6A Business tax return – Partnership/consortium, Instructions

Use tax return Form 6A to report all your income and expenses. Enter the amounts in the ‘Accounting’ and ‘Tax accounting’ columns. If more than one accounting period has ended during the calendar year, use a single tax return form and supplemental forms to report the information on all the accounting periods. When reporting the values of your assets, do it on the basis of the accounting period that ended last. Enter the amounts to the cent.

If you are making corrections to a previously submitted tax return, you must file an entirely new return as a replacement. Resubmit all the details you filed before. It is not enough that you fix incorrect details or add new information.

If you need to add an enclosure, fill out an official enclosure form that you have downloaded on the Tax Administration’s site. Send other types of additional documentation (e.g. receipts, vouchers and itemisations) only if the Tax Administration asks you to do so.

You can file the business tax return and enclosures electronically in MyTax or through other e-filing channels. In order to e-file, you will need personal online banking codes or a mobile certificate.

If any changes to the partners’ shareholding or to the investment and interest rate of a limited partner have taken place, you must report them only on a Notification on amendments and on termination of business on the ytj.fi (BIS) website. You can file the notification electronically or on Form Y5 on paper. The changes you report will become effective upon their entry to the Trade Register by the Finnish Patent and Registration Office (PRH).

Use the BIS Form Y5 also to report any changes to company information (e.g. a changed accounting period) or its line of business. You can file the notification electronically or on Form Y5 on paper.

Table of contents:

1 Partnership details and tax year

2 Calculation of taxable income

3 Information on partners, and itemisation of rents, interests, selling prices and other payments to their relatives

4 Itemisation of apartments and real estate included in business assets and in residential use by a partner or their family

5 Calculation of interest expenses relating to business income source which are non-deductible if equity is negative due to cash withdrawals for private use

6 Calculation of net worth

7 Specification of the business partnership’s equity

8 Audit

9 Capital gains derived from securities and real estate included in the partnership’s fixed assets

10 Wages paid

1 Partnership details and tax year

Name

The name of the business partnership.

Business ID

The Business ID of the business partnership.

Tax year

The tax year for which the tax return is filed.

Accounting period

The partnership’s accounting period.

Please note that any information you may fill in here on a change to the start or end date of the accounting period is not passed on to other databases. If you need to change the accounting period, you must submit a ‘Notification on amendments or on termination of business’ to the Business Information System (ytj.fi). You can file the notification electronically or on Form Y5 on paper.

If more than one accounting period has ended during the tax year, use a single tax return form and the necessary supplement forms to report the information on all the accounting periods.

Line of business

The line of business based on the Standard Industry Classification of Statistics Finland:

- code for the line of business

- the name of the line of business

Please note that any information you fill in here on a changed line of business is not passed on to other databases if you just report it on your tax return. If you need to report a changed line of business, you must submit a ‘Notification on amendments or on termination of business’ to the Business Information System (ytj.fi). You can file the notification electronically or on Form Y5 on paper.

Additional information provided by (name)

This line is for the name and phone number of an individual who can provide further information to the Tax Administration.

Shareholder in a foreign partnership

If the partnership is a shareholder in a foreign partnership, you must check the box.

Partnership claims refund of foreign taxes paid

Check the box if the partnership has paid taxes in a foreign country during the tax year and you are claiming credit for the foreign taxes paid. Complete Form 70 (Claim for relief for double taxation) to claim it. In addition, you must also indicate the gross amount of the foreign income on this tax return.

2 Calculation of taxable income

Fill in the partnership's taxable income and tax-deductible expenses in the Tax accounting column of this section.

The ‘Calculation of taxable income’ section has a separate Accounting column for any income and expense items where the amount booked in the accounts may be different from the amount to be taken into account in the tax assessment.

Enter the amounts for the calculation of taxable income to the cent without a prefix (no plus or minus sign). If the reported item differs from its usual default value, enter a minus sign (-).

Income and expenses are divided by source of income

A business partnership can have three sources of income. The taxable income and deductible expenses of each source of income are determined according to different legal provisions:

- Business: act on business tax (EVL (360/1968))

- Agricultural: agricultural income tax act (543/1967)

- Personal: act on income tax (TVL (1535/1992))

Personal source of income

Fill in the revenue relating to personal sources of income as a lump sum in section 2.3 on the ‘Profit on personal source of income and taxable capital gains’ line. However, do not include any dividends and co-operative surplus relating to personal sources in the lump sum. They are instead reported on a separate line in section 2.3 – Dividends and co-operative surplus relating to personal income source. Report also the expenses, as a lump sum, in section 2.6 (Total expenses attributable to personal source of income).

Itemise the revenue and expenditure attributable to personal source of income on Form 7B (Information on business partnership's personal source of income) and the related dividends and surplus on Form 73B Business partnership's dividends and co-operative surplus received.

Agricultural source of income

Fill in your revenue from an agricultural source of income as a lump sum in section 2.4 (Total profit from agricultural source of income). In the same way, fill in your expenditure as a lump sum in section 2.7 (Total expenses attributable to agricultural source of income). Itemise the related revenue and expenditure on Form 7C (Information on business partnership's agricultural source of income).

2.1 Business income

Net sales

This line is for the net sales/turnover for the tax year. Net sales comprise the sales income from the partnership's primary operation minus any discounts granted, and minus VAT and any other taxes based on sales volumes.

Report any dividends and co-operative surplus included in net sales under Financial income, on line ‘Dividends and co-operative surplus’ in section 2.1 of the form.

Grants and subsidies received

This line is only used to report grants and subsidies relating to business activities (from the Ministry of Economic Affairs and Employment, Ministry of the Environment, Business Finland, etc.) that you have booked as income. This line is not for any grants received from the public sector for the purpose of buying fixed assets for the partnership; instead, you should book them indirectly as deductions from paid acquisition costs.

If you have been granted a VAT relief (for small businesses), its amount must be entered here.

Other business income

Other taxable business income, such as

- Capital gains on any fixed assets sold/transferred (if you made a profit)

- Received insurance indemnities, received damages

- Other types of taxable business income, not reported elsewhere in section 2.1

Financial income

Dividends and co-operative surplus

The total amount of dividends and co-operative surplus received as a result of business activities.

Provide more detailed information on Form 73B (Business partnership's dividends and co-operative surplus received). The Tax Administration automatically grants a deduction for the tax-exempt portion of dividends and co-operative surplus in the shareholder’s tax assessment. The amount is deducted against the profit-share received from the partnership. The Tax Administration calculates the deduction on the basis of the information provided on Form 73B.

