Reporting data to the Incomes Register: households as employers

- Date of issue

- 4/17/2019

- Record no.

- VH/697/00.01.00/2019

- Validity

- 4/17/2019 - 1/7/2020

These instructions are intended for households that pay wages or other earned income and report the data to the Incomes Register.

The instructions describe:

- the information required for reporting in the most common payment situations

- deadlines for reporting

- channels for reporting data

- correcting submitted data

- handling employer obligations

- examples of different payment situations and the reports to be submitted for them.

These instructions concern domestic situations. International situations are described in Reporting data to the Incomes Register: international situations.

These instructions replace the earlier instructions named Reporting data to the Incomes Register: households as employers. The instructions have been updated:

- we have specified the reporting instructions in more detail for situations where wages have been paid several times during the same month

- we have further specified the instructions on a joint pool of household employers acting as a payer

- we have added details to the instructions on non-wage compensation for work: how to withhold taxes and the applicability of the EUR 1,500 limit

- we have added instructions on reporting payments made for services targeted for large consumer groups

- corrected: example 17 and a new one added: example 18.

1 Household as employers and data providers

Households may have their house renovated or cleaned, pay childminders, or arrange festive occasions through a catering service. Private individuals and death estates may act as household employers. When you agree on the work-related details with the worker or service provider, you should ascertain whether the work is performed in an employment relationship or a commission relationship. In an employment relationship, the work is performed by a hired employee, i.e. wage earner, to whom you pay wages. In a commission relationship, you purchase the work from a company or an entrepreneur and pay them non-wage compensation for work based on an invoice. The obligations related to wages and non-wage compensation for work are different.

Wages and earned income are reported to the Incomes Register from 1 January 2019. The work may have been performed in 2018, but if it is paid for in 2019, it must be reported to the Incomes Register. Reports on payments made in 2018 and previous years must be submitted according to the instructions for the year in question. If these reports need to be corrected, the corrections are not made in the Incomes Register.

Data reported to the Incomes Register include wages, bonuses, fringe benefits, non-wage compensations for work, and other earned income. Tax-exempt and taxable reimbursements of expenses must also be reported. The payments are reported to the Incomes Register on an earnings payment report separately for each income earner. Additionally, the employer's health insurance contributions paid are reported as a total sum, using the employer's separate report. If you use the Palkka.fi payroll system aimed at small employers for paying wages, the service will report earnings payment data to the Incomes Register on your behalf. In this case, you need not report any earnings payment data to the Incomes Register. If you use another payroll system, you need to check if this system reports data to the Incomes Register.

When the employer is a household, the work is reported using the payer’s name and personal identity code. The wage or non-wage compensation for work paid by a household must be kept apart from the same person’s agricultural or business activities. Work related to agricultural or business activities is reported using a business ID. Work for a household employer is not reported as business activities using a business ID.

The key points of reporting to the Incomes Register for household employers:

1. When you pay wages or other earned income, report the data to the Incomes Register. Earnings payment data is only reported once, to one place.

2. Submit an earnings payment report for each income earner and each payment separately. If you have paid employer’s health insurance contributions, you should also submit the employer's separate report every month.

3. Submit the earnings payment report and the employer's separate report no later than on the fifth day of the calendar month following the payment month. If you report on a paper form, the deadline is the eighth day of the month.

4. Report the data electronically. You can only report on a paper form in special circumstances.

When you hire someone to perform work, you should determine the following matters:

- Is the payment wages or non-wage compensation for work?

- Is the recipient of a non-wage compensation for work registered in the prepayment register?

- Are you obliged to withhold tax and pay the social insurance contributions? The limits for wages are checked annually. Read more about wage and age limits in Section 8. The amount of wages and the employee’s age affect the following employer obligations:

- withholding tax and paying the employer’s health insurance contributions

- paying the employer’s unemployment insurance contributions

- the obligation to take out earnings-related pension insurance for the employees

- the obligation to take out accident and occupational disease insurance for the employees.

- Are you a temporary employer or a contract employer?

- Are you a regular employer or a casual employer?

If both spouses act as employers, both have the obligation to report their own payments to the Incomes Register. The monetary limits for employer obligations apply individually to each payer.

The amounts used in the examples are merely illustrative. You must check the amount of the social insurance contributions annually from the websites of pension insurance companies or the Tax Administration, for example. Tax is withheld according to each income earner's withholding rate.

You can find more information on a household’s obligations in the Tax Administration guidelines Households as employers (in Finnish) and the Finnish Centre for Pensions' guidelines The criteria for an employment relationship and entrepreneurial activities and drawing the line between employment and self-employment (in Finnish).

The income earner is a person or business to whom a contribution is paid. A person who is in an employment relationship is also called an employee or a wage earner. Income earners are not required to report their own income to the Incomes Register. The data is always reported by the payer.

Payment refers to the wages, non-wage compensation for work, or other related payment, such as a daily allowance, paid by the household.

The payer is a household, i.e. an individual or estate that makes a payment to an income earner.

Work performed for a household refers to work performed for an individual or estate that is not related to the person’s agricultural or business activities.

Income type means the type of income according to which the payments reported to the Incomes Register are itemised. Income types include, for example, time-rate pay, contract pay, and non-wage compensation for work.

Temporary employer and contract employer are concepts used by earnings-related pension providers, describing whether or not the payer of the contribution has taken out a pension insurance policy from an earnings-related pension provider. The employer arranges pension provision for its employees either as a temporary employer or as contract employer.

- In terms of earnings-related pension insurance, the wage payer is a temporary employer if it pays no more than EUR 8,502 in wages over a period of six consecutive months (in 2019) and does not have any permanent employees. Temporary employers do not have a valid pension insurance policy with an earnings-related pension provider.

- Employers who have permanent employees or pay more than EUR 8,502 in wages over a period of six consecutive months (in 2019) must take out a pension insurance policy from an earnings-related pension provider. In such a case, the employer becomes a contract employer.

The concepts of casual employer and regular employer are related to the Tax Administration’s employer registration. This affects the deadlines for households’ reporting and their obligation to submit the employer's separate report.

- Casual employers have only one employee over the tax year, or alternatively no more than five employees whose employment contract is not intended to continue for the full calendar year.

- Regular employers pay the wages of at least two or more employees, or pay the wages of six or more employees simultaneously, even though their employment contracts are temporary and intended for a short period of time. Employers who pay wages regularly must register with the Tax Administration’s Employer Register before they begin wage payments.

2 A single earnings payment report

Submit one earnings payment report to the Incomes Register for each payment that you make. General rules for reporting:

- Submit a report for each payment. There is no monetary minimum threshold for reporting data.

- Report wages paid and other payments to the Incomes Register individually for each income earner. Each payer reports their own payments.

- The report contains data on one payment transaction paid to a single income earner.

- You can report several income types for the same income earner on the same report if they have been paid at the same time.

- You can enter several different income types, but you should report the deductions made from the wages (for all income types) as a total amount:

- Deductions include, for example, withholding and the employee's earnings-related pension, and unemployment insurance contributions.

- Report the taxes withheld from payments such as hourly wages, overtime compensation, and holiday bonus as a total amount.

This will allow you to fulfil your statutory payment-related reporting obligations on a single earnings payment report. The data users of the earnings payment data, such as the authorities, will be able to access the data that you have reported and to which they are entitled directly from the Incomes Register.

Note that if you need to pay the employer’s health insurance contribution, you should submit the employer’s separate report in addition to the earnings payment report. For further instructions, see Section 9 Employer's separate report on the employer’s health insurance contribution.

Report monetary amounts to the Incomes Register to the cent.

3 Employing someone to work for a household

When you pay wages to an employee, you are responsible for the employer’s obligations, such as withholding tax and taking out an earnings-related pension insurance policy for the employee. The amount of wages and the employee’s age affect the employer obligations.

You can find more information on

- the obligation to withhold tax and the employer's health insurance contribution in the Tax Administration guidelines Household hires a worker

- taking out pension insurance from the Finnish Centre for Pensions’ Pensions Act service and the pension insurance providers’ websites

- taking out accident and occupational disease insurance from the Accident Compensation Centre’s website

- the obligation to pay unemployment insurance contributions from the Employment Fund website

- if you do not have internet access, you can contact these bodies personally.

Examples of reporting wages paid in different situations can be found in Section 8.

