Information reporting requirement in the construction industry

Key terms:

- Date of issue

- 7/1/2013

- Validity

- - 6/29/2016

This is an unofficial translation. The official guidance is drafted in Finnish and Swedish languages.

In addition to construction activities at a site and in addition to employee information, reporting also applies to individuals (natural persons) in the role of customers or constructors, if a construction permit is required for the project. This guideline only addresses the individuals' and households' reporting requirements in cases where construction is associated with their enterprising activities, and in cases where a house manufacturer is present at a site.

1 General information about the new procedure

1.1 A new information reporting requirement

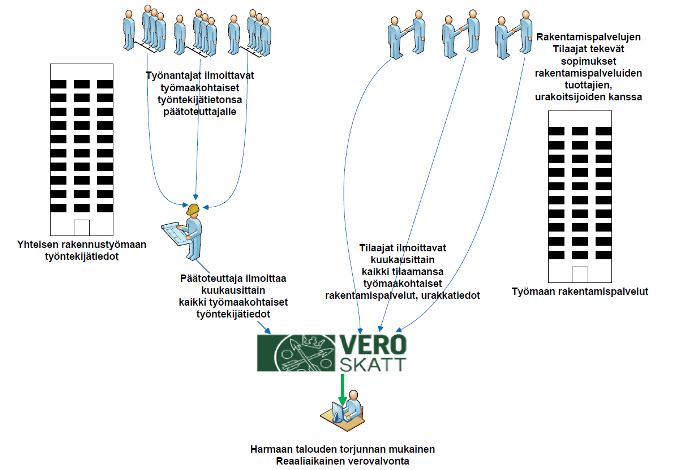

The information-reporting requirement and the information to be provided concern activities related to construction, repairs and maintenance at a construction site, and companies and employees engaging in such activities. The concepts of construction and a construction site are also linked with the obligation to use construction sector Tax Numbers.

As contract information, you must report details of the contract (including contracting parties, total amount, and duration) and transaction data related to the contract (including the amount invoiced during the reporting period). Every month, each customer must give the names – directly to the Tax Administration – of all companies or people from whom they have ordered construction services.

You must provide details on all people working at a shared construction site, regardless of the type of their employment relationship or employer – this is known as employee information. This information must also be provided on self-employed persons. The project supervisor at each site must first gather the details, and then report them to us in a centralised manner. This means that each company must give details on their employees to the project supervisor, who sends them on to the Tax Administration on a monthly basis.

The grounds for providing contract information and employee information are different. Contract information must be provided on construction services referred to in the VAT Act (arvonlisäverolaki 1501/1993), or on services relating to setup or dismantling of scaffolding, or on who lease employees to the customer for the said purposes. Employee information must be provided whenever they work at a site referred to in Government Decree on the Safety of Construction Work (205/2009) as a "shared site". A shared site means a workplace where work within the meaning of this Decree is done, and where more than one employer, or more than one self-employed worker, operate simultaneously or successively.

Similarly, the thresholds for providing contract information and employee information are different. This means that the authorities require contract and employee information to be provided on grounds that are independent, and the grounds for each type of reporting do not necessarily have anything to do with one another.

Individuals must report information on companies performing construction work and payments made to them, as well as on any wages and other considerations they pay to the workers. This report must be submitted to the Tax Administration prior to the final inspection to be carried out before the project is commissioned. At the final inspection, the individual must present the building supervision authority a certificate issued by the Tax Administration of having met the reporting requirement.

This guidance mainly addresses the reporting requirement applicable to organisations and, as for households; it addresses it when the construction project is associated with a natural person's enterprising activities. Its fourth chapter contains an additional discussion of the individuals' reporting requirement in cases where a house-manufacturer (construction company) is present at the site.

Figure 1: Parties required to report information

1.2 Definitions of certain concepts in the construction sector

Definitions of construction related concepts are contained in the General Conditions for Building Contracts (YSE 1998). Provisions on construction are also found in legislation. See below for definitions of the most common concepts related to construction that are relevant to the issues addressed in this guideline.

A construction contract is a contract in which a party (a contractor) undertakes, against a consideration (contract price), to construct a building, a built structure or other construction project, such as a road, a water pipeline etc., for the other party (constructor, customer).

The constructor is the party on whose account the main contractor performs construction work and who ultimately receives the results of the work. Auxiliary contracts, or contracts ordered by the constructor that are not part of the main contract, may also be undertaken at a construction site. The constructor only has a contractual relationship with the main contractor and any auxiliary contractors, not with a subcontractor.

The main contractor is the one who has made an agreement with the constructor, the one to whom the commercial documentation refers to as the main contractor, and the one who is designated as having responsibility for site management – to the extent discussed in the text of the agreement. During a project, there may be a transfer of these responsibilities and a transfer of the main contractor's role from the original main contractor to another contractor.

Under the Decree on the Safety of Construction Work (205/2009), the project supervisor means the main contractor appointed by the customer, or an employer using the main authority, or where there is no such employer, the customer.

A subcontractor is a contractor performing a separate subcontract agreed upon with the main contractor and a contractor. A subcontract is an independent entity which the main contractor has separated from the main contract and which is performed by a subcontractor selected by the main contractor. In this case, the customer is the main contractor rather than the constructor.

The main contractor and a subcontractor are customers in the subcontracting chain when they purchase construction work from another contractor.

Based on the extent of the contractual obligations, contracts are categorised into various contract forms (including a main contract, a partial contract and a contract that includes design). Of the various forms of main contract, the most common ones are turnkey contracts and divided contracts. In a turnkey contract, the customer concludes a contract with a single contractor. This contractor may enter into subcontracts, but the parties performing subcontracting work do not have a contractual relationship with the original customer. In a divided contract, the customer concludes separate contracts on work divided into separate parts. As a rule, there is no contractual relationship between the various contractors in a divided contract. An auxiliary contract may, however, be subordinate to a main contract. The customer may divide a contract into partial contracts, in which case separate agreements are concluded on different parts of the work with the customer.

In Government Decree (205/2009), a shared site means a workplace where work referred to in the Decree's scope of application is carried out and where more than one employer, or more than one self-employed worker, operate simultaneously or successively. Regional State Administrative Agencies (their units of occupational safety) give guidance and supervision in respect of shared sites. For more information on what is treated as a shared site, see 3.2.1. below or see the memorandum of the Regional Administrative Agency (in Finnish).

A construction service means building and repair work on immovable property, referred to in Section 31.3 paragraph 1 of the VAT Act (1501/1993), as well as deliveries of any goods installed in connection with the work. The information-reporting requirement referred to in this guideline also applies to the erecting and dismantling of scaffolding and the leasing of employees for construction services or erecting/dismantling scaffolding, even if these are not construction services referred to in VAT Act.