If the partnership owns corporate stock and shares that are related to its business source of income, they are fully regarded as part of its business net worth.

Dividends

If the stock and shares related to the partnership’s business have earned dividends, it is regarded as dividend income relating to business activities.

The taxable portion of such dividends is determined on the basis of whether the dividends are distributed by a listed company or by a non-listed company.

- Distributions by listed companies are 85% taxable business income and 15% tax-exempt income.

- Dividends received from companies that are not listed on any stock exchange are 75% taxable business income and 25% tax-exempt income.

Read more about the taxation of dividends and about distribution of retained earnings (guidance in Finnish and Swedish, links to Finnish).

Surplus

If received by your partnership within its business source of income, the taxable part of surplus is determined on the basis of whether the cooperative that distributed the surplus is listed or not.

- The surplus paid by a listed cooperative is 85% taxable business income and 15% tax-exempt income. A cooperative is “listed” if its participations or securities are traded in the stock exchange. Currently, there are no listed (=publicly traded) cooperatives in Finland.

- The surplus funds distributed by a non-listed cooperative are 25% taxable business income and 75% tax-exempt income up to €5,000 in total. If the total surplus exceeds €5,000, 75% of the exceeding part is taxable business income and 25% is tax-exempt.

In other words, surplus from nonlisted co-operatives not exceeding €5,000 is taxed more lightly. This tax relief is personal for every individual taxpayer and applied only once for every tax year. If the surplus funds relate to several sources of income, the 5,000-euro relief is applied in the following order:

- Surplus on personal source of income

- Surplus on agricultural source of income

- Surplus on business source of income.

However, if the cooperative pays out a refund of surplus and enters it as a deductible expense in its accounting, it is fully taxable income for the beneficiary receiving it.

Read more about the taxation of surplus funds (in Finnish and Swedish, links to Finnish).

Interest income

The taxable interest income received as the result of the partnership’s business. For example, interest on various bank deposits.

Profit sharing among partnerships/consortia

This line is for income in the form of profits received by your partnership from other partnerships and consortia. Enter the amount as they are booked in accounting. Shares of profits received from a partnership/consortium are tax-exempt income for the recipient. Instead, the recipient is taxed on the basis of the partnership's share of income. Shares of income are calculated according to the income tax act (§ 16 and § 16a).

Taxable portion of income

Enter your partnership’s shares of income relating to domestic partnerships, as defined in § 16 of the income tax act. The shares of income you are aware of at the time of filing the tax return is what you must report. If you are not yet aware of the sizes of such shares, leave blank. The Tax Administration will take the shares of income into account on the basis of the information it obtains from domestic partnerships and consortia. Check your tax decision to ensure that all the shares of income have been included in the partnership's profit and loss for the tax year.

This section of the tax return form is also for reporting shares of income received from foreign partnerships and European economic interest groupings, as defined in § 16a of the act. If you are not aware of the sizes at the time of filing the return, please supplement your return as soon as the income information becomes available to you.

Income from capital redemption policies and certain insurance policies

Accounting column:

Enter your income derived from insurance policies with a capital-redemption clause, form life insurance policies containing a saved deposit, and from pension insurance contracts (§ 35.1 and § 35 b of the act on income tax).

Tax accounting column:

Enter the part of the above income that is subject to taxation. Tax must be paid on received amounts from a capital redemption policy, or from a life insurance policy, that are part of the company’s business source of income, and for which there is no interest income at a fixed rate (for more information, see § 35.1 of the act on income tax). Such a received amount of income may be an insurance indemnity or an amount paid to you in connection with a repurchase. Your taxable income would consist of the proportional part of the received amount that equals the yield from the savings deposit at the date of receipt. If this kind of income is received, it is treated as income for the ongoing tax year when received.

In addition, if you receive income in the form of revenue from a life insurance policy containing savings, from a capital redemption policy, or from a pension insurance contract as referred to in § 35 b of the act on income tax, it is treated as taxable income and its amount must be calculated as laid down in § 35 b of the act.

Other financial income

Other taxable financial income including foreign exchange gains.

Revaluation gains

Revaluation gains, as shown by accounting, on

- financial assets (§ 5a, subsection 1, act on business tax)

- current assets (§ 5a, subsection 2, act on business tax)

- fixed assets (§ 5a, subsection 4, act on business tax).

Taxable portion

Enter the taxable part of the gains. Generally, revaluation gains are subject to tax in their entirety. However, they are tax-exempt income in cases where the historical write-off (under § 42 of the act on business tax) had not been approved as a tax-deductible expense in the year when it was made.

Decreases of reserves

Decreases of reserves, as shown by accounting. Enter the reserves on Form 62 (Reserves, revaluations and depreciation of fixed assets) as well.

Taxable portion

The taxable portion of the decreases must be reported here.

The following are subject to tax:

- If an operating reserve has been cancelled and booked as income

(§ 46a, act on business tax) - If a replacement reserve or part of it has not been used

(§ 43, act on business tax) - If there has been a warranty reserve in a partnership/consortium operating a construction, shipbuilding or metal industry business, and part of the reserve exceeds the expenses arising from warranty repairs (§47, act on business tax)

Income-entry for private use, if expenses for private use have been deducted in the accounts

The private expenses of shareholders cannot be booked as tax-deductible expenses for a partnership. For example, if a shareholder has used the partnership's property, or products manufactured by the partnership, for private purposes, the expenses are not tax-deductible for the partnership. If expenses are included in the expenses deducted in the accounts, make an income-entry for private use here in order to reverse the booking.

Private use of car

Enter the expenses attributable to private use of a motor vehicle (car) if they are included in the expenses deducted in business accounting.

Private driving includes daily commuting between home and work – if a shareholder has used a car owned or controlled by the partnership for his or her commute.

Private use of goods

Enter the original price i.e. acquisition cost, without VAT, of any goods that have been taken into private use.

Other private use

This line is for other types of private use, such as using a telephone, real estate unit, leisure home or boat for private purposes.

If any of the shareholders in your partnership utilises a unit of real estate for private purposes, enter the amounts reflecting private use of the expenses of that real estate and of its depreciation.

Example: The partnership's shareholder has used a business-related real estate unit as a holiday home for their family. The total expenses attributable to the real estate unit are €10,000, of which the portion attributable to private use is €3,000. €3,000 for other private use is added to the partnership’s business income.

Total taxable business income

This line is for the sum total of the Tax accounting column 2.1 (Business income).