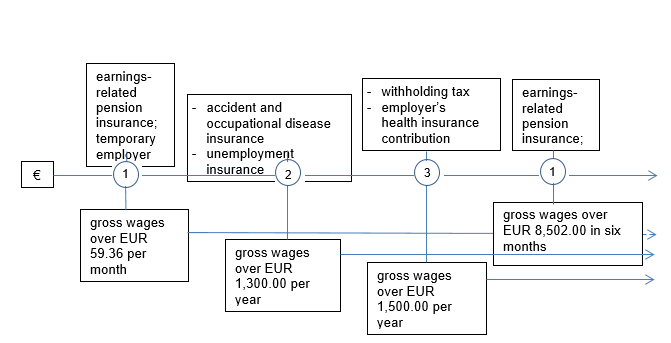

Monetary thresholds for households’ obligations related to the payment of wages (in 2019):

When the wages paid exceed one of the limits above, you must fulfil the respective obligation, such as taking out an insurance policy for the employee.

- If you pay wages over EUR 59.36 per month (in 2019), you must take out an earnings-related pension insurance for the employee. In terms of earning-related pension insurance, you are a temporary employer if you pay one person no more than EUR 8,502 in gross wages over a period of six consecutive months and do not employ anyone permanently. In other cases, you are a contract employer.

If you wish, you can act as a contract employer, i.e. take out a pension insurance policy from an earnings-related pension provider, even if the aforementioned criteria are not met. An earnings-related pension insurance must be taken out for an employee between the ages of 17 and 67.

- If you pay EUR 1,300 or more in gross wages to one or more employees during a calendar year, you must take out accident and occupational disease insurance for them and pay unemployment contributions. Please note that the employee's share of the unemployment insurance contribution must be collected from the employee, also when no more than EUR 1,300 is paid in wages. Unemployment insurance contributions must be paid for employees of ages 17 to 64.

- If you pay one employee more than EUR 1,500 in gross wages per year, you must withhold tax from the wages and pay the employer's health insurance contribution. If requested by the employee, tax can also be withheld from lower wages. The employer's health insurance contribution must be paid for employees between the ages of 16 and 67.

Withholding tax and the employer's health insurance contribution are self-assessed taxes, which you must calculate and pay yourself. Other social insurance contributions are paid using the invoicing method used by the insurance provider.

4 Household buys services from a company or an entrepreneur

If you buy services from a company or an entrepreneur and pay them non-wage compensation for work on the basis of an invoice, this is a commission relationship, not an employment relationship. When work is based on a commission relationship, you must check whether the company or entrepreneur is registered in the prepayment register.

If the company or entrepreneur is registered in the prepayment register, the non-wage compensation for work need not be reported to the Incomes Register. For example, if you pay non-wage compensation for work on a monthly basis for home cleaning to a company or entrepreneur registered in the prepayment register, you do not need to report information to the Incomes Register. You only need to pay the invoice for the work done.

If the company or entrepreneur is not registered in the prepayment register, you must always report work-related payments to the Incomes Register. For more information on reporting, see Section 12 Non-wage compensation for work to a company or an entrepreneur not registered in the prepayment register.

You can check if the company or entrepreneur is registered in the prepayment register from BIS company search or by contacting the Tax Administration.

More information on registration in the prepayment register can be found in the Tax Administration Guidelines Prepayment register.

5 Temporary employer

From the perspective of earnings-related pension insurance, you are a temporary employer if you pay no more than EUR 8,502 in wages over a period of six consecutive months (in 2019) and do not have any permanent employees. Temporary employers do not have a valid pension insurance policy with an earnings-related pension provider. In this case, you must enter both Household and Temporary employer as payer types in the Incomes Register earnings payment report.

You must select the earnings-related pension provider for your employee’s insurance yourself. If you report the data in the Incomes Register’s e-service, choose the earnings-related pension provider from the menu. If you are reporting on a paper form, provide the earnings-related pension provider code. If you are reporting the data via the technical interface or in the upload service, you must enter the pension policy number (technical insurance policy number) in addition to the code. You should request the pension policy number from the earnings-related pension provider. The pension provider will send you an invoice based on the data you have submitted.

If you are using the Palkka.fi service, you can choose the earnings-related pension provider and pay the earnings-related pension insurance contribution at the same time as you calculate the wages. The Palkka.fi service will automatically send a report to the Incomes Register. If you use another payroll system, you need to check if this system reports data to the Incomes Register.

The turn of the calendar year will not interrupt the calculation of the six-month time limit. If you have a permanent employee or pay more than EUR 8,502 in wages over a period of six consecutive months (in 2019), you are no longer a temporary employer but considered a contract employer, which means you must take out a pension insurance policy from an earnings-related pension provider. In this case, enter the payer type as Household in the earnings payment report to the Incomes Register.

If you take out an insurance policy as a temporary employer and thus become a contract employer, report your new pension policy number to the Incomes Register starting from the following payment of wages.

If you wish, you can take out an earnings-related pension insurance policy even if the EUR 8,502 limit is not exceeded.

6 Reporting to the incomes register

6.1 Mandatory and complementary data in the earnings payment report

Some of the data reported to the Incomes Register on the earnings payment report is mandatory data and some is voluntarily reported complementary additional data. The earnings payment report must always include at least the mandatory data.

Some of the mandatory data must be provided on every report and some in specific situations, such as when making a specific payment. You can also report complementary data in addition to mandatory data. The complementary data is necessary for the enforcement of income earners’ statutory benefits or customer fees, for example, or the performance of other duties by the data users. The data is used for example for social insurance purposes. It is recommended that complementary data be provided as comprehensively as possible, so that all data users obtaining data from the Incomes Register can use the data at the level of precision they need. This fulfils the single report principle, so that the data in the register does not need to be requested from the payer or income earner afterwards.

Mandatory data includes:

- pay period

- payment date or other report date

- identification of the payer using a customer identifier (personal identity code) or, in its absence, contact information

- identification of the income earner using a customer identifier (personal identity code or business ID) or, in its absence, contact information

- some of the income types used in the Incomes Register, which must always be reported when the payment in question is made.

Some of the complementary data concerns individual income types and some concerns separate data sets.

Complementary additional data includes

- certain data on employment or public-sector employment relationships

- absence data

- the earnings periods of the income types.

Reporting different types of data is described in more detail in Reporting data to the Incomes Register: mandatory and complementary data in the earnings payment report.

6.2 Two methods of reporting monetary wages

There are two methods of reporting monetary wages to the Incomes Register. It is recommended to report monetary wages in an itemised manner, but at a minimum, they must be reported as a total amount (reporting method 1).

Reporting method 1, reporting monetary wages as a total amount: If the wages are reported as a total amount, some data users may have to request more detailed information, since a lower level of detail is not sufficient for all users. For example, Kela needs more detailed information on monetary wages when granting sickness allowances or parental allowances.

Reporting method 2, reporting monetary wages in an itemised manner: If the payer wishes, they can report wages they have paid in more detail than required by the mandatory reporting method, using the separate complementary income types intended for this purpose. With this reporting method, the wage is generated from the reported earnings, and the payer does not have to calculate the wage by adding up earnings.

Reporting methods 1 and 2 cannot be used simultaneously in the same report. However, you are free to change reporting methods between reports.

The examples in the instructions describe the reporting of data. The examples do not present all mandatory data, only the data related to the reporting method.

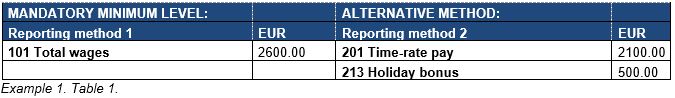

Example 1: A household makes a total wage payment of EUR 2,600 to a housekeeper as a lump sum. In addition to the regular monthly salary of EUR 2,100, the wages consist of a EUR 500 holiday bonus.

The payer can report the monetary wages in two ways: either by reporting the wages as a total amount or by itemising them in more detail using complementary income types:

When reporting method 2 is used, the income earner’s wages comprise the total amount of the reported income types. The payer does not separately need to report the total amount of the income types.

The wages are reported using the income type Time-rate pay (201) if the wages are paid according to hourly or weekly rates, for example. The wages are reported using the income type Contract pay (227) if the wages are paid based on a contract.