2 Customer's obligation to provide information on a contract (contract information)

2.1 Who is required to report information?

Under the new Section 15 c of Act on Assessment Procedure (verotusmenettelylaki 1558/1995), the requirement to report contract information applies to the parties who order a construction service. The customer may be the constructor, the main contractor, an auxiliary contractor or a subcontractor. The customer of construction work is the contracting partner of the main contractor, other contractor or subcontractor who orders a construction project from this contractor. The reporting requirement always applies to the constructor as a customer. The constructor's duty to provide information concerns projects on which they have concluded a contract.

It is important to be aware of the fact that in a subcontracting chain, each customer, for their part, has the duty to file reports on their subcontractors. For this reason, every subcontractor (not only the main contractor) must report the information on the contracts they have signed and on their use of leased employees.

In most cases, the customer is a corporate entity, a company or other legal person under private law. However, the customer may also be the State of Finland, a municipality, a joint municipal authority, the Province of Åland Islands or a municipality or a joint municipal authority in this province, a parish, a federation of parishes, other religious organisation, other legal person under public law, an association, a joint interest (including a private road maintenance association) and a foundation. A similar reporting requirement applies to a housing company as a customer of construction work. In addition, a company operating abroad or its Finnish subsidiary, when this foreign organisation orders construction work to be carried out in Finland, may be a customer to whom the reporting requirement applies.

Individuals (natural persons) are treated as customers when the construction project is associated with their enterprising activities. In these situations, the requirement to file monthly reports applies.

Under a specific agreement to this effect, the customer may delegate the fulfilment of the reporting requirement to another party, for example, a constructor may transfer it to a consulting firm. However, the ultimate responsibility for meeting the reporting requirement rests with the customers themselves. The reporting requirement may also apply to a building management company that represents a housing company, if there is a specific agreement to this effect. In that case, too, the management of the housing company is ultimately responsible for meeting the reporting requirement.

Section 15 c, Act on Assessment Procedure contains the following provisions on the reporting requirements applicable to the customers of construction services:

Section 15 c

The duty of the customer of construction services to provide information on the contract

The customer shall, on a monthly basis, submit to the Tax Administration for the purposes of tax control the required identification contact information of companies who are performing construction services referred to in Section 31.3, paragraph 1 of VAT Act (1501/1993) for the customer or erecting or dismantling scaffolding, or who lease employees to the customer for the said purposes. In addition, the customer shall provide information on the type and duration of the assignment, the location of the site and the payments made by the customer to these companies.

More detailed orders on the information to be reported, the time and method of reporting the information and the right to refrain from reporting the information referred to in this section in situations that have minor financial or tax control relevance will be issued by the Tax Administration."

2.2 For what type of work must information be reported?

2.2.1 Construction services

Under Section 15 c of Act on Assessment Procedure, the requirement to report contract information applies to construction services referred to in VAT Act. Under Section 31.3, paragraph 1 of VAT Act, such services are the building and repair work on immovable property, as well as the deliveries of goods, which are installed in connection with the work. The reporting requirement also applies to the erecting and dismantling of scaffolding and the leasing of employees for construction services or for erecting/dismantling scaffolding, even if these are not construction services referred to in the Act.

Construction can be divided into housing construction, civil engineering and specialist construction. The object of a construction service may be a building, the ground or a water area located on a property. Construction includes new buildings, renovations, repairs and alterations, extensions and maintenance. Civil engineering (also known as the construction of infrastructure) includes the building of roads, other transport routes and networks. Specialist construction includes building installation (e.g. electrical installations, heating, plumbing and ventilation, roofing), finishing (e.g. plastering, painting and glazing), site preparation and demolition.

Construction services also comprise the installation and maintenance of equipment and devices that serve the general use of a building, such as elevators and general monitoring and alarm systems, ventilation systems, extinguishing systems, lighting systems.

For example, 'construction service' as defined in Section 31.3 of VAT Act is used to determine the reverse charge liability in the construction sector. However, it should be noted that even if the reverse charge liability does not apply to the party required to report information, they must still provide this information if the work is deemed construction services referred to in Section 31, Subsection 3 of the Act. This means that housing companies etc. are required to file reports when they buy construction services referred to in the Act. Typical jobs in housing companies are – besides the erection of new buildings – renovations of plumbing and electrical systems, roof replacements, façade renovations, painting work inside and outside, paving of yards and driveways, lift maintenance, and adjustments of a heating or air conditioning system.

For more information on the concept of a construction service, see the Tax Administration's guideline on VAT reverse charge (in Finnish). In addition, the Confederation of Finnish Construction Industries RT has, in cooperation with the Tax Administration, drawn up a list of the most common construction services to which reverse charge applies. The purpose of these guides is to help taxpayers to interpret the rules and determine whether work is regarded as a construction service referred to in VAT Act – i.e. subject to the reporting requirement.

2.2.2 Maintenance

The reporting requirement applies to maintenance and repair work on a property. This includes many different repairs that are done for purposes of upkeep of e.g. any building, or of public transport routes (such as a street, road, railway or waterway).

Machinery and equipment in a building, including its lifts or elevators, monitoring and alarm systems, ventilation, fire extinguishing and lighting control systems and similar installations, intended to serve the property in general, become part of it after they are installed. Repairs to and maintenance of such systems – that are installed in the property – are construction services. However, the mere testing of a system is not considered a construction service. The installation of such systems is a construction service.

It must be noted that in the sector of municipal administration, 'maintenance' (in Finnish: kunnossapito) does not mean the same thing. The Finnish Act governing the municipal upkeep of streets and other public spaces (laki kadun ja eräiden yleisten alueiden kunnossa- ja puhtaanapidosta 31.8.1978/669) sets out a definition (of maintenance; kunnossapito) that amounts to service performance that under VAT Act, is not regarded as a construction service. This way, the references in this guidance to maintenance are intended to concern what the VAT Act has defined, and they may not be interpreted in the wider sense which is the legally defined norm in municipalities.

2.3 For what type of work do you not need to report contract information?

2.3.1 Planning and supervision provided as a specific service

The reporting requirement does not apply to planning, supervision and other similar services referred to in Section 31.3 paragraph 2 of the Value Added Tax Act associated with work referred to in paragraph 1 of this provision.

When purchased separately, the reporting requirement does not apply to such services, but if it has been agreed in the construction contract that planning services are bought from the company providing the construction service, the reporting requirement applies.

2.3.2 Supply of goods and other services

The reporting requirement does not apply to the supply of goods or other services related to the construction sector besides construction services. For example, the reporting requirement does not apply when a company (of the construction sector) buys building materials from a supplier, or buys services other than construction services from a subcontractor, including consultancy or healthcare.

The reporting requirement applies when the main performance is a construction service. However, the share of an auxiliary performance, such as the building materials included in a construction contract, must not be deducted. Instead, information must be reported for both construction services and building materials.

2.3.3 Installing, repairing and maintaining the equipment used for a particular activity on the property

Machinery, equipment and fittings (e.g. in a production facility) used for a particular activity carried out in the property is not regarded as part of the property. This means that installation, repairs and maintenance of such equipment are not treated as construction services referred to in VAT Act. Such work includes maintenance of machinery and instruments that are part of the process in production plants.