2.2 Tax-exempt income in the profit and loss account

This line is for reporting the total of other tax-exempt revenues, recorded in the profit and loss account.

Examples of this kind of income include movie production incentives (§ 6.1, subsection 1, paragraph 5, act on business tax) and foreign income subjected to the exemption method (itemise on Form 70, ‘Claim for relief for double taxation’).

2.3 Profit from personal source of income

Personal source of income comprises, for example, rental income earned from apartments rented to tenants outside of the partnership, interest collected from a shareholder for borrowing the partnership's cash, and capital gains and capital losses arising from any selling of assets relating to personal sources of income.

Profit on personal source of income and taxable capital gains

Enter the revenues and taxable capital gains relating to personal sources of income.

Provide an itemisation on Form 7B – Information on a business partnership’s personal source of income.

Add line 2.3 (Total income) on Form 7B to line 4.4 (Taxable capital gains for the tax year) on Form 7B. Enter the total on this line.

To arrive at capital gains subject to tax, subtract your capital losses for the tax year, and for previous years if they had not been tax-deductible previously, from the capital gains for the tax year.

Do not add the dividends and co-operative surplus on personal source of income to the profits reported on this line. You must enter them on the next line instead.

Dividends and co-operative surplus on personal source of income

The dividends and co-operative surplus that your partnership has received relating to its personal source of income.

Provide an itemisation on Form 73B (Business partnership's dividends and co-operative surplus received). Receipts of dividends and surplus relating to the partnership’s personal source of income are not taken into account when the Tax Administration calculates the income for the partnership's personal source of income. Instead, they are distributed directly to the shareholders as their taxable income, in proportion to the income shares of each shareholder.

For the shareholders, the receipts of dividends and surplus can be fully tax-exempt, partly tax-exempt, or fully taxable income.

Detailed guidance (in Finnish and Swedish, links to Finnish): on taxes on receipts of dividends and surplus funds

Please note that any dividends and surplus relating to the partnership’s income from business or agriculture is part of business income. The Tax Administration divides it into capital income and earned income according to different rules than the ones applied on the division of corresponding income when it relates to a personal source of income.

2.4 Total profit from agricultural source of income

This section is for reporting your partnership’s income relating to agricultural sources.

Itemise agricultural revenue, expenditure, and assets on Form 7C (Information on business partnership's agricultural source of income). Enter the same amount here that you report on Form 7C, section 2 – Total profit.

Report any receipts of dividends and co-operative surplus relating to the agricultural source on Form 7C, and add them to the total of profits on Form 7C, section 2. If your partnership receives dividends and co-operative surplus on its agricultural source of income, it is fully taxable as the partnership’s income from agricultural activities.

Additionally, provide an itemisation on Form 73B – Business partnership’s dividends and co-operative surplus received. When assessing the shareholders’ taxes for the year, the Tax Administration automatically grants a deduction for the tax-exempt portion of dividends and co-operative surplus. It is deducted from the income the shareholder receives from the partnership. The Tax Administration calculates the deduction on the basis of the information provided on Form 73B.

The entire value of shares and participations relating to the partnership’s agricultural source of income is part of the partnership's agricultural assets.

Detailed guidance (in Finnish and Swedish, links to Finnish): on taxes on receipts of dividends and surplus funds

2.5 Business expenses

Goods and services

Purchases, variation in stocks and inventory

Fill in the total cost of goods sold during the accounting period.

The way to arrive at the cost of goods sold is to adjust actual purchases with the change in inventory (initial inventory, incl. finished goods and work-in-progress + purchases during the accounting period – final inventory, incl. finished goods and work-in-progress).

External services

The expenses arising from external services. External services include services, work and subcontracts for which your supplier, service provider, etc. has been paid, and which relate to the primary operation.

Staff expenses

Wages, salaries and fringe benefits

Enter the wages, salaries and fringe benefits as they are in your partnership’s payroll accounts.

Pension and other contributions

Enter the partnership’s pension insurance contributions and other contributions.

These include insurance contributions and other similar payments relating to pension, sickness, disability and other similar benefits of employees and their family.

Depreciation and revaluation of fixed assets

Depreciation

This line is for depreciation according to plan and for the change in the difference between book depreciation and depreciation as planned, and booked as expenses in the P/L.

Fill in Form 62 (Reserves, revaluations and depreciation of fixed assets).

Deductible portion

Enter the deductible depreciation expense set out by the act on the taxation of business income (§ 24, § 30–34 and § 36–41 of the act). The deductible expense cannot exceed the maximum limit for depreciation laid down in the act.

If your partnership uses any assets that are leased, they are under a leasing contract so you do not own them, and no depreciation expenses can be booked against them.

This line is additionally for any depreciation from previous years that has so far not been deducted in the partnership’s tax assessment (i.e. remaining unused) that you want to deduct this year. Specify the unused depreciation on Form 12A (Specification of unused tax depreciation).

Reduction in the value of fixed assets

This line is for decreases in the value of fixed assets, as shown by accounting, not reported in the form of depreciation.

Deductible portion

The deductible portion of the decreases in value of fixed assets that are “permanent”, i.e. not subject to wear (§ 42, act on business tax). Only a decrease in the value of securities other than shares, or in the value of fixed assets other than land areas is deductible. This requires that the end-of-year value is substantially lower than the undepreciated acquisition cost.

Other business expenses

Entertainment expenses

This line is for the total of entertainment expenses as they are in your books.

Deductible portion 50%

For tax purposes, only 50% of them is deductible. Fill in the deductible portion – i.e. 50% – on the appropriate line.

Rents

This line is for your partnership’s rental expenses that relate to its business, including office space, premises, rented machinery, etc.

Other deductible business expenses

The types of business expenses that are tax-deductible and not included in any of the other expense items in section 2.5. Examples:

- travel expenses

- motor vehicle expenses

- leasing fees.

Non-deductible expenses

The items deducted in accounting that are not tax-deductible. Do not include the non-deductible expenses in any other expenses of the Calculation of taxable income.

Non-deductible expenses include the expenses that relate to foreign-source income subjected to the exemption method. Provide an itemisation on Form 70 (Claim for removal of double taxation).

Direct taxes

Direct taxes, as shown by accounting.

However, this line is not for taxes like real estate tax for a building that your partnership has for a business purpose. If you pay real estate tax, enter it under Other business expenses – Other deductible business expenses (in section 2.5).

Fines and other penalty fees

This line is for the partnership’s non-deductible expenses that consist of fines, financial sanctions and other penalty fees.

