

The occupational class must be specified if the income earner is covered by occupational accident insurance and they receive earnings subject to the occupational accident insurance contributions. Reporting the occupational class is also recommended when the income earner is not covered by occupational accident insurance, but the payment made to them was earned in an employment relationship. Accident and occupational disease insurance is mandatory when the employer pays more than EUR 1,400 in wages to one or more persons.

8.2.2 Gross wages more than EUR 1,400 but no more than EUR 1,500 per year

If the sum of gross wages paid by you to all employees totals over EUR 1,400 per year, but the wages of one person amount to no more than EUR 1,500 per year, you must take care of the following matters in addition to those outlined in Section 8.2.1:

- Take out accident and occupational disease insurance for your employees and report the employee's occupational class on the Incomes Register’s earnings payment report. Accident and occupational disease insurance must be taken out before the start of work. The insurance cannot be taken out retroactively.

- Pay unemployment insurance contributions to the Employment Insurance Fund. Note that as an employer you must always collect the employee's share of the unemployment insurance contributions from the wages, even if the gross wages of one person do not exceed EUR 1,400.

Example 8: The household pays EUR 1,450 in wages. No other payments are made during the year. The unemployment insurance contribution and accident and occupational disease insurance contribution must be paid for the employee in addition to the earnings-related pension insurance contribution. The earnings-related pension insurance and unemployment insurance contributions are reported to the Incomes Register with their own income types, but the accident and occupational disease insurance contribution is not.

In this example, no tax is withheld. Neither does the employer's health insurance contribution need to be paid or the employer's separate report be submitted. The wages can be reported using the time-rate pay or contract pay income type, for example, depending on whether the work was agreed to be performed using an hourly rate or for a contract price. The household reports the following data to the Incomes Register:

|

INCOME TYPE DETAILS |

EUR |

|---|---|

|

201 Time-rate pay or 227 Contract pay |

1450.00 |

|

413 Employee's earnings-related pension insurance contribution |

103.67 |

|

414 Employee's unemployment insurance contribution |

21.75 |

8.2.3 Gross wages over EUR 1,500 per year

If you pay one person more than EUR 1,500 in gross wages per year, you must take care of the following matters in addition to those outlined in Section 8.2.2:

- Withhold tax from the wages and report it to the Incomes Register.

- Pay the employer's health insurance contributions and report their total amount to the Incomes Register on the employer's separate report.

Example 9: A household pays EUR 1,600 in wages in January. The household makes no other payments to other employees. The employer’s unemployment insurance contribution and accident and occupational disease insurance contribution must be paid for the employee in addition to the earnings-related pension insurance contribution and health insurance contribution. In addition to these, tax must be withheld from the wages.

The wages can be reported using the Time-rate pay or Contract pay income type, for example, depending on whether the work was agreed to be performed using an hourly rate or for a contract price. The household reports the following data to the Incomes Register:

|

INCOME TYPE DETAILS |

EUR |

|---|---|

|

201 Time-rate pay or 227 Contract pay |

1600.00 |

|

402 Withholding tax |

640.00 |

|

413 Employee's earnings-related pension insurance contribution |

114.40 |

|

414 Employee's unemployment insurance contribution |

24.00 |

In addition to the earnings payment report, you must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9.

8.3 Earnings-related pension insurance

In terms of earnings-related pension insurance, it makes a difference whether you are a temporary employer or a contract employer. The earnings-related pension insurance contribution is paid from the earned income of employees turned 17 years. The upper age limit for earnings-related pension insurance depends on the employee’s year of birth, and it is

- 68 years for employees born in 1957 or earlier

- 69 years for employees born in 1958–1961

- 70 years for employees born in 1962 or later.

If you pay wages to an employee in an employment relationship and the employee has pension insurance for the self-employed (YEL) on the basis of their other activities, you still need to pay the employee's earnings-related pension insurance contribution. YEL insurance does not affect a household employer’s insurance obligations.

Self-employed persons take out YEL insurance for themselves. If you pay non-wage compensation for work to an entrepreneur with a YEL insurance who is not registered in the prepayment register, you do not need to pay the TyEL contribution, but you must withhold tax from the non-wage compensation for work.

If you pay an employee no more than EUR 65.26 in wages per month (in 2023), you do not need to collect the employee's share of earnings-related pension insurance contribution from the employee. The employee's age is irrelevant.