6.3 Reporting channels

If you calculate the wages in the Palkka.fi service, the service will automatically report the data of the wages calculated in the service to the Incomes Register. You are not required to report this data separately to the Incomes Register. Note that the Palkka.fi service can only be used to calculate wages, not non-wage compensation for work.

The Incomes Register has its own e-service, which you can log into at incomesregister.fi. Through the e-service, you can submit a report by entering the data on an online form.

If you use payroll software, you should check how to submit reports to the Incomes Register. The payroll software may be able to generate a complete set of data, which you can send to the Incomes Register in the Incomes Register’s e-service.

If electronic reporting is not an option, you can also submit the report on wages paid to the Incomes Register on a paper form. From 1 January 2019, you can print out the form at incomesregister.fi.

6.4 Reporting deadlines

The reporting deadline depends on whether the household is a casual or regular employer from the perspective of the Tax Administration’s employer registration.

If your household is a casual employer, report the wages paid and other payments made electronically to the Incomes Register no later than on the fifth day of the calendar month following the payment month. If you submit the report on a paper form, the deadline is the eighth day of the following calendar month. If you have paid wages more than once during the calendar month, report the wages you have paid on different reports, separately for each payment date.

Example 2: A household that is a casual employer pays wages in June and September as lump-sum payments. The report for the June wage payment must be submitted electronically on 5 July at the latest or on a paper form on 8 July at the latest. The report for the September wage payment must be submitted electronically on 5 October at the latest or on a paper form on 8 October at the latest.

If you are registered in the Tax Administration’s employer register, i.e. you are a regular employer, you should report the wages paid and other payments made to the Incomes Register electronically no later than on the fifth calendar day following the payment date. If you submit the report on a paper form, the deadline is the eighth day from the wage payment.

Example 3: A household that is a regular employer pays wages on 15 June. The report for this wage payment must be submitted electronically on 20 June at the latest or on a paper form on 23 June at the latest.

If you need to pay the employer’s health insurance contribution, submit the employer's separate report electronically no later than on the fifth day of the next calendar month. If the report is submitted on a paper form, the deadline is the eighth day of the calendar month following the payment.

If you are a regular employer and do not pay wages during the month, you should only report the No wages payable information on the employer's separate report for this month. Even in this case, the employer's separate report must be submitted no later than on the fifth day of the next calendar month. For example, if no wages are paid in July, submit the report electronically on 5 August at the latest or on a paper form on 8 August at the latest. If you are a casual employer, you only need to submit the employer's separate report for the months in which you have paid wages or reimbursements of expenses.

There is no specific deadline for reporting complementary data, but it is advisable to provide it simultaneously with mandatory data whenever possible.

If you notice an error in the data you reported, you must correct it by submitting a replacement report. In certain situations, a report with errors must first be cancelled, and a completely new report submitted afterwards. For more information on errors requiring cancellation, see Section 14, Correcting data reported to the Incomes Register. There is no specific deadline for submitting a replacement earnings payment report or replacement employer's separate report, but it is advisable to correct the error as soon as it is detected.

Payer |

Mandatory data in the report |

Electronic report |

Paper form |

|

A casual employer |

|||

|

|

Fifth day of the calendar month following the payment month |

Eighth day of the calendar month following the payment month |

|

|

Fifth day of the calendar month following the payment month |

Eighth day of the calendar month following the payment month |

|

A regular employer |

|||

|

|

Fifth calendar day after the payment date |

Eighth calendar day after the payment date |

|

|

Fifth day of the calendar month following the payment month |

Eighth day of the calendar month following the payment month |

|

|

No wages payable: fifth day of the next calendar month |

No wages payable: eighth day of the next calendar month |

|

Complementary data |

|||

All payers

|

for example:

|

No deadline. Recommended to be submitted simultaneously with the mandatory data. |

No deadline. Recommended to be submitted simultaneously with the mandatory data. |

| Data submitted on a replacement report | |||

All payers

|

|

No deadline. Must be corrected immediately after the error has been detected. | No deadline. Must be corrected immediately after the error has been detected. |

| Data to be submitted when cancelling a report | |||

|

All payers

|

|

No deadline. Must be cancelled immediately after the error has been detected. |

No deadline. Must be cancelled immediately after the error has been detected. |

Paper forms must arrive at the Incomes Register Unit by the due date.

Saturdays, Sundays, and other holidays must be counted when determining the fifth calendar day after the payment date, but if the report's due date falls on a Saturday, Sunday, or other holiday, the information can be reported on the following business day.

The concepts of casual and regular employer are defined in Section 1.

The employer's separate report is described in more detail in Section 9 Employer's separate report.

Replacement reports are described in more detail in Section 14 Correcting data.

6.5 Sanctions for submitting data late

The Tax Administration will not impose a late filing penalty or negligence penalty for failures in reporting to the Incomes Register for individuals or estates. The Incomes Register's data users may impose other sanctions.

7 Payer’s and recipient’s identifying information

7.1 Individual household as payer

Report data on the payer and payment receiver to the Incomes Register on every earnings payment report. If you pay wages, enter the pay period and payment date. The pay period is the period for which wages are paid. The income earner's identifier is the personal identity code for individuals and the business ID for companies or entrepreneurs.

When reporting data as a household employer, you should always report the data using a personal identity code. This applies to both regular and casual employers.

A household may have a guardian or agent who, in practice, handles data reporting and wage payments on behalf of the household. The principal, i.e. the household, is still responsible for ensuring that the data is reported to the Incomes Register, and the household is the actual wage payer. An underage person can be the payer using their own income.

When the payer type is specified as Household, the Tax Administration will know that there is a EUR 1,500 limit for the obligation to withhold tax and pay the employer's health insurance contribution.

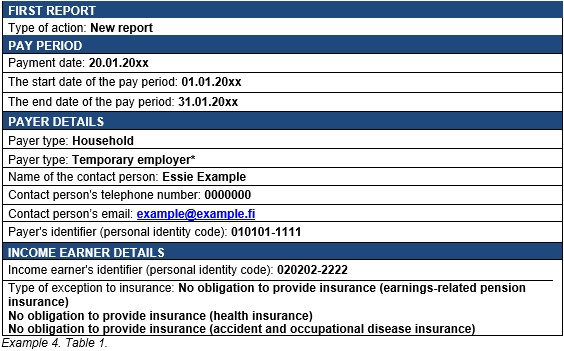

Example 4: A household pays EUR 40 in wages to one 19-year-old employee as a lump sum. The household does not make any other payments during the year to this or other employees. The wages are so low that the household is not obliged to pay social insurance contributions. Despite this, the employee's unemployment insurance contribution must be collected from the employee. In this case, the employer keeps the contribution.

The household reports the following data to the Incomes Register:

* If the household is a contract employer, this section is left blank.

The type of exception to insurance "No obligation to provide insurance (unemployment insurance)" is used when the employee is under 17 or over 64 years of age.

If the payment is non-wage compensation for work and the income earner is not registered in the prepayment register, enter the data for the payer and recipient in accordance with the example above.

If the household paying wages has employer obligations (see Sections 3 and 8 for details), you must provide more information on the payer and payment recipient.

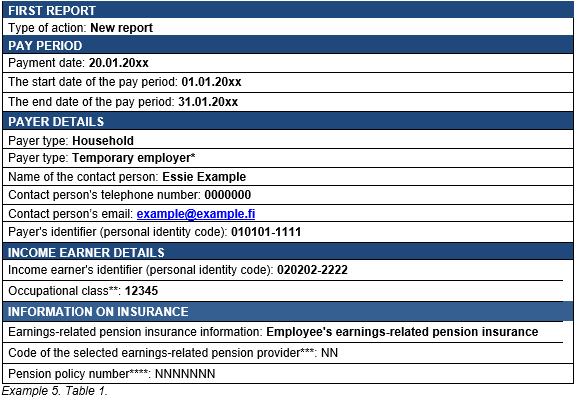

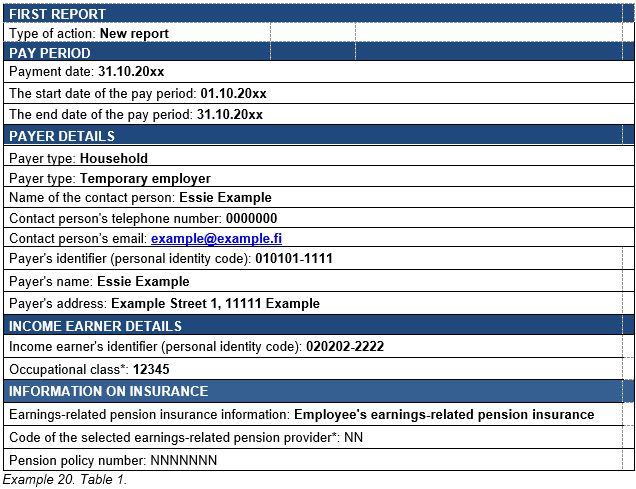

Example 5, temporary employer: A household pays EUR 1,400 in wages to one employee as a lump sum. The household does not make any other payments during the year to this or other employees. The household must take out earnings-related pension insurance, unemployment insurance, and accident and occupational disease insurance for the employee. The household reports the following data to the Incomes Register:

* If the household is a contract employer, this section is left blank.