If a punitive tax increase has been imposed, the partnership cannot treat it as a deductible expense. Punitive increases may be imposed on a variety of taxes. However, it is not relevant what the tax in question is. Other penalty charges such as surtax, late penalties or penalty interest are also not deductible.

Other non-deductible expenses

Other expenses recorded in your partnership’s accounts that are not tax-deductible.

For example, the direct taxes of the partnership's shareholders if they have been recorded in the accounts.

Financial expenses

Interest

The total amount of interest expenses recorded in the accounts.

Interest expenses with restricted deductibility (§ 18 a, act on business tax)

Enter the interest expenses that you cannot deduct fully during the current tax year due to the restriction set out by § 18 a, act on the taxation of business income.

The provisions of § 18 a and § 18 b restrict the deductibility of interest expenses in some circumstances. If the partnership has paid any interest expenses falling into this category, fill in Form 81 (“List of net interest expenses” – Selvitys nettokorkomenoista) to itemise the sum total. In addition, you can use Form 81 to claim deductions for the interest expenses from previous years that have been subject to restriction.

Detailed guidance on the restricted deductibility of interest expenses (in Finnish and Swedish, link to Finnish)

Deductible portion

The deductible part of expenses that you deduct this year. To arrive at this amount, you must deduct the restricted amount above (in reference to § 18 a, act on business tax) and any other interest expenses that cannot be deducted for tax purposes (under § 18, subsection 2 of the act).

Section 5 (Calculation of non-deductible interest expenses) contains a calculation formula for calculating non-deductive interest based on § 18, subsection 2 of the act on business tax. According to § 18, subsection 2 of the act on business tax, interest is not deductible if the partnership's equity is negative due to withdrawals for private use if such withdrawals have been financed with loans. In these circumstances, part of the loans taken by the partnership has been used to finance private withdrawals. The related interest expenses is not deductible from your partnership’s business income. Please note that it is not possible that non-deductible interest would be higher than interest expenses in total.

Other financial expenses

This line is for other financing costs as they are in the partnership’s books, such as:

- Loan management fees

- Bank fees for providing a credit limit

- Bank guarantee commissions

- Credit insurance expenses

- Mortgage expenses

- Recovery and collection expenses

- Exchange rate losses

Deductible portion

The amount to fill in is the deductible part attributable to business activities. Only the financing expenses that relate to your partnership’s business can be deducted as business expenses.

Examples of non-deductible financial costs include the case discussed above where private withdrawals have been made by the partnership’s shareholder (and the money they withdraw has been borrowed).

Increases in reserves

Increases in voluntary reserves as recorded in the accounts.

Provide an itemisation on Form 62 (Reserves, revaluations and depreciation of fixed assets).

Deductible portion

The deductible part of the amount of increases in voluntary reserves.

Under certain conditions, the business partnership’s deductible reserves for tax purposes are:

- a reserve made in the balance sheet for replacement of fixed assets (§ 43, act on business tax)

- a reserve made in the balance sheet to safeguard the continuity of business operations (§ 46 a, act on business tax)

- a reserve made in the balance sheet in order to cover any warranty expenses in the future (§ 47, act on business tax)

Deductible expenses not recorded in the accounts

Any deductible expenses that are not included in the profit and loss account for the accounting period. An example is the deduction for training expenses (koulutusvähennys; utbildningsavdrag). If your partnership has paid expenses falling into this category, itemise the deduction on Form 79 (“Claim for training deduction in business operations” – Vaatimus elinkeinotoiminnan koulutusvähennyksestä).

Total deductible business expenses

Enter the total business expenses from the Tax accounting column, section 2.5, that are deductible.

2.6 Total expenses attributable to personal source of income

Itemise the expenses attributable to personal source of income on Form 7B (Information on business partnership's personal source of income).

Transfer the total expenses from Form 7B, line 3.4 (Total expenses) to this line.

Do not enter an allowable capital loss as expenses attributable to personal source of income. The Tax Administration deducts any allowable capital loss from capital gains in the course of the next five years.

Expenses attributable to a personal source of income must not be included in items that you report as expenses attributable to a business or an agricultural source in sections 2.5 and 2.7.

2.7 Total expenses attributable to agricultural source of income

Itemise the expenses attributable to agricultural source of income on Form 7C (Information on business partnership's agricultural source of income).

Transfer the total expenses from Form 7C, section 3 (Total expenses) to this line.

Expenses attributable to an agricultural source of income must not be included in the items that you report as expenses attributable to a business or a personal source in sections 2.5 and 2.6.

Profit or loss for the tax year

Business profit

Enter the result if it is positive, relating to the business source of income:

Subtract total deductible business expenses (i.e. the sum of section 2.5) from total taxable business income (sum of section 2.1). If the result is positive, enter it here.

If your partnership has any allowable losses from previous tax years, the Tax Administration grants deductions for them automatically, so do not enter them in the tax return.

Business loss

This line is for filling in the amount of the loss if the result is negative.

Subtract total deductible business expenses (i.e. the sum of section 2.5) from total taxable business income (sum of section 2.1). If the result is negative, enter it on this line. Do not add a prefix (-).

If your partnership has any allowable losses from previous tax years, the Tax Administration grants deductions for them automatically, so do not enter them in the tax return.

Result for personal source of income

If the result relating to a personal source of income is positive, fill it in:

Subtract deductible expenses relating to a personal source of income (i.e. the amount in section 2.6) from the revenues relating to a personal source of income (i.e. from Profit on personal source of income and taxable capital gains, section 2.3 first line). If the result is positive, enter it here.

Any receipts of dividends and co-operative surplus that relates to your partnership’s personal source of income (i.e. the amount in section 2.3 on the appropriate line “Dividends and co-operative surplus relating to personal income source") are not taken into account. The Tax Administration distributes the dividends and surplus funds to be taxed as shareholder income, in proportion to their shares of income.

Loss for the personal source of income

If the result relating to a personal source of income is negative, fill it in:

Subtract deductible expenses relating to a personal source of income (i.e. the amount in section 2.6) from the revenues relating to a personal source of income (i.e. from Profit on personal source of income and taxable capital gains, section 2.3 first line). If the result is negative, enter it on this line. Enter the loss without a prefix (-).

Profit for the agricultural source of income

This line is for filling in the profit relating to an agricultural source:

Subtract the expenses relating to an agricultural source of income (i.e. the amount in section 2.7) from the revenues relating to the agricultural source (i.e. from Total profit from agricultural source of income, section 2.4). If the result is positive, enter it here.