Example 10: A household is a temporary employer and pays EUR 1,600 in wages for a renovation. The household makes no other payments to other employees. The unemployment insurance contribution and accident and occupational disease insurance contribution must be paid for the employee in addition to the earnings-related pension insurance contribution and employer’s health insurance contribution. In addition to these, taxes withheld from the wages must be reported.

The household reports the following data to the Incomes Register:

|

INCOME TYPE DETAILS |

EUR |

|---|---|

|

201 Time-rate pay or 227 Contract pay |

1600.00 |

|

402 Withholding tax |

640.00 |

|

413 Employee's earnings-related pension insurance contribution |

114.40 |

|

414 Employee's unemployment insurance contribution |

24.00 |

In addition to the earnings payment report, you must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9.

9 Employer's separate report on the employer’s health insurance contribution

If you pay more than EUR 1,500 in wages to the same employee in a calendar year, you must pay the employer's health insurance contribution and report it to the Incomes Register on the employer's separate report.

The employer must calculate the employee’s health insurance contribution on the gross wages paid in each month. Gross wages include, in addition to monetary wages, for example, fringe benefits. A household does not need to the pay the employer’s health insurance contribution or report it to the Incomes Register if the same income earner is paid no more than EUR 1,500 in wages in a calendar year. For example, if you pay two employees both EUR 1,000 in wages, the employer's health insurance contribution does not need to be paid on the basis of these payments. The employer's health insurance contribution is paid for employees between the ages of 16 and 67.

You should report the total amount of the employer's health insurance contribution on the employer's separate report. The total amount of gross wages is not reported in this section. You should submit the employer's separate report for each wage payment month.

Submit the employer's separate report monthly in electronic form, no later than on the fifth day of the calendar month following the payment month. The deadline for reporting on paper is the eighth day of the calendar month following the payment month.

You can also pay and report the employer's health insurance contribution for wages less than EUR 1,500, if you know that the employee’s gross wages will later exceed the limit. In this case, submit the separate report in accordance with each pay period. If you have not paid the employer's health insurance contribution before the EUR 1,500 limit is exceeded and the limit is exceeded later in the year, you must calculate and make the payment based on the amount of gross wages for the entire year. Report the employer's health insurance contribution payable from the full year’s wage amount as a total amount in the separate report of the month in which the annual limit of EUR 1,500 is exceeded.

The following data must be included in the employer’s separate report:

- details of the payer, contact person, date of reporting, and the reporting period (payment month and payment year)

- payer type Household

- payer types Household and Pool of household employers if the reporting party is a representative of the pool of household employers

- employer’s health insurance contribution in total if wages have been paid

- any deductions made from the total amount of the health insurance contribution

- the "No wages payable" data if wages have not been paid and the payer is a regular employer.

Read more about the employer's separate report in the instructions Reporting data to the Incomes Register: employer's separate report.

Read more about the employer’s health insurance contribution from the Tax Administration Guidelines Employers’ and employee’s pension and insurance contribution rates or the earnings-related pension insurance providers’ websites.

Employer’s health insurance contributions do not need to be paid or reported for non-wage compensation for work.

10 Income types related to wages

10.1 Fringe benefits

Fringe benefits include accommodation, meal and car benefit. The Tax Administration issues an annual decision in which it lays down the values of fringe benefits. Tax is withheld from the total amount of monetary wages and fringe benefits, however no more than the amount of monetary wages. If the employee’s wages solely comprise fringe benefits, taxes cannot be withheld. Fringe benefits are considered wages, so they affect the calculation of the employer’s health insurance contribution and other social insurance contributions. Read more about reporting fringe benefits in the instructions Reporting data to the Incomes Register: fringe benefits and reimbursements of expenses.

Example 11: A household provides a meal benefit to an employee. In addition to the data specified in Sections 7 and 8, the employer must report the meal benefit to the Incomes Register.

The payer can report the meal benefit separately or as a total amount using the Other fringe benefit (317) income type. If the payer uses the latter reporting method, the Type of benefit additional data related to the Other fringe benefit income type must be used to report that the income reported using the Other fringe benefit includes a meal benefit. If the benefit is reported separately using the Meal benefit (334) income type, it should not be added to the income reported using the Other fringe benefit income type.