** The occupational class must be specified if accident and occupational disease insurance has been taken out for the income earner (the insurance is mandatory when the employer pays more than EUR 1,300 in wages to one or more persons). Enter the occupational class code according to Statistics Finland's classification of occupations. The classification of occupations can be found on Statistics Finland's website.

*** Code of the selected earnings-related pension provider: Select the earnings-related pension provider of your choice and specify its code. Examples below:

46 Ilmarinen Mutual Pension Insurance Company

54 Elo Mutual Pension Insurance Company

55 Varma Mutual Pension Insurance Company

56 Veritas Pension Insurance Company

**** If you are a temporary employer and submit the report in the Incomes Register’s e-service or on a paper form, you do not need to provide a pension policy number.

7.2 Joint pool of household employers as payer

Households can jointly pay wages to a single income earner for cleaning, for example. In such a case, they form a pool of household employers. When the members of the pool hire an employee under one common employment contract, they are jointly responsible employers for the employee. In such a case, the members of the group of employers are jointly responsible for paying the employer obligations related to the employment relationship. The households must mutually agree on who will collect and pay the tax withholding and the employer's health insurance contribution, and who will handle the rest of the employer obligations, i.e. the earnings-related pension insurance, accident insurance and occupational disease insurance, and pay the unemployment insurance contributions. The responsible person is the group's representative and uses their own personal identity code for reporting and paying.

The employer is obligated to provide insurance to its employees for an occupational accident or illness when the employer pays or has agreed to pay more than EUR 1,300 for work it has commissioned during one calendar year. The limit for the obligation to provide insurance is specific to the employer and the calendar year, i.e. all work commissioned by the employer in question during the calendar year will be taken into account and the wages paid or agreed by the employer for these are totalled. Households can agree on and authorise one person to take out the insurance. A pool of employers is considered to be one employer, so the limit for the obligation to provide insurance also applies to the entire group, though one insurance policy is sufficient. If each household concludes a separate work contract with the employee, this is a case of several employment relationships, and the arrangement is not considered to be a pool of employers referred to here.

The Employment Fund will not determine an unemployment insurance contribution until the employer has paid more than EUR 1,300 per year in wages to an employee or employees. Even if the EUR 1,300 limit for the obligation to pay unemployment insurance contributions is not exceeded, the employee's unemployment insurance contribution must be collected from the income earner and the data reported to the Incomes Register.

In the case of earnings-related pension insurance, the amount of wages paid and the EUR 8,502 limit (in 2019) determine whether the payer is a temporary employer or contract employer (see Section 1 or 8.3). If households form a joint pool of employers, they can have a single insurance policy with an earnings-related pension provider, taken out in the name of the party responsible for arranging earnings-related pension insurance coverage. The limit for earnings-related pension insurance then applies jointly to all members of the pool of employers. If each employer has taken out their own insurance policy and each one reports their own share of the wages – for example, as a temporary employer – the threshold for providing earnings-related pension insurance concerns each employer separately.

Households do not need to withhold taxes or pay the employer's health insurance contribution when the wages paid to the same recipient do not exceed EUR 1,500 per calendar month. This limit is applied to each member of the pool of employers; the total amount paid by the group or a family does not matter here.

If the employer pool pays non-wage compensation for work to an income earner who is not registered in the prepayment register, only tax is withheld from the compensation. Only the amounts of payment and withholding are reported as income data. Other social insurance contributions are not paid or reported. If the income earner is registered in the prepayment register, no data is reported to the Incomes Register.

If the pool of household employers has a business ID that is used to pay wages or non-wage compensation for work, the lighter obligations concerning household employers are not applied to the pool (such as the EUR 1,500 withholding limit or the deadline for reporting to the Incomes Register). In this case, the pool of employers reports the data to the Incomes Register in the same way as other employers. More information is provided in e.g. the instructions Reporting data to the Incomes Register: monetary wages and items deducted from the wages.

8 Reporting wages paid by a household

There is no monetary minimum threshold for reporting to the Incomes Register, so you should report all the wages and other payments you make. The age of the recipient has no impact on the reporting obligation.

The amount of wages and the employee's age affect which payments must be reported in connection with the payment of wages and which insurances need to be taken out for the employees. You should report earnings payment data to the Incomes Register even if no tax has been withheld due to the low wages or the tax rate specified in the employee's tax card. Neither is the reporting obligation affected by whether social insurance contributions need to paid on the wages.

- An earnings-related pension insurance must be taken out for an employee between the ages of 17 and 67 if other criteria are met.

- The employer's health insurance contribution must be reported and paid for employees between the ages of 16 and 67.

- The employee's unemployment insurance contribution must be paid for employees between the ages of 17 and 64.

- There are no similar age limits for accident and occupational disease insurance.

8.1 Composition of pay

In addition to money, wages may also include fringe benefits, holiday pay, various bonuses, exchange of work, and received goods with cash value.

If you provide fringe benefits to an employee or pay reimbursements for travel expenses or reimbursements of expenses (taxable or tax-exempt), you should also refer to Section 10 Income types related to wages for their reporting.

8.2 Reporting the actual wages paid

8.2.1 Gross wages up to EUR 1,300 per year

If the gross total amount of wages you pay to one or several employees is up to EUR 1,300 per year, you must report to the Incomes Register

- the wages paid

- the employee's share of the earnings-related pension insurance contribution withheld from wages if the wages are over EUR 59.36 per month (in 2019)

- the employee’s share of the unemployment insurance contribution withheld from the wages for 17–64-year-olds.

- As an employer, you must always withhold the employee’s share of the unemployment insurance contribution from the wages even if you do not need to pay the employer's share. In this case, the employer keeps the unemployment insurance contribution. The income earner receives the collected amount as a deduction from their own taxation.

- The Employment Fund does not set the unemployment insurance contribution until EUR 1,300 is exceeded. In that case, the contribution is based on the total sum of wages, not only the share exceeding EUR 1,300. For this reason, also wages equal to or less than EUR 1,300 are entered as payments subject to unemployment insurance contributions.

No withholding tax or employer's health insurance contributions are payable from the wages if no employee’s wages exceed EUR 1,500 per year. However, if you have withheld tax or paid the employer's health insurance contributions, you should report those to the Incomes Register.

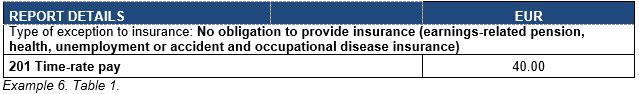

Example 6: A household pays EUR 40 in wages to a 15-year-old. There are no other employees. The wages are so low that the household does not need to pay earnings-related pension insurance contributions or take out an accident or occupational disease insurance. Based on the employee’s age, no employer's health insurance contribution, unemployment insurance contribution, or earnings-related pension insurance contribution is paid. In this example, no tax is withheld. As the employer's health insurance contribution does not need to be paid, the employer's separate report does not need to be submitted. The household reports the following data to the Incomes Register:

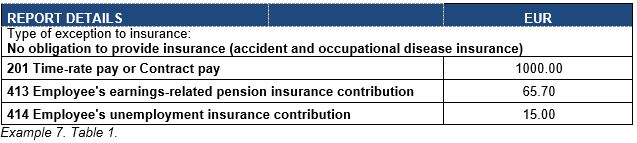

Example 7: A household pays EUR 1,000 in wages to a 30-year-old. There are no other employees and no other payments are made during the same year. The earnings-related pension insurance contribution and employee’s unemployment insurance contribution must be paid and reported for the employee. In this example, no tax is withheld. The employer's health insurance contribution does not need to be paid and the employer's separate report does not need to be submitted.