Loss for the agricultural source of income

This line is for filling in the loss relating to an agricultural source:

Subtract the expenses relating to an agricultural source of income (i.e. the amount in section 2.7) from the revenues relating to the agricultural source (i.e. from Total profit from agricultural source of income, section 2.4). If the result is negative, enter it on this line. Do not enter a prefix (-).

3. Information on partners, and itemisation of rents, interests, selling prices and other payments to their relatives

This section is for giving details on any changes to the income shares attributed to different partners, and on any payments made to partners’ relatives, and other similar details.

This section is not for reporting

- Changes in shareholders’ identities

- Changes to a limited partner’s investment and to the interest rate of a limited partner

- Shares of profits

- Cash withdrawals for private use, or investments received by the partnership

If any changes to shareholding or to the investment and interest rate of a limited partner have taken place, you must report them only on a Notification on amendments and on termination of business, Form Y5, on the ytj.fi (BIS) website. The changes you report will become effective after the Finnish Patent and Registration Office (PRH) has entered them in the Trade Register.

This section is not for filling in the amounts of any contributions that the payer must file an annual information return for, or submit a report to the Incomes Register for. This means that you must not fill in paid-out wages and salaries, fringe benefits and interest expenses. There is enough space for reporting the information on four partners. If your partnership has more than four partners, fill in Form 72A (Partnership's partners, Supplement to Form 6A).

Name and personal identity code or Business ID

The name and personal identity code of every partner. If shares are held by an entity, not a natural person, fill in its Business ID.

In addition, enter the name and personal identity code of any relative of a shareholder or partner to whom the partnership has paid rent, interest, selling prices, or other payments during the tax year.

The partner’s status

Check the box according to whether the partner’s status is general (vastuunalainen; ansvarig) or limited partner (hiljainen; tyst).

Leave the boxes unchecked if the payment has been made to a relative, not to a partner (section ‘Paid in the calendar year’).

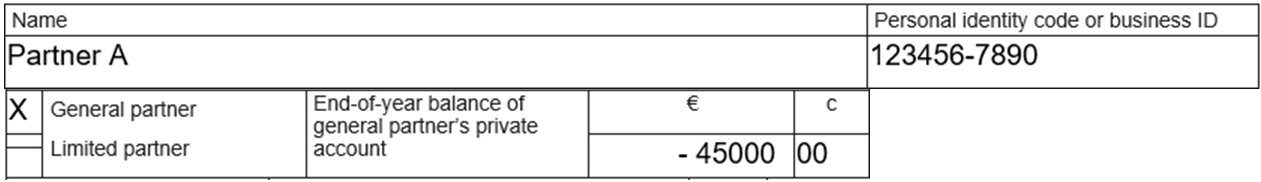

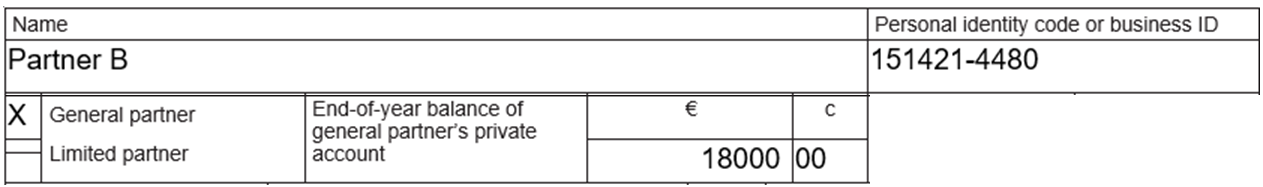

End-of-year balance of general partner’s private account

Report on this line the balance of a partner's private account at the end of the accounting period. Do not include in this amount the partner’s share of the profit or loss for the accounting period ended.

Example of balance of private account:

Starting balance of equity (January 1)

Investment by a limited partner €2,000

Equity: Partner A €-50,000

Equity: Partner B €30,000

Private account: Partner A €5,000

Private account: Partner B €-12,000

Profit for the accounting period €60,000

Ending balance of equity (Dec 31) €35,000

Partner A:

Equity, 1 Jan. (€-50,000) + private investments during the accounting period (€5,000) = €-45,000

Partner B:

Equity, 1 Jan. (€30,000) + private withdrawals during the accounting period (€-12,000) = €18,000

Partner’s share of income (%)

Indicate how many percent of the partnership's income for the tax year is the partner’s share. When the percentage shares of all the partnership's shareholders are added together, the sum must always be 100%.

Report the share of income and the partner’s details also if a silent partner holds a share in the partnership’s income for the tax year. Do not include any interest paid to the limited partner here.

Detailed guidance on how the partners’ income is divided for tax purposes (in Finnish and Swedish)

Shareholder has worked for the company during the accounting period

Check the box as appropriate. The Tax Administration sends this information on to the Finnish Centre for Pensions, which needs it to supervise compliance with the self-employed persons’ pensions act.

Paid in the calendar year: rents, interest and selling prices, as well as other payments.

Fill in the amounts paid to partners and their relatives

- as paid rent

- as interest expenses

- as prices for any purchases of assets and property, and

- other payments not reported on an annual information return or on a report submitted to the Incomes Register.

These payments must be reported for the calendar year, regardless of the partnership's accounting period.

For shareholders and partners who have not received anything, leave the fields blank.

Please note that the shareholders themselves also have to include their income received from the partnership in their pre-completed tax returns.

4. Itemisation of apartments and real estate included in business assets and in residential use by a partner or their family

Report the following information only if the partner using the apartment is a natural person or a domestic estate of a deceased person:

- Personal identity code, in full, of the shareholder/partner who used the apartment

- Name of real estate unit, real estate company or housing company

- Period of residential use means the length of time, during the partnership’s accounting period, when the shareholder, partner, or family members have lived in the apartment.

- The value of the apartment or real estate unit used in the previous year's calculation of net worth.

When the partner's share of capital income is calculated in circumstances where the partner has lived in an apartment or real estate unit owned by the partnership, the value of the apartment/real estate must be subtracted from the partner's share of the partnership's net worth.