Tax is withheld from the value of the meal benefit and the social insurance contribution is paid if the criteria are met.

|

SEPARATELY REPORTED INCOME TYPES |

|||

|---|---|---|---|

|

Reporting method 1 |

EUR |

Reporting method 2 |

EUR |

|

317 Other fringe benefit |

150.00 |

334 Meal benefit |

150.00 |

|

Type of benefit: Meal benefit |

|

||

Other fringe benefits are reported in the same manner according to the benefit type (e.g. car benefit or accommodation benefit).

10.2 Tax-exempt reimbursements of travel expenses

Tax-exempt reimbursements of travel expenses include meal allowance, kilometre allowance, and various daily allowances. Reimbursements can be paid for work-related travel. Each year, the Tax Administration issues a decision defining the requirements for the tax-exempt status of reimbursements of travel expenses. If these prerequisites are not met, the reimbursements are deemed as wages to their full amount. In such a case, they are reported to the Incomes Register as wages. If the reimbursements exceed the tax-exempt minimum amounts, the extraneous amount is wages. If the employee is in a commission relationship and not in an employment relationship, reimbursement of expenses cannot be paid exempt from tax. In this case, the paid reimbursements of expenses are reported as non-wage compensation for work (see Example 16).

Example 12: A household pays a daily allowance, meal allowance and kilometre allowance to the employee. In addition to the information specified in Sections 7 and 8, the following data must be reported on these to the Incomes Register.

|

MANDATORY MINIMUM LEVEL |

ALTERNATIVE METHOD |

||

|---|---|---|---|

|

Reporting method 1 |

EUR |

Reporting method 2 |

EUR |

|

331 Daily allowance |

156.00 |

331 Daily allowance |

144.00 |

|

Type of daily allowance: Meal allowance |

|

Type of daily allowance: Full daily allowance |

|

|

Type of daily allowance: Full daily allowance |

|

303 Meal allowance |

12.00 |

|

311 Kilometre allowance (tax-exempt) |

79.50 |

311 Kilometre allowance (tax-exempt) |

79.50 |

|

Number of kilometres: 150* |

|

Number of kilometres: 150* |

|

* Data on the number of kilometres can be submitted by pay period, but must be submitted in the last report of the year at the latest.

Tax-exempt reimbursements of travel expenses can be reported electronically no later than on the fifth day of the calendar month following the payment month.

10.3. Taxable reimbursement of expenses

Taxable reimbursements of expenses are used to reimburse expenses directly incurred by the worker in the performance of their work. Such expenses include the costs arising from the purchase of tools and materials.

The income type Taxable reimbursement of expenses (353) is used to report reimbursements of expenses (excluding those paid for business trips) from which tax has not been withheld and which have not been reported using other income types. These reimbursements are not considered wages when withholding taxes. This means that the employer does not add them to the reported wages using the Time-rate pay (201) income type, for example. No social insurance contributions are paid or reported for such reimbursements of expenses.

Example 13: A construction worker is paid a tool allowance of EUR 35 based on a collective agreement. No tax is withheld or social insurance contributions are paid from such a reimbursement. The monetary amount of the allowance is reported using the income type Taxable reimbursement of expenses (353).

|

SEPARATELY REPORTED INCOME TYPES |

EUR |

|---|---|

|

353 Taxable reimbursement of expenses |

35.00 |

11 Household and private day care allowance

If your family hires a nanny and receives a private day care allowance from Kela, Kela acts as the substitute payer of the benefit. However, the family is the actual employer. Kela pays the allowance to the nanny and withholds tax from the allowance it pays. Kela will not withhold the employee's share of earnings-related pension insurance or unemployment insurance contributions from the allowance. Kela only reports the private day care allowance it has paid as a substitute payer and the tax it has withheld from it to the Incomes Register.

Your family must take out earnings-related pension insurance and accident and occupational disease insurance for a nanny in an employment relationship. In addition, your family must pay the unemployment insurance contribution to the Employment Fund. If your family pays other wages to the nanny in addition to the allowance paid by Kela, your family must take care of its employer obligations and pay the social insurance contributions both from the private day care allowance paid by Kela and the other wages you pay yourself. Even if your family does not pay anything itself to the nanny, your family must report the wages paid by Kela as a substitute payer to the Incomes Register (private day care allowance).

Private day care allowance may comprise a care allowance, an income-based care supplement and a municipal supplement. The amounts of the care allowance and care supplement may be increased with a municipal supplement according to a decision by the relevant municipality. The payment of the municipal supplement may be carried out by the municipality itself or by Kela, if the municipality has agreed on its payment through Kela.