Example 1: The company that owns a food processing plant is located has commissioned a cooling system to be installed. This is regarded as equipment for a particular activity. Its installation, repairs and maintenance are not considered construction services – no reports should be filed.

Example 2: The company that owns a building has commissioned an escalator. It is installed there and free for everyone to use. The installation job is considered a construction service – reports on it must be filed.

2.3.4 Maintenance and care of real property and related technical service

Building services and maintenance, including any technical service jobs that are closely related to this activity, are not construction services, and are excluded from the reporting requirement.

These services are packages that include regular cleaning, maintenance of facilities, snow ploughing, spreading of sand, attention to the heating system, ventilation and air conditioning and associated minor repairs.

Minor repairs are usually covered by the service agreement, and no separate charge is made for them. If the service provider charges a separate fee for repair services, these are considered construction services and the reporting requirement applies. This means that a particular repair job is done that does not belong in what has been agreed as the regular service. The important distinction is that there is a specific reason for charging an extra fee (the method of issuing the invoices is not of importance).

The minor repairs that are part of regular service mainly consist of preventive action designed for troubleshooting and prevention of further problems. Work excluded from the reporting requirement includes chimney sweeping, checks and cleaning operations of electrical, plumbing, sewage and ventilation systems in a building or property and various checks, measurements and testing of cooling systems.

Monitoring and alarm systems, ventilation, fire extinguishing and lighting control systems and similar installations that serve the property in general become part of the property after their installation. Repairs and maintenance of such systems – installed in the property – are construction services. Similarly, their installation work is a construction service for which reports must be filed. However, if the service only consists of system testing, it is not treated as a construction service.

2.3.5 Buying services from a different unit in an organisation or enterprise group

Contracts are not reported if a subsidiary, other member company or unit of a large organisation buys the service from another. This requires that the legal identity of the organisation is the same (the Business ID of the buyer and the service provider are the same). For example, no reporting requirement applies to a municipality that has made a contract with its own "facilities unit" in order to have a construction job done, and the facilities unit has the same ID code as the municipality itself.

However, if the contract is signed with a unit that has a different legal identity and Business ID, reports must be filed even if both contracting parties were members of the same enterprise group. This means that contract details must be given even if the provider of the construction services is a subsidiary or other group member if the value goes over the threshold of €15,000.

2.3.6 The threshold that applies to contract details

Under the law, the Tax Administration may limit the reporting requirement in situations where the information is of minor relevance from the perspective of tax control.

If contract value is at maximum €15,000 ex VAT, the information need not be reported. If the 15,000-euro threshold is not reached until the work has been going on for some time, the reporting requirement begins from the month when it is reached.

There is no need for retroactive reports or corrections.

Example 3: The 'S' renovation expert company receives an order from a housing company. The work to be done is the renovation of the roof of the building, and 'S' has given an estimate amounting to €10,000. Work begins in April. The billing for April is €5,000. When work progresses, it is established that more work is needed, and a new estimate is given, now bringing the value of the contract to €25,000. The billing for June is €3,000. In these circumstances, the housing company must file a report for the €3,000 that 'S' has billed for June. This is because they have now become aware that contract value is going to go over the threshold. The report must give €25,000 as the estimated contract value. However, there is no need to file a report for April.

The threshold for contract details is not applied to each building site. Instead, it concerns the contract that has been made. For this reason, the value of the contracted work at a specific site may stay below €15,000, but you must still give a report to the Tax Administration if the total value of the contract is above €15,000. If work is being done at multiple sites, and there is only one contract where this is agreed, the report must give a specification of the amounts pertaining to each site.

Example 4: The contract between 'X' and 'Y' has set out that 'Y' takes on a renovation job worth €30,000, broken down between the three separate buildings that 'X' owns: Renovation of the 'A' building - €10,000 and the 'B' building - €8,000 and finally, the 'C' building - €12,000.

'X' must file reports that give site-specific information on how much 'Y' has invoiced. The invoices that 'Y' issued so far are: for 'A' - €3,000, for 'B' - €2.000 and for 'C' – €5,000. 'X' files a report that gives the following breakdown: for the 'A' site - €3.000 invoiced of the €10,000 contract value, for the 'B' site - €2.000 invoiced of the €8,000 contract value, and for the 'C' site - €5.000 invoiced of the €12,000 contract value.

When calculating the threshold, each separate order for a construction service whose payment is determined separately is considered a single contract. For example, whether or not the reporting requirement applies to maintenance work carried out under a yearly contract thus depends on the value of each separate order. This principle is not only applicable to maintenance but also to other work that must be reported.

Example 5: The 'Z' real estate company has signed an agreement on repair work to be provided by 'X' on an annual basis. This is a general service agreement that defines a unit price for different repair jobs for the duration of one year, regardless of whether repairs are going to be done.

In February, the building has a water leak. An emergency call to 'X' is made, because the damages must be repaired separately. This separate repair job costs €19,000 ex VAT. In March, one of the loading ramps requires special repair. Again, 'X' receives a call. This separate repair job costs €13,000 ex VAT. Towards the end of March, 'Z' buys a floor tiling job from 'X', the value of the contract is €17,000 ex VAT.

In this case, each one of the separate jobs must be treated as a specific contract for the purposes of the reporting threshold. As a result, 'Z' must file reports on the water leak job (February, €19,000) and the floor tiling (March, €17,000).

Example 6: The local electric power company has made a framework agreement with a self-employed excavator operator regarding summertime digging and excavation work. No advance knowledge is available to the power company as to what power grid problems may come up, and where and when they must use the digging service. As for reporting, each job that indeed is commissioned from the self-employed operator is a specific contract – and reports must be filed only if the value of a single contract is above €15,000.

This threshold is based on an official decision dated 14 February 2014 (record no A3/200/2014), in Finnish.

2.4 Contract split; additional work

It should be noted that if work carried out for a customer, or the results achieved, are based on several successive contracts that are uninterrupted, or continue with small interruptions only, these should be considered a single contract for purposes of the threshold. If it is obvious that two separate performances of work are done, and there are good commercial reasons to treat the work orders as separate contracts, they are not treated as a single contract.

The general rule is that every contract is treated as an independent whole. However, if it seems that an artificial splitting of a large contract into two or more separate ones has been attempted – in order to avoid reporting – the Tax Administration may treat such arrangements as a single contract for purposes of the threshold.

If the customer has commissioned a job, and is aware that he is likely to do so again with the same provider, at the same site, with short intervals or on a recurring basis, the series of contracts that are signed are treated as one. However, as in the case of an annual framework agreement on building maintenance, each separate work order is regarded as a single contract.

Example 7: The 'X' construction company has received an order for steel reinforcement installations at a building site. Agreed job value is €8,000. Soon afterwards, the same customer signs another contract with 'X' for concrete casting work, €6,000, the building site being the same. Then the next stage of the project is reached and 'X' gets another order – this time for floor preparation, job value €3,000. In these circumstances, all of the above must be treated as one single contract, and reports to the Tax Administration must be filed accordingly.