5. Calculation of non-deductible interest expenses

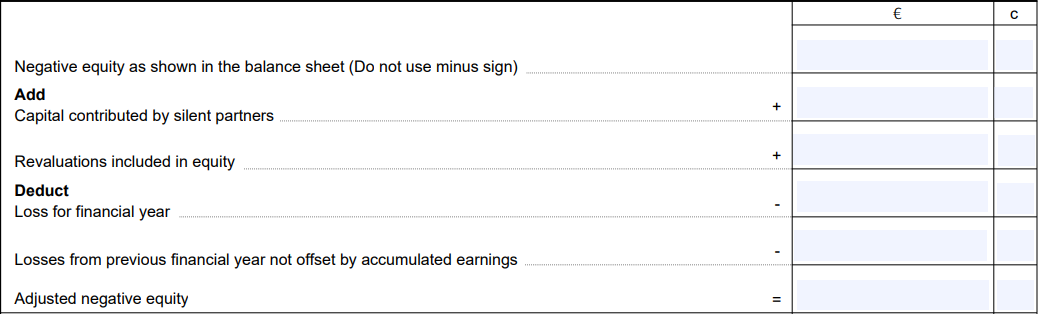

If the partnership's equity is negative due to cash withdrawals for private use and taking out a loan was needed to cover the private withdrawals, as a result, a portion of the partnership’s loans is allocated to financing the private withdrawals rather than to business activities. Interest on such a loan is not deductible as a business expense.

Calculate the amount of non-deductible interest with the following formula:

Add the investments made by limited partners and the increases in value included in the partnership's equity to the negative equity on the balance sheet for the tax year. Then, subtract the loss for the accounting period, as well as the losses for the previous accounting periods, which cannot be covered by retained earnings. See the calculation example below for guidance.

Enter the adjusted negative shareholders' equity in the appropriate box in the “Non-deductible interest on income from the business source” section. Multiply the adjusted negative equity by the basic interest rate on the date of financial statements plus one percentage point. From 1 January 2020 to 30 June 2020, the basic interest rate was -0.25%, and from 1 July 2020 to 31 December 2020, -0,25%.

The result is the amount of interest that cannot be deducted as an expense from business income. Enter it in this section. When filling in section 2.5, deduct the above amount that cannot be deducted from the partnership interest expenses (see “Deductible portion” in the guidance for section 2.5 “Financial expenses – Interest”). The amount of non-deductible interest cannot exceed the interest expenses in total.

Transfer the adjusted negative equity to the ‘Calculation of net worth’ section 6.2 (Business liabilities) line ‘Adjusted negative equity’. However, the figure to be entered on this line cannot be greater than the total of business liabilities. Add the amount of the adjusted negative equity also to section 6.4 (Personal source of income) line ‘Total liabilities’.

The provisions on the deductibility of interest expenses, when they relate to a personal source of income, are laid down in § 58 of the act on income tax (Tuloverolaki 1535/1992). The financing of a partner's private household cannot be deemed as expenses attributable to the partnership's operation that aims for the production of income, so no deduction can be accepted within the personal source of income.

6. Calculation of net worth

The ‘Calculation of net worth’ section is for reporting the business partnership's assets and liabilities. The information is reported by source of income: business source of income, personal source of income and agricultural source of income have their own sections in the tax return. For each asset and liability item in your reporting, there must only be one related source of income.

The calculation of net worth also covers the business and the agricultural sources of income. The principle of calculation is to subtract the source of income’s liabilities from the same source's assets. The result – the net values specific for business and agricultural sources – is used when assessing the income taxes for each individual shareholder, in order to determine how much of the income from business activities and taxable income from agricultural activities are earned income and capital income.

There is no need to calculate the difference between the assets and liabilities of the personal source of income because for the individual shareholder, any income from a personal source is taxed in full as capital income.

6.1 Business assets

Enter the residual, undepreciated acquisition costs of your partnership’s assets. Exceptions to this rule are specified below.

Fixed assets

Fixed assets include land, securities, buildings, machinery, equipment and other tangible assets intended for permanent use in the business activities, patents and other transferable immaterial rights, as well as gravel and sand pits, mines, quarries, peat bogs, and other comparable assets.

Fill in Form 62 to itemise the depreciation expenses and the differences between book/planned depreciation (Form 62 – Reserves, revaluations and depreciation of fixed assets).

Fixed assets subject to decrease in value as they wear include:

- buildings,

- machinery and equipment,

- other tangible assets,

- patents, and

- other transferable immaterial property.

Permanent fixed assets, not subject to wear, include

- land,

- shares, securities, and

- other comparable assets.

Intangible assets

Enter the total value of the partnership’s intangible assets.

Intangible assets include:

- patents,

- copyrights,

- trademarks,

- licenses in force,

- concession and permit rights, and

- the license fees for computer software.

Long-term assets

This line is for the types of long-term assets that have a value from the perspective of your partnership’s business.

Assets are long-term assets if they generate income or retain income for three or more years. Only assets that are capitalised on the balance sheet, as required by the act on business tax, are long-term assets, in other words, their purchase price is not booked as an expense. These include the improvement costs for premises that your partnership has rented, and the price paid for goodwill (§ 24, act on business tax).

However, the expenses that arise from the setting up of a business and from organising it, and any research and product development expenses (§25, act on business tax) are not necessarily capitalised and are not taken into account in the calculation of net worth.

Real estate

A land or ground area and the buildings located on it are part of real estate property. According to § 6 of the act on income tax, real estate also refers to a building, structure or other facility located on another owner's land, which can be handed over to a third party without consulting the landowner so that the right of possession for the land also is transferred.

Itemise the real estate, buildings and structures included in fixed assets on Form 18B (Fixed assets – Real estate). Enter the value of each real estate unit using the undepreciated acquisition cost or the comparison value for 2020, whichever is higher. Make the comparison and select the value individually for each real estate unit. Transfer the total value of real estate from Form 18B to this line.

Machinery and equipment

Enter the total undepreciated (for tax purposes) acquisition cost.

Machinery and equipment include:

- Machines and various pieces of equipment

- Trucks, lorries and vans

- Passenger cars

- Commercial vehicles (such as tow trucks)

- Furniture

- Any machinery and equipment you offer for rent

If you have equipment in your partnership held under a leasing contract, it is not regarded as being part of fixed assets for tax purposes. Do not enter its value here.

Fixed asset securities

Itemise the securities included in fixed assets and financial assets on Form 8B (Securities and book-entries relating to business source of income – Business partnership and business operator/self-employed person). The purpose is to determine which is the greater of the two: the total undepreciated acquisition cost of securities included in fixed assets and financial assets, or the aggregate comparison value.

Compare the amounts entered on the final line of Form 8B (Fixed assets and financial assets in total). If the undepreciated acquisition cost is greater, transfer the total amount of undepreciated acquisition cost from line ‘Total fixed assets’ of Form 8B to this line (‘Fixed-asset securities’) of the tax return. If the comparison value is greater, enter it on this line.