The municipal supplement is a part of private day care allowance if the municipality has agreed on its payment through Kela. The private day care allowance paid by Kela may include a care allowance, income-related care supplement and a municipal supplement. Municipalities may also pay the municipal supplement themselves.

If your family receives a private day care allowance municipal supplement, the payer withholds tax from the allowance regardless of whether the payer is the municipality or Kela. You family’s obligations as the actual employer are as described above.

It is important that the family member who made the application on private day care allowance to Kela also takes out the insurance for the employee and submits reports to the Incomes Register using their own personal identity code.

The family must report the private day care allowance and municipal supplement received by a nanny in an employment relationship using the income type Wages paid by substitute payer: the employer pays for the employer's social insurance contributions (321). As the family is the actual employer, it pays the social insurance contributions from the total amount of wages. The family only withholds taxes from the amount of wages that it possibly pays itself to the nanny (read more in Section 8 and from the instructions Reporting data to the Incomes Register: payments made by a substitute payer).

If the family does not deduct the employee’s social insurance contributions from the nanny’s salary, but pays them on the nanny’s behalf, the contributions are considered income for the nanny. The family must declare the amount paid on behalf of the nanny in the Incomes Register under the income type Other fringe benefit (317). The family must also report the employee contributions it has paid using income types Employee's earnings-related pension insurance contribution (413) and Employee’s unemployment insurance contribution (414) to have the payment taken into account as a deduction in the nanny’s taxation. For more information, see Section 1.3 in Reporting data to the Incomes Register: fringe benefits and reimbursements of expenses.

Example 14: The household is a contract employer and has agreed that the nanny’s wages are EUR 1,000 per month from the beginning of the year. Of this sum, EUR 200 is private day care allowance paid by Kela. The wages paid by the household amount to EUR 800. The household submits the following report for November:

|

REPORT DETAILS |

|

|---|---|

|

Type of action: New report |

|

|

Pay period |

|

|

Payment date: 30.11.20xx The start date of the pay period: 01.11.20xx The end date of the pay period: 30.11.20xx |

|

|

Payer details (Actual employer, i.e. the household) |

|

|

Payer type: Household Name of the contact person: Essie Example Contact person's telephone number: 0000000 Contact person’s email: example@example.fi Payer's identifier (personal identity code): 010101-1111 Payer's name: Essie Example Payer's address: Example Street 1, 11111 Example |

|

|

Income earner details |

|

|

Income earner's identifier (personal identity code): 020202-2222 Occupational class*: 12345 |

|

|

Information on insurance |

|

| Code of the selected earnings-related pension provider: Earnings-related pension insurance information: Employee's earnings-related pension insurance Pension policy number: xx-xxxxxx |

|

|

INCOME TYPE DETAILS |

EUR |

|

201 Total wages |

800.00 |

|

321 Wages paid by substitute payer: the employer pays for the employer's social insurance contributions |

200.00 |

|

402 Withholding tax (of EUR 800) |

220.00 |

|

413 Employee's earnings-related pension insurance contribution (of EUR 1,000) |

71.50 |

|

414 Employee's unemployment insurance contribution (of EUR 1,000) |

14.00 |

*The occupational class according to Statistics Finland’s classification of occupations (TK10) must be specified because the income earner is covered by occupational accident insurance and they receive earnings subject to the occupational accident insurance contributions. You can find the classification of occupations on Statistics Finland's website.

If the payer were a temporary employer, payer type Temporary employer (no TyEL insurance policy) would additionally be given as the second payer type. In the Incomes Register e-service, the information on a temporary employer must be reported in the income earner’s insurance information.

In addition to the earnings payment report, the family must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9.

Example 15:

The family is a temporary employer and has signed a contract with a nanny from the beginning of May to the end of August. The family receives a private day care allowance from Kela amounting to EUR 470 per month (private day care allowance EUR 170 and municipal supplement EUR 300), which Kela pays directly to the nanny. A 62-year-old grandparent has been hired as the nanny. The family pays no other wages to the nanny.

Kela only withholds tax when it pays the private day care allowance to the nanny and reports that to the Incomes Register.

In this case, the family must invoice the employee's share of earnings-related pension and unemployment insurance contributions from the employee and pay them to the insurance providers together with the employer’s share.

The family must report the earnings-related pension and unemployment insurance contributions collected from the private day care allowance paid to the nanny to the Incomes Register.

