Advancement – how gifts affect the assessment of inheritance tax?

If you receive a gift as an advancement of inheritance, you must file a gift tax return and pay gift tax. If you plan to give someone an advancement, or if you expect to receive an advancement, see instructions: When is a gift treated as an advancement of inheritance?

After the death of the person who gave a gift as an advancement, certain consequences concern both the distribution of the estate and the assessment of inheritance taxes:

- If you received an advancement during the person’s lifetime, you will now receive a smaller part of the estate property than the other inheritors.

- If you received no advancement, you receive a larger part of the property than those of the other inheritors who received an advancement.

Advancement of inheritance – how is inheritance tax calculated?

If you were given an advancement which was a gift subject to gift taxation, you have already paid the gift tax on it. After the death of the person who gave you the advancement, the amount of inheritance tax is calculated as follows:

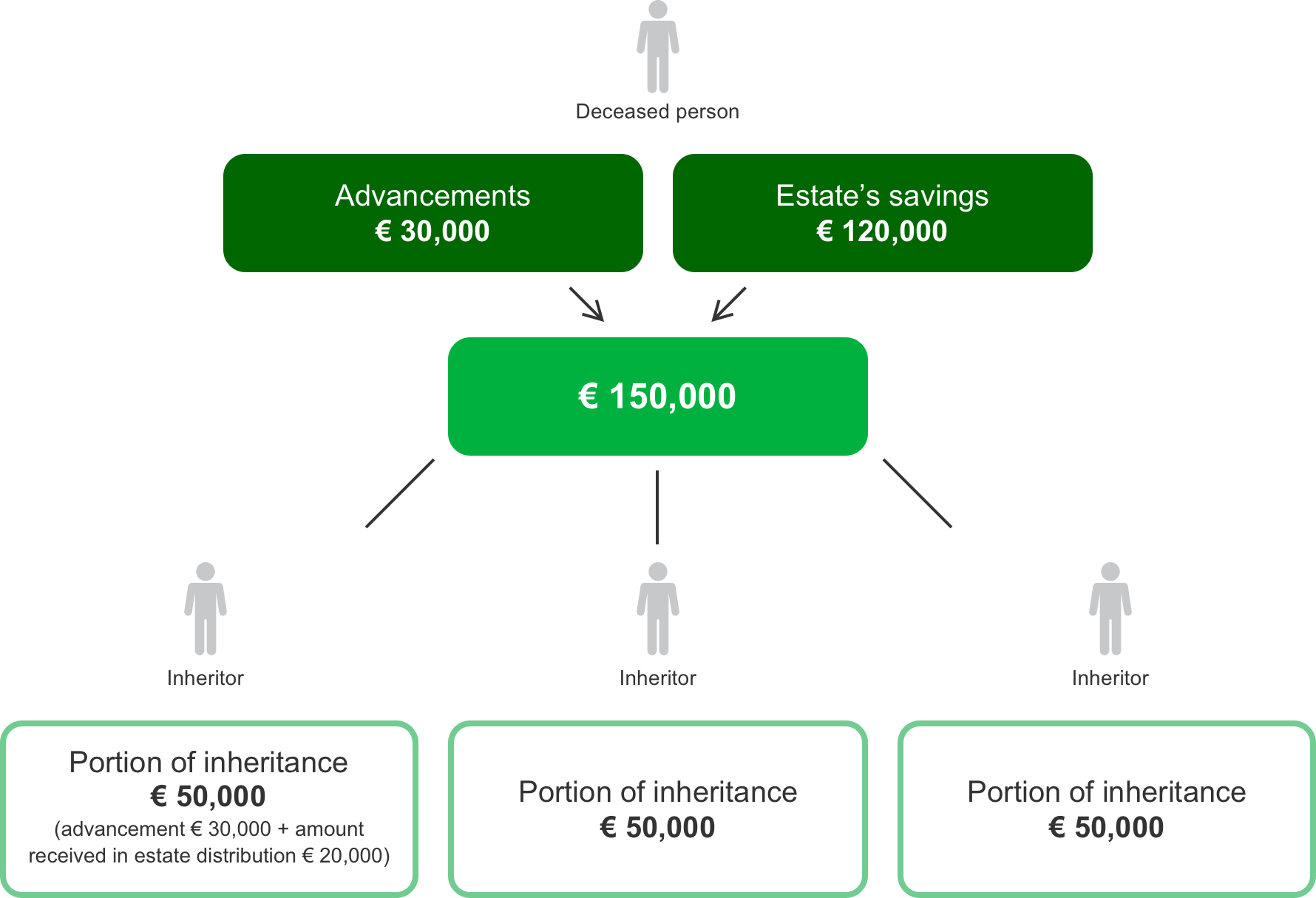

- The value of the advancement must first be determined, usually based on the date when the gift was given.

- The sum total of the decedent’s property and all advancements is calculated.

- This total is then divided between the inheritors. After this, we impose inheritance tax on each inheritor based on the results of the above division.

- Because you already paid gift tax on the advancement you received, we will subtract it from the inheritance tax calculated for you. The subtraction is based on the gift tax scale that was in force when the decedent passed away. However, in case the amount of gift tax you paid in the past is higher than the amount of inheritance tax, the difference cannot be refunded to you.