The employee's share of the unemployment insurance contribution must always be collected from the employee even if the employer has no payment obligation because the EUR 1,300 limit applied to the employer is not exceeded. The household reports the following data to the Incomes Register:

8.2.2 Gross wages more than EUR 1,300 but no more than EUR 1,500 per year

If the sum of gross wages paid by you to all employees totals over EUR 1,300 per year, but the wages of one person amount to no more than EUR 1,500 per year, you must take care of the following matters in addition to those outlined in Section 8.2.1:

- Take out accident and occupational disease insurance for your employees and report the employee's occupational class on the Incomes Register’s earnings payment report. Accident and occupational disease insurance must be taken out before the start of work. The insurance cannot be taken out retroactively.

- Pay unemployment insurance contributions to the Employment Insurance Fund. Note that as an employer you must always collect the employee's share of the unemployment insurance contributions from the wages, even if the gross wages of one person do not exceed EUR 1,300.

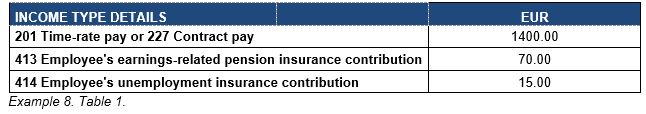

Example 8: The household pays EUR 1,400 in wages. No other payments are made during the year. The unemployment insurance contribution and accident and occupational disease insurance contribution must be paid for the employee in addition to the earnings-related pension insurance contribution. The earnings-related pension insurance and unemployment insurance contributions are reported to the Incomes Register with their own income types, but the accident and occupational disease insurance contribution is not.

In this example, no tax is withheld. Neither does the employer's health insurance contribution need to be paid or the employer's separate report be submitted. The wages can be reported using the time-rate pay or contract pay income type, for example, depending on whether the work was agreed to be performed using an hourly rate or for a contract price. The household reports the following data to the Incomes Register:

8.2.3 Gross wages over EUR 1,500 per year

If you pay one person more than EUR 1,500 in gross wages per year, you must take care of the following matters in addition to those outlined in Section 8.2.2:

- Withhold tax from the wages and report it to the Incomes Register.

- Pay the employer's health insurance contributions and report their total amount to the Incomes Register on the employer's separate report.

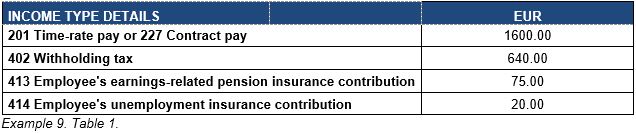

Example 9: A household pays EUR 1,600 in wages in January. The household makes no other payments to other employees. The employer’s unemployment insurance contribution and accident and occupational disease insurance contribution must be paid for the employee in addition to the earnings-related pension insurance contribution and health insurance contribution. In addition to these, tax must be withheld from the wages.

The wages can be reported using the Time-rate pay or Contract pay income type, for example, depending on whether the work was agreed to be performed using an hourly rate or for a contract price. The household reports the following data to the Incomes Register:

In addition to the earnings payment report, you must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9.

8.3 Earnings-related pension insurance

In terms of earnings-related pension insurance, it makes a difference whether you are a temporary employer or a contract employer. Earnings-related pension insurance contributions are paid for the earned income of employees 17–67 years old.

If you pay wages to an employee in an employment relationship and the employee has pension insurance for the self-employed (YEL) on the basis of their other activities, you still need to pay the employee's pension insurance contribution. YEL insurance does not affect a household employer’s insurance obligations.

Self-employed persons take out YEL insurance for themselves. If you pay non-wage compensation for work to an entrepreneur with a YEL insurance who is not registered in the prepayment register, you do not need to pay the TyEL contribution, but you must withhold tax from the non-wage compensation for work.

If you pay an employee no more than EUR 59.36 in wages per month (in 2019), you do not need to collect the employee's share of earnings-related pension insurance contribution from the employee. The employee's age is irrelevant.

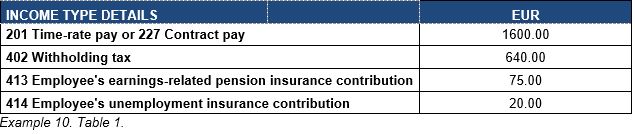

Example 10: A household is a temporary employer and pays EUR 1,600 in wages for a renovation. The household makes no other payments to other employees. The unemployment insurance contribution and accident and occupational disease insurance contribution must be paid for the employee in addition to the earnings-related pension insurance contribution and employer’s health insurance contribution. In addition to these, taxes withheld from the wages must be reported.

The household reports the following data to the Incomes Register:

In addition to the earnings payment report, you must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9.

9 Employer's separate report on the employer’s health insurance contribution

If you pay more than EUR 1,500 in wages to the same employee in a calendar year, you must pay the employer's health insurance contribution and report it to the Incomes Register on the employer's separate report.

The employer must calculate the employee’s health insurance contribution on the gross wages paid in each month. Gross wages include, for example, fringe benefits. A household does not need to the pay the employer’s health insurance contribution or report it to the Incomes Register if the same income earner is paid no more than EUR 1,500 in wages in a calendar year. For example, if you pay two employees both EUR 1,000 in wages, the employer's health insurance contribution does not need to be paid on the basis of these payments. The employer's health insurance contribution is paid for employees between the ages of 16 and 67.

You should report the total amount of the employer's health insurance contribution on the employer's separate report. The total amount of gross wages is not reported in this section. You should submit the employer's separate report for each wage payment month.

Submit the employer's separate report monthly in electronic form, no later than on the fifth day of the calendar month following the payment month. The deadline for reporting on paper is the eighth day of the calendar month following the payment month.

You can also pay and report the employer's health insurance contribution for wages less than EUR 1,500, if you know that the employee’s gross wages will later exceed the limit. In this case, submit the separate report in accordance with each pay period. If you have not paid the employer's health insurance contribution before the EUR 1,500 limit is exceeded and the limit is exceeded later in the year, you must calculate and make the payment based on the amount of gross wages for the entire year. Report the employer's health insurance contribution payable from the full year’s wage amount as a total amount in the separate report of the month in which the annual limit of EUR 1,500 is exceeded.

The employer's health insurance contribution is not paid or reported for non-wage compensation for work.

The following data must be included in the employer’s separate report:

- details of the payer, contact person, date of reporting, and the reporting period (payment month and payment year)

- employer’s health insurance contribution in total if wages have been paid

- any deductions made from the total amount of the health insurance contribution

- the "No wages payable" data if wages have not been paid and the payer is a regular employer.

Read more about the employer's separate report in the instructions Reporting data to the Incomes Register: employer's separate report.

Read more about the employer’s health insurance contribution from the Tax Administration Guidelines Employers’ and employee’s pension and insurance contribution rates or the earnings-related pension insurance providers’ websites.

10 Income types related to wages

10.1. Fringe benefits

Fringe benefits include accommodation, meal, and car benefit. The Tax Administration issues an annual decision in which it lays down the values of fringe benefits. Tax is withheld from the total amount of monetary wages and fringe benefits, however no more than the amount of monetary wages. Taxes cannot be withheld from the value of a benefit issued as just a fringe benefit. Fringe benefits are considered wages, so they affect the calculation of the employer's health insurance contribution and other social insurance contributions. Read more about reporting fringe benefits in the instructions Reporting data to the Incomes Register: fringe benefits and reimbursements of expenses.

Example 11: A household provides a meal benefit to an employee. In addition to the data specified in Sections 7 and 8, the employer must report the meal benefit to the Incomes Register.

The payer can report the meal benefit separately or as a total amount using the Other fringe benefit (317) income type. If the payer uses the latter reporting method, the Type of benefit additional data related to the Other fringe benefit income type must be used to report that the income reported using the Other fringe benefit includes a meal benefit. If the benefit is reported separately using the Meal benefit (334) income type, it should not be added to the income reported using the Other fringe benefit income type.

Tax is withheld from the value of the meal benefit and the social insurance contribution is paid if the criteria are met.

Other fringe benefits are reported in the same manner according to the benefit type (e.g. car benefit or accommodation benefit).

10.2. Tax-exempt reimbursements of travel expenses

Tax-exempt reimbursements of travel expenses include meal allowance, kilometre allowance, and various daily allowances. Reimbursements can be paid for work-related travel. Each year, the Tax Administration issues a decision defining the requirements for the tax-exempt status of reimbursements of travel expenses. If these prerequisites are not met, the reimbursements are deemed as wages to their full amount. In such a case, they are reported to the Incomes Register as wages. If the reimbursements exceed the tax-exempt minimum amounts, the extraneous amount is wages.

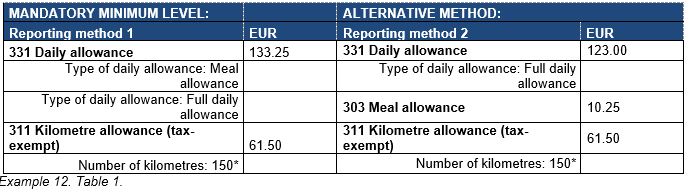

Example 12: A household pays a daily allowance and kilometre allowance to the employee. In addition to the information specified in Sections 7 and 8, the following data must be reported on these to the Incomes Register.

* Data on the number of kilometres can be submitted by pay period, but must be submitted in the last report of the year at the latest.

10.3. Taxable reimbursement of expenses

Taxable reimbursements of expenses are used to reimburse expenses directly incurred by the worker in the performance of their work. Such expenses include the costs arising from the purchase of tools and materials.

The income type Taxable reimbursement of expenses (353) is used to report reimbursements of expenses (excluding those paid for business trips) from which tax has not been withheld and which have not been reported using other income types. These reimbursements are not considered wages when withholding taxes. This means that the employer does not add them to the reported wages using the Time-rate pay (201) income type, for example. No social insurance contributions are paid or reported for such reimbursements of expenses.

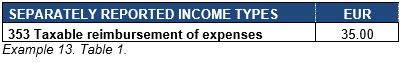

Example 13: A construction worker is paid a tool allowance of EUR 35 based on a collective agreement. No tax is withheld or social insurance contributions are paid from such a reimbursement. The monetary amount of the allowance is reported using the income type Taxable reimbursement of expenses.

11 Household and private day care allowance

If your family hires a nanny and receives a private day care allowance from Kela, Kela acts as the substitute payer of the benefit. However, the family is the actual employer. Kela pays the allowance to the nanny and withholds tax from the allowance it pays. Kela will not withhold the employee's share of earnings-related pension insurance or unemployment insurance contributions from the allowance. Kela only reports the private day care allowance it has paid as a substitute payer and the tax it has withheld from it to the Incomes Register.

Your family must take out earnings-related pension insurance and accident and occupational disease insurance for a nanny in an employment relationship. In addition, your family must pay the unemployment insurance contribution to the Employment Fund. If your family pays other wages to the nanny in addition to the allowance paid by Kela, your family must take care of its employer obligations and pay the social insurance contributions both from the private day care allowance paid by Kela and the other wages you pay yourself. Even if your family does not pay anything itself to the nanny, your family must report the wages paid by Kela as a substitute payer to the Incomes Register (private day care allowance).

The municipal supplement is a part of private day care allowance if the municipality has agreed on its payment through Kela. The private day care allowance paid by Kela may include a care allowance, income-related care supplement and a municipal supplement. Municipalities may also pay the municipal supplement themselves.

If your family receives a private day care allowance municipal supplement, the payer withholds tax from the allowance regardless of whether the payer is the municipality or Kela. You family’s obligations as the actual employer are as described above.

It is important that the family member who made the application on private day care allowance to Kela also takes out the insurance for the employee and submits reports to the Incomes Register using their own personal identity code.

The family must report the private day care allowance and municipal supplement received by a nanny in an employment relationship using the income type Wages paid by substitute payer: the employer pays for the employer's social insurance contributions (321). As the family is the actual employer, it pays the social insurance contributions from the total amount of wages. The family only withholds taxes from the amount of wages that it possibly pays itself to the nanny (read more in Section 8 and from the instructions Reporting data to the Incomes Register: payments made by a substitute payer).

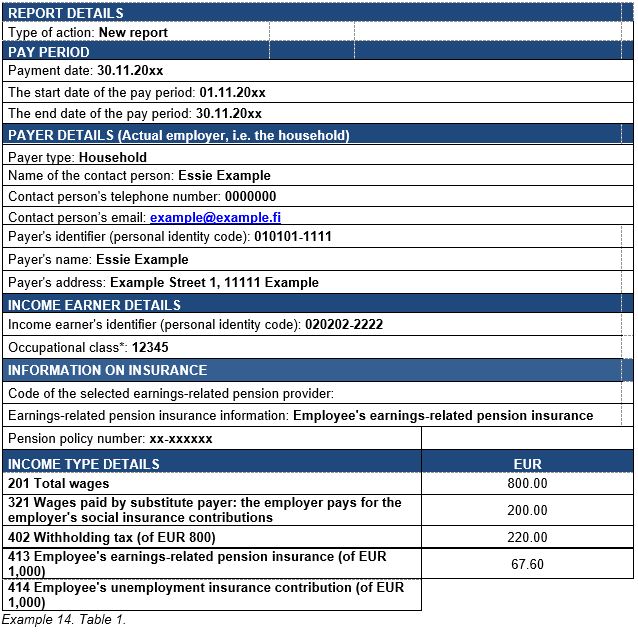

Example 14: The household is a contract employer and has agreed that the nanny’s wages are EUR 1,000 per month from the beginning of the year. Of this sum, EUR 200 is private day care allowance paid by Kela. The wages paid by the household amount to EUR 800. The household submits the following report for November:

* Enter the occupational class code according to Statistics Finland's classification of occupations if an accident and occupational disease insurance has been taken out for the income earner. You can find the classification of occupations on Statistics Finland's website.

If the payer were a temporary employer, payer type Temporary employer would additionally be given as the second payer type.

In addition to the earnings payment report, the family must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9.

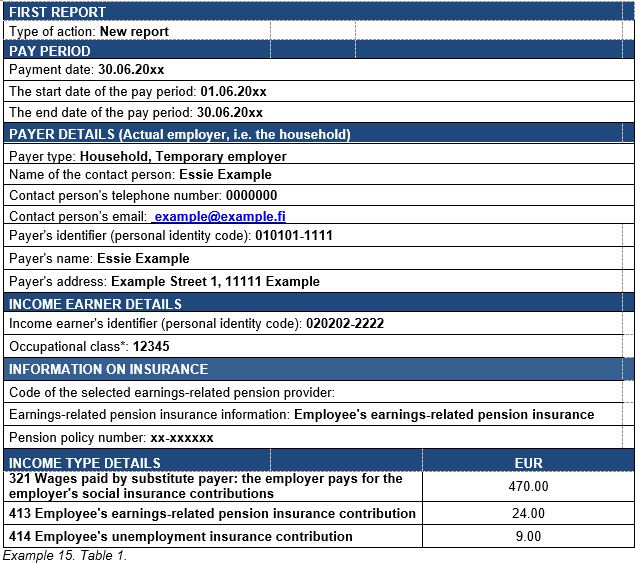

Example 15: The family is a temporary employer and has signed a contract with a nanny from the beginning of May to the end of August. The family receives a private day care allowance from Kela amounting to EUR 470 per month (private day care allowance EUR 170 and municipal supplement EUR 300), which Kela pays directly to the nanny. A 62-year-old grandparent has been hired as the nanny. The family pays no other wages to the nanny.

Kela only withholds tax when it pays the private day care allowance to the nanny and reports that to the Incomes Register.

In this case, the family must invoice the employee's share of earnings-related pension and unemployment insurance contributions from the employee and pay them to the insurance providers together with the employer’s share.

The family must report the earnings-related pension and unemployment insurance contributions collected from the private day care allowance paid to the nanny to the Incomes Register.

The report for June is as follows:

* Enter the occupational class code according to Statistics Finland's classification of occupations TK10. You can find the classification of occupations on the website of Statistics Finland or the Incomes Register.

If the payer is a contract employer, only the Household payer type would be specified.

In addition to the earnings payment report, you must submit the employer's separate report on the employer's health insurance contribution in accordance with Section 9, since you know at the start of employment that the EUR 1,500 limit will be exceeded.

12 Non-wage compensation for work to a company or an entrepreneur not registered in the prepayment register

If you pay non-wage compensation for work to a company, entrepreneur, or private day care provider who is not registered in the prepayment register, you should report the non-wage compensation for work paid, tax withheld, and reimbursements of travel expenses as well as other reimbursements of expenses to the Incomes Register. Social insurance contributions are not paid or reported to the Incomes Register. Neither is the employer's separate report submitted.

If you commission work as a household and pay no more than EUR 1,500 to the same recipient in a calendar year, you do not have to withhold taxes from the payment or report it to the Incomes Register. This also applies to non-wage compensation for work. If the EUR 1,500 limit is exceeded during the year, withhold taxes and report the amount of withholding to the Incomes Register beginning from the moment the EUR 1,500 limit was exceeded (see example 20, which also applies to withholding from non-wage compensation for work and reporting it). If, however, you have withheld taxes from a smaller amount of income, you should report the withholding to the Incomes Register. There is no corresponding limit to the reporting of the amount of non-wage compensation for work as there is for reporting the amount of withholding. Any non-wage compensation for work must always be reported to the Incomes Register. If the work has not been commissioned as a household, but the non-wage compensation for work is connected with, for example, the payer’s farming or business activities, the EUR 1,500 limit is not applied.

Non-wage compensation for work is usually paid against an invoice drawn up by a company or an entrepreneur. The payment may include both the sales price of goods and non-wage compensation for work. Tax must be withheld for the amount of work included in the non-wage compensation for work, and it must be reported according to the above-mentioned EUR 1,500 limit. Withhold taxes from the amount of the work with VAT excluded. The share of work in the non-wage compensation for work can be itemised on the invoice or in an invoice attachment. The goods and the share of work may also be separately invoiced. If the share of the work has not been itemised, withhold taxes from the entire VAT-excluded amount.

Withhold tax as follows:

- If the non-wage compensation for work was paid to a company (general partnership, limited partnership, limited liability company, cooperative), withhold 13 percent in taxes from the share of work of the non-wage compensation for work and any reimbursements for travel expenses.

- If the non-wage compensation for work was paid to an entrepreneur with a business name, withhold taxes from the share of work of the non-wage compensation for work according to the entrepreneur’s personal withholding rate.

- Calculate the withholding from the amount excluding VAT of the share of work and report it to the Incomes Register.

You can report the non-wage compensation for work in the Incomes Register’s e-service, via payroll software, or on paper. As non-wage compensation for work cannot be paid in the Palkka.fi service, the service does not send reports to the Incomes Register on them.

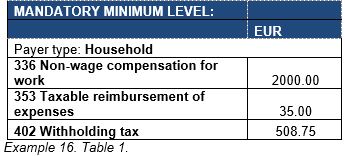

Example 16: A household pays a non-wage compensation for work of EUR 2,000 and a taxable reimbursement of expenses for tools of EUR 35 to an entrepreneur with a business name who is not registered in the prepayment register. Tax is withheld from the amount of EUR 2,035. According to the entrepreneur’s tax card, the withholding rate is 25%. In addition to the payer’s and recipient’s identifying information, the following data is reported:

Services produced as mass services, designed and marketed for large consumer groups, are treated as the sales of goods, and payments made for them are not reported to the Incomes Register. Such services include, for example, public transport, health care services (including health care centre fees), hairdressing services, and restaurant/accommodation services. However, payments for charter transport and catering services represent non-wage compensation for work that must be reported to the Incomes Register

13 Payment of wages and employer contributions

When you hire an employee, you must take care of the following payments:

- Pay wages to the employee as agreed.

- Pay the taxes withheld and the employer's health insurance contributions to the Tax Administration in MyTax or through your online bank no later than on the twelfth day of the month following the payment month.

- Pay any earnings-related pension and accident and occupational disease insurance contributions to the insurance providers of your choice and the unemployment insurance contributions to the Employment Fund. The earnings-related pension insurance providers will invoice the payments directly from the employer unless otherwise agreed.

If you use the Palkka.fi service for payroll calculation, the service will automatically generate the payment details for withholding, employer's health insurance contribution, and earnings-related pension insurance contribution, which you can pay through your online bank.

The unemployment insurance contribution cannot be paid in the Palkka.fi service. The Employment Fund will impose the payment when the wage amount exceeds EUR 1,300 in a calendar year. Accident and occupational disease insurance contributions cannot be paid in the Palkka.fi service, either. The insurance companies will invoice the contributions separately.

Instructions for payment can be obtained from the websites of the Tax Administration, insurance companies, and the Employment Fund, or by contacting these bodies.

14 Correcting data reported to the incomes register

If there is an error in the data reported to the Incomes Register, the data must be corrected. If you want to change a report that you have submitted, you should send a replacement earnings payment report. If you have reported earnings payment data for several employees, you only need to submit a replacement report on the employee whose earnings payment data needs to be corrected. In certain situations, data must be corrected by cancelling the previously submitted report and by giving a new report. If you have paid and reported the employer's health insurance contribution and the correction affects its total amount, you should also submit a replacement employer's separate report.

In addition to the changed data, you must also report all the correct information again. The replacement report will replace the original report in its entirety. The latest report is always the valid report. Enter the original report’s report reference on the replacement report to ensure that the correction is allocated to the correct original report in the Incomes Register. When submitting a new report, you will always receive a report reference generated by the Incomes Register that can be used to allocate the corrections to the correct report. If you gave the original report a payer’s report reference that you defined yourself, you can use that for correcting the report instead of the report reference generated by the Incomes Register.

For example, if you have paid EUR 800 in wages and accidentally reported the wages as EUR 80 in the original report, report all the previously reported data as such on the replacement report and the corrected earnings payment data as EUR 800.

If you correct information on an individual report in the Incomes Register’s e-service, you can open the original report and only correct the incorrect information. The other data will remain the same.

An erroneous report must be corrected in the Incomes Register as soon as the error is detected. There is no specific deadline for this. All incorrect data must be corrected, whether it is mandatory data or complementary voluntarily submitted data. If a mandatory data item was missing from the original report, it must also be added to the replacement report.

If you submitted the report in the Palkka.fi service, you can correct the report there.

If correcting information reported to the Incomes Register affects the amounts of social insurance contributions, the earnings-related pension providers and insurance companies are responsible for updating this data.

Although information in the Incomes Register is usually corrected with a replacement report, in certain situations the earlier report must first be cancelled, i.e. deleted from the Incomes Register, and an entirely new report must then be submitted. The information must be cancelled if there is an error in one of the following, for example:

- payment date

- pay period

- the payer's or income earner’s customer identifier (e.g. personal identity code or business ID)

- the income earner's date of birth

- pension policy number

- occupational accident insurance company identifier or policy number.

Read more about correcting data reported to the Incomes Register in the instructions Correcting data in the Incomes Register.

15 Examples of reporting

15.1 Gross wages EUR 400

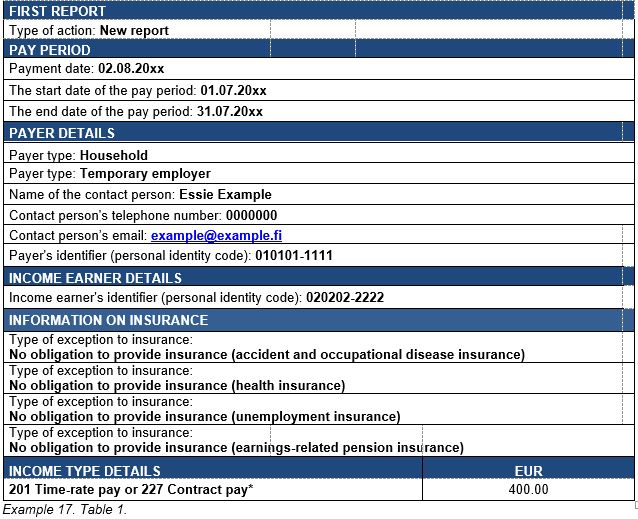

Example 17: A household is a temporary employer and is not registered in the Tax Administration’s Employer Register. The household pays EUR 400 in wages as a lump sum to a 15-year-old neighbour for caring for school-aged children. The family is not entitled to private day care allowance. The work was performed in July and the wages were paid on 2 August. No taxes are withheld in this example and no other payments are made during the year.