The total value of the securities accounted for as financial assets by your partnership must be entered under “Financial-asset securities”, further down in section 6.1.

Other fixed assets

The value of the assets regarded as being other fixed assets.

Other fixed assets may include:

- Gravel and sand pits

- Ore and mineral deposits

- Quarries

- Peat bogs

- Railway tracks

- Dams

- Bridges

- Basins

If your partnership has animals in constant use in business activities, the value of such animals should be included in the amount you enter on this line.

Total fixed assets

Add together and report here the aggregate value of fixed assets.

Current assets

Current assets are merchandise: items and products that are meant to be sold (or otherwise given) as part of the business operation. They can be sold, transferred, given “as is” or after further refining, enhancement or development. Examples of current assets include:

- Merchandise in a commercial business operation

- Raw materials

- Semi-finished products

- Other commodities

Current assets also include fuels, lubricants, and other consumables that your partnership buys for its business use.

Report the value of current assets as the acquisition cost from which any deduction (under § 28, subsection 1, act on business tax) reflecting an impairment has been made.

Goods

Goods acquired from external suppliers and intended to be sold as such in the course of business.

If your partnership is engaged in a commercial wholesale or retail operation, the packaging materials acquired for the purpose of selling the goods can also be added to the value of the goods.

Other current assets

This line is for other commodities that must be included in current assets. They include materials, supplies, and self-manufactured products.

Total current assets

Add together and fill in the total value of goods and other current assets.

Financial assets

Financial assets include

- Cash

- The balances of bank accounts, and of accounts receivable (to be received from customers, debtors etc.)

- Receivables converted into bills-of-exchange

- Other financial assets

The value of a receivable item included in financial assets is its nominal value. In contrast, the value of an item among other financial assets is the price paid for it. First, subtract any allowance from impairment (decrease in value) from both the above values as provided in § 17 of the act on business tax. If the receivables are denominated in a foreign currency, their value is calculated with the same method that is used in accounting: generally, at the exchange rate on the balance sheet date (Accounting Act, chapter 5, § 3).

Accounts receivable

Fill in the total of long-term and short-term accounts receivable, instalment accounts receivable, and other comparable amounts you expect to receive from customers.

Loans receivable

Fill in the balances of loans you have given.

Note: Loans receivable from shareholders are reported in section 6.4 (Personal source of income) on line ‘Receivables from shareholders’.

Prepayments and accrued income

Enter any prepayments and accrued income from your partnership’s balance sheet.

Cash

The partnership's cash on hand. This line is not for reporting bank deposits.

Cash equivalents

Cash deposited in banks, including bank balances, investment funds and foreign currencies.

Financial asset securities

Itemise the securities included in fixed assets and financial assets on Form 8B (Securities and book-entries relating to business source of income – Business partnership and business operator/self-employed person). The purpose is to determine which is the greater of the two: the total undepreciated acquisition cost of securities included in fixed assets and financial assets, or the aggregate comparison value.

Compare the amounts entered on the final line of Form 8B (Fixed assets and financial assets in total). If the undepreciated acquisition cost is greater, enter it here (‘Fixed-asset securities’) – the same amount as ‘Total financial assets’ of Form 8B. Correspondingly, enter the comparison value if is greater.

The total value of the securities accounted for as fixed assets by your partnership must be entered under “Fixed-asset securities”, further down in section 6.1.

Other financial assets

Items included in financial assets that have not been reported in the form's other sections.

Total financial assets

Calculate the total financial assets and enter the sum total on this line.

Total business assets

This line if for the total aggregate amount of fixed assets, current assets and financial assets relating to business activities.

6.2 Business liabilities

Long-term loans from financial institutions

Long-term loans from finance companies, long-term factoring debt, and other long-term loans from financial institutions.

A loan or part it is considered “long-term” if it is due for payment after a longer period than one year or 12 months.

Short-term loans from financial institutions

This line is for short-term loans from finance companies, short-term factoring debt and other short-term borrowing from financial institutions.

“Short term” means that you must pay back the loan within a year or less.

Accounts payable

Long-term and short-term accounts payable, instalments to pay, debts relating to advance invoicing, and other accounts payable.

Amounts owed to shareholders

If your partnership's owes money to its shareholders, enter the total balance on this line.

Prepayments and accrued

This line is for accrued expenses and deferred income.

Long-term and short-term accrued expenses and deferred income include:

- Rental income that you have received in advance

- Payroll expenses that relate to the current the accounting period but your partnership has not paid them to its employees yet, such as vacation pay, or various other wage items.

Other long-term liabilities

Long-term amounts owed that have not been reported in the form's other sections.

Debts or unpaid parts of debts are “long-term” if they are due for payment after a longer period than one year or 12 months.

Other short-term liabilities

Short-term amounts owed that have not been reported in the form's other sections.

“Short term” means that you must pay the amount back in one year or less.

Subtract

Adjusted negative equity

This line is for the adjusted negative equity that is subtracted from liabilities.

However, such an adjusted negative equity cannot be higher than the total of liabilities. Enter the adjusted equity amount also on the “Total liabilities” line in section 6.4 (Personal source of income).

Total business liabilities

This line is for the final total of your partnership’s business liabilities. Subtract the amount of adjusted negative equity reported on the previous line from the sum total of liabilities.

6.3 Net worth of business

How the income of the partnership is divided into capital income and earned income

The partnership’s net worth must be calculated in order to facilitate the shareholders’ tax assessment. The Tax Administration uses net worth for dividing the shareholders’ income into a capital-income portion and an earned-income portion. The portion of capital income, in the tax assessment of an individual or an estate of a deceased individual, is equivalent to a 20-percent annual return on the shareholder's investment in the partnership – i.e. on the part of the previous year's net worth attributable to every shareholder or partner. For tax year 2020, the calculation is based on their share of the partnership's net worth of business in 2019.

A non-standard accounting period (longer or shorter than 12 months) affects the size of the capital-income portion. An accounting period of more than 12 months increases the capital-income portion, while an accounting period of less than 12 months decreases it.

The Tax Administration adds 30% of the paid-out wages subject to withholding that the partnership has paid over the 12 months preceding the end of the tax year to previous year’s net worth (before capital-income portions are calculated). (Paid wages must be entered in section 10.) In addition, an adjustment is made to a shareholder’s share of the net worth if the partnership's assets include an apartment where the shareholder or his/her family member have lived in. The value of such an apartment is deducted from the shareholder’s share of the net worth. The same procedure is applied if the partnership’s shareholder has any interest-bearing debt that was used to buy shares in the partnership.