When a construction job is ongoing and agreements are made along the way concerning additional work that was not enumerated in the original contract but is related to the ongoing job, the resulting new or additional work is treated as part of the original contract (e.g. there is an unexpected increase in how much work must be done in order to continue the project).

Example 8: The customer has agreed with a contractor to repair a damp 200-square-metre floor that has suffered from a water leak. As it turns out, the damp area is larger than expected. The job increases from 200 to 500 square metres. The extended, additional work is treated as falling into the same contract as the original job.

2.5. Content of contract information to be reported

The required facts about a contract at a site include the filer submitting the report, the contractor and the contract. Customers must file their reports on contracts directly to the Tax Administration. The information to be reported concerns contractors operating at the site - and their contracts. Information must also be provided on employers providing leased employees and payments made to them.

For more detailed descriptions of the information, see the specifications of data records. The record descriptions indicate whether the information is mandatory, voluntary or conditionally mandatory; in the latter case, the information is only mandatory in certain situations. In conditional sections, filling in the field, or the result of a calculation determine whether some other information is mandatory.

We have given a short review of the required content below. This is not an exhaustive list. For more information, see the computer record descriptions.

General information:

- Type of report

- When you are reporting the details for any period for the first time, enter basic report (perusilmoitus, P). It may contain all the information for all sites the filer has – or alternatively, basic reports can be decentralised and submitted by various sites. As a basic report is submitted, the Tax Administration assigns a report ID to it, which can be used later to amend or delete the information.

- If you wish to make corrections to your report, you must file a correction report (korjausilmoitus, K). In a correction report, all information must be re-completed, after which it will replace the earlier report. A correction report cannot be submitted without a basic report ID for the same month.

- If, exceptionally, the filer wishes to cancel the previous file entirely, they must file a deletion report (poistoilmoitus, D). Similarly as in the case of corrections, the deletion cannot be filed unless there is a basic report ID for the same month.

- Reporting year

- If you give December 2014 details during February 2015, enter 2014 as the reporting year.

- Reporting month

- This the month which the information concerns; for example, the information for October is submitted in December. In that case, enter 10 (October) as the reporting month.

- You cannot give the details in advance. In other words, you can only file the report for the reporting month. For example, for the basic report for February to be submitted at the correct time, it should be submitted between 1 February and 5 April.

Provide the following information on the filer:

- Name

- Always give the name of the party to which the reporting requirement applies, i.e. the customer (constructor, main contractor, contractor or subcontractor).

- The Tax Administration is notified of an authorised information provider (e.g. consultants, accountants, project supervisors or maintenance companies) through Katso system authorisations, so the authorisation holder should never be given as the filer.

- Business ID or personal identity code

- If the filer is a Finnish organisation, the reports cannot be filed without a Business ID. This means that if the reporting requirement applies to you, you must apply for a Business ID.

- A foreign identification

- You can only give a foreign identification if the filer does not have a Finnish Business ID. If a foreign filer has a Finnish Business ID, you should give that.

- If necessary, the authorities take the initiative in assigning a Business ID to a foreign filer. If the filer is assigned a Business ID, they will be notified. In the future, the filer must use the Business ID when filing their reports.

- Type of foreign identification, numbered in the order of priority:

- 1=Value-added tax ID (i.e. the VAT number)

- 2= a foreign identification corresponding with a trade register entry

- 3=TIN (foreign taxpayer identification number)

- 4=Foreign personal identity code

- If the filer does not have a VAT number, you should give a foreign ID corresponding with a trade register entry. If you do not have this, either, you should give your TIN and, as the last alternative, a foreign personal identity code.

- Country of tax residence

- Give the country code of the filer's country. For a Finnish company, this is FI. The record description has a link to a list of all country codes.

- If it cannot be found on the country codes list, you must write the name of the country.

- Address details in Finland and in the home country (in the case of a foreign filer)

- The Tax Administration particularly recommends that you give the address of your main office.

- Contact person name, telephone number, e-mail address and address in Finland

- Information on the party for whom the filer works as a contractor

- This is not a mandatory field. However, the Tax Administration recommends that you provide this information, as it makes it easier to trace the subcontracting chain and improves the options for tax control.

Provide the following details on where site is located:

- Site number

- 1) The site number that a service provider has assigned to the site on the Web.

- 2) Project supervisor's, main contractor's or customer's site number

- We recommend indicating the site location with a site number that identifies the site. This may be the string of numbers generated by an external service provider or it may be the number assigned to the site by the main contractor.

- If no such number is available, give the customer's own site number for the site that the contract concerns.

- If the filer has engaged the services of an external provider who assigns a separate site number electronically, we recommend giving both that number and the main contractor's site number.

- Site location

- Address and municipality

- If the site does not have an address yet, you may give a freely worded description of its location, e.g. the area or the site name.

- If the site does not yet have a site number to identify it, we recommend that you give the exact postal address of the site. This way, the filer can avoid being contacted by the Tax Administration later.

Provide the following information on the contractor:

- Name

- Business ID or personal identity code

- If it is a Finnish organisation, Business ID is mandatory

- A foreign identification

- To be given if the contractor does not have a Finnish Business ID

- If necessary, the authorities take the initiative in assigning a Business ID to a foreign company.

- Type of foreign identification, numbered in the order of priority:

- 1=Value-added tax ID (i.e. the VAT number)

- 2= a foreign identification corresponding with a trade register entry

- 3=TIN (foreign taxpayer identification number)

- 4=Foreign personal identity code

- If the filer does not have a VAT number, you should give a foreign ID corresponding with a trade register entry. If you do not have this, either, you should give your TIN and, as the last alternative, a foreign personal identity code.

- Country of tax residence

- Give the country code. For a Finnish company, this is FI. The record description has a link to a list of all country codes..

- If it cannot be found on the country codes list, you must write the name of the country.

- Address details in Finland and in the home country (in case of a foreign contractor).

- Contact person name and telephone number.

Provide the following details on the contract:

- The invoiced amount of the contract during the reporting period

- Give the amount excluding value-added tax; and in performances subject to tax, the tax basis

- As the customer, you must give the amounts that are calculated for the month when the job is done, and you, the customer have approved it as received. If an installment scheme is agreed, i.e. the payments are made one by one during the ongoing job; you must give the invoiced amounts.

- If the entire contract is billed when the job is completed, the customer is expected to give the entire amount on his report filed for the period when the invoice is dated. In this case, the calendar month of that date defines the filing period.

- The invoiced amount takes precedence over the paid amount

- The invoiced amount may contain both a service and goods and materials – in this case, the entire amount must be reported and the part representing goods or materials must be included.

- The paid amount of the contract

- Companies with a smaller turnover (and the self-employed) are allowed to use cash-basis accounting. They can report the amount that has actually been paid to them during the month, regardless of the date when they had finished the construction job or service i.e. delivered it.

- This is only to be reported if cash basis is used, or if there was no written invoice.

- Give the amount excluding value-added tax; and in performances subject to tax, the tax basis.

- Advance payment

- Report any payments made in advance before the work is initiated.

- Total contract amount

- Give this amount as ex VAT.

- Changes need not be reported, but if the contract amount changes, the Tax Administration recommends that you give the new amount in the report for the following period.

- What you must include in Total contract amount is both the construction service and the goods and materials (such as pre-fab blocks etc.).

- In case of hourly and yearly contracts, give an estimate of the total for the year in question.

- Type of assignment

- Options 1 = contracting, 2 = employee leasing or 3 = maintenance work of a continuous nature.

- Contracting refers to a construction service ordered from another company.

- Employee leasing is an arrangement by which one company provides employees to another (the hirer) under a leasing contract.

- Maintenance work of a continuous nature refers to work that does not have an exact end time.

- Reverse charge liability applies

- Select 1 = yes or 2 = no.

- Contract start date

- Give the start date of the work as stated in the contract.

- Date format: ddmmyyyy (for example, 23032014).

- Contract end date

- Give the contract end date, if known. Otherwise, give an estimated end date.

- If maintenance work of a continuous nature is carried out on the property round the year and you entered maintenance as the assignment type, you can leave the end date blank.

- The Tax Administration recommends that you correct the information in the report for the following month if the end date changes. In the case of foreign companies, this information is vital from the perspective of tax control.

- Date format: ddmmyyyy (for example, 02092015).

- Not active - an entry for specific contractors

- Make this entry if the work carried out by the contractor whom the report concerns is 1 = temporarily interrupted or 2 = concluded.

- The Tax Administration recommends that you make a Not active entry if the work has been interrupted on a temporary basis and the end date of the contract remains open. This way, you or the filer can avoid a request for information concerning a failure to report.

- Not active - an entry for specific sites

- Make this entry if all work carried out at the site is 1 = temporarily interrupted or 2 = concluded.

- The Tax Administration recommends that you make a Not active entry if the work has been interrupted on a temporary basis and the end date of the contract remains open. This way, you or the filer can avoid a request for information concerning a failure to report.

Accrual basis, invoice basis and cash basis

The general rule is to use the accrual basis. As the customer, you must give the amounts that are calculated for the month when the job is done, and you, the customer, have approved it as received. If an installment scheme is agreed, i.e. the payments are made one by one during the ongoing job; you must give the invoiced amounts.

Example 10: The 'A' contractor (the provider of construction services) finished and delivered the agreed job to 'B', the customer (customer / the buyer of construction services) in July 2014. As for the report that 'B' must file, the period is 7/2014, and a report on contract details must be filed, containing the necessary information on the job that 'A' delivered in July.

Example 11: The 'A' contractor signed an agreement with 'B' on a project that will take a number of years to complete. They agreed that billing is with installments during the ongoing construction - and the final installment may not be invoiced until the entire job is completed, delivered and approved by 'B'. As for reporting when construction is ongoing, 'B' must file reports on the amounts for the periods when invoices arrive to 'B'.

If the entire contract is billed when the job is completed, the customer is expected to give the entire amount on his report filed for the period when the invoice is dated. In this case, the calendar month of that date defines the filing period.

Example 12: The 'A' contractor (the provider of construction services) finished and delivered the agreed job to 'B', the customer (customer / the buyer of construction services) in July 2014. In August 2014, 'A' gave 'B' an invoice for the entire amount. As for the report that 'B' must file, the period is 8/2014, for a report containing the necessary information on the job that 'A' delivered in July and billed in August.

This way, the rules on the timing of report explained in this guidance usually lead to Periodic Tax Returns and reports on contract details to be filed simultaneously.

3 Project supervisor's duty to report information on people working at a shared construction site (employee information)

3.1 Who is required to report information?

Information on the employees at a site should be reported by the project supervisor. Project supervisors submit reports on their own employees and the employees of other contractors working at the site. Information on self-employed workers and leased employees must also be reported.

'Project supervisor' is defined in Section 2.4 of the Government Decree on the Safety of Construction Work (205/2009). Accordingly, the project supervisor means the main contractor appointed by the customer, or an employer using the main authority, or where there is no such employer, the customer. Ultimately, it means that the reporting requirement applies to the constructors themselves, unless they have appointed a project supervisor for the site.

The main contractor usually acts as the project supervisor. The project supervisor gives out access passes, or permissions to enter the site. In connection with the new information-reporting requirement in the construction sector, a duty to keep a list of those who work at a shared construction site is imposed on the project supervisor in Section 52 b of the Occupational Safety and Health Act (738/2009). The people on the list are the ones required to wear a visible photo ID with a Tax Number entered in the Tax Number Register. Information must be reported to the Tax Administration every month on these people. The list must be kept up to date, and the authorities must be given easy access to it. On the other hand, the list of who works at the site, and to whom access passes have been given, is shorter than the list of employees whose details must be submitted to the Tax Administration.

Each company operating at the site has the duty to submit a list of their employees to the project supervisor. Self-employed workers are also required to do so for their own part. The information must be provided before work is initiated. In addition, the project supervisor must be informed immediately of any changes in this information to allow them to meet their own reporting requirements to the Tax Administration.

Project supervisors or main contractors may complete their building and deliver it to the customer, but the site administration may still remain in business. If work is done at a later stage, i.e. after the main contractor's job is finished, there must be an agreement as to who is going to be the project supervisor. If employees of other companies still remain working at the site, the reporting duties are handed over to the customer unless a new project supervisor has been appointed or unless it is agreed that the main contractor continues to take care of the project supervisor obligations although his part of the job is finished.

Section 15 b of the taxation procedure act (1558/1995) contains the following provision on the project supervisor's obligation to report information and the obligation of other companies operating at the site to provide information to the project supervisor:

Section 15 b

The duty of the site's project supervisor to provide information on the employees

The main contractor or other project supervisor of a shared site referred to in Section 7 of the Occupational Safety and Health Act (738/2002) must, for the purposes of tax control, every month report to the Tax Administration the necessary identification and contact information of the employees, self-employed workers and leased employees, including employers and customers using leased employees working at a shared site, as well as as information on the employer's home country, the nature of the employment relationship or contractual relationship, and information on working, residence and insurance in Finland. This information need not be provided on persons delivering goods to the site on a temporary basis, however.

A company operating at a shared site must submit the information referred to in Subsection 1 on their employees working at the site to the main contractor or project supervisor of the site. Self-employed workers must submit similar information on themselves. The information must be provided before the work is initiated, and notification of any changes in it must be given without delay.

The party subjected to the reporting requirement referred to in this Section must keep on file the information and documents in which information covered by the reporting requirement can be found for six years from the end of the year in which work at the site was completed, unless a longer filing period than this is laid down elsewhere in the law.

More detailed orders on the information to be reported, the time and method of reporting the information and the right to refrain from reporting the information referred to in this Section in situations that have minor financial relevance, or relevance from the perspective of tax control, will be issued by the Tax Administration

3.2 For what type of work must information be reported?

3.2.1 A shared construction site

The project supervisor has the duty to submit information to the Tax Administration on the people who work at a shared construction site. In the Government Decree, this means a workplace where work referred to in the Decree's scope of application is carried out and where more than one employer, or more than one self-employed worker, operate simultaneously or successively.

The authorities in charge of occupational safety have interpreted 'simultaneously' to mean”working at the same time". As for working 'successively', they have interpreted it to mean that when one party has been present at the site and leaves it, the next party arrives to it immediately or almost immediately afterwards. Working 'successively' additionally means that some kind of link between the first and the second party exist, either in relation to time, or as agreed in a contract.

If the work is performed by the employees of a single company (e.g. painting or other surface treatment work), there is no need to file reports on employee details. In this case, too, it should be noted that the customer must report the contract details.

The grounds for providing contract and employee details are different. Contract details must be provided on construction services referred to in VAT Act and on the erection or dismantling of scaffolds. Employee details, on the other hand, must be provided on all those who work at a shared site. Employee information may also need to be reported when the requirement to report contract information does not apply to the work in question. The reporting requirement applies to everyone who works at a shared site, even if the individual in question is not engaged in construction work. For example, reports giving the details of office workers, cleaners, security guards and trainees from educational institutions must be filed. If it is difficult to isolate the work treated as non-construction work, only the details of the people who actually participate in the construction work are required (for more information, see 3.3.).

The decree does not set limits to the existence of a shared site that results in a reporting requirement, for example in terms of the duration of site operation or the volume of work carried out, which would have to be exceeded in order for the site to be deemed a shared site. The crucial factor is that at least two different companies are engaged in the work. Even a small renovation site may thus become a shared site if, in addition to surface treatment work carried out by a painting company, installations are being performed by electrical contractors.

For the existence of a shared site, the essential factor is the knowledge that work at the site in question was planned to be carried out by more than one employer. This is true regardless of the fact that when the site is launched, only one employer is active at it and the subsequent employers only join in at later stages. The reporting requirement commences as soon as the first employer starts working at the site.

Example 13: Municipal employees who normally work on maintenance are present at a renovation site, working there for two months on a building owned by the local municipality, until another construction company arrives there and initiates work. At the very start of this project it is known that the other construction company is going to arrive and work on the renovation. Because this site is a shared site from the beginning, the municipality must file reports on its employee details since the start.

If work at the site was planned to be carried out by a single employer but while the work is in progress, employees in the service of several different employers end up working there, it becomes a shared site. The reporting requirement begins on the date when it becomes a shared site.

3.2.2 What does construction work at a shared construction site mean?

As construction work referred to in Government Decree on the Safety of Construction Work (205/2009) is regarded new buildings, renovations and maintenance to a building and other structure that takes place under or above the ground or in the water, and related installations, demolition, civil engineering and construction-related planning, as well as the preparation and planning of a construction project involving any of the above.

The intention was that the decree could be applied to construction in rather a broad sense. All activities associated with construction are within the decree's scope of application.

Based on the decree's scope of application, construction work comprises building construction and, for example, the construction of such structures as bridges, dams, harbours, quays, canals, roads, streets, railways, airports and district heat networks, and the construction of and repairs to raw water pumping stations and treatment plants, sewers, all types of water supply and other pipe systems and other similar structures. The decree also applies to foundation engineering, for example digging an excavation, backfilling and embankment construction.

In the area of subterranean construction, there is a clear line between excavation and mining. The former is construction work, comprising e.g. rock excavation for a traffic route, for a subterranean storage, for a section of a raw water supply network, of a sewer pipeline or for other similar use. Work carried out to exploit minerals, on which provisions are contained in the Mining Act (621/2011), is excluded from the scope of the decree and also from the concept of construction work.

Construction work in water includes dredging a shipping lane or other fairway, dam construction and underwater excavation. The Decree on the Safety of Construction Work also applies to the construction of pipeline networks. Maintenance of a road, a street or a similar structure, and even partial repairs to the paving, repaving or other similar activities fall within the decree's scope of application.

It is buildings and structures that must be the object of the repairs, maintenance and installation work within the meaning of the decree. Building maintenance referred to in the provisions includes painting the façade, replacing or repairing the roofing, replacement of plumbing, heating and ventilation equipment and similar work.

Installation is not treated as construction work unless it relates to the erection of a building. For example, when installation jobs of machinery and equipment in a power plant or paper factory are in question, they are not construction work unless they are done during an ongoing construction, either of a new building or as part of a major repair project. Similarly, the decree applies to the installation of plumbing, heating and ventilation systems, as well as to the installation of elevators and similar equipment in connection with the building, renovation and maintenance of a building or other structure. In addition, the reporting requirement also concern sites where productive activity is interrupted (for more information, see 3.3.2 for a discussion of downtime maintenance interruptions necessary for a process).

The occupational safety administrations of Regional Administrative Agencies supervise the application of the Government Decree on the Safety of Construction Work. Regional Administrative Agencies have issued a guideline on the concepts of a shared site and construction work, which describes in greater detail how a shared site comes into existence, and what must be treated as construction work.

3.3 When to report employee details

3.3.1 People who deliver goods to the site

No reporting on those who bring goods to the site is necessary under the guidelines. This means that unless the driver of a truck participates in the construction work, details on him do not have to be given.

According to the Regional Administrative Agency guide, drivers must be regarded as being present at the site and working there, if they participate in the construction work doing something elsewhere than on the back of their truck or in the immediate vicinity of their vehicle. This way, a driver who brings prefab building blocks to the site is treated as working there if he unloads them at a location where they are not going to be kept in storage, and if he participates in the work where the blocks are to be installed. Similarly, if a driver of a concrete mixer distributes the unhardened mixture from the chute in his vehicle, he is treated as working at the site.

3.3.2 Maintenance related to keeping a process running

A guideline issued by the Ministry of Social Affairs and Health / Regional Administrative Agency excludes maintenance related to keeping a process running from the scope of application of the Government Decree on the Safety of Construction Work (205/2009). Maintenance of machinery and instruments at industrial production plants and replacement of machinery parts, for example, are thus excluded from the reporting requirement.

However, the type of work that requires an interruption or downtime of a production plant normally involves such repairs, maintenance and installations of the structures that it is included in the reporting requirement.

According to the Regional Administrative Agency, taking into account the nature of the work being done and the extent of it, sites that compare to traditional construction sites are concerned by the reporting requirement even though the work is done during a downtime of a production process. Occupational safety rules apply, which means that arrangements must be made in order to put the usual work safety procedures in place at the construction site. The type of work that requires an interruption or downtime of a production plant normally involves repairs, maintenance and installation. Examples include work on a heat exchange, cisterns, the electric power network, the plumbing, and steel structures. Work may consist of upkeep and repairs (e.g., dismantling, replacement of parts, refitting, sand blasting, and painting) and also involves the erection of scaffolds and platforms and the dismantling of them.

According to the guide of the Agency, examples of sites that fall into this category and where reporting is required are

- those where work duration is longer than one month and where there are at least 10 people working at the same time, and

- those where the workload is more than 500 man-days.