Gifts may be accounted for in inheritance tax assessment – how is the tax calculated?

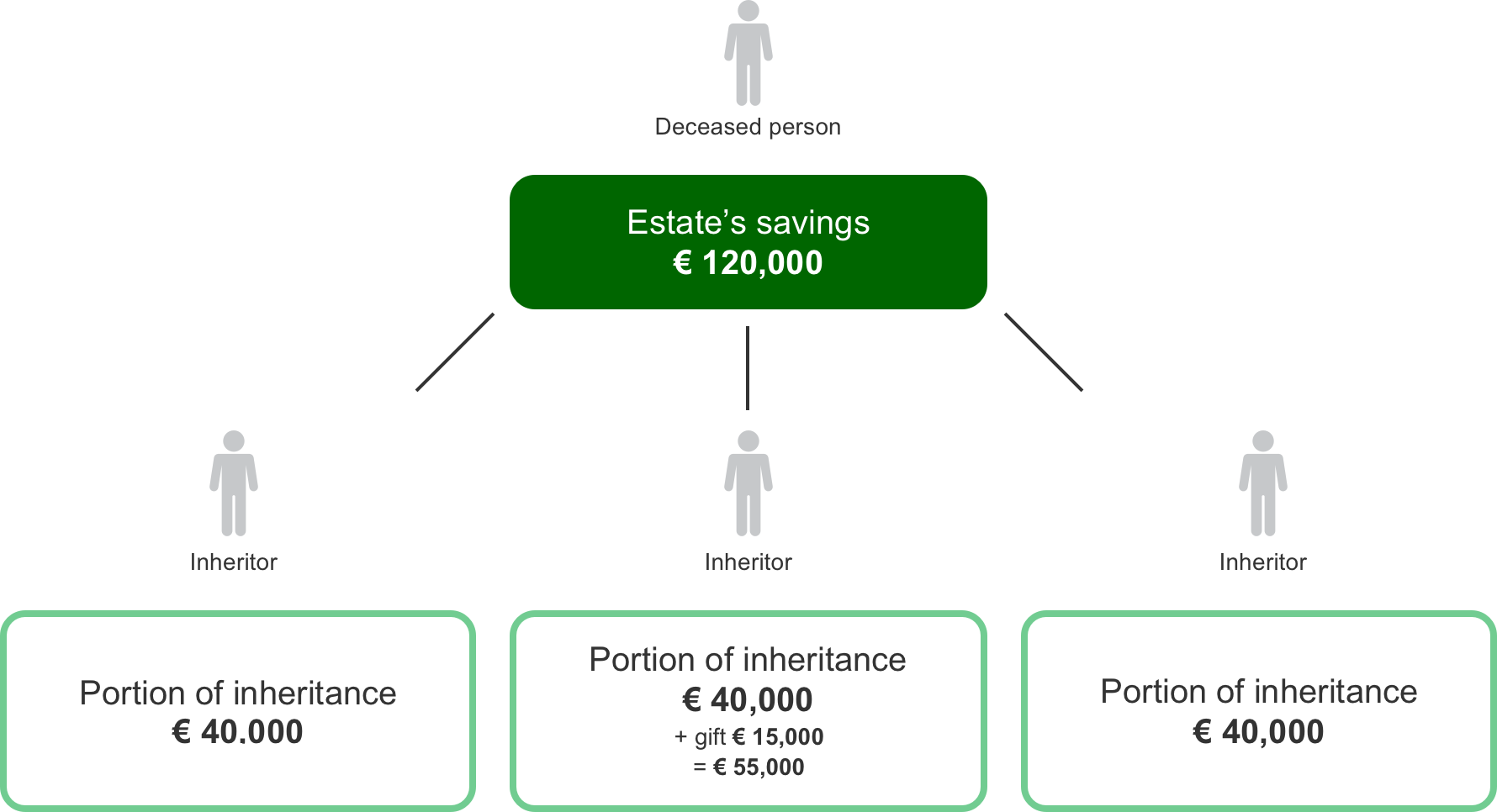

If you had received a gift from the person who passed away during the three years that preceded the date of death, the gift is taken into account in the assessment of inheritance tax. The amount of inheritance tax is calculated as follows:

- We add the value of the gift to your portion of the inheritance.

- We calculate your inheritance tax based on the total amount.

- Because you already paid gift tax on the advancement you received, we will subtract it from the inheritance tax calculated for you. The subtraction is based on the gift tax scale that was in force when the decedent passed away. However, in case the amount of gift tax you paid in the past is higher than the amount of inheritance tax, the difference cannot be refunded.

Advance rulings on inheritance tax

You can request an advance ruling on inheritance tax

Frequently asked questions

You are allowed to make one person a tax-exempt gift, worth less than €5,000, every 3 years.

However, it is important to note that after you die, the gift will be accounted for in the assessment of inheritance taxes if the gift was received 3 years prior to your date of death.

Read more: How much can you donate free of tax?

Advancements are gifts. Accordingly, they are subject to gift tax. Family relationships between the person giving the gift and the recipient, together with the gift’s value, determine the percentage of tax.

The page on the tax.fi website containing information about tax brackets also has a schedule and a calculator for gift taxes. You can use it for making an estimate.

Key terms: