Study: Earnings payment data reporters find the Incomes Register useful

4/27/2021The deployment of the Incomes Register at the start of 2019 changed the way earnings payment data is reported. According to a survey conducted by the Incomes Register earlier this year, 64% of accounting firms and 71% of other companies have found Incomes Register to be useful.

The respondents mentioned, for example, the removed need to file annual information returns, their workload being distributed more evenly throughout the year and increased digitalisation as the benefits of the Incomes Register. However, some respondents reported that their workload has increased and hoped that the requirement for submitting data within five days could be increased for smaller companies particularly.

Overall, 50% of accounting firms and 57% of other companies said that using the Incomes Register is effortless. Accounting firms using the upload service found using the Incomes Register effortless more often than others.

The Incomes Register has sped up earnings payment data reporting for companies, but also made it more slow for accounting firms

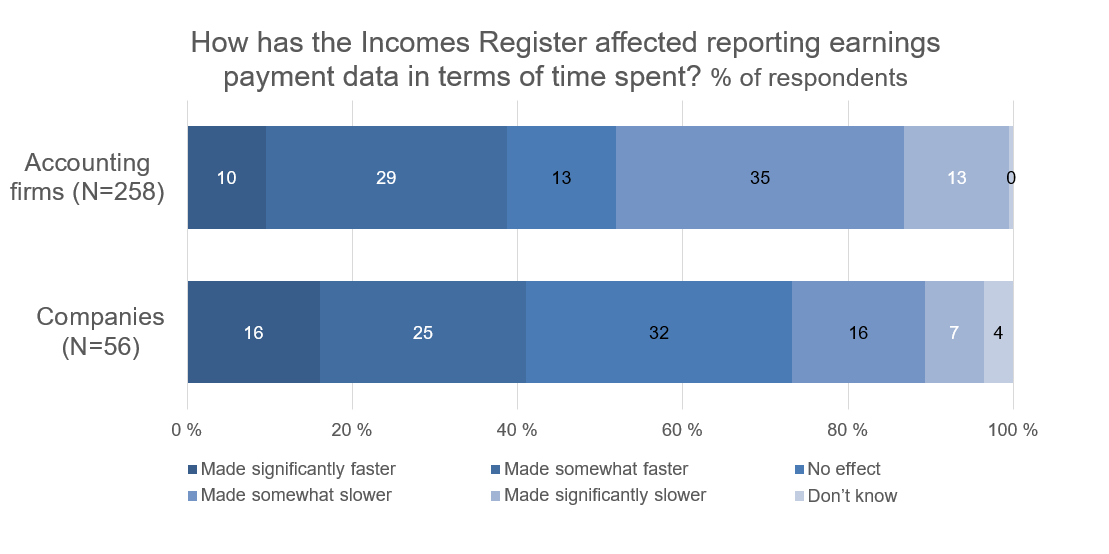

Of other types of companies, 41% reported that reporting earnings payment data is now faster. Of the companies, 54% used the technical interface, 30% used the web form and 20% used the upload service. Companies handling their reporting themselves most often only use one channel for their reporting, whereas accounting firms usually use more than one.

Of accounting firms, 39% said that the Incomes Register had made reporting faster. However, compared to other companies, accounting firms more often reported that reporting earnings payment data has become slower with the Incomes Register.

Of accounting firms, 63% used the technical interface, 37% used the web form and 19% used the upload service. Accounting firms using the technical interface or the upload service felt reporting data had become faster, whereas the firms using the web form felt it had become slower.

A total of 40% of accounting firms and 45% of other companies reported that the Incomes Register has made their work more digital and automatised. In particular, the companies using the technical interface and the upload service reported that the Incomes Register has made their work more digital and automatised.

In both survey groups, only one fifth of the respondents felt that the Incomes Register had increased manual work.

The Incomes Register has somewhat increased expenses

The deployment of the Incomes Register increased expenses for 48% of accounting firms and 32% of other companies as a lump sum cost. Opting to use the technical interface as a reporting channel increased the amount of the lump sum cost more than the other reporting channels.

A more long-term increase in expenses was reported by 29% of accounting firms and 23% of other companies. However, 66% of accounting firms and 64% of other companies assessed that their reporting costs have not increased in the long-term. System maintenance costs were the largest factor increasing expenses.

Half of the accounting firms reported that the deployment of the Incomes Register had an effect on their customer service charges. Nearly all of these had increased their prices.

In addition, 16% of accounting firms reported that their business activity had increased due to the deployment of the Incomes Register.

Instructions and transcripts still require improvement

A total of 45% of accounting firms and 51% of other companies said that the instructions and communications of the Incomes Register were clear. On the other hand, 52% of accounting firms and 43% of other companies felt the instructions were unclear.

Incomes Register provides a variety of transcripts to assist data reporters with reconciliation, for example.

Incomes Register transcripts were used by 59% of accounting firms and 39% of other companies. On average, accounting firms with at least 2 employees and using the e-service web form used transcripts more than the other companies. A total of 42% of accounting firms and 39% of other companies felt that the Incomes Register transcripts were suited to their needs.

The instructions and transcripts are further developed based on user feedback. For example, the transcript on the income type specific summary of a payer’s earnings payment reports has been developed after deployment to suit the needs of payers better. In addition, new development proposals for improving the transcripts are currently being assessed to be implemented as part of the Incomes Register’s continuous development efforts.

The survey was commissioned by the Incomes Register and conducted as telephone interviews in February and March 2021. The survey was conducted by Feelback Oy. The target group of the survey comprised accounting firms and Finnish companies that report earnings payment data to the Incomes Register. A total of 314 respondents were interviewed, 258 of which were representatives of accounting firms providing payroll services and 56 were from Finnish companies that handle payroll themselves.