3.3.3 Guests and representatives of public authorities

The guide of the Agency excludes officers who work for a public authority and site guests from the reporting requirement, as they do not work at the site under a contract. Because the presence of these individuals is not regarded as work at a shared construction site, no reporting is necessary. For more information, see the guide of the Regional Administrative Authority (in Finnish).

3.4 Construction sites that cannot be physically separated from their environment

According to the guide of the Regional Administrative Agency, where there is a site area that cannot be enclosed inside a barrier, fence, ribbon or other physical boundary, everyone who works in that area must wear a name tag with a photo (in other words, they are held to be working at a shared site).

However, in the Tax Administration's opinion the information-reporting requirement only concerns those who work on construction. This means that at such sites – e.g. at factories, schools, hospitals, and shopping centres, where construction work is in progress but it cannot be fenced, so as to be separate from the factory workers, teachers and pupils, doctors and patients as the case may be, employee details must be given on the individuals who participate in construction work only. For more information on the definition of construction work for the purposes of reporting, see 3.2.2.

Example 14: Renovation is in progress in the lobby of a very large office building. Office workers, customers and other people walk through the lobby every day and no ribbons etc. can be used to set up boundaries that would clearly separate the site area. In these circumstances, the filer must give the employee details only on the people who work with renovation.

3.3.5 Threshold that applies to employee details

Under the law, the Tax Administration may limit the reporting requirement in situations where the information is of minor relevance from the perspective of tax control.

If the total value of the project per site is at maximum €15,000 ex VAT, there is no need to file reports. The sum total must not include the work efforts or payroll costs of the customer's own employees – only the construction services purchased from an external provider can be included.

Example 15: Municipal employees who normally work on maintenance are present at a renovation site, working there for an entire month. Their wages equal €16,000 for this period. To have some additional special work done at the renovation site, the municipality signs an agreement with an outside provider of building repair services, the value of this agreement being €8,000. In these circumstances, no reports have to be filed, because the amount does not go over the threshold.

However, if the value of the outside provider's contract exceeds €15,000, the requirement to report employee details not only concerns the provider's employees but also the employees of the municipality.

If the value exceeds €15,000, the project supervisor or constructor must advise the other employers operating at the site in order to allow them to meet their own requirement of providing information to the project supervisor.

If the value of the main contract exceeds €15,000, the main contractor must notify the other companies operating at the site of the threshold being exceeded. If the value of the main contract is €10,000, on the other hand, and the value of the auxiliary contracts of three constructors are €2,000 each, the constructor must notify the main contractor and the other companies of the threshold being exceeded.

If it is already known that the threshold will be exceeded at the time of concluding the contract, the parties can be informed of the reporting requirement in the contract document. If it is not reached until work has been going on for some time, the reporting requirement begins the month when the filer becomes aware that it will be reached.

It should be noted that if work carried out for a customer - or the results achieved - are based on several successive contracts that are uninterrupted or continue with small interruptions only, these should be considered a single contract for purposes of the threshold.

This threshold is based on an official decision dated 14 February 2014 (record no A3/200/2014), in Finnish.

3.4 Content of the report on employee details

Before starting to work at a site, each company operating at a shared site is required to submit information on their employees to the site's project supervisor, who has the duty to collect this information and report it to the Tax Administration. If no project supervisor has been appointed for the site, the reporting requirement applies to the constructor.

If an employee is not working at a site during a certain month, for example because he or she has been transferred to another site for two months, he or she will not be included at all in the employee information of the site.

We have given a short review of the required content below. This is not an exhaustive list. For more information, see Specifications: They indicate whether the information is mandatory, voluntary or conditionally mandatory; in the latter case, the information is only mandatory in certain situations. In conditional sections, filling in the field, or the result of a calculation, determine whether some other information is mandatory.

General information:

-

Type of report

-

When you are reporting the details for any period for the first time, enter basic report (perusilmoitus, P). The basic report may contain all the information for all sites the reporting unit has, or basic reports can be decentralised and submitted by various sites. As a basic report is submitted, the Tax Administration assigns a report ID to it, which can be used later to amend or delete the information.

-

If you wish to make corrections to your report, you must file a correction report (korjausilmoitus, K). In a correction report, all information must be re-completed, after which it will replace the earlier report. A correction report cannot be submitted without a basic report ID for the same month.

-

If, exceptionally, the filer wishes to cancel the previous file entirely, they must file a deletion report (poistoilmoitus, D). Similarly as in the case of corrections, the deletion cannot be filed unless there is a basic report ID for the same month.

-

-

Reporting year

-

If you give December 2014 details during February 2015, enter 2014 as the reporting year.

-

-

Reporting month

-

This the month which the information concerns; for example, the information for October is submitted in December. In that case, enter 10 (October) as the reporting month.

-

You cannot give the details in advance. In other words, you can only file the report for the reporting month. For example, for the basic report for February to be submitted at the correct time, it should be submitted between 1 February and 5 April.

-

Provide the following information on the reporting unit:

- Name

- Always give the name of the party to whom the reporting requirement applies, i.e. the project supervisor (the main contractor, the employer using the main authority or the constructor).

- The Tax Administration is notified of an authorised information provider (e.g. consultants, accountants, project supervisors or maintenance companies) through Katso system authorisations, so the authorisation holder should never be given as the filer.

- Business ID or personal identity code

- If the filer is a Finnish organisation, the reports cannot be filed without a Business ID. This means that if the reporting requirement applies to you, you must apply for a Business ID.

- A foreign identification

- You can only give a foreign identification if the filer does not have a Finnish Business ID. If a foreign filer has a Finnish Business ID, you should give that.

- If necessary, the authorities take the initiative in assigning a Business ID to a foreign filer. If the filer is assigned a Business ID, they will be notified. In the future, the filer must use the Business ID when filing their reports.

- Type of foreign identification, numbered in the order of priority:

- 1=Value-added tax ID (i.e. the VAT number)

- 2= a foreign identification corresponding with a trade register entry

- 3=TIN (foreign taxpayer identification number)

- 4=Foreign personal identity code

- If the unit does not have a VAT number, you should give a foreign ID corresponding with a trade register entry. If you do not have this, either, you should give your TIN and, as the last alternative, a foreign personal identity code.

- Home country

- Give the country code of the reporting unit's home country. For a Finnish company, this is FI. The record description has a link to a list of all country codes..

- If the name of your home country cannot be found on the country codes list, you must write the entire name.

- Address details in Finland and in the home country (in case of a foreign reporting unit)

- The Tax Administration particularly recommends that you give the address of you main offices.

- Contact person name, telephone number, e-mail address and address in Finland

- Information on the party for whom the reporting unit works as a contractor

- Voluntary section. However, the Tax Administration recommends that you provide this information, as it makes it easier to trace the subcontracting chain and improves the possibilities for tax control.

Provide the following details on where the site is locatede:

- Site number

- 1) The site number that a service provider has assigned to the site on the Web

- 2) Project supervisor's, main contractor's or customer's site number

- We recommend giving the site number when explaining the location. They may be assigned by external service providers or by the project supervisor.

- If no such number is available, give the customer's own site number for the site that the contract concerns.

- If the filer has engaged the services of an external provider who assigns a separate site number electronically, we recommend giving both that number and the main contractor's site number.

- Site location

- Address and municipality

- If the site does not have an address yet, you may give a freely worded description of its location, e.g. the area or the site name.

- If the filer does not have a site number to identify it, we recommend that you give the exact postal address of the site. This way, the filer can avoid being contacted by the Tax Administration later.

Provide the following information on an employee:

- Employee personal identity code

- The Tax Administration recommends that you use personal identity codes when filing the report

- Employee tax number and date of birth

- Entering the tax number and date of birth is an alternative for the personal identity code. The Tax Administration recommends that you use personal identity codes.

- Employee's first name and last name

- Employee's telephone number

- Address in country of residence

- Details on coverage of a social security regime (whether the country where the employee comes from still covers his/her social insurance)

- Enter 1 = Yes, if he or she has an A1 Certificate or another similar document proving coverage by the social security regime of the foreign country.

- Enter 2 = No, he or she is covered by the Finnish social security system (e.g works longer than four months, has no Certificate).

- Nature of the employment or service relationship

- Is the employee 1= in an employment relationship, 2= a leased employee, 3 = self-employed or similar (e.g. goods inspector or an evaluator of a competence-based examination), 4 = trainee or 5 = voluntary worker.

- In the case of a leased employee, the hirer company at the construction site must submit his or her employee details to the project supervisor.

- Start date of working at the site

- This detail arrives from the project supervisor. However, it is the duty of each employer to submit details to the project supervisor.

- Use the ddmmyyyy format.

- Remember that no importance is attached to the date of the payday. What is important is the date/period when the work is done.

- Estimated end date of working at the site

- This detail arrives from the project supervisor. However, it is the duty of each employer to submit details to the project supervisor.

- In format ddmmyyyy

- Do not report the employee's information for the months when he or she has not in fact been working at the site.

- Working hours and days completed

- Voluntary information. Can be given if known.

- In the working days section, enter the number of days on which the employee was at the site in the month in question.

- In the working hours section, enter the number of hours for which the employee was at the site in the month in question.

- Employer

- The company that pays the employee's wages

- For a self-employed worker, enter self-employed.

- Employer's business ID or personal identity code

- If it is a Finnish organisation, Business ID is mandatory.

- A foreign identification

- You can only give a foreign identification if the employer does not have a Finnish Business ID.

- If necessary, the authorities can take the initiative in assigning a business ID to a foreign company.

- Type of foreign identification, numbered in the order of priority:

- 1=Value-added tax ID (i.e. the VAT number)

- 2= a foreign identification corresponding with a trade register entry

- 3=TIN (foreign taxpayer identification number)

- 4=Foreign personal identity code

- If the unit does not have a VAT number, you should give a foreign ID corresponding with a trade register entry. If you do not have this, either, you should give your TIN and, as the last alternative, a foreign personal identity code.

- Employer's home country

- Give the country code of the reporting unit's home country. For a Finnish company, this is FI. The record description has a link to a list of all country codes.

- If the name of your home country cannot be found on the country codes list, you must write the entire name.

- Name, telephone number and address of a representative of the employer

- Employer's address, if no representative has been appointed

- Name and business ID or personal identity code of the customer purchasing leased labour

- Foreign identification and ID type of the customer purchasing leased labour

- Home country of the customer purchasing leased labour

- Not active - entry for individual sites

- Enter if 1 = work at the site has been interrupted or 2 = work at the site has been concluded

- No employee report received from the employer (employer's failure)

- Enter if 1 = all employee information is missing or 2 = part of the employee information is missing

Provide the following information on an employee:

- Employee personal identity code

- The Tax Administration recommends that you use personal identity codes when submitting the report

- Employee tax number and date of birth

- Entering the tax number and date of birth is an alternative for the personal identity code. The Tax Administration recommends that you use personal identity codes when submitting the report.

- Employee's first names and last name

- Employee's telephone number

- Address details in country of residence

- Does the person have an A1 certificate or other posted employee certificate showing that he or she has been insured in his/her home country?

- Nature of the employment or service relationship

- Is the employee 1= in an employment relationship, 2= a leased employee, 3 = self-employed or similar (e.g. goods inspector or an evaluator of a competence-based examination), 4 = trainee or 5 = voluntary worker.

- Start date of working at the site

- Information received from the project supervisor

- In format ddmmyyyy

- Estimated end date of working at the site

- Information received from the project supervisor

- In format ddmmyyyy

- Do not report the employee's information for months during which he or she has not in fact been working at the site

- Working hours and days completed

- Voluntary information. Can be given if known.

- In the working days section, enter the number of days on which the employee was at the site in the month in question

- In the working hours section, enter the number of hours for which the employee was at the site in the month in question

- Employer

- The company that pays the employee's wages

- For a self-employed worker , enter self-employed

- Employer's business ID or personal identity code

- For a Finnish organisation, the business ID is mandatory

- A foreign identification

- To be given if the employer does not have a Finnish business ID

- If necessary, the authorities can take the initiative in assigning a business ID to a foreign company.

- Type of foreign identification, numbered in the order of priority:

- 1=Value-added tax ID (so-called VAT number)

- 2= a foreign identification corresponding with a trade register entry

- 3=TIN (foreign taxpayer identification number)

- 4=Foreign personal identity code

- If the unit has no VAT number, you should give a foreign identification corresponding with a trade register entry. If you do not have this, either, you should give your TIN and, as the last alternative, a foreign personal identity code.

- Employer's home country

- Give the country code of the home country. For a Finnish company, this is FI. The record description has a link to a list of all country codes..

- If the name of your home country cannot be found on the country codes list, you must write the entire name.

- Name, telephone number and address of a representative of the employer

- Employer's address, if no representative has been appointed

- Name and business ID or personal identity code of the customer purchasing leased labour

- Foreign identification and ID type of the customer purchasing leased labour

- Home country of the customer purchasing leased labour

- Not active - entry for individual sites

- Enter if 1 = work at the site has been interrupted or 2 = work at the site has been concluded

- No employee report received from the employer (employer's failure)

- Enter if 1 = all employee information is missing or 2 = part of the employee information is missing

3.4.1 Examples of employee details

A site employee works just one day a week for a period of eight months.

Example 16: Start and end dates of any individual's work period at a building site must be reported in the same way as they have been agreed in his or her employment contract. This way, if it is agreed with the employee that work goes on for 8 months, the start dates must be reported accordingly, from 1 January to 31 August, for example, even if he or she were to work at the site for just one day a week. However, we recommend that all filers give the exact quantities of days worked for each month. In this example, what is reported as the number of days worked would be 4 days..

4 A household as the customer

4.1 Reports required for jobs covered by a building permit