The report for June is as follows:

|

FIRST REPORT |

|

|---|---|

|

Type of action: New report |

|

|

Pay period |

|

|

Payment date: 30.06.20xx The start date of the pay period: 01.06.20xx The end date of the pay period: 30.06.20xx |

|

|

Payer details (Actual employer, i.e. the household) |

|

|

Payer type: Household, Temporary employer (no TyEL insurance policy)* Name of the contact person: Essie Example Contact person's telephone number: 0000000 Contact person’s email: example@example.fi Payer's identifier (personal identity code): 010101-1111 Payer's name: Essie Example Payer's address: Example Street 1, 11111 Example |

|

|

Income earner details |

|

|

Income earner's identifier (personal identity code): 020202-2222 Occupational class**: 12345 |

|

|

Information on insurance |

|

|

Code of the selected earnings-related pension provider: |

|

|

INCOME TYPE DETAILS |

EUR |

|

321 Wages paid by substitute payer: the employer pays for the employer's social insurance contributions |

470.00 |

|

413 Employee's earnings-related pension insurance contribution |

33.60 |

|

414 Employee's unemployment insurance contribution |

6.58 |

* If the payer were a contract employer, only Household would be reported as the payer type. In the Incomes Register e-service, information about temporary employer is reported in the income earner’s insurance information.

**Enter the occupational class code according to Statistics Finland's classification of occupations TK10. You can find the classification of occupations on the website of Statistics Finland or the Incomes Register.

In addition to the earnings payment report, you must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9, since you know at the start of employment that the EUR 1,500 limit will be exceeded.

In addition to the earnings payment report, you must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9, since you know at the start of employment that the EUR 1,500 limit will be exceeded.

12 Non-wage compensation for work to a company or an entrepreneur not registered in the prepayment register

Non-wage compensation for work is usually paid against an invoice drawn up by a company or an entrepreneur. It can also be paid to a company or natural persons such as an entrepreneur, a person performing the work in a non-employment relationship, or a family day-care provider. A non-wage compensation for work is reported to the Incomes Register only if the recipient is not registered in the prepayment register. In such a case, you must report the non-wage compensation for work paid, tax withheld, and reimbursements of travel expenses, as well as other reimbursements of expenses to the Incomes Register. A non-wage compensation for work must always be reported, with no lower limit, if the recipient of the payment is not registered with the prepayment register. Social insurance contributions are not paid or reported to the Incomes Register. Neither is the employer’s separate report submitted.

If you commission work as a household and pay no more than EUR 1,500 to the same recipient in a calendar year, you do not have to withhold taxes from the payment or report the withholding to the Incomes Register. This relief on withholding tax granted to households also applies to non-wage compensation for work. If the EUR 1,500 limit is exceeded during the year, withhold taxes and report the amount of withholding to the Incomes Register beginning from the moment the EUR 1,500 limit was exceeded (see Example 21, which also applies to withholding from non-wage compensation for work and reporting it). If, however, you have withheld taxes from a smaller amount of income of less than EUR 1,500, you must report the withholding to the Incomes Register. There is no corresponding limit to the reporting of the amount of non-wage compensation for work as there is for reporting the amount of withholding. Any non-wage compensation for work must always be reported to the Incomes Register if the recipient is not registered with the prepayment register, even if no tax has been withheld. If the work has not been commissioned as a household, but the non-wage compensation for work is connected with, for example, the payer’s agricultural or business activities, the EUR 1,500 limit is not applied.

A non-wage compensation for work paid against an invoice may comprise both the sales price of goods and non-wage compensation for work. Tax must be withheld from the amount of work included in the non-wage compensation for work, and it must be reported according to the above-mentioned EUR 1,500 limit. Withhold taxes from the amount of the work with VAT excluded. The share of work in the non-wage compensation for work can be itemised in the invoice or in an invoice attachment. The goods and the share of work may also be separately invoiced. If the share of the work has not been itemised, withhold taxes from the entire VAT-excluded amount.

Withhold tax as follows:

- If the non-wage compensation for work was paid to a company (general partnership, limited partnership, limited liability company, cooperative), withhold 13% in taxes from the share of work of the non-wage compensation for work and any reimbursements for travel expenses.

- If the non-wage compensation for work was paid to an entrepreneur with a business name or another natural person, withhold taxes from the share of work of the non-wage compensation for work according to the entrepreneur’s personal withholding rate.