If the distributable business income of the partnership contains any capital gains on real estate or securities (fixed assets), the shareholder’s share of such capital gains is invariably treated as capital income. (These capital gains must be entered in section 9.) Net worth does not affect the taxes on those gains.

The income tax rate for capital income is 30% for the 2020 tax year. However, for the portion of capital income that exceeds €30,000, the income tax rate is 34%. Earned income is taxable on the basis of a progressive scale, i.e. when taxable income increases, the tax rate increases.

Positive net worth of the business

Subtract total business liabilities (line ‘Total business liabilities’, section 6.2) from total business assets (end of section 6.1). If the difference between assets and liabilities is positive, enter it here.

Negative net worth of the business

Subtract from the total amount of business assets (last line in section 6.1: Total business assets) the total amount of business liabilities (last line in section 6.2: Total business liabilities). If the difference between assets and liabilities is negative, report it here.

6.4 Personal source of income

Assets

Receivables from shareholders

The partnership's receivables from shareholders.

Other receivables

Other receivables relating to the partnership’s personal source of income.

Other assets

Assets (relating to the personal source) other than receivables, such as the value of an apartment in a housing company that is rented to an outside tenant.

Total assets

Calculate the total assets and enter the sum total on this line.

Liabilities total

This line is for the total of liabilities attributable to the personal source of income.

If your partnership has an adjusted negative equity (accounted for in section 5 above), enter the amount on this line.

6.5 Agricultural source of income

Total assets

Itemise the assets of the agricultural source of income on Form 7C (Information on business partnership's agricultural source of income). Transfer the amount from Form 7C, section 4 (Itemisation of assets and liabilities of agricultural income source), line ‘Total assets’.

Liabilities total

Itemise the liabilities of the agricultural source of income on Form 7C (Information on business partnership's agricultural source of income). Transfer the amount from on Form 7C, section 4 (Itemisation of assets and liabilities of agricultural income source), line ‘Total liabilities’.

Positive net worth of the agricultural operation

Subtract the liabilities of the agricultural income source (line ‘Total liabilities’) from total assets. If the difference between assets and liabilities is positive, enter it here.

The Tax Administration will calculate which portion of the partnership's income from an agricultural source, received by each shareholder, is taxable income for the shareholder as capital income; and which portion is earned income. This division is based on the net worth of the agricultural source in the same manner as business income is divided on the basis of the net worth of business (for more information, see section 6.3 “Net worth of business").

Negative net worth of the agricultural operation

Subtract the liabilities of the agricultural income source (line ‘Total liabilities’) from total assets. If the difference is negative, report it on this line.

7. Development of partnership equity

Provide a full account of the partnership’s book equity. If the amount of equity is negative, enter a minus sign (-).

Investments by silent partners, starting balance

Enter the total amount of money that the limited partners have invested, either in money or in kind. Enter the balance at the beginning of the accounting period.

Change in investments by limited partners

Account for the changes to the investments by limited partners that have occurred during the accounting period. If the investments have diminished, enter a minus sign (-).

Other equity, starting balance

Fill in the amount of the partnership's other equity at the beginning of the accounting period. This generally includes the profit or loss for previous accounting periods and the difference between the capital investments and cash withdrawals for private use by general partners. If the amount of other equity was negative, enter a minus sign (-).

Distribution of profits to limited partners

This line is for the share of profits distributed to a limited partner. This share is based on the amount of that the limited partner invested.

The limited partner's percentage share of income, if any, excluding the profits paid to the partner, is reported in section 3 (Information on partners and rents, interest and selling prices, as well as other payments to partners and their relatives). The share of income is not added to the amount reported on this line.

General partner’s cash investments/withdrawals for private use

Report on this line the difference between cash withdrawals for private use and cash investment, if the general partners have made these transactions during the accounting period. If there have been more withdrawals than investments, enter a minus sign (-).

Profit/loss for the accounting period (as shown by accounting)

Enter the profit or the loss for the accounting period, as shown by the bottom line of the P/L account. If it shows a loss, enter a minus sign (-).

Total equity

Enter the positive or negative amount of equity at end of accounting period. If the equity is negative, enter a minus sign (-).

8. Audit

Check one of the boxes to indicate whether or not an audit has been carried out. Also indicate whether the auditor’s report contains any disapproving statements, remarks or additional details as defined in chapter 3, § 5 of the Auditing Act.

Audit complete

If an audit has been completed before the tax return is filed, check the ‘Yes’ box.

If no audit has not been carried out by the time you submit the return, check the ‘No’ box.

If certain conditions are fulfilled, small partnerships do not have to appoint an auditor. If the partnership has opted for this, check the box ‘No, under chapter 2, § 2 of the Auditing Act, no auditor has been appointed’.

The auditor’s report includes disapproving statements, remarks or additional details as defined in chapter 3, § 5 of the act on auditing (1141/2015).

Check the box for ‘Yes’, as necessary, and attach a copy of the auditor’s report to the return. Deliver a photocopy of the auditor’s report to the Tax Administration also in the event that the audit has been carried out after you submitted the return.

9. Capital gains derived from securities and real estate included in the partnership’s fixed assets

Report the capital gains that you have received from securities and real estate included in fixed assets. “Capital gains” means the difference between the selling price and the tax-undepreciated acquisition cost.

If the partnership has used the capital gains to form a replacement reserve, do not enter the amount transferred to the replacement reserve.

10 Wages paid

Amount of wages to be taken into account when calculating the share of capital income

Report the wages subject to withholding, related to the business operation of the partnership, paid out in the 12 months preceding the end of the tax year.

In the Tax Administration's calculation of the shareholder's capital-income portion, 30% of the amount of wages reported here is added to the net worth of the business.

Example: The partnership’s tax year 2020 is the accounting period 1 January – 30 June 2020, which is shorter than usual, due to a change made to the accounting period (the next accounting period is 1 July 2020 – 30 June 2021). The amount of wages subject to withholding tax paid during 1 July 2019 – 30 June 2020 must be reported under section 10 ‘Wages paid’. The Tax Administration adds 30% of this amount to the partnership's net worth of business in 2019 when the business income is divided into a capital-income portion and an earned-income portion to the shareholders.

Date, signature and telephone number

If you submit your tax return on paper, remember to sign the form.

You may also provide your telephone number here.