Because the income earner is 15 years old, the income paid is not subject to earnings-related pension, unemployment, or health insurance contributions. Neither is the accident and occupational disease insurance contribution paid, because the amount of income paid by the household is less than EUR 1,300 per year

The household reports the following data to the Incomes Register:

* Report the wages using the Time-rate pay income type if you pay wages based on an hourly rate, for example. Report the wages using the Contract pay income type if you pay wages based on a contract.

The employer's health insurance contribution does not need to be paid and the employer's separate report does not need to be submitted.

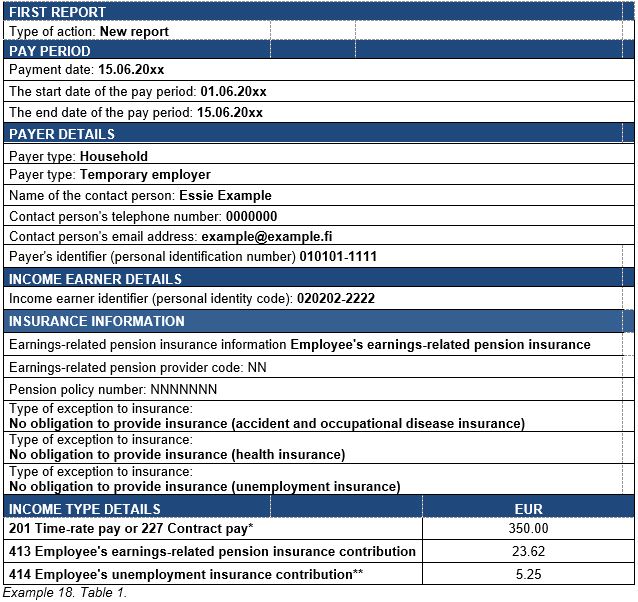

Example 18: A household is a temporary employer and is not registered with the Tax Administration's Employer Register. The household pays EUR 350 in wages as a lump sum payment to an 18-year-old youth for babysitting school-aged children. The family is not entitled to a private day care allowance. The work was performed in June and the wages were paid on 15 June. Taxes are not withheld in this example, and no other payments are made over the rest of the year.

The payment is subject to the earnings-related pension insurance contribution but not to the health, unemployment, or accident and occupational disease insurance contributions. The employer's unemployment insurance contribution must be collected though the employer will not be under payment obligation in this case, as the employer limit of EUR 1,300 is not exceeded. In this case, the employer ends up with the unemployment insurance contribution.

* Report the wages using the income type Time-rate pay if you are paying an hourly rate, for example. Report the wages using the income type Contract pay if you are paying as based on a contract.

** As an employer, you must always withhold the employee’s share of the unemployment insurance contribution from the wages, even if you are not required to pay the employer's share. In this case, the employer ends up with the unemployment insurance contribution. The income earner receives the collected amount as a deduction from their own taxation.

15.2 Gross wages EUR 2,000, reimbursements of expenses and monthly cleaning work

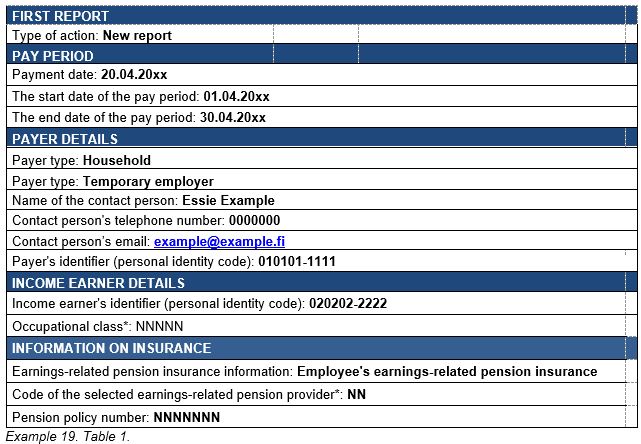

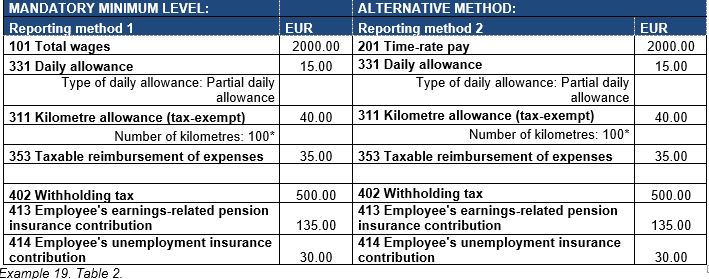

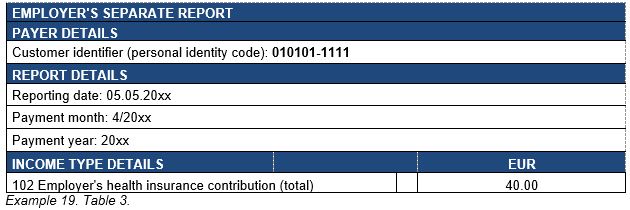

Example 19: A household is a temporary employer and is not registered in the Tax Administration’s Employer Register. The household pays a lump sum of EUR 2,000 for a renovation, a reimbursement of EUR 35 for work equipment, a tax-exempt kilometre allowance of EUR 40 for 100 km for picking up materials, and a partial daily allowance of EUR 15. The work was performed in April and the wages were paid on 20 April. The household had not paid any other wages earlier in the year.

The household withholds taxes according to the tax card at a rate of 25% on the gross wages of EUR 2,000. No tax is withheld or social insurance contributions are paid from the reimbursement of expenses of EUR 35.

In addition, the household pays a non-wage compensation for work of EUR 150 per month for cleaning to a company that is registered in the prepayment register. The cleaning work is not reported to the Incomes Register at all, as the recipient is registered in the prepayment register.

The household reports the following data to the Incomes Register:

* See example 5.

The household can report data on monetary wages using one of two methods:

* Data on the number of kilometres can be submitted by pay period, but must be submitted in the last report of the year at the latest

In addition, the household reports the amount of the employer’s health insurance contribution on the employer's separate report:

15.3 Gross wages EUR 1,000, with a previous payment of EUR 1,300

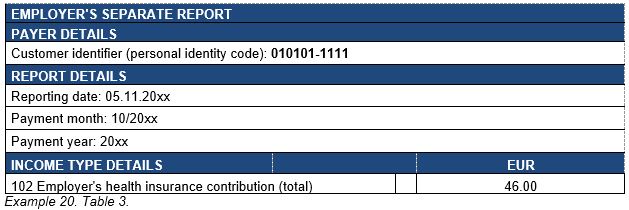

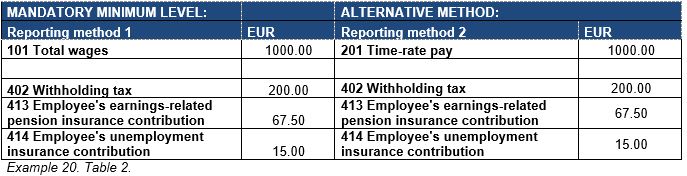

Example 20: A household is a temporary employer and is not registered in the Tax Administration’s Employer Register. The household paid the employee EUR 1,300 in wages for a renovation in March. The report was submitted electronically on 5 April. No taxes were withheld or employer's health insurance contributions paid from the wages, as the wages paid did not exceed EUR 1,500. The wages and other social insurance contributions were duly paid and reported.

The same employee is paid EUR 1,000 in wages on 31 October for another renovation carried out in October of the same year. The wage amount for the full year exceeds the EUR 1,500 limit. According to the employee's tax card, the withholding rate is 25%. Tax is withheld from the amount exceeding EUR 1,500, i.e. EUR 800 (2,300 – 1,500). The employer's health insurance contribution is paid and reported for EUR 2,300, i.e. the wage amount for the full year.

Of the wages paid in October, wages of EUR 1,000 and a withholding of EUR 200 are reported to the Incomes Register. The previous report does not need to be corrected or supplemented.

The household reports the following data to the Incomes Register:

* See example 5.

The household can report data on monetary wages using one of two methods:

In addition, the household reports the amount of the employer’s health insurance contribution on the employer's separate report. The month in which the EUR 1,500 limit was exceeded and during which the total amount of health insurance contributions accrued by that time was reported is entered as the